Sensors In Oil And Gas Market Report

Published Date: 31 January 2026 | Report Code: sensors-in-oil-and-gas

Sensors In Oil And Gas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sensors In Oil And Gas market, covering market trends, size, and forecasts from 2023 to 2033. It includes insights into technology advancements, regional breakdowns, and key players that shape the industry.

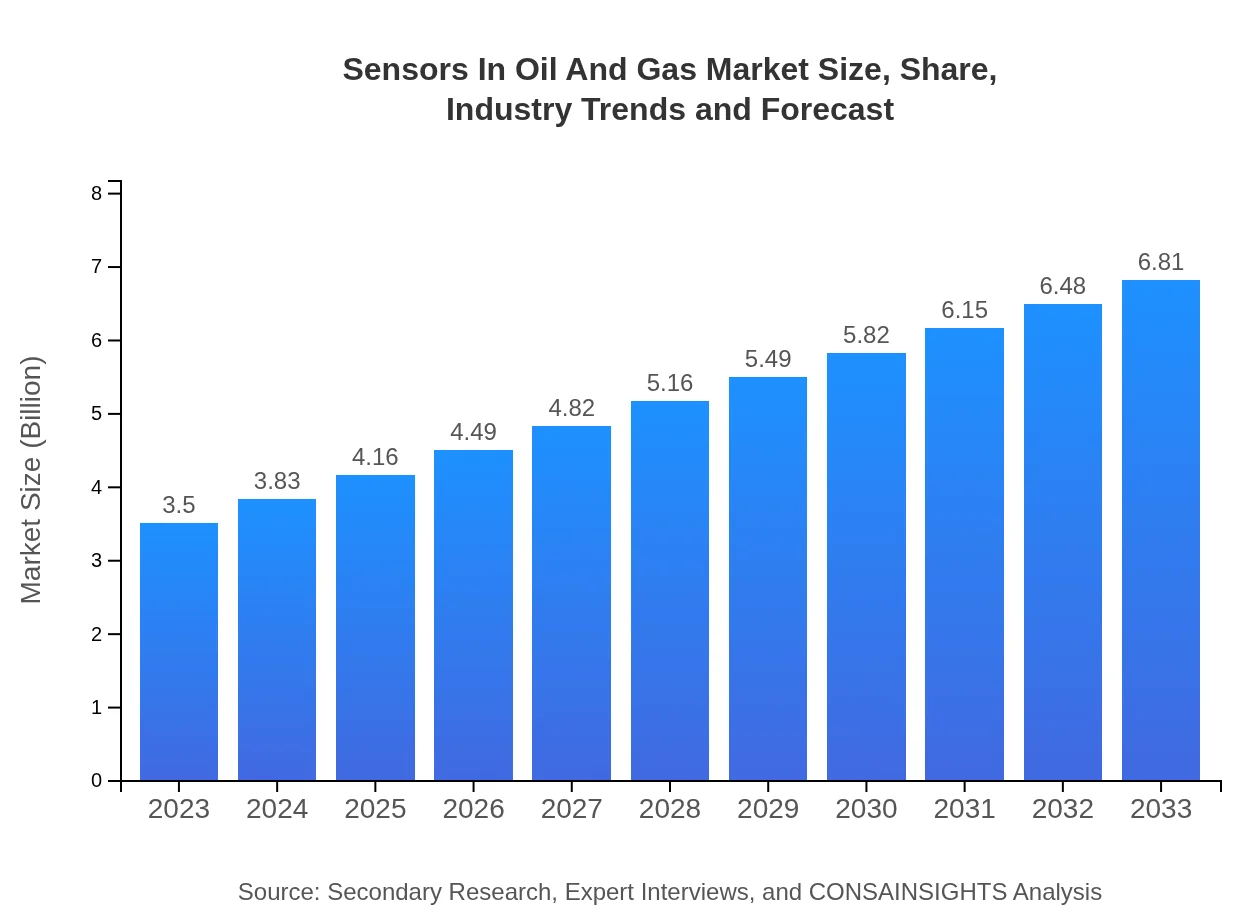

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $6.81 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., Schneider Electric, Emerson Electric Co., Bosch Sensortec |

| Last Modified Date | 31 January 2026 |

Sensors In Oil And Gas Market Overview

Customize Sensors In Oil And Gas Market Report market research report

- ✔ Get in-depth analysis of Sensors In Oil And Gas market size, growth, and forecasts.

