Selective Laser Sintering Equipment Market Report

Published Date: 31 January 2026 | Report Code: selective-laser-sintering-equipment

Selective Laser Sintering Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Selective Laser Sintering Equipment market, including market size, trends, and growth forecasts from 2023 to 2033. Key insights and data on segmentation, regional analysis, and the impact of technology on the industry are also presented.

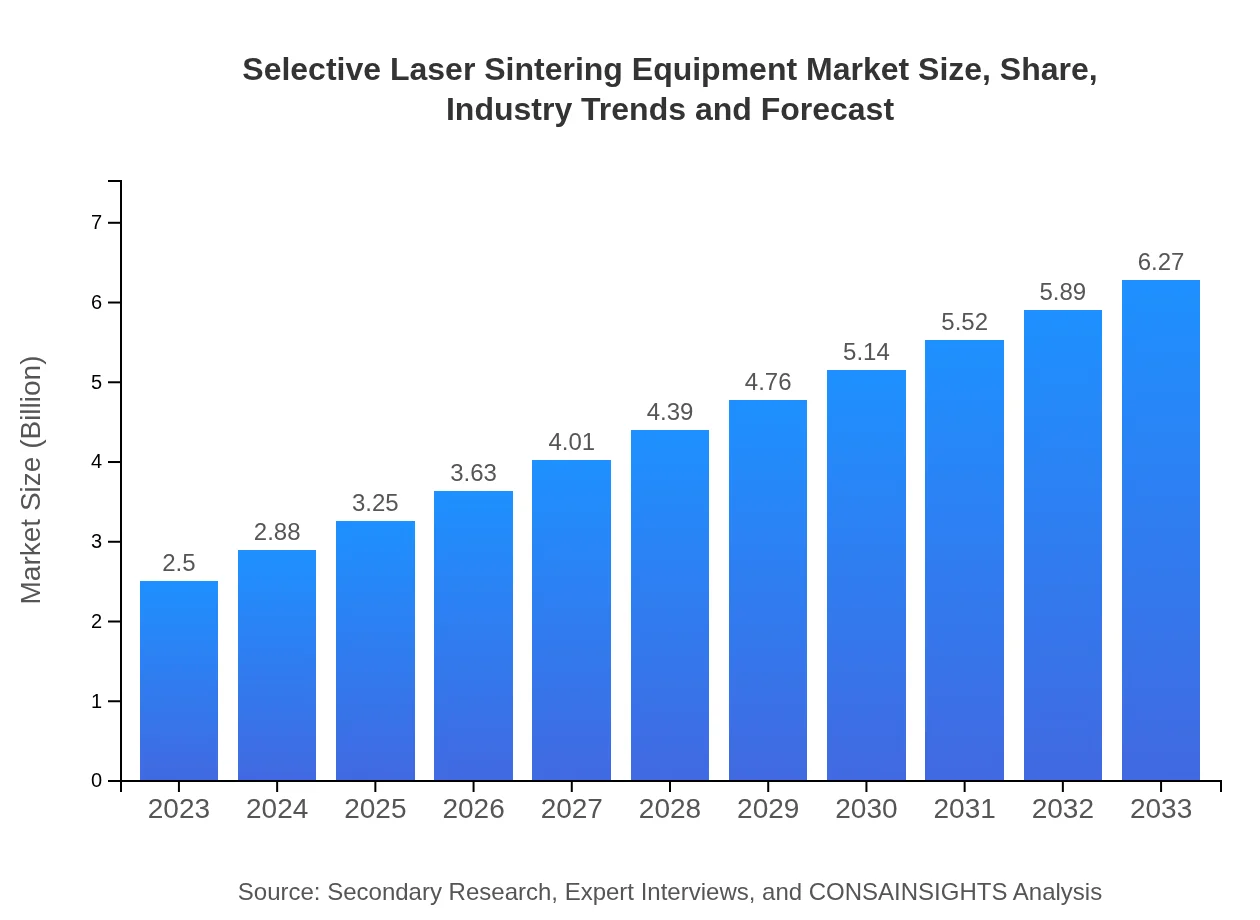

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $6.27 Billion |

| Top Companies | 3D Systems, EOS GmbH, Stratasys Ltd., HP Inc. |

| Last Modified Date | 31 January 2026 |

Selective Laser Sintering Equipment Market Overview

Customize Selective Laser Sintering Equipment Market Report market research report

- ✔ Get in-depth analysis of Selective Laser Sintering Equipment market size, growth, and forecasts.

