Security Paper Market Report

Published Date: 02 February 2026 | Report Code: security-paper

Security Paper Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Security Paper market from 2023 to 2033. Key insights include market size, growth projections, trends, and regional analyses, offering valuable data for stakeholders in the Security Paper industry.

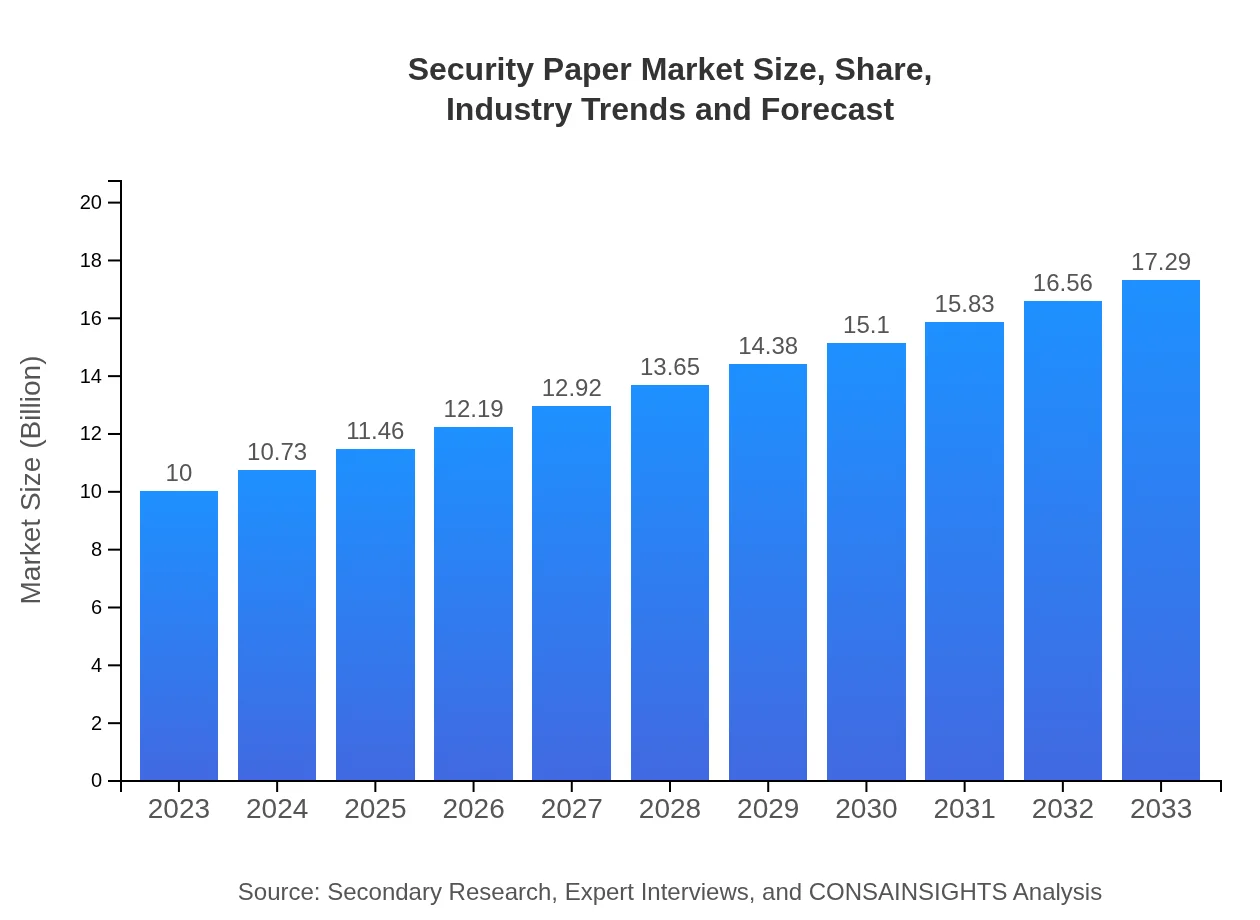

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $17.29 Billion |

| Top Companies | Mitsubishi Paper Mills Limited, Crane & Co., Giesecke+Devrient, De La Rue, Avery Dennison Corporation |

| Last Modified Date | 02 February 2026 |

Security Paper Market Overview

Customize Security Paper Market Report market research report

- ✔ Get in-depth analysis of Security Paper market size, growth, and forecasts.

