Security Solutions Market Report

Published Date: 22 January 2026 | Report Code: security-solutions

Security Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global Security Solutions market for the forecast period from 2023 to 2033. It covers market size, growth rates, regional insights, technology trends, and an overview of key players in the industry.

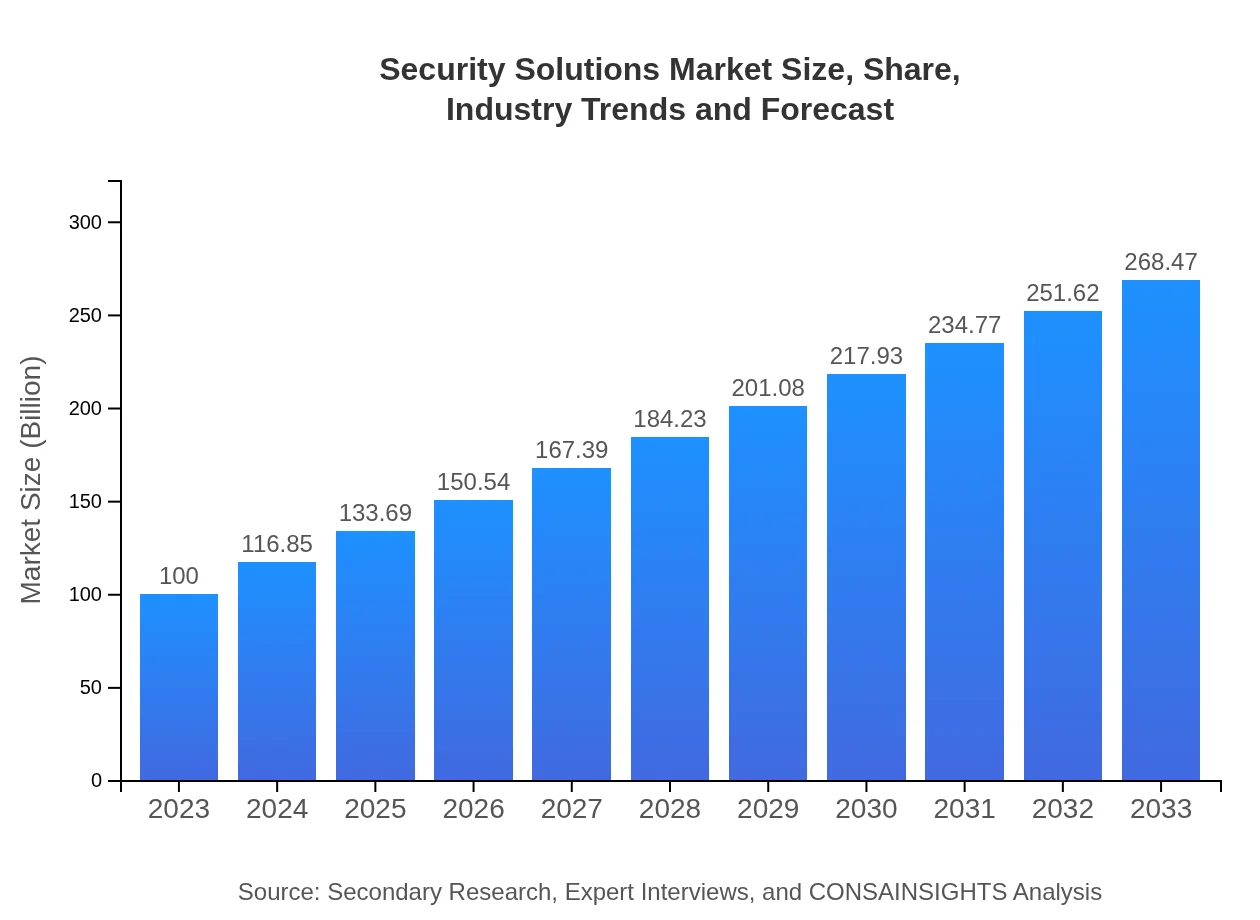

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $268.47 Billion |

| Top Companies | Cisco Systems, Palo Alto Networks, McAfee Corp., Fortinet Inc., Symantec (now NortonLifeLock) |

| Last Modified Date | 22 January 2026 |

Security Solutions Market Overview

Customize Security Solutions Market Report market research report

- ✔ Get in-depth analysis of Security Solutions market size, growth, and forecasts.

