Security As A Service Market Report

Published Date: 31 January 2026 | Report Code: security-as-a-service

Security As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Security As A Service market, providing detailed insights into market size, growth rates, segments, regional analysis, and key players. The forecast period spans from 2023 to 2033, enabling stakeholders to understand market dynamics and future opportunities.

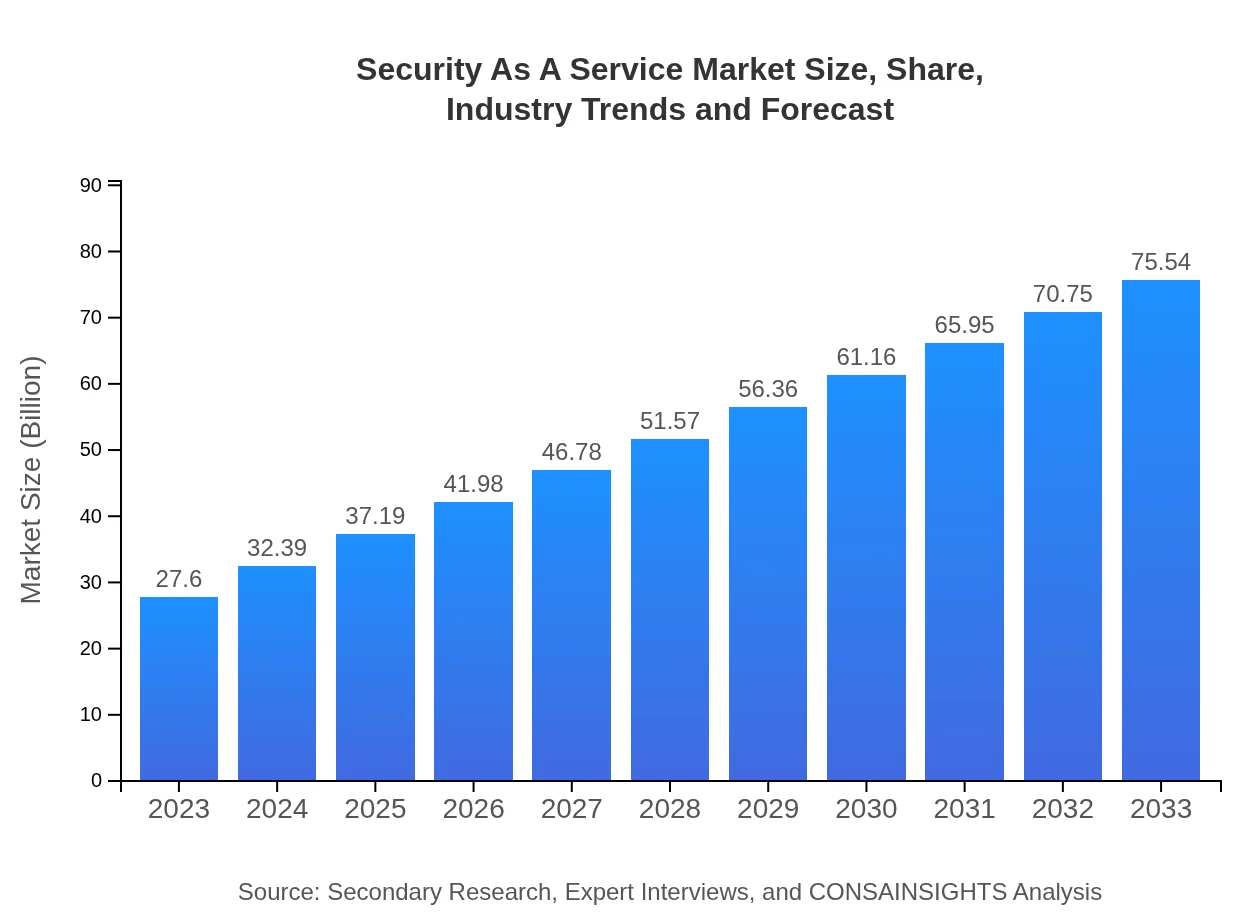

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $75.54 Billion |

| Top Companies | IBM Security, Cisco Systems, McAfee, Symantec (NortonLifeLock) |

| Last Modified Date | 31 January 2026 |

Security As A Service Market Overview

Customize Security As A Service Market Report market research report

- ✔ Get in-depth analysis of Security As A Service market size, growth, and forecasts.

