Sensors Market Report

Published Date: 31 January 2026 | Report Code: sensors

Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Sensors market, projecting insights from 2023 to 2033, including market size, growth rates, and trends across various segments and regions.

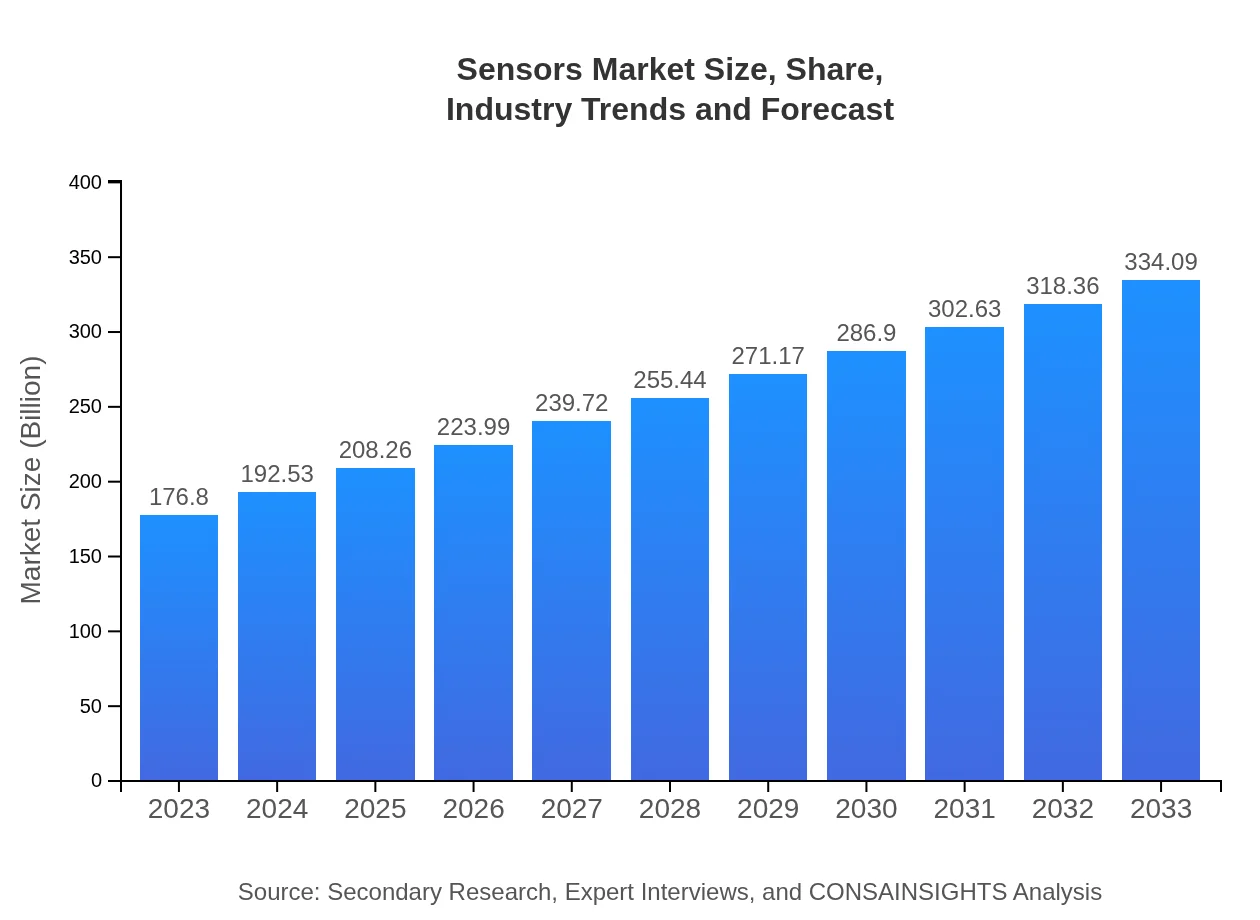

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $176.80 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $334.09 Billion |

| Top Companies | Honeywell International Inc., Bosch Sensortec, Texas Instruments, Analog Devices, Inc., STMicroelectronics |

| Last Modified Date | 31 January 2026 |

Sensors Market Overview

Customize Sensors Market Report market research report

- ✔ Get in-depth analysis of Sensors market size, growth, and forecasts.

