Separation Systems For Commercial Biotechnology Market Report

Published Date: 31 January 2026 | Report Code: separation-systems-for-commercial-biotechnology

Separation Systems For Commercial Biotechnology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Separation Systems for Commercial Biotechnology market, covering current trends, forecasts for the period 2023-2033, and insights into technology and regional performance.

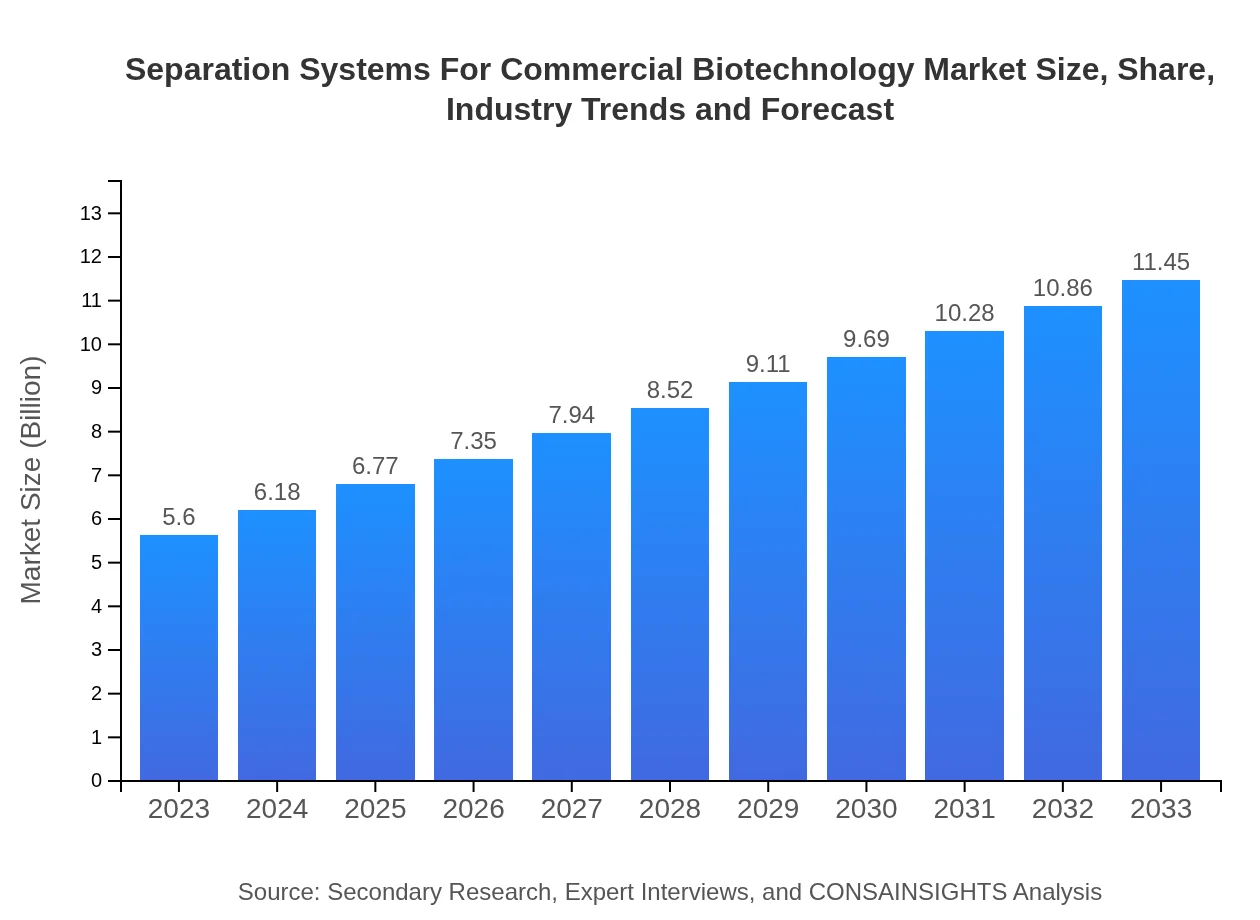

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Thermo Fisher Scientific, Merck KGaA, Sartorius AG, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Separation Systems For Commercial Biotechnology Market Overview

Customize Separation Systems For Commercial Biotechnology Market Report market research report

- ✔ Get in-depth analysis of Separation Systems For Commercial Biotechnology market size, growth, and forecasts.

