Sequencing Reagents Market Report

Published Date: 31 January 2026 | Report Code: sequencing-reagents

Sequencing Reagents Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Sequencing Reagents market, including market size, growth forecasts, regional analyses, and key trends from 2023 to 2033.

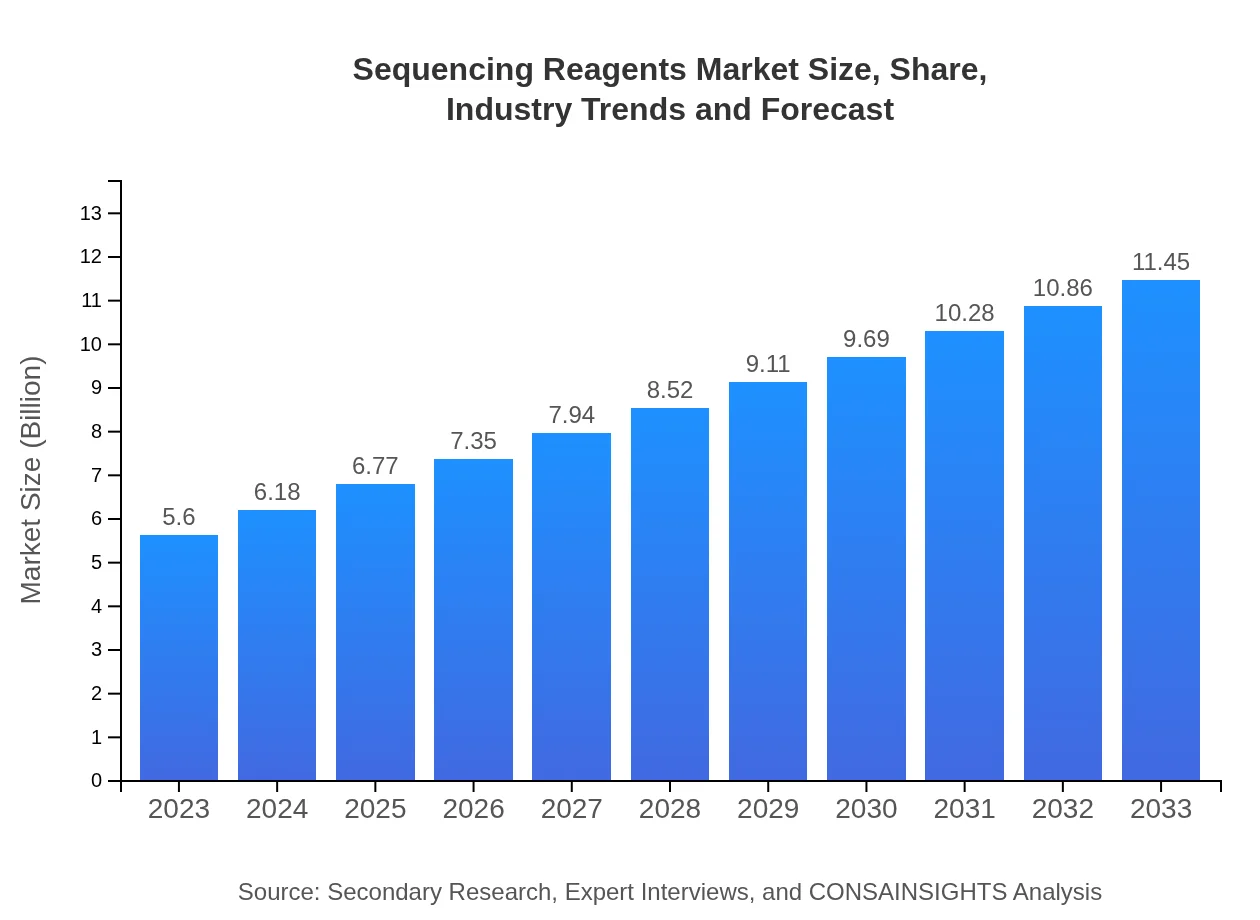

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Illumina, Inc., Thermo Fisher Scientific Inc., Roche Diagnostics, Agilent Technologies, Inc. |

| Last Modified Date | 31 January 2026 |

Sequencing Reagents Market Overview

Customize Sequencing Reagents Market Report market research report

- ✔ Get in-depth analysis of Sequencing Reagents market size, growth, and forecasts.

