Security Operation Center As A Service Market Report

Published Date: 31 January 2026 | Report Code: security-operation-center-as-a-service

Security Operation Center As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Security Operation Center as a Service market, including insights into market size, growth factors, regional dynamics, and trends. The forecast period covers 2023 to 2033, aiming to offer a comprehensive view of the industry's future.

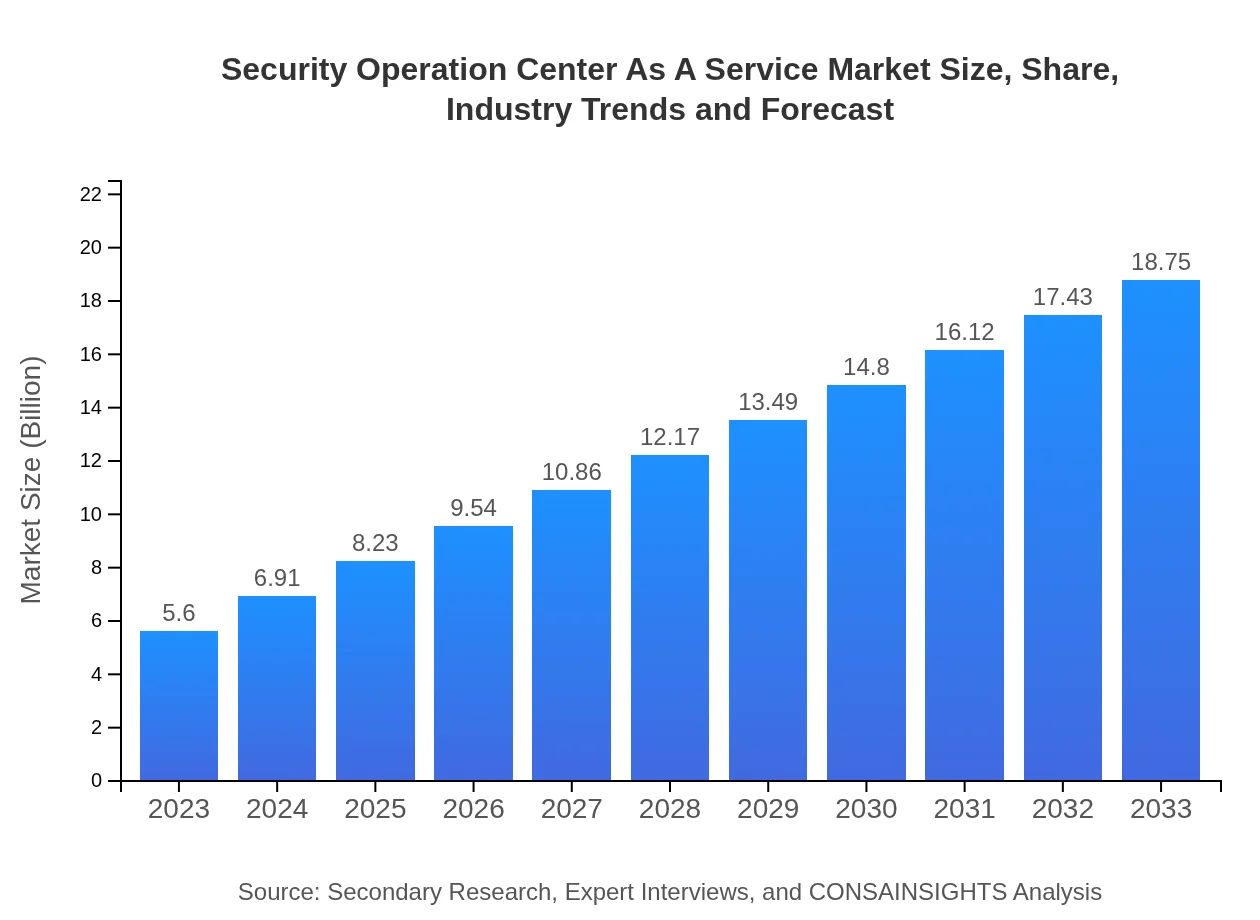

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $18.75 Billion |

| Top Companies | IBM Security, Cisco Systems, Inc., Secureworks, AT&T Cybersecurity, McAfee Corp. |

| Last Modified Date | 31 January 2026 |

Security Operation Center As A Service Market Overview

Customize Security Operation Center As A Service Market Report market research report

- ✔ Get in-depth analysis of Security Operation Center As A Service market size, growth, and forecasts.