- ✔ Understand Separation Systems For Commercial Biotechnology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Separation Systems For Commercial Biotechnology

What is the Market Size & CAGR of Separation Systems For Commercial Biotechnology market in 2023?

Separation Systems For Commercial Biotechnology Industry Analysis

Separation Systems For Commercial Biotechnology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Separation Systems For Commercial Biotechnology Market Analysis Report by Region

Europe Separation Systems For Commercial Biotechnology Market Report:

The European market is anticipated to grow significantly, from $1.72 billion in 2023 to $3.52 billion in 2033. Stringent regulations and a strong focus on innovation enhance market opportunities across the region.Asia Pacific Separation Systems For Commercial Biotechnology Market Report:

The Asia Pacific region is expected to witness substantial growth, with a market size increasing from $1.04 billion in 2023 to $2.12 billion in 2033. Rapid industrialization, a booming biotechnology sector, and government initiatives to enhance healthcare infrastructure are propelling this growth.North America Separation Systems For Commercial Biotechnology Market Report:

North America holds a prominent position in the market, with the size expected to double from $2.07 billion in 2023 to $4.24 billion in 2033. Strong R&D investments and a mature biopharmaceutical sector are vital growth drivers.South America Separation Systems For Commercial Biotechnology Market Report:

In South America, the market is projected to grow from $0.04 billion to $0.09 billion by 2033. The increasing adoption of biotechnology practices in agriculture and healthcare contributes to this gradual expansion.Middle East & Africa Separation Systems For Commercial Biotechnology Market Report:

In the Middle East and Africa, the market size is expected to increase from $0.72 billion to $1.48 billion by 2033, driven by growing healthcare needs and increasing biopharmaceutical activities.Tell us your focus area and get a customized research report.

