Selective Laser Sintering Market Report

Published Date: 22 January 2026 | Report Code: selective-laser-sintering

Selective Laser Sintering Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Selective Laser Sintering market from 2023 to 2033, including market size, growth rate, segmentation, regional insights, and key trends influencing the industry. Comprehensive data is presented to support strategic decision-making.

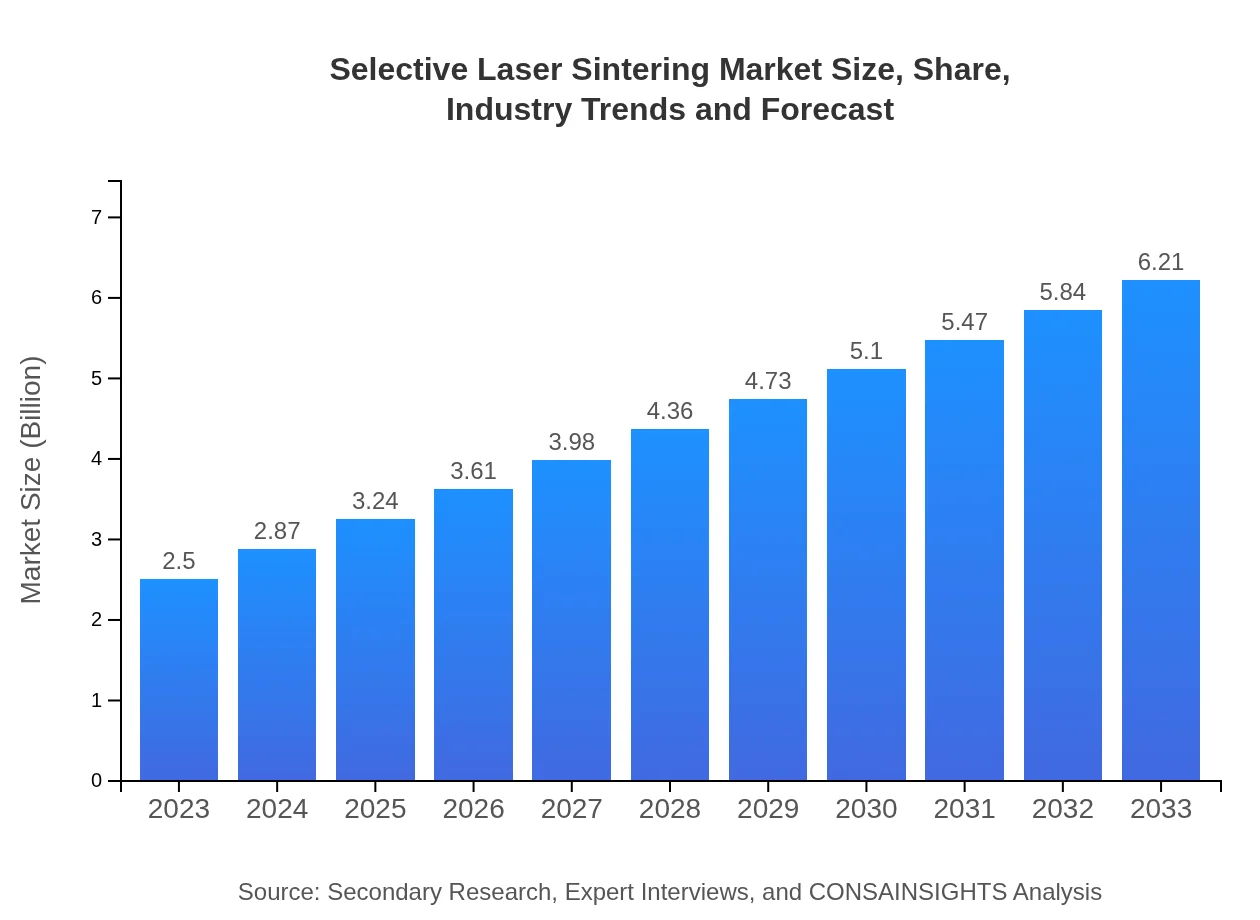

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $6.21 Billion |

| Top Companies | 3D Systems Corporation, Stratasys Ltd., EOS GmbH, Sinterit |

| Last Modified Date | 22 January 2026 |

Selective Laser Sintering Market Overview

Customize Selective Laser Sintering Market Report market research report

- ✔ Get in-depth analysis of Selective Laser Sintering market size, growth, and forecasts.