- ✔ Understand Security Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Security Solutions

What is the Market Size & CAGR of Security Solutions market in 2023?

Security Solutions Industry Analysis

Security Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Security Solutions Market Analysis Report by Region

Europe Security Solutions Market Report:

The European Security Solutions market is anticipated to expand from $30.95 billion in 2023 to $83.09 billion by 2033. The region's stringent data protection regulations, such as GDPR, have propelled significant investments in security frameworks.Asia Pacific Security Solutions Market Report:

In the Asia Pacific region, the market for Security Solutions is projected to grow from $18.99 billion in 2023 to $50.98 billion by 2033, spurred by increased digitalization and a rise in cybercrime incidents. Countries like China and India are leading the growth, driven by high investments in IT infrastructure.North America Security Solutions Market Report:

North America remains the largest Security Solutions market, with a value of $35.06 billion in 2023, projected to reach $94.12 billion by 2033. The presence of multiple established cybersecurity firms and the high adoption rate of advanced technologies such as AI and IoT are key drivers.South America Security Solutions Market Report:

The South American Security Solutions market, valued at $6.00 billion in 2023, is expected to grow to $16.11 billion by 2033. Growth is driven by increasing awareness of cybersecurity threats and the need for regulatory compliance, especially in Brazil and Argentina.Middle East & Africa Security Solutions Market Report:

In the Middle East and Africa, the market will increase from $9.00 billion in 2023 to $24.16 billion by 2033. The growing number of cyber threats and initiatives to enhance IT infrastructure across countries like UAE and South Africa are significant contributors.Tell us your focus area and get a customized research report.

