Security Software Market Report

Published Date: 31 January 2026 | Report Code: security-software

Security Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Security Software market, covering key insights, trends, regional outlooks, and futuristic forecasts for the period 2023 to 2033. It includes a detailed examination of market segmentation, technology impacts, product performance, and industry leaders.

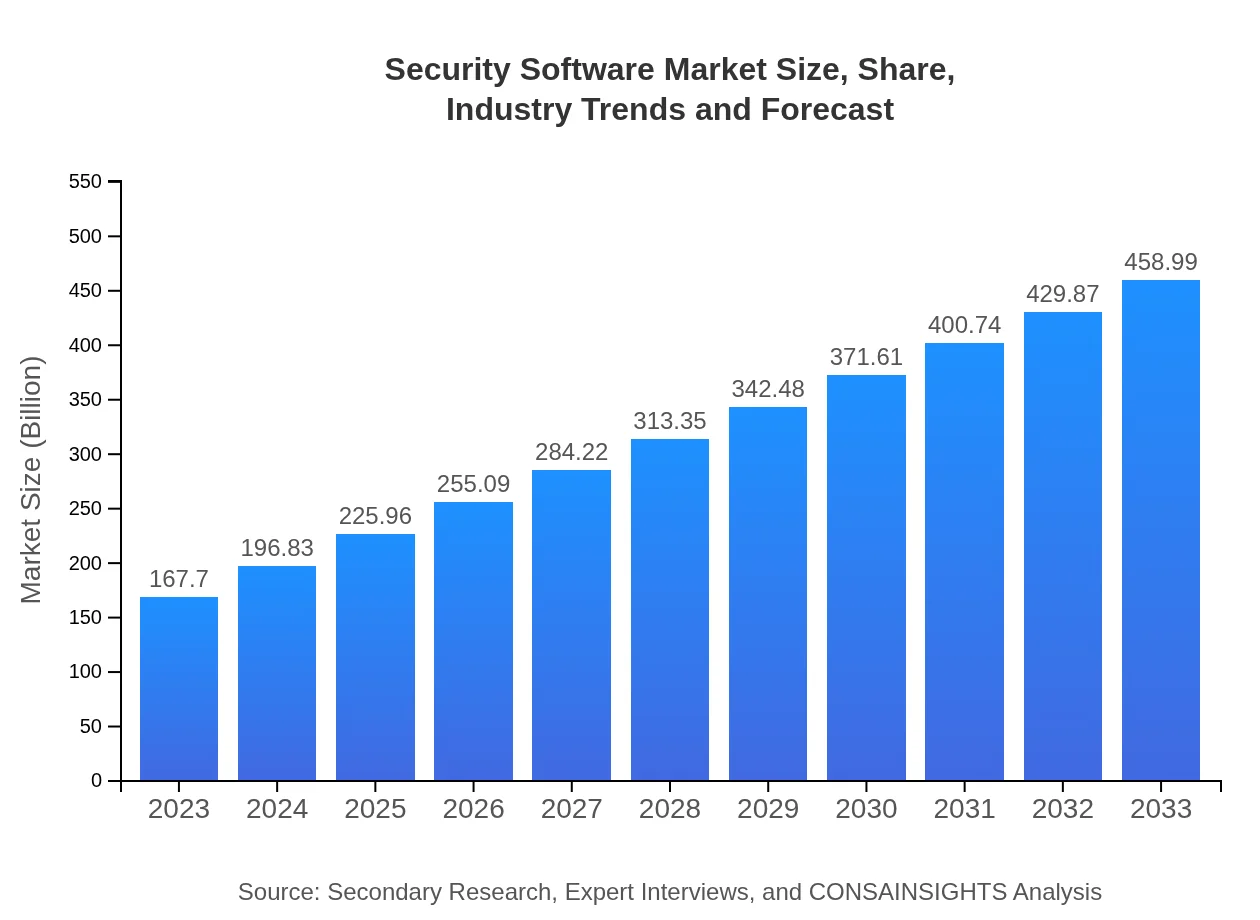

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $167.70 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $458.99 Billion |

| Top Companies | Symantec Corporation, McAfee Corp., Trend Micro, Palo Alto Networks |

| Last Modified Date | 31 January 2026 |

Security Software Market Overview

Customize Security Software Market Report market research report

- ✔ Get in-depth analysis of Security Software market size, growth, and forecasts.