- ✔ Understand Security As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security As A Service

What is the Market Size & CAGR of Security As A Service market in 2023?

Security As A Service Industry Analysis

Security As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security As A Service Market Analysis Report by Region

Europe Security As A Service Market Report:

In Europe, the market size is expected to rise from $7.36 billion in 2023 to $20.13 billion by 2033. Strict data protection regulations like GDPR significantly boost the demand for advanced security solutions. Organizations are keen on aligning with compliance mandates to avoid penalties, consequently adopting SECaaS.Asia Pacific Security As A Service Market Report:

In the Asia Pacific region, the Security As A Service market is projected to grow from $5.59 billion in 2023 to $15.29 billion by 2033. Rising adoption of cloud technology, coupled with increasing awareness around cyber threats, drives this growth. Countries like China, India, and Japan are witnessing a proliferation of cyber-attacks, promoting substantial investments in cybersecurity solutions.North America Security As A Service Market Report:

North America remains the leader in the Security As A Service market, with a projected growth from $10.51 billion in 2023 to $28.77 billion by 2033. The presence of established cybersecurity firms and continuous innovation in threat detection and management augment the region's growth.South America Security As A Service Market Report:

The South American Security As A Service market is expected to evolve from $0.86 billion in 2023 to $2.35 billion in 2033. Limited awareness regarding cybersecurity measures has traditionally hindered growth, but awareness is improving as more businesses undergo digital transformation.Middle East & Africa Security As A Service Market Report:

The Middle East and Africa's Security As A Service market will expand from $3.29 billion in 2023 to $9.00 billion by 2033. The growing focus on digital transformation across enterprises in this region is paving the way for increased investment in cybersecurity services.Tell us your focus area and get a customized research report.

