Semi Conductor And Ic Packaging Materials Market Report

Published Date: 31 January 2026 | Report Code: semi-conductor-and-ic-packaging-materials

Semi Conductor And Ic Packaging Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Semiconductor and IC Packaging Materials market, covering insights on market trends, segmentation, regional performance, and forecasts from 2023 to 2033.

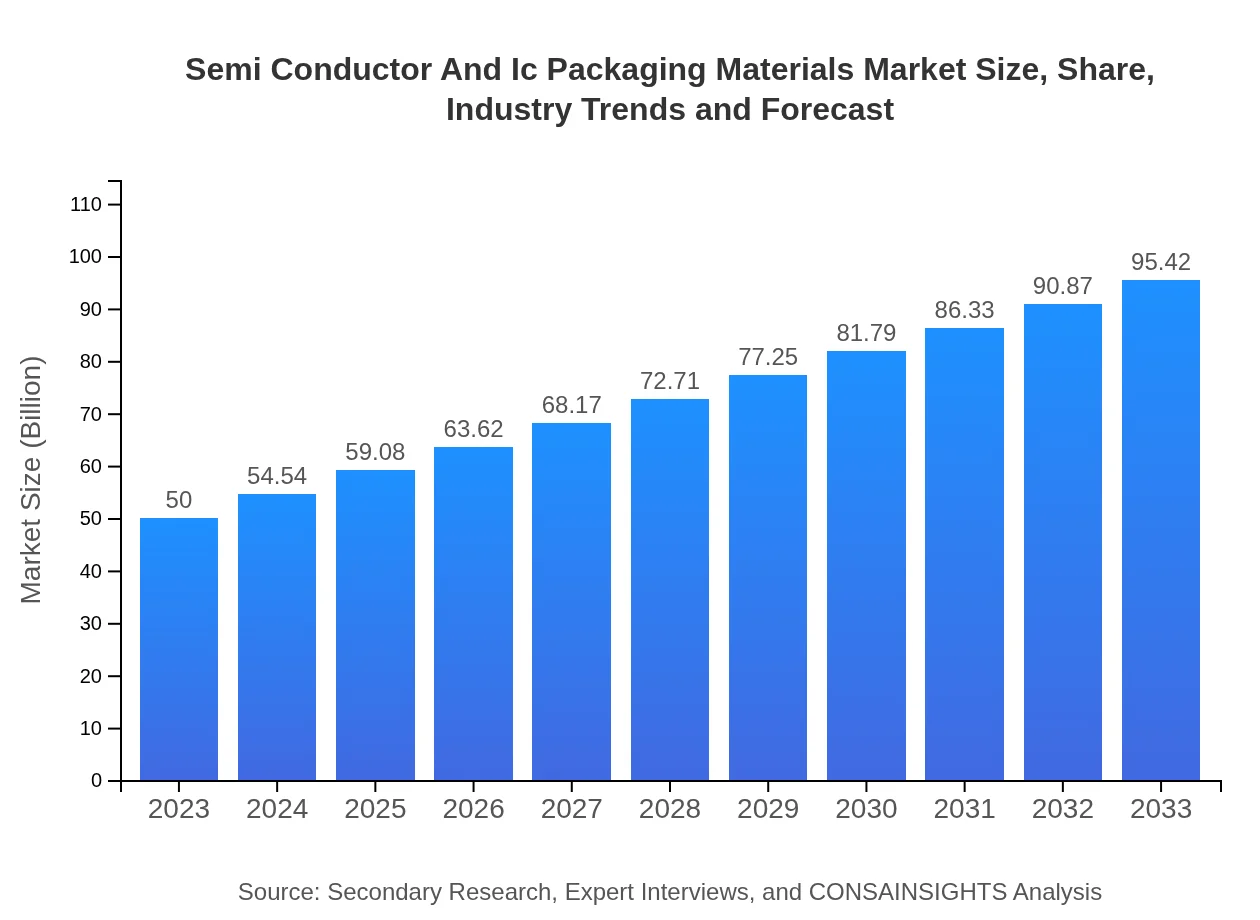

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $95.42 Billion |

| Top Companies | Amkor Technology, ASE Group, Nihon Superior Co., Ltd., Siliconware Precision Industries Co., Ltd. (SPIL), Jiangsu Changjiang Electronics Technology Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Semi Conductor And Ic Packaging Materials Market Overview

Customize Semi Conductor And Ic Packaging Materials Market Report market research report

- ✔ Get in-depth analysis of Semi Conductor And Ic Packaging Materials market size, growth, and forecasts.

