Security Services Market Report

Published Date: 31 January 2026 | Report Code: security-services

Security Services Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Security Services market, including insights on market size, growth trends, and forecasts from 2023 to 2033. It addresses various segments, regional performance, and key industry players, providing valuable data for stakeholders in this evolving landscape.

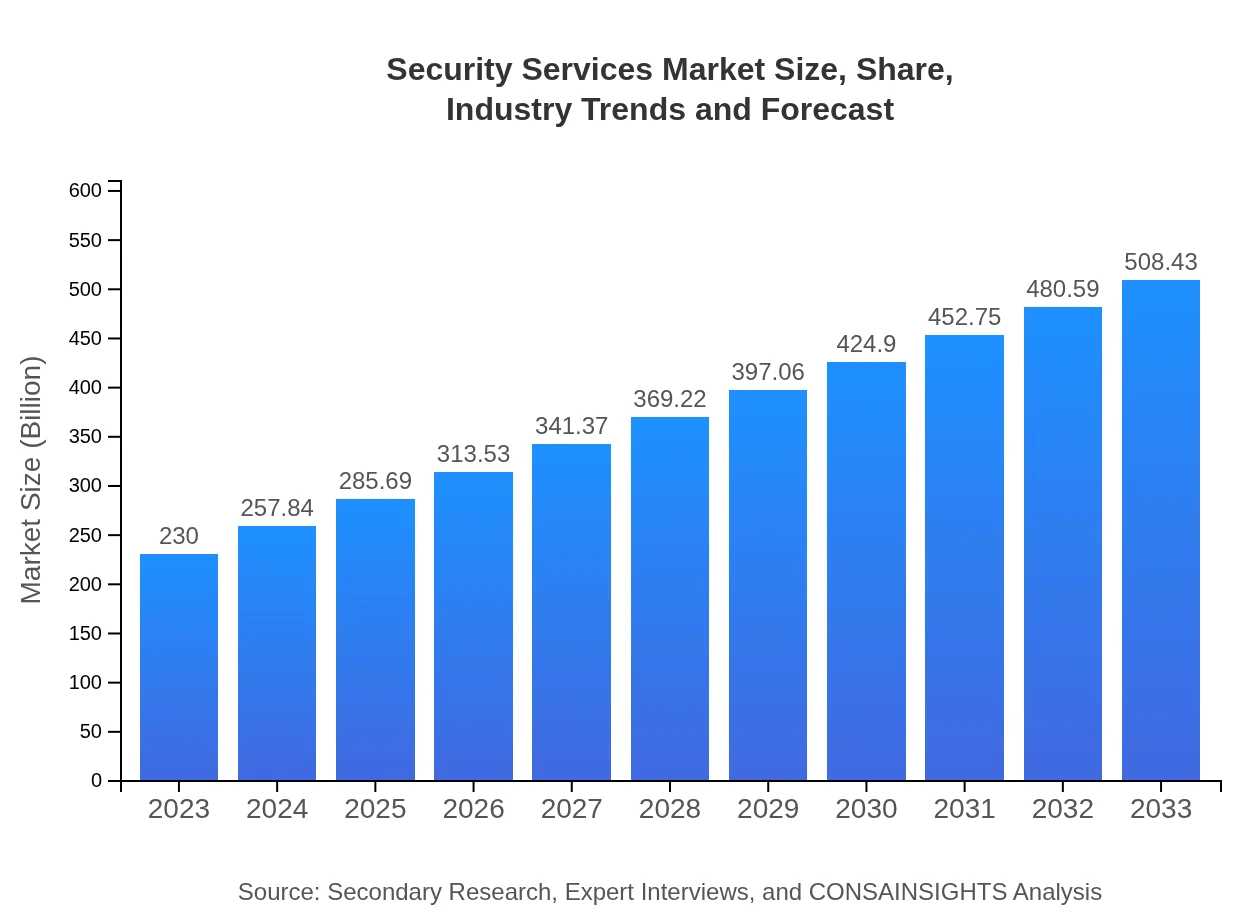

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $230.00 Billion |

| CAGR (2023-2033) | 8% |

| 2033 Market Size | $508.43 Billion |

| Top Companies | G4S plc, Brink's Inc., ADT Inc., Allied Universal |

| Last Modified Date | 31 January 2026 |

Security Services Market Overview

Customize Security Services Market Report market research report

- ✔ Get in-depth analysis of Security Services market size, growth, and forecasts.

