Security Screening Market Report

Published Date: 31 January 2026 | Report Code: security-screening

Security Screening Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Security Screening market, detailing market size, growth trends, segment insights, regional performances, and forecasts from 2023 to 2033. It highlights critical data to assist stakeholders in making informed business decisions.

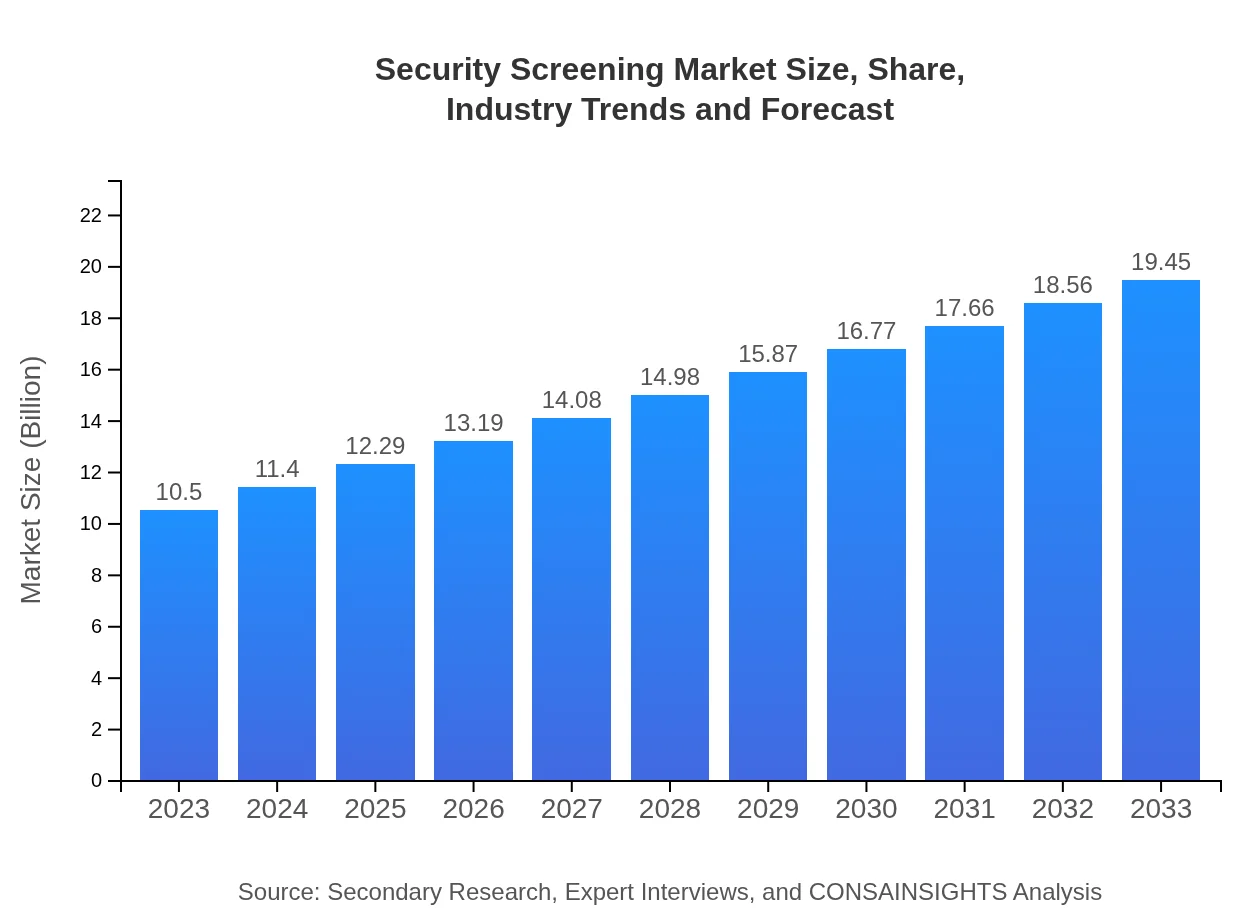

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | Smiths Detection, Leidos Holdings, Inc., L3Harris Technologies |

| Last Modified Date | 31 January 2026 |

Security Screening Market Overview

Customize Security Screening Market Report market research report

- ✔ Get in-depth analysis of Security Screening market size, growth, and forecasts.