- ✔ Understand Sensors In Oil And Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sensors In Oil And Gas

What is the Market Size & CAGR of Sensors In Oil And Gas market in 2023?

Sensors In Oil And Gas Industry Analysis

Sensors In Oil And Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sensors In Oil And Gas Market Analysis Report by Region

Europe Sensors In Oil And Gas Market Report:

The European market is estimated at around $0.97 billion in 2023, growing to $1.88 billion by 2033. The demand in this region is spurred by the stringent environmental regulations and an increasing shift towards cleaner energy solutions.Asia Pacific Sensors In Oil And Gas Market Report:

In Asia-Pacific, the market was valued at approximately $0.77 billion in 2023 and is projected to reach $1.50 billion by 2033. Rapidly growing economies, increased oil and gas exploration activities, and a push for advanced monitoring systems drive this growth.North America Sensors In Oil And Gas Market Report:

North America represents a robust market, valued at $1.15 billion in 2023 and expected to grow to $2.23 billion by 2033. The presence of major oil and gas companies, coupled with technological advancements and the adoption of smart sensors, is here to drive substantial growth.South America Sensors In Oil And Gas Market Report:

The South American market is currently valued at $0.18 billion in 2023, with projections to double to $0.36 billion by 2033. The region is focusing on oil production enhancements, largely due to favorable oil prices and increasing investments in infrastructure.Middle East & Africa Sensors In Oil And Gas Market Report:

Middle East and Africa's market is projected to rise from $0.44 billion in 2023 to $0.85 billion in 2033. The region's oil production potential and initiatives to modernize existing equipment play significant roles in this growth.Tell us your focus area and get a customized research report.

