Seed Coating Ingredients Market Report

Published Date: 31 January 2026 | Report Code: seed-coating-ingredients

Seed Coating Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Seed Coating Ingredients market, including market size, growth trends, segmentation, and forecasts from 2023 to 2033. Detailed insights into regional performance and key market players are also covered.

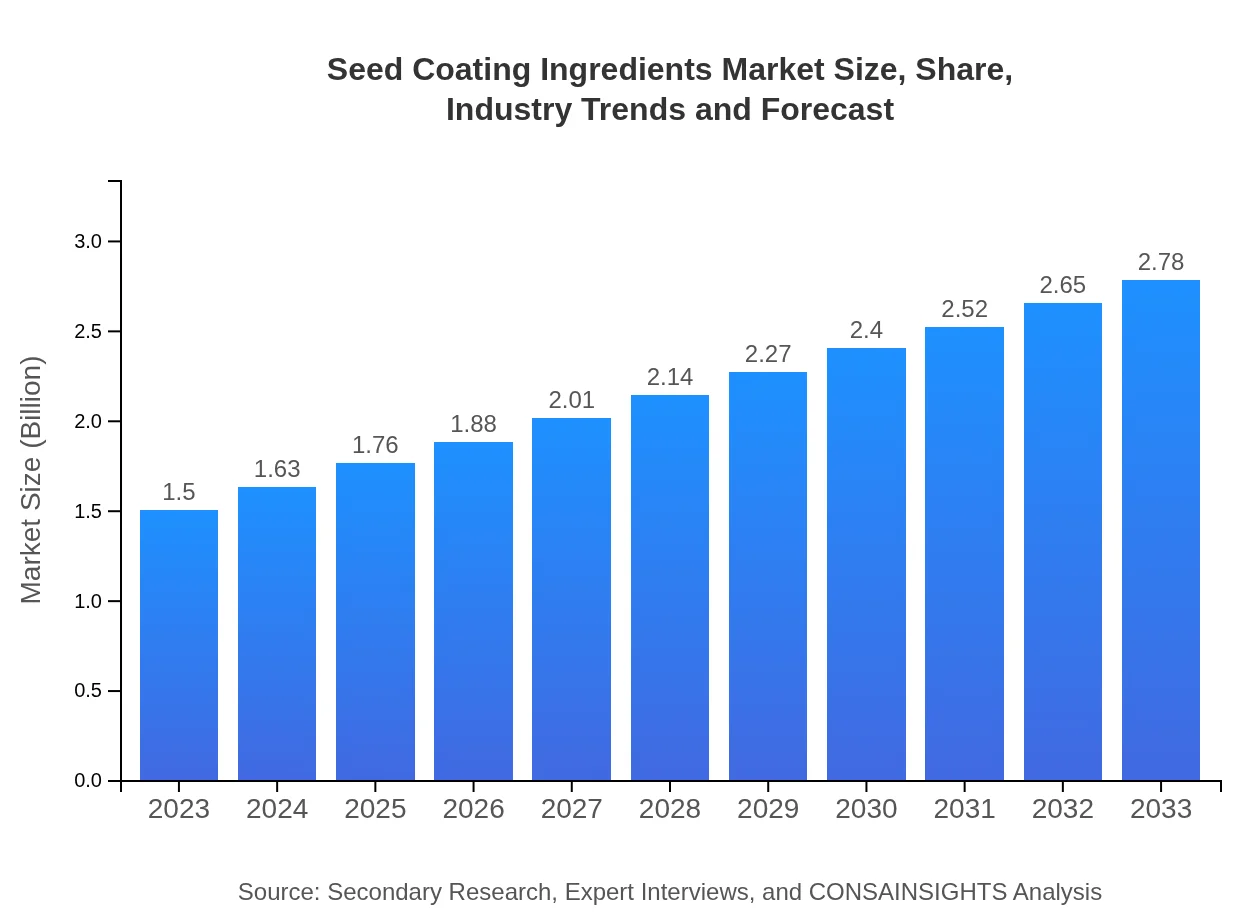

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | BASF SE, Syngenta AG, Mahindra Agribusiness, Clariant AG, Croda International |

| Last Modified Date | 31 January 2026 |

Seed Coating Ingredients Market Overview

Customize Seed Coating Ingredients Market Report market research report

- ✔ Get in-depth analysis of Seed Coating Ingredients market size, growth, and forecasts.

