Self Monitoring Blood Glucose Market Report

Published Date: 31 January 2026 | Report Code: self-monitoring-blood-glucose

Self Monitoring Blood Glucose Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Self Monitoring Blood Glucose market, providing insights into market dynamics, size assessments, future trends, and competitive landscape from 2023 to 2033.

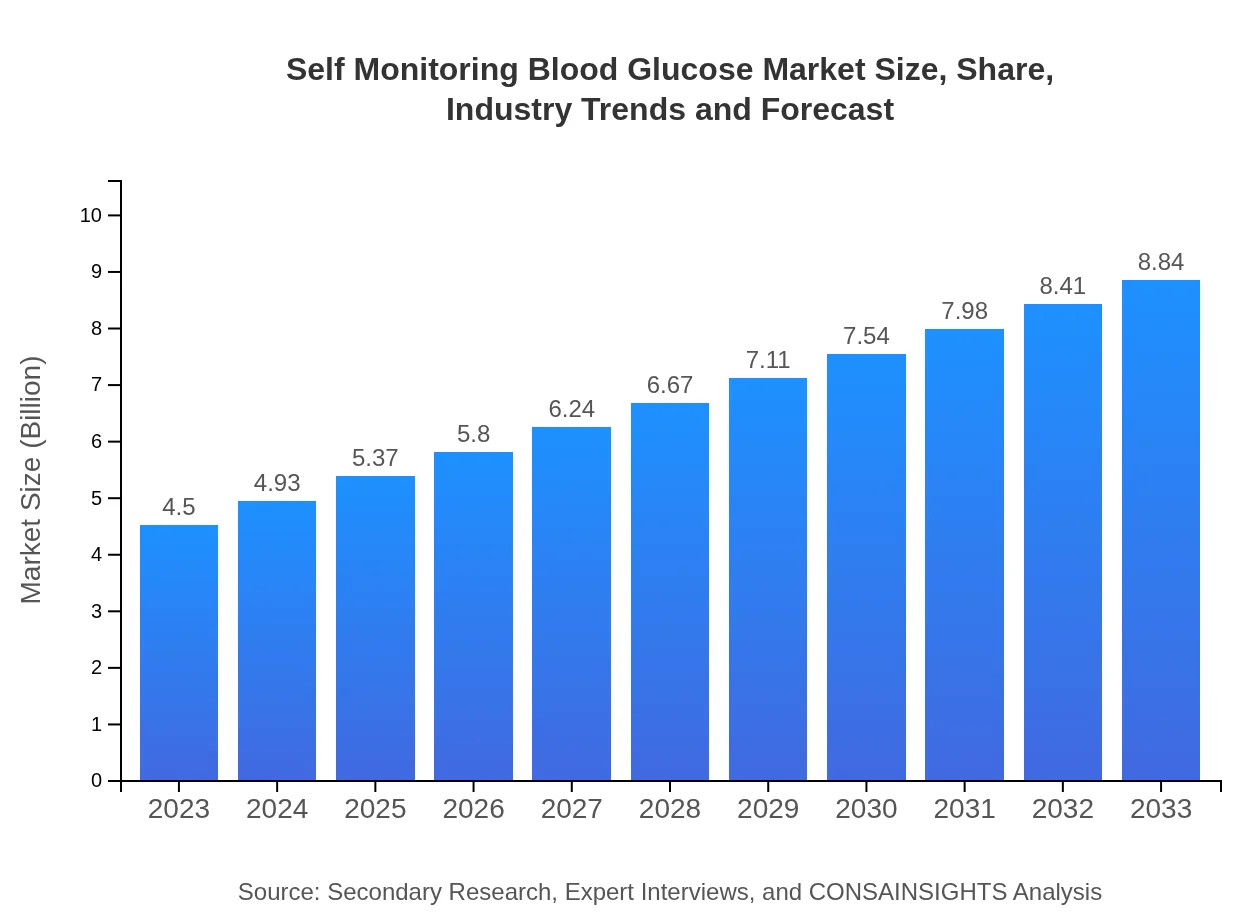

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Medtronic , Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Self Monitoring Blood Glucose Market Overview

Customize Self Monitoring Blood Glucose Market Report market research report

- ✔ Get in-depth analysis of Self Monitoring Blood Glucose market size, growth, and forecasts.