- ✔ Understand Security Screening's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Screening

What is the Market Size & CAGR of Security Screening market in 2023?

Security Screening Industry Analysis

Security Screening Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Screening Market Analysis Report by Region

Europe Security Screening Market Report:

The European market stands at USD 3.05 billion in 2023 with projections of USD 5.66 billion by 2033. European regulations focusing on transportation security have enhanced the demand for comprehensive screening solutions.Asia Pacific Security Screening Market Report:

In 2023, the Asia Pacific Security Screening market is valued at USD 1.99 billion, projected to reach USD 3.68 billion by 2033. Growth is driven by increasing investments in security infrastructure and the region's rising air traffic, necessitating enhanced security protocols.North America Security Screening Market Report:

North America leads the Security Screening market with a size of USD 3.89 billion in 2023, forecasted to increase to USD 7.20 billion by 2033. The presence of major airports and federal regulations significantly drives demand in this region.South America Security Screening Market Report:

The South American market, currently valued at USD 0.21 billion in 2023, is expected to grow to USD 0.39 billion by 2033. The region's focus on security for events, coupled with regulatory improvements, supports this growth.Middle East & Africa Security Screening Market Report:

The Middle East and Africa market size reached USD 1.36 billion in 2023, expected to rise to USD 2.52 billion by 2033. Increased security spending and terrorism threats drive the need for robust screening technologies in critical sectors.Tell us your focus area and get a customized research report.