- ✔ Understand Security Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Software

What is the Market Size & CAGR of the Security Software market in 2023?

Security Software Industry Analysis

Security Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Software Market Analysis Report by Region

Europe Security Software Market Report:

Europe's Security Software market will see significant growth from $61.36 billion in 2023 to $167.95 billion by 2033. Rising regulatory requirements such as GDPR and a strong focus on privacy among consumers are fueling demand for security solutions across various industries.Asia Pacific Security Software Market Report:

In the Asia-Pacific region, the Security Software market is anticipated to grow from $31.09 billion in 2023 to $85.10 billion by 2033, reflecting increased investments in cybersecurity amid rising digital threats. Countries like China, India, and Japan are leading this growth due to rapid technological advancement and regulatory compliance needs.North America Security Software Market Report:

North America remains the largest market for Security Software, forecasted to increase from $55.32 billion in 2023 to $151.42 billion by 2033. The region's strong emphasis on advanced cybersecurity measures and the presence of numerous leading security software providers are key drivers of this growth.South America Security Software Market Report:

The South American market is projected to benefit significantly, with growth from $13.00 billion in 2023 to $35.57 billion by 2033. This expansion is attributed to growing concern about data breaches and the increasing implementation of secure digital solutions among government and private sectors.Middle East & Africa Security Software Market Report:

The Middle East and Africa are expected to experience steady growth in their Security Software market, rising from $6.93 billion in 2023 to $18.96 billion by 2033. Increased cyber threats and government initiatives to enhance cybersecurity frameworks are pivotal in driving this trend.Tell us your focus area and get a customized research report.