- ✔ Understand Sequencing Reagents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sequencing Reagents

What is the Market Size & CAGR of Sequencing Reagents market in 2023?

Sequencing Reagents Industry Analysis

Sequencing Reagents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sequencing Reagents Market Analysis Report by Region

Europe Sequencing Reagents Market Report:

The European market is currently valued at $1.73 billion in 2023, with a forecasted growth to $3.53 billion in 2033. This growth is driven by advances in medical technology and the high demand for genomic testing.Asia Pacific Sequencing Reagents Market Report:

The Asia Pacific region's market for Sequencing Reagents is valued at $1.10 billion in 2023 and is projected to increase to $2.25 billion by 2033. The increase is propelled by government investments in biotechnology and the expansion of research facilities.North America Sequencing Reagents Market Report:

In North America, the market size is $1.83 billion for 2023, projected to reach approximately $3.74 billion by 2033. The region leads in biotechnology innovations fueled by strong funding in academic research and an increasing prevalence of genetic disorders.South America Sequencing Reagents Market Report:

The South American market is expected to grow from $0.33 billion in 2023 to $0.68 billion by 2033. The burgeoning focus on improving healthcare and investing in genomic research are positive indicators for market growth.Middle East & Africa Sequencing Reagents Market Report:

The Middle East and Africa's market for Sequencing Reagents starts at $0.61 billion in 2023, aiming to grow to about $1.25 billion by 2033. Investments in healthcare infrastructure and research ventures are fostering improvements and demand.Tell us your focus area and get a customized research report.