- ✔ Understand Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sensors

What is the Market Size & CAGR of Sensors market in 2023?

Sensors Industry Analysis

Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sensors Market Analysis Report by Region

Europe Sensors Market Report:

Europe's market is forecasted to grow significantly, from $53.84 billion in 2023 to $101.73 billion by 2033. The EU's push for smart city initiatives and stringent regulations around industrial efficiency and environmental impact are powerful catalysts for market growth.Asia Pacific Sensors Market Report:

The Asia Pacific region is projected to reach a market size of approximately $58.37 billion by 2033, growing from $30.89 billion in 2023. The growth is mainly driven by increased electronic manufacturing and the rising demand for smart devices. Countries like China, Japan, and India are leading the charge due to their booming industrial sectors.North America Sensors Market Report:

North America holds a notable position, with the market expected to expand from $66.34 billion in 2023 to $125.35 billion by 2033. This region is characterized by technological advancements, especially in the automotive and healthcare sectors where sensor integration is critical.South America Sensors Market Report:

In South America, the Sensors market is expected to grow from $14.02 billion in 2023 to $26.49 billion by 2033, indicating significant investment in industrial automation and smart agriculture solutions. Brazil is at the forefront of this growth due to its extensive agricultural sector.Middle East & Africa Sensors Market Report:

The Middle East and Africa (MEA) region is anticipated to see growth from $11.72 billion in 2023 to $22.15 billion by 2033. The increase is driven by investments in smart technologies and infrastructure improvements, particularly in the Gulf Cooperation Council (GCC) countries.Tell us your focus area and get a customized research report.