- ✔ Understand Selective Laser Sintering Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Selective Laser Sintering Equipment

What is the Market Size & CAGR of Selective Laser Sintering Equipment market in 2023?

Selective Laser Sintering Equipment Industry Analysis

Selective Laser Sintering Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Selective Laser Sintering Equipment Market Analysis Report by Region

Europe Selective Laser Sintering Equipment Market Report:

The European market is also witnessing substantial growth, moving from USD 0.82 billion in 2023 to USD 2.05 billion by 2033. Advanced manufacturing frameworks and stringent quality regulations in Europe are pushing companies to adopt SLS technologies in their processes.Asia Pacific Selective Laser Sintering Equipment Market Report:

The Asia Pacific region, with a market size of USD 0.45 billion in 2023, is projected to reach USD 1.12 billion by 2033. The growth is driven by high demand for advanced manufacturing technologies in countries like China, Japan, and South Korea, where there is a strong focus on industrial automation and innovation.North America Selective Laser Sintering Equipment Market Report:

North America holds a significant share of the market, with a size of USD 0.91 billion in 2023, forecasted to reach USD 2.29 billion by 2033. The presence of several key players and increasing integration of additive manufacturing in aerospace and automotive sectors drive this regional growth.South America Selective Laser Sintering Equipment Market Report:

In South America, the market is expected to grow from USD 0.20 billion in 2023 to USD 0.50 billion by 2033. The emerging economies in this region are increasingly adopting SLS technology for various applications, aided by rising investments in manufacturing technologies.Middle East & Africa Selective Laser Sintering Equipment Market Report:

In the Middle East and Africa, the market is relatively smaller, expected to grow from USD 0.12 billion in 2023 to USD 0.31 billion by 2033. Nevertheless, the region shows potential for growth as industries explore innovative manufacturing techniques to meet evolving market demands.Tell us your focus area and get a customized research report.