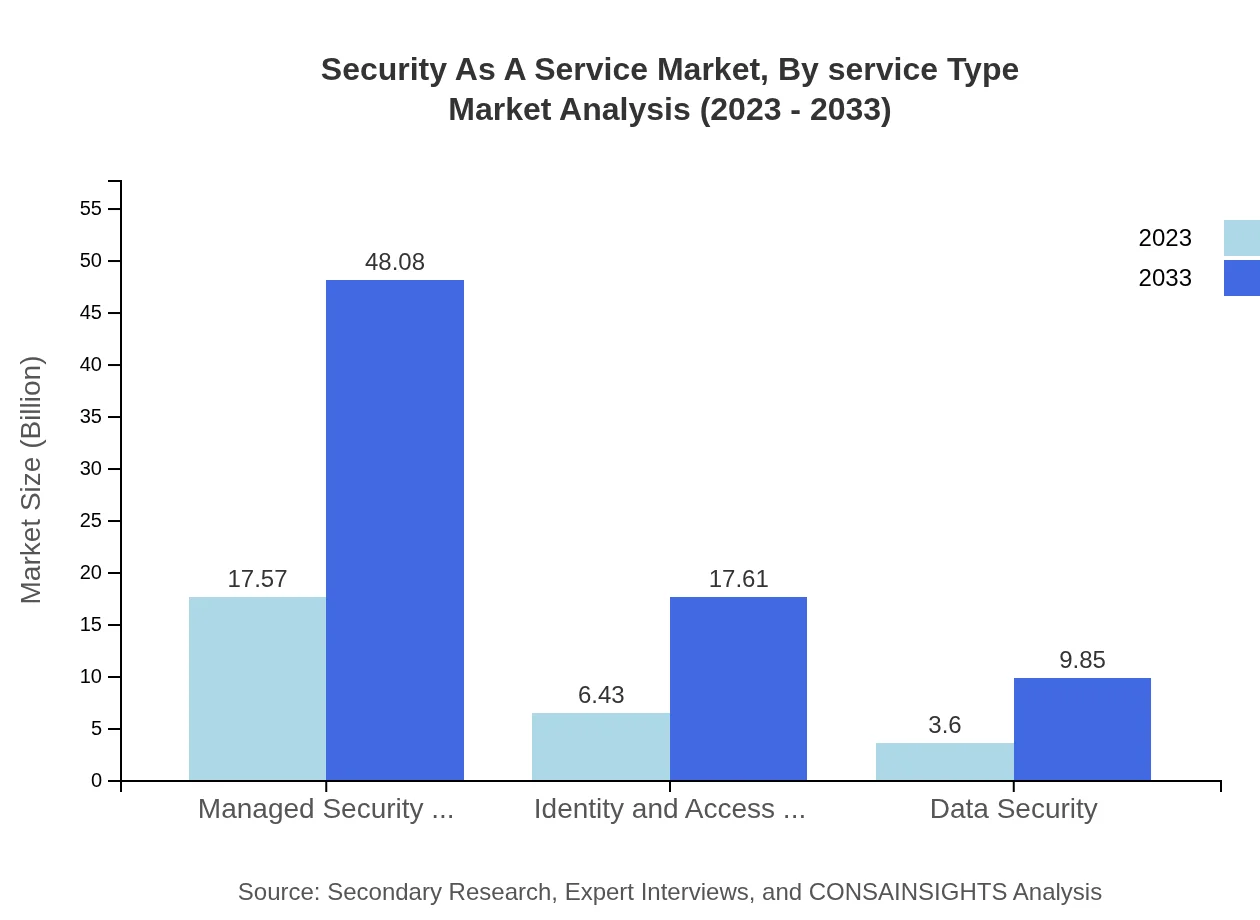

Security As A Service Market Analysis By Service Type

The Managed Security Services segment commands a substantial share, with market sizes projected to grow from $17.57 billion in 2023 to $48.08 billion by 2033, accounting for over 63.65% market share throughout the forecast period. Identity and Access Management services exhibit notable growth from $6.43 billion to $17.61 billion, while Data Security is also on the rise, reflecting the heightened focus on data privacy.