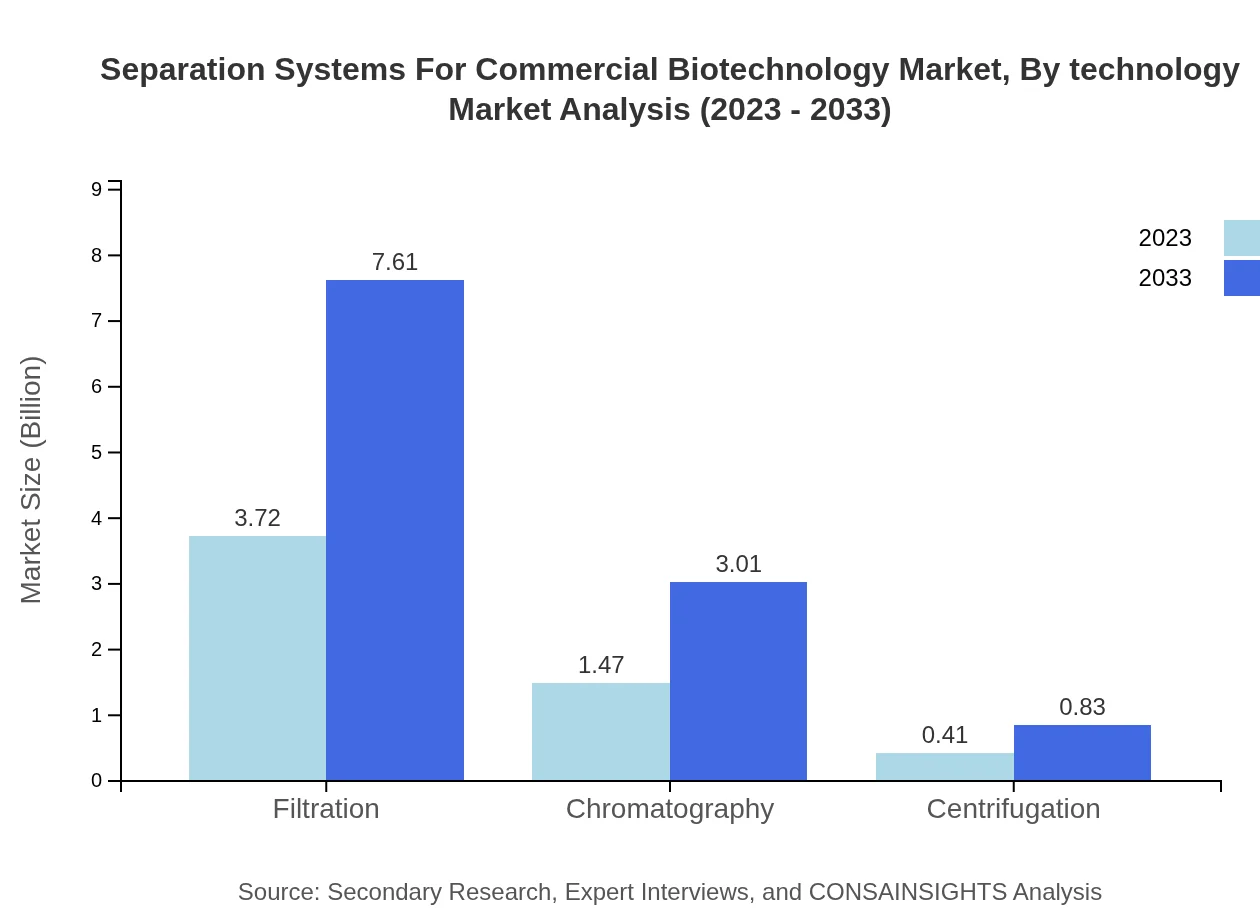

Separation Systems For Commercial Biotechnology Market Analysis By Technology

The Separation Systems market is segmented into various technologies: Filtration dominates with a size of $3.72 billion in 2023, expected to reach $7.61 billion by 2033, holding a share of 66.47%. Chromatography follows with a size increase from $1.47 billion in 2023 to $3.01 billion in 2033, accounting for a 26.29% share. Centrifugation and other technologies contribute to the overall market growth through increasing automation and efficiency in separation processes.