- ✔ Understand Security Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Services

What is the Market Size & CAGR of the Security Services market in 2033?

Security Services Industry Analysis

Security Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Services Market Analysis Report by Region

Europe Security Services Market Report:

Europe's Security Services market is expected to rise from $64.42 billion in 2023 to $142.41 billion by 2033. The expansion is influenced by stringent regulations such as GDPR, which compel organizations to bolster their security protocols significantly.Asia Pacific Security Services Market Report:

The Asia Pacific Security Services market is projected to grow from $46.05 billion in 2023 to approximately $101.79 billion by 2033, reflecting increasing investments in security infrastructure driven by urbanization and regulatory mandates. Countries like China and India are leading the charge due to their rising insurance rates against cyber threats.North America Security Services Market Report:

North America is the largest market for Security Services, projected to grow from $79.01 billion in 2023 to $174.65 billion in 2033. This growth is fueled by high cybersecurity investments in the U.S. and Canada, driven by increasing data breaches and the rapid advancement of technology.South America Security Services Market Report:

The South American region is anticipated to witness growth from $15.92 billion in 2023 to $35.18 billion by 2033, largely due to increasing awareness of cybersecurity threats in emerging economies. Brazil and Argentina are key players in adopting security services, recognizing their essential value in protecting economic interests.Middle East & Africa Security Services Market Report:

In the Middle East and Africa, the market is projected to increase from $24.61 billion in 2023 to $54.40 billion by 2033, with region-specific concerns over terrorism and political instability driving the necessity for robust security services.Tell us your focus area and get a customized research report.

