Seed Treatment Fungicides Market Report

Published Date: 02 February 2026 | Report Code: seed-treatment-fungicides

Seed Treatment Fungicides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Seed Treatment Fungicides market, examining trends, growth opportunities, and market dynamics over the forecast period of 2023 to 2033, focusing on market size, segmentation, and future forecasts.

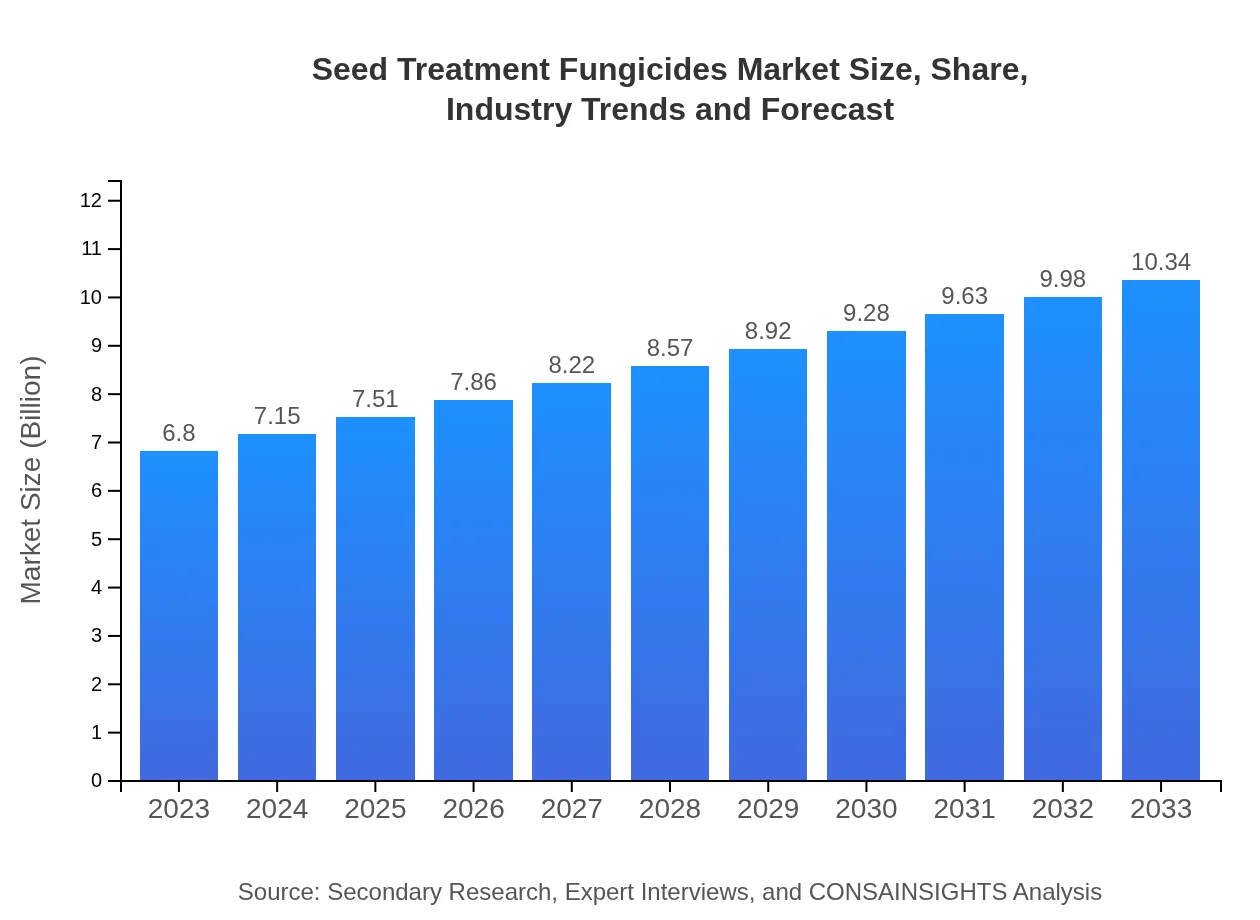

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $10.34 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, UPL Limited |

| Last Modified Date | 02 February 2026 |

Seed Treatment Fungicides Market Overview

Customize Seed Treatment Fungicides Market Report market research report

- ✔ Get in-depth analysis of Seed Treatment Fungicides market size, growth, and forecasts.