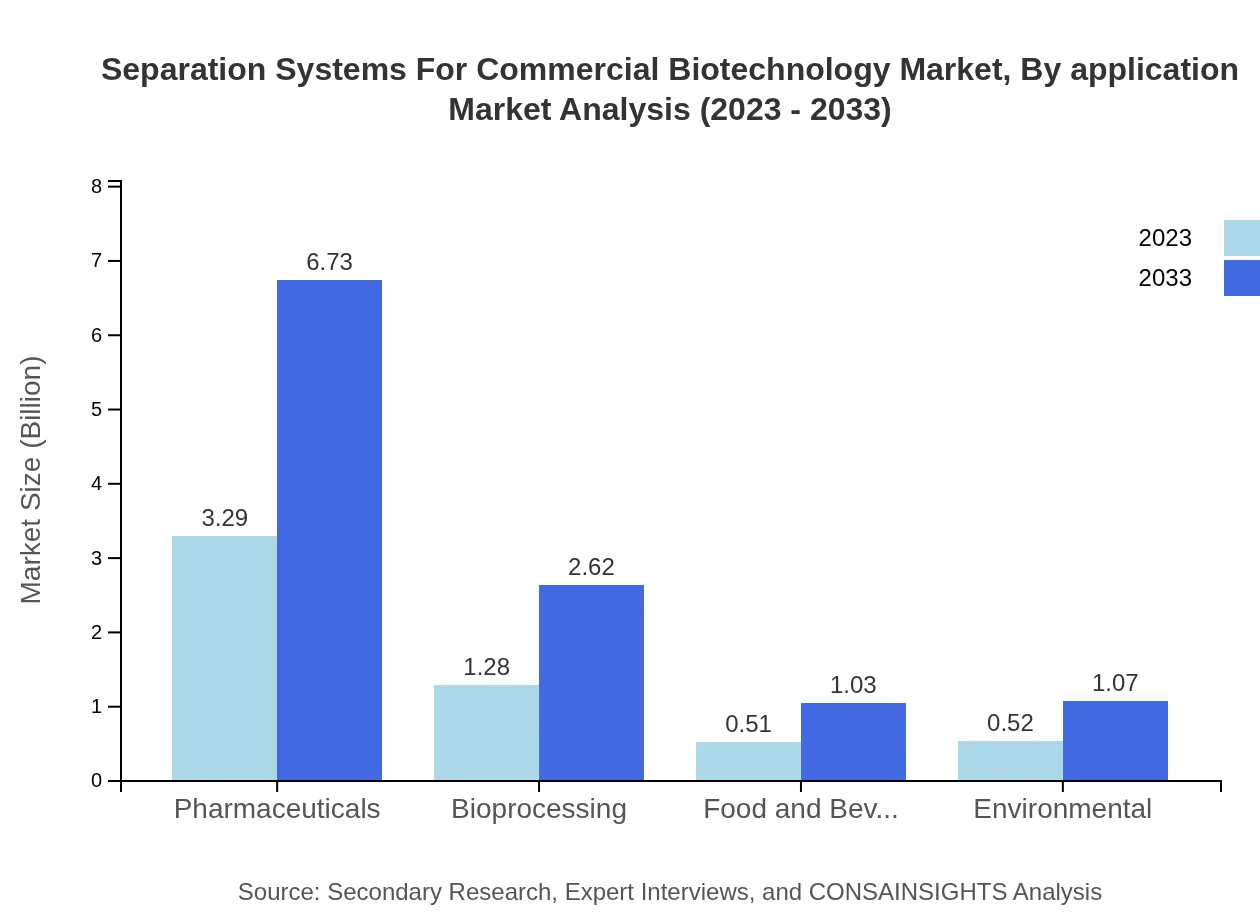

Separation Systems For Commercial Biotechnology Market Analysis By Application

Pharmaceuticals represent the largest application segment, with a size of $3.29 billion in 2023, rising to $6.73 billion by 2033. Biotechnology firms follow, starting at $1.28 billion and expected to grow to $2.62 billion. Food industry applications are also significant, driven by increasing demand for processed bio-products. Research Institutes contribute to the market by developing innovative applications and enhancing technological capabilities.

