Security Orchestration And Automation Soar

Published Date: 31 January 2026 | Report Code: security-orchestration-and-automation-soar

Security Orchestration And Automation Soar Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers the dynamic landscape of the Security Orchestration And Automation Soar market, providing deep insights into current trends, market size and growth projections, regional dynamics, and segmentation analysis. The forecast period spans from 2024 to 2033, offering valuable data-driven perspectives and strategic foresight for stakeholders.

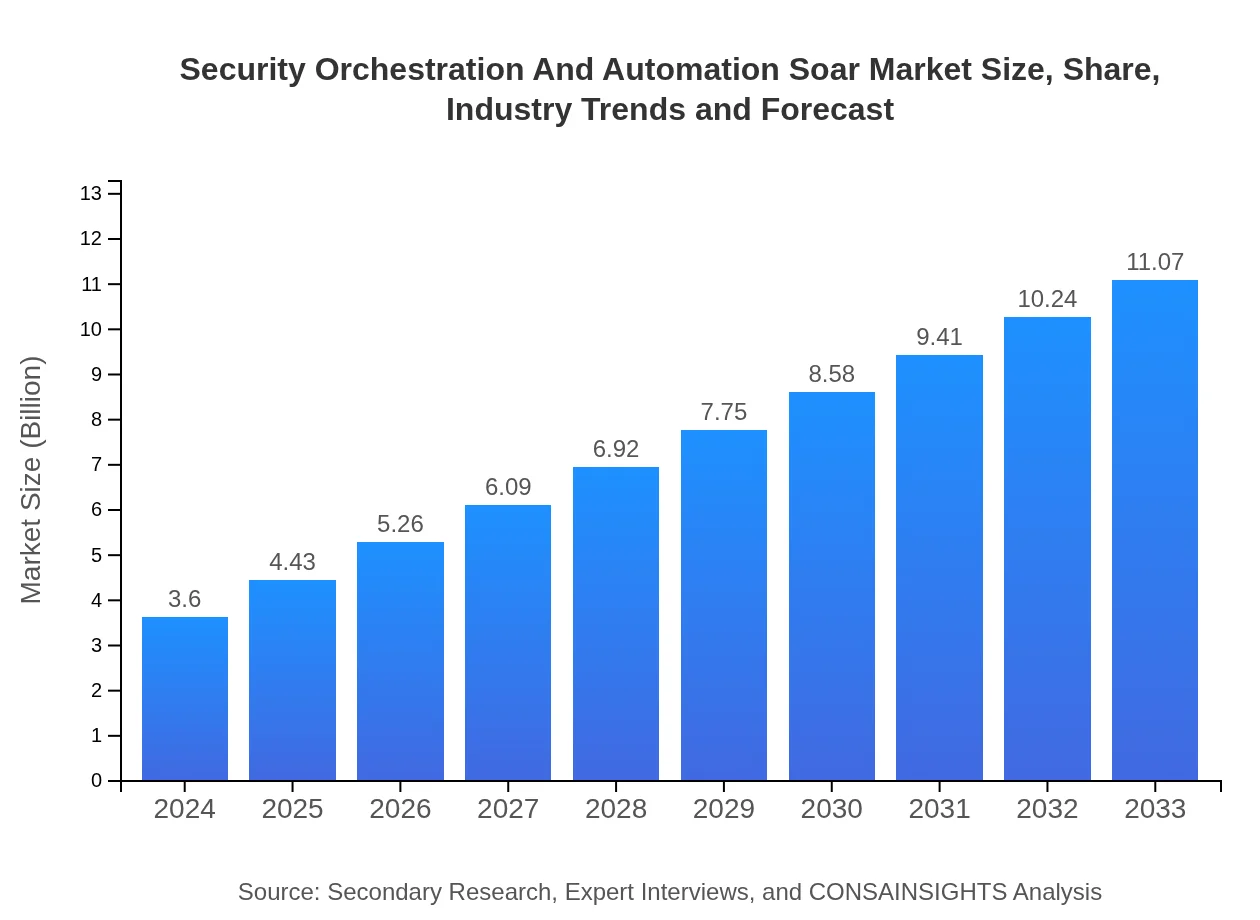

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.60 Billion |

| CAGR (2024-2033) | 12.7% |

| 2033 Market Size | $11.07 Billion |

| Top Companies | CyberSecure Innovations, SecureX Technologies, FortGuard Systems, NextGen Cyber Defense |

| Last Modified Date | 31 January 2026 |

Security Orchestration And Automation Soar Market Overview

Customize Security Orchestration And Automation Soar market research report

- ✔ Get in-depth analysis of Security Orchestration And Automation Soar market size, growth, and forecasts.