- ✔ Understand Seed Treatment Fungicides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Seed Treatment Fungicides

What is the Market Size & CAGR of Seed Treatment Fungicides market in 2023?

Seed Treatment Fungicides Industry Analysis

Seed Treatment Fungicides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Seed Treatment Fungicides Market Analysis Report by Region

Europe Seed Treatment Fungicides Market Report:

In Europe, the market for Seed Treatment Fungicides is valued at USD 1.69 billion in 2023 and is projected to reach USD 2.58 billion by 2033. The European market is influenced by stringent regulations on pesticide use and a growing preference for organic farming.Asia Pacific Seed Treatment Fungicides Market Report:

In 2023, the Seed Treatment Fungicides market in Asia Pacific is valued at USD 1.34 billion, projected to reach USD 2.04 billion by 2033 with a CAGR of 4.4%. The region is experiencing rapid growth due to increased agricultural activities, government support for modern farming techniques, and high crop yield demands.North America Seed Treatment Fungicides Market Report:

North America holds a significant market value of USD 2.52 billion in 2023, anticipated to expand to USD 3.83 billion by 2033, reflecting a CAGR of 5.3%. The demand is fueled by advanced agricultural practices and a strong focus on crop protection strategies among farmers.South America Seed Treatment Fungicides Market Report:

The South American market is estimated at USD 0.40 billion in 2023, and is expected to grow to USD 0.60 billion by 2033. The key drivers include growing agricultural exports and the increasing adoption of seed treatment technologies to enhance crop quality and yield.Middle East & Africa Seed Treatment Fungicides Market Report:

The Middle East and Africa market is valued at USD 0.85 billion in 2023, expected to grow to USD 1.29 billion by 2033. Factors such as climatic changes affecting agriculture and rising investments in agricultural technologies drive market growth in this region.Tell us your focus area and get a customized research report.