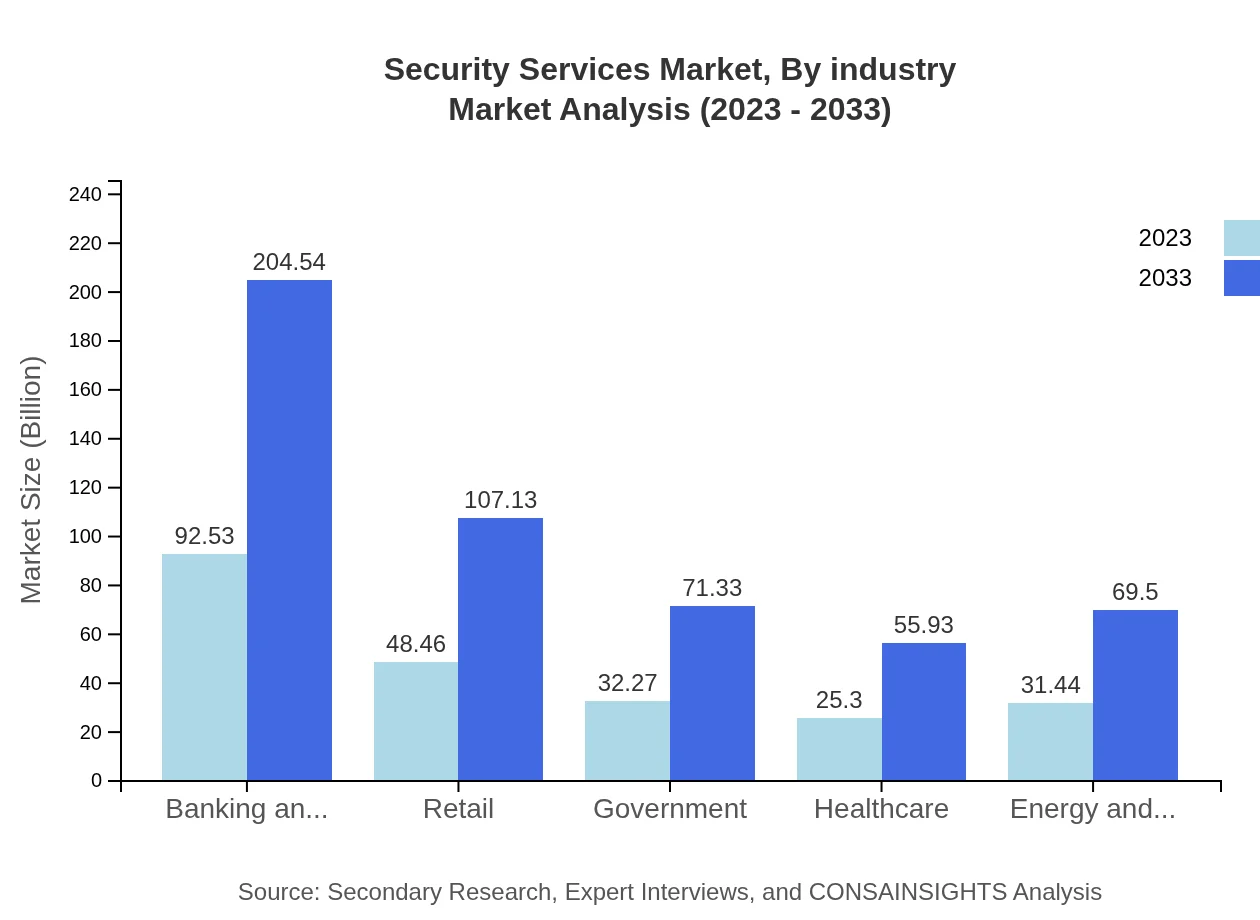

Security Services Market Analysis By Industry

The following industries are essential within the Security Services market: 1. Banking and Finance - From $92.53 billion in 2023 to $204.54 billion in 2033, representing a robust growth. 2. Retail - Expected to increase from $48.46 billion to $107.13 billion due to rising ecommerce security needs. 3. Government - Projecting growth from $32.27 billion to $71.33 billion, emphasizing public safety. 4. Healthcare - Estimated from $25.30 billion to $55.93 billion as data security is crucial. 5. Energy and Utilities - Growth from $31.44 billion to $69.50 billion, driven by infrastructure protection measures.