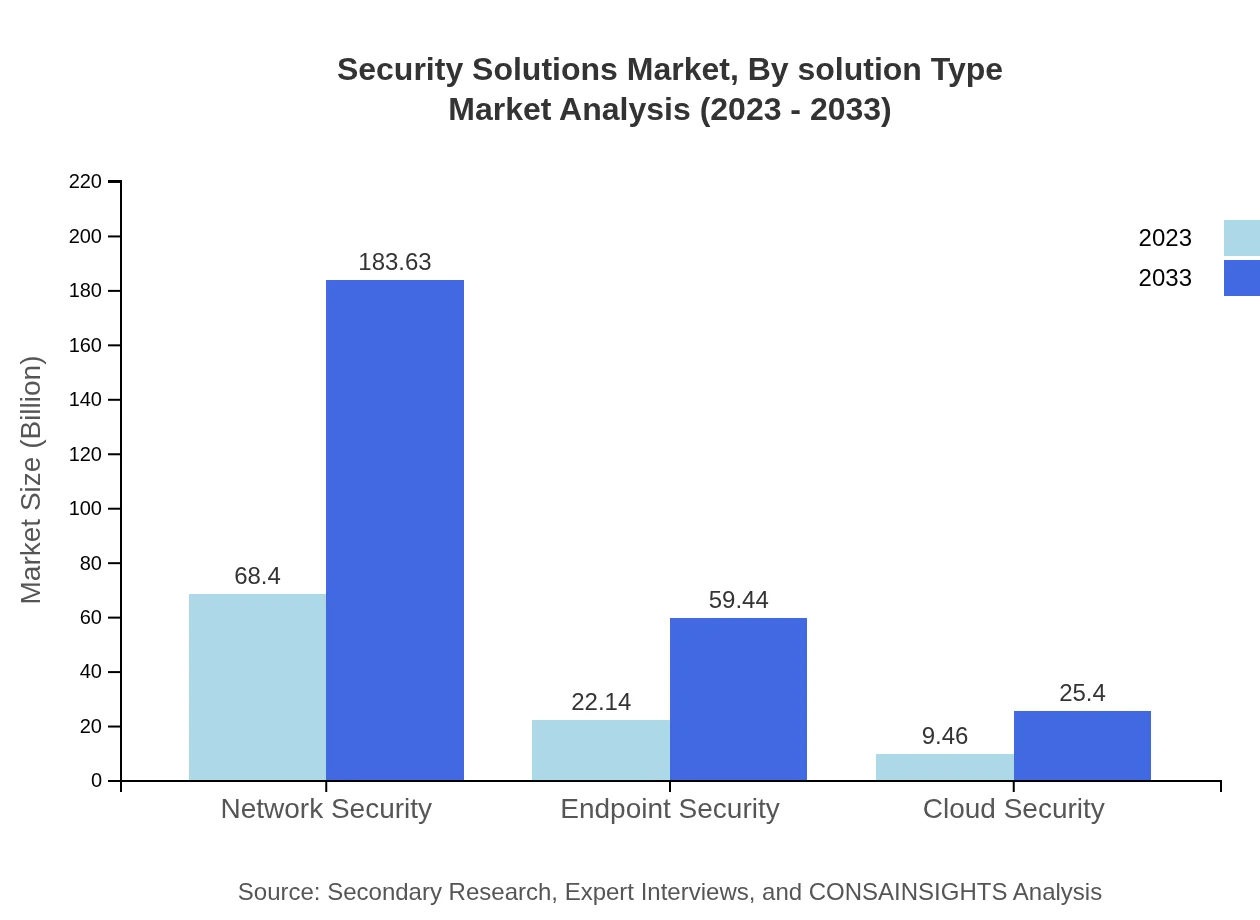

Security Solutions Market Analysis By Solution Type

The segment for IT and Telecommunications holds a considerable share of the market, forecasted to grow from $54.25 billion in 2023 to $145.64 billion by 2033. Healthcare solutions are expected to increase from $23.36 billion to $62.71 billion, while Banking and Financial Services will grow from $11.07 billion to $29.72 billion.