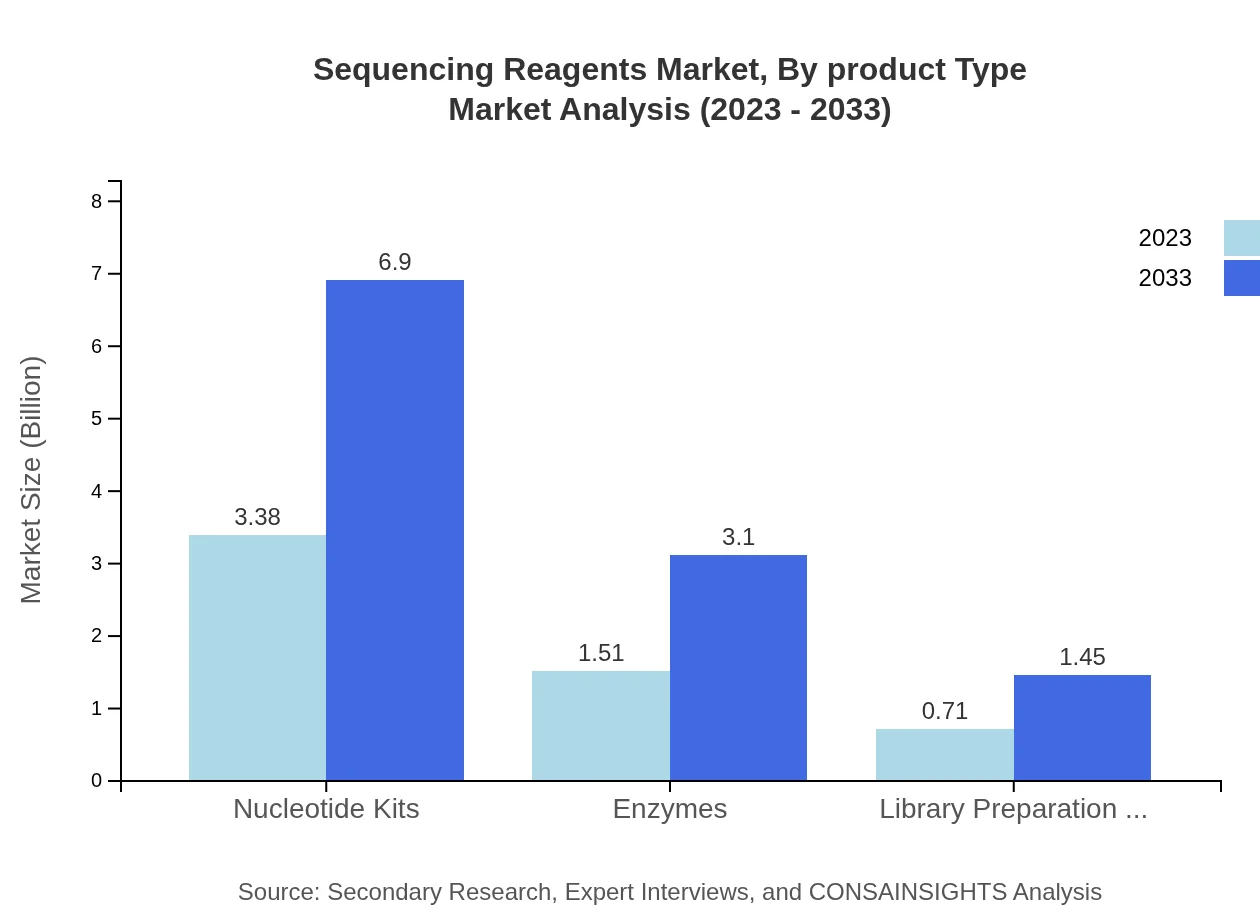

Sequencing Reagents Market Analysis By Product Type

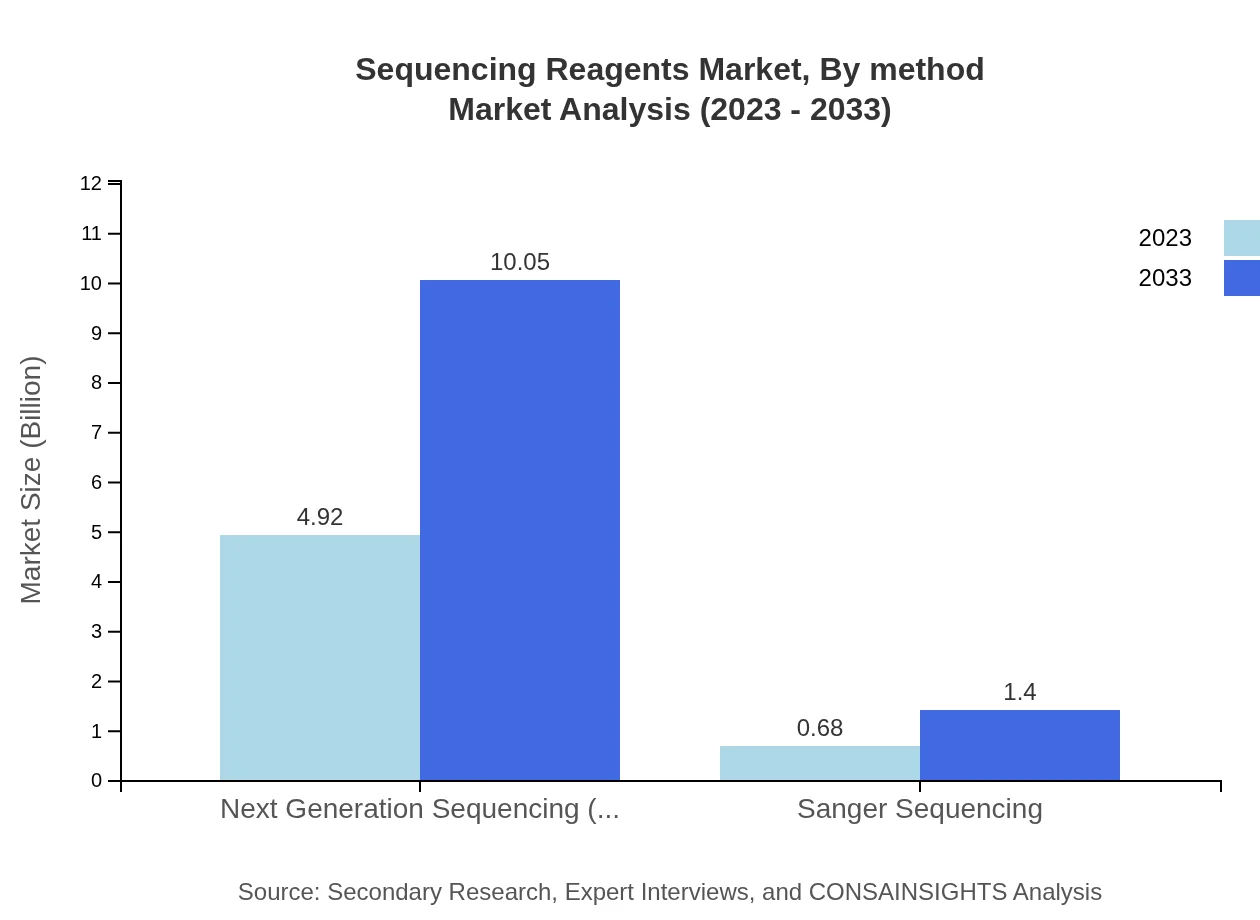

By product type, Next Generation Sequencing (NGS) contributes significantly with a market value of $4.92 billion in 2023 expected to escalate to $10.05 billion by 2033, capturing 87.81% of the market share in both years. Sanger sequencing, valued at $0.68 billion in 2023, holds a market share of 12.19% and is projected to increase to $1.40 billion by 2033.