- ✔ Understand Security Operation Center As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Operation Center As A Service

What is the Market Size & CAGR of Security Operation Center As A Service market in 2023?

Security Operation Center As A Service Industry Analysis

Security Operation Center As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Operation Center As A Service Market Analysis Report by Region

Europe Security Operation Center As A Service Market Report:

The European market is expected to grow significantly from USD 1.50 billion in 2023 to USD 5.03 billion by 2033. The European Union's regulatory framework concerning data protection, specifically GDPR, is pushing organizations to enhance their cybersecurity measures. This regulatory push creates substantial demand for SOC service providers.Asia Pacific Security Operation Center As A Service Market Report:

In the Asia Pacific region, the market size is projected to grow from USD 1.13 billion in 2023 to approximately USD 3.78 billion by 2033. The rapid digital transformation and increased adoption of cloud technologies are critical drivers contributing to this growth. Additionally, heightened government initiatives for cybersecurity across countries like India and Japan are expected to foster further market expansion.North America Security Operation Center As A Service Market Report:

North America is anticipated to remain the largest market, increasing from USD 1.96 billion in 2023 to USD 6.57 billion by 2033. The presence of major global players and high cybersecurity spending across various sectors, particularly healthcare and finance, make this region a focal point for SOC as a Service.South America Security Operation Center As A Service Market Report:

The South America market is expected to increase from USD 0.44 billion in 2023 to USD 1.47 billion by 2033. The growing awareness of cybersecurity risk and the need for strict regulatory compliance in financial transactions are major contributors. Investments in digital infrastructure, primarily in Brazil and Argentina, will also aid the market's growth.Middle East & Africa Security Operation Center As A Service Market Report:

The Middle East and Africa region is projected to grow from USD 0.57 billion in 2023 to USD 1.90 billion by 2033. With increasing cybersecurity threats, particularly in the financial sector, organizations are seeking robust SOC solutions. Major initiatives by governments to bolster national infrastructure security will also drive market growth.Tell us your focus area and get a customized research report.

