Security Labels Market Report

Published Date: 02 February 2026 | Report Code: security-labels

Security Labels Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Security Labels market from 2023 to 2033, highlighting key trends, regional insights, market size, CAGR, and competitive analysis to aid stakeholders in strategic decision-making.

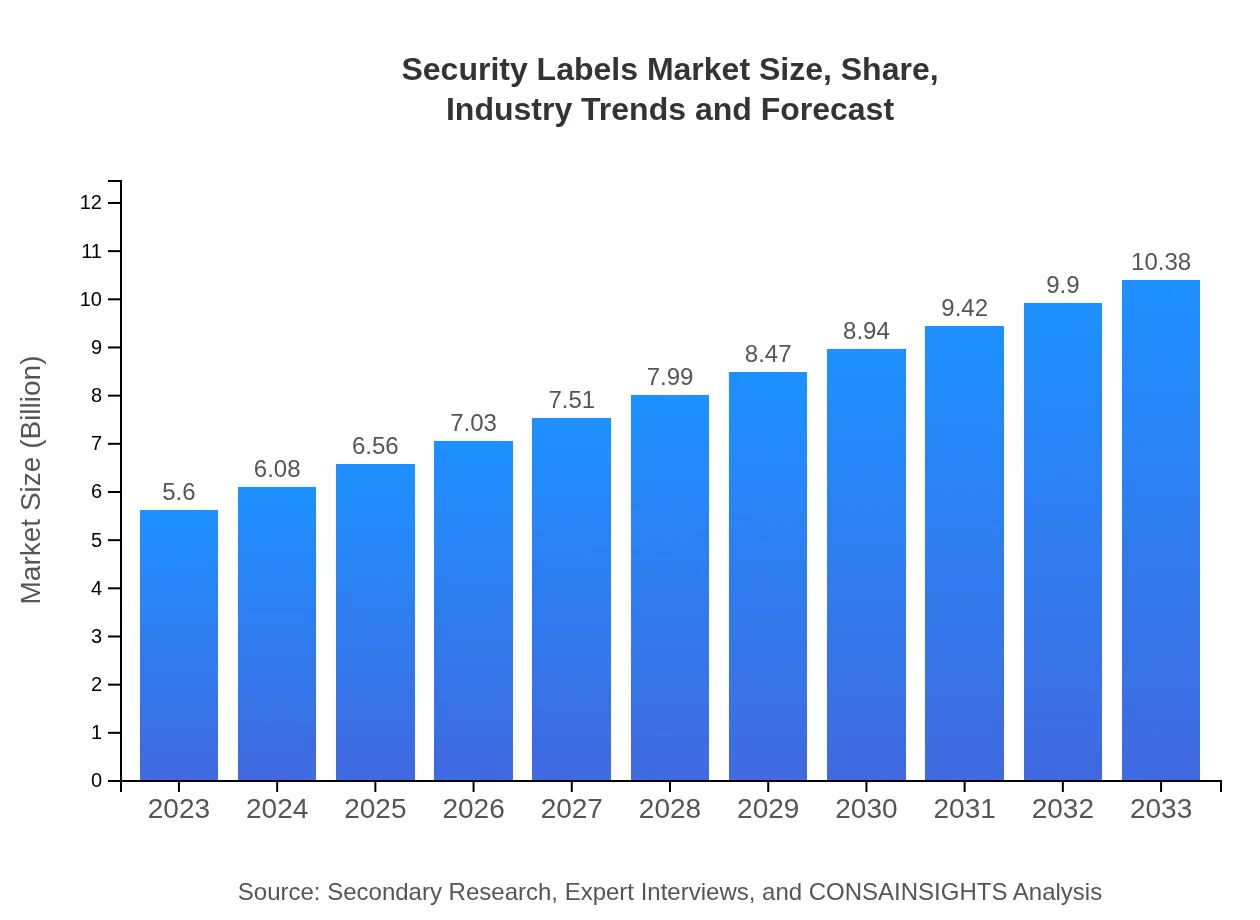

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | 3M, Avery Dennison, Brother Industries, Zebra Technologies |

| Last Modified Date | 02 February 2026 |

Security Labels Market Overview

Customize Security Labels Market Report market research report

- ✔ Get in-depth analysis of Security Labels market size, growth, and forecasts.