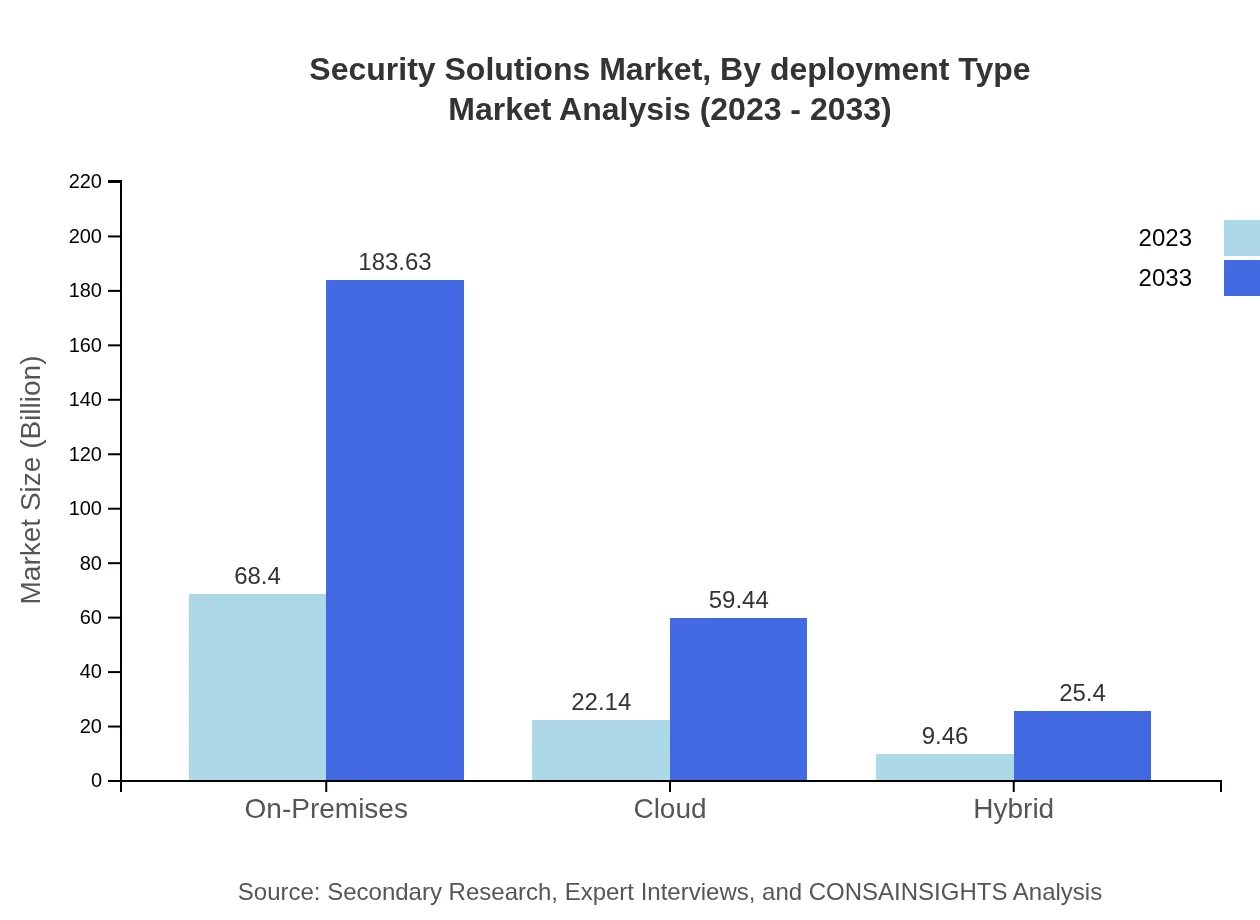

Security Solutions Market Analysis By Deployment Type

On-premises solutions dominate the deployment segment, rising from $68.40 billion in 2023 to $183.63 billion in 2033. Cloud-based solutions are expected to grow significantly from $22.14 billion to $59.44 billion, while hybrid models will also show consistent growth.