- ✔ Understand Seed Coating Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Seed Coating Ingredients

What is the Market Size & CAGR of Seed Coating Ingredients market in 2023?

Seed Coating Ingredients Industry Analysis

Seed Coating Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Seed Coating Ingredients Market Analysis Report by Region

Europe Seed Coating Ingredients Market Report:

Europe's market value stands at $0.52 billion in 2023, projected to grow to $0.96 billion by 2033. Stringent regulations promoting sustainable practices and a strong focus on organic farming are key drivers for the growth of seed coating ingredients in this region.Asia Pacific Seed Coating Ingredients Market Report:

In 2023, the Asia Pacific region holds a market size of $0.25 billion and is expected to reach $0.47 billion by 2033. The growth is attributed to increasing agricultural practices, modernization initiatives in farming, and a focus on sustainable agriculture in countries like China and India.North America Seed Coating Ingredients Market Report:

North America represents a significant market size of $0.52 billion in 2023, expected to double by 2033. Factors driving this growth include advanced agricultural techniques and increased investments in research and development in seed technology.South America Seed Coating Ingredients Market Report:

The South American market is relatively small, with a value of $0.06 billion in 2023, projected to grow to $0.11 billion by 2033. This growth is fueled by the expansion of agricultural lands and the increasing adoption of seed coating technologies to enhance crop quality.Middle East & Africa Seed Coating Ingredients Market Report:

In the Middle East and Africa, the seed coating ingredients market is valued at $0.15 billion in 2023, potentially reaching $0.28 billion by 2033. Challenges such as water scarcity and the need for improved agricultural outputs play a vital role in boosting market demand.Tell us your focus area and get a customized research report.