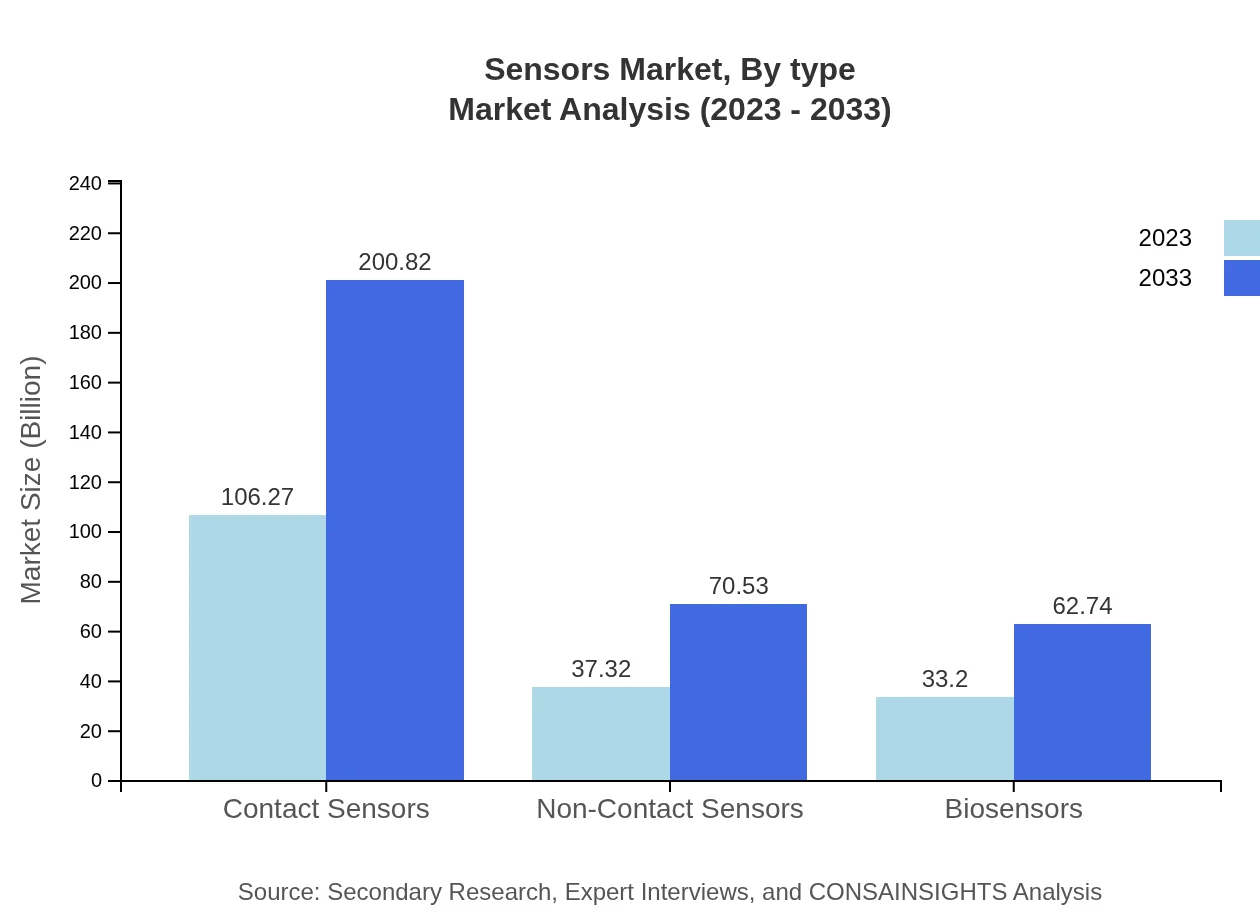

Sensors Market Analysis By Type

The Sensors market can be categorized into contact sensors, non-contact sensors, and biosensors. Contact sensors, with a market size of $106.27 billion in 2023, are expected to reach $200.82 billion by 2033, holding a significant share due to demand in automation and industrial applications. Non-contact sensors are projected to grow from $37.32 billion to $70.53 billion during the same period, reflecting the growing need for speed and safety in various applications. Biosensors, essential for healthcare and biomedicine, are set for growth from $33.20 billion to $62.74 billion.