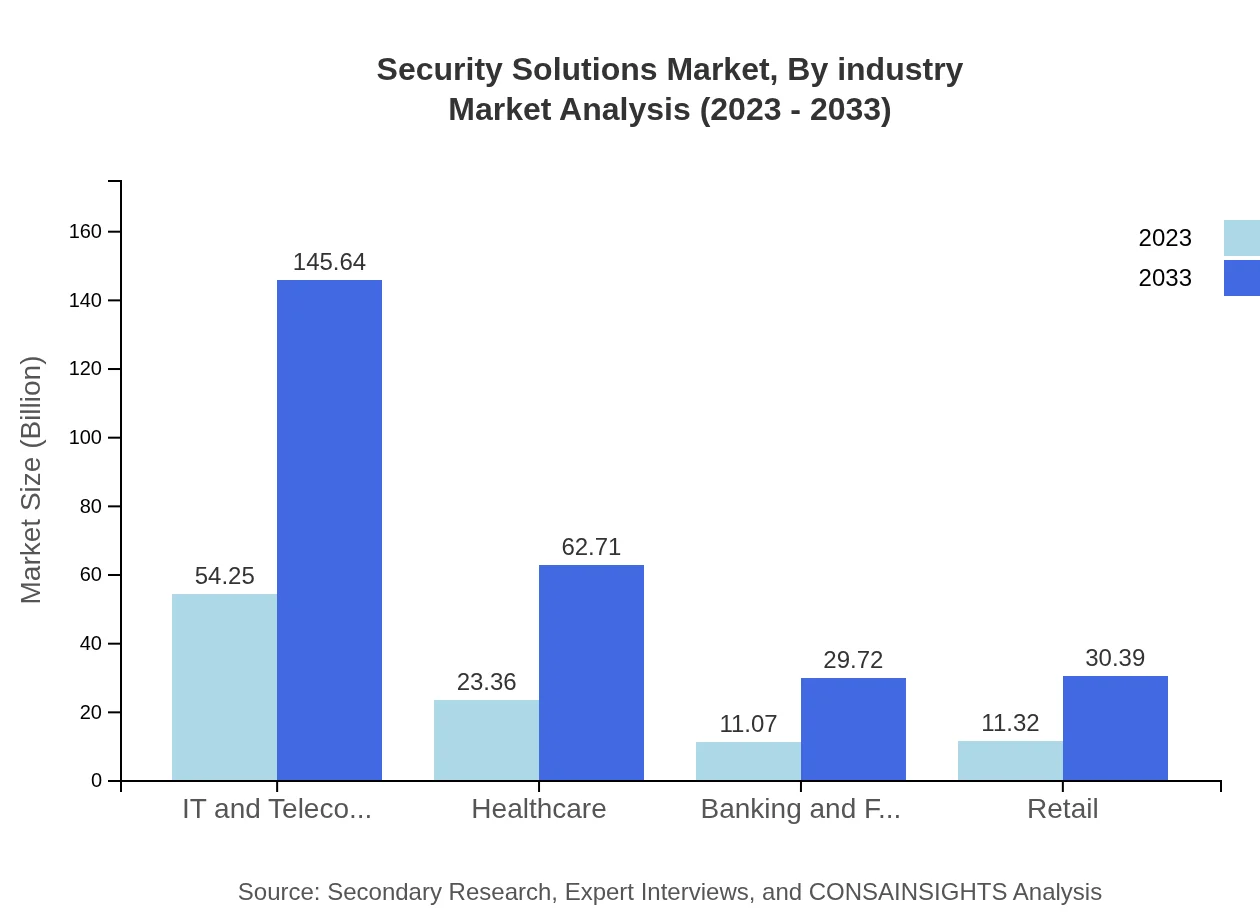

Security Solutions Market Analysis By Industry

Industries such as IT and Telecommunications, Healthcare, and Retail will experience significant growth in adopting security solutions. For instance, the IT and Telecommunications sector is projected to grow from $54.25 billion in 2023 to $145.64 billion by 2033, reflecting the increasing need for robust security measures.