- ✔ Understand Security Paper's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Paper

What is the Market Size & CAGR of Security Paper market in 2023?

Security Paper Industry Analysis

Security Paper Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Paper Market Analysis Report by Region

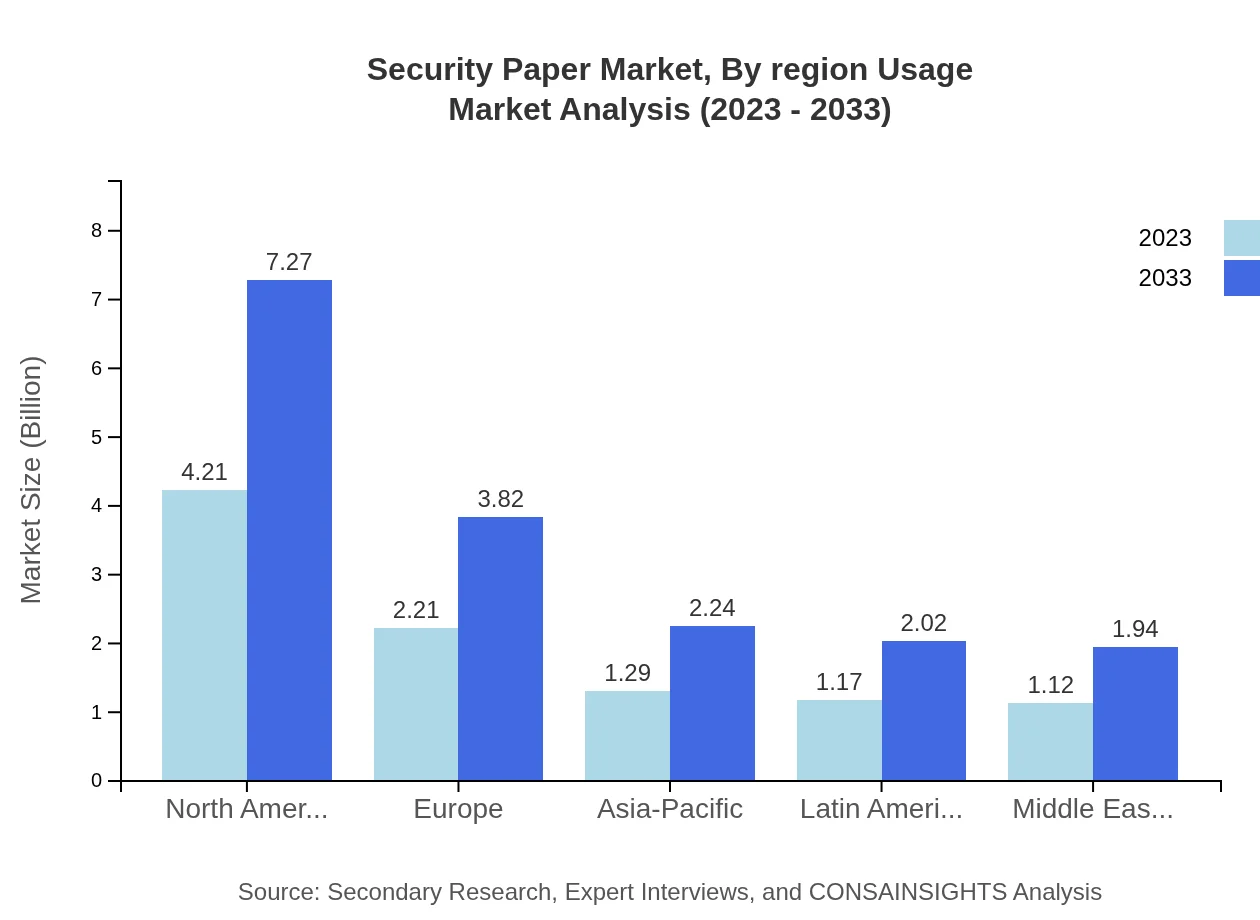

Europe Security Paper Market Report:

In Europe, the market is set to expand from $2.42 billion in 2023 to $4.19 billion in 2033. The European market benefits from high regulatory standards and increasing security concerns among consumers, leading to enhanced demand for secure documentation in banks and government institutions.Asia Pacific Security Paper Market Report:

The Asia-Pacific region is projected to grow from $2.04 billion in 2023 to $3.53 billion by 2033, showcasing a rising demand driven by economic growth and technological advancements in security solutions. The increasing number of counterfeit cases is prompting both governments and businesses to invest more in secure documentation.North America Security Paper Market Report:

North America, valued at $3.81 billion in 2023, is anticipated to reach $6.59 billion by 2033. This growth is propelled by the advanced technological landscape and the stringent regulations surrounding secure documents. The U.S. government initiatives focusing on combating identity theft and fraud are key drivers.South America Security Paper Market Report:

In South America, the Security Paper market is expected to grow from $0.89 billion in 2023 to $1.55 billion in 2033, with an emphasis on enhancing domestic security measures and authentication processes across various sectors. Brazil and Argentina lead the market due to governmental reforms aimed at reducing fraud.Middle East & Africa Security Paper Market Report:

The Middle East and Africa region is expected to grow from $0.83 billion in 2023 to $1.43 billion in 2033. This increase can be attributed to rising investments in infrastructure and security initiatives by governmental bodies, alongside the growing demand for secure identification documents and financial transactions.Tell us your focus area and get a customized research report.