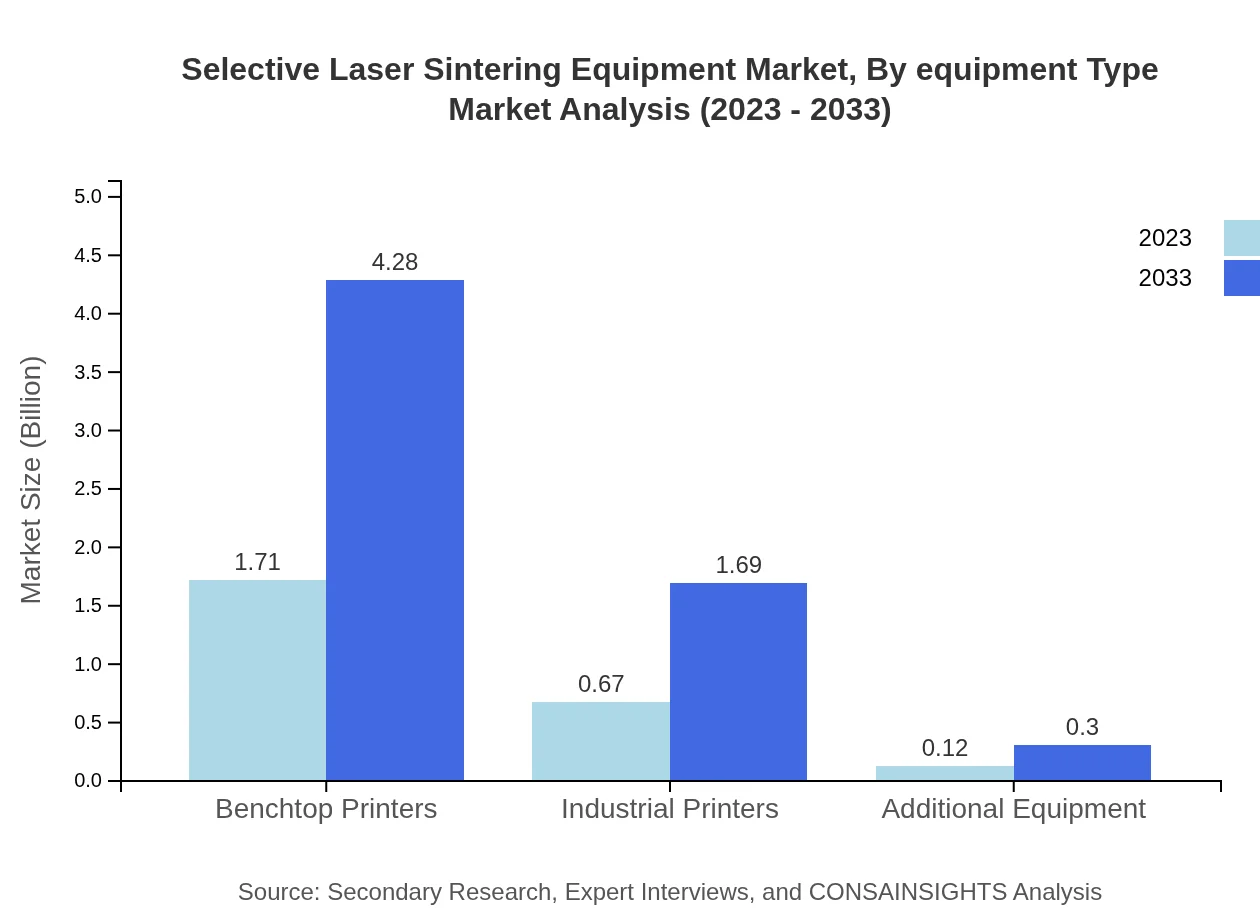

Selective Laser Sintering Equipment Market Analysis By Equipment Type

The market by equipment type encompasses benchtop printers and industrial printers, with benchtop models showing a size of USD 1.71 billion in 2023, expected to rise to USD 4.28 billion by 2033, accounting for 68.32% market share. Industrial printers, on the other hand, amount to USD 0.67 billion in 2023 with an anticipated growth to USD 1.69 billion by 2033, representing a 26.88% market share.