- ✔ Understand Security Orchestration And Automation Soar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Orchestration And Automation Soar

What is the Market Size & CAGR of Security Orchestration And Automation Soar market in 2024?

Security Orchestration And Automation Soar Industry Analysis

Security Orchestration And Automation Soar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Orchestration And Automation Soar Market Analysis Report by Region

Europe Security Orchestration And Automation Soar:

Europe boasts a mature market with widespread adoption of advanced security orchestration tools. Starting with a 2024 market value of $1.17 Billion, the market is projected to advance to $3.60 Billion by 2033. European organizations are at the forefront of implementing integrated security frameworks that combine policy-making, technology upgrades, and robust compliance mandates. The progressive regulatory environment along with growing investments in cyber defense initiatives plays a significant role in driving market expansion. Collaborative efforts between the public and private sectors further catalyze the adoption of innovative SOAR solutions across the continent.Asia Pacific Security Orchestration And Automation Soar:

The Asia Pacific region is emerging as a dynamic growth driver in the SOAR market, with rising cybersecurity concerns and increasing digital transformation across industries. In 2024, the market was estimated at $0.68 Billion and is projected to expand to $2.08 Billion by 2033. Rapid urbanization, increased internet penetration, and aggressive investments in IT infrastructure are pivotal factors contributing to this growth. Companies in this region are increasingly leveraging automated security solutions, spurred by both governmental initiatives and private sector demand for streamlined operational efficiency.North America Security Orchestration And Automation Soar:

North America continues to be a leader in the SOAR market, with its robust technological infrastructure and heightened awareness of cybersecurity threats. The region recorded a market size of $1.22 Billion in 2024, expected to soar to $3.76 Billion by 2033. Enhanced threat intelligence systems, coupled with significant investments in digital security, are major growth catalysts. North American businesses are adopting cutting-edge automation solutions to streamline operations, mitigate risks, and comply with strict regulatory frameworks, securing its position as a key market segment.South America Security Orchestration And Automation Soar:

South America is witnessing an accelerated pace of adoption for SOAR solutions, though its market remains relatively nascent compared to other regions. In 2024, the market size was about $0.25 Billion, with expectations to grow to $0.78 Billion by 2033. Increased focus on cybersecurity amid rising digitalization and a greater need for integrated incident response systems are driving this progressive market scenario. Emerging local vendors along with partnerships with international technology providers further reinforce the region's potential.Middle East & Africa Security Orchestration And Automation Soar:

The Middle East and Africa region is gradually emerging as a promising market for SOAR solutions. In 2024, the market size stood at approximately $0.27 Billion, with forecasts projecting growth to around $0.84 Billion by 2033. Rapid advancements in digital transformation, coupled with increasing cyber threats, are prompting both governments and enterprises in this region to adopt automated security measures. Investments in infrastructure and a growing focus on modernizing legacy systems enhance the regional prospects, providing a fertile ground for the adoption of advanced security orchestration solutions.Tell us your focus area and get a customized research report.