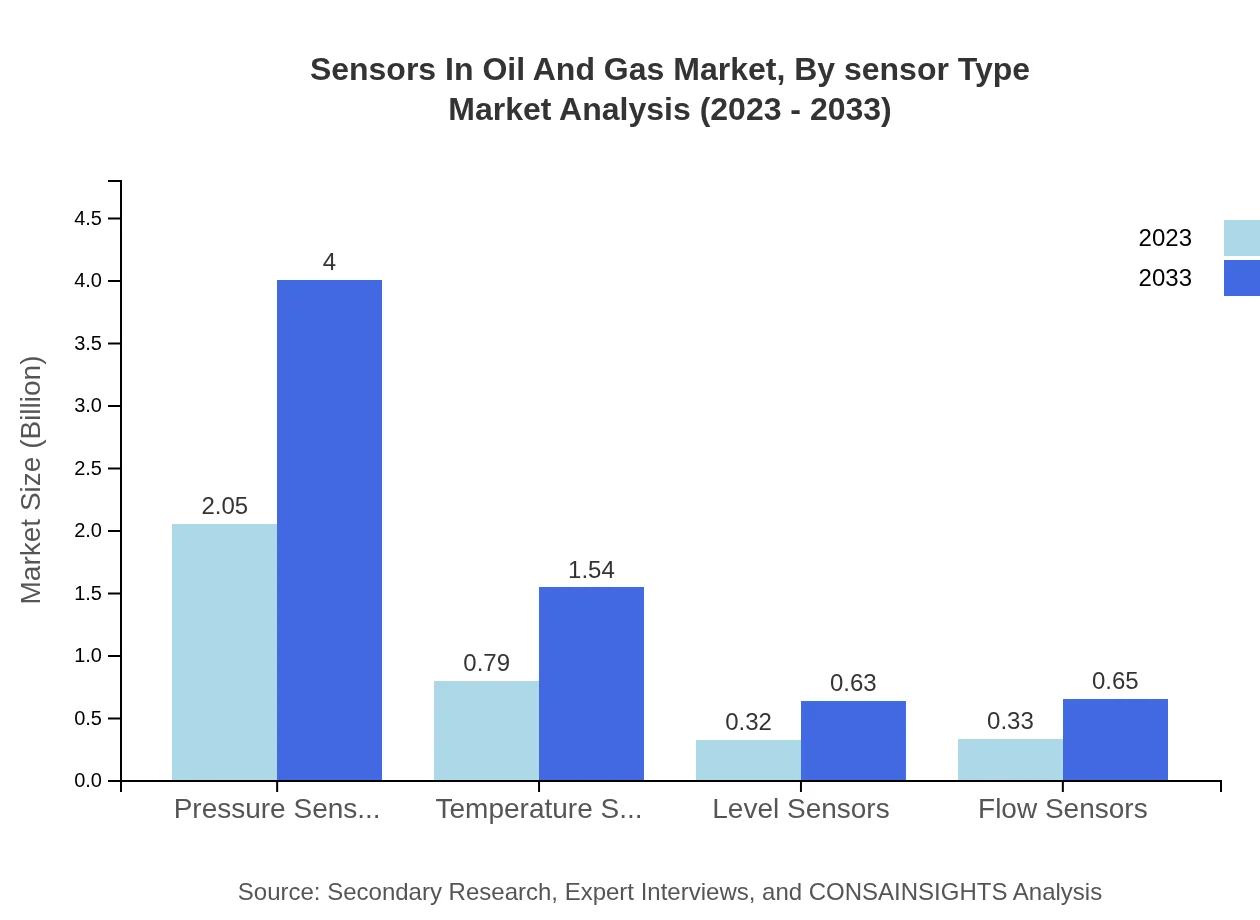

Sensors In Oil And Gas Market Analysis By Sensor Type

The Sensors in Oil and Gas market is dominated by pressure sensors, with a market share of approximately 58.67% in 2023. Temperature sensors account for 22.66%, while flow and level sensors make up 9.49% and 9.18%, respectively. As the industry shifts towards safer and more efficient practices, the performance of these sensors becomes increasingly critical.