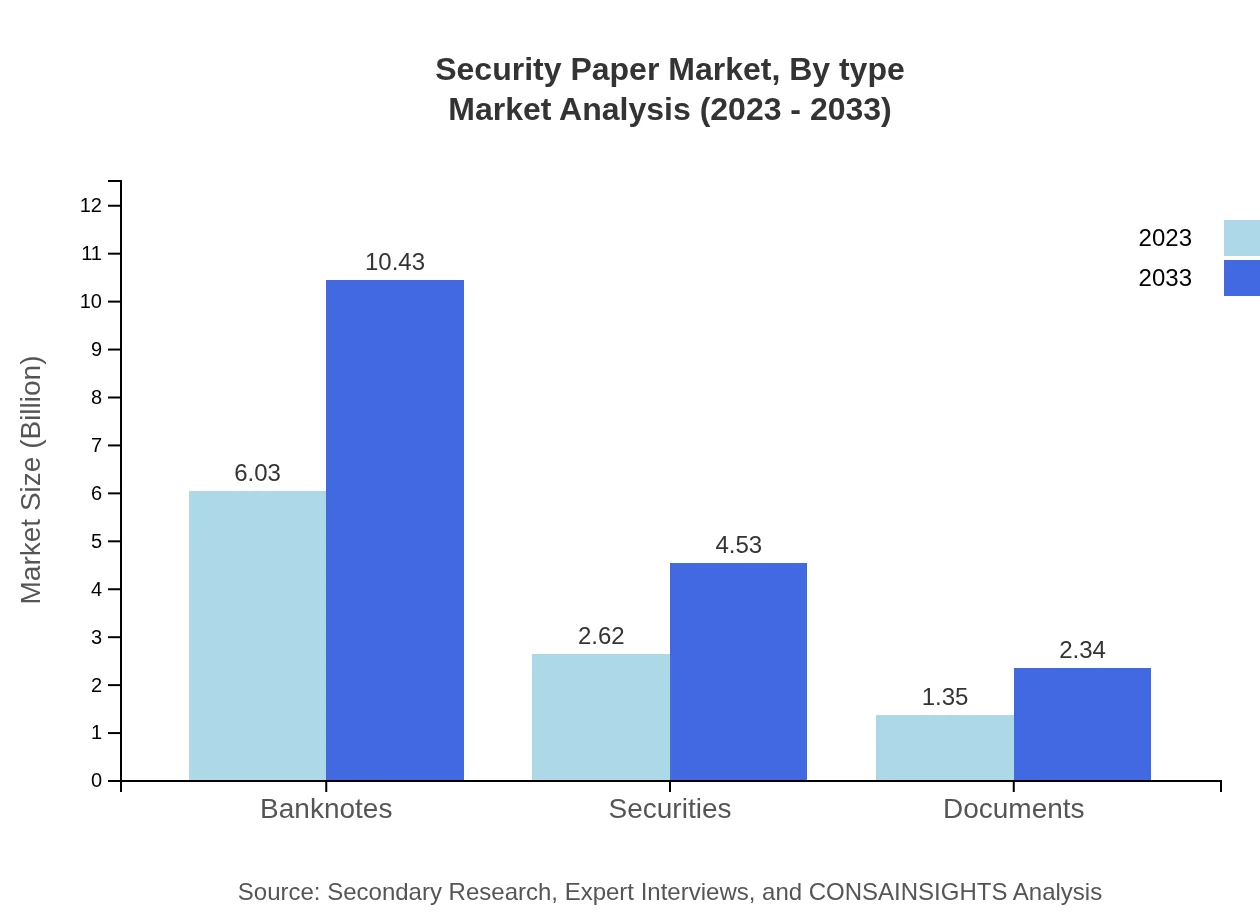

Security Paper Market Analysis By Type

Banknotes dominate the market, contributing significantly to overall revenue due to their necessity in daily transactions. In 2023, the banknotes segment accounted for a market size of $6.03 billion, with an expected size of $10.43 billion by 2033. Additionally, security features also hold a prominent position, reflecting a substantial market size due to their criticality in preventing counterfeiting.