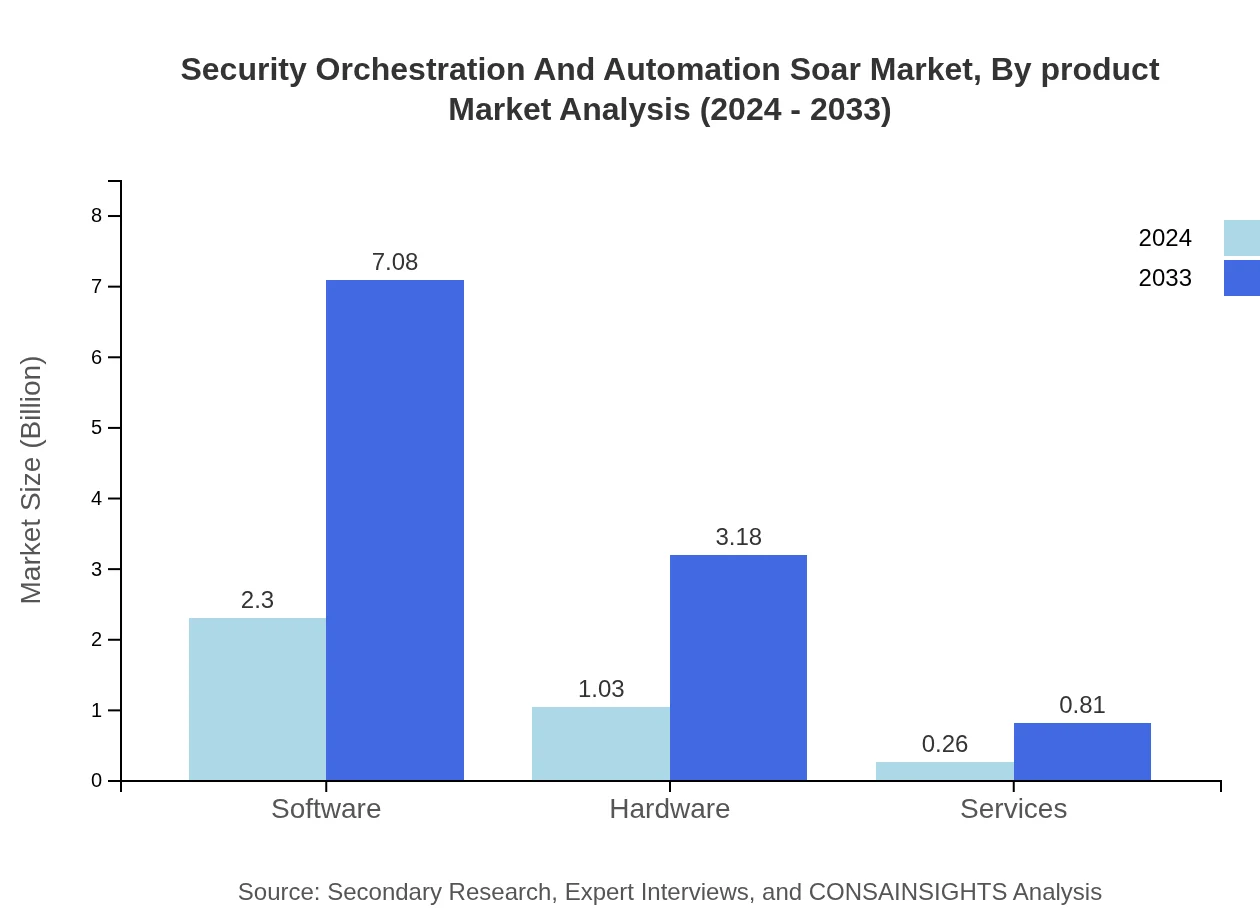

Security Orchestration And Automation Soar Market Analysis By Product

The by-product segmentation of the SOAR market is segmented into three primary groups: software, hardware, and services. For the software segment, 2024 saw a market size of $2.30 Billion growing to $7.08 Billion by 2033, capturing a constant market share of 63.94%. Hardware follows with a market size increase from $1.03 Billion in 2024 to $3.18 Billion in 2033, maintaining a share of 28.72%. Meanwhile, the services segment, albeit smaller, grew from $0.26 Billion to $0.81 Billion while keeping a steady share of 7.34%. These figures indicate a robust evolution in product innovation and customer preference, with software leading due to its flexibility and scalable deployment.