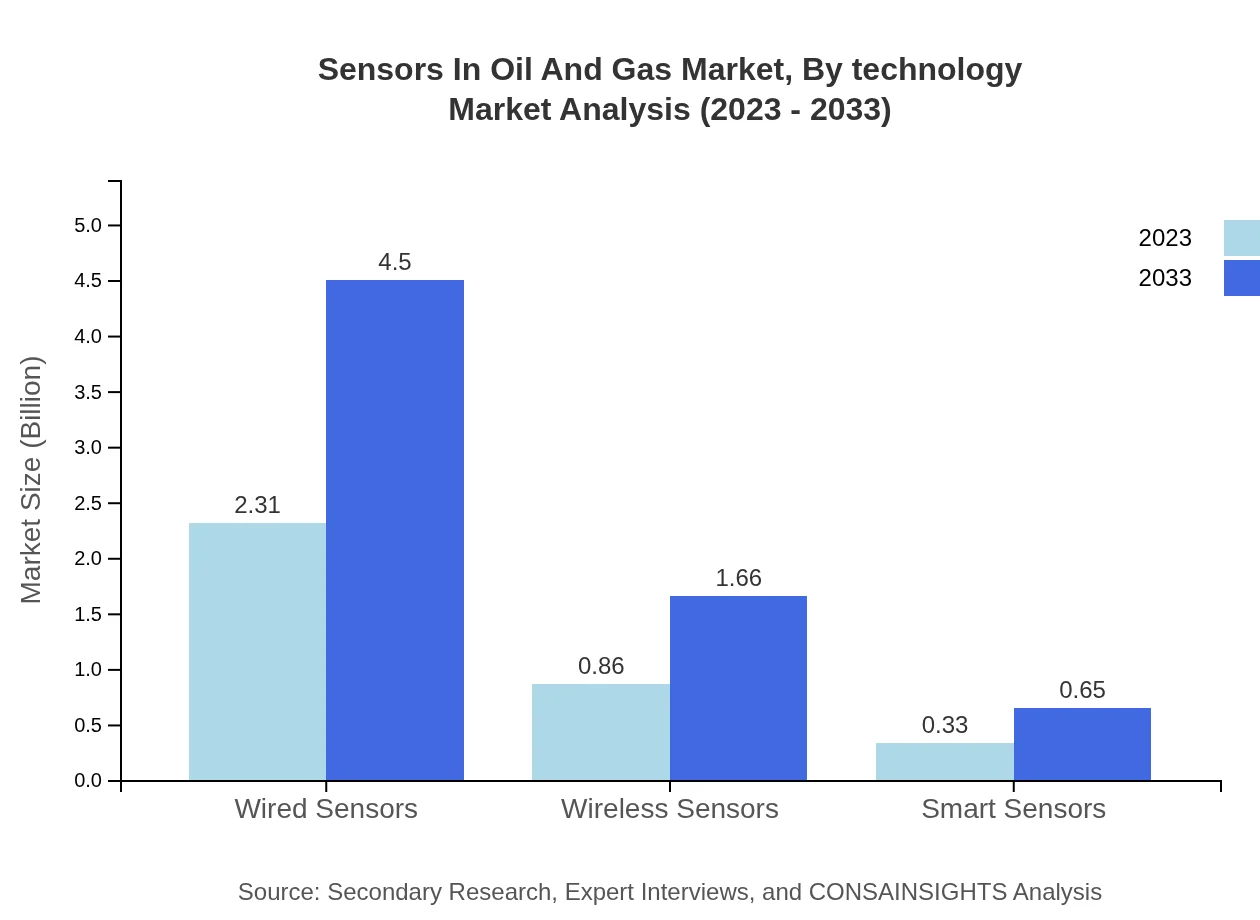

Sensors In Oil And Gas Market Analysis By Technology

Wired sensors currently dominate the market, accounting for about 66% of the overall size in 2023. However, there's a significant shift towards wireless and smart sensors as companies seek flexibility and advanced functionalities, signaling a growth trajectory for these technologies amid the oil and gas industry's modernization efforts.