- ✔ Understand Selective Laser Sintering's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Selective Laser Sintering

What is the Market Size & CAGR of the Selective Laser Sintering market in 2023?

Selective Laser Sintering Industry Analysis

Selective Laser Sintering Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Selective Laser Sintering Market Analysis Report by Region

Europe Selective Laser Sintering Market Report:

Europe is also a critical market for SLS technology, with growth from $0.80 billion in 2023 to $1.99 billion by 2033. The European regulations favoring sustainable manufacturing practices are likely to positively influence the adoption of SLS across multiple industries.Asia Pacific Selective Laser Sintering Market Report:

The Asia Pacific region is anticipated to witness considerable growth in the SLS market, with a size of $1.04 billion expected by 2033, up from $0.42 billion in 2023. This growth is driven by the increasing adoption of advanced manufacturing technologies and a rise in government initiatives supporting additive manufacturing.North America Selective Laser Sintering Market Report:

North America is leading the SLS market with an expected growth from $0.94 billion in 2023 to $2.34 billion by 2033. The region's dominance is attributed to the presence of key industry players and significant investments in innovation across various sectors, particularly aerospace and automotive.South America Selective Laser Sintering Market Report:

In South America, the SLS market is projected to expand from $0.23 billion in 2023 to $0.58 billion by 2033. The growth is contingent on the rising demand for customized product solutions and improvements in manufacturing infrastructure.Middle East & Africa Selective Laser Sintering Market Report:

In the Middle East and Africa, the SLS market is expected to grow from $0.11 billion in 2023 to $0.26 billion by 2033. The region's growth is propelled by burgeoning manufacturing initiatives and a shift towards technology-driven production processes.Tell us your focus area and get a customized research report.