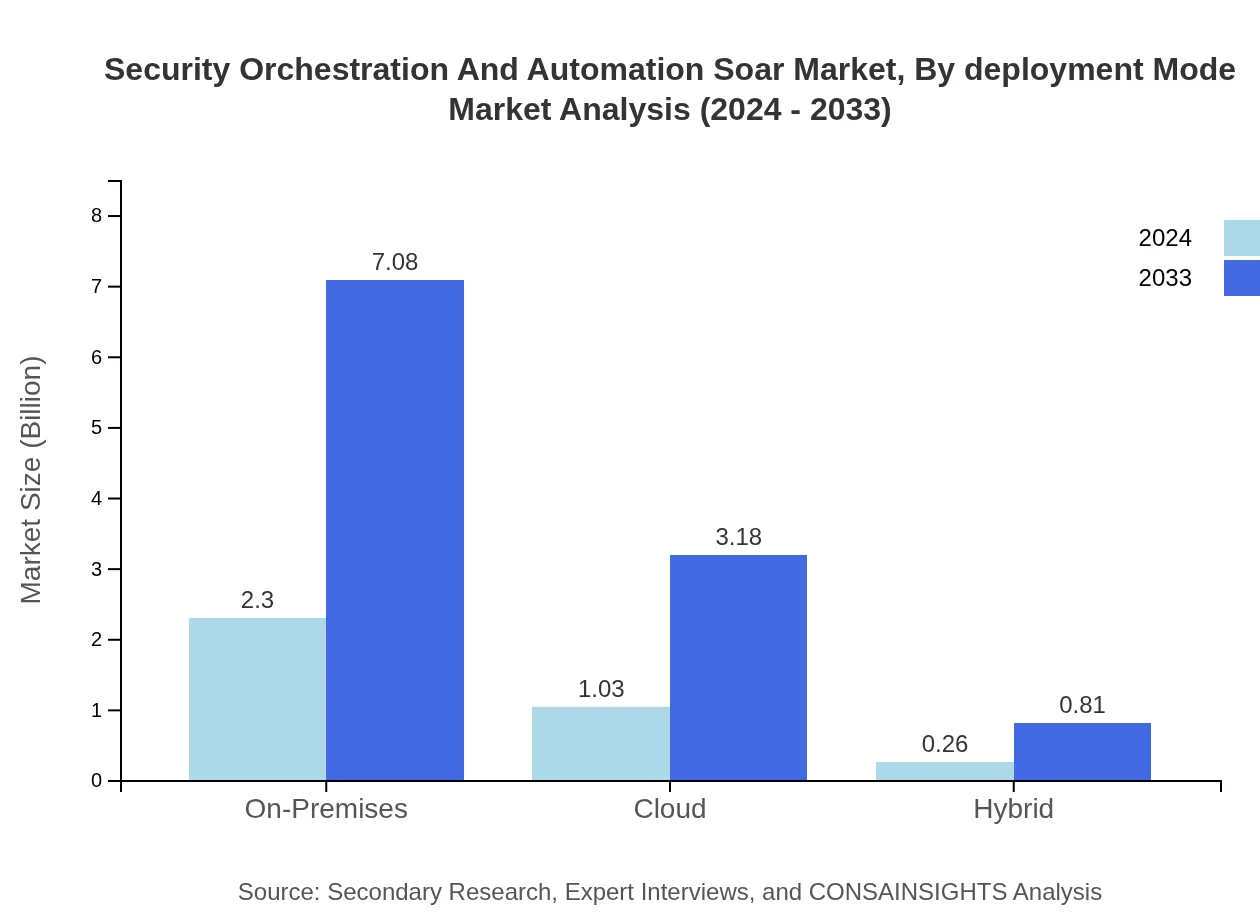

Security Orchestration And Automation Soar Market Analysis By Deployment Mode

The deployment mode analysis within the SOAR market differentiates between on-premises, cloud, and hybrid solutions. In 2024, on-premises solutions accounted for a market size of $2.30 Billion with a market share of 63.94%, which is projected to increase significantly by 2033 to $7.08 Billion. Cloud-based deployments similarly are on an upward trajectory, demonstrating strong performance and user confidence, as evidenced by recent investments in cloud infrastructure. Hybrid deployment options continue to gain traction, offering a balanced approach that accommodates both the security demands of on-premises systems and the flexibility of cloud services. The evolving trends demonstrate a clear industry shift towards integrated, multi-deployment strategies.