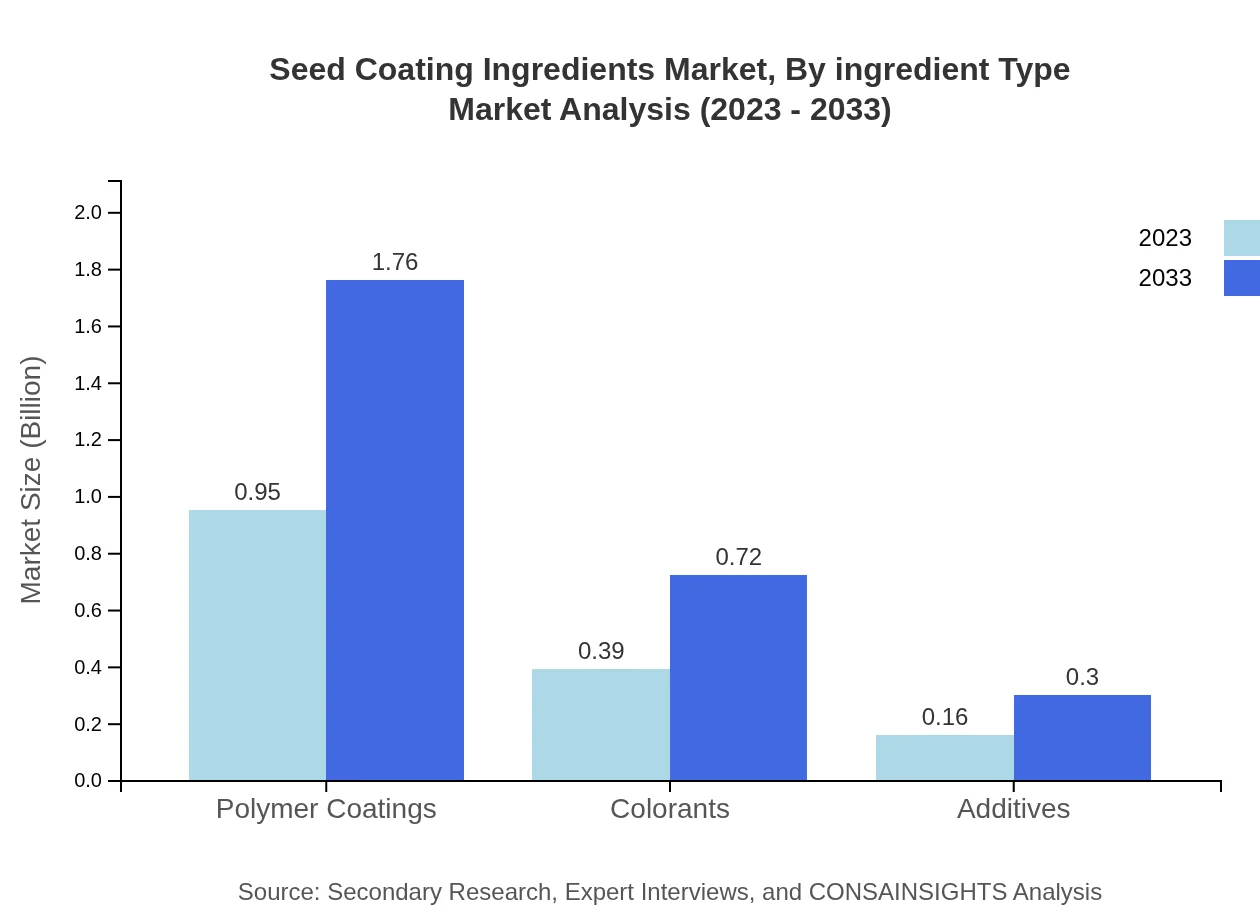

Seed Coating Ingredients Market Analysis By Ingredient Type

In 2023, polymer coatings dominate the market, accounting for a size of $0.95 billion (63.16% share), driven by their performance in protecting seeds from environmental factors. Colorants represent a market size of $0.39 billion (25.93% share), while additives account for $0.16 billion (10.91% share). By 2033, polymer coatings are expected to grow to $1.76 billion, continuing to lead the segment.