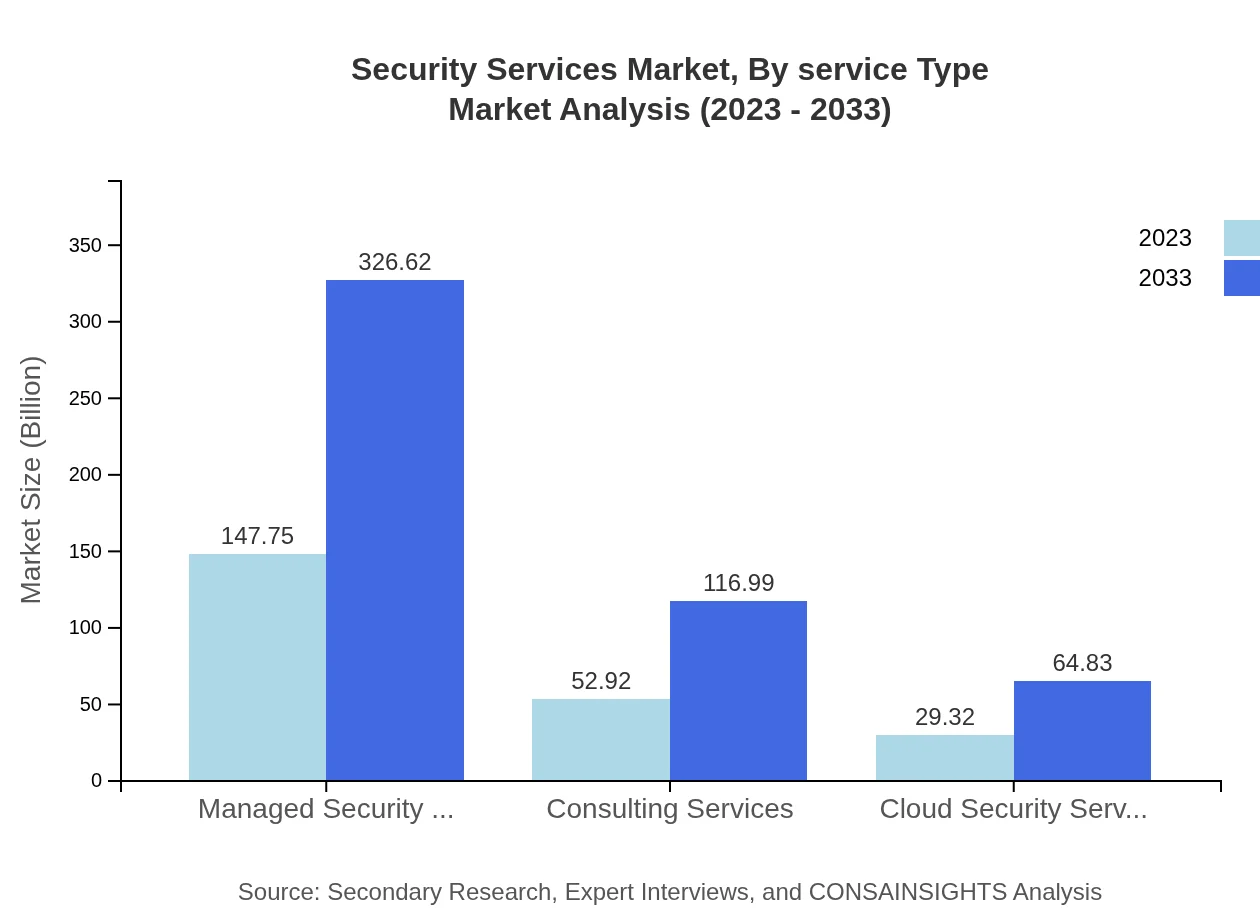

Security Services Market Analysis By Service Type

Service types within the Security Services market include: 1. Managed Security Services - Expected to grow from $147.75 billion to $326.62 billion. 2. Consulting Services - From $52.92 billion to $116.99 billion. 3. Cloud Security Services - Anticipated growth from $29.32 billion to $64.83 billion, aimed at protecting cloud-based applications.