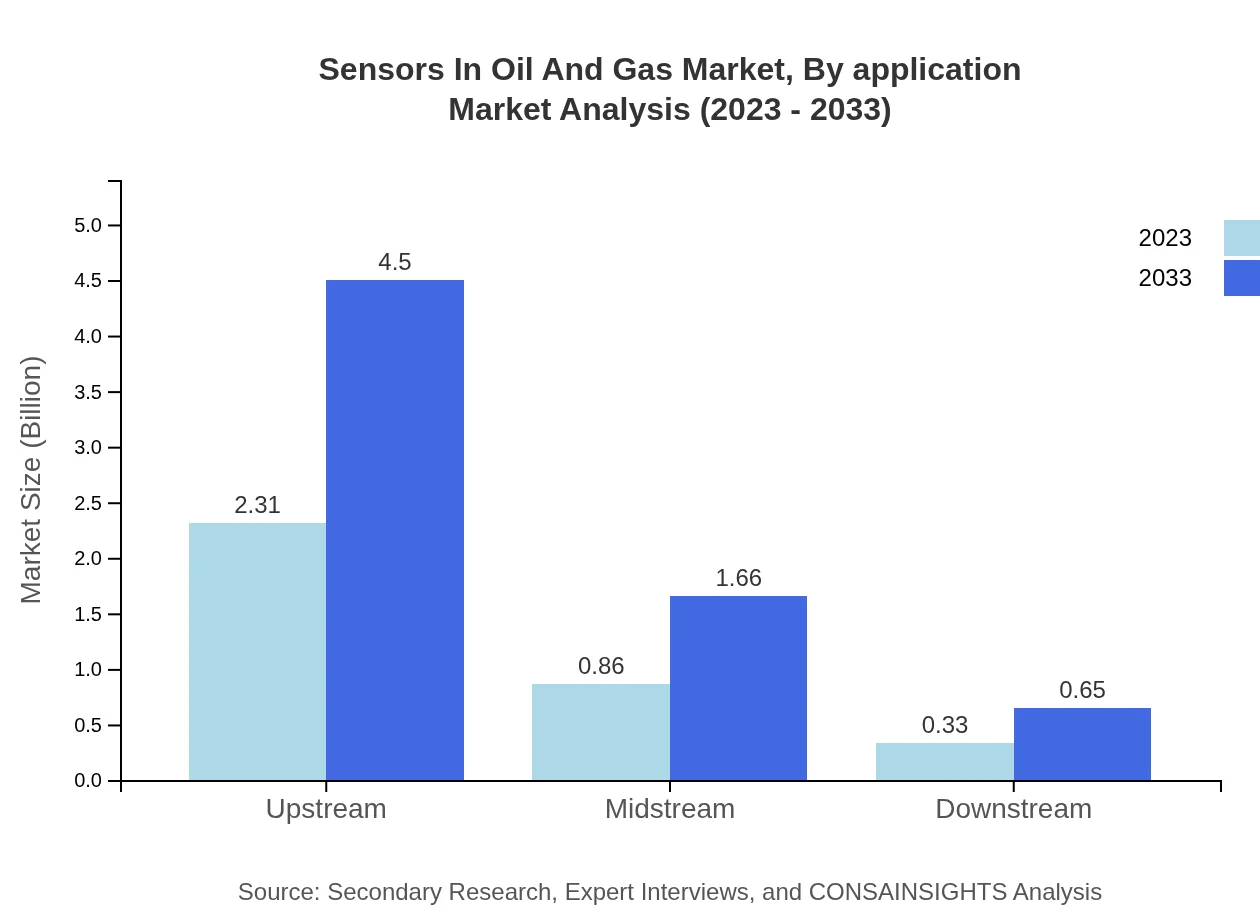

Sensors In Oil And Gas Market Analysis By Application

In terms of application, the upstream segment accounts for the largest share of about 66% in 2023. Midstream follows with 24.44%, while downstream makes up 9.56%. The focus on exploration and production efficiency primarily drives the upstream applications.