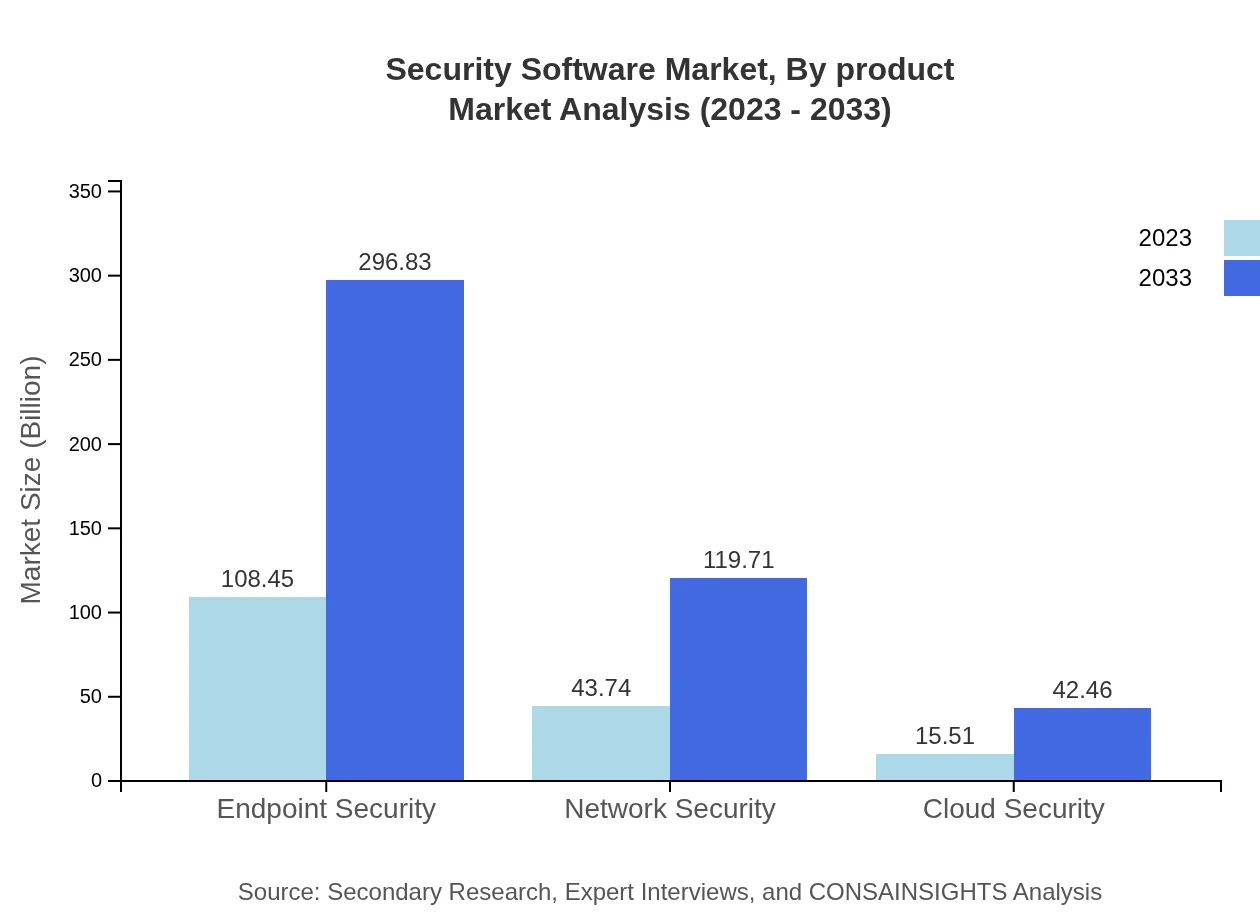

Security Software Market Analysis By Product

In 2023, Endpoint Security leads the market with a size of $108.45 billion, expected to grow to $296.83 billion by 2033, maintaining a share of approximately 64.67%. Network Security follows closely, with a current valuation of $43.74 billion projected to increase to $119.71 billion, holding a market share of 26.08%. Cloud Security shows promising growth from $15.51 billion to $42.46 billion, with a share of 9.25%. Each product type offers unique strengths, responding to various industry needs.

