Security Information And Event Management Market Report

Published Date: 31 January 2026 | Report Code: security-information-and-event-management

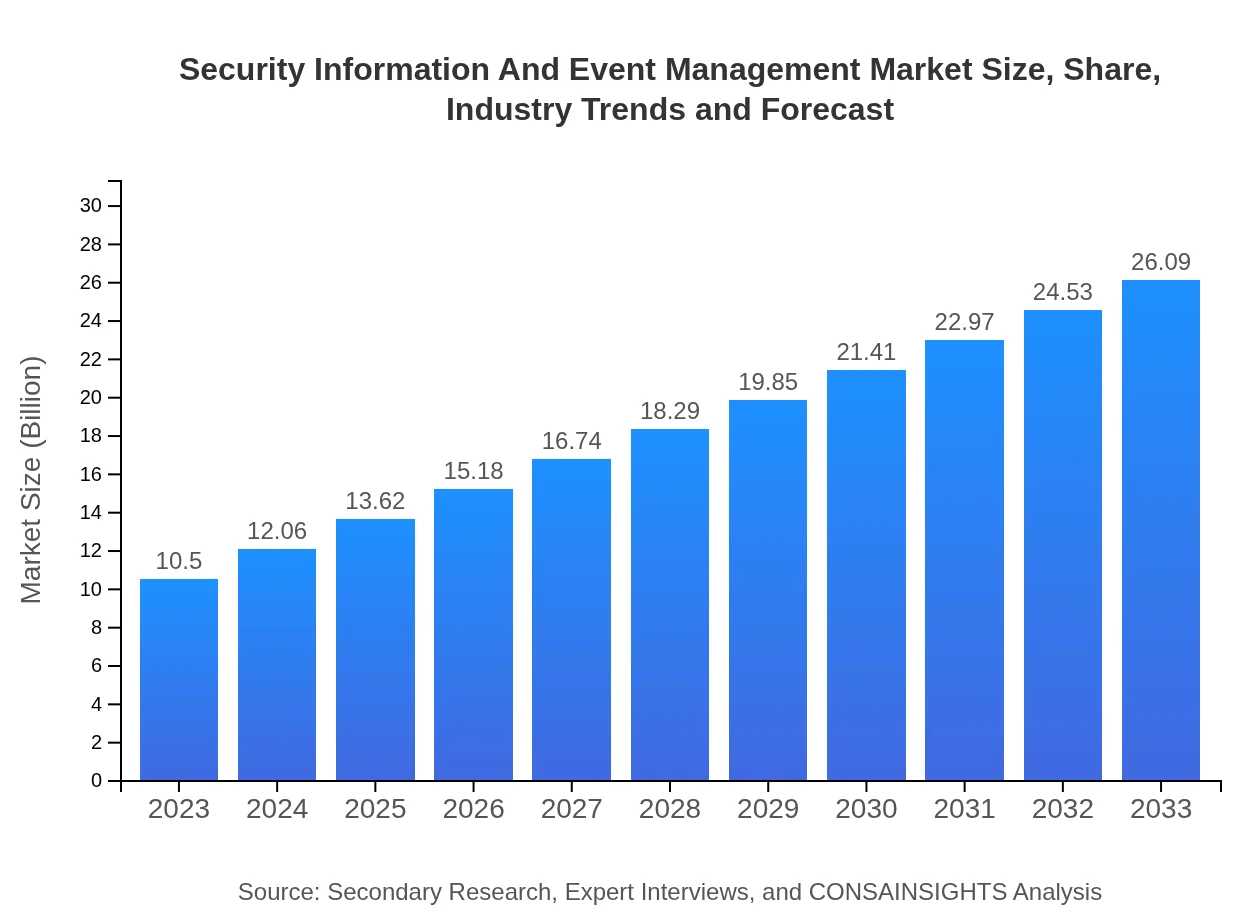

Security Information And Event Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Security Information And Event Management market, focusing on market trends, size, regional insights, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | IBM, Splunk, LogRhythm, McAfee, Sumo Logic |

| Last Modified Date | 31 January 2026 |

Security Information And Event Management Market Overview

Customize Security Information And Event Management Market Report market research report

- ✔ Get in-depth analysis of Security Information And Event Management market size, growth, and forecasts.

- ✔ Understand Security Information And Event Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Information And Event Management

What is the Market Size & CAGR of Security Information And Event Management market in 2023?