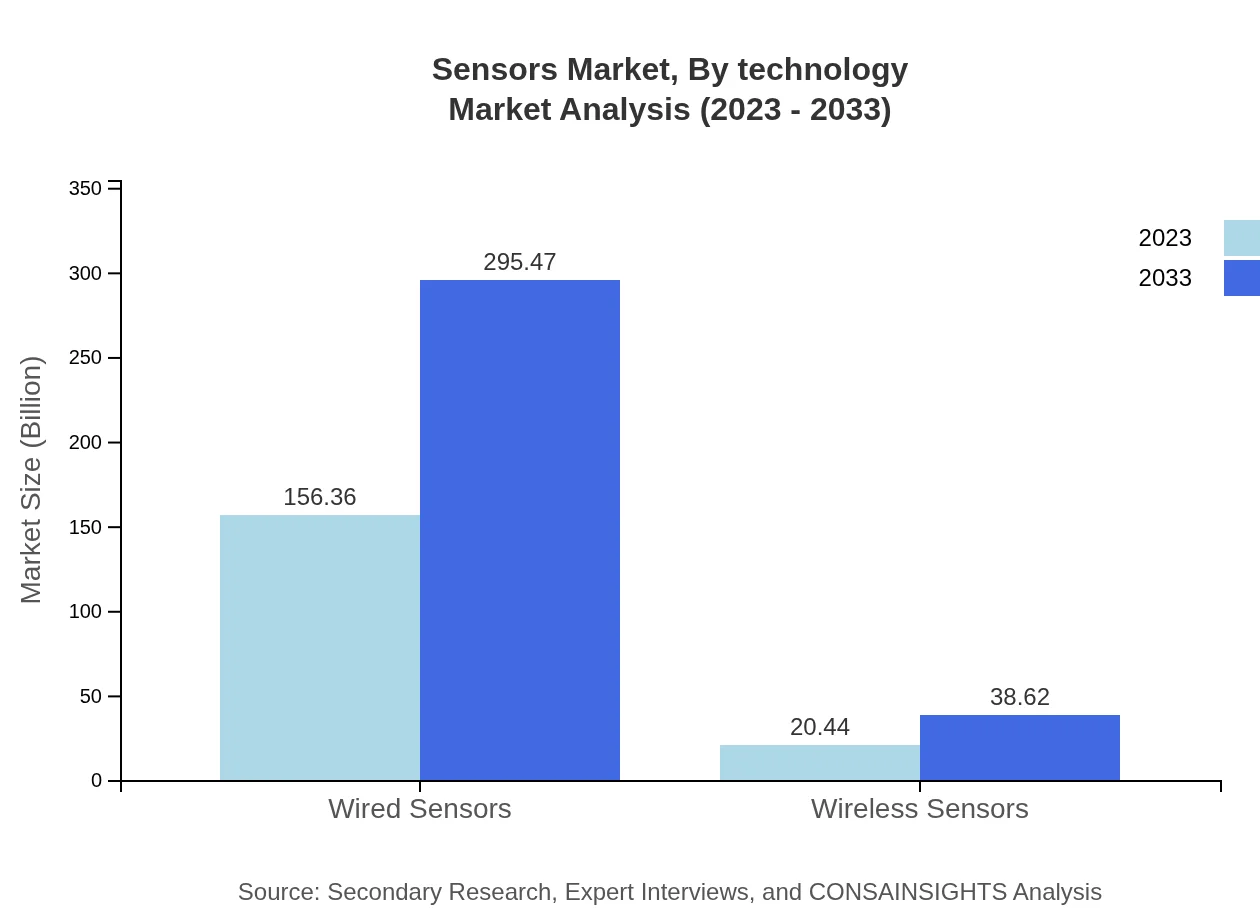

Sensors Market Analysis By Technology

The Sensors market is also segmented according to technology into wired and wireless sensors. Wired sensors dominate the market, valued at $156.36 billion in 2023, with an expected increase to $295.47 billion by 2033. They are favored in industrial applications due to reliability. Wireless sensors, on the other hand, are anticipated to grow robustly from $20.44 billion to $38.62 billion, spurred by IoT advancements and the demand for flexible installations.