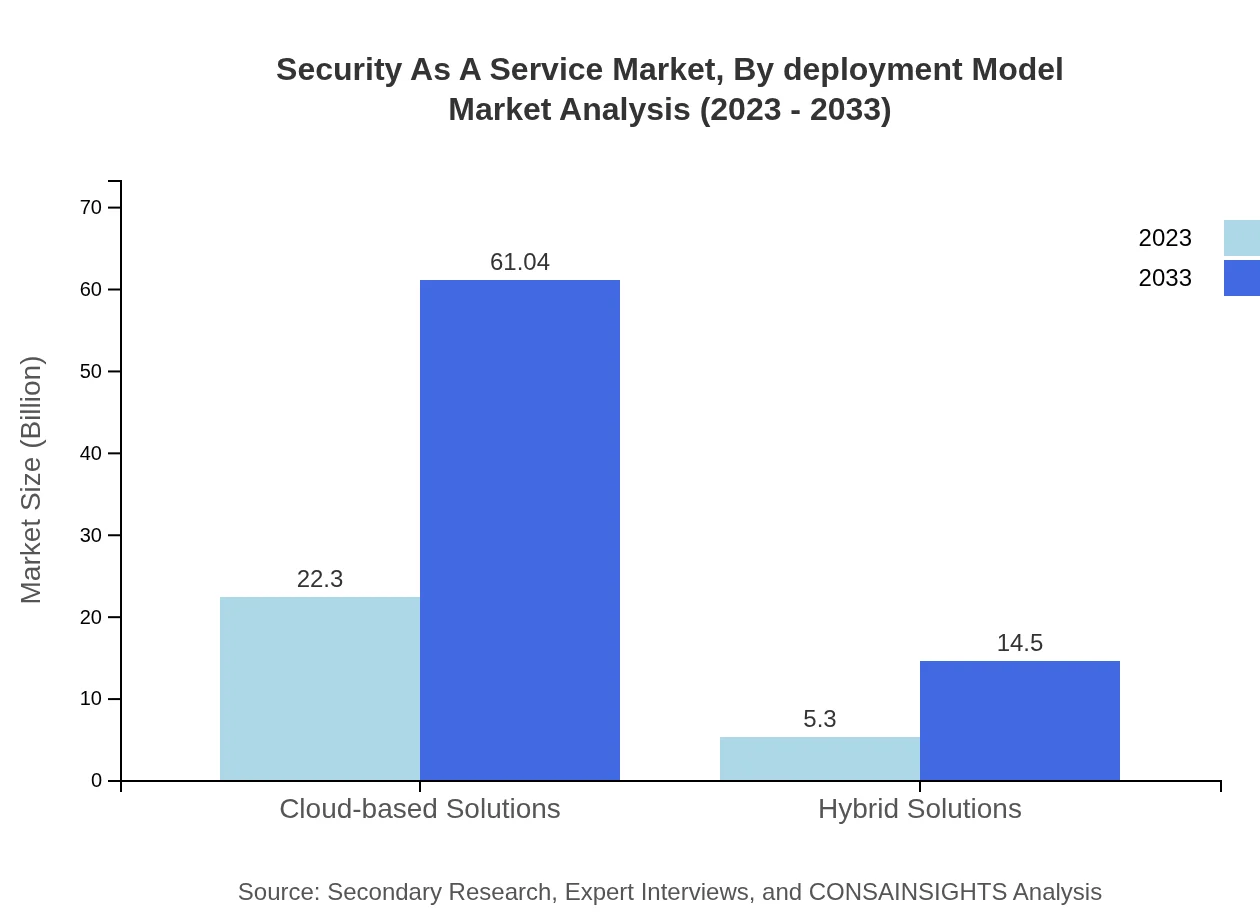

Security As A Service Market Analysis By Deployment Model

Cloud-based Solutions are poised to dominate the SECaaS market with a significant share of 80.81%, growing from $22.30 billion in 2023 to $61.04 billion by 2033. Furthermore, Hybrid Solutions are gaining traction as businesses strive for a balanced approach to managing on-premise and cloud-based security.