- ✔ Understand Security Labels's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Labels

What is the Market Size & CAGR of Security Labels market in 2023?

Security Labels Industry Analysis

Security Labels Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Labels Market Analysis Report by Region

Europe Security Labels Market Report:

Europe shows a solid growth trajectory, moving from $1.36 billion in 2023 to $2.51 billion by 2033. The region's focus on anti-counterfeiting measures and sustainable packaging solutions makes it a significant market for security labels, particularly in the luxury and pharmaceutical sectors.Asia Pacific Security Labels Market Report:

The Asia Pacific region, with a market value of $1.21 billion in 2023 projected to reach $2.24 billion by 2033, is witnessing increased demand for security labels driven by the booming retail and e-commerce sectors. Countries like China and India are experiencing significant growth due to rising disposable incomes and increased product safety regulations.North America Security Labels Market Report:

The North American market is the largest, with an estimated value of $2.05 billion in 2023 and expected growth to $3.80 billion by 2033. The market benefits from stringent regulatory standards, particularly in pharmaceuticals and food packaging, which is leading to a rise in demand for security labeling solutions.South America Security Labels Market Report:

In South America, the Security Labels market is anticipated to grow from $0.54 billion in 2023 to $1.01 billion by 2033, driven by heightened efforts to combat counterfeit goods and increased consumer awareness regarding product safety. The region's burgeoning retail segment further propels market growth.Middle East & Africa Security Labels Market Report:

The Middle East and Africa region, though smaller, demonstrates promising growth, with market values projected from $0.44 billion in 2023 to $0.81 billion by 2033. Increased investments in retail and manufacturing and rising concerns over product authenticity are driving demand within this region.Tell us your focus area and get a customized research report.

