Seed Coating Agent Market Report

Published Date: 02 February 2026 | Report Code: seed-coating-agent

Seed Coating Agent Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Seed Coating Agent market, offering insights into market size, growth rate, segmentation, and regional dynamics from 2023 to 2033. It also highlights industry trends and forecasts that shape the future landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer Crop Science, FMC Corporation, Nufarm Limited |

| Last Modified Date | 02 February 2026 |

Seed Coating Agent Market Overview

Customize Seed Coating Agent Market Report market research report

- ✔ Get in-depth analysis of Seed Coating Agent market size, growth, and forecasts.

- ✔ Understand Seed Coating Agent's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Seed Coating Agent

What is the Market Size & CAGR of Seed Coating Agent market in 2023?

Seed Coating Agent Industry Analysis

Seed Coating Agent Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Seed Coating Agent Market Analysis Report by Region

Europe Seed Coating Agent Market Report:

In Europe, the Seed Coating Agent market was valued at USD 0.48 billion in 2023 and is expected to reach USD 0.88 billion by 2033. The market is driven by stringent regulations favoring environmentally friendly agricultural practices and a growing trend towards biological seed treatments.Asia Pacific Seed Coating Agent Market Report:

The Asia Pacific region is witnessing strong growth in the Seed Coating Agent market, driven by increasing agricultural activities and heightened demand for innovative farming practices. In 2023, the market size was approximately USD 0.36 billion, projected to reach USD 0.66 billion by 2033 as farmers seek improved crop yields to meet food security challenges.North America Seed Coating Agent Market Report:

The North American market for Seed Coating Agents stood at about USD 0.66 billion in 2023 and is anticipated to grow to USD 1.23 billion by 2033. Increased focus on crop efficiency and sustainability measures contribute to the region's substantial growth fueled by advanced agricultural practices.South America Seed Coating Agent Market Report:

In South America, where agriculture forms a significant part of the economy, the Seed Coating Agent market is growing steadily. The market was valued at around USD 0.06 billion in 2023 and is expected to attain USD 0.12 billion by 2033, largely attributed to rising investments in modern agricultural technologies and practices.Middle East & Africa Seed Coating Agent Market Report:

The Middle East and Africa show potential for growth in the Seed Coating Agent market, with a market value of USD 0.24 billion in 2023, projected to increase to USD 0.45 billion by 2033. The growth is supported by rising agricultural investments aimed at enhancing crop productivity in challenging climatic conditions.Tell us your focus area and get a customized research report.