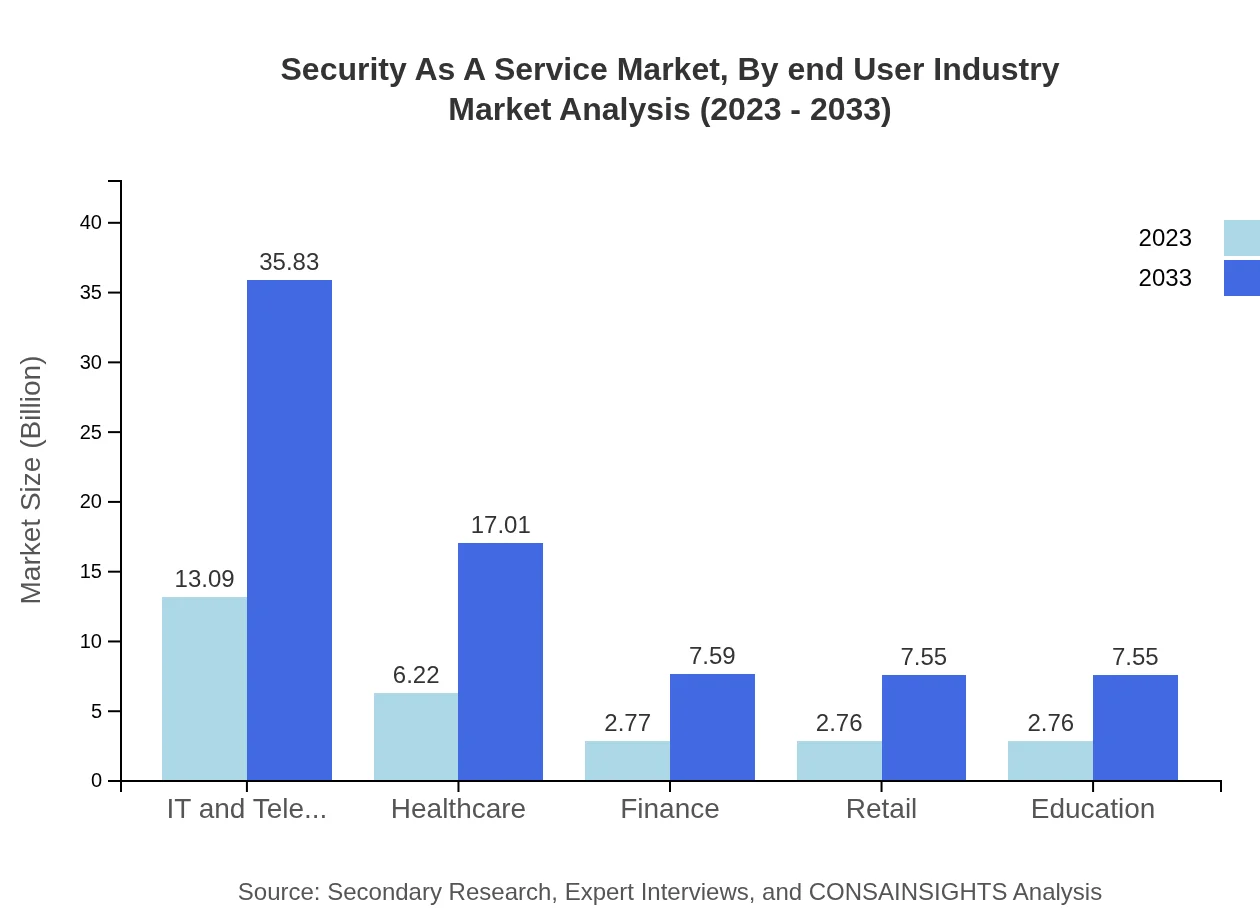

Security As A Service Market Analysis By End User Industry

Key end-user industries include IT and Telecom, Healthcare, Finance, Retail, and Education. The IT and Telecom sector holds 47.43% market share growing from $13.09 billion to $35.83 billion. Healthcare and Finance sectors are also significant contributors to market growth, with respective shares of 22.52% and 10.05%.