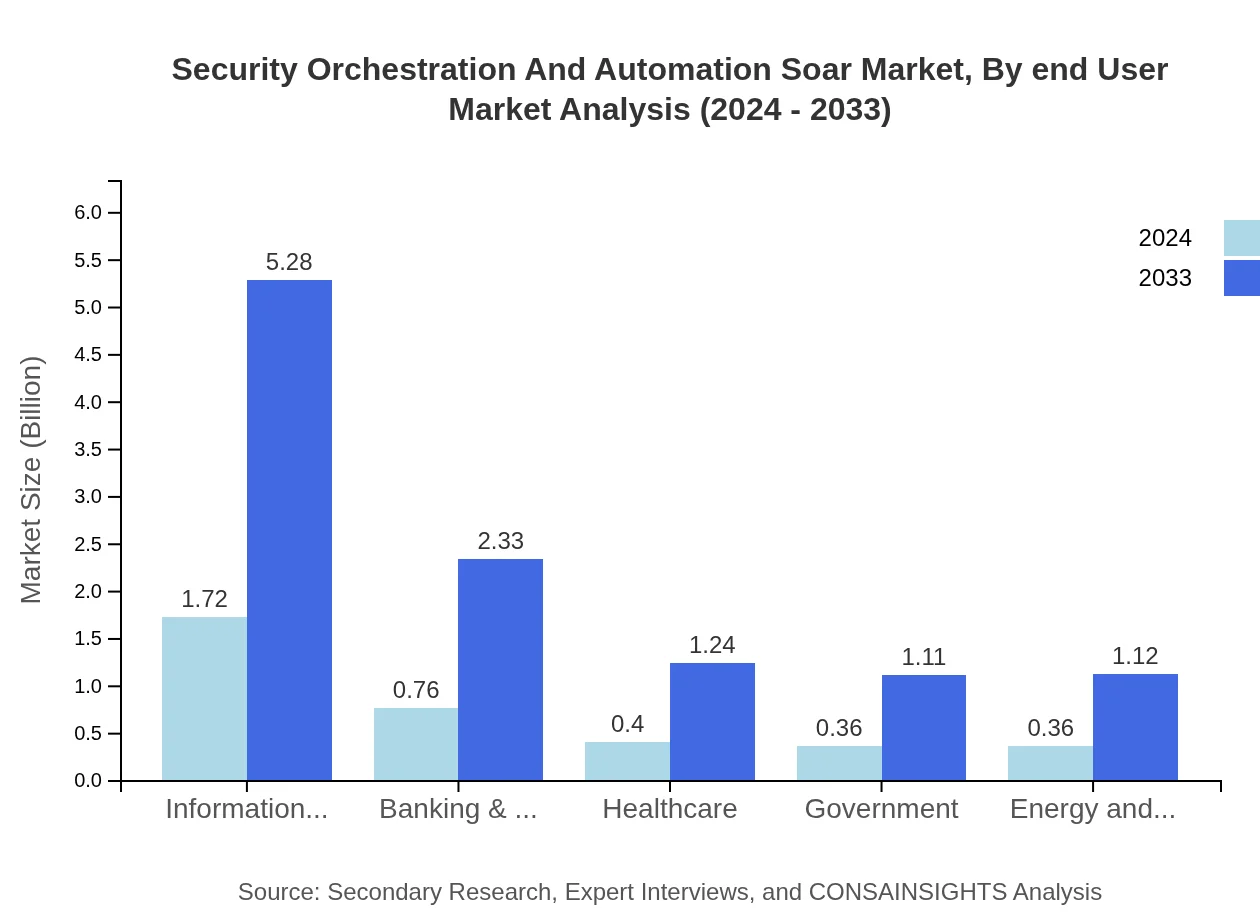

Security Orchestration And Automation Soar Market Analysis By End User

From the perspective of end-users, the SOAR market is segmented by industry verticals such as Information Technology, Banking & Financial Services, Healthcare, Government, and Energy and Utilities. The Information Technology sector commands the highest share, with a market size growing from $1.72 Billion in 2024 to $5.28 Billion in 2033, representing 47.68% of the total market. Banking & Financial Services continue to invest heavily in security automation, followed by Healthcare, Government, and Energy and Utilities, all of which are adopting these solutions to mitigate risks and streamline security operations. These trends emphasize the critical role of SOAR in supporting a diverse range of industries faced with unique cybersecurity challenges.