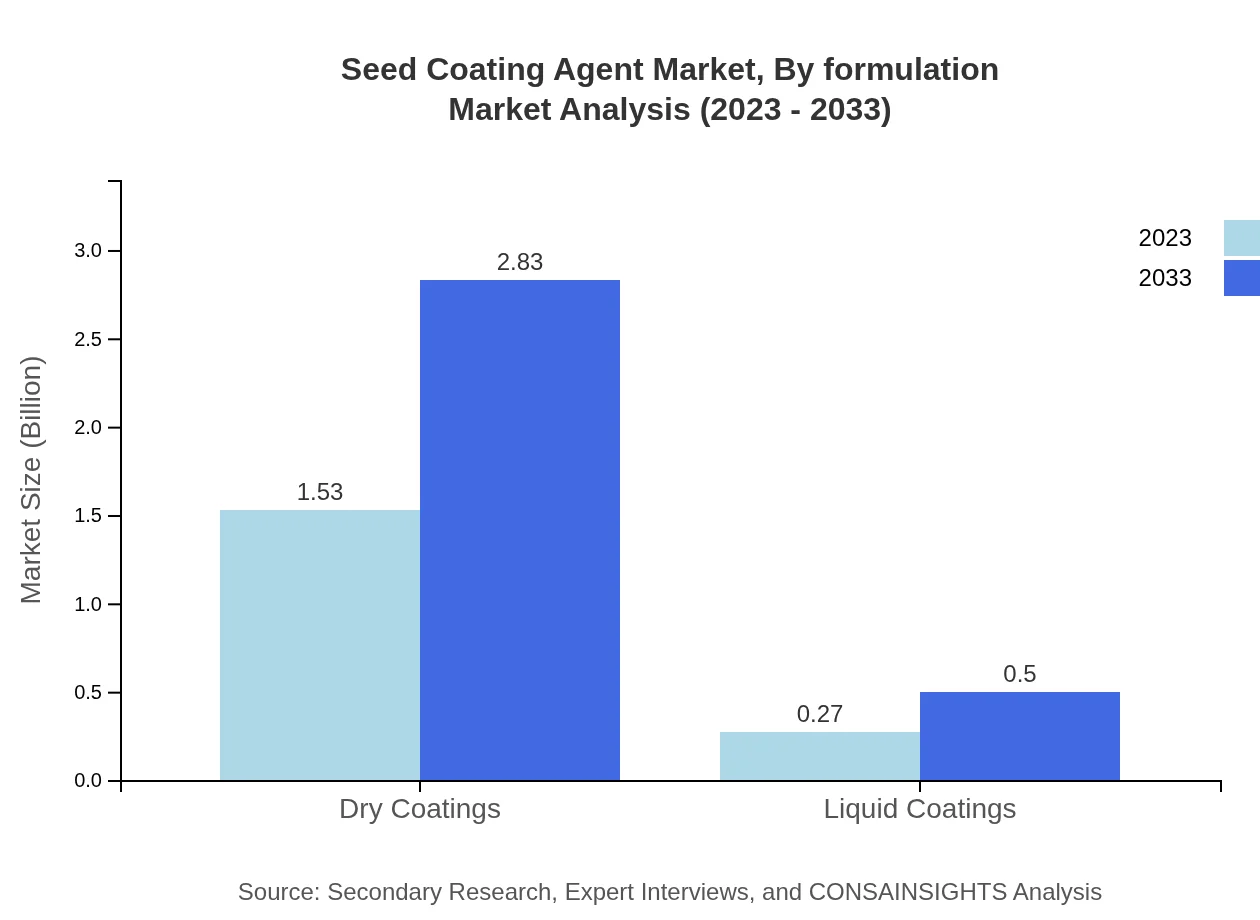

Seed Coating Agent Market Analysis By Product Type

In 2023, the Seed Coating Agent market by product type reached USD 1.53 billion, projected to increase to USD 2.83 billion by 2033. The dominance of dry coatings, with an 84.98% market share in 2023, reflects end-users' preference for products that promise enhanced seed protection and performance.