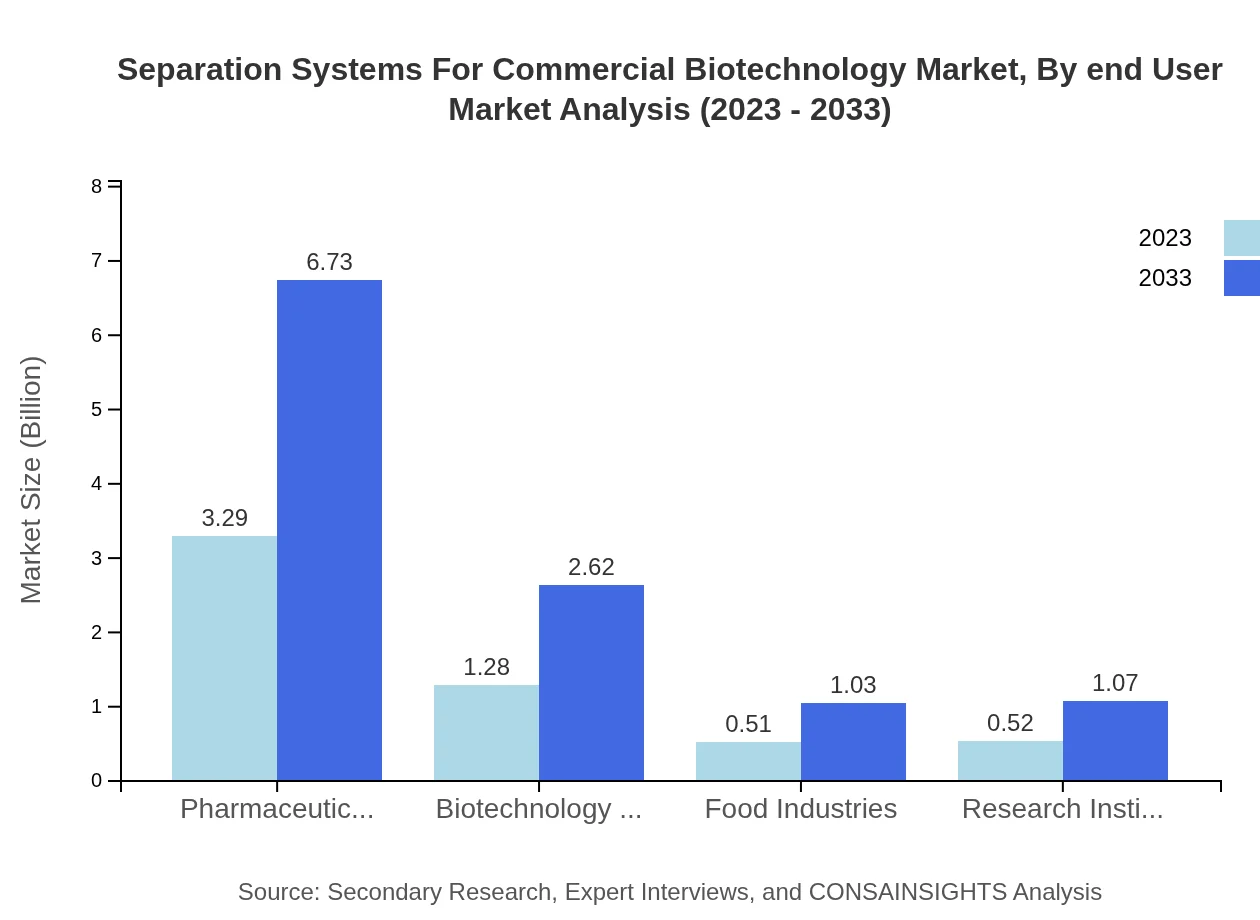

Separation Systems For Commercial Biotechnology Market Analysis By End User

The end-user market is primarily driven by pharmaceuticals (58.76% share), followed by biotechnology firms (22.87% share). The food and beverage sector, along with environmental applications, account for smaller but growing segments as industries seek innovative separation solutions.

