Seed Coating Materials Market Report

Published Date: 02 February 2026 | Report Code: seed-coating-materials

Seed Coating Materials Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Seed Coating Materials market, providing extensive insights spanning from 2023 to 2033. It covers market dynamics, size, regional performances, segmentation, technology trends, and global leaders, offering a well-rounded perspective on expected industry developments.

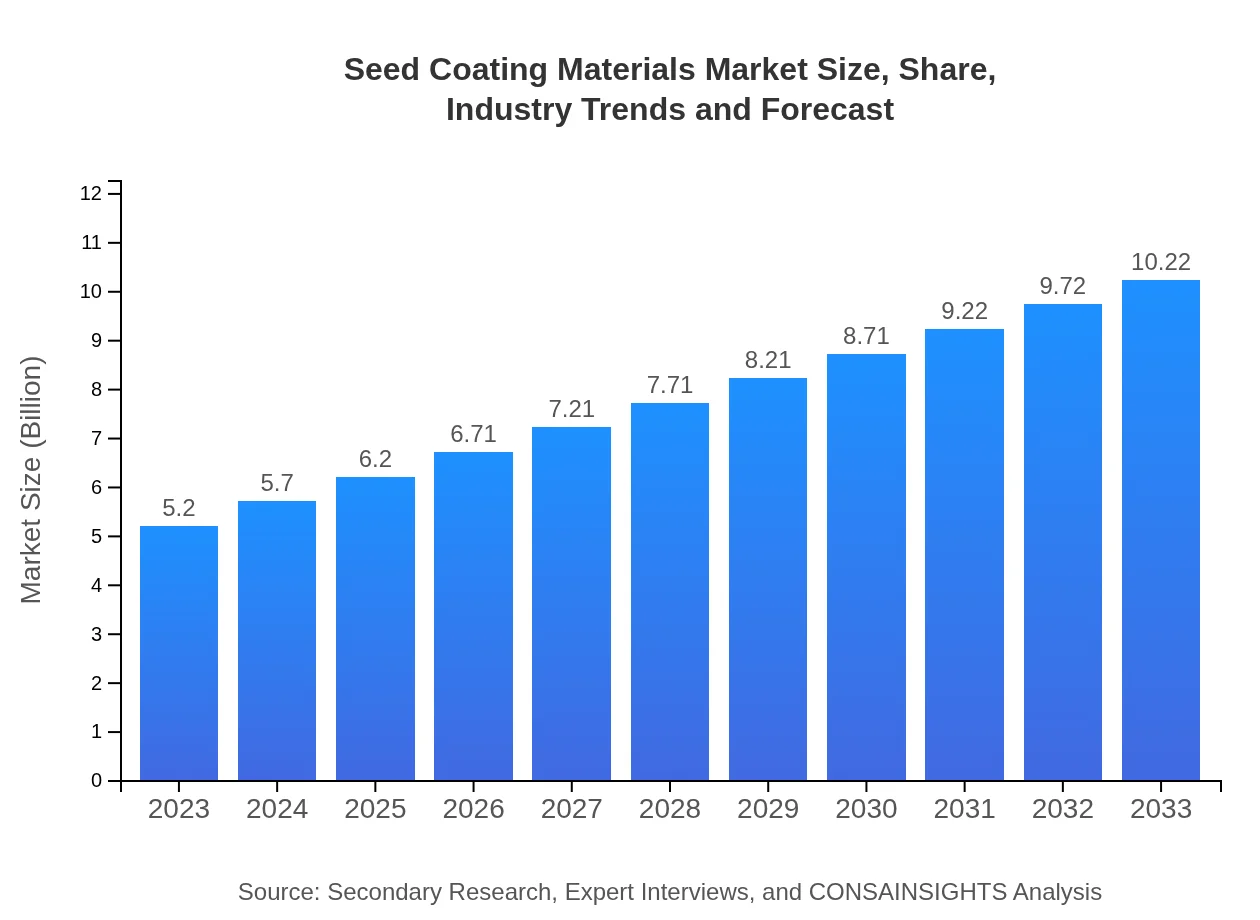

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | BASF SE, Syngenta AG, Verdesian Life Sciences |

| Last Modified Date | 02 February 2026 |

Seed Coating Materials Market Overview

Customize Seed Coating Materials Market Report market research report

- ✔ Get in-depth analysis of Seed Coating Materials market size, growth, and forecasts.