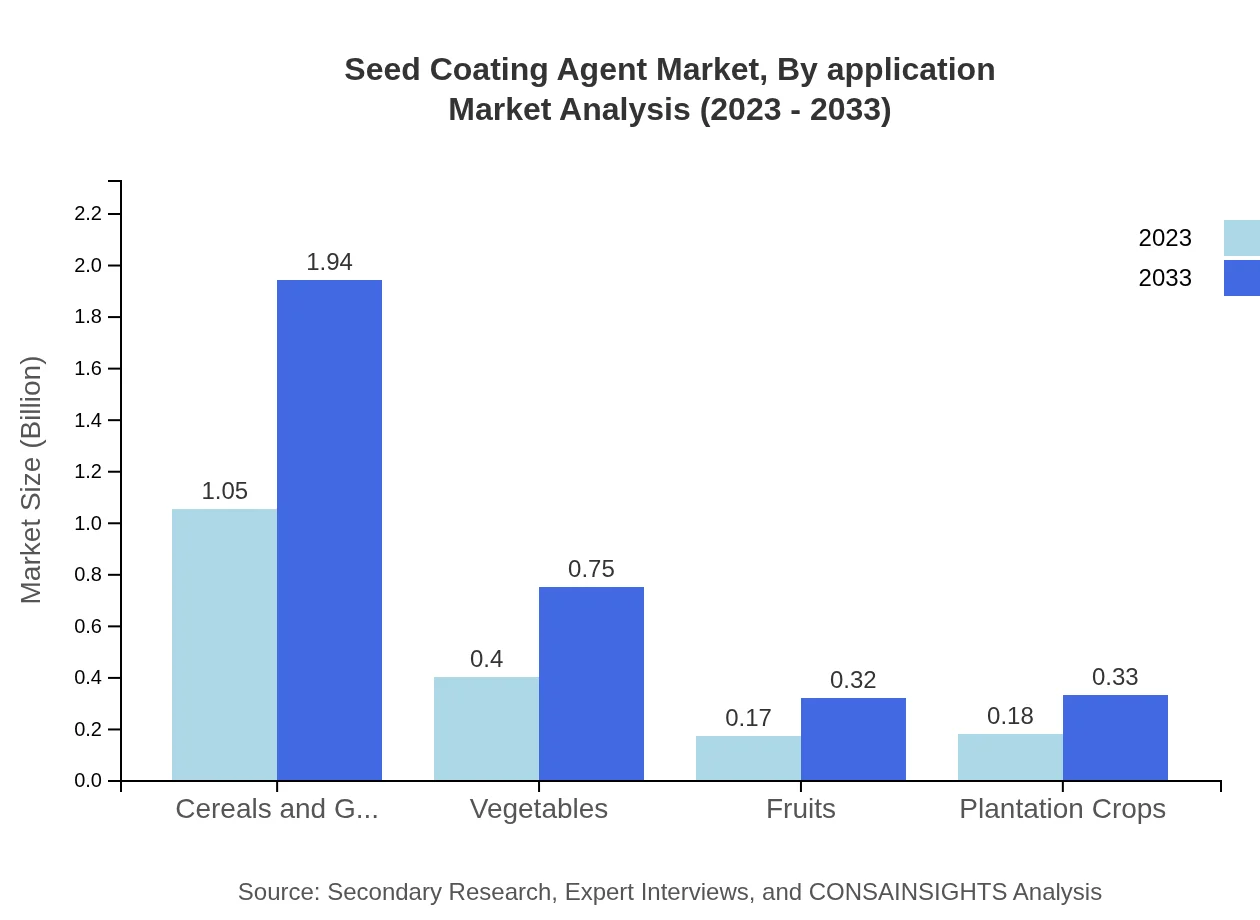

Seed Coating Agent Market Analysis By Application

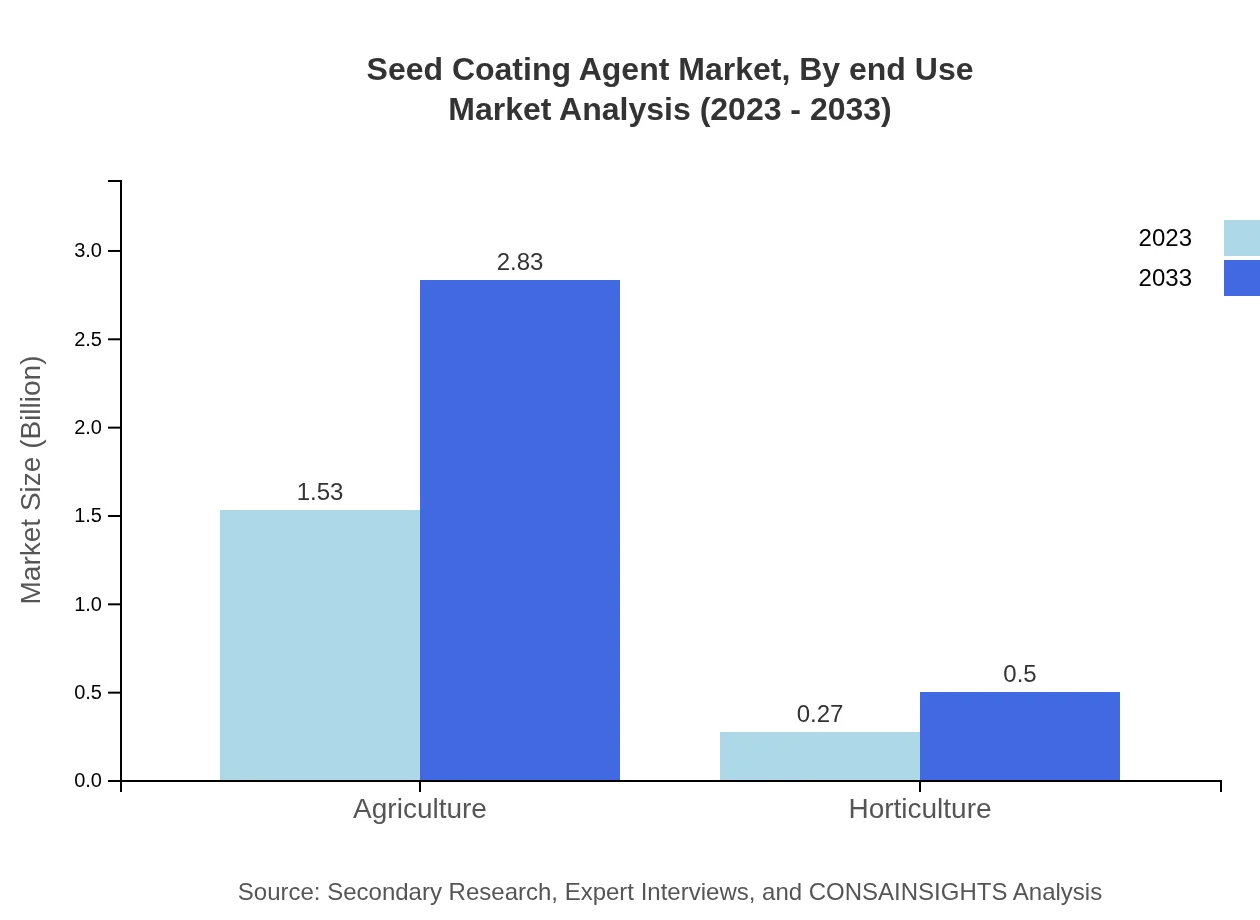

The application segment for agriculture commands the majority share, accounting for approximately 84.98% of the market in 2023, with a forecast for continual dominance through 2033. Horticulture follows with a stable growth pattern due to increasing emphasis on ornamental, fruits, and vegetable cultivation.