- ✔ Understand Semi Conductor And Ic Packaging Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Semi Conductor And Ic Packaging Materials

What is the Market Size & CAGR of Semiconductor And Ic Packaging Materials market in 2023?

Semi Conductor And Ic Packaging Materials Industry Analysis

Semi Conductor And Ic Packaging Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Semi Conductor And Ic Packaging Materials Market Analysis Report by Region

Europe Semi Conductor And Ic Packaging Materials Market Report:

Europe's Semiconductor and IC Packaging Materials market is anticipated to grow from $12.48 billion in 2023 to $23.83 billion by 2033. Factors contributing to this growth include advancements in automotive electronics and strong commitments to semiconductor research.Asia Pacific Semi Conductor And Ic Packaging Materials Market Report:

In the Asia Pacific region, the Semiconductor and IC Packaging Materials market is expected to grow from $9.82 billion in 2023 to $18.74 billion by 2033. This growth is primarily driven by the region's strong electronics manufacturing base and increasing investments in semiconductor technologies.North America Semi Conductor And Ic Packaging Materials Market Report:

North America shows a promising trajectory with a market value of $16.32 billion in 2023, projected to reach $31.13 billion by 2033. The growth is supported by technological advancements and the increasing adoption of smart technologies in various industries.South America Semi Conductor And Ic Packaging Materials Market Report:

The South American market, starting at $4.82 billion in 2023, is projected to reach $9.19 billion by 2033. Growth in consumer electronics and automotive sectors is fueling demand for semiconductor packaging materials in this region.Middle East & Africa Semi Conductor And Ic Packaging Materials Market Report:

In the Middle East and Africa, the market is expected to expand from $6.57 billion in 2023 to $12.53 billion by 2033. The region is witnessing growing investments in electronic manufacturing, particularly in the automotive and telecommunications sectors.Tell us your focus area and get a customized research report.