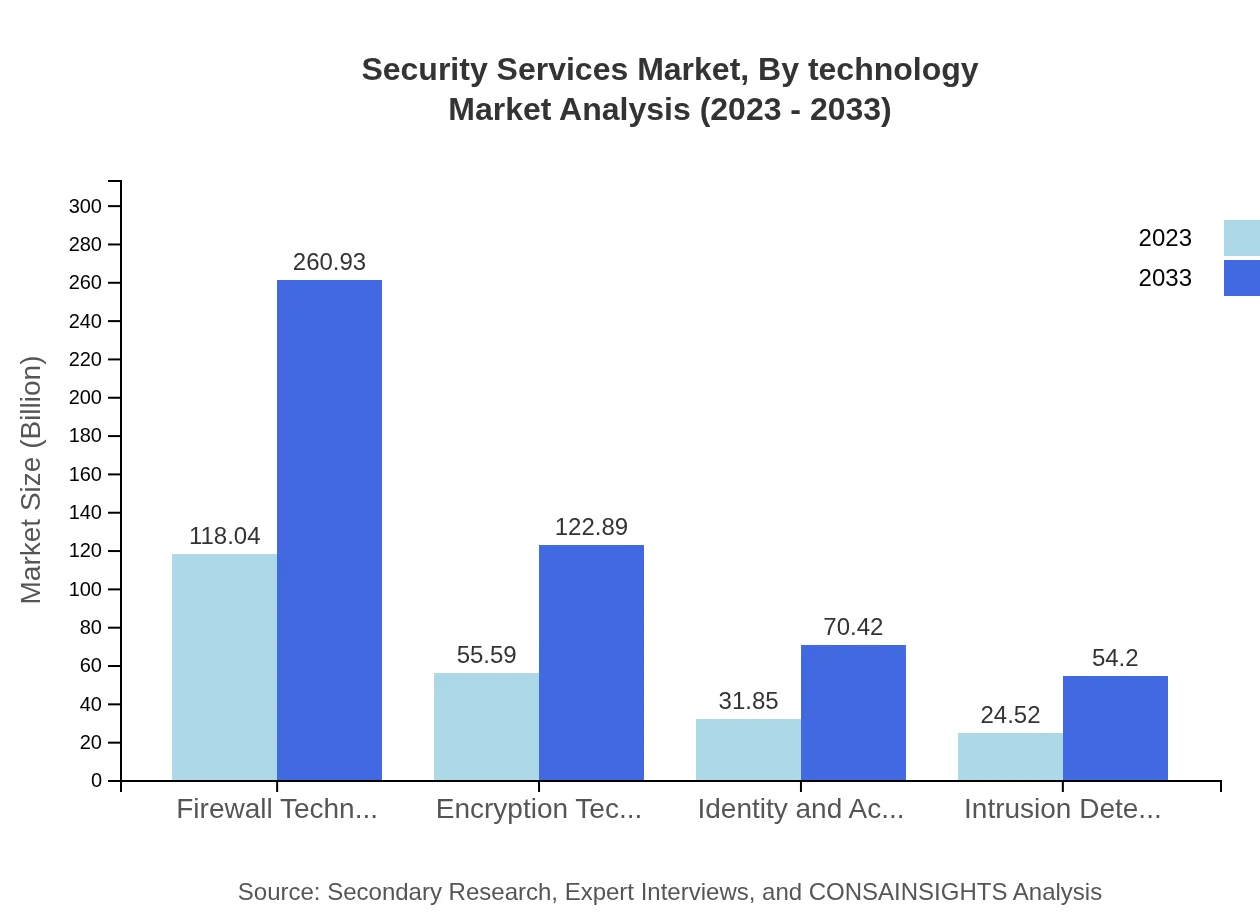

Security Services Market Analysis By Technology

Key technologies enhancing the Security Services market include: 1. Firewall Technologies - Expected to grow from $118.04 billion to $260.93 billion. 2. Encryption Technologies - From $55.59 billion to $122.89 billion, as organizations focus on securing sensitive data. 3. Identity and Access Management - Projecting growth from $31.85 billion to $70.42 billion, crucial in mitigating unauthorized access.