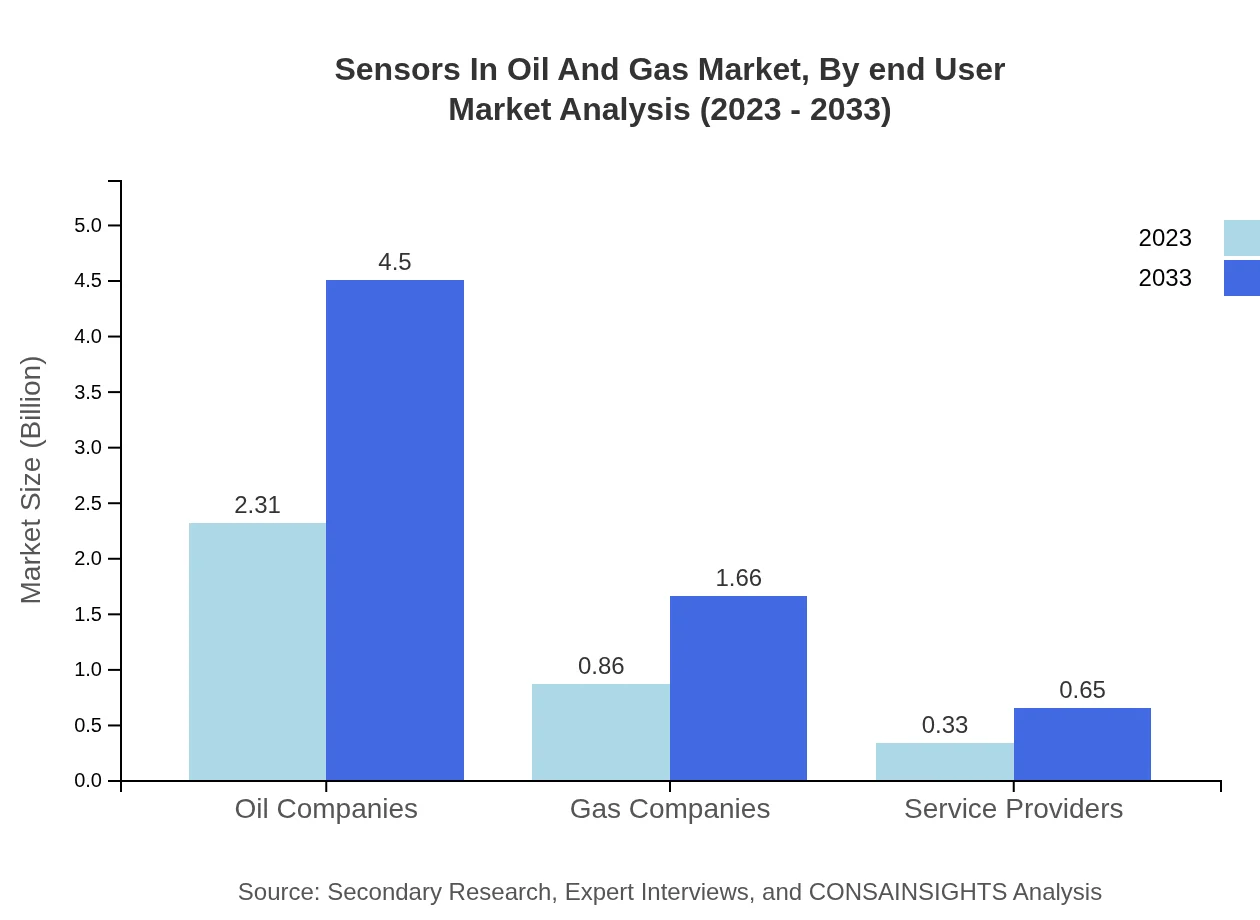

Sensors In Oil And Gas Market Analysis By End User

Oil companies lead the market with a 66% share in 2023, emphasizing the critical nature of sensors in resource extraction. Gas companies represent 24.44%, while service providers hold 9.56%. This distribution highlights the importance of sensor technologies across various operational layers.