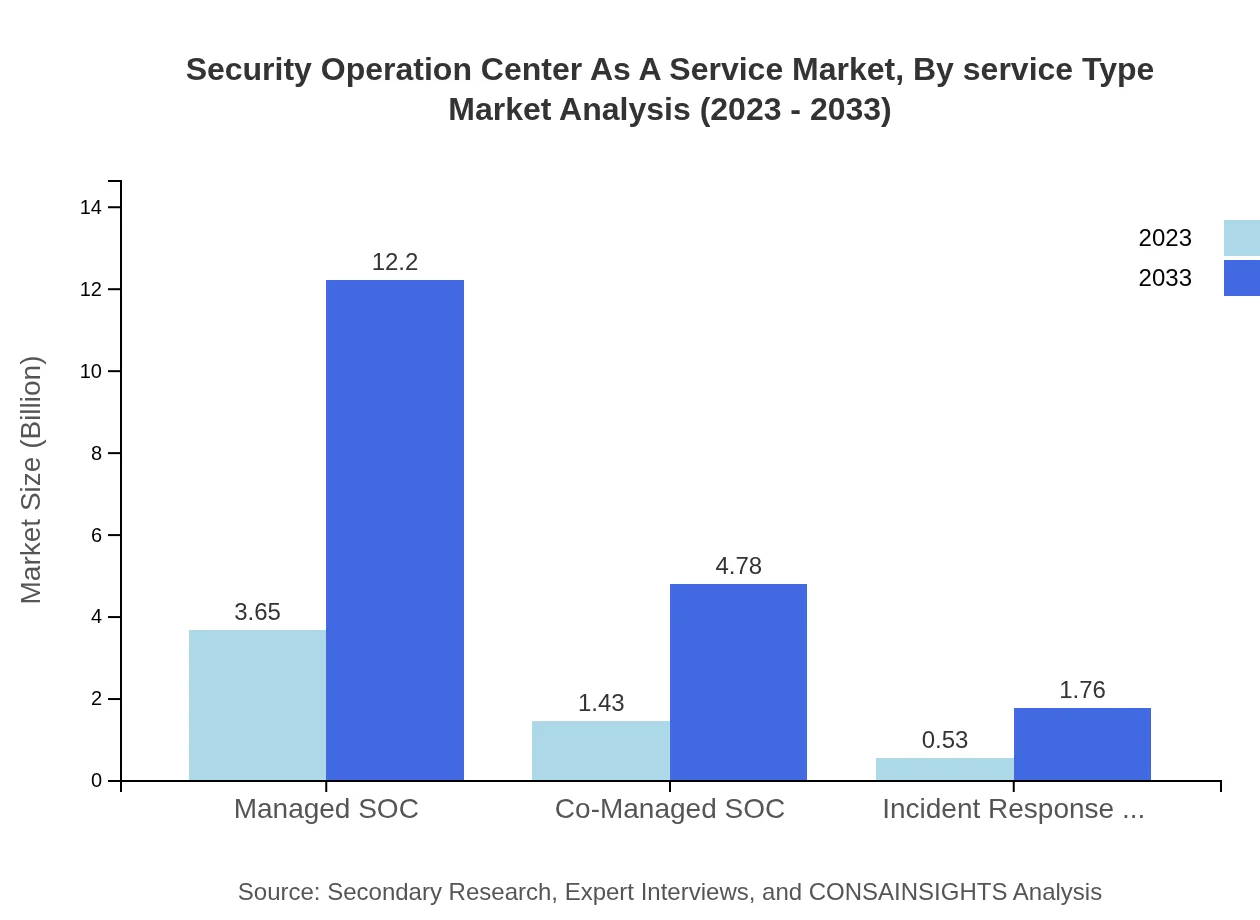

Security Operation Center As A Service Market Analysis By Service Type

The service type segment includes Managed SOC, which is expected to reach USD 12.20 billion by 2033 from USD 3.65 billion in 2023, indicating a strong growth trajectory facilitated by rising demand for outsourced security management. Co-managed SOC services are also growing, projected to expand from USD 1.43 billion to USD 4.78 billion, emphasizing the collaborative nature of security solutions.