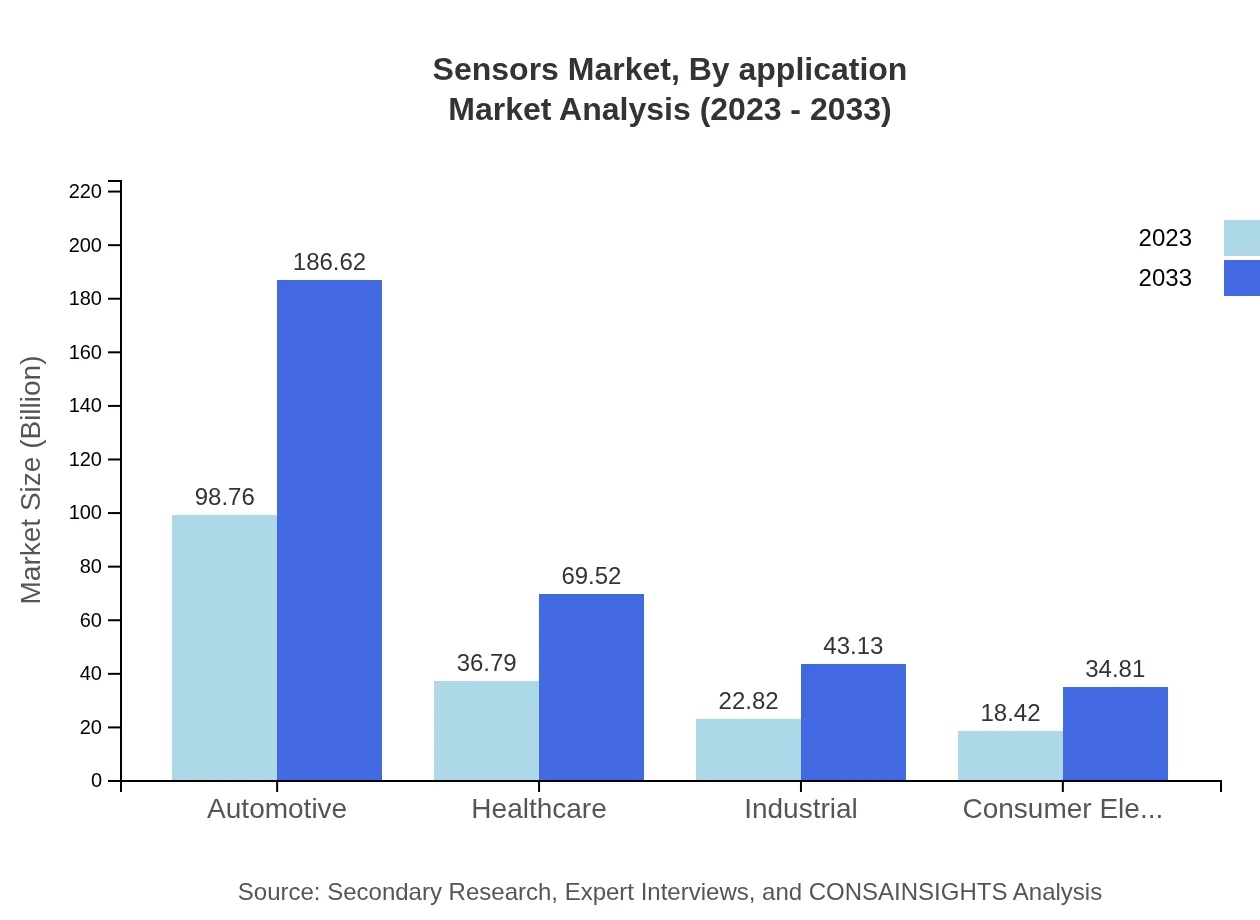

Sensors Market Analysis By Application

Application-wise, the Sensors market is considerably supported by sectors like automotive, healthcare, and smart home technology. The automotive sector alone is projected to grow from $98.76 billion to $186.62 billion by 2033, reflecting the trend towards smarter, safer vehicles. The healthcare application segment, growing from $36.79 billion to $69.52 billion, is driven by the rising demand for diagnostic tools and monitoring systems.