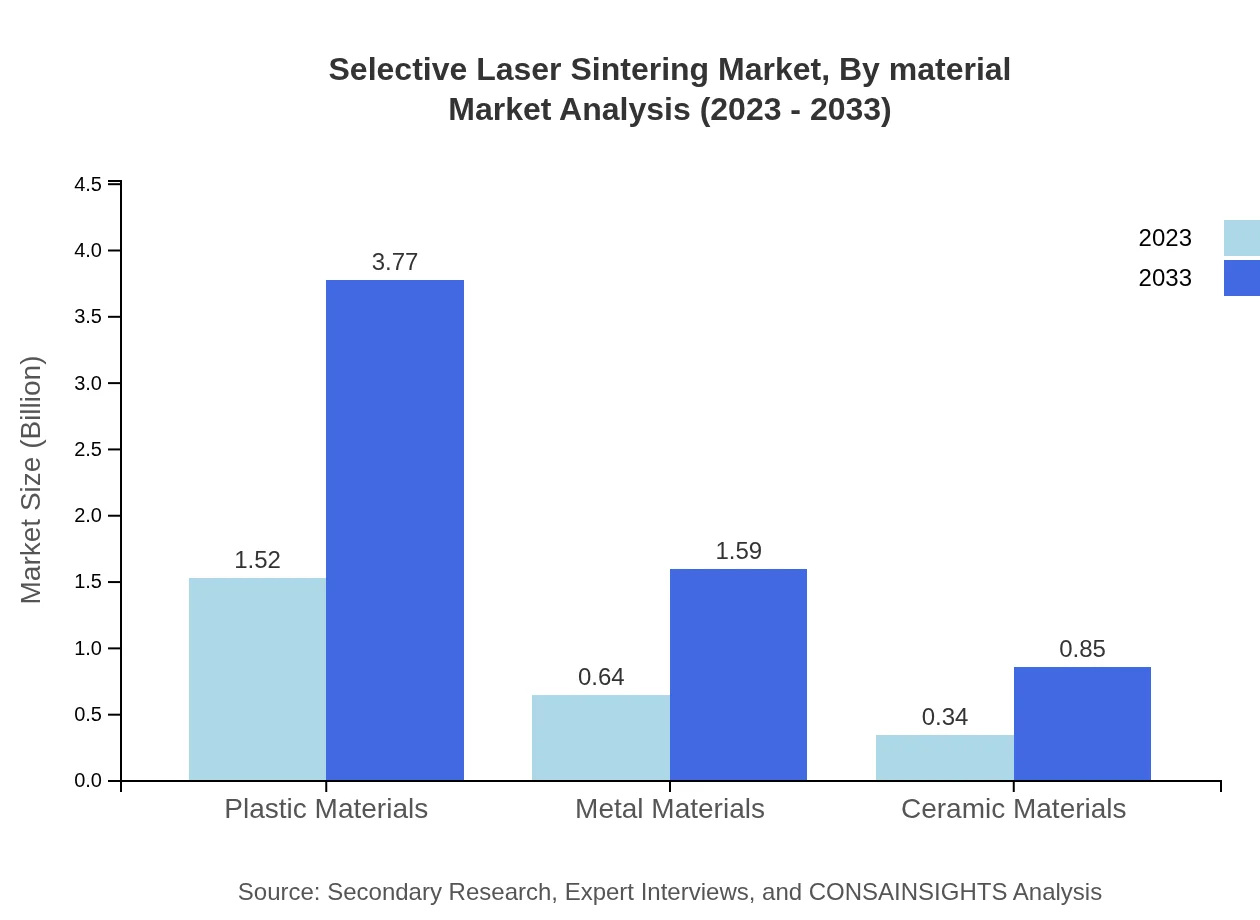

Selective Laser Sintering Market Analysis By Material

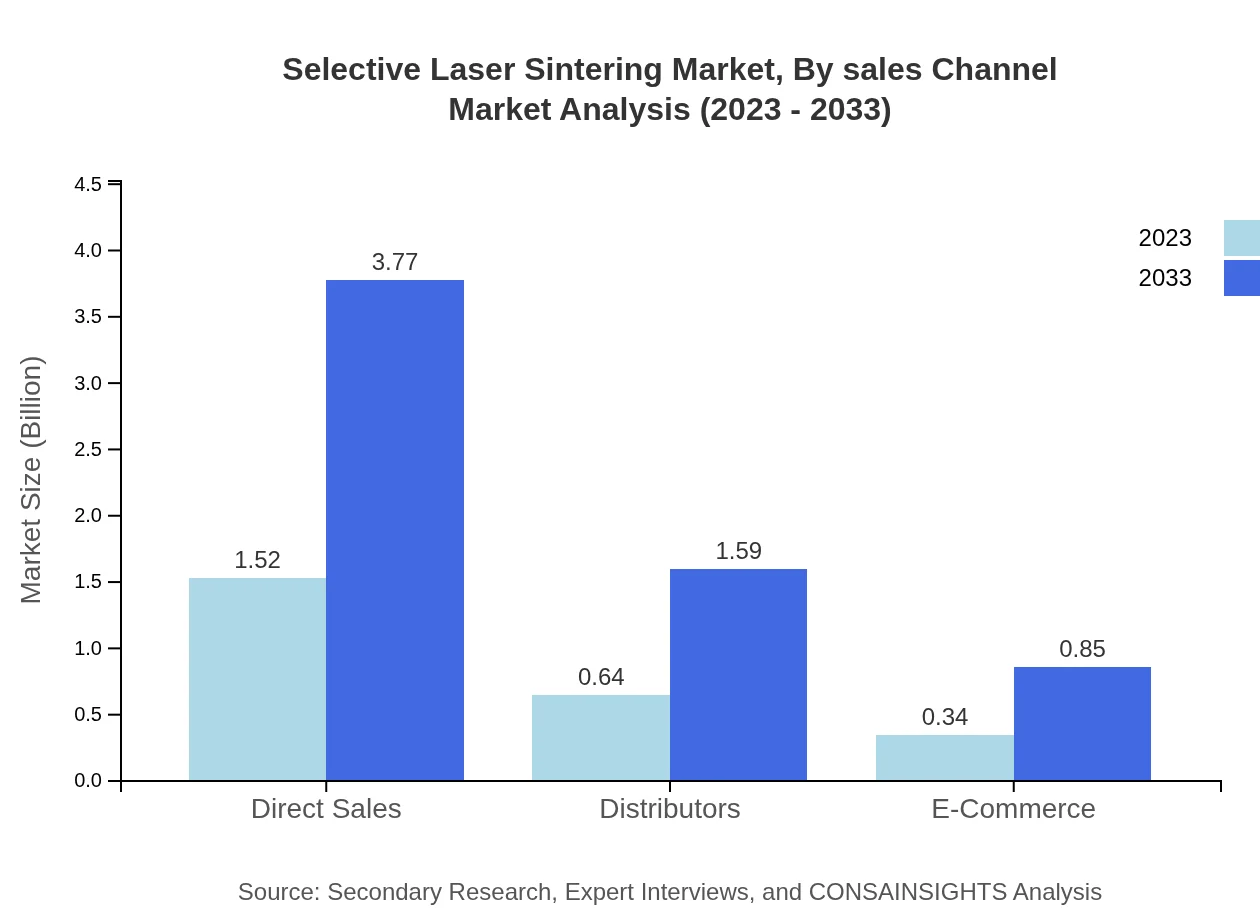

In the SLS market, plastic materials dominate, with a market size of $1.52 billion expected in 2023, projected to grow to $3.77 billion by 2033, accounting for 60.63% market share. Metal materials follow, estimated at $0.64 billion in 2023 and expected to reach $1.59 billion, while ceramic materials comprise a smaller share, anticipated to grow from $0.34 billion to $0.85 billion during the same period.