- ✔ Understand Self Monitoring Blood Glucose's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Self Monitoring Blood Glucose

What is the Market Size & CAGR of Self Monitoring Blood Glucose market in 2023?

Self Monitoring Blood Glucose Industry Analysis

Self Monitoring Blood Glucose Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Self Monitoring Blood Glucose Market Analysis Report by Region

Europe Self Monitoring Blood Glucose Market Report:

In Europe, the market stands at $1.41 billion in 2023, anticipated to nearly double to $2.77 billion by 2033. Factors such as high levels of diabetes awareness, strong healthcare systems, and technological advancements contribute to this growth.Asia Pacific Self Monitoring Blood Glucose Market Report:

The Asia Pacific region represents a burgeoning market for Self Monitoring Blood Glucose devices, estimated at $0.83 billion in 2023, expected to grow to $1.64 billion by 2033. Factors driving this growth include a rising population of diabetic patients and increased healthcare spending, alongside growing awareness of SMBG among patients and healthcare providers.North America Self Monitoring Blood Glucose Market Report:

The North American Self Monitoring Blood Glucose market is one of the largest, valued at $1.66 billion in 2023 and expected to see significant growth to $3.27 billion by 2033. This region benefits from advanced healthcare systems, high rates of diabetes, and a growing trend towards personal health management technologies.South America Self Monitoring Blood Glucose Market Report:

In South America, the SMBG market is estimated to be valued at $0.16 billion in 2023, with projections reaching $0.32 billion by 2033. The growth is predicated on increasing diabetes prevalence, improving healthcare infrastructure, and an emphasis on patient education and self-management strategies.Middle East & Africa Self Monitoring Blood Glucose Market Report:

The market in the Middle East and Africa is valued at $0.43 billion in 2023 and is expected to grow to $0.85 billion by 2033. This expansion is driven by a rising diabetic population, increasing healthcare investments, and a greater focus on preventive healthcare measures.Tell us your focus area and get a customized research report.