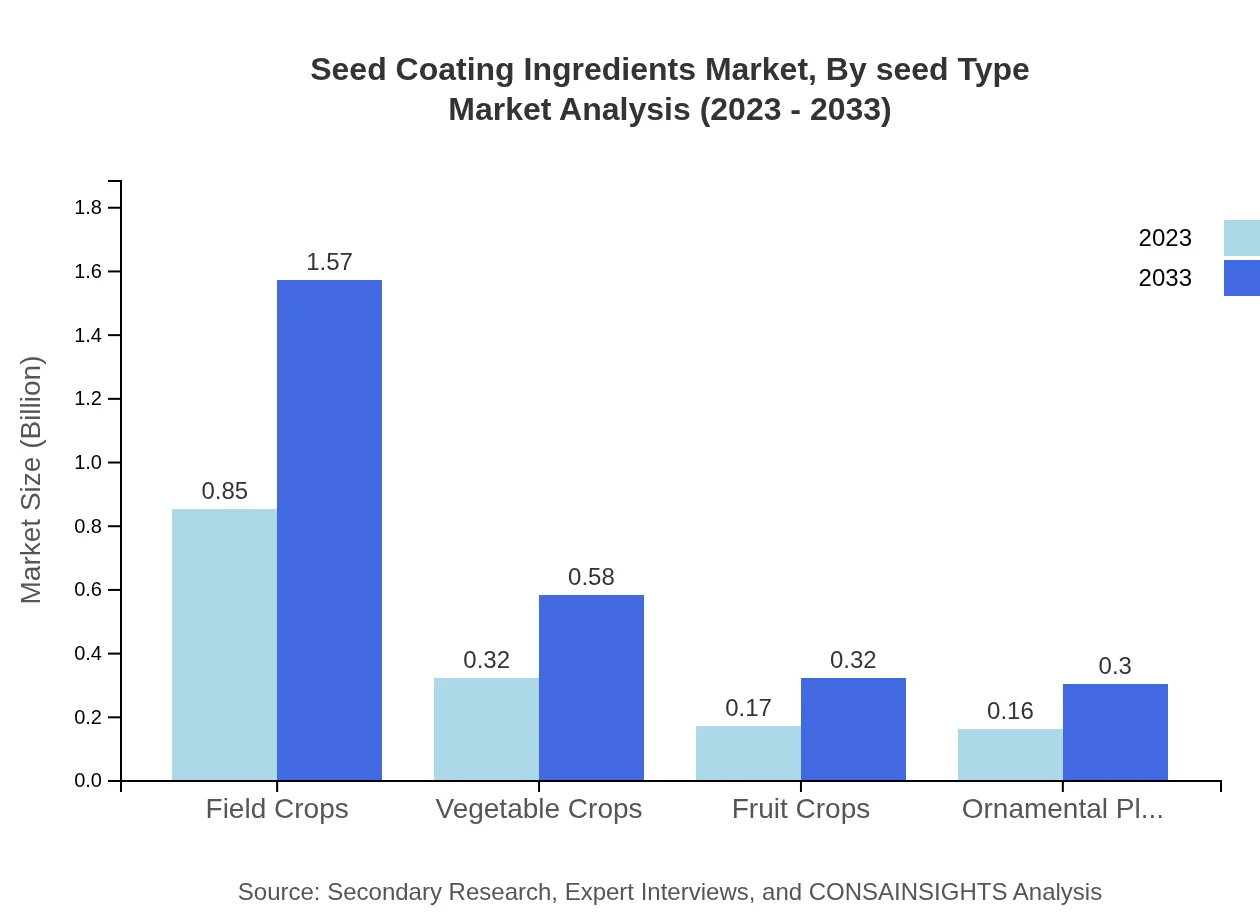

Seed Coating Ingredients Market Analysis By Seed Type

Field crops hold the largest share in the seed coating ingredients market, with a size of $0.85 billion (56.57% share) in 2023, expected to increase to $1.57 billion by 2033. Vegetable crops account for $0.32 billion (21.04% share), growing to $0.58 billion, while fruit crops are projected to grow from $0.17 billion (11.55% share) to $0.32 billion. Ornamental plants, starting from $0.16 billion (10.84% share), are expected to reach $0.30 billion.