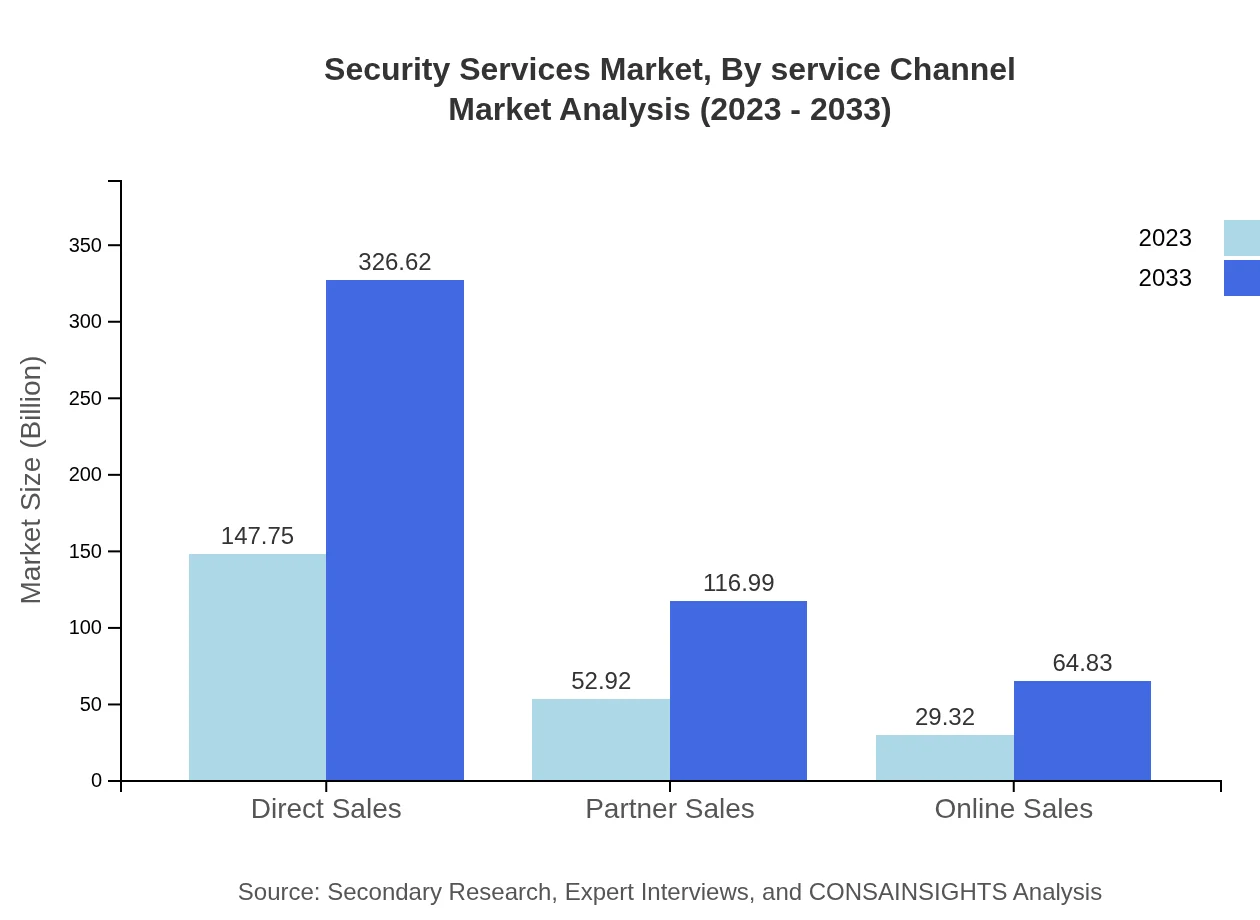

Security Services Market Analysis By Service Channel

The service channels yielding growth for the market include: 1. Direct Sales - Expected to reach $326.62 billion from $147.75 billion. 2. Partner Sales - From $52.92 billion to $116.99 billion, utilizing third-party collaborations. 3. Online Sales - Projecting from $29.32 billion to $64.83 billion, reflecting changing consumer behaviors towards online security solutions.

Security Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Services Industry

G4S plc:

A leading multinational company specializing in security solutions, G4S provides a wide array of services including security personnel, technology solutions, and consulting.Brink's Inc.:

Known for cash management services, Brink's Inc. also offers extensive security solutions, becoming a trusted partner for financial institutions worldwide.ADT Inc.:

A prominent player in the North American security market, ADT provides residential and commercial security solutions, emphasizing the use of cutting-edge technology.Allied Universal:

As one of the largest security companies globally, Allied Universal combines security personnel with advanced technology to provide robust protection for various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of security services?

The global security services market is expected to reach approximately $230 billion by 2033, growing at a CAGR of 8% from its current value in 2023. This growth is driven by increasing demand for security solutions across various sectors.

What are the key market players or companies in the security services industry?

Key players in the security services market include multinational corporations and specialized firms that offer comprehensive security solutions, catering to sectors like banking, healthcare, and retail, enhancing their market presence and services.

What are the primary factors driving the growth in the security services industry?

Growth in the security services sector is primarily driven by rising criminal threats, advancements in technology, regulatory compliance requirements, and increased spending by organizations on security measures to protect assets and data.

Which region is the fastest Growing in the security services market?

The fastest-growing region in the security services market is Asia Pacific, expected to increase from $46.05 billion in 2023 to $101.79 billion by 2033, highlighting robust growth due to urbanization and rising security concerns.

Does ConsaInsights provide customized market report data for the security services industry?

Yes, ConsaInsights offers customized market report data for the security services industry, allowing clients to tailor information and insights to specific needs, enhancing decision-making and strategic planning.

What deliverables can I expect from this security services market research project?

Deliverables from the security services market research project typically include detailed reports, data visualizations, market trends analyses, competitive landscapes, and actionable insights tailored to client requirements.

What are the market trends of security services?

Current market trends in the security services sector include increased demand for managed security services, the rise of cybersecurity solutions, integration of AI technologies, and greater focus on regulatory compliance across industries.