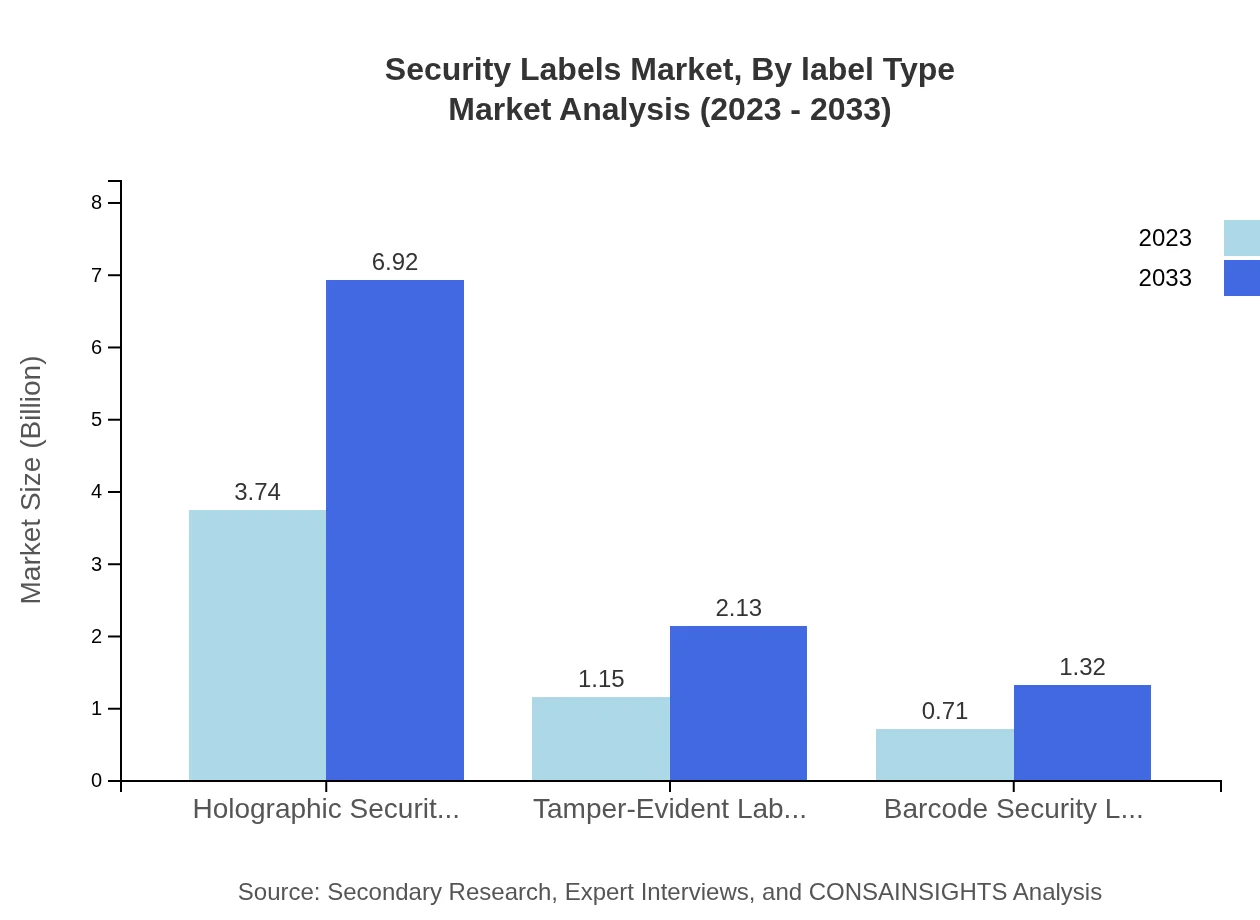

Security Labels Market Analysis By Label Type

The Security Labels Market is segmented by label type into paper labels, plastic labels, metal labels, holographic security labels, and others. Notably, paper labels dominate with $3.74 billion in 2023, maintaining a 66.74% share. Plastic labels follow with a 20.53% share and a growth from $1.15 billion to $2.13 billion by 2033. Holographic security labels, recognized for their high security features, encounter robust demand with similar growth trajectories.