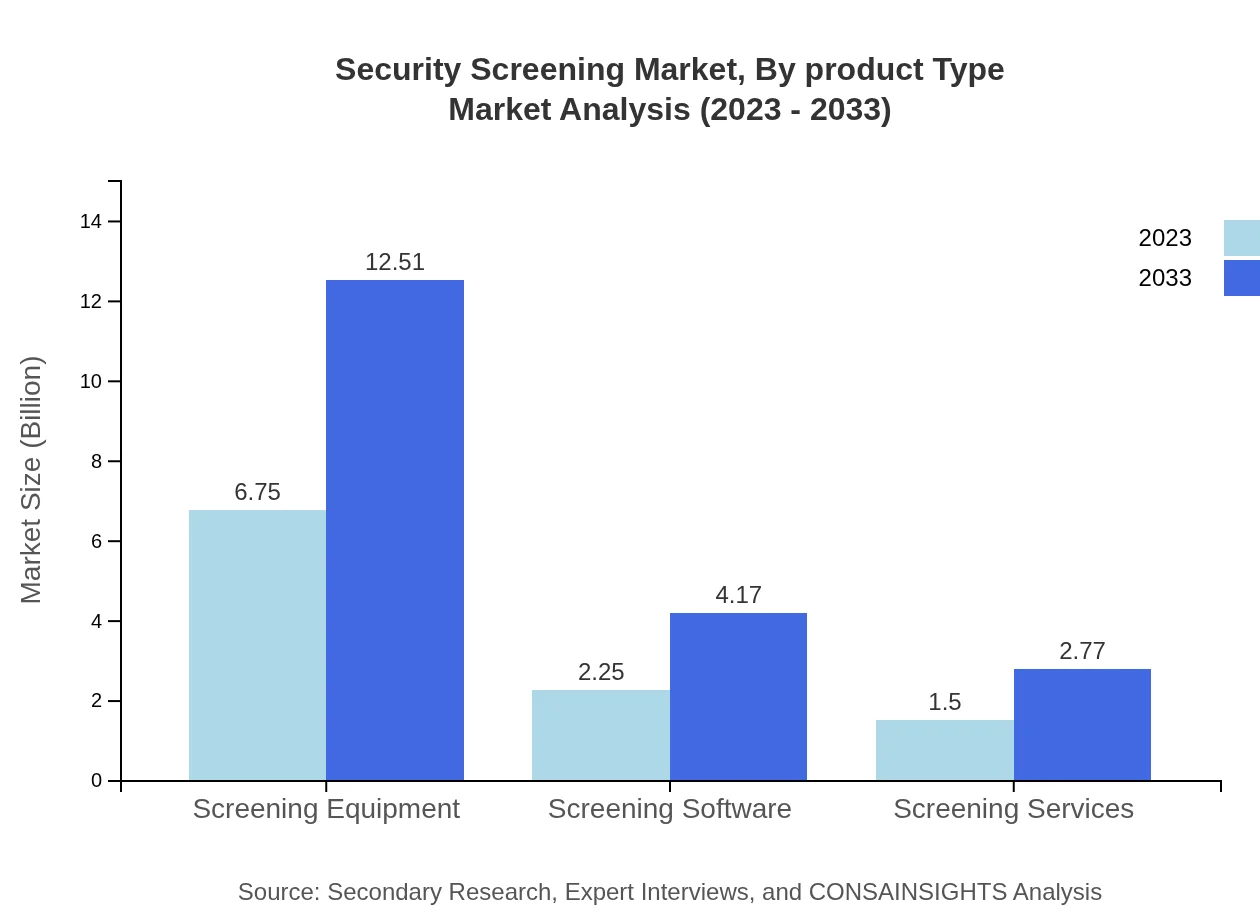

Security Screening Market Analysis By Product Type

The market for Security Screening by product type consists of Screening Equipment, Screening Software, and Screening Services. Screening Equipment, valued at USD 6.75 billion in 2023 and projected to grow to USD 12.51 billion by 2033, dominates the space. Notably, Screening Software and Services also show significant projected growth, reflecting the ongoing digitalization and personalization of security solutions.