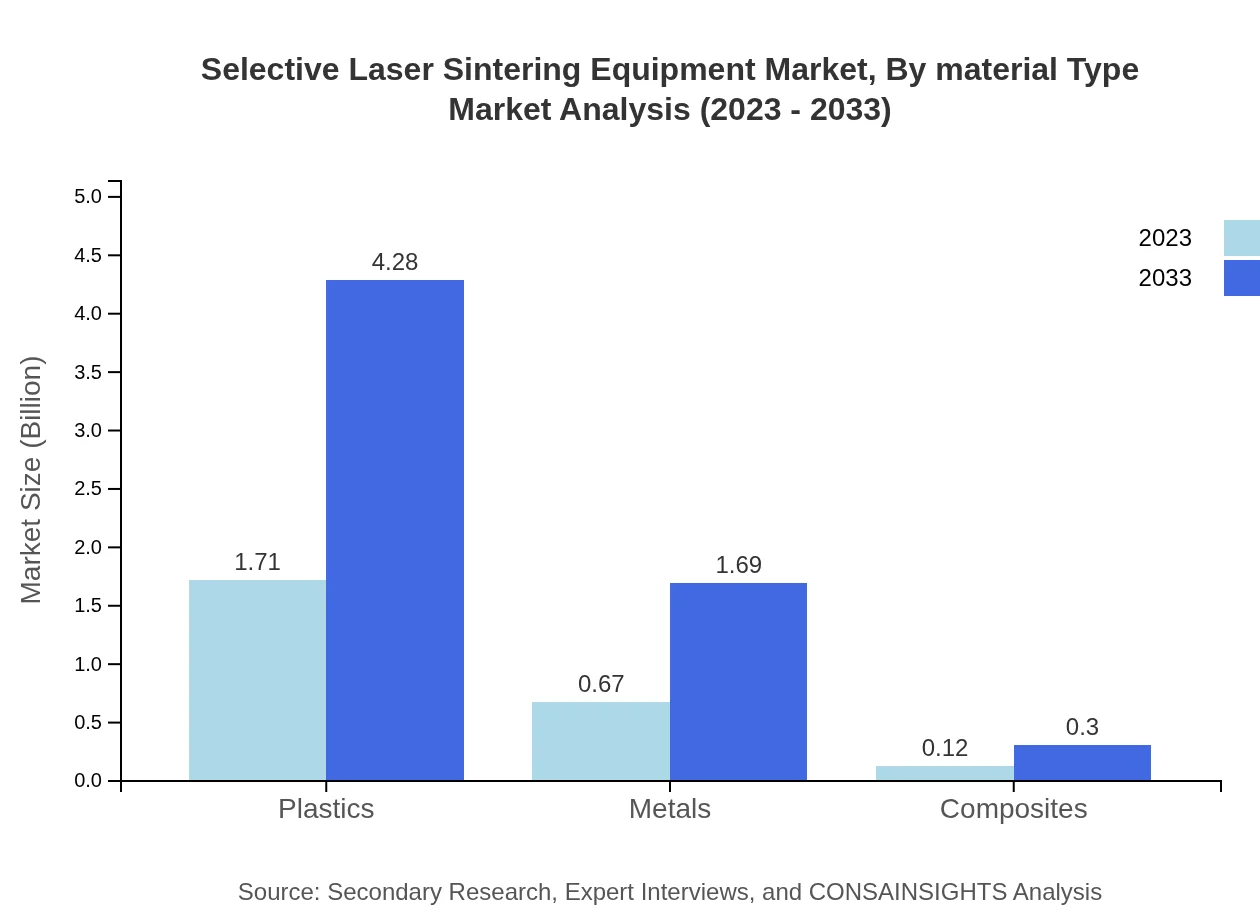

Selective Laser Sintering Equipment Market Analysis By Material Type

Material types are critical to the SLS market, with plastics leading the segment, valued at USD 1.71 billion in 2023 and projected to grow to USD 4.28 billion by 2033 (68.32% share). Metals, while smaller at USD 0.67 billion in 2023, are expected to reach USD 1.69 billion by 2033, securing 26.88% of the market share.