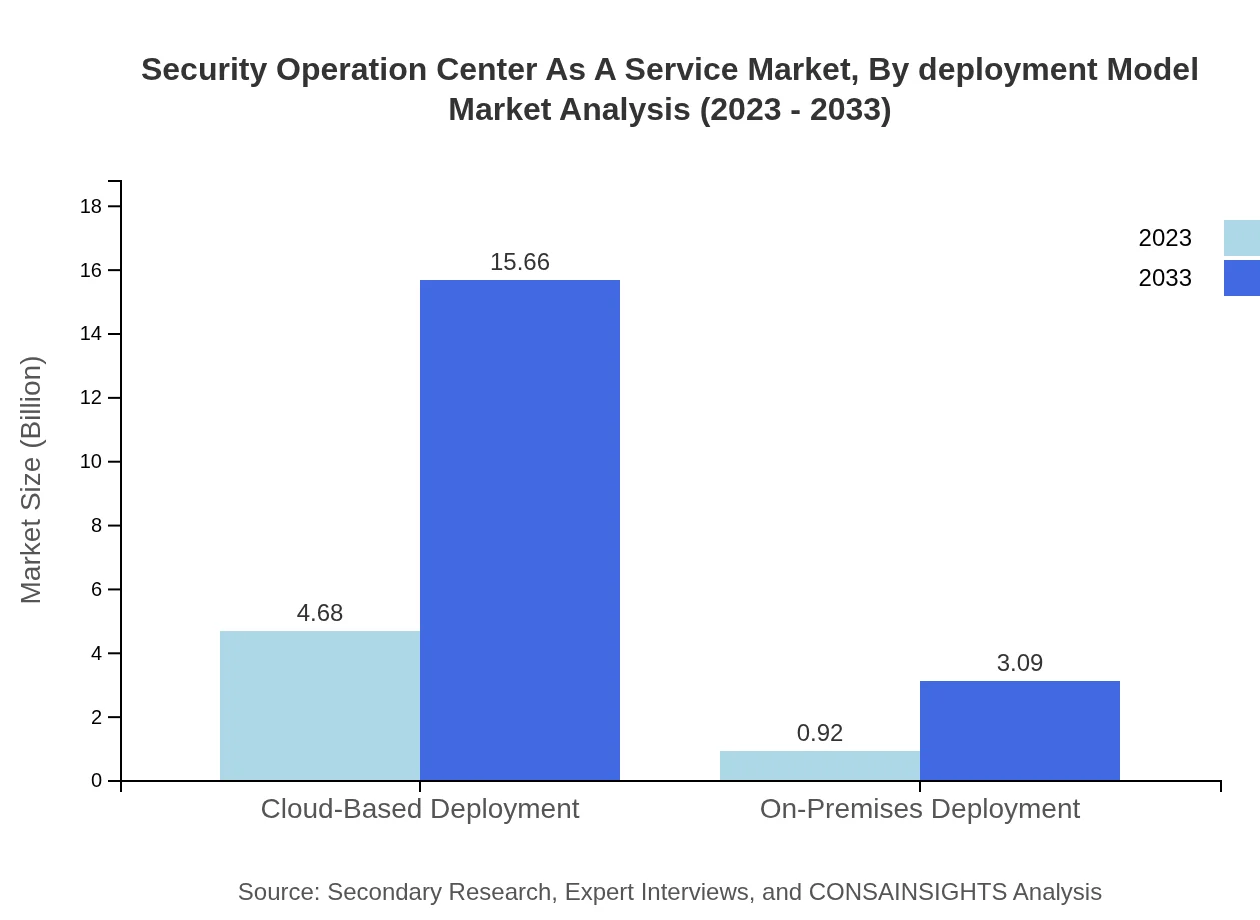

Security Operation Center As A Service Market Analysis By Deployment Model

The deployment model shows a clear preference for cloud-based solutions with expected growth from USD 4.68 billion in 2023 to USD 15.66 billion by 2033. This surge is attributed to the flexibility and scalability offered by cloud platforms, while on-premises deployment is projected to grow from USD 0.92 billion to USD 3.09 billion, indicating a stable but slower growth due to traditional adoption concerns.