- ✔ Understand Seed Coating Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Seed Coating Materials

What is the Market Size & CAGR of Seed Coating Materials market in 2023?

Seed Coating Materials Industry Analysis

Seed Coating Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

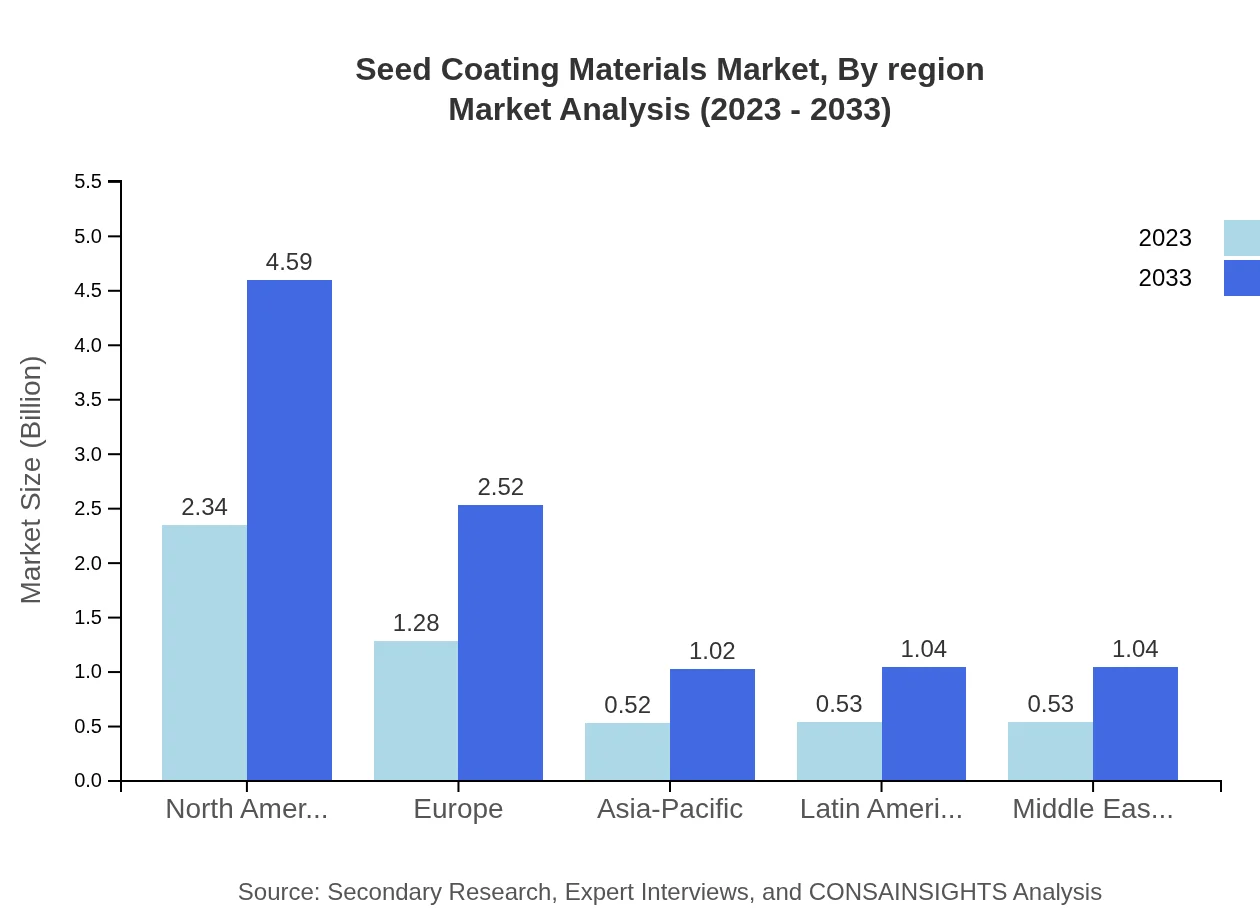

Seed Coating Materials Market Analysis Report by Region

Europe Seed Coating Materials Market Report:

Europe boasts a market size of USD 1.84 billion in 2023, likely nearly doubling to USD 3.62 billion by 2033. The focus on sustainable farming practices, supported by stringent environmental regulations, is a significant catalyst for this growth.Asia Pacific Seed Coating Materials Market Report:

In 2023, the Asia Pacific region holds a market size of USD 0.91 billion, projected to grow to USD 1.79 billion by 2033. The rapid expansion of agriculture and the adoption of modern farming techniques contribute significantly to this growth. Moreover, governmental initiatives in supporting sustainable agricultural practices further drive market demand.North America Seed Coating Materials Market Report:

North America is anticipated to see its market grow from an estimated USD 1.79 billion in 2023 to USD 3.51 billion in 2033. High adoption rates for advanced farming techniques and seed technologies bolster the demand for innovative seed coatings.South America Seed Coating Materials Market Report:

The South American market for Seed Coating Materials is expected to grow from USD 0.36 billion in 2023 to USD 0.70 billion in 2033. Factors such as increasing demands for food security and rising investments in agricultural innovation are key drivers in this region.Middle East & Africa Seed Coating Materials Market Report:

The Middle East and Africa market is projected to expand from USD 0.31 billion in 2023 to USD 0.60 billion by 2033. Increasing awareness about crop protection and efficient farming methods are key factors influencing growth in this region.Tell us your focus area and get a customized research report.