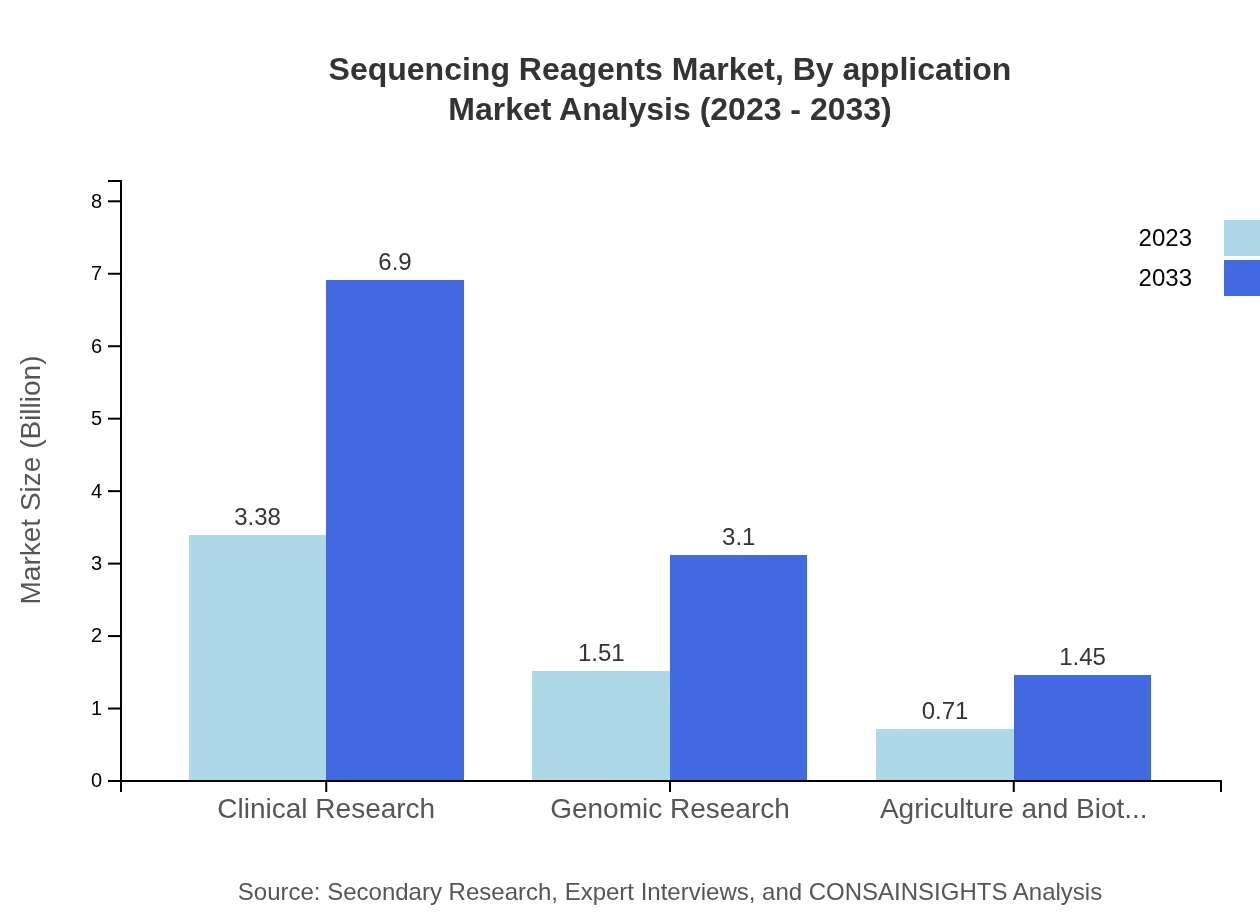

Sequencing Reagents Market Analysis By Application

In terms of applications, academic research institutions dominate the market with a size of $3.38 billion in 2023, accounting for 60.31% of the share. This is anticipated to rise to $6.90 billion by 2033, while pharmaceutical companies hold a significant portion of the clinical sequencing market.