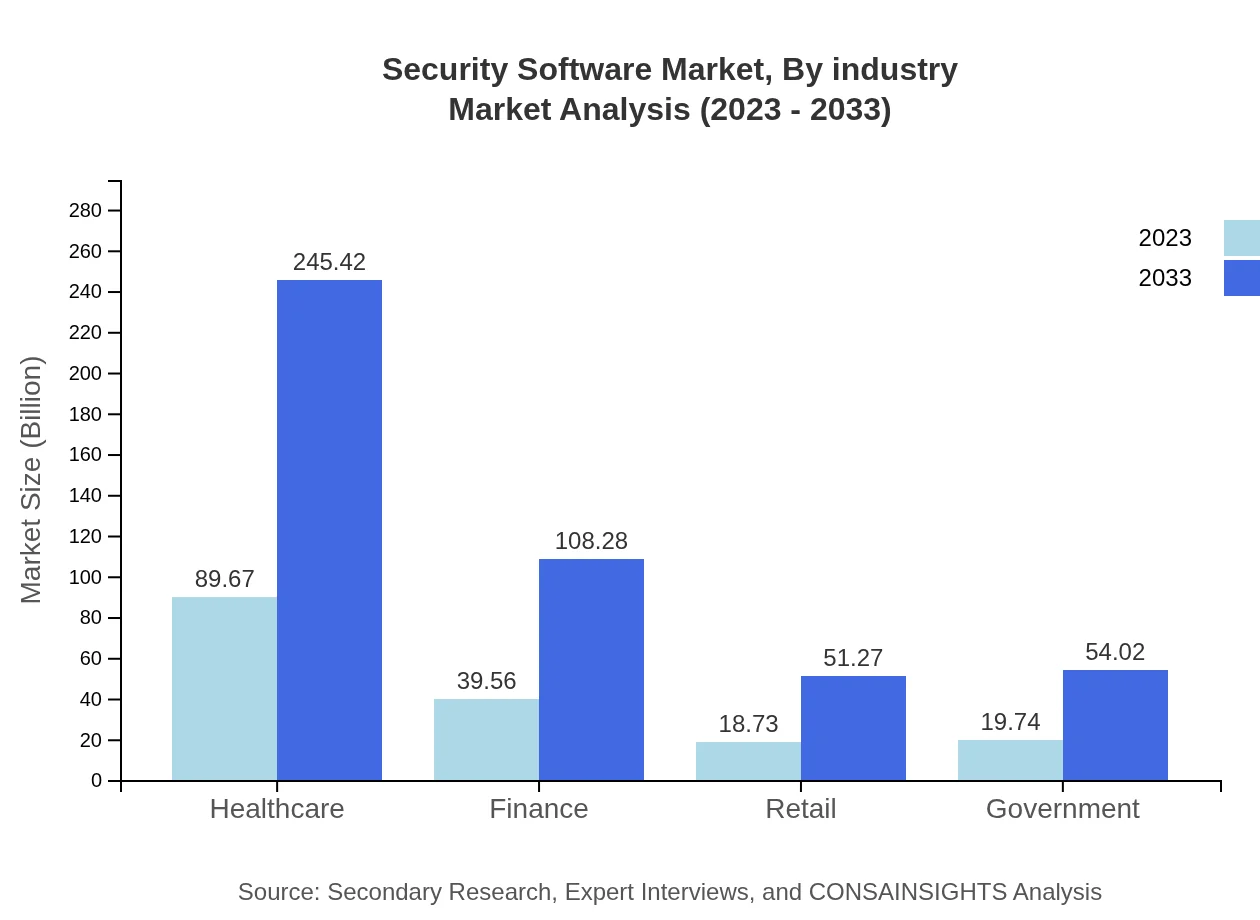

Security Software Market Analysis By Industry

Healthcare accounts for a significant portion of the market at $89.67 billion in 2023, projected to reach $245.42 billion by 2033, driven by stringent data protection regulations. The finance sector shows strong demand as well, with market sizes of $39.56 billion and $108.28 billion over the same period. Other sectors, including retail and government, also contribute notably to the overall growth, underlining the importance of tailored security solutions for varied applications.