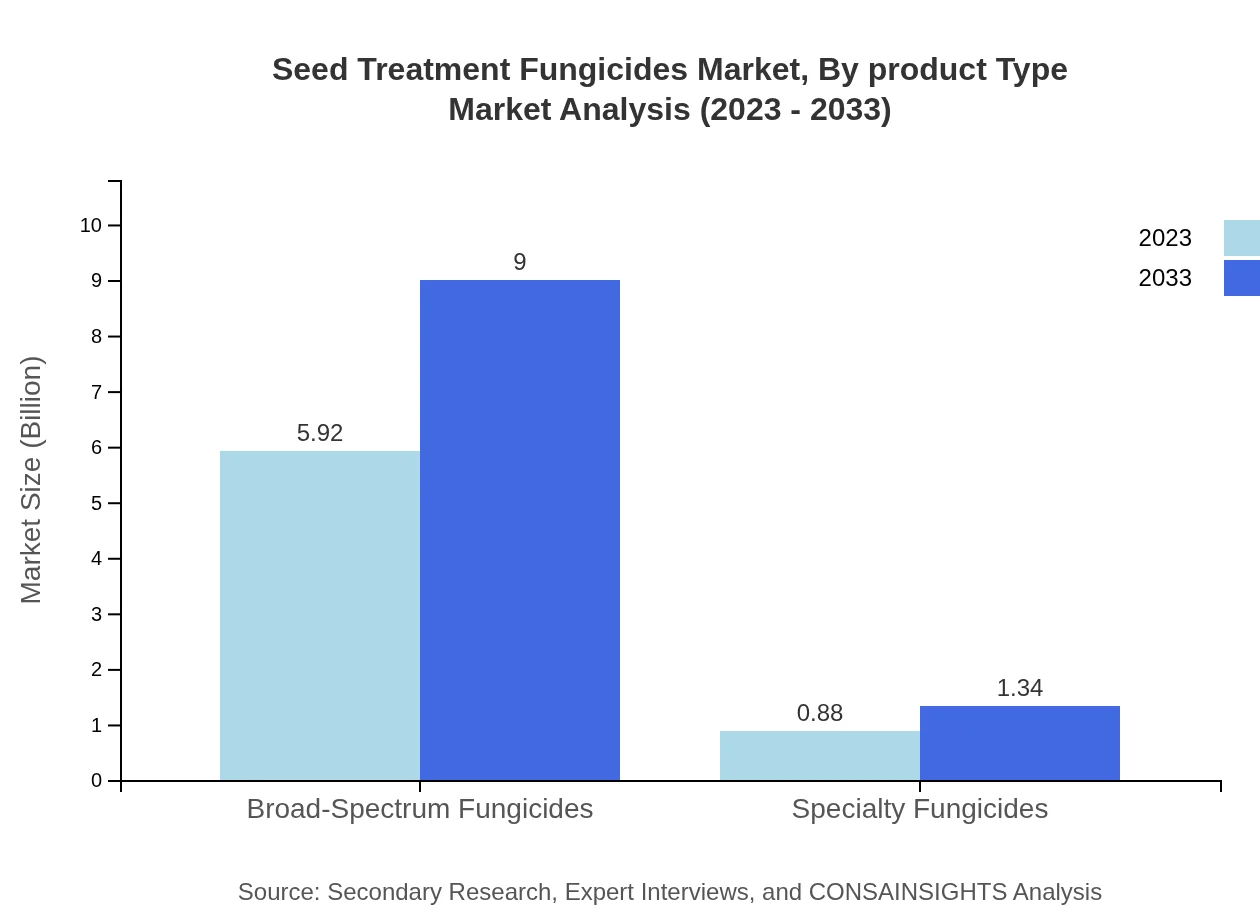

Seed Treatment Fungicides Market Analysis By Product Type

The Seed Treatment Fungicides market is primarily categorized into broad-spectrum and specialty fungicides. Broad-spectrum fungicides dominate the market with a size of USD 5.92 billion in 2023 and an anticipated growth to USD 9.00 billion by 2033, holding an 87.02% market share. Specialty fungicides, while smaller, are also growing, with market sizes moving from USD 0.88 billion to USD 1.34 billion during the same period.