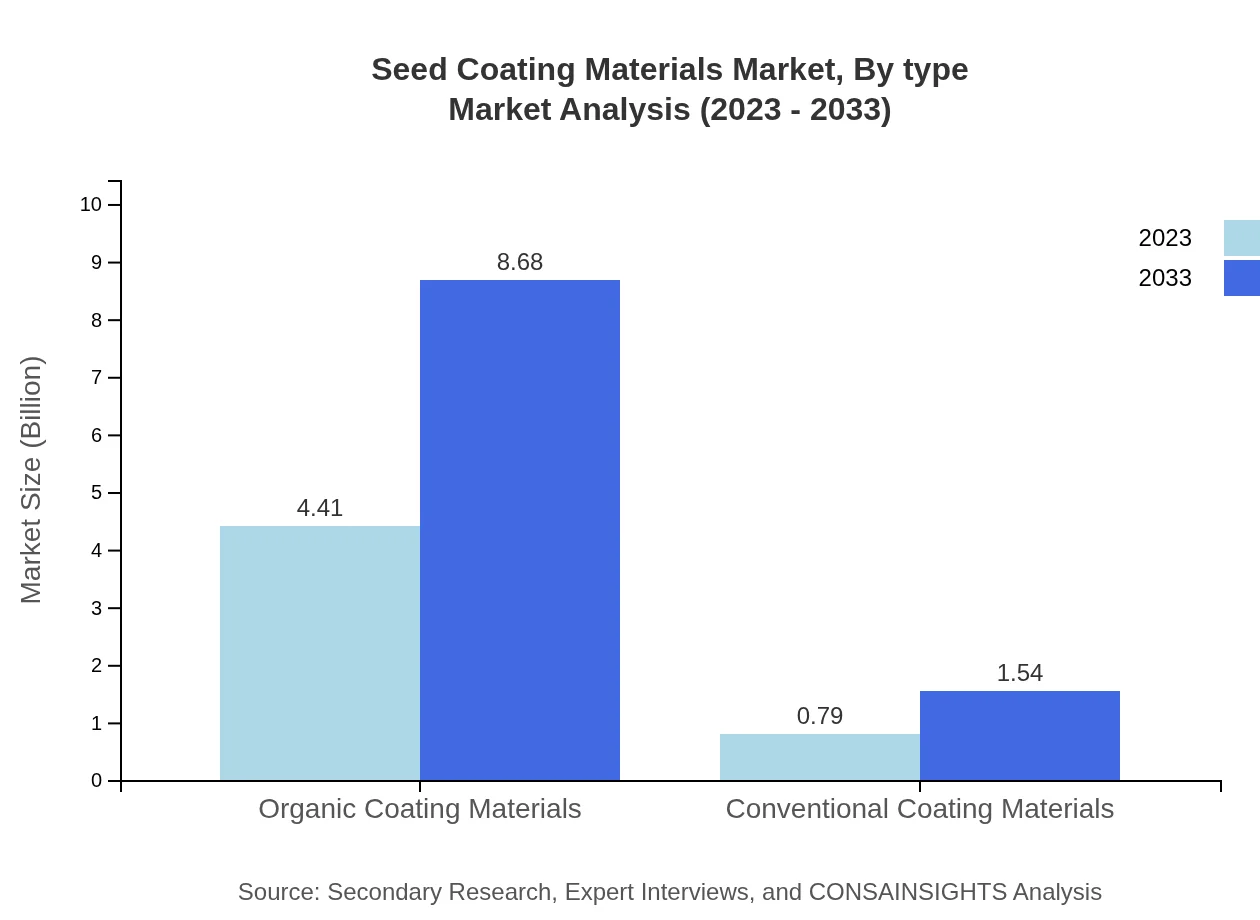

Seed Coating Materials Market Analysis By Type

The analysis reveals that organic coating materials dominate the market, with a size of USD 4.41 billion in 2023, expected to reach USD 8.68 billion in 2033, maintaining a steadfast 84.9% market share. Conventional coating materials, while notably smaller, are projected to grow from USD 0.79 billion to USD 1.54 billion, capturing a 15.1% share.