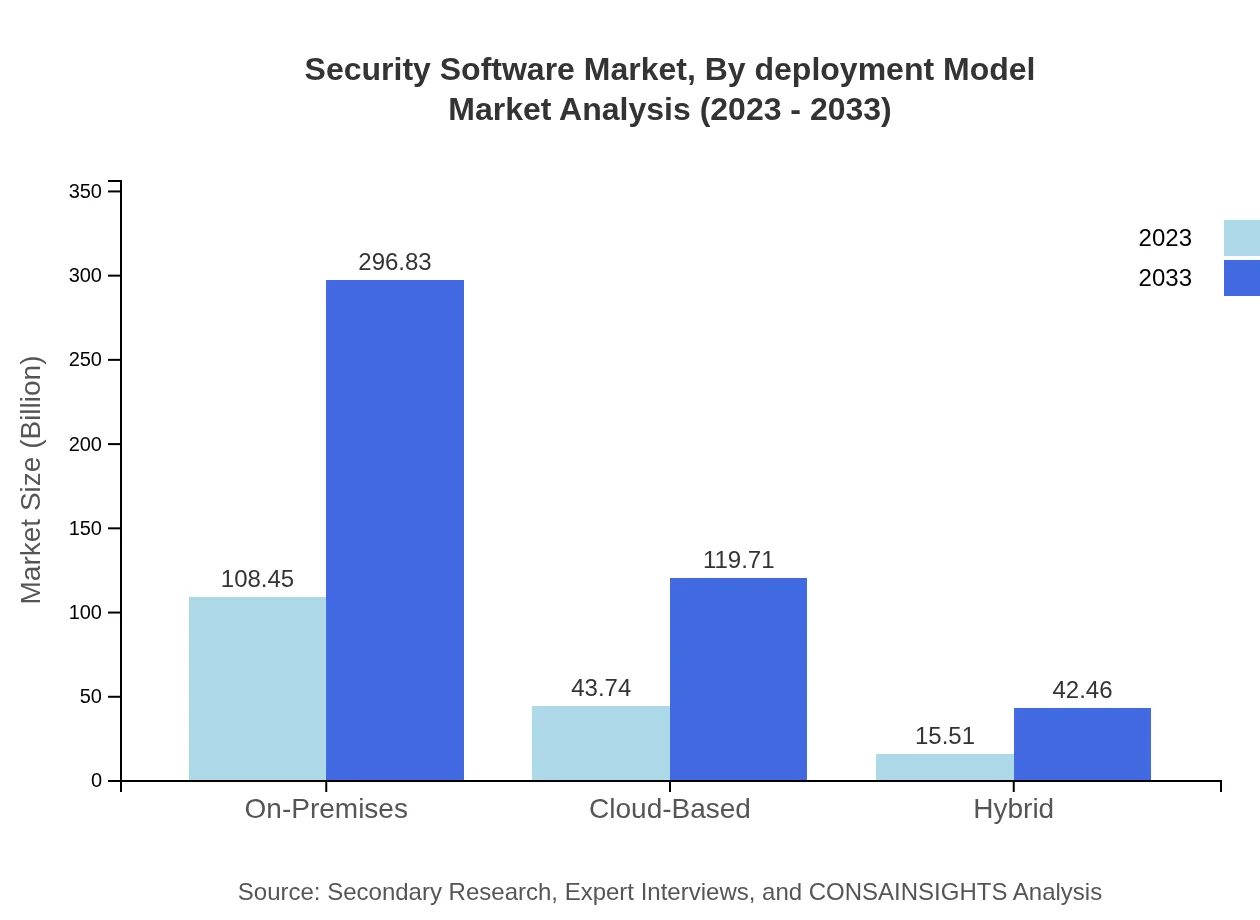

Security Software Market Analysis By Deployment Model

The On-Premises deployment model is leading with a market size of $108.45 billion in 2023, expected to grow to $296.83 billion by 2033. Cloud-based security solutions follow, starting at $43.74 billion and projected to reach $119.71 billion. The Hybrid deployment model, while smaller, still shows considerable growth potential, moving from $15.51 billion to $42.46 billion, indicating a trend towards flexibility in security deployment strategy.