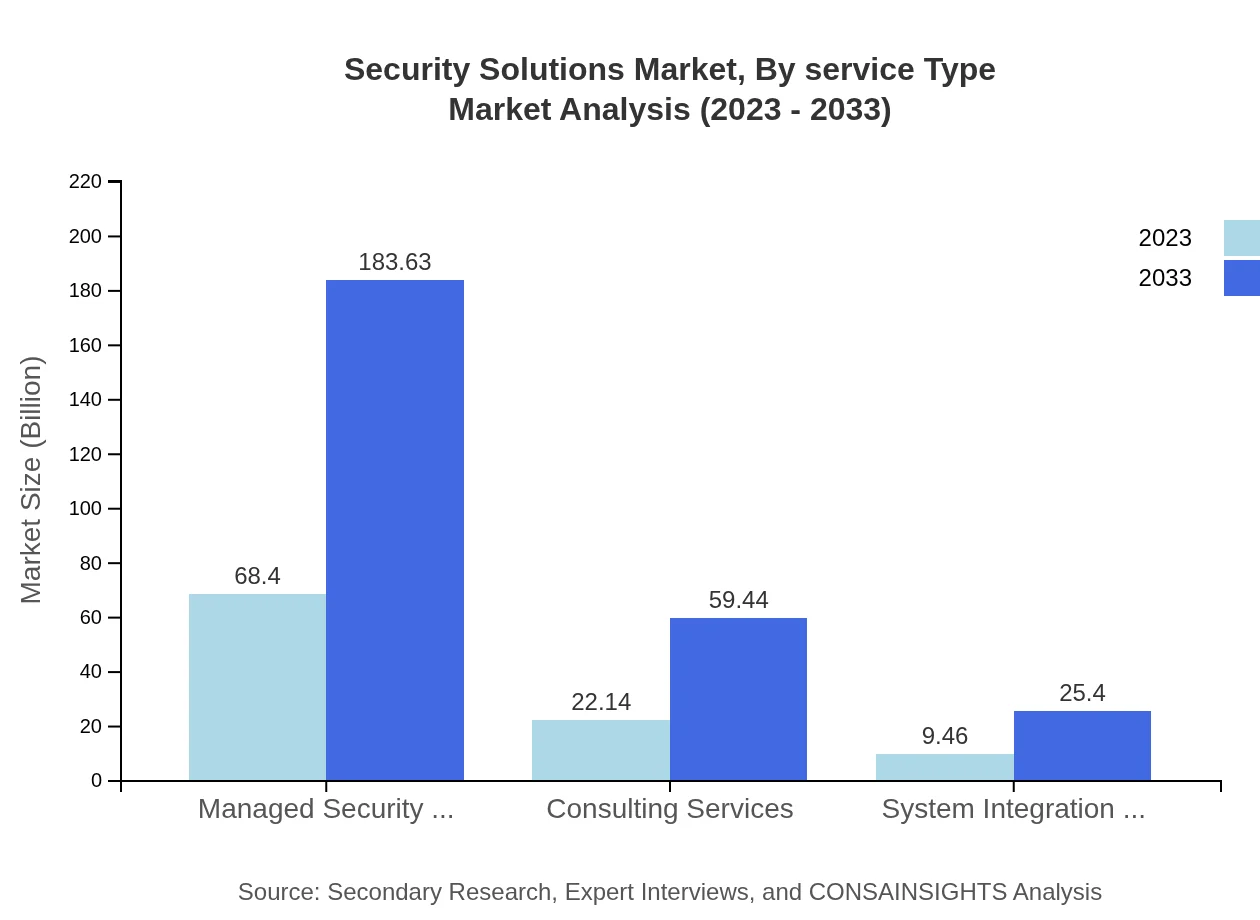

Security Solutions Market Analysis By Service Type

Managed Security Services (MSS) will witness substantial growth, moving from $68.40 billion in 2023 to $183.63 billion by 2033. Other service types, including consulting and system integration, will also grow to meet rising security demands.