Security Information And Event Management Industry Analysis

Security Information And Event Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Information And Event Management Market Analysis Report by Region

Europe Security Information And Event Management Market Report:

Europe's SIEM market is set to expand from $3.21 billion in 2023 to approximately $7.98 billion in 2033, supported by rigorous data protection laws like GDPR and heightened awareness of cybersecurity risks.Asia Pacific Security Information And Event Management Market Report:

In Asia-Pacific, the SIEM market is projected to grow from $1.90 billion in 2023 to approximately $4.71 billion by 2033. This growth is driven by increasing digital transformation activities and a rising number of cyber threats, prompting organizations to invest heavily in cybersecurity infrastructure.North America Security Information And Event Management Market Report:

North America leads the market with an expected increase from $4.01 billion in 2023 to $9.96 billion by 2033. The region's growth is bolstered by higher expenditures in cybersecurity and stringent regulatory compliance mandates.South America Security Information And Event Management Market Report:

The South American market, while smaller, is showing promising trends, with the SIEM market expected to grow from $0.01 billion in 2023 to $0.03 billion by 2033. This indicates a gradual recognition of the need for enhanced security measures across the region.Middle East & Africa Security Information And Event Management Market Report:

The Middle East and Africa region’s market is forecasted to increase from $1.37 billion in 2023 to around $3.40 billion by 2033 as organizations seek advanced solutions to combat growing cyber threats in a more connected world.Tell us your focus area and get a customized research report.

Security Information And Event Management Market Analysis Security_info

Global Security Information and Event Management Market, By Solution Market Analysis (2023 - 2033)

The Security segment is projected to dominate, growing from $8.44 billion in 2023 to $20.97 billion by 2033, reflecting a sustained focus on enhancing security measures in various sectors.

Security Information And Event Management Market Analysis Event_management

Global Security Information and Event Management Market, By Solution Segment (2023 - 2033)

Similarly, the Event Management segment anticipates growth from $2.06 billion in 2023 to $5.12 billion by 2033, driven by the need for organizations to monitor events in real-time.

Security Information And Event Management Market Analysis Managed_services

Global Security Information and Event Management Market, By Service Type Market Analysis (2023 - 2033)

Managed Services is another significant area expected to grow, from $8.44 billion in 2023 to $20.97 billion by 2033, due to organizations seeking outsourced security management solutions for efficiency.

Security Information And Event Management Market Analysis Professional_services

Global Security Information and Event Management Market, By Service Type Market Analysis (2023 - 2033)

Professional Services, which include consulting and support services, are expected to rise from $2.06 billion in 2023 to $5.12 billion by 2033, as companies look for expert guidance in implementing SIEM solutions.

Security Information And Event Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Information And Event Management Industry

IBM:

IBM's QRadar SIEM platform is renowned for its strong analytics capabilities and threat intelligence integrations, providing comprehensive security monitoring solutions.Splunk:

Splunk offers powerful data analytics to enhance event management, streamlining security monitoring and incident response processes.LogRhythm:

LogRhythm's SIEM solution combines machine learning and analytics to provide advanced threat detection and compliance capabilities.McAfee:

McAfee's SIEM solutions focus on delivering comprehensive data protection and real-time threat detection functionalities.Sumo Logic:

Sumo Logic provides cloud-native SIEM capabilities that offer updated insights into security risks and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of security Information And Event Management?

The security information and event management market is valued at approximately $10.5 billion in 2023 and is projected to grow with a CAGR of 9.2% through 2033. This growth signifies an increasing investment in cybersecurity measures among businesses.

What are the key market players or companies in this security Information And Event Management industry?

Major players in the security information and event management market include IBM, Splunk, Sumo Logic, and McAfee, among others. These companies contribute significantly to innovations and solutions that address the growing demand for security and compliance.

What are the primary factors driving the growth in the security Information And Event Management industry?

Key factors include rising cybersecurity threats, the increasing complexity of compliance regulations, and the growing need for real-time data analysis. With the digital transformation of businesses, organizations are investing more in advanced security solutions.

Which region is the fastest Growing in the security Information And Event Management?

North America is currently the fastest-growing region in the security information and event management market, with a market size projected to increase from $4.01 billion in 2023 to $9.96 billion by 2033, driven by high cybersecurity demands.

Does ConsaInsights provide customized market report data for the security Information And Event Management industry?

Yes, ConsaInsights offers customized market report data specifically for the security information and event management industry, tailored to meet the unique needs of clients based on their specific interests and market dynamics.

What deliverables can I expect from this security Information And Event Management market research project?

Expect detailed market analyses, regional insights, competitive analysis, and strategic recommendations. Deliverables typically include comprehensive reports, presentations, and executive summaries that aid in informed decision-making.

What are the market trends of security Information And Event Management?

Current trends include the shift towards cloud-based solutions, increased investment in AI for threat detection, and greater integration of managed services. The focus is on enhancing data security while ensuring compliance with evolving regulations.