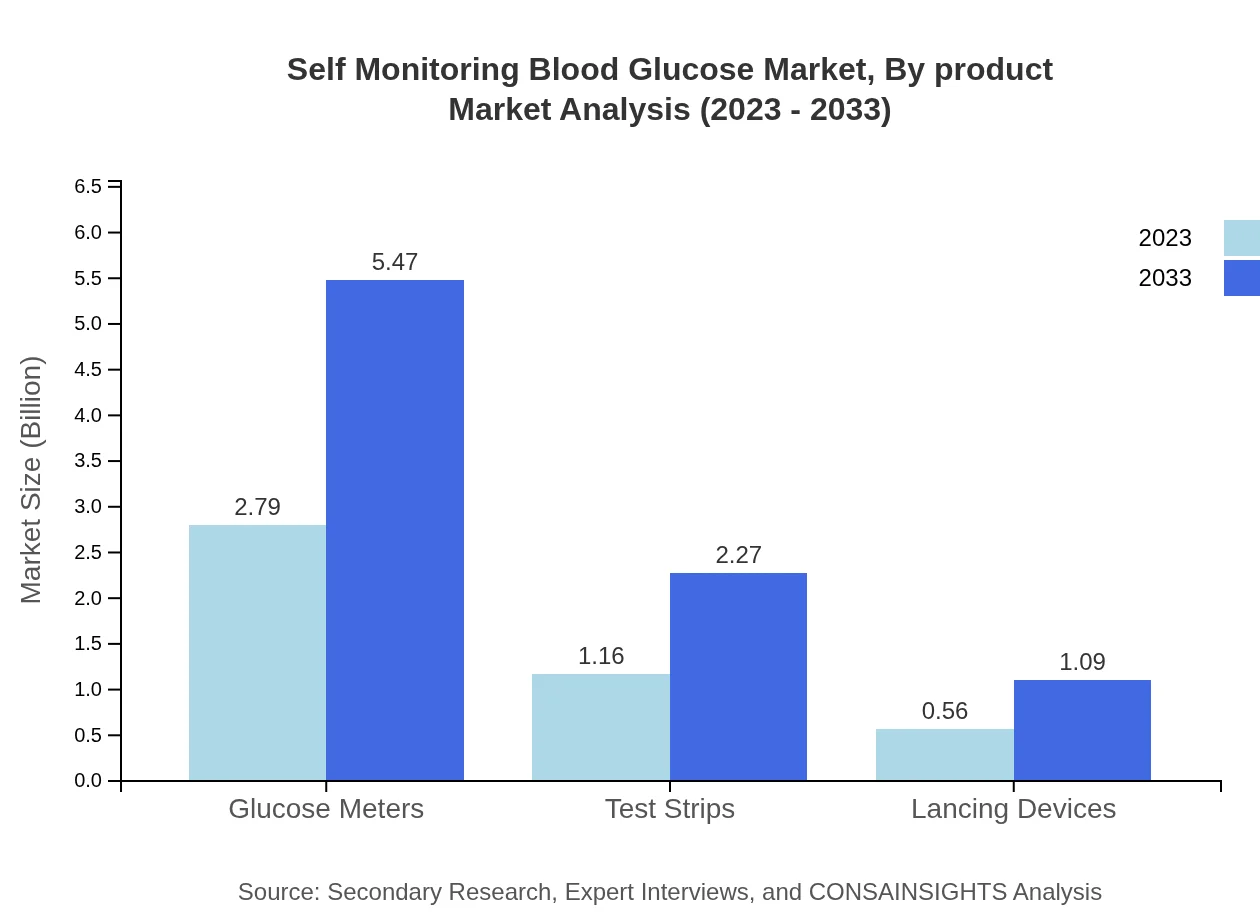

Self Monitoring Blood Glucose Market Analysis By Product

The product segments of the SMBG market show significant financial performance. Glucose Meters dominate this segment, with market sizes expected to rise from $2.79 billion in 2023 to $5.47 billion by 2033 (61.9% market share). Test strips also show robust growth with size estimates moving from $1.16 billion to $2.27 billion (25.72% share), while lancing devices account for $0.56 billion, projected to reach $1.09 billion (12.38% share) in the same period.