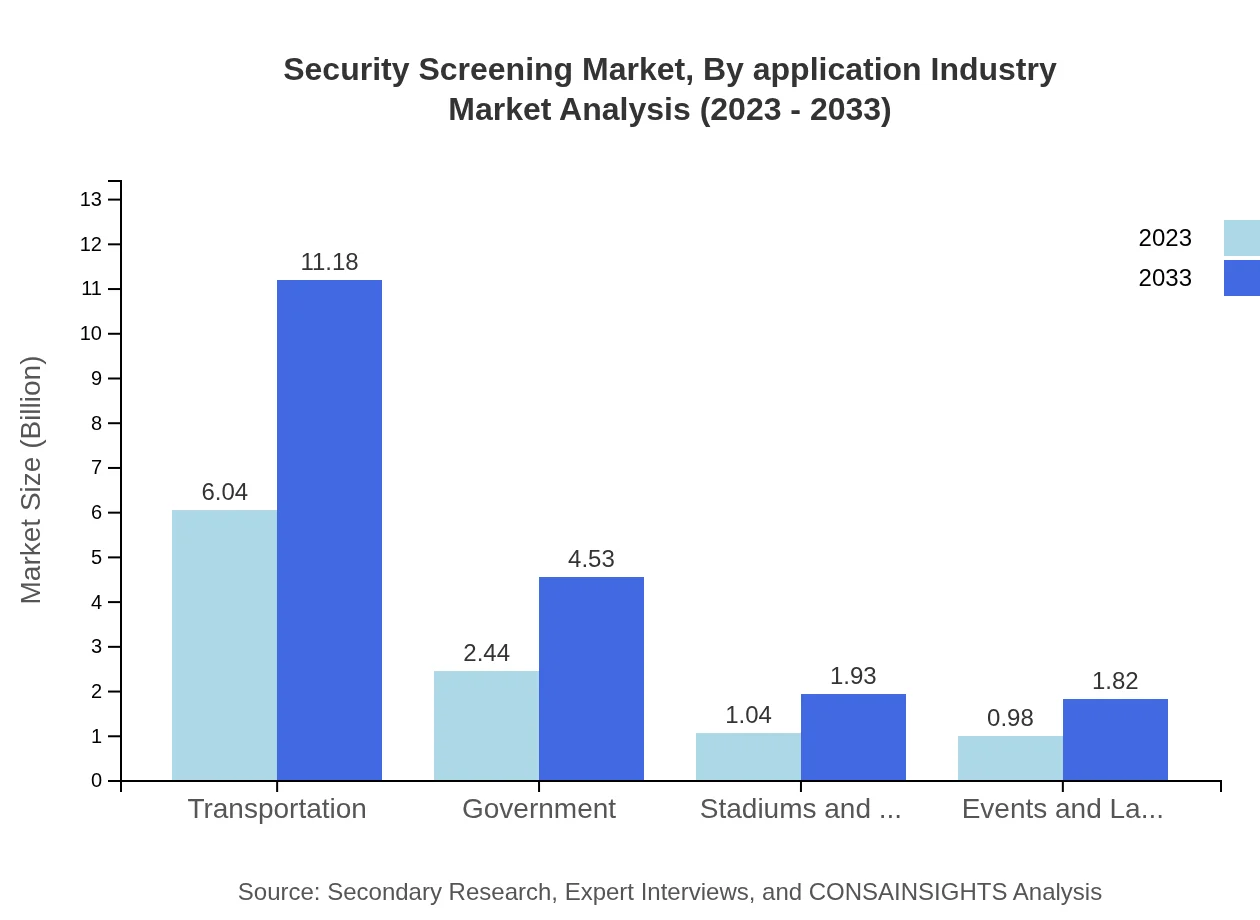

Security Screening Market Analysis By Application Industry

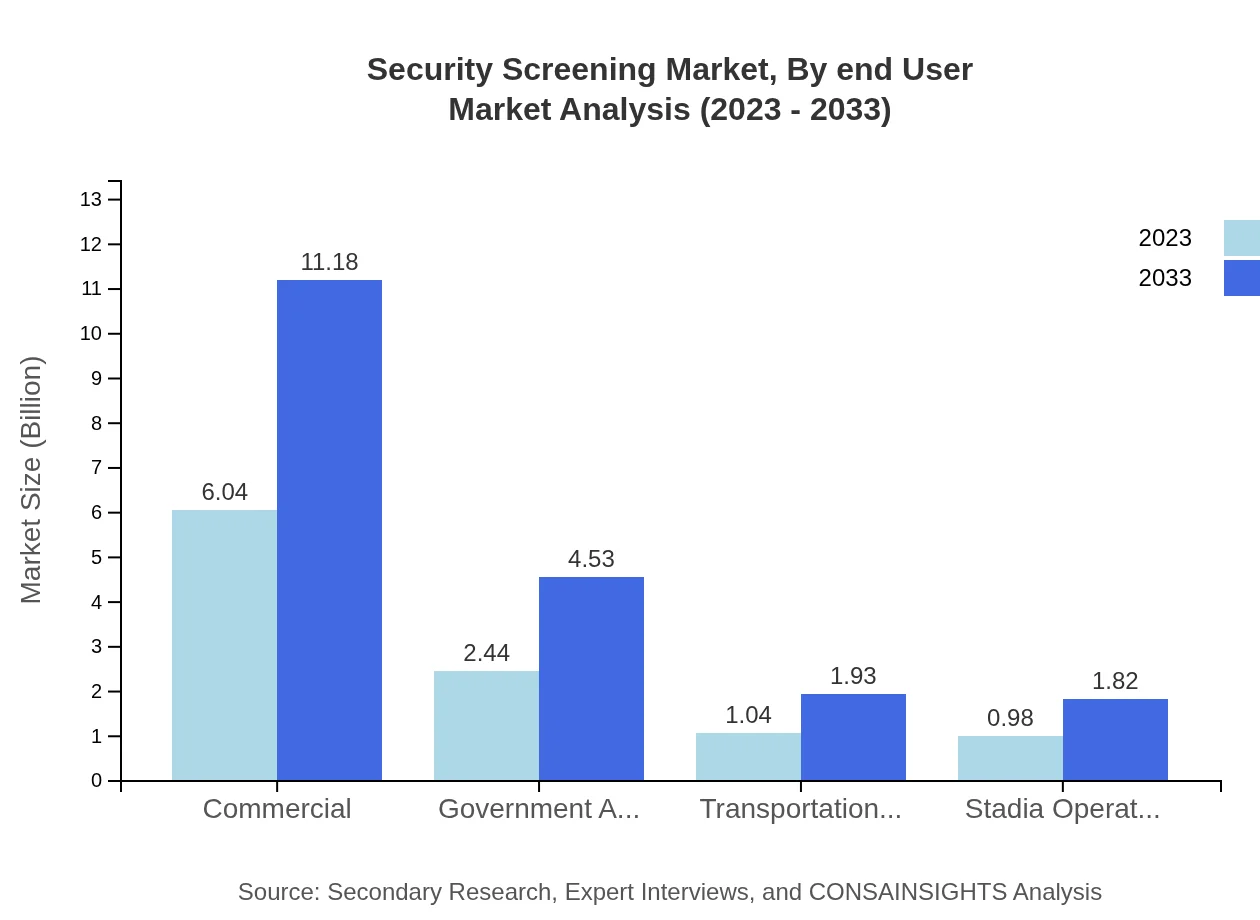

In terms of application industries, significant segments include Commercial, Government Agencies, and Transportation. The Commercial segment is the largest, valued at USD 6.04 billion in 2023 and anticipated to reach USD 11.18 billion by 2033, reflecting the increasing demand from businesses to ensure a secure environment.