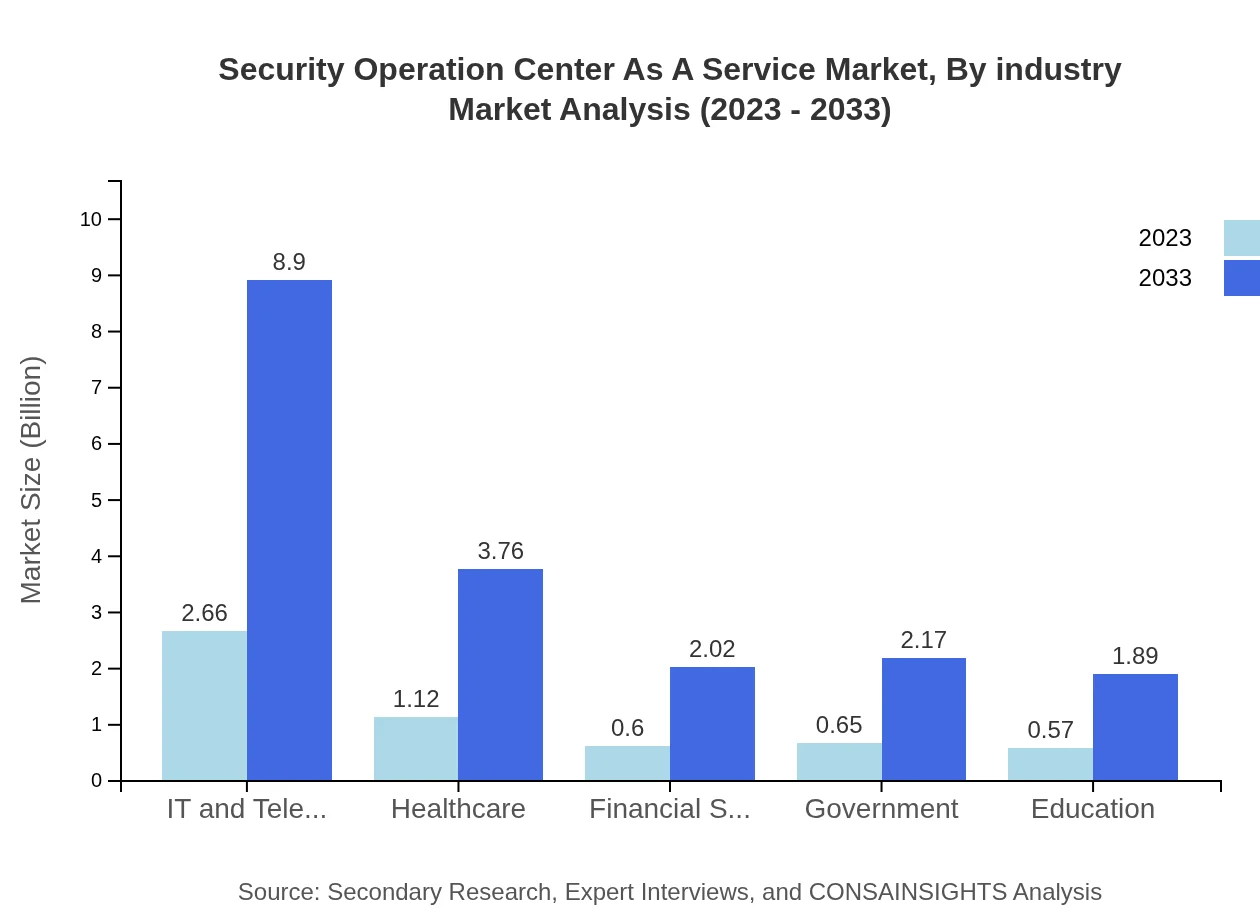

Security Operation Center As A Service Market Analysis By Industry

In healthcare, the market size is expected to rise from USD 1.12 billion to USD 3.76 billion, driven by stringent data protection regulations. The Financial Services sector will see growth from USD 0.60 billion to USD 2.02 billion focusing on fraud prevention and threat detection, while the Government sector is projected to expand from USD 0.65 billion to USD 2.17 billion, particularly focusing on national security initiatives.