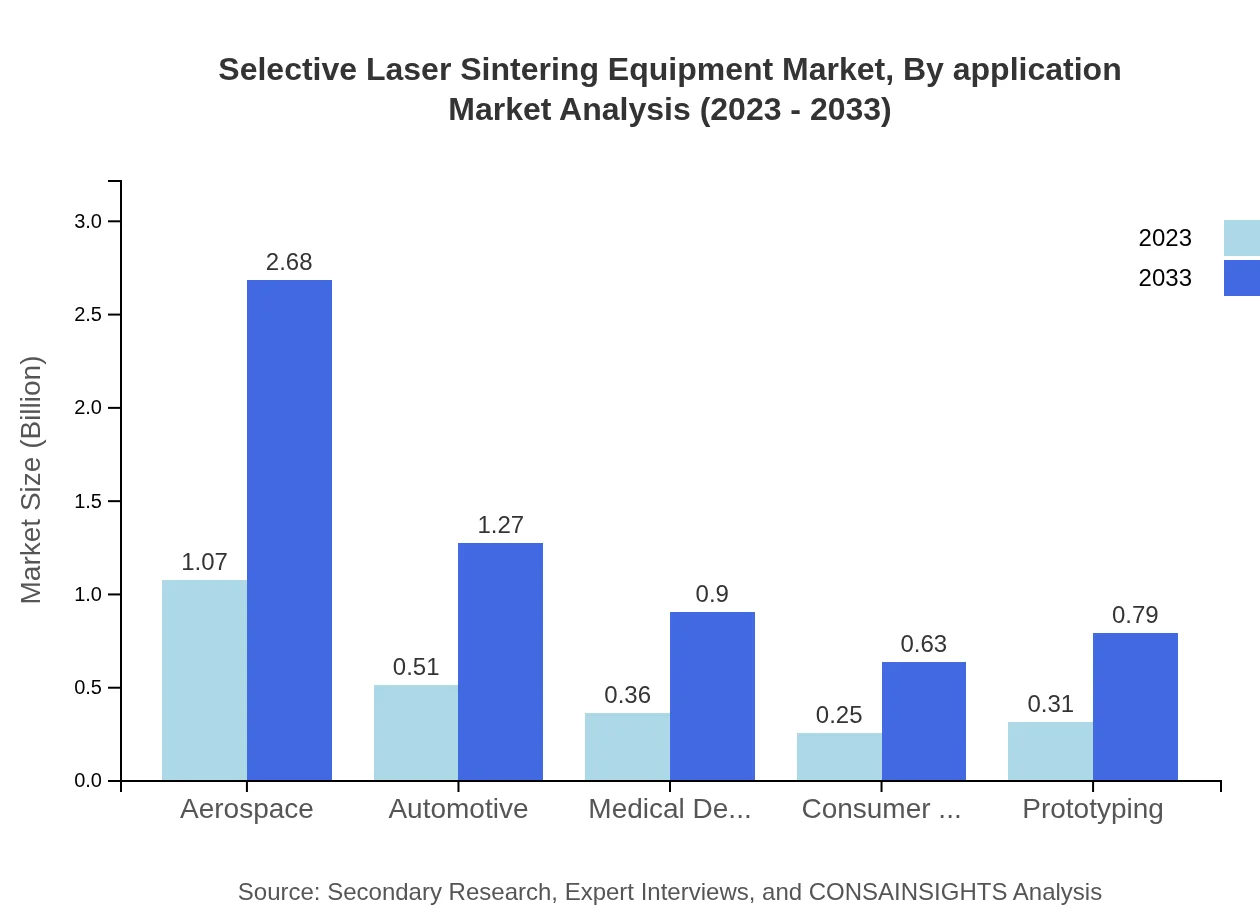

Selective Laser Sintering Equipment Market Analysis By Application

Applications of SLS technology span across several industries. The aerospace sector leads with a market size of USD 1.07 billion in 2023, growing to USD 2.68 billion by 2033 (42.72% share). Other significant applications include automotive at USD 0.51 billion expanding to USD 1.27 billion by 2033 (20.32% share) and medical devices at USD 0.36 billion growing to USD 0.90 billion (14.39% share).