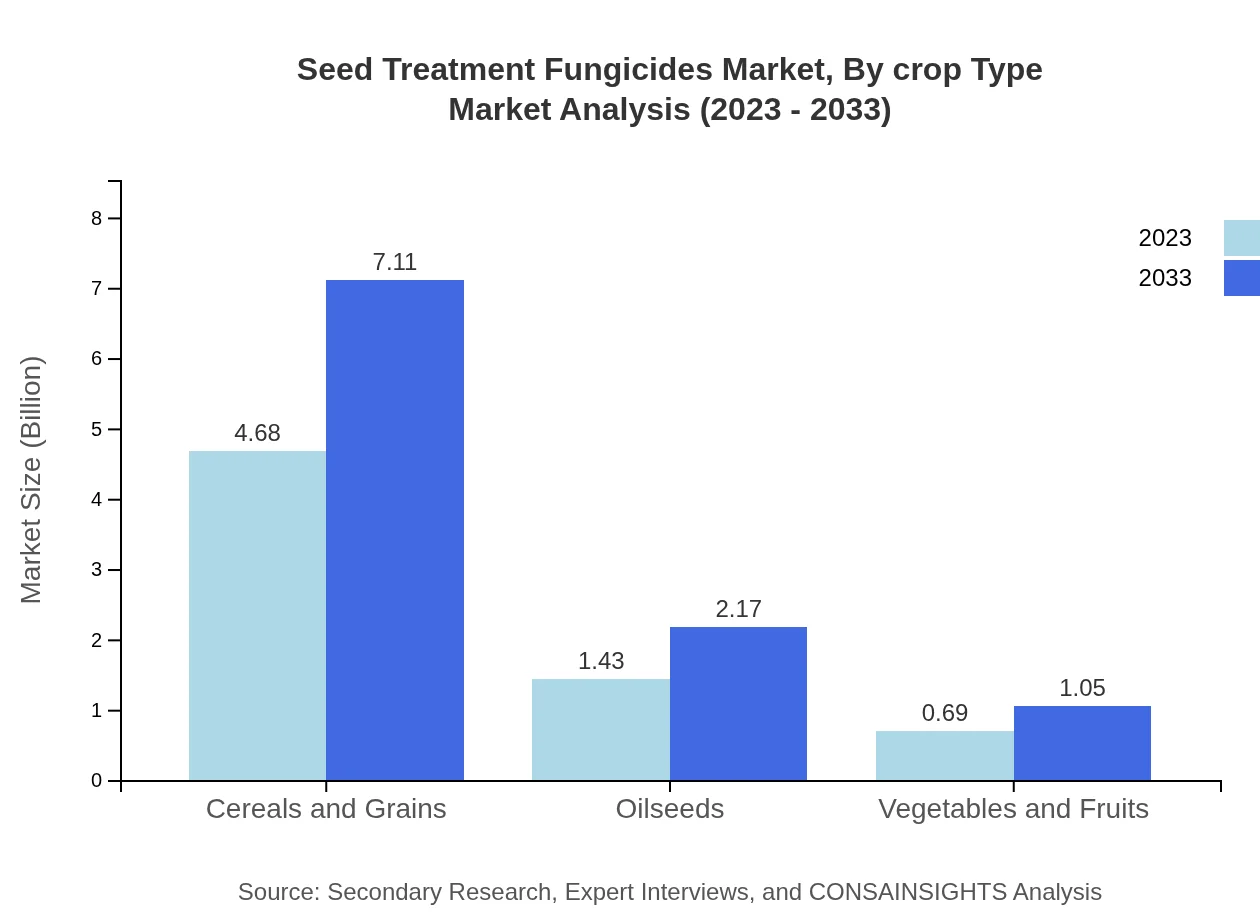

Seed Treatment Fungicides Market Analysis By Crop Type

The cereals and grains segment leads the market, valued at USD 4.68 billion in 2023 and projected to grow to USD 7.11 billion by 2033, maintaining a market share of 68.78%. The oilseeds segment accounts for USD 1.43 billion in 2023, expected to rise to USD 2.17 billion, while vegetables and fruits, starting at USD 0.69 billion, will grow to USD 1.05 billion.