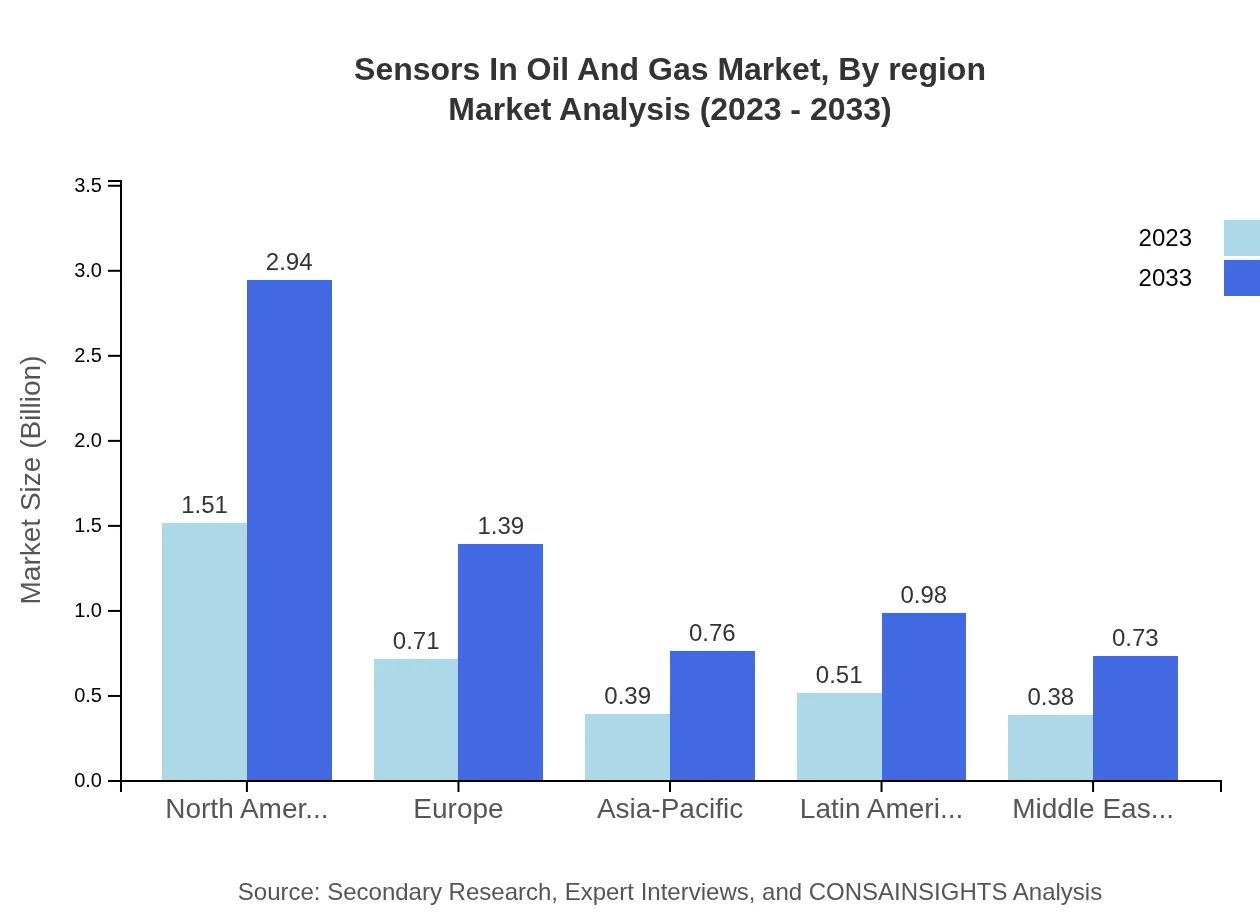

Sensors In Oil And Gas Market Analysis By Region

The regional market analysis reflects significant disparities in demand and growth potential. North America leads with the highest market size, followed closely by Europe. The Asia-Pacific region shows strong growth, supported by industrial growth and increased exploration activities, setting the stage for a competitive landscape.

Sensors In Oil And Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sensors In Oil And Gas Industry

Siemens AG:

A global leader in digitalization and automation technologies, Siemens provides advanced sensor solutions which optimize performance and safety in oil and gas operations.Honeywell International Inc.:

Honeywell is known for its innovative sensor technologies that enhance efficiency and safety, providing comprehensive solutions for the oil and gas industry.Schneider Electric:

Schneider Electric specializes in energy management and automation, offering a wide range of IoT-enabled sensor technologies for enhanced operational efficiency.Emerson Electric Co.:

Emerson offers extensive sensor solutions that improve operational reliability and ensure safety across oil and gas applications, leveraging decades of industry experience.Bosch Sensortec:

Bosch is renowned for its smart sensor technologies that provide advanced capabilities, enabling the integration of sensors with IoT and enhancing monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of sensors In Oil And Gas?

The global sensors in oil and gas market is valued at approximately $3.5 billion in 2023, with a projected growth at a CAGR of 6.7%, aiming to significantly expand by 2033.

What are the key market players or companies in this sensors In Oil And Gas industry?

Key players in the sensors in oil and gas industry include major oil companies, gas corporations, and specialized service providers, all competing in the technological advancement of sensor applications.

What are the primary factors driving the growth in the sensors In Oil And Gas industry?

The growth of the sensors in oil and gas industry is mainly driven by increases in exploration activities, the need for safety and compliance, and advancements in sensor technologies improving efficiency.

Which region is the fastest Growing in the sensors In Oil And Gas?

North America is the fastest-growing region in the sensors in oil and gas market, with market size expected to rise from $1.15 billion in 2023 to $2.23 billion in 2033.

Does ConsaInsights provide customized market report data for the sensors In Oil And Gas industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the sensors in oil and gas industry, ensuring relevant insights for decision-making.

What deliverables can I expect from this sensors In Oil And Gas market research project?

Deliverables from the sensors in oil and gas market research project include detailed market analysis, segmentation insights, strategic recommendations, and trend forecasting.

What are the market trends of sensors In Oil And Gas?

Trends in the sensors in oil and gas market include a shift towards smart sensors, increasing wireless technology usage, and greater integration with IoT for enhanced operational efficiency.