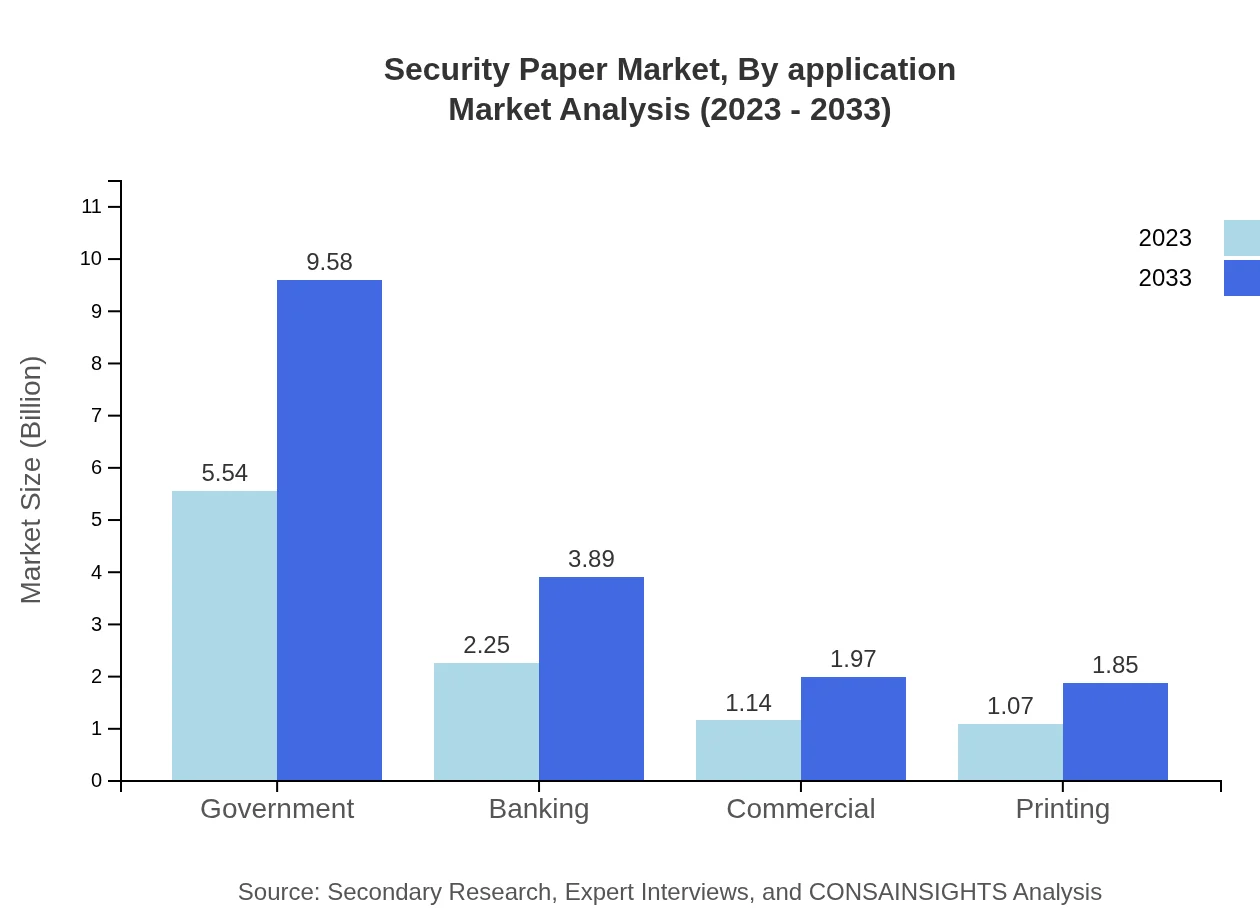

Security Paper Market Analysis By Application

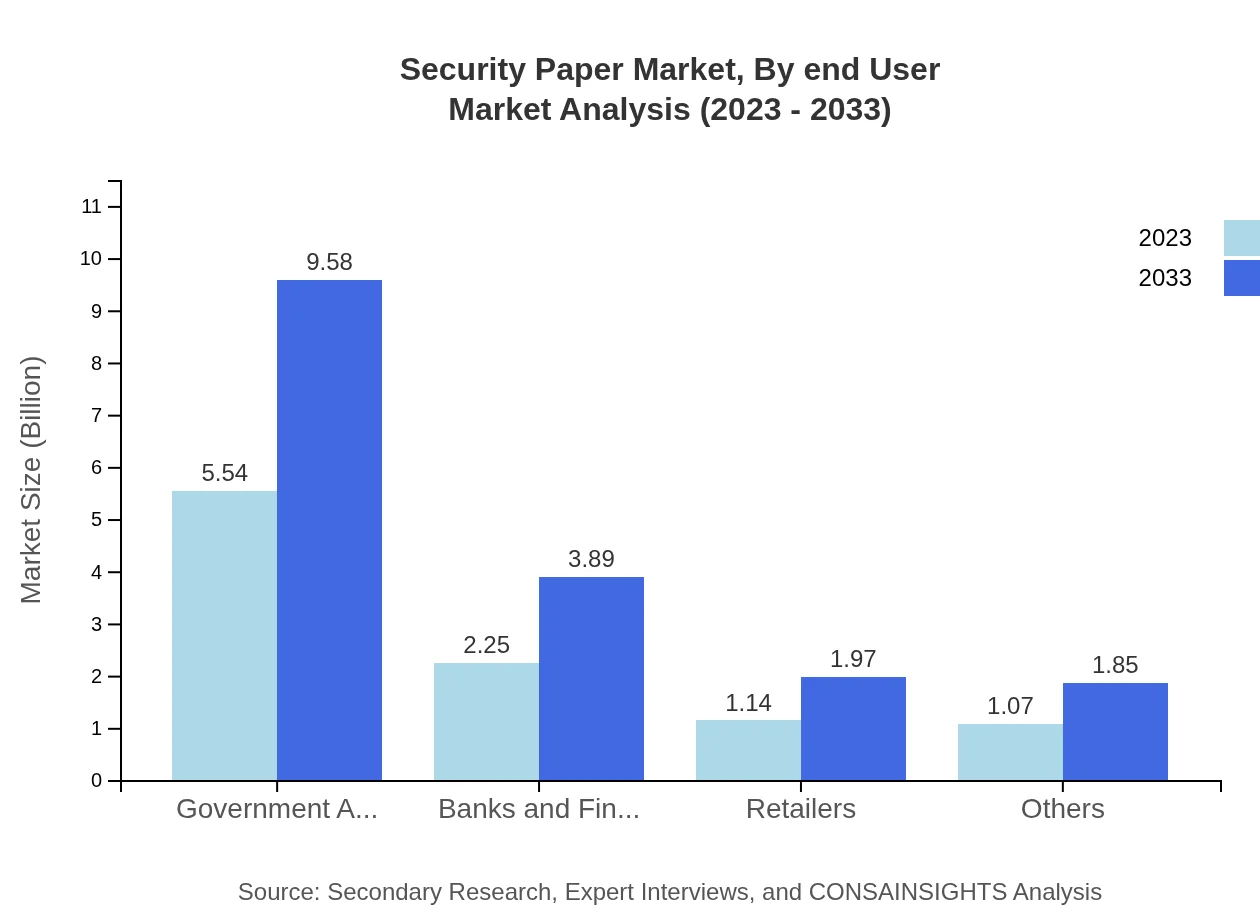

The Government Agencies segment showcases the largest share due to various government initiatives requiring highly secure documents, holding $5.54 billion in 2023 and rising to $9.58 billion by 2033. This is closely followed by Banks and Financial Institutions, which also demonstrate robust growth driven by evolving needs for secure transactions.