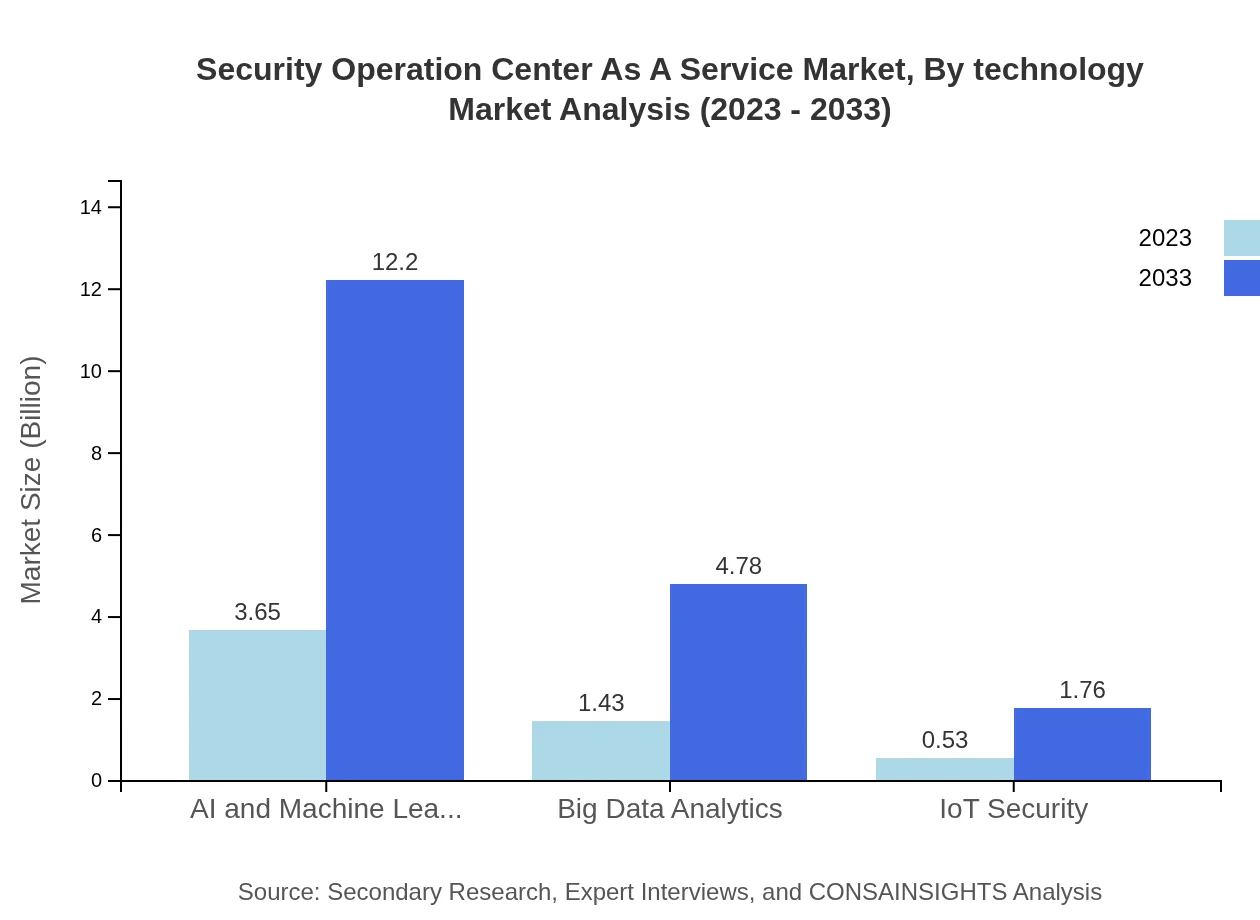

Security Operation Center As A Service Market Analysis By Technology

AI and Machine Learning technologies underpin a significant part of the SOC as a Service model, growing from USD 3.65 billion to USD 12.20 billion by 2033. Innovations in Big Data analytics and IoT security also play crucial roles, highlighting a trend toward proactive incident management and threat detection.