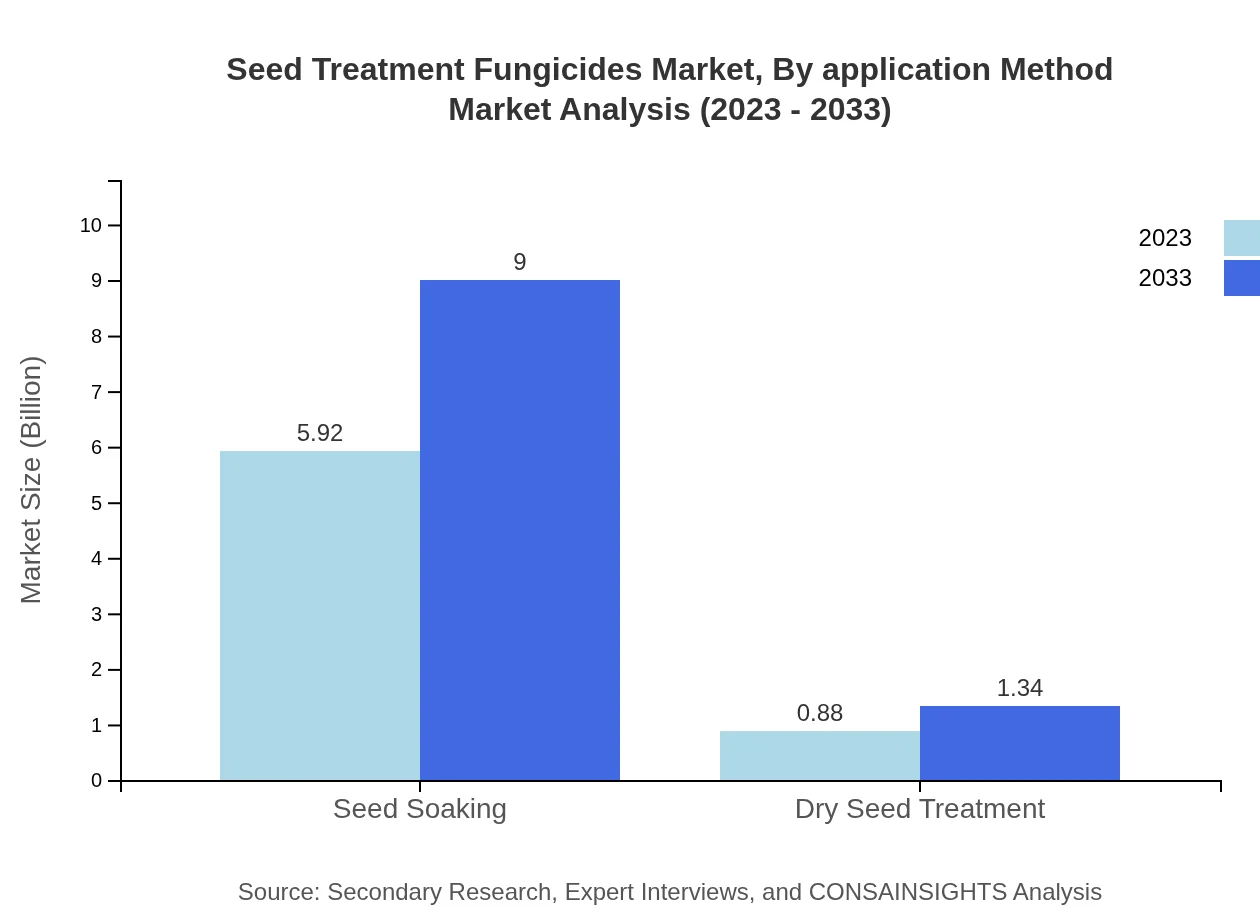

Seed Treatment Fungicides Market Analysis By Application Method

The market is divided into seed soaking, which commands a size of USD 5.92 billion, and dry seed treatment valued at USD 0.88 billion in 2023. Both segments are projected to grow significantly up to 2033, with seed soaking maintaining its strong position due to its effectiveness in safeguarding seeds prior to planting.