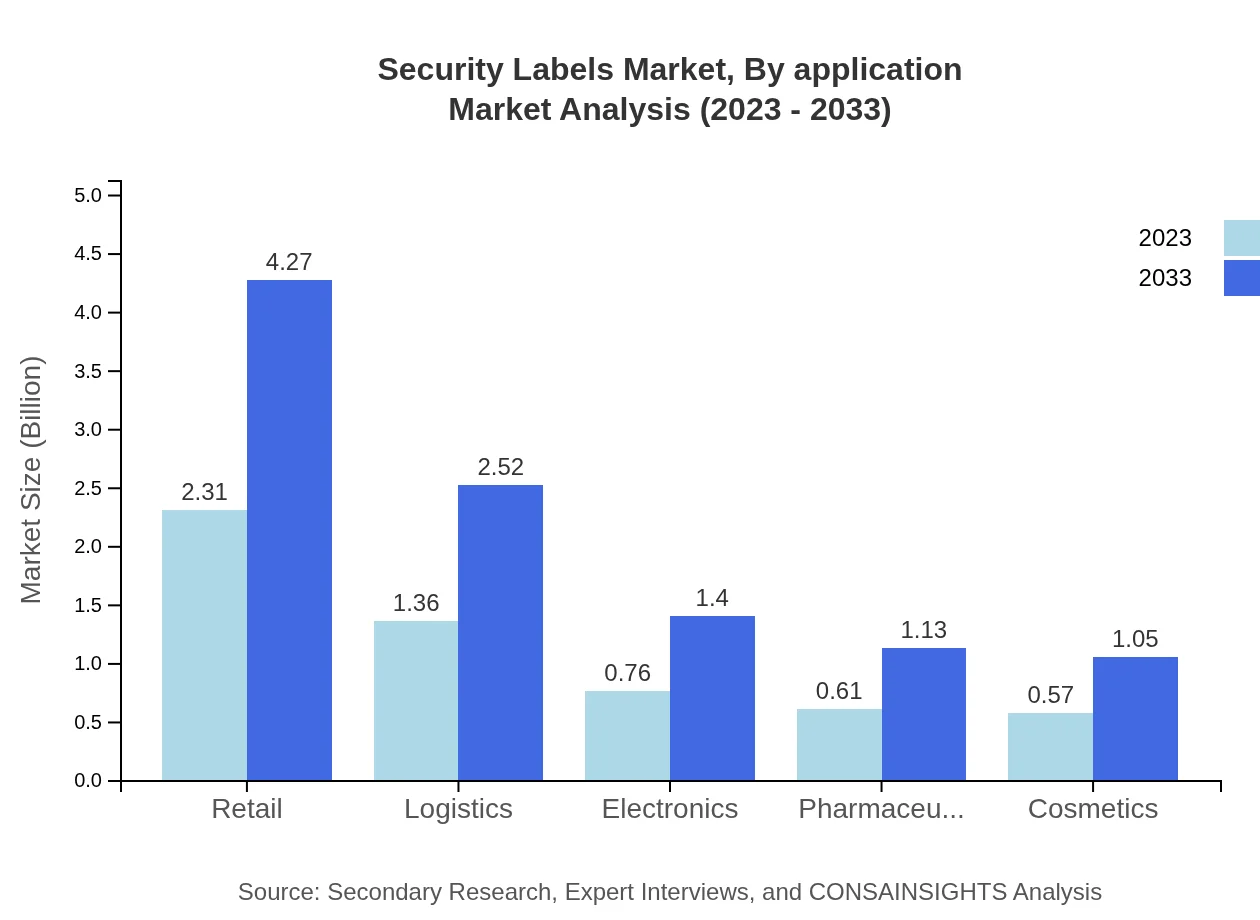

Security Labels Market Analysis By Application

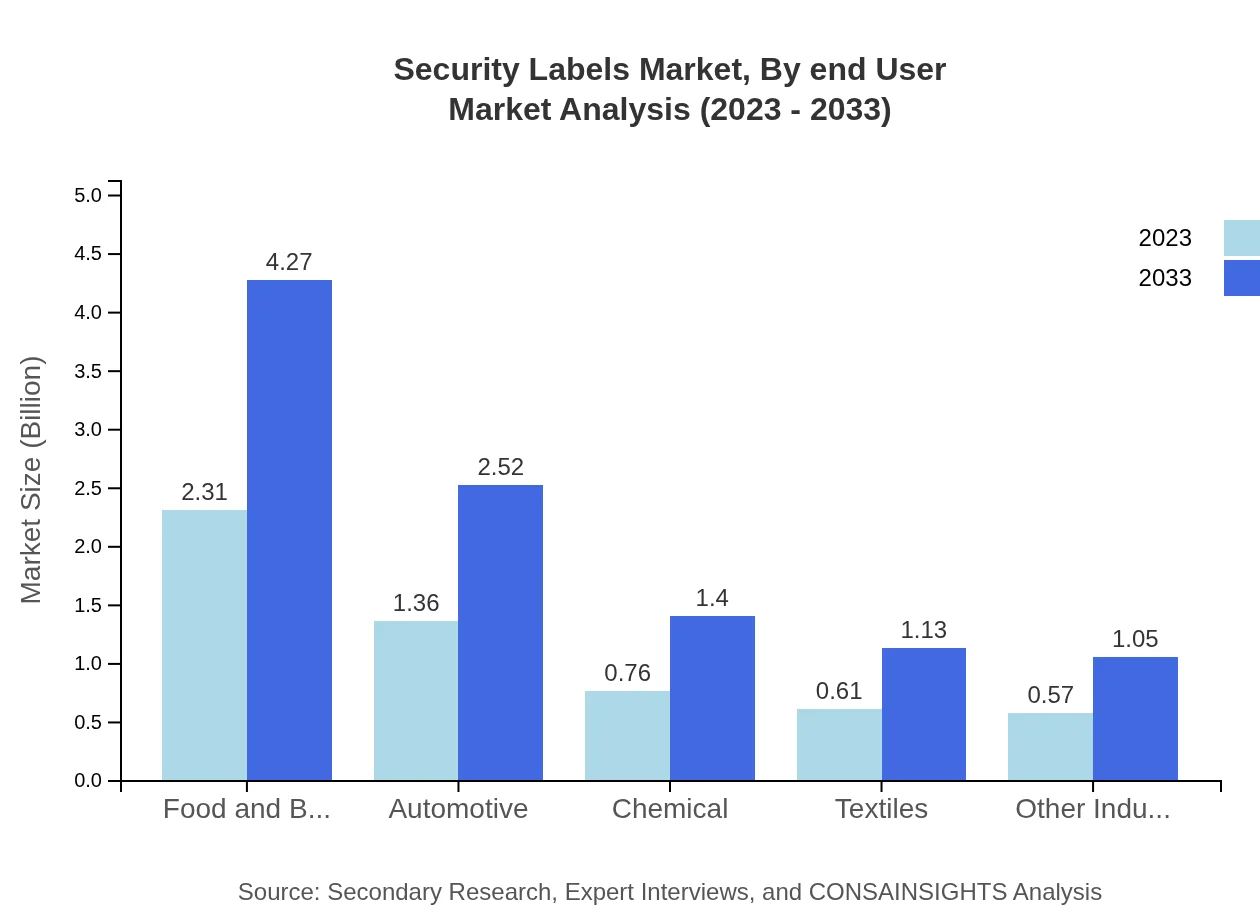

Applications in the Security Labels Market include sectors such as Food and Beverage, Automotive, Chemicals, and Pharmaceuticals. The Food and Beverage sector leads with market sizes of $2.31 billion in 2023 to $4.27 billion by 2033, claiming a 41.2% share. The Automotive sector also holds a substantial portion at 24.31%, with respective market values of $1.36 billion and $2.52 billion during the same period.