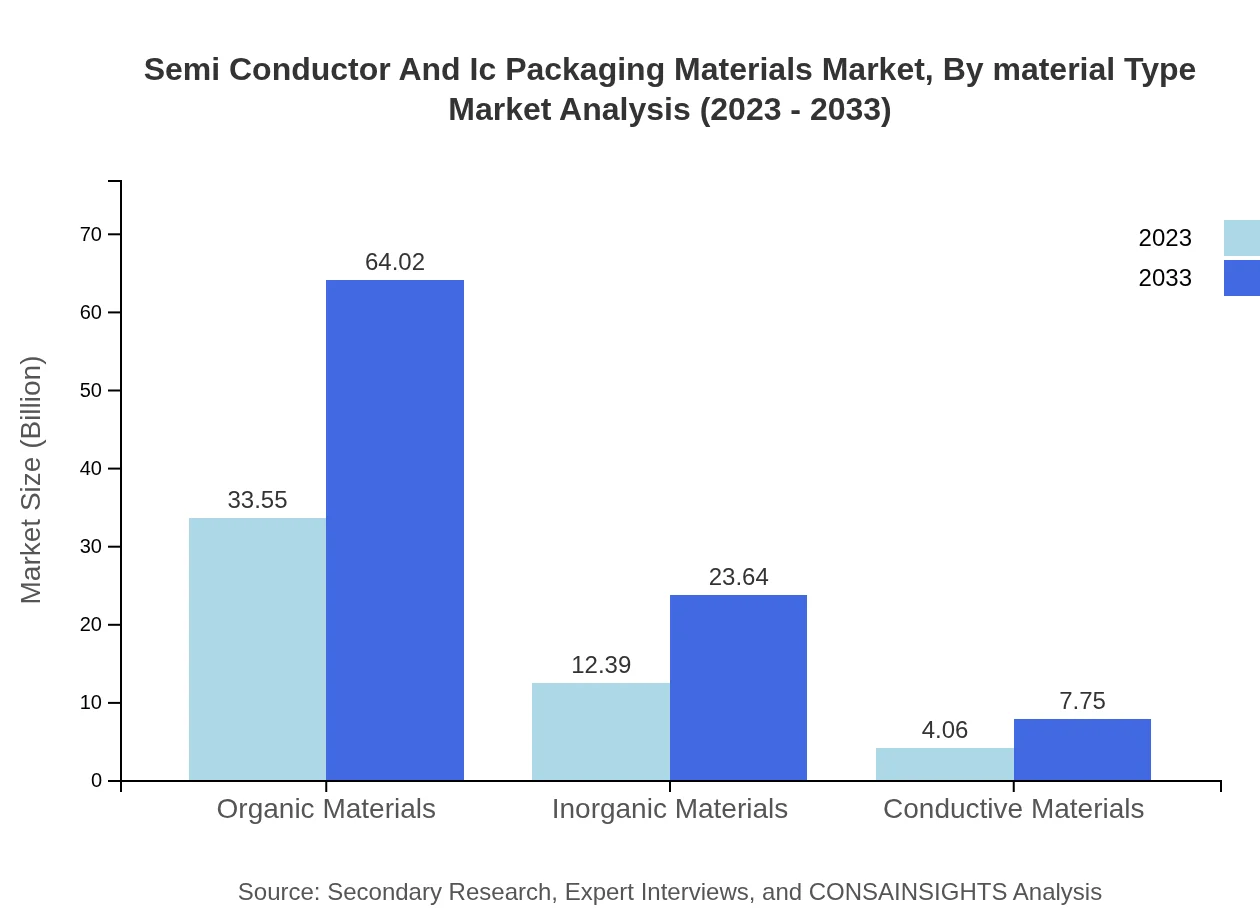

Semi Conductor And Ic Packaging Materials Market Analysis By Material Type

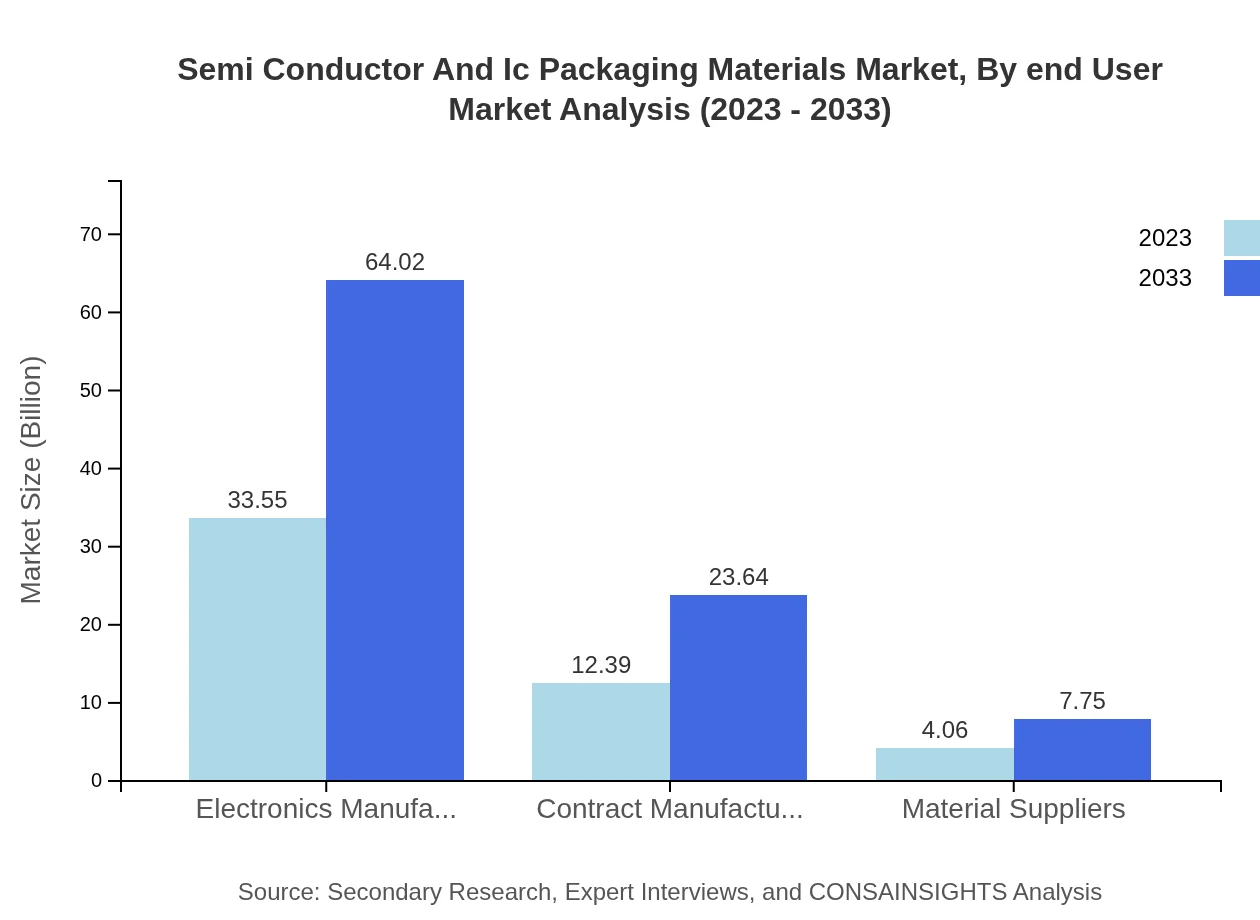

In terms of material types, organic materials dominate the market, reflecting a size of $33.55 billion in 2023 and projected to grow to $64.02 billion by 2033, accounting for around 67.1% market share throughout the period. Inorganic materials are also notable, starting at $12.39 billion and expected to grow to $23.64 billion by 2033. Conductive materials, while smaller in size - from $4.06 billion to $7.75 billion - still represent a critical segment, contributing around 8.12% market share.