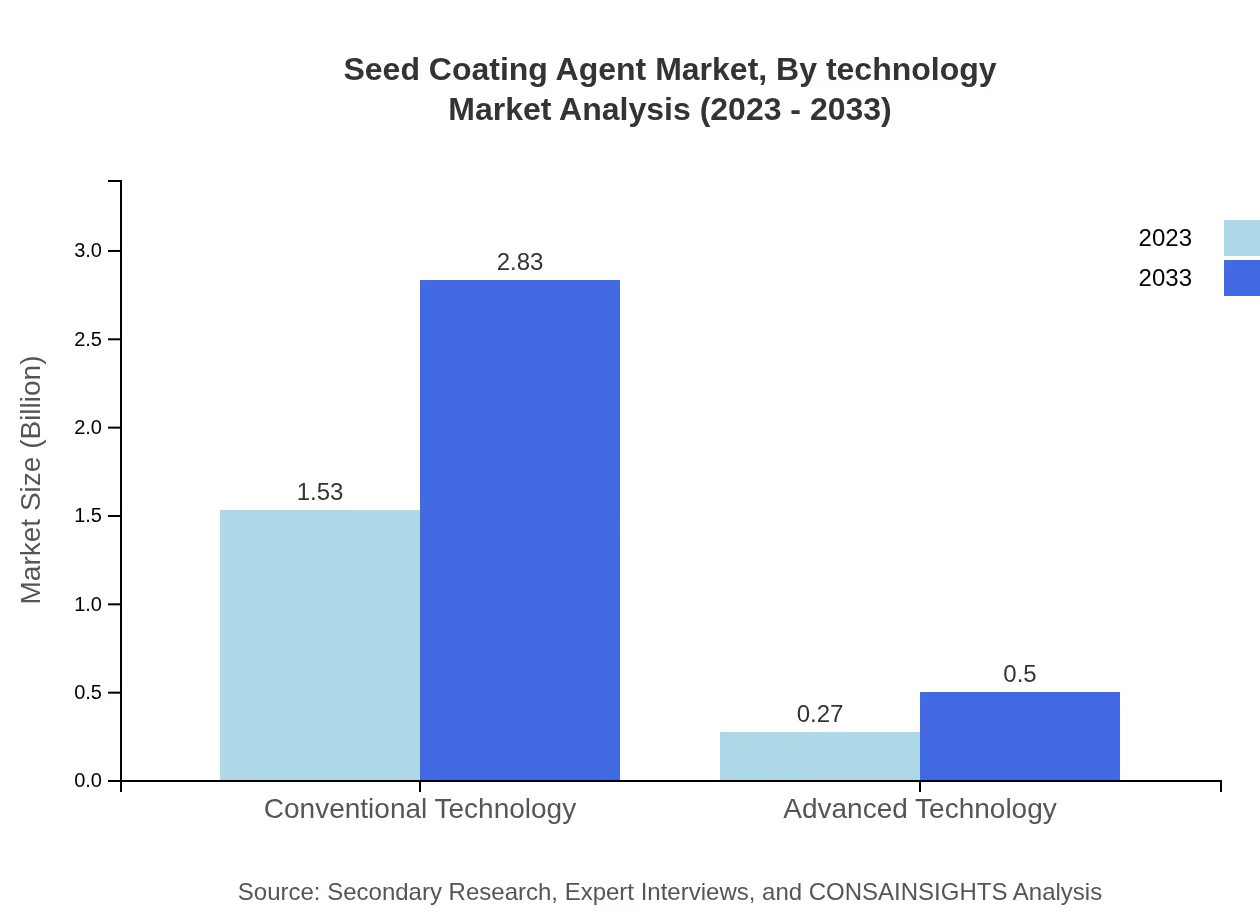

Seed Coating Agent Market Analysis By Technology

Conventional technology continues to spearhead the Seed Coating Agent market with a size of USD 1.53 billion in 2023, expected to grow to USD 2.83 billion by 2033. This segment benefits from longstanding practices in agriculture, although advanced technology segments are gradually gaining traction.