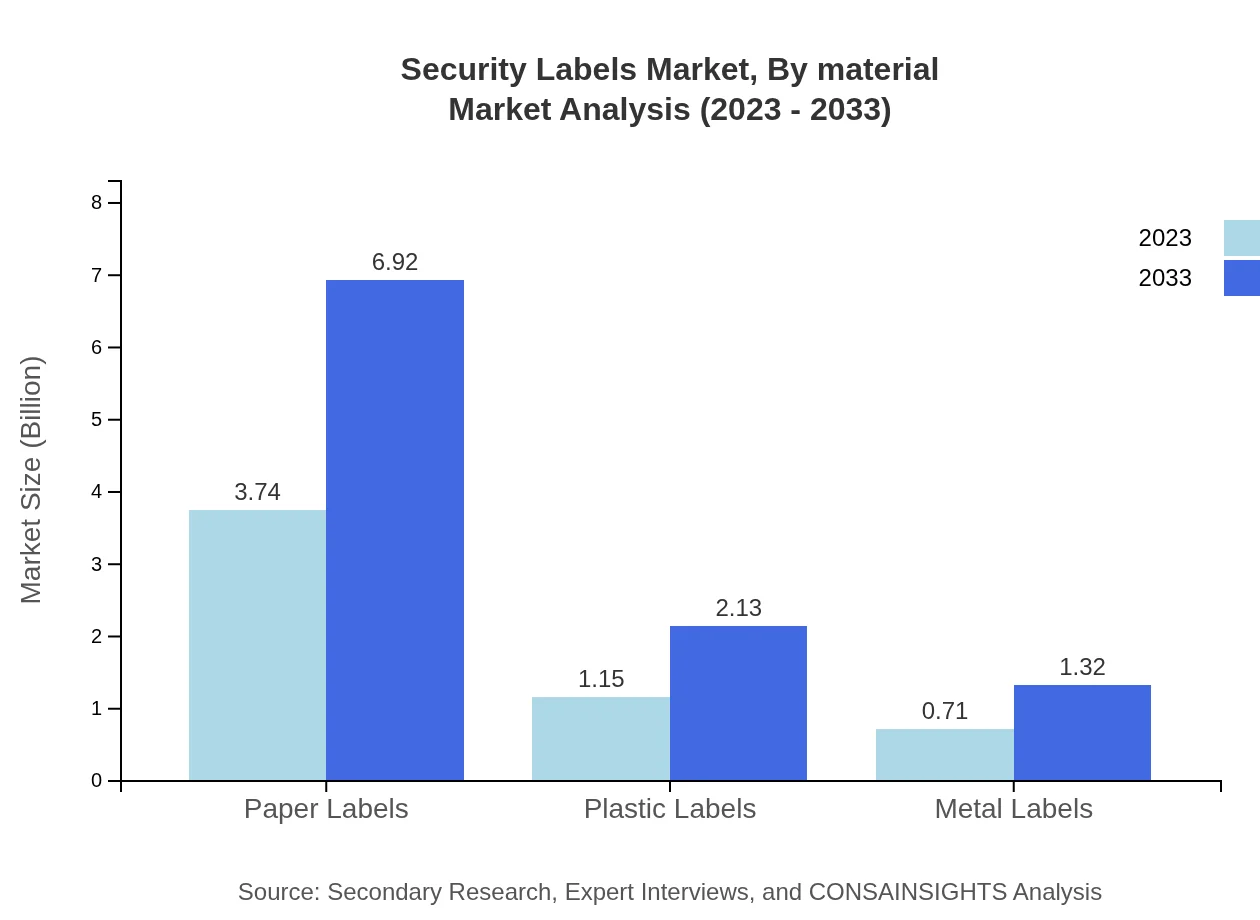

Security Labels Market Analysis By Material

Materials used in the Security Labels Market include paper, plastic, and metal. Sustainability trends are gradually boosting demand for eco-friendly materials within label production. Paper labels remain predominant, while the interest in plastic and metal labels is increasing due to their durability and functionality in diverse environments.

Security Labels Market Analysis By End User

The end-user segmentation covers key sectors such as electronics, pharmaceuticals, cosmetics, and retail. The Pharmaceuticals segment is vital, claiming a 10.88% market share in 2023, growing from $0.61 billion to $1.13 billion by 2033. Similarly, the retail sector represents a significant market share due to increasing concerns over counterfeit products and brand integrity.

Security Labels Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Labels Industry

3M:

3M is a leading global diversified technology company known for its innovative security labels that incorporate unique features such as tamper-evident and anti-counterfeit technologies.Avery Dennison:

Avery Dennison specializes in labeling and packaging materials and is a key player in the security labels market, providing advanced solutions that enhance brand protection and consumer safety.Brother Industries:

Brother Industries offers a wide range of labeling solutions, including high-quality security labels targeted at retail and logistics applications, helping businesses ensure product authenticity.Zebra Technologies:

Zebra Technologies focuses on automatic identification and data capture solutions, producing innovative security labels designed for inventory management and anti-counterfeiting.We're grateful to work with incredible clients.

FAQs

What is the market size of security Labels?

The global security labels market is projected to grow from $5.6 billion in 2023 to an estimated value in 2033, reflecting a CAGR of 6.2%. This growth is driven by a heightened focus on security across various industries.

What are the key market players or companies in the security Labels industry?

Key players in the security labels industry include major manufacturers and suppliers who focus on technologies like anti-counterfeiting labels, tamper-evident seals, and holographic labels. These companies contribute significantly to innovation and market growth.

What are the primary factors driving the growth in the security labels industry?

Growth in the security labels sector is driven by increasing counterfeiting activities, rising demand for product authenticity, regulatory compliance, and advancements in label technology, enhancing both efficiency and security features.

Which region is the fastest Growing in the security labels market?

The Asia Pacific region is the fastest-growing market for security labels, expected to rise from $1.21 billion in 2023 to $2.24 billion by 2033, primarily driven by increased manufacturing and consumer goods activities.

Does ConsaInsights provide customized market report data for the security labels industry?

Yes, ConsaInsights offers customized market report data for the security labels industry, tailoring insights to meet specific client needs and providing detailed analysis relevant to various segments and regions.

What deliverables can I expect from the security labels market research project?

Deliverables from the security labels market research project include comprehensive reports, segmented market data, trend analyses, competitive landscape evaluations, and forecasts that support strategic decision-making.

What are the market trends of security labels?

Current trends in the security labels market include increased adoption of eco-friendly materials, advancements in digital printing technologies, and the integration of smart technologies for enhanced security and traceability.