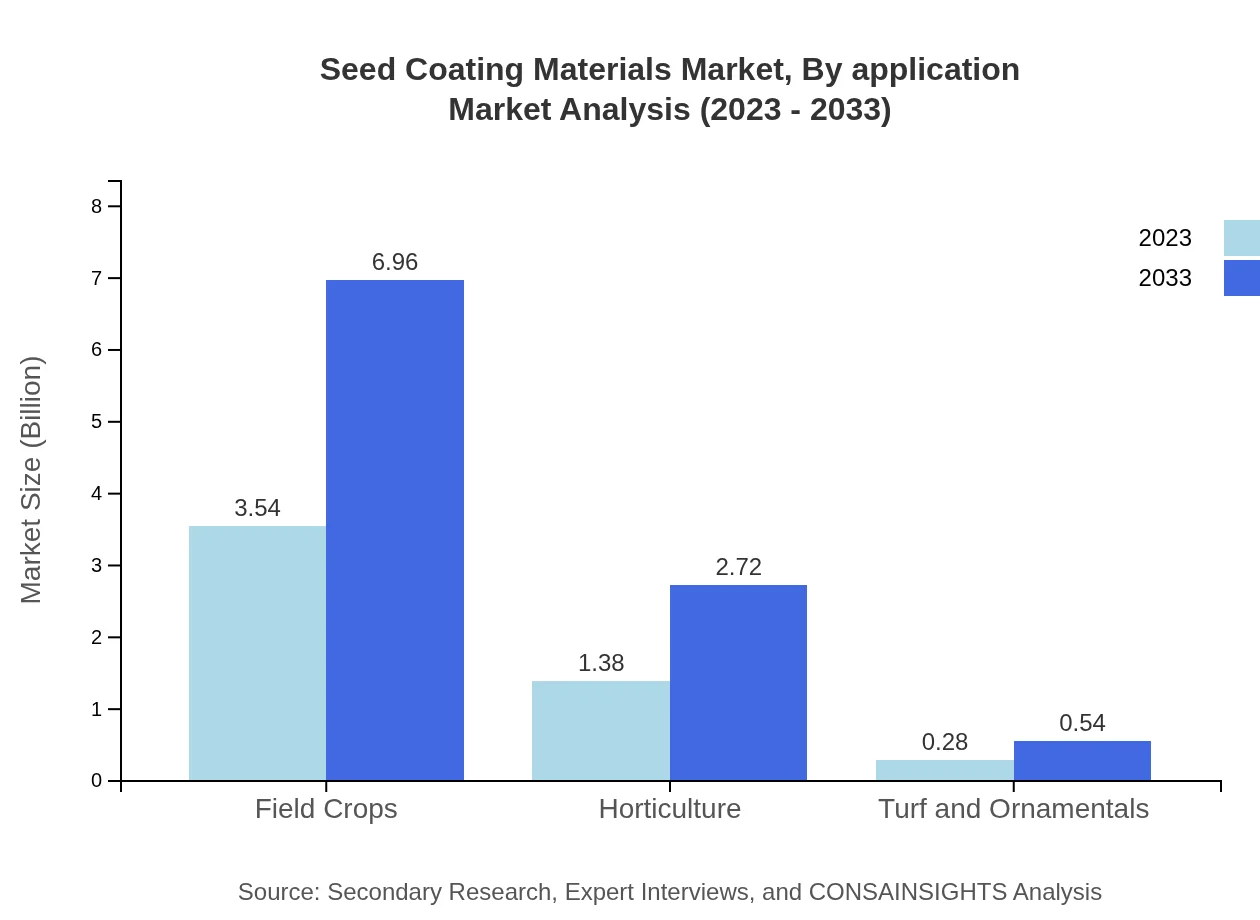

Seed Coating Materials Market Analysis By Application

Field crops represent the highest share of the market, valued at USD 3.54 billion in 2023 and anticipated to reach USD 6.96 billion by 2033. Horticulture follows suit, projected to increase from USD 1.38 billion to USD 2.72 billion. The turf and ornamentals segment, while smaller, is also expected to grow, emphasizing the diverse applications of seed coatings.