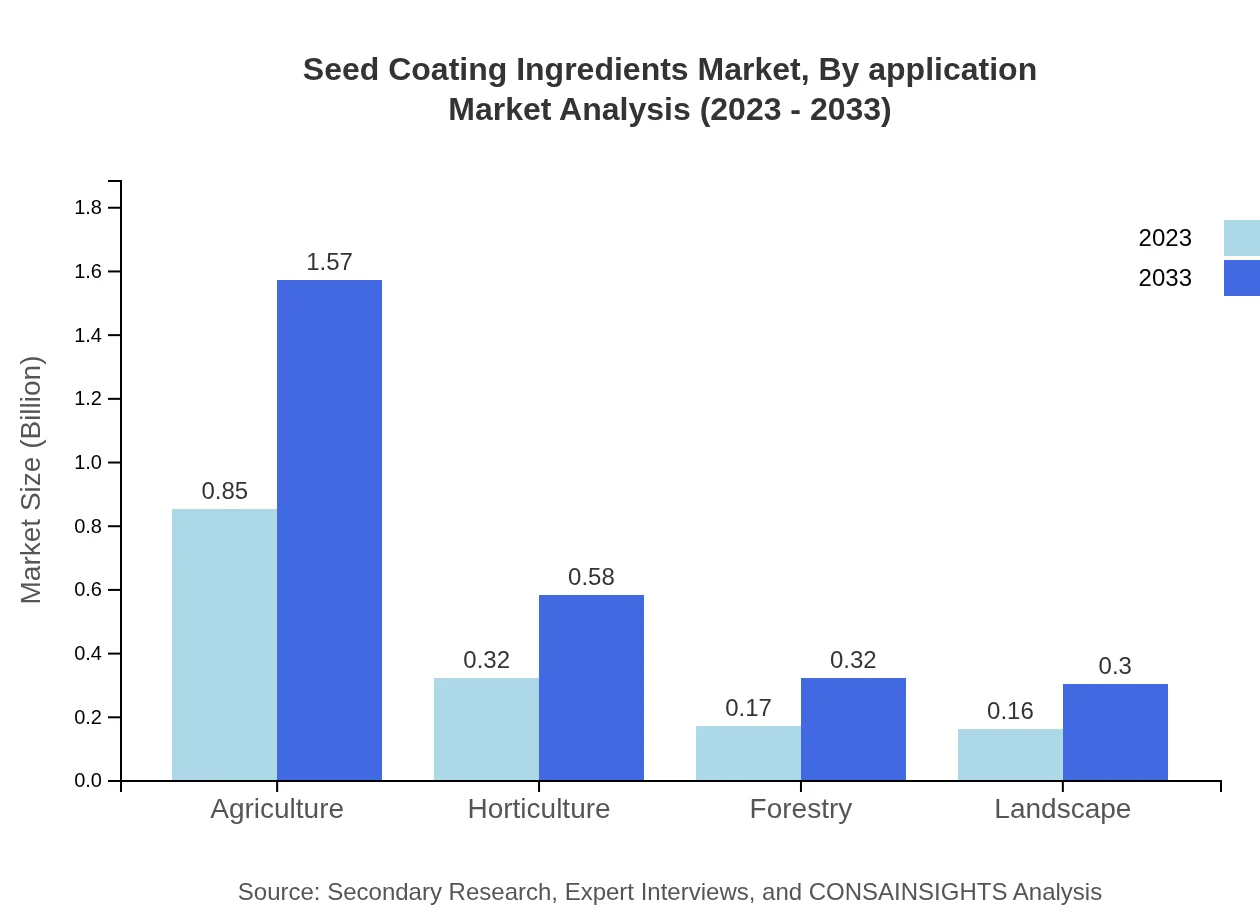

Seed Coating Ingredients Market Analysis By Application

The agriculture sector leads with a market size of $0.85 billion (56.57% share) in 2023, projected to grow to $1.57 billion by 2033. Horticulture follows with $0.32 billion (21.04% share), expected to expand to $0.58 billion, while forestry and landscape applications show growth, reaching $0.32 billion and $0.30 billion respectively by 2033.