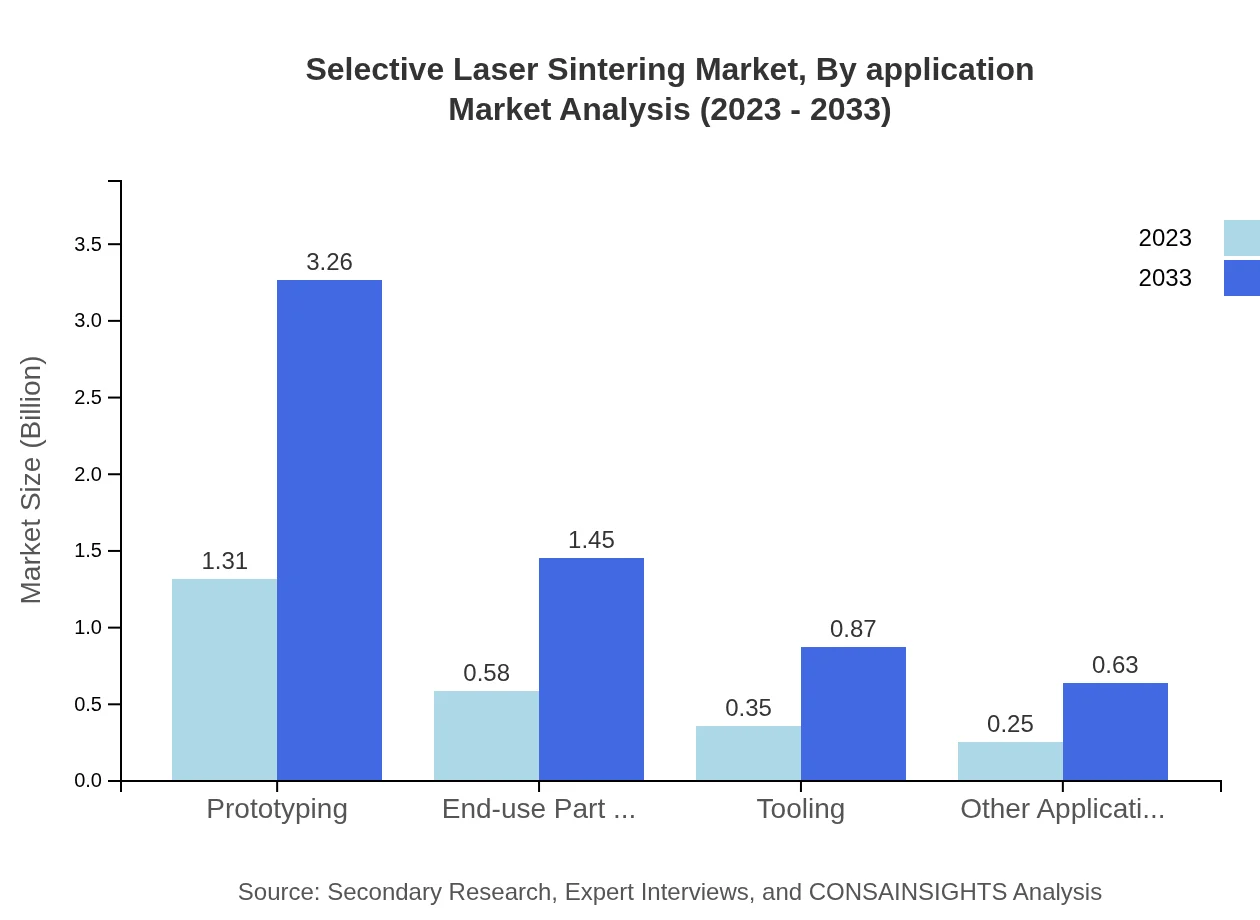

Selective Laser Sintering Market Analysis By Application

The major applications of SLS technology include prototyping, tooling, and end-use part production. The prototyping segment will have a size of $1.31 billion in 2023, growing to $3.26 billion by 2033, securing a 52.41% market share. End-use part production and tooling are also significant, expected to grow substantially due to increasing demand for custom solutions.