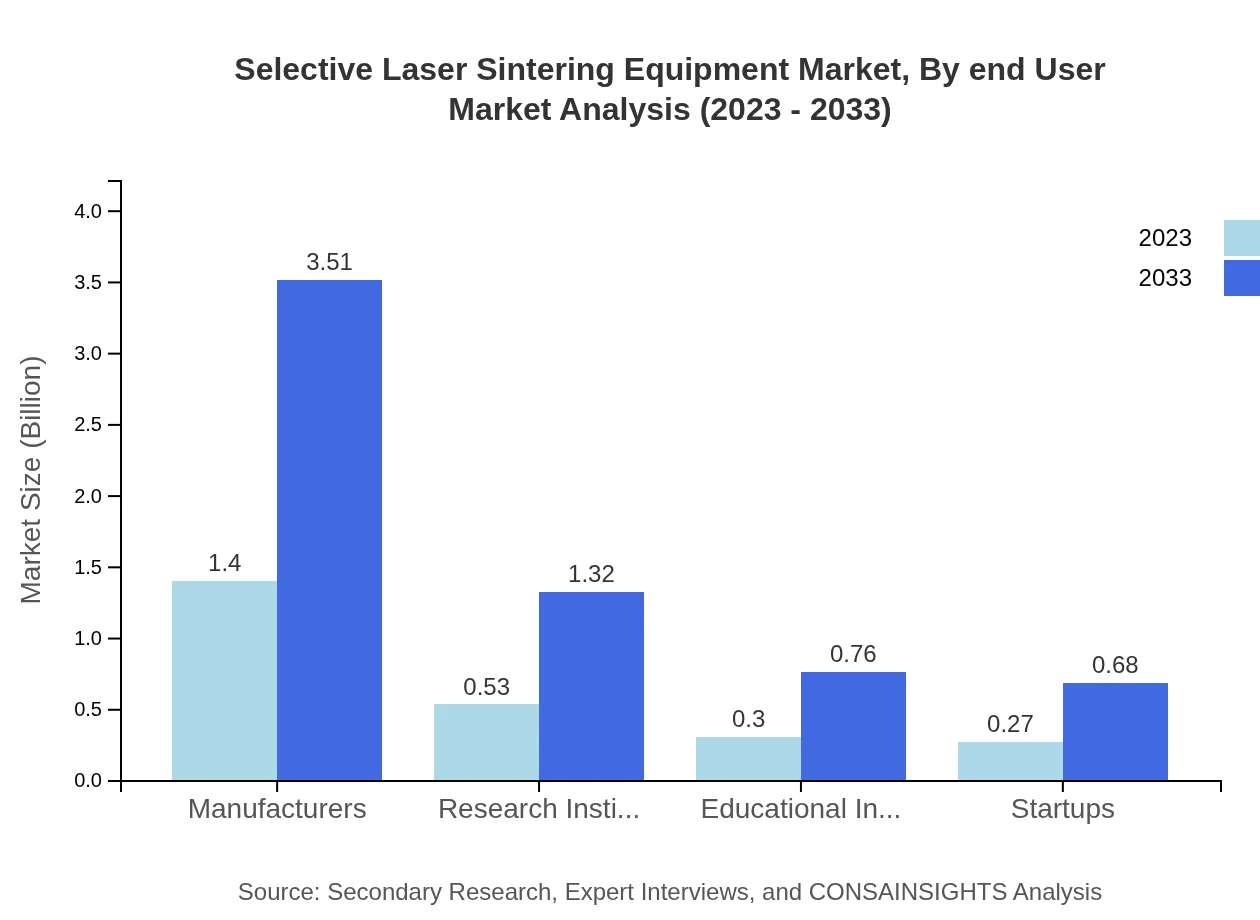

Selective Laser Sintering Equipment Market Analysis By End User

End-users are categorized into manufacturers, research institutes, educational institutions, and startups. Manufacturers dominate the segment with a size of USD 1.40 billion in 2023, projected to reach USD 3.51 billion (55.99% share) by 2033. Research institutes hold a substantial share with USD 0.53 billion in 2023, anticipated to grow to USD 1.32 billion (21.07% share).

Selective Laser Sintering Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Selective Laser Sintering Equipment Industry

3D Systems:

3D Systems is a pioneering company in additive manufacturing, specializing in SLS technology, offering a range of materials and 3D printing services tailored for numerous industries.EOS GmbH:

EOS GmbH is recognized as a leader in industrial 3D printing solutions, providing SLS systems and materials known for their high performance and reliability in production environments.Stratasys Ltd.:

Stratasys is a global leader in 3D printing and additive manufacturing solutions, delivering advanced SLS equipment and supporting services to enhance manufacturing efficiencies.HP Inc.:

HP Inc. has made significant strides in the SLS market with its innovative 3D printing solutions, focusing on developing sustainable production processes and high-quality materials for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of selective Laser Sintering Equipment?

The selective laser sintering equipment market is valued at approximately $2.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 9.3% over the next decade, indicating significant growth potential.

What are the key market players or companies in this selective Laser Sintering Equipment industry?

Leading companies in the selective laser sintering equipment industry include major manufacturers specializing in 3D printing technology, particularly those focusing on industrial applications, materials providers, and software developers to enhance production efficiency.

What are the primary factors driving the growth in the selective Laser Sintering Equipment industry?

Growth in the selective laser sintering equipment market is driven by increasing demand for rapid prototyping, advancements in materials science, and a shift towards additive manufacturing in various sectors, enhancing production capabilities and reducing lead times.

Which region is the fastest Growing in the selective Laser Sintering Equipment?

The Asia Pacific region is emerging as the fastest-growing market for selective laser sintering equipment, projected to grow from $0.45 billion in 2023 to $1.12 billion by 2033, driven by industrialization and technological adoption.

Does ConsaInsights provide customized market report data for the selective Laser Sintering Equipment industry?

Yes, ConsaInsights offers customized market reports for the selective-laser-sintering-equipment industry, tailoring insights and data to meet specific client needs and business objectives for informed decision-making.

What deliverables can I expect from this selective Laser Sintering Equipment market research project?

Deliverables from the selective laser sintering equipment market research project typically include comprehensive reports, market analytics, growth forecasts, competitive analysis, and segmented data across various parameters for strategic planning.

What are the market trends of selective Laser Sintering Equipment?

Current market trends in selective laser sintering include increasing emphasis on sustainable materials, integration of AI in manufacturing processes, and growth in customized solutions, reflecting evolving consumer demands and technological advancements.