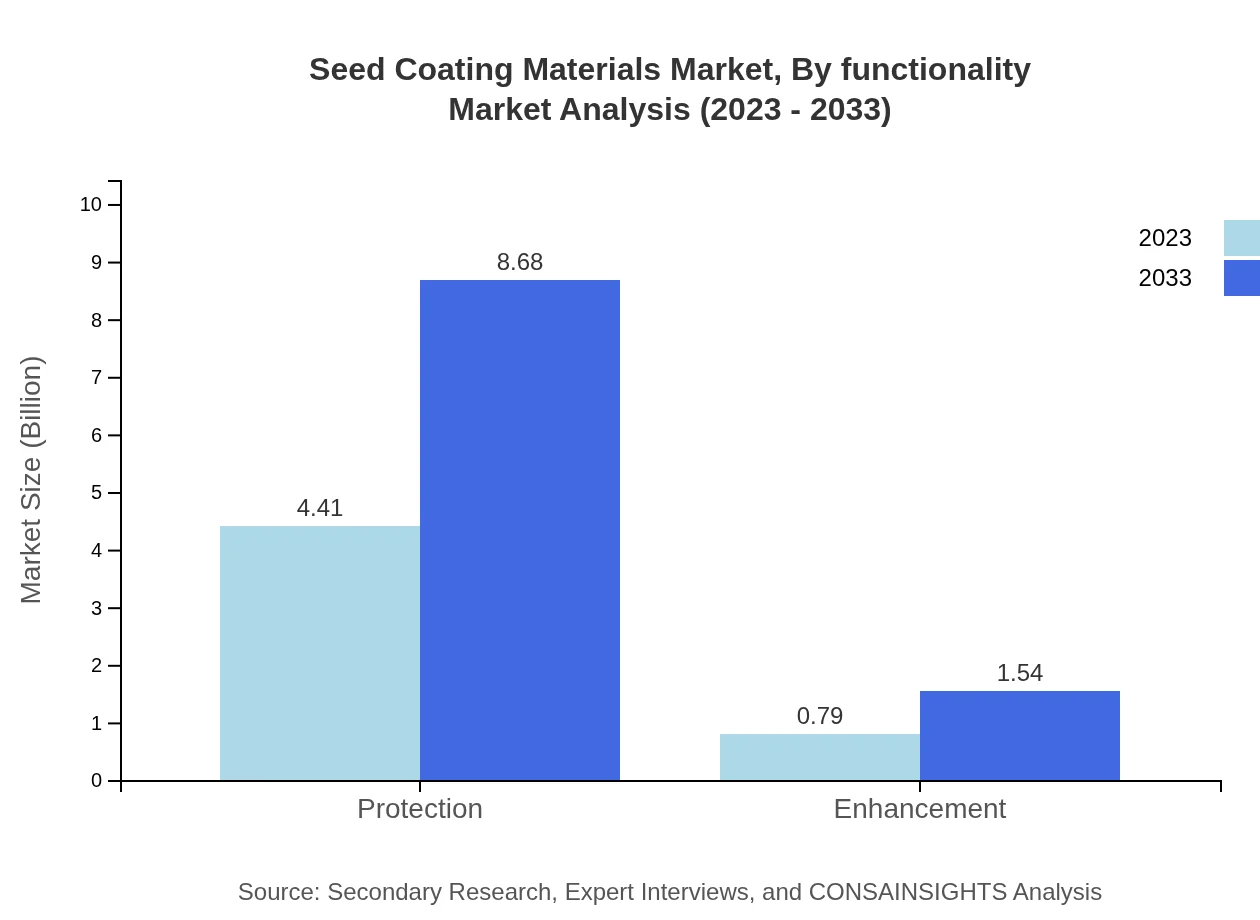

Seed Coating Materials Market Analysis By Functionality

Seed coatings primarily focus on protection, with a revenue of USD 4.41 billion in 2023 and expected to grow to USD 8.68 billion by 2033. Enhancement functionalities account for a smaller yet growing segment, valued at USD 0.79 billion in 2023, projected to reach USD 1.54 billion.

Seed Coating Materials Market Analysis By Region

Regional analysis highlights that North America and Europe lead in market size, followed by Asia Pacific, which is gaining traction due to increased agricultural activities. South America and Middle East & Africa, while smaller markets, show promising growth potential, driven by rising agricultural investments.

Seed Coating Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Seed Coating Materials Industry

BASF SE:

BASF SE is a global leader in the agricultural sector, offering innovative seed coating solutions that enhance crop protection and yield. Their focus on sustainable practices and research-driven products positions them at the forefront of the market.Syngenta AG:

Syngenta AG is renowned for its advanced seed treatments, providing tailored solutions for various crops. Their extensive portfolio and commitment to R&D have made significant contributions to seed coating technologies.Verdesian Life Sciences:

Verdesian Life Sciences is a key player in agricultural technologies, specializing in biological seed coating materials that focus on enhancing seed performance and environmental sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of seed Coating Materials?

The global seed coating materials market is currently estimated at $5.2 billion, with a projected CAGR of 6.8% from 2023 to 2033, reflecting a robust growth trajectory as the sector adapts to emerging agricultural demands.

What are the key market players or companies in this seed Coating Materials industry?

Key players in the seed coating materials market include BASF SE, Bayer AG, Syngenta AG, and Croda International Plc. These companies are strategically positioned to harness technological advancements and respond to evolving market needs.

What are the primary factors driving the growth in the seed Coating Materials industry?

Growth drivers in the seed coating materials industry include increasing demand for high-yield crops, environmental concerns leading to sustainable agriculture practices, and the rise of organic farming, all contributing to a more competitive landscape.

Which region is the fastest Growing in the seed Coating Materials?

The European region is the fastest-growing market for seed coating materials, projected to grow from $1.84 billion in 2023 to $3.62 billion by 2033, fueled by stringent regulations and a preference for advanced agricultural solutions.

Does ConsaInsights provide customized market report data for the seed Coating Materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the seed coating materials industry, providing clients with niche insights and detailed analyses to inform strategic decisions.

What deliverables can I expect from this seed Coating Materials market research project?

Deliverables from a seed coating materials market research project include comprehensive reports, detailed market analyses, segmentation data, competitive landscape assessments, and strategic recommendations tailored to the client's objectives.

What are the market trends of seed Coating Materials?

Current market trends in seed coating materials include an emphasis on organic coatings, increased investment in innovative technologies, and the growing importance of sustainability, which influences both consumer preferences and regulatory policies.