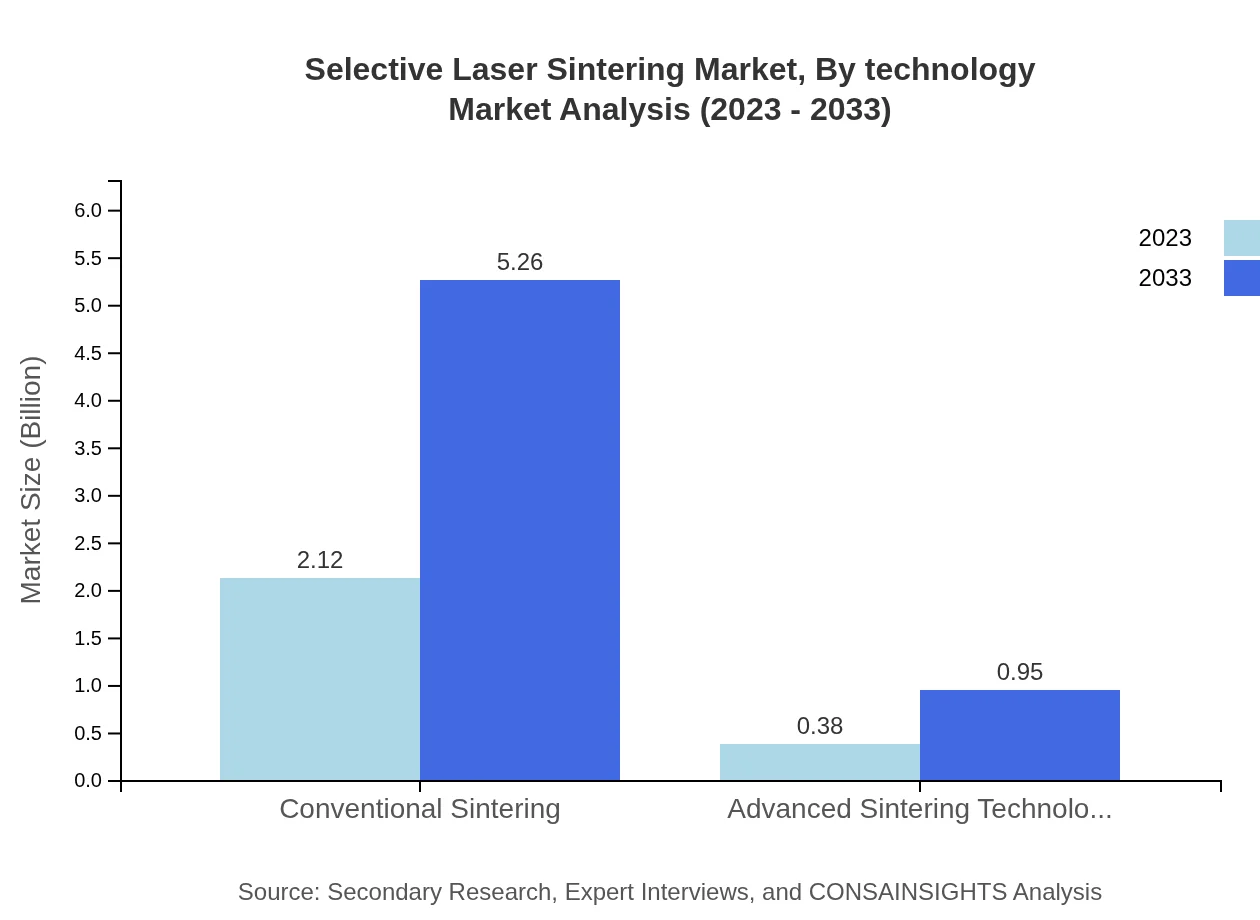

Selective Laser Sintering Market Analysis By Technology

SLS technology is evolving, with a notable focus on advanced sintering technologies. In 2023, conventional sintering will dominate with $2.12 billion and a share of 84.74%. However, advanced sintering technologies are projected to expand their presence, growing from $0.38 billion to $0.95 billion by 2033.