Seed Coating Agent Market Analysis By Formulation

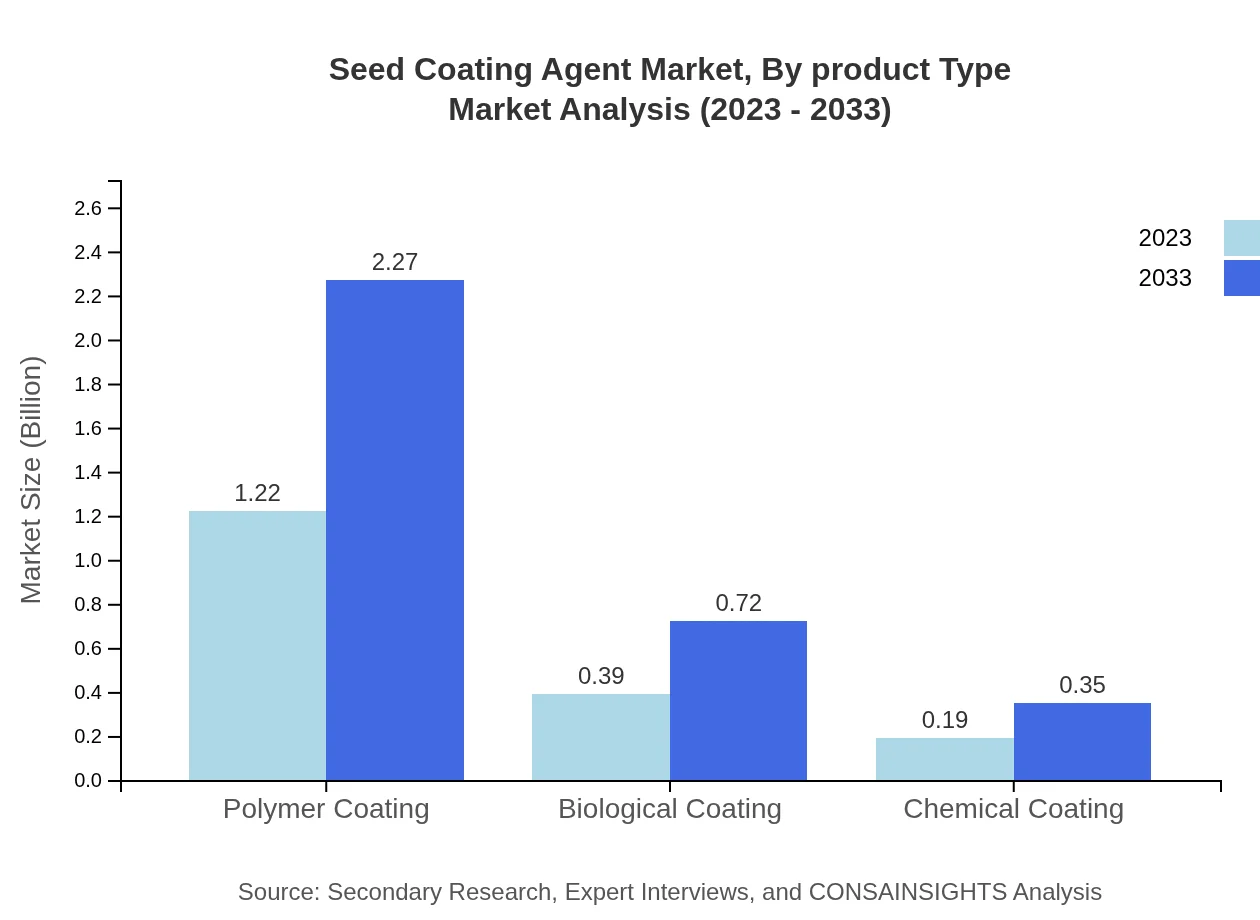

Polymer coatings lead the formulation segment with a significant share of 67.93% and a value of USD 1.22 billion in 2023, projected to reach USD 2.27 billion by 2033. Biological coatings, while smaller at 21.47%, are increasing due to their compatibility with organic farming methods.

Seed Coating Agent Market Analysis By End Use

The agricultural sector remains the primary end-use market for Seed Coating Agents, representing around 84.98% of the segment share. Efforts to enhance yield in cereals, grains, and horticultural products drive this demand, promoting a robust growth trajectory through the forecast period.

Seed Coating Agent Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Seed Coating Agent Industry

BASF SE:

BASF SE is a global leader in chemical production, offering a comprehensive range of agricultural solutions including innovative seed coating agents that enhance seed performance and sustainability.Syngenta AG:

Syngenta AG specializes in seed and crop protection, well-known for developing advanced seed coating formulations aimed at improving crop yields and protecting from diseases.Bayer Crop Science:

Bayer Crop Science provides various agricultural products, including seed coating agents designed to optimize seed performance and support sustainable farming practices.FMC Corporation:

FMC Corporation is recognized for its advanced agricultural technologies, focusing on seed protection and enhancement solutions, including innovative seed coating agents.Nufarm Limited:

Nufarm Limited offers a diverse range of agricultural chemicals and has developed specialized seed coating agents aimed at improving yield and plant health.We're grateful to work with incredible clients.

FAQs

What is the market size of seed Coating Agent?

The seed coating agent market is valued at $1.8 billion in 2023, with a projected CAGR of 6.2%. This growth highlights the increasing significance of innovative agricultural practices to enhance seed performance and yield.

What are the key market players or companies in the seed Coating Agent industry?

Key players in the seed-coating-agent market include major agricultural companies specializing in seed technology, chemical manufacturers focused on agricultural solutions, and innovative startups introducing advanced coating technologies to enhance seed performance.

What are the primary factors driving the growth in the seed Coating Agent industry?

The growth of the seed coating agent market is driven by increasing demand for high-yield crops, advancements in coating technologies, and the need for sustainable agricultural practices to enhance seed durability and protect against diseases.

Which region is the fastest Growing in the seed Coating Agent market?

The North American region is witnessing significant growth in the seed-coating-agent market, projected to increase from $0.66 billion in 2023 to $1.23 billion by 2033, reflecting a burgeoning demand for innovative agricultural inputs.

Does ConsaInsights provide customized market report data for the seed Coating Agent industry?

Yes, ConsaInsights provides tailored market report data for the seed-coating-agent industry, allowing clients to access specific insights based on their unique business needs and market interests.

What deliverables can I expect from this seed Coating Agent market research project?

Deliverables from the seed-coating-agent market research project include detailed market analysis reports, segment data, competitive landscape insights, and forecasts for market growth and trends.

What are the market trends of seed Coating Agent?

Market trends in the seed-coating-agent industry involve a shift towards sustainable coatings, increased adoption of polymer coatings, and a rising focus on biological agent utilization for enhancing seed performance and resilience.