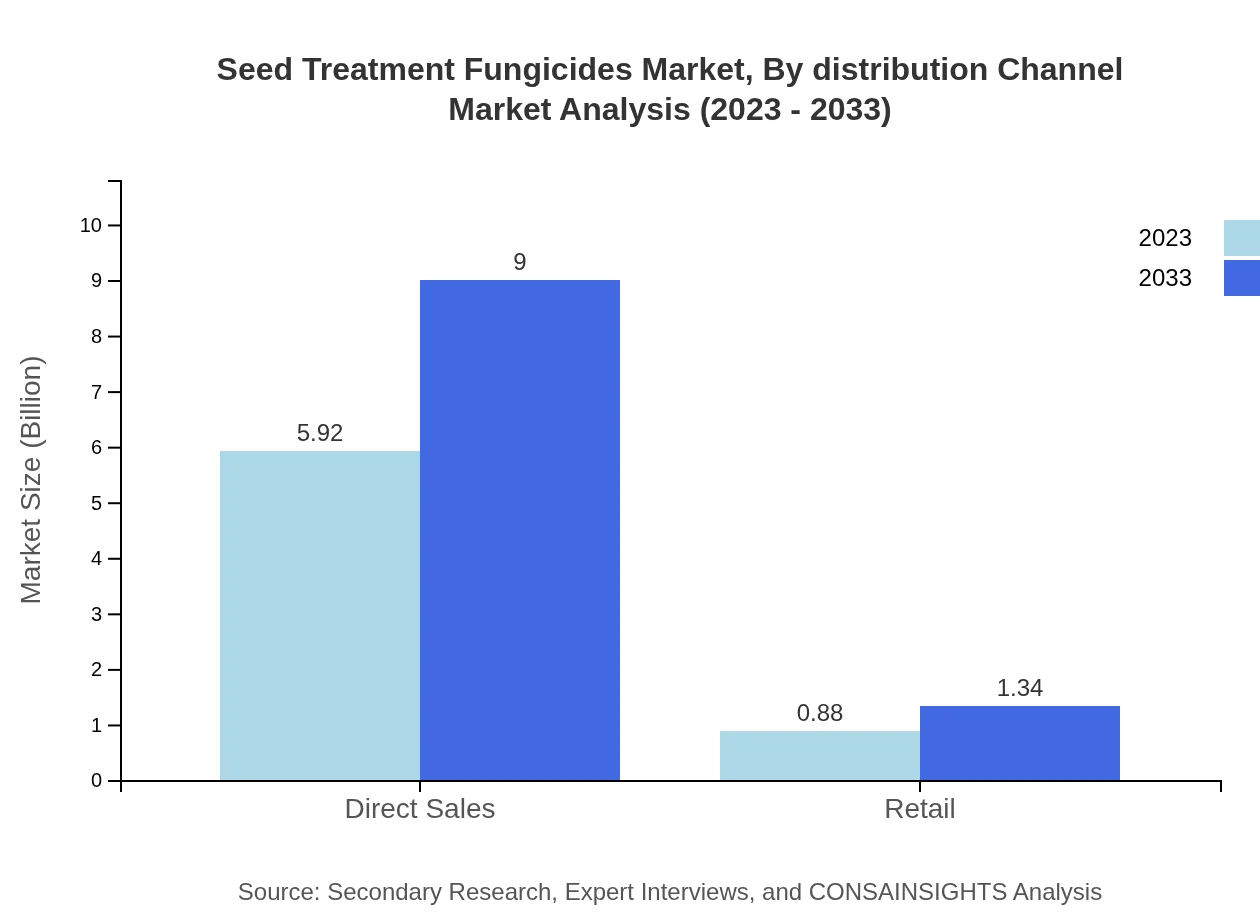

Seed Treatment Fungicides Market Analysis By Distribution Channel

The distribution market is characterized by direct sales of USD 5.92 billion in 2023, with growth anticipated to USD 9.00 billion by 2033. Retail channels represent a smaller market size of USD 0.88 billion, slated to grow to USD 1.34 billion, indicating a trend towards increased availability of seed treatment products.

Seed Treatment Fungicides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Seed Treatment Fungicides Industry

BASF SE:

A leading global chemical company, BASF offers innovative agricultural solutions, including seed treatment fungicides that support sustainable crop protection.Syngenta AG:

As a major player in the agrochemical market, Syngenta specializes in crop protection and seed treatment products, focusing on enhancing agricultural productivity.Bayer AG:

Bayer is a key competitor known for its wide range of agricultural products, including cutting-edge seed treatment fungicides designed to manage plant health effectively.Corteva Agriscience:

An agriculture-focused company that delivers advanced seeds and crop protection solutions, including effective seed treatments to protect against diseases.UPL Limited:

UPL is recognized for its commitment to sustainable agricultural practices, providing a diverse line of seed treatment solutions that address global farming challenges.We're grateful to work with incredible clients.

FAQs

What is the market size of seed Treatment Fungicides?

The global seed treatment fungicides market is expected to reach $6.8 billion by 2033, growing at a CAGR of 4.2% from its base market data in 2023.

What are the key market players or companies in the seed Treatment Fungicides industry?

Key players in the seed-treatment-fungicides industry include leading agribusinesses and chemical manufacturers focused on developing advanced fungicides, ensuring effective pest and disease management, and enhancing crop yield quality.

What are the primary factors driving the growth in the seed Treatment Fungicides industry?

Growth in the seed treatment fungicides market is primarily driven by increasing demand for high-yield crops, rising awareness of sustainable agriculture practices, and advancements in seed treatment technologies.

Which region is the fastest Growing in the seed Treatment Fungicides?

The fastest-growing region is Asia Pacific, expected to grow from $1.34 billion in 2023 to $2.04 billion by 2033. Other significant regions include North America and Europe, contributing to overall market growth.

Does ConsaInsights provide customized market report data for the seed Treatment Fungicides industry?

Yes, ConsaInsights offers customized market report data, allowing clients to tailor their analysis according to specific market segments, regional insights, and competitive landscapes in the seed-treatment-fungicides sector.

What deliverables can I expect from this seed Treatment Fungicides market research project?

Clients can expect comprehensive reports including market size estimates, growth projections, segmentation analysis, competitive landscape reviews, and actionable insights tailored to the seed-treatment-fungicides industry.

What are the market trends of seed Treatment Fungicides?

Current trends in the seed-treatment-fungicides market include a strong emphasis on innovation in formulation technologies, an increase in organic fungicides, and growing adoption of integrated pest management strategies.