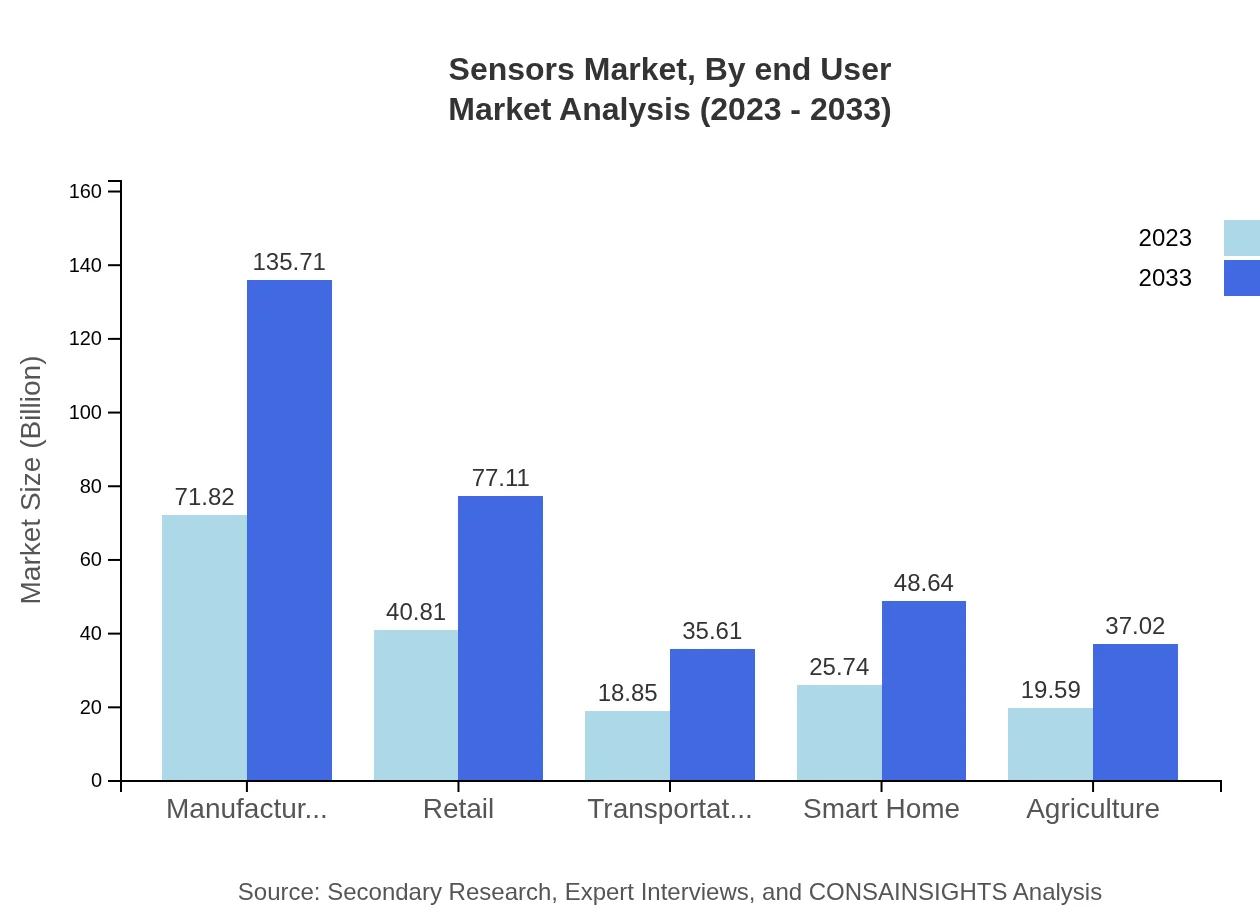

Sensors Market Analysis By End User

End-user segmentation highlights the dominance of manufacturing and retail industries, project growth from $71.82 billion to $135.71 billion and $40.81 billion to $77.11 billion respectively. Meanwhile, sectors like agriculture and industrial demand for sensors will also continue to grow, indicative of the market's versatility across industries.

Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sensors Industry

Honeywell International Inc.:

Honeywell is a leader in sensors with a diverse portfolio including temperature, pressure, and gas sensors and applications in various industries.Bosch Sensortec:

Bosch is known for its advanced sensor solutions that drive everything from automotive innovations to smart home technologies.Texas Instruments:

A significant player in the semiconductors industry, Texas Instruments offers high-quality sensors, particularly for automotive and industrial applications.Analog Devices, Inc.:

Analog Devices specializes in high-performance sensors and signal processing solutions, particularly for aerospace and healthcare.STMicroelectronics:

Offering a wide range of sensors, STMicroelectronics excels in MEMS technology, catering to automotive and industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of sensors?

The global sensors market is valued at approximately $176.8 billion in 2023, with a projected CAGR of 6.4% through 2033, indicating robust growth and increasing demand across various industries.

What are the key market players or companies in the sensors industry?

Key players in the sensors market include major corporations such as Texas Instruments, Bosch Sensortec, Honeywell, and STMicroelectronics, among others, driving innovation and market growth through advanced sensor technologies.

What are the primary factors driving the growth in the sensors industry?

Growth in the sensors industry is primarily driven by technological advancements, increased demand for automation in manufacturing, the rise of IoT devices, and expanding applications in healthcare, automotive, and consumer electronics sectors.

Which region is the fastest Growing in the sensors market?

The Asia Pacific region is the fastest-growing market for sensors, expected to grow from $30.89 billion in 2023 to $58.37 billion in 2033, fueled by rapid industrialization and a surge in consumer electronics production.

Does ConsaInsights provide customized market report data for the sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs of clients in the sensors industry, ensuring relevant insights and analytics for strategic decision-making.

What deliverables can I expect from this sensors market research project?

Deliverables from this sensors market research project include comprehensive market reports, segmentation analysis, regional insights, competitive landscape analysis, and actionable recommendations for market entry and growth strategies.

What are the market trends of sensors?

Current market trends in the sensors industry include the increasing adoption of smart sensors, enhancements in wireless sensor technology, and the integration of AI for data analysis, which collectively contribute to improved operational efficiency.