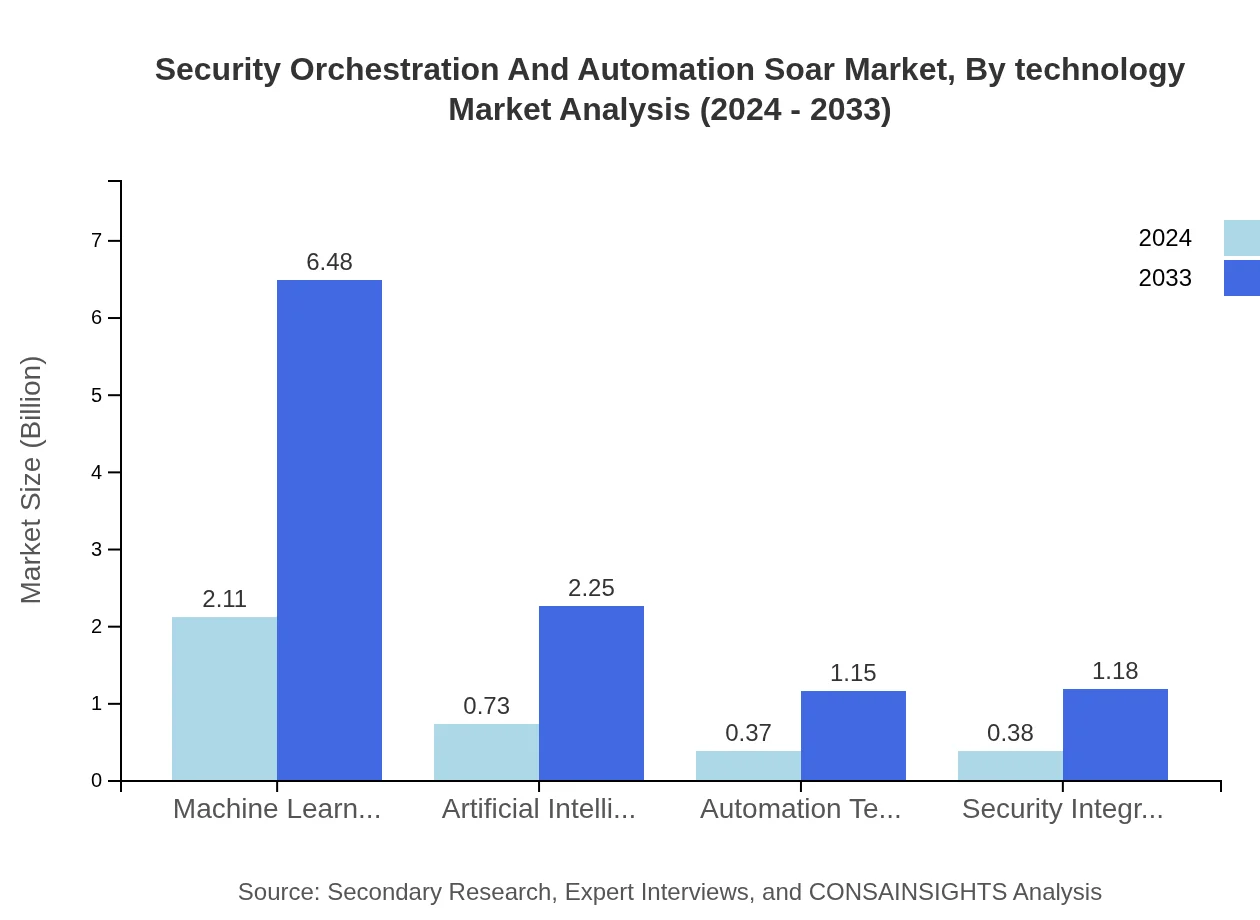

Security Orchestration And Automation Soar Market Analysis By Technology

The technology segmentation within the SOAR market highlights the impact of innovations such as Machine Learning, Artificial Intelligence, Automation Techniques, and Security Integration. Machine Learning exhibits robust growth with its market size expanding from $2.11 Billion in 2024 to $6.48 Billion in 2033, capturing 58.54% of the technology segment. Artificial Intelligence continues to be a pivotal part of improving threat detection and response, growing from $0.73 Billion to $2.25 Billion with a steady share of 20.36%. Automation techniques and security integration also maintain consistent shares of 10.41% and 10.69% respectively, driving transformative changes in the way security operations are executed. These technological advancements are critical in shaping the future of automation in security.

Security Orchestration And Automation Soar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Orchestration And Automation Soar Industry

CyberSecure Innovations:

CyberSecure Innovations is a leading provider of SOAR solutions, renowned for integrating advanced analytics and AI-driven threat intelligence to deliver comprehensive cybersecurity defense systems. Their innovative platforms have set new benchmarks in automated incident response.SecureX Technologies:

SecureX Technologies stands at the forefront of the SOAR industry, offering cutting-edge security orchestration platforms designed to seamlessly integrate with existing IT infrastructures. Their robust solutions empower enterprises to mitigate cyber threats efficiently.FortGuard Systems:

FortGuard Systems has made significant contributions in the field of automated security solutions. Specializing in hybrid deployment models that merge on-premises reliability with cloud flexibility, the company is recognized for its strategic approach to cybersecurity automation.NextGen Cyber Defense:

NextGen Cyber Defense delivers innovative SOAR solutions that leverage machine learning and automation to enhance incident response and risk management. Their commitment to continuous improvement and research has positioned them as a trusted global market leader.We're grateful to work with incredible clients.