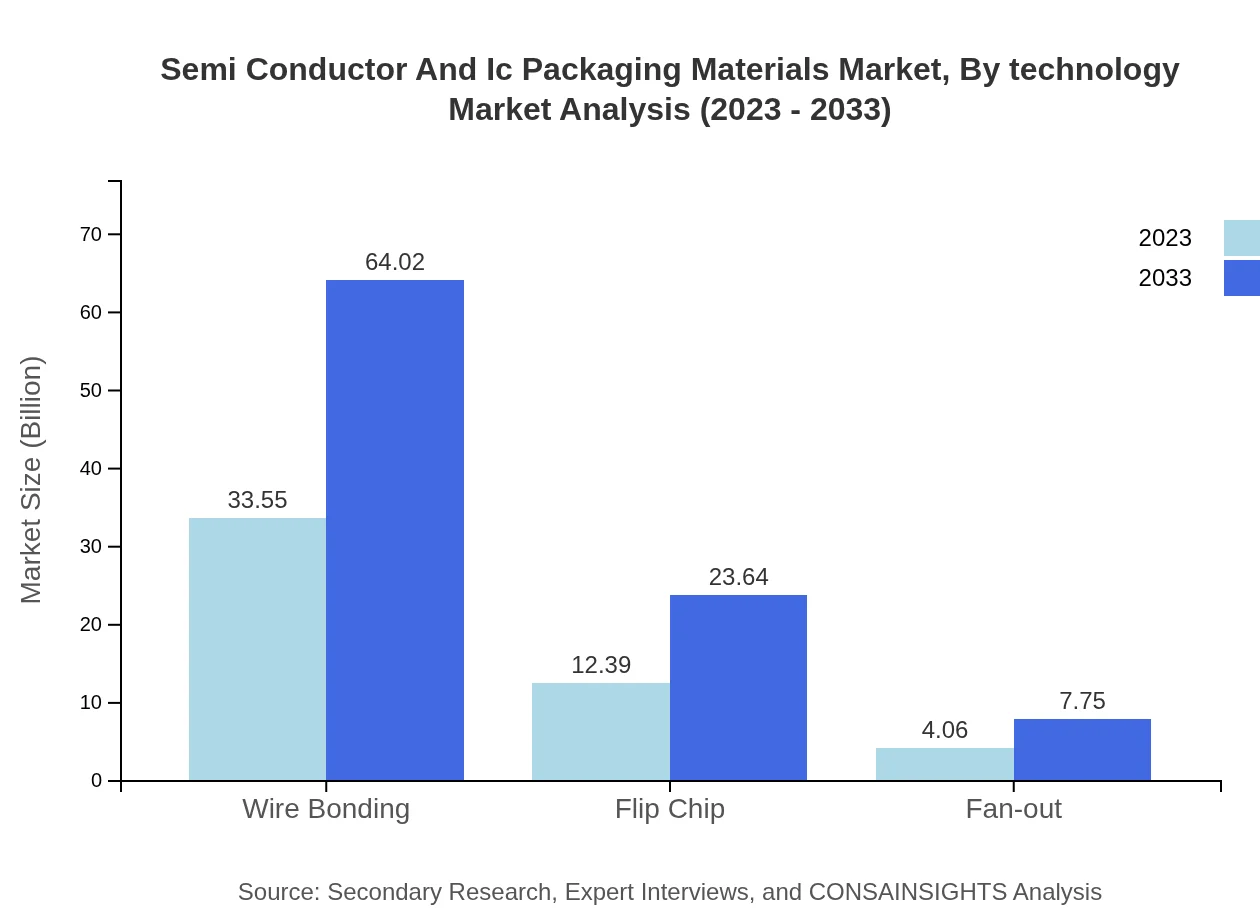

Semi Conductor And Ic Packaging Materials Market Analysis By Technology

Technology-wise, wire bonding remains a prominent choice, with a market size projected from $33.55 billion in 2023 to $64.02 billion by 2033, maintaining a share of 67.1%. Similarly, flip chip technology is set to grow from $12.39 billion to $23.64 billion, while fan-out technology presents a smaller market starting at $4.06 billion and reaching $7.75 billion by 2033, illustrating the diverse technological approaches in packaging solutions.