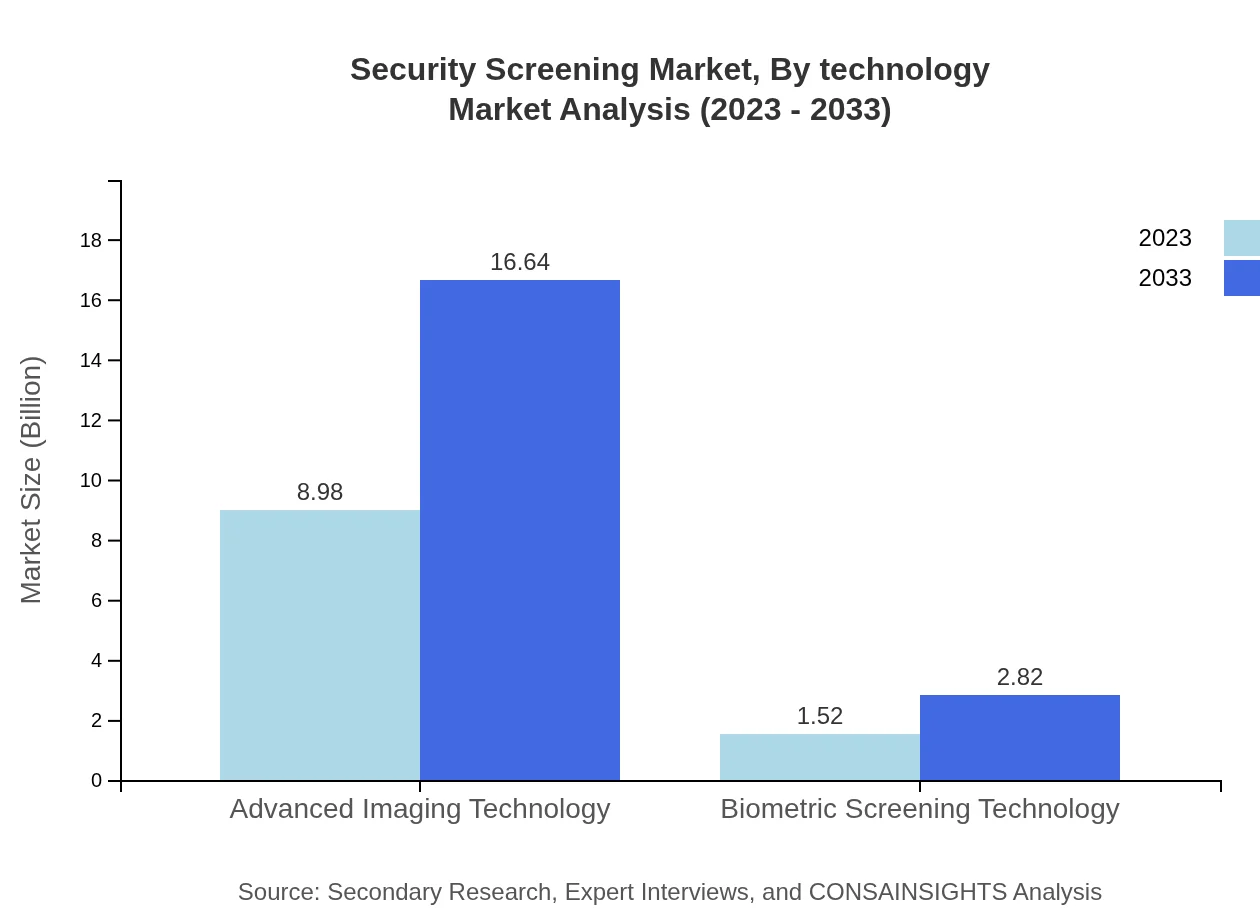

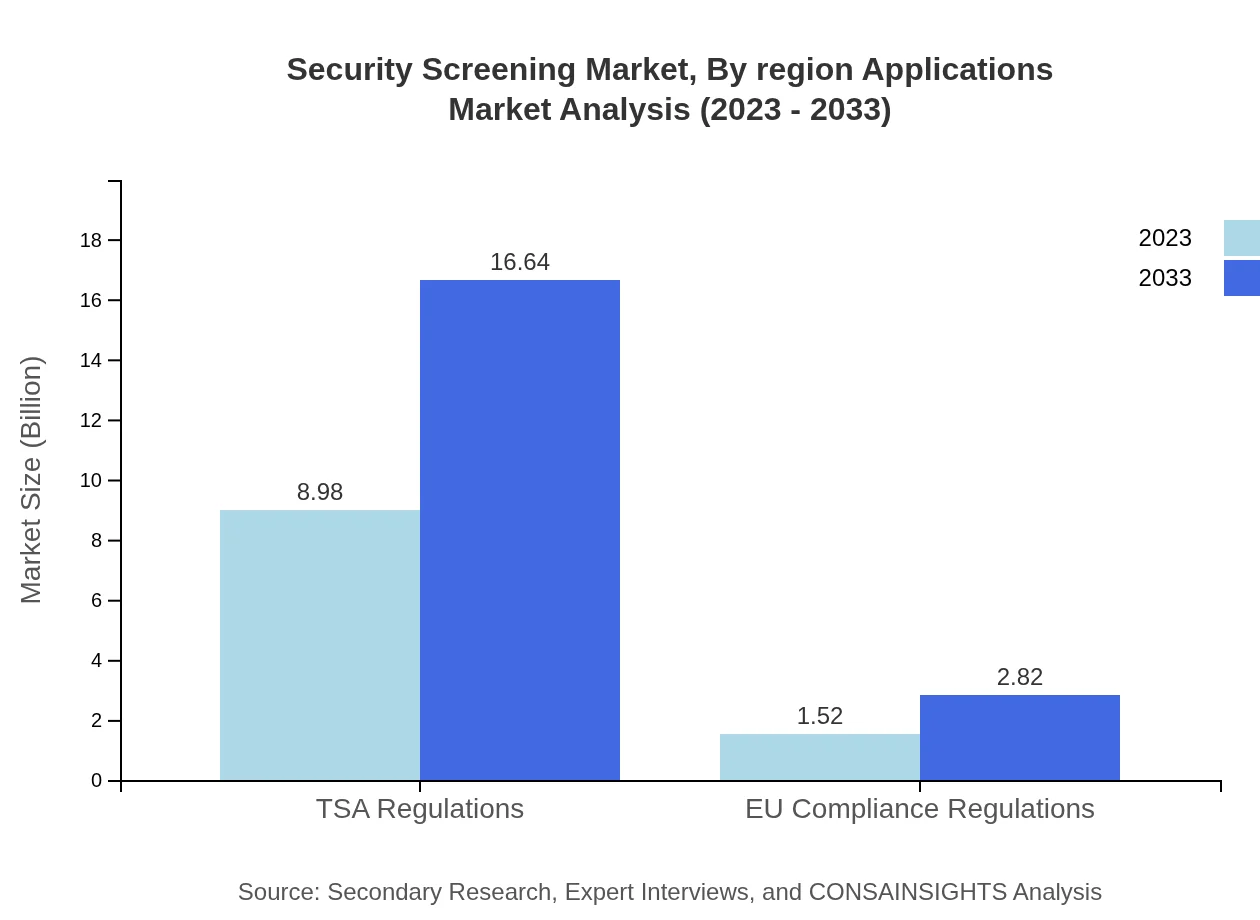

Security Screening Market Analysis By Technology

Technological advancements such as Advanced Imaging Technology dominate the market with a size of USD 8.98 billion in 2023 and a forecast to reach USD16.64 billion by 2033. This segment's robust growth is driven by ongoing innovation in imaging and scanning technologies that enhance security operations.

Security Screening Market Analysis By End User

Key end-user segments include Government, Transportation, and Stadia Operators. The Government segment, in particular, is projected to grow significantly with a size of USD 2.44 billion in 2023 to USD 4.53 billion by 2033, highlighting the importance of safety in public spaces.

Security Screening Market Analysis By Region Applications

Compliance with regulatory aspects such as TSA Regulations and EU Compliance Regulations drives significant engagement in the market, with TSA Regulations representing a notable share of USD 8.98 billion in 2023 and forecasting to reach USD 16.64 billion by 2033 due to stringent security mandates.

Security Screening Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Screening Industry

Smiths Detection:

Smiths Detection specializes in advanced threat detection and security screening technologies used in airports, critical infrastructure, and urban spaces.Leidos Holdings, Inc.:

Leidos is dedicated to reinventing security with innovative screening technologies used widely in government and transportation sectors.L3Harris Technologies:

L3Harris provides security screening solutions tailored to the requirements of government and commercial markets, emphasizing technology-driven strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of security Screening?