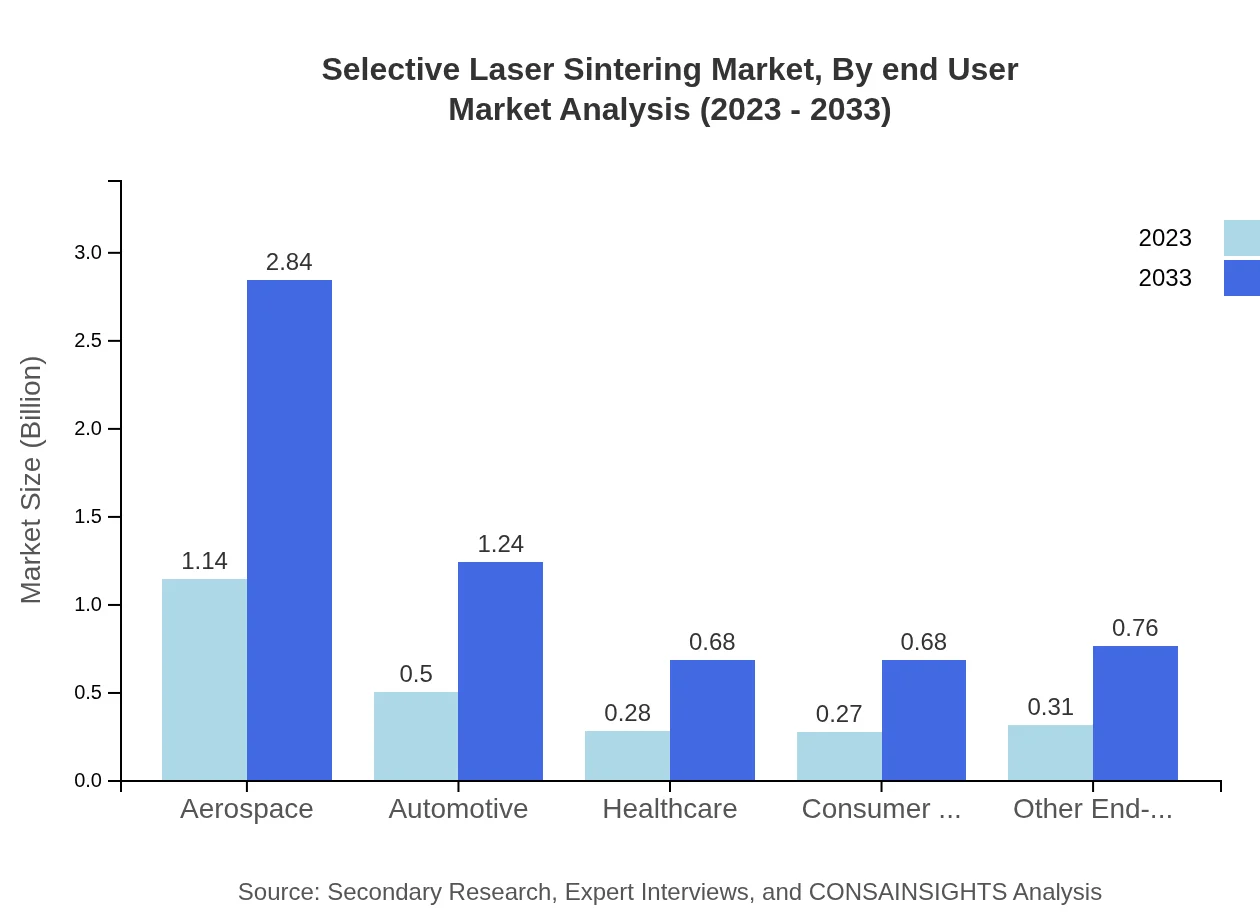

Selective Laser Sintering Market Analysis By End User

Key end-user industries include aerospace, automotive, healthcare, and consumer goods. Aerospace leads with a market size of $1.14 billion in 2023, expected to grow to $2.84 billion. Automotive follows with significant growth from $0.50 billion to $1.24 billion, driven by the need for lightweight components.

Selective Laser Sintering Market Analysis By Sales Channel

Sales channels for SLS products include direct sales, distributors, and e-commerce. Direct sales will account for $1.52 billion in 2023, while e-commerce is anticipated to grow significantly from $0.34 billion to $0.85 billion, reflecting changing purchasing behaviors.

Selective Laser Sintering Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Selective Laser Sintering Industry

3D Systems Corporation:

A pioneer in 3D printing technologies, 3D Systems offers advanced Selective Laser Sintering solutions for various applications in manufacturing, healthcare, and other sectors.Stratasys Ltd.:

Stratasys specializes in additive manufacturing solutions and materials, providing comprehensive SLS offerings that cater to different industries, enhancing design and production capabilities.EOS GmbH:

EOS is a leader in industrial 3D printing and additive manufacturing, known for its innovative SLS systems that facilitate high-quality production for aerospace, automotive, and medical applications.Sinterit:

Sinterit is recognized for its compact and cost-effective SLS solutions, expanding accessibility to small and medium enterprises looking to utilize 3D printing technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of Selective Laser Sintering?

The global market size for Selective Laser Sintering is projected to reach approximately $2.5 billion by 2033, with a compound annual growth rate (CAGR) of 9.2% from 2023 to 2033.

What are the key market players or companies in the Selective Laser Sintering industry?

Key players in the Selective Laser Sintering industry include major manufacturers of 3D printers and materials. Leading companies constantly innovate and focus on research to enhance their product offerings and market reach.

What are the primary factors driving the growth in the Selective Laser Sintering industry?

Growth drivers include increasing demand for rapid prototyping, advancements in materials and technology, and a shift towards additive manufacturing in various industries, enhancing efficiency and reducing production costs.

Which region is the fastest Growing in the Selective Laser Sintering market?

The Asia Pacific region is witnessing the fastest growth in the Selective Laser Sintering market, with expected growth from $0.42 billion in 2023 to $1.04 billion by 2033.

Does ConsaInsights provide customized market report data for the Selective Laser Sintering industry?

Yes, ConsaInsights offers customized market report data that caters to specific client needs in the Selective Laser Sintering industry, providing tailored insights and analyses.

What deliverables can I expect from this Selective Laser Sintering market research project?

Deliverables include comprehensive market analysis, segment trends, competitive landscape insights, regional data, and tailored recommendations to support strategic decision-making.

What are the market trends of Selective Laser Sintering?

Market trends indicate a growing adoption of Selective Laser Sintering across various sectors such as aerospace, automotive, and healthcare, driven by technological advancements and increased material availability.