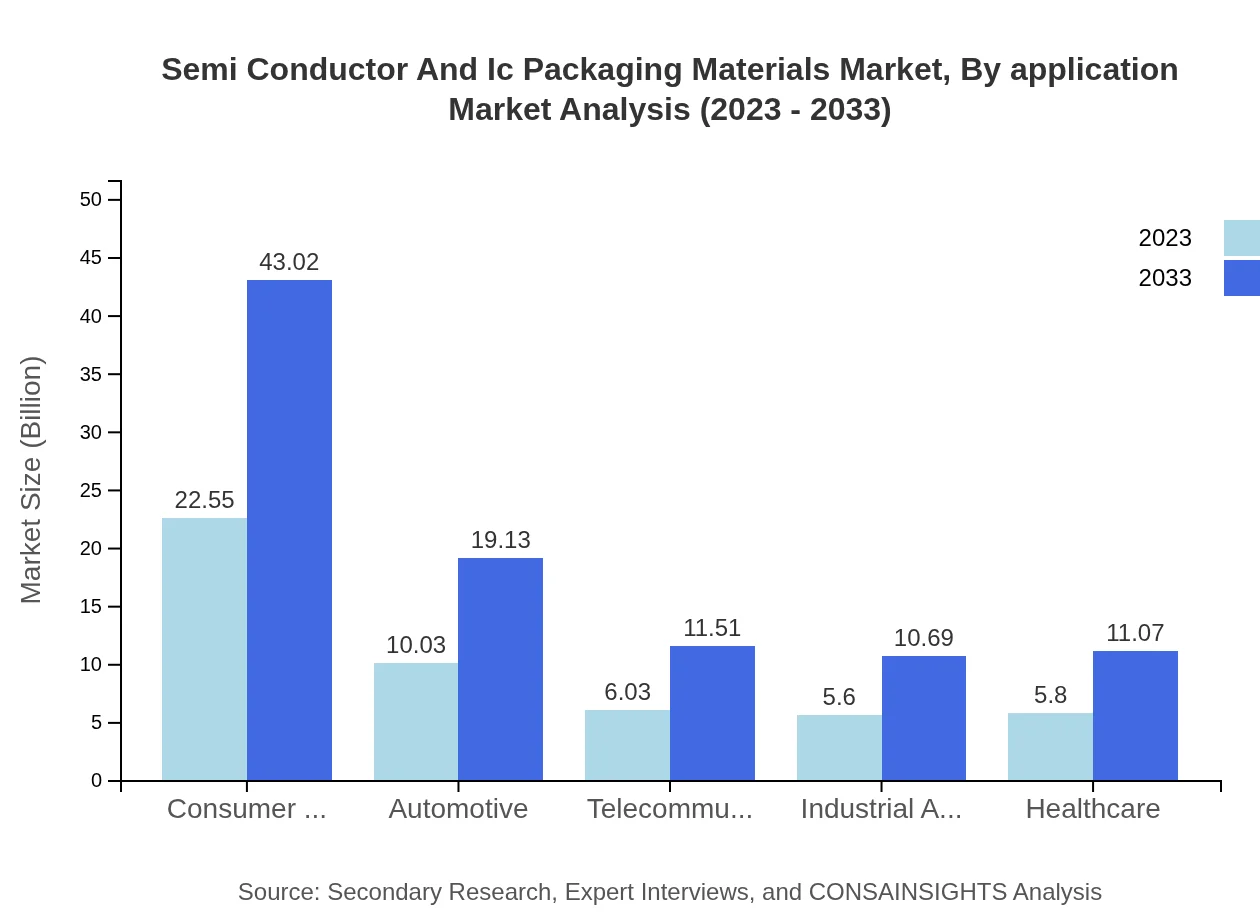

Semi Conductor And Ic Packaging Materials Market Analysis By Application

Applications of semiconductor and IC packaging materials are diverse, with consumer electronics holding the largest share of $22.55 billion in 2023, expected to reach $43.02 billion by 2033, accounting for 45.09% market share. In addition, the automotive sector is growing from $10.03 billion to $19.13 billion, along with telecommunications from $6.03 billion to $11.51 billion, highlighting the broad applicability of these materials.

Semi Conductor And Ic Packaging Materials Market Analysis By End User

End-user segments demonstrate a broad array of industries including healthcare, industrial automation, and automotive. In 2023, the healthcare sector is expected to consume approximately $5.80 billion worth of packaging materials, projected to grow to $11.07 billion by 2033, while industrial automation is also anticipated to escalate from $5.60 billion to $10.69 billion, contributing to the expanding market landscape.

Semi Conductor And Ic Packaging Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Semiconductor And Ic Packaging Materials Industry

Amkor Technology:

Amkor Technology is a leading provider of semiconductor packaging services, specializing in advanced packaging technology for various applications.ASE Group:

ASE Group is a renowned company in semiconductor packaging and testing, providing innovative solutions to enhance performance in the electronic industry.Nihon Superior Co., Ltd.:

Nihon Superior offers high-quality soldering materials and advanced packaging solutions to meet the growing demands of the electronics market.Siliconware Precision Industries Co., Ltd. (SPIL):

SPIL is a leading manufacturer of semiconductor packaging services with a strong focus on advanced technologies and customer-driven solutions.Jiangsu Changjiang Electronics Technology Co., Ltd.:

Jiangsu Changjiang is a prominent player in semiconductor packaging and is recognized for its innovative technologies in packaging and testing.We're grateful to work with incredible clients.

FAQs

What is the market size of Semi-Conductor and IC Packaging Materials?

The global semiconductor and IC packaging materials market is projected to reach approximately $50 billion by 2033, growing at a CAGR of 6.5% from 2023 to 2033.

What are the key market players or companies in the Semi-Conductor and IC Packaging Materials industry?

Key players in the semiconductor and IC packaging materials industry include major electronics manufacturers, contract manufacturers, and material suppliers, which are instrumental in driving innovation and quality in the market.

What are the primary factors driving the growth in the Semi-Conductor and IC Packaging Materials industry?

Growth drivers include the rising demand for consumer electronics, advancements in automotive technology, and increased utilization of semiconductors across various industries, contributing to the robust expansion of this market.

Which region is the fastest Growing in Semi-Conductor and IC Packaging Materials?

North America is expected to be the fastest-growing region in the semiconductor and IC packaging materials market, increasing from $16.32 billion in 2023 to $31.13 billion by 2033, reflecting significant market development.

Does ConsaInsights provide customized market report data for the Semi-Conductor and IC Packaging Materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the semiconductor and IC packaging materials industry, helping clients gain unique insights for strategic decision-making.

What deliverables can I expect from this Semi-Conductor and IC Packaging Materials market research project?

Deliverables include comprehensive market analysis reports, segment breakdowns, competitive landscape insights, and actionable recommendations tailored to your business needs.

What are the market trends of Semi-Conductor and IC Packaging Materials?

Key trends include an increasing focus on sustainable materials, enhanced packaging technologies, and rising demand for miniaturization in electronics, significantly shaping the market landscape.