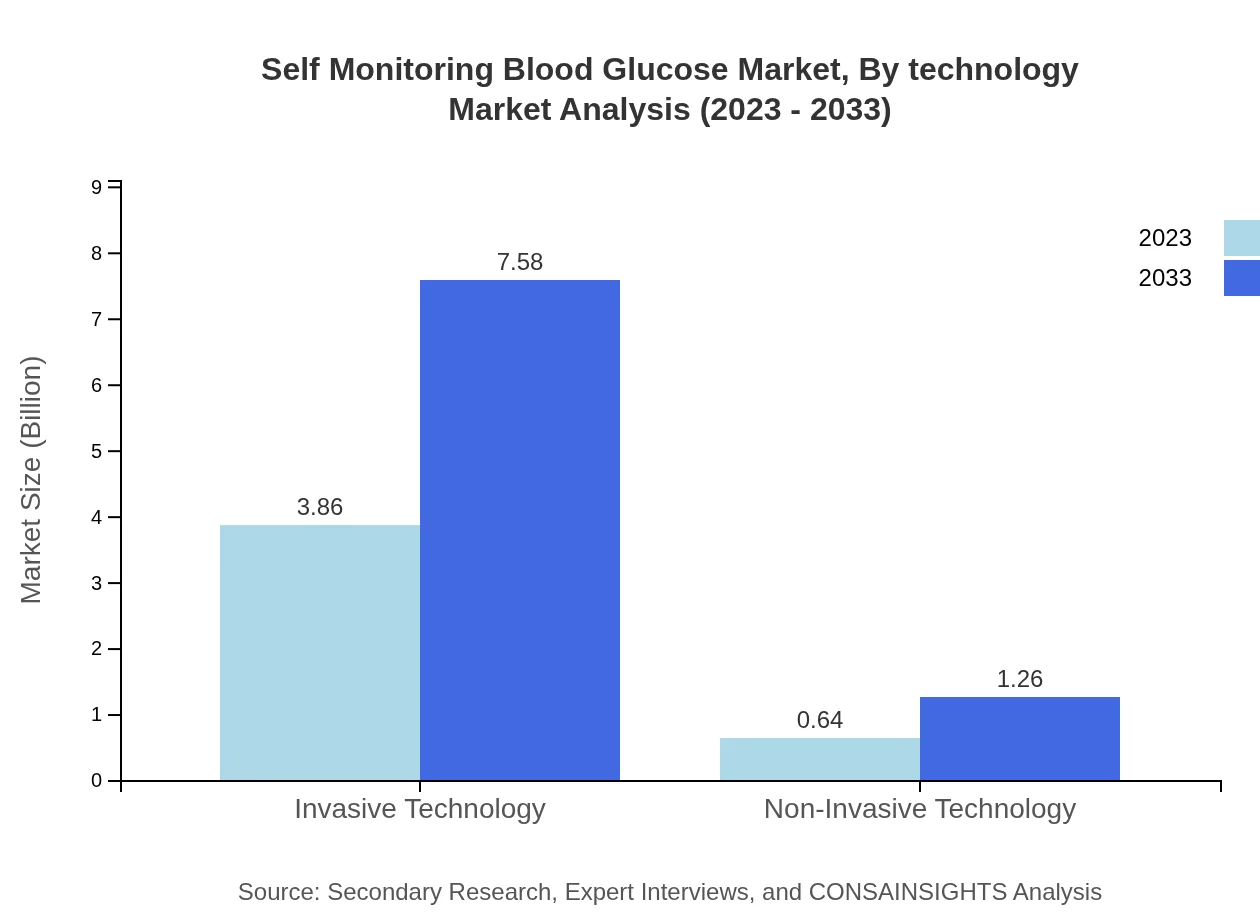

Self Monitoring Blood Glucose Market Analysis By Technology

The SMBG market is categorized into invasive and non-invasive technologies. The invasive technology segment holds a massive market size of $3.86 billion in 2023, poised to double to $7.58 billion by 2033, thereby retaining an 85.72% market share. Meanwhile, non-invasive technology is gradually gaining traction, moving from $0.64 billion to $1.26 billion, holding a 14.28% market share.