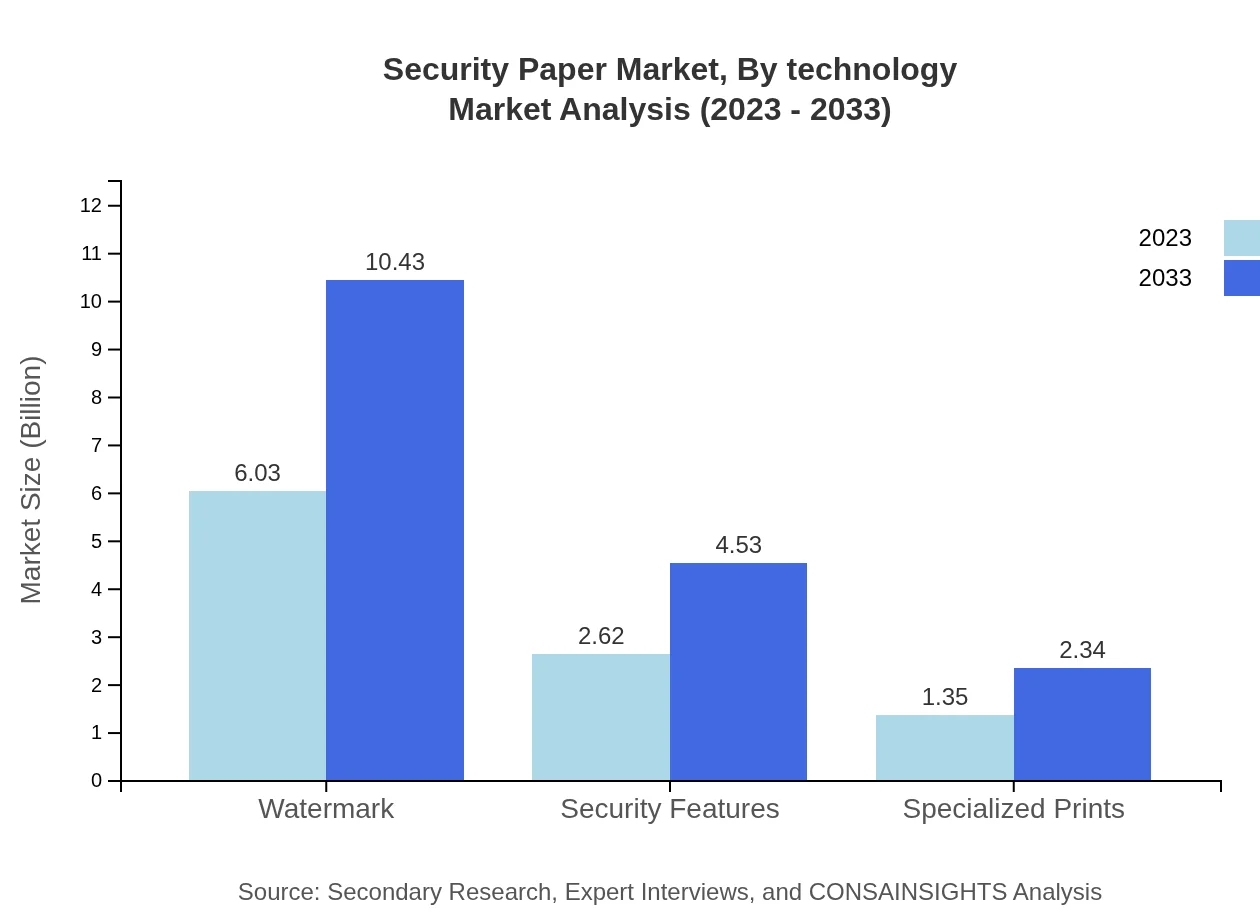

Security Paper Market Analysis By Technology

Technological advancements are pivotal in producing advanced security papers, including techniques such as co-extrusion and holographic features. The emphasis on developing environmentally friendly production techniques is also becoming prevalent, responding to global sustainability goals.

Security Paper Market Analysis By End User

The largest end-user segment is Government Agencies, which necessitate high-security papers for documentation. Following closely are Banks and Financial Institutions that are also investing heavily in secure identification and transaction solutions as a direct response to increasing fraudulent activities.

Security Paper Market Analysis By Region Usage

North America leads in usage, attributed to a mature market landscape and stringent regulations. Europe follows closely, with a strong market presence driven by high-security standards. The Asia-Pacific region, however, offers significant growth potential as economic activities increase.

Security Paper Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Paper Industry

Mitsubishi Paper Mills Limited:

A leading manufacturer of security paper, Mitsubishi focuses on innovations in paper technology and provides a broad range of secure products.Crane & Co.:

Recognized for its high-quality paper products, Crane & Co. offers various security papers, including banknote and check stock.Giesecke+Devrient:

Specializing in cash management and security technology, Giesecke+Devrient leads the market in delivering advanced currencies and secure identification solutions.De La Rue:

A prestigious player in the security printing and paper industry, De La Rue excels in producing highly secure documents and banknotes.Avery Dennison Corporation:

Avery Dennison delivers a wide range of security and labeling solutions, focusing on innovations in protective technology.We're grateful to work with incredible clients.

FAQs

What is the market size of security Paper?

The global security paper market is projected to reach approximately $10 billion by 2033, growing from its current size with a CAGR of 5.5%. This growth reflects increasing demand for secure document solutions worldwide.

What are the key market players or companies in the security Paper industry?

Key players in the security paper market include top manufacturers specializing in anti-counterfeit technologies, document security solutions, and advanced printing methods. These companies continuously innovate to meet the rising security needs.

What are the primary factors driving the growth in the security paper industry?

The growth of the security paper industry is driven by rising counterfeiting issues globally, increasing demand for secure transactions, and the need for reliable documentation in banking, government, and related sectors.

Which region is the fastest Growing in the security Paper market?

The North America region is expected to be the fastest-growing area in the security paper market, with growth projections increasing from $3.81 billion in 2023 to $6.59 billion by 2033, driven by high security demands.

Does ConsaInsights provide customized market report data for the security Paper industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the security-paper industry, ensuring detailed insights into market trends and competitor strategies.

What deliverables can I expect from this security Paper market research project?

From the security paper market research project, clients can expect comprehensive reports, market forecasts, competitive analysis, regional insights, and segment data that provide a thorough understanding of the industry landscape.

What are the market trends of security Paper?

Current trends in the security paper market include increased adoption of advanced printing technologies, integration of digital security features, and a focus on sustainable materials, aligning with global movements toward eco-friendly practices.