The global Security Screening market is projected to reach $10.5 billion by 2033, with a CAGR of 6.2% from 2023. This growth reflects increasing security demands across various sectors, including transportation and government.

What are the key market players or companies in this security Screening industry?

Key players in the security screening industry include industry giants specializing in screening technologies and advanced imaging solutions. Companies are enhancing product offerings to cater to an expanding market, driving innovation and competition.

What are the primary factors driving the growth in the security screening industry?

Major growth drivers include escalating security concerns globally, advancements in screening technology, and stricter compliance regulations. Additionally, increased investments in transportation infrastructure are propelling market expansion.

Which region is the fastest Growing in the security screening industry?

The North American region is the fastest-growing market for security screening, expected to reach $7.20 billion by 2033. The rise in security threats and technological advancements in surveillance are key contributors to this growth.

Does ConsaInsights provide customized market report data for the security screening industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs. Clients can request insights that suit their strategic goals, ensuring relevant and actionable market intelligence.

What deliverables can I expect from this security screening market research project?

Deliverables include detailed reports on market size, trends, regional analyses, and segment breakdowns. Clients will receive comprehensive data to guide strategic decisions in the security screening sector.

What are the market trends of security screening?

Key trends include rising adoption of biometric technologies, integration of AI in screening processes, and increased collaboration between private and public sectors to enhance security measures.