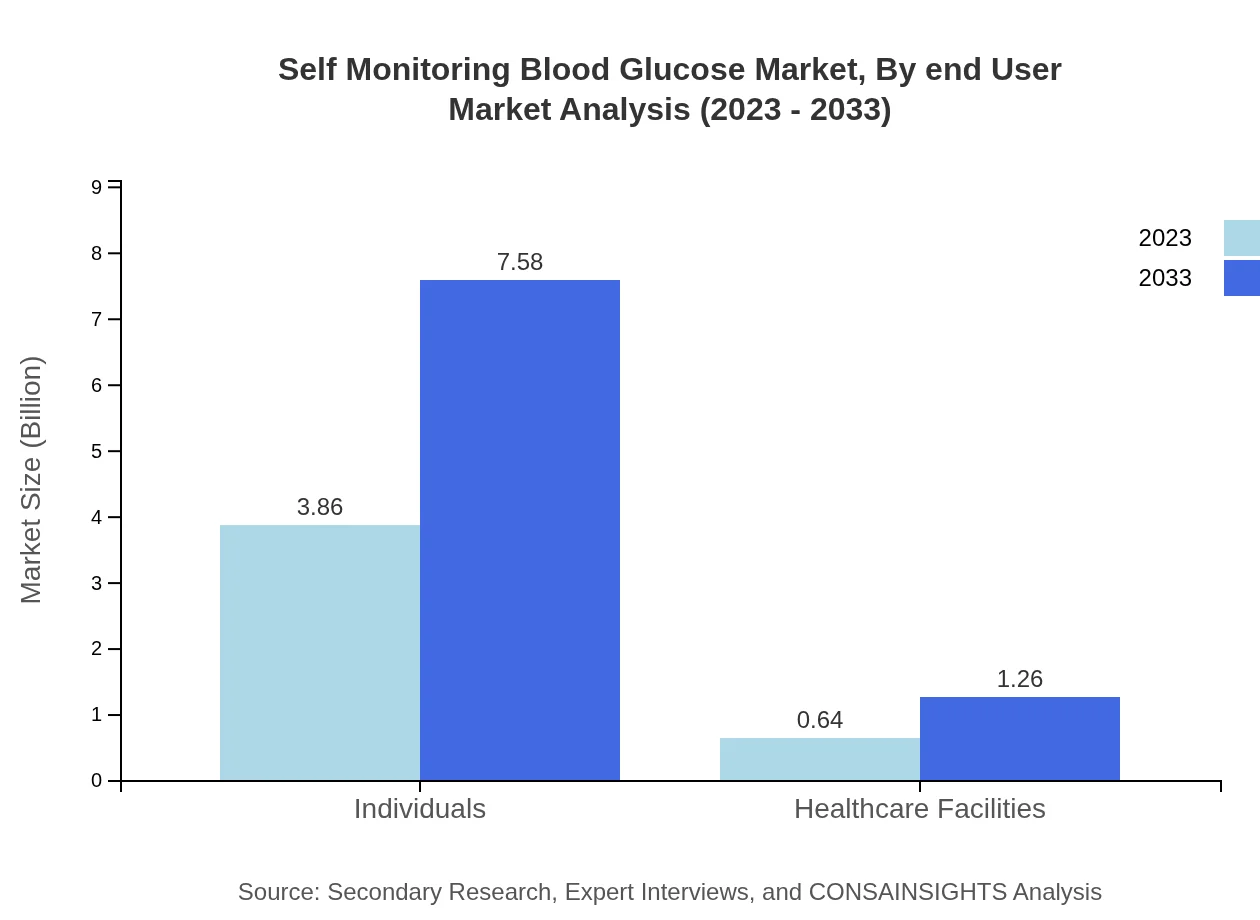

Self Monitoring Blood Glucose Market Analysis By End User

The end-user segment primarily consists of individuals, which dominate the market with a size of $3.86 billion in 2023, expected to increase to $7.58 billion by 2033 (85.72% share). Healthcare facilities, though smaller, are projected to grow from $0.64 billion to $1.26 billion, maintaining a 14.28% market share.