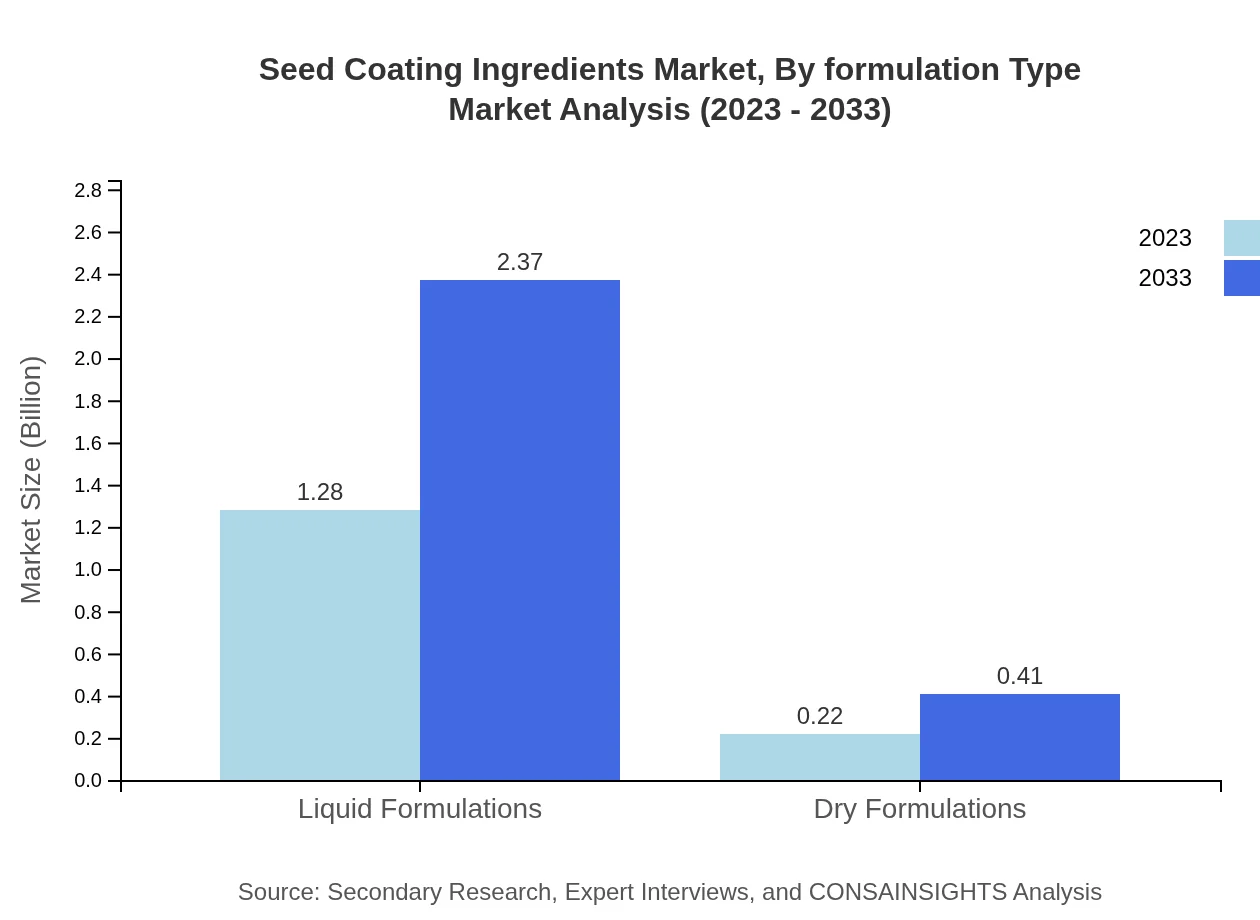

Seed Coating Ingredients Market Analysis By Formulation Type

Liquid formulations dominate the seed coating market with a size of $1.28 billion (85.2% share) in 2023, projected to increase to $2.37 billion by 2033. Dry formulations represent a smaller segment with $0.22 billion (14.8% share), expected to grow to $0.41 billion as innovation in coating technologies continues to gain traction.

Seed Coating Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Seed Coating Ingredients Industry

BASF SE:

A global leader in the chemical industry, BASF develops innovative seed coating solutions that enhance seed performance and protect crops.Syngenta AG:

A leading agricultural company, Syngenta specializes in crop protection and seed technologies, offering comprehensive seed coating products.Mahindra Agribusiness:

Known for its wide range of agricultural products, Mahindra Agribusiness provides state-of-the-art seed coating solutions aimed at sustainable agriculture.Clariant AG:

Clariant is a global specialty chemicals company, actively engaged in developing eco-friendly seed coatings that ensure high-quality crop yields.Croda International:

Croda International focuses on sustainability and innovation in seed coatings, delivering products that improve seed germination and survivability.We're grateful to work with incredible clients.

FAQs

What is the market size of seed Coating Ingredients?

The global seed-coating ingredients market is valued at $1.5 billion in 2023, and it is projected to grow at a CAGR of 6.2% over the next decade, establishing it as a robust segment within the agricultural products sector.

What are the key market players or companies in the seed Coating Ingredients industry?

Key players in the seed-coating ingredients market include companies specializing in agrochemicals and agricultural inputs. Notable names often include Syngenta, BASF, Bayer, Corteva Agriscience, and Croda, known for their innovation and sustainable practices.

What are the primary factors driving the growth in the seed Coating Ingredients industry?

The growth in the seed-coating ingredients market is primarily driven by the increasing demand for sustainable agriculture practices, the necessity for higher yields to meet global food requirements, and innovations in seed technology enhancing crop resilience and performance.

Which region is the fastest Growing in the seed Coating Ingredients?

The fastest-growing region in the seed-coating ingredients market is projected to be Europe, with a market increase from $0.52 billion in 2023 to $0.96 billion by 2033, driven by advanced agricultural technologies and sustainable farming initiatives.

Does ConsaInsights provide customized market report data for the seed Coating Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to the seed-coating ingredients industry, addressing specific client needs and providing insights pertinent to unique market segments and regional developments.

What deliverables can I expect from this seed Coating Ingredients market research project?

Deliverables from the seed-coating ingredients market research include comprehensive reports featuring market sizes, trends, competitive analysis, regional insights, and segmentation data, allowing for informed business decisions and strategic planning.

What are the market trends of seed Coating Ingredients?

Current market trends in seed-coating ingredients include the rising adoption of bio-based coatings, innovative formulations for enhanced seed performance, and a shift towards environmentally friendly practices, emphasizing sustainability in agriculture.