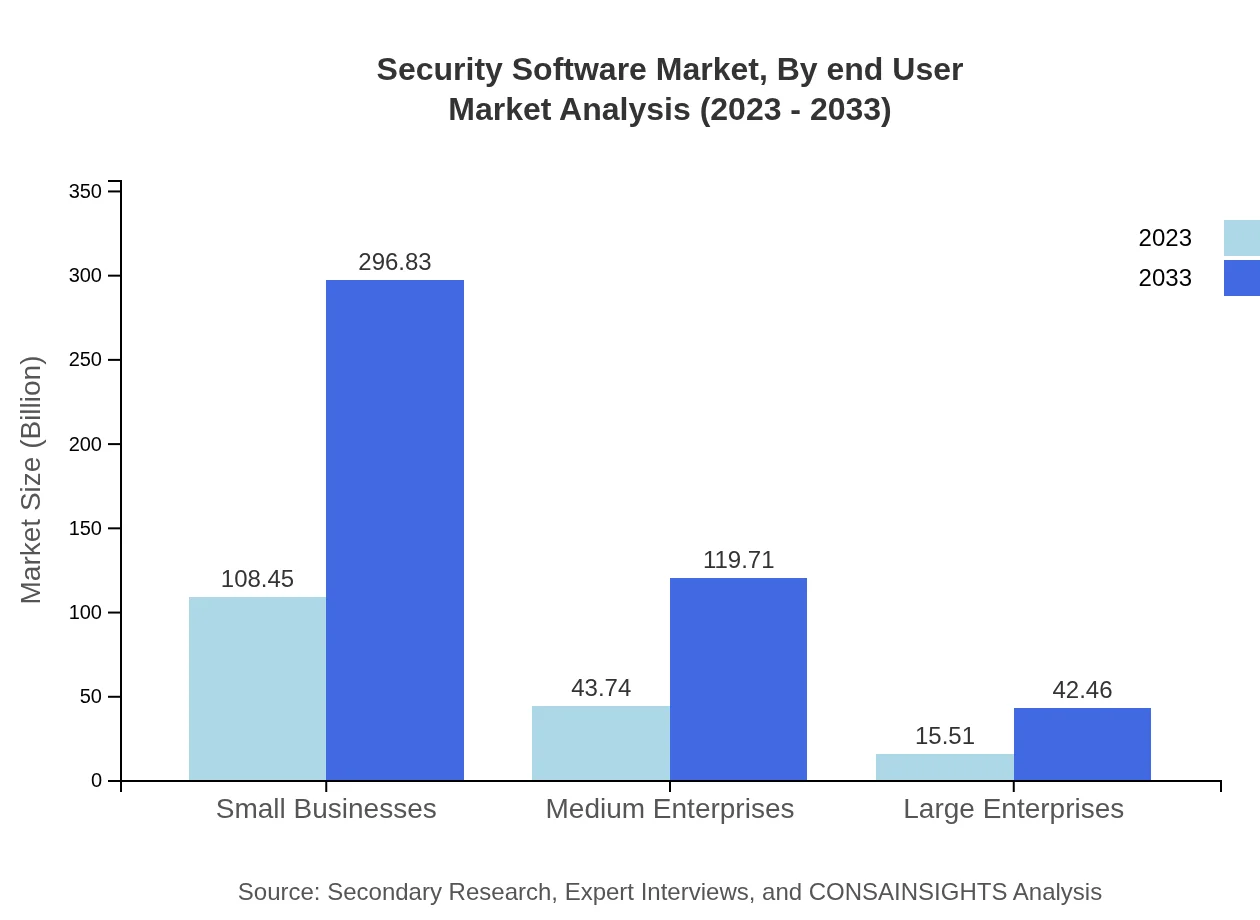

Security Software Market Analysis By End User

Small businesses hold a substantial share, growing from $108.45 billion in 2023 to $296.83 billion by 2033. Medium enterprises follow with a growth trajectory from $43.74 billion to $119.71 billion. Large enterprises are also significant players with current values of $15.51 billion anticipated to expand to $42.46 billion, confirming the essential need for robust security measures among organizations of all sizes.

Security Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Software Industry

Symantec Corporation:

A leader in cybersecurity, Symantec offers endpoint protection, cloud security solutions, and advanced threat intelligence services worldwide, helping organizations mitigate risks.McAfee Corp.:

McAfee is known for its extensive security software portfolio, focusing on endpoint security, cloud security, and integrated digital protection, serving both individual and enterprise customers.Trend Micro:

Trend Micro specializes in hybrid cloud security, endpoint protection, and advanced threats mitigation, with a strong emphasis on data protection for enterprises globally.Palo Alto Networks:

Palo Alto Networks offers a variety of cloud-based security solutions, recognized for pioneering next-generation firewall technologies and enabling secure application development.We're grateful to work with incredible clients.

FAQs

What is the market size of security Software?

The global security software market is projected to reach approximately $167.7 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.2%. This significant growth reflects the increasing need for robust cybersecurity solutions across various sectors.

What are the key market players or companies in the security Software industry?

Key players in the security software industry include major companies such as Symantec, McAfee, Trend Micro, Palo Alto Networks, and Fortinet. These companies provide a range of security solutions, including endpoint protection, network security, and cloud security services.

What are the primary factors driving the growth in the security Software industry?

The growth in the security software industry is driven by increasing cyber threats, greater reliance on digital platforms, regulatory requirements for data protection, and the rise of remote work. Additionally, advancements in technology promote the adoption of advanced security solutions.

Which region is the fastest Growing in the security Software?

The fastest-growing region in the security software market is expected to be North America, with a market size projected to increase from $55.32 billion in 2023 to $151.42 billion by 2033. This growth is driven by the high demand for security solutions in various sectors.

Does ConsaInsights provide customized market report data for the security Software industry?

Yes, ConsaInsights offers customized market report data for the security software industry. Clients can request tailored reports based on specific needs, enabling them to gain insights relevant to their business and market strategy.

What deliverables can I expect from this security Software market research project?

Deliverables from a security software market research project typically include detailed market analysis reports, growth forecasts, competitive landscape insights, and segmentation analysis. Clients can also expect actionable recommendations based on data-driven findings.

What are the market trends of security Software?

Market trends in the security software industry include the shift towards cloud-based solutions, increasing investments in AI-driven security technologies, and the growing focus on endpoint and network security. Additionally, the rise of IoT devices is shaping security strategies.