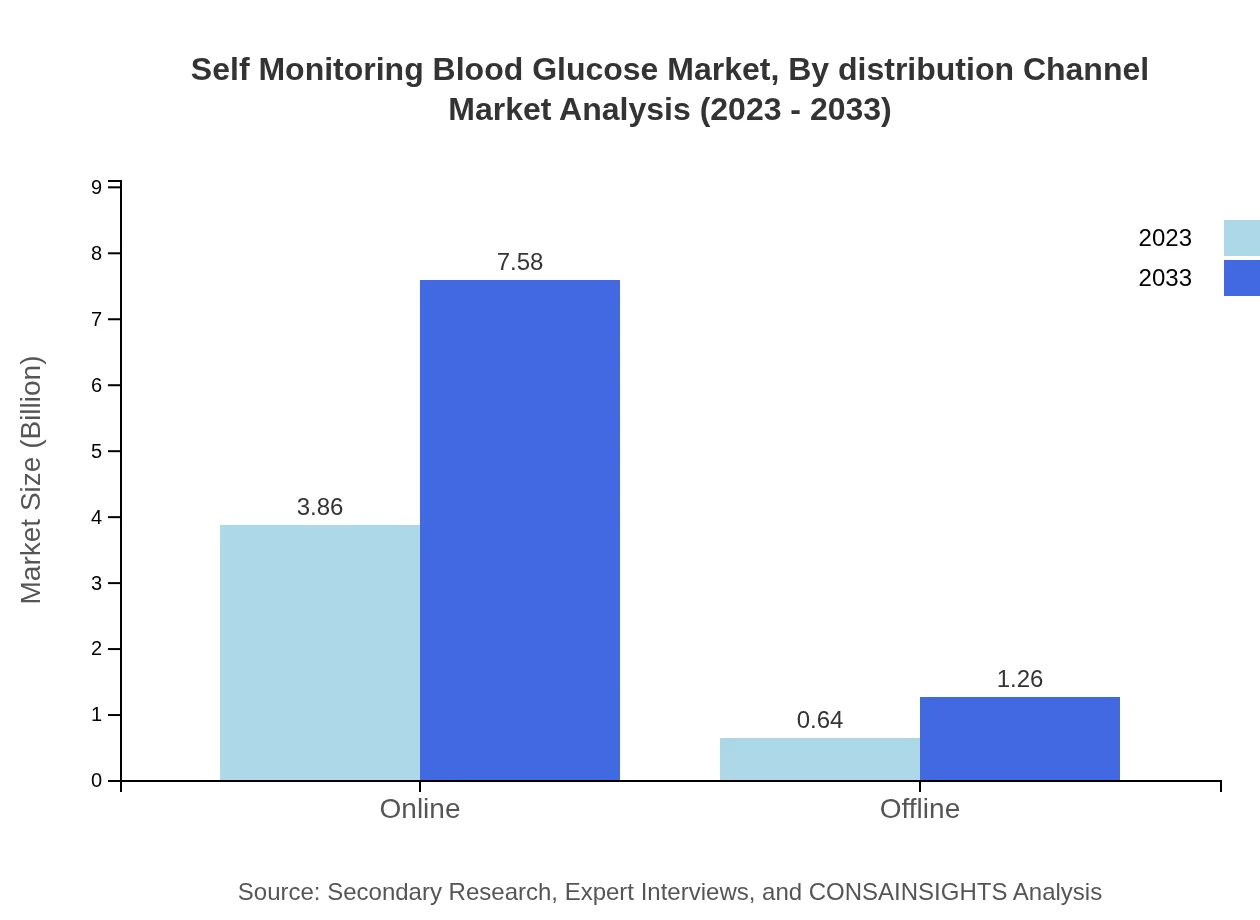

Self Monitoring Blood Glucose Market Analysis By Distribution Channel

E-commerce plays a crucial role in the SMBG market, holding a substantial market size of $3.86 billion in 2023 and forecasted to rise to $7.58 billion by 2033 (85.72% share). Offline channels are also relevant but smaller, forecasted to grow from $0.64 billion to $1.26 billion, capturing a 14.28% market share.

Self Monitoring Blood Glucose Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Self Monitoring Blood Glucose Industry

Abbott Laboratories:

Abbott is at the forefront of diabetes care technology, offering innovative glucose monitoring systems that empower patients with real-time data, such as the FreeStyle Libre.Roche Diagnostics:

Roche provides a comprehensive range of SMBG devices and plays a pivotal role in advancing diabetes monitoring with products like the Accu-Chek series.Medtronic :

Medtronic is a leader in medical technology and offers various diabetes care solutions, including insulin delivery systems and advanced blood glucose monitoring.Johnson & Johnson:

Through its LifeScan segment, Johnson & Johnson offers the OneTouch brand, which is a widely recognized name in blood glucose monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of self Monitoring blood glucose?

The global self-monitoring blood glucose market is currently valued at $4.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8% projected up to 2033.

What are the key market players or companies in this self Monitoring blood glucose industry?

Key players in the self-monitoring blood glucose market include major companies that manufacture glucose meters, test strips, and lancing devices, focusing on innovation and market expansion.

What are the primary factors driving the growth in the self Monitoring blood glucose industry?

Key drivers include the rising prevalence of diabetes globally, advancements in glucose monitoring technologies, increased health awareness, and supportive government initiatives promoting diabetes management.

Which region is the fastest Growing in the self Monitoring blood glucose?

The fastest-growing region for self-monitoring blood glucose is North America, projected to grow from $1.66 billion in 2023 to $3.27 billion by 2033, driven by technological advancements and a high diabetes prevalence.

Does ConsaInsights provide customized market report data for the self Monitoring blood glucose industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing clients to gain insights into the self-monitoring blood glucose industry based on their unique requirements.

What deliverables can I expect from this self Monitoring blood glucose market research project?

Expect detailed market analysis reports, data on market size, trends, competitive landscape, regional insights, and segment performance, providing a comprehensive overview to inform strategic decisions.

What are the market trends of self Monitoring blood glucose?

Market trends include increasing demand for digital health technologies, integration of smartphone applications with glucose monitoring devices, and a shift towards personalized diabetes management solutions.