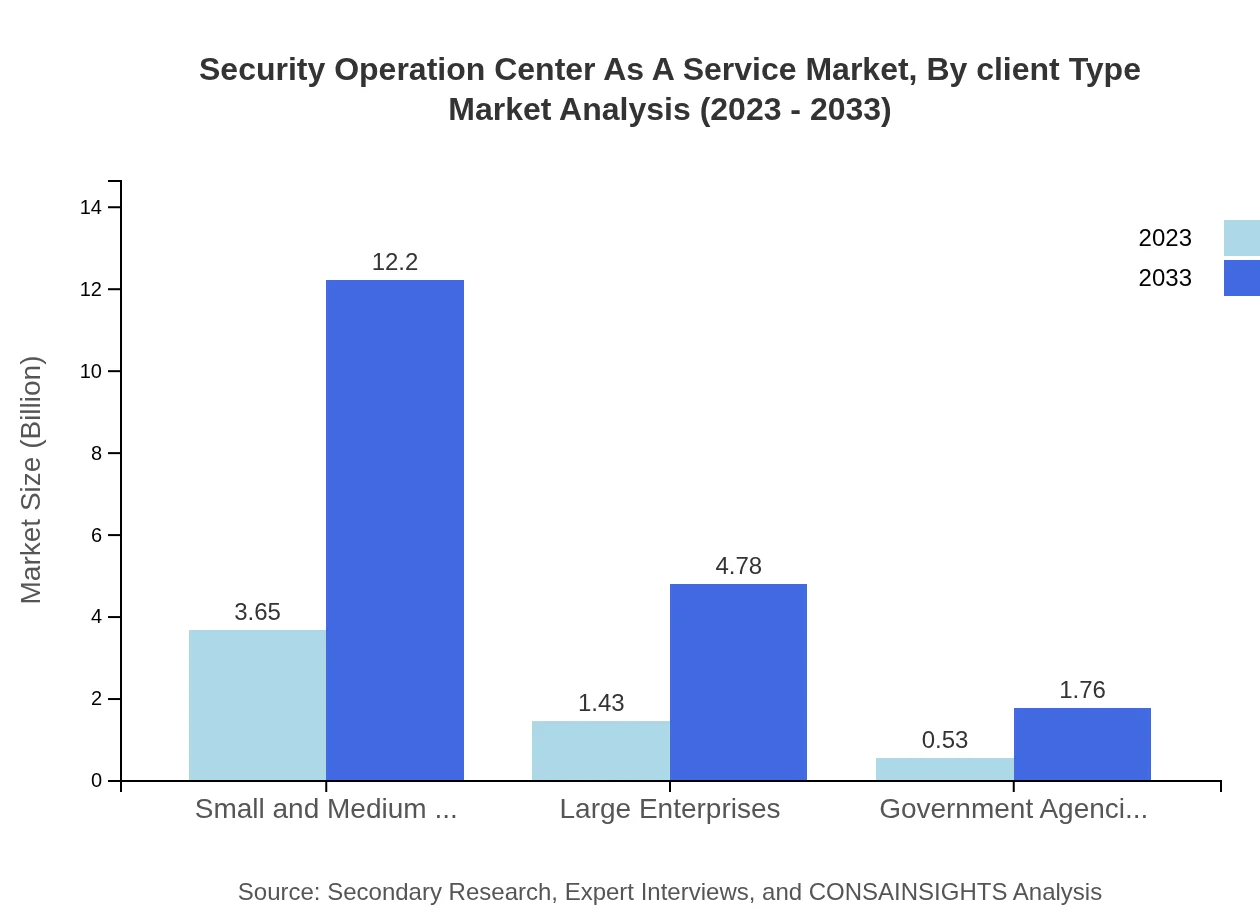

Security Operation Center As A Service Market Analysis By Client Type

SMBs represent a substantial share, growing from USD 3.65 billion to USD 12.20 billion by 2033, indicating a robust trend of increased cybersecurity investment among smaller enterprises. In contrast, the segment for large enterprises sees growth from USD 1.43 billion to USD 4.78 billion, reflecting the ongoing prioritization of cybersecurity among major players.

Security Operation Center As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Operation Center As A Service Industry

IBM Security:

IBM Security provides an extensive portfolio of cybersecurity solutions including managed security services that help organizations protect data and comply with regulations.Cisco Systems, Inc.:

Cisco offers a range of cybersecurity solutions, including SOC services that leverage their networking equipment to enhance security operations.Secureworks:

Secureworks specializes in cybersecurity threat detection and response, providing SOC services that help organizations secure their digital assets.AT&T Cybersecurity:

AT&T Cybersecurity offers a comprehensive suite of SOC services using AI-driven analytics to improve threat detection and mitigation.McAfee Corp.:

McAfee provides advanced security solutions, including SOC as a Service, focusing on endpoint security and threat intelligence.We're grateful to work with incredible clients.

FAQs

What is the market size of security Operation Center As A Service?

The global market size for Security Operation Center as a Service (SOCaaS) is projected to reach approximately $5.6 billion by 2033, with a robust CAGR of 12.3%. This growth will reflect the increasing demand for cybersecurity solutions across various sectors.

What are the key market players or companies in this security Operation Center As A Service industry?

The key market players in the Security Operation Center as a Service industry include prominent cybersecurity firms and service providers that specialize in managed security services and cloud solutions, ensuring comprehensive security strategies to clients across multiple sectors.

What are the primary factors driving the growth in the security Operation Center As A Service industry?

Growth in the SOCaaS industry is driven by the rising cyber threats, increasing adoption of cloud computing, regulatory compliance requirements, and the necessity for 24/7 monitoring services, allowing organizations to effectively manage security operations.

Which region is the fastest Growing in the security Operation Center As A Service?

The fastest-growing region for SOCaaS is North America, expected to reach approximately $6.57 billion by 2033. Other rapidly growing regions include Europe and Asia Pacific, driven by rising investments in cybersecurity infrastructure.

Does ConsaInsights provide customized market report data for the security Operation Center As A Service industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients interested in detailed analyses and insights within the SOCaaS sector, ensuring they receive relevant and actionable information.

What deliverables can I expect from this security Operation Center As A Service market research project?

From a SOCaaS market research project, expect comprehensive reports, data on market trends, competitive analysis, segment performance, regional insights, and detailed forecasts, providing a well-rounded understanding of the industry landscape.

What are the market trends of security Operation Center As A Service?

Current trends in the SOCaaS market include increasing investment in AI and machine learning technologies, the shift toward cloud-based deployments, enhanced focus on operational resilience, and rising demand for incident response services among businesses.