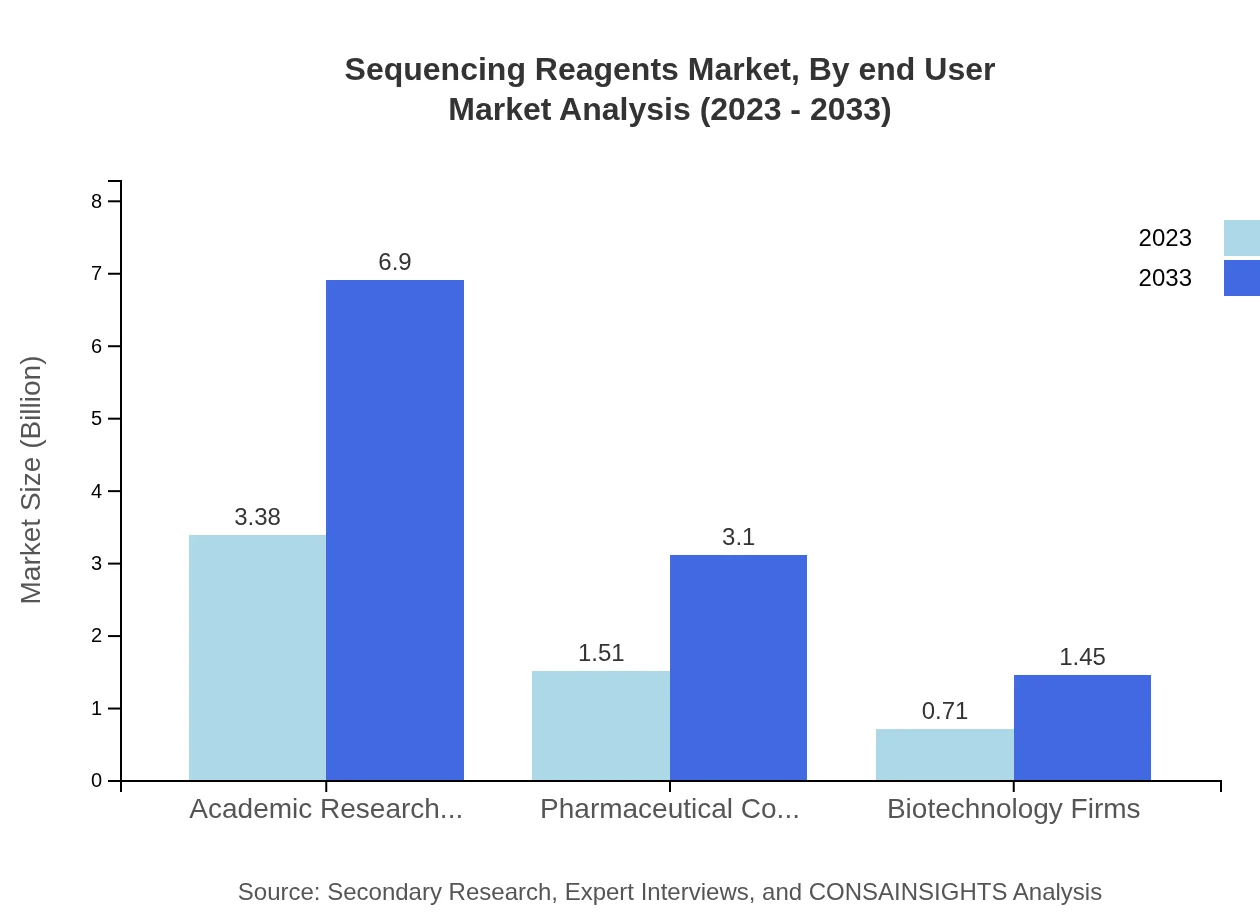

Sequencing Reagents Market Analysis By End User

The market is extensively utilized by clinical research entities and genomic research firms, both demonstrating considerable growth. Clinical research is projected to maintain a market of 60.31% share from $3.38 billion in 2023 to $6.90 billion by 2033.

Sequencing Reagents Market Analysis By Method

The By Method segment indicates that NGS methodologies are increasingly preferred for their speed and accuracy, representing the majority of usage in laboratories conducting genetic research.