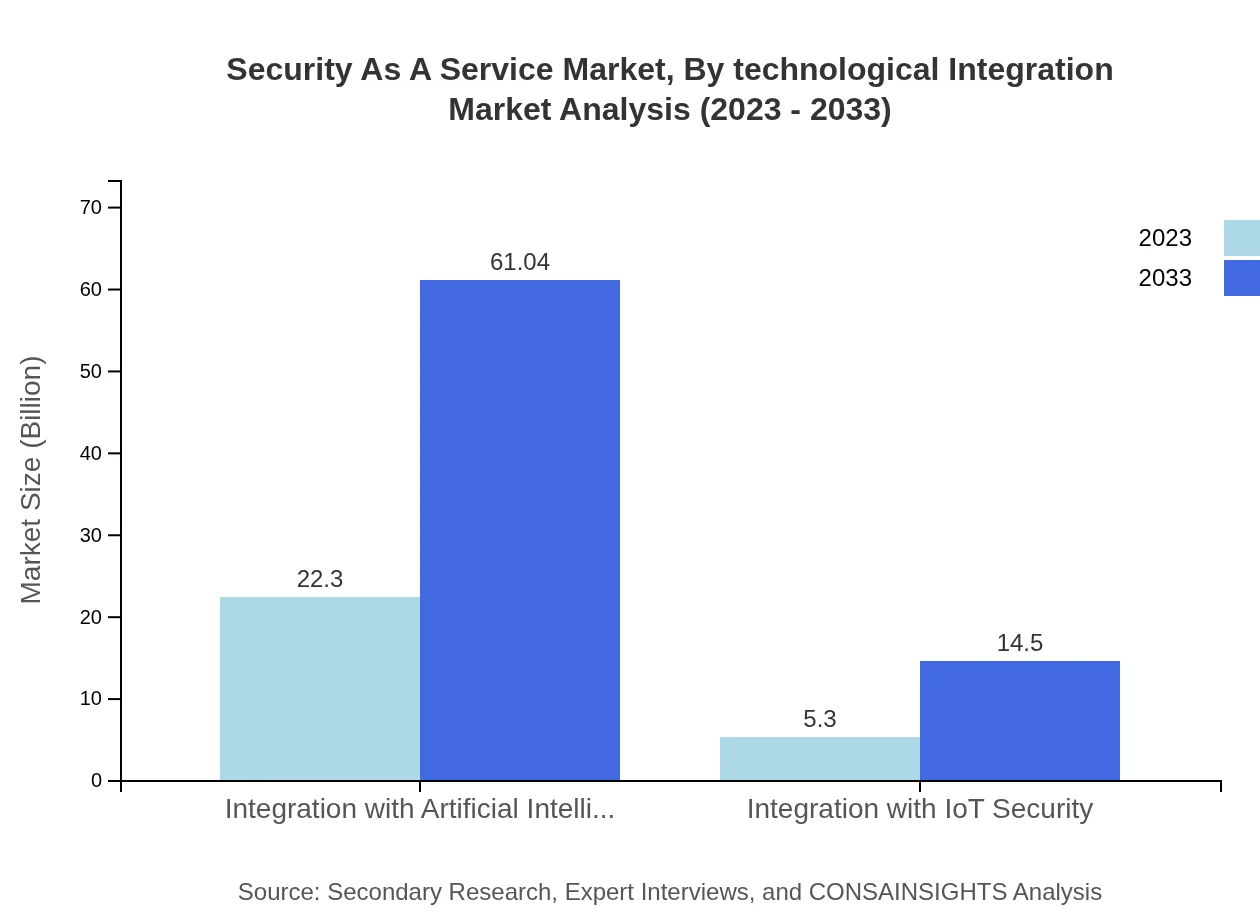

Security As A Service Market Analysis By Technological Integration

The integration with Artificial Intelligence and IoT Security is revolutionizing the SECaaS market. AI integration is projected to grow from $22.30 billion to $61.04 billion, maintaining the same share of 80.81%. IoT Security integration, while currently smaller, is also expected to rise, indicating the imperative nature of cybersecurity within rapidly evolving tech landscapes.

Security As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security As A Service Industry

IBM Security:

A pioneer in the cybersecurity realm, IBM Security provides comprehensive threat management solutions, including security analysis, data protection, and identity management to businesses worldwide.Cisco Systems:

Cisco is renowned for its network security solutions, including firewalls and intrusion prevention systems. Their cloud-based security operations center offers integrated SECaaS solutions.McAfee:

McAfee delivers advanced security solutions that include endpoint protection, cloud security, and total protection services tailored for enterprises of all sizes.Symantec (NortonLifeLock):

Symantec, now part of NortonLifeLock, specializes in cybersecurity software for consumers as well as enterprise solutions, focusing on holistic security methodologies.We're grateful to work with incredible clients.

FAQs

What is the market size of security As A Service?

The global Security-as-a-Service market is projected to reach approximately $27.6 billion by 2033, growing at a CAGR of 10.2%. This indicates substantial growth driven by increasing demand for flexible and scalable security solutions.

What are the key market players or companies in this security As A Service industry?

Key players in the Security-as-a-Service industry include global leaders such as Cisco, IBM, McAfee, Palo Alto Networks, and Symantec. These companies are consistently innovating to provide comprehensive security solutions that cater to diverse customer needs.

What are the primary factors driving the growth in the security As A Service industry?

Significant factors driving growth include increasing cyber threats, the rising adoption of cloud computing, and the demand for regulatory compliance. Additionally, the shift towards remote work has necessitated enhanced security measures, fueling industry expansion.

Which region is the fastest Growing in the security As A Service market?

North America currently leads the Security-as-a-Service market, expected to grow from $10.51 billion in 2023 to $28.77 billion by 2033. However, the Asia Pacific region, projected to grow from $5.59 billion to $15.29 billion, exhibits the fastest growth rate.

Does ConsaInsights provide customized market report data for the security As A Service industry?

Yes, ConsaInsights offers customized market report data tailored to the specific requirements of clients in the Security-as-a-Service industry. This includes bespoke insights, granular data analysis, and strategic recommendations.

What deliverables can I expect from this security As A Service market research project?

Deliverables from the Security-as-a-Service market research project include detailed market analysis reports, segment breakdowns, competitive landscape assessments, and actionable insights. Additionally, expect data visualizations and strategic recommendations based on findings.

What are the market trends of security As A Service?

Key trends in the Security-as-a-Service market include the growing adoption of cloud-based solutions, increased integration of AI technologies, and a focus on hybrid security models. These trends reflect the industry's responsiveness to evolving security challenges and technological advancements.