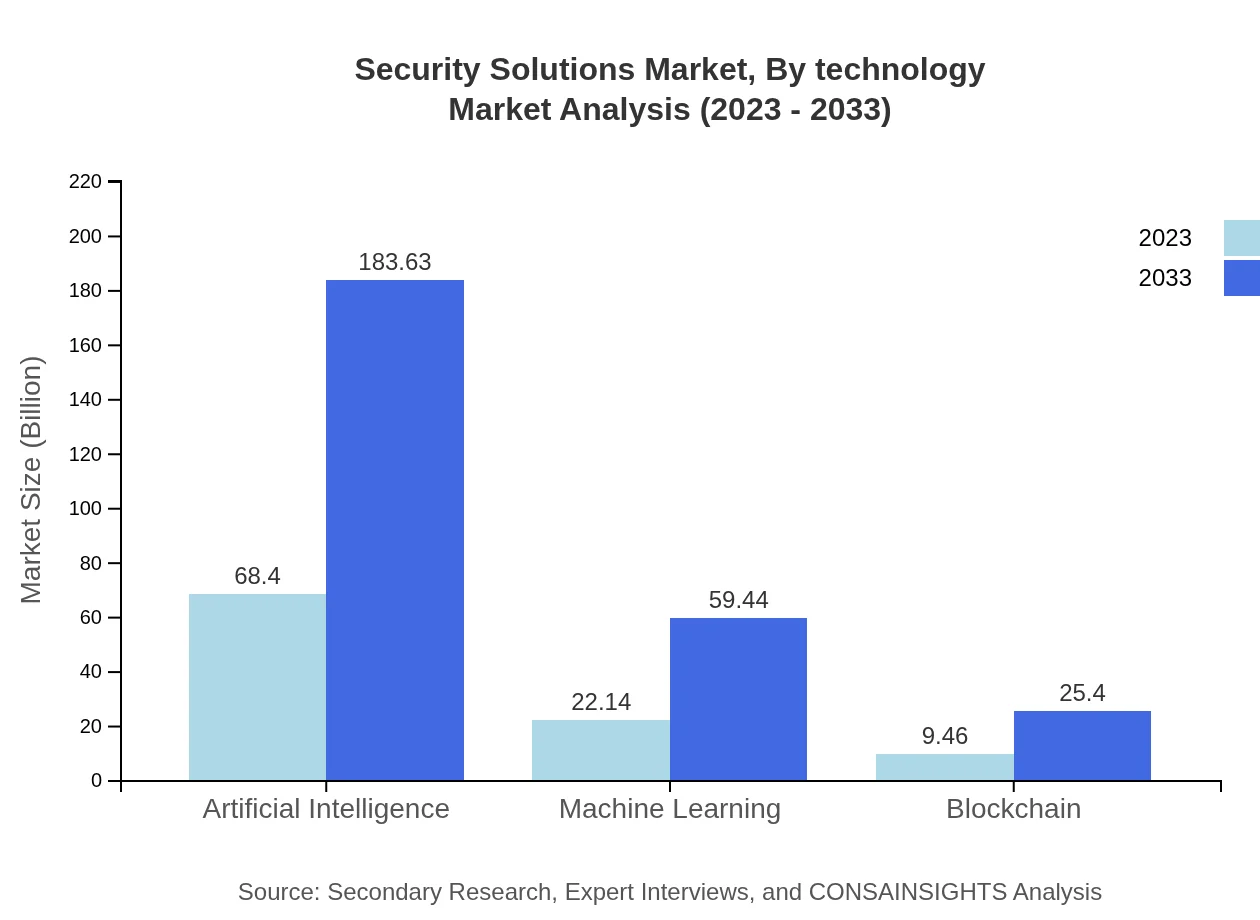

Security Solutions Market Analysis By Technology

Technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain will significantly impact the market. AI is expected to grow from $68.40 billion to $183.63 billion, while ML will rise from $22.14 billion to $59.44 billion over the same period.

Security Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Security Solutions Industry

Cisco Systems:

Cisco is known for its innovative cybersecurity solutions that incorporate advanced technology to safeguard networks and data.Palo Alto Networks:

Palo Alto Networks specializes in cybersecurity solutions, providing next-generation firewalls and cloud-based security services.McAfee Corp.:

McAfee is a prominent player in endpoint security solutions and multi-layered security technologies.Fortinet Inc.:

Fortinet offers comprehensive security solutions, specializing in high-performance firewalls and network security systems.Symantec (now NortonLifeLock):

Symantec is a leader in integrated cybersecurity solutions, focusing on endpoint protection and threat intelligence.We're grateful to work with incredible clients.

FAQs

What is the market size of Security Solutions?

The global Security Solutions market was valued at approximately $100 billion in 2023, with a projected CAGR of 10% over the next decade. By 2033, the market is expected to expand significantly, marking robust growth in the sector.

What are the key market players or companies in this Security Solutions industry?

The Security Solutions industry features key players such as Symantec, McAfee, Palo Alto Networks, and Cisco Systems. These companies lead in innovations addressing security concerns across various sectors including IT, healthcare, and finance.

What are the primary factors driving the growth in the Security Solutions industry?

Key growth drivers include the increasing frequency of cyberattacks, regulatory compliance requirements, and the rising demand for cloud security solutions. Organizations are investing significantly in enhancing their security measures, thus accelerating market growth.

Which region is the fastest Growing in the Security Solutions market?

The Asia Pacific region represents the fastest-growing area in the Security Solutions market, with significant market growth projected from $18.99 billion in 2023 to $50.98 billion by 2033, highlighting the increasing focus on digital security in emerging economies.

Does ConsaInsights provide customized market report data for the Security Solutions industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the Security Solutions industry. This service allows clients to receive insights that are highly relevant to their operational needs and market interests.

What deliverables can I expect from this Security Solutions market research project?

Deliverables from the Security Solutions market research project include comprehensive market analysis reports, detailed segment data, growth forecasts, and insights into regional trends, all aimed at enabling informed decision-making.

What are the market trends of Security Solutions?

Current trends in the Security Solutions market include the escalating adoption of AI-driven security technologies, increased focus on managed security services, and a shift towards integrated security solutions that address diverse security needs across industries.