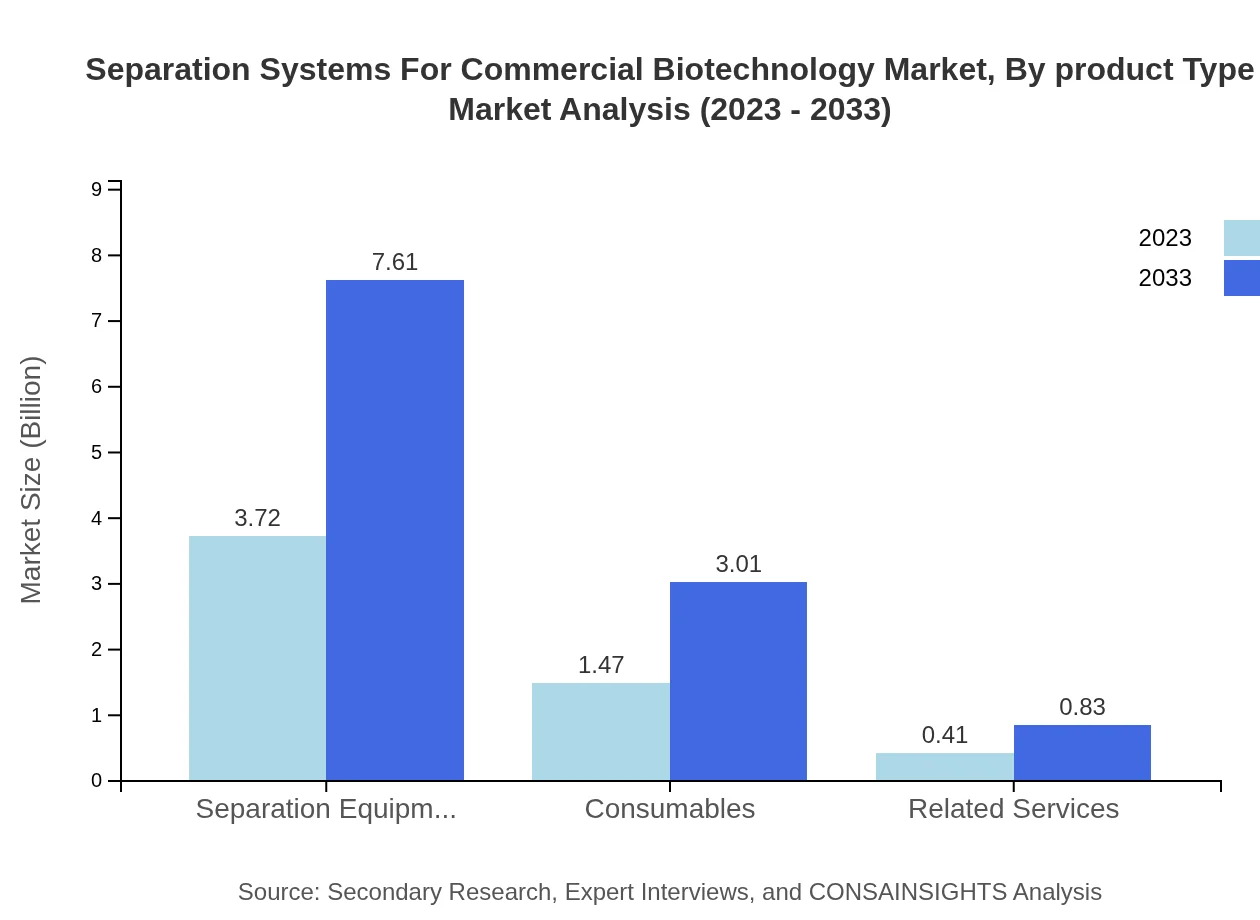

Separation Systems For Commercial Biotechnology Market Analysis By Product Type

The product types consist of separation equipment and consumables. Separation equipment accounted for a size of $3.72 billion in 2023 and is expected to show significant growth to $7.61 billion by 2033. Consumables, vital for maintenance and operational efficiency, will expand from $1.47 billion to $3.01 billion by 2033.

Separation Systems For Commercial Biotechnology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Separation Systems For Commercial Biotechnology Industry

Thermo Fisher Scientific:

A leading provider of separation and purification solutions, known for innovative chromatography and purification technologies used in bioprocessing.Merck KGaA:

Merck is recognized for its extensive range of separation technologies, enhancing efficiency for biopharmaceutical manufacturing.Sartorius AG:

Sartorius specializes in providing high-quality filtration and purification systems tailored for the biotechnology and pharmaceuticals industries.GE Healthcare:

A major player in the biotechnology sector, offering a wide array of separation technologies aimed at improving process efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of separation Systems For Commercial Biotechnology?

The global separation systems for commercial biotechnology market size is estimated at USD 5.6 billion in 2023, with a projected CAGR of 7.2% from 2023 to 2033, indicating robust growth prospects in this sector.

What are the key market players or companies in this separation Systems For Commercial Biotechnology industry?

Key players in the separation systems market include major biotechnology firms, pharmaceutical companies, and specialized equipment manufacturers, contributing significantly to innovations and market dynamics with their advanced technologies and solutions.

What are the primary factors driving the growth in the separation Systems For Commercial Biotechnology industry?

Growth drivers include increasing demand for biopharmaceuticals, advancements in biotechnology, and the need for efficient purification technologies. Regulatory requirements and innovation in separation technologies further propel this market.

Which region is the fastest Growing in the separation Systems For Commercial Biotechnology?

The Asia Pacific region is expected to exhibit significant growth in the separation systems market, rising from USD 1.04 billion in 2023 to USD 2.12 billion by 2033, indicating a strong CAGR and increasing investments.

Does ConsaInsights provide customized market report data for the separation Systems For Commercial Biotechnology industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the separation systems for biotechnology sector, ensuring relevant insights and data for informed decision-making.

What deliverables can I expect from this separation Systems For Commercial Biotechnology market research project?

Expect comprehensive reports, detailed market analysis, segment breakdowns, and competitive landscapes as key deliverables from the market research project, providing valuable insights for strategic planning.

What are the market trends of separation Systems For Commercial Biotechnology?

Current market trends include increased adoption of automation in separation processes, integration of AI for improved efficiency, and eco-friendly technology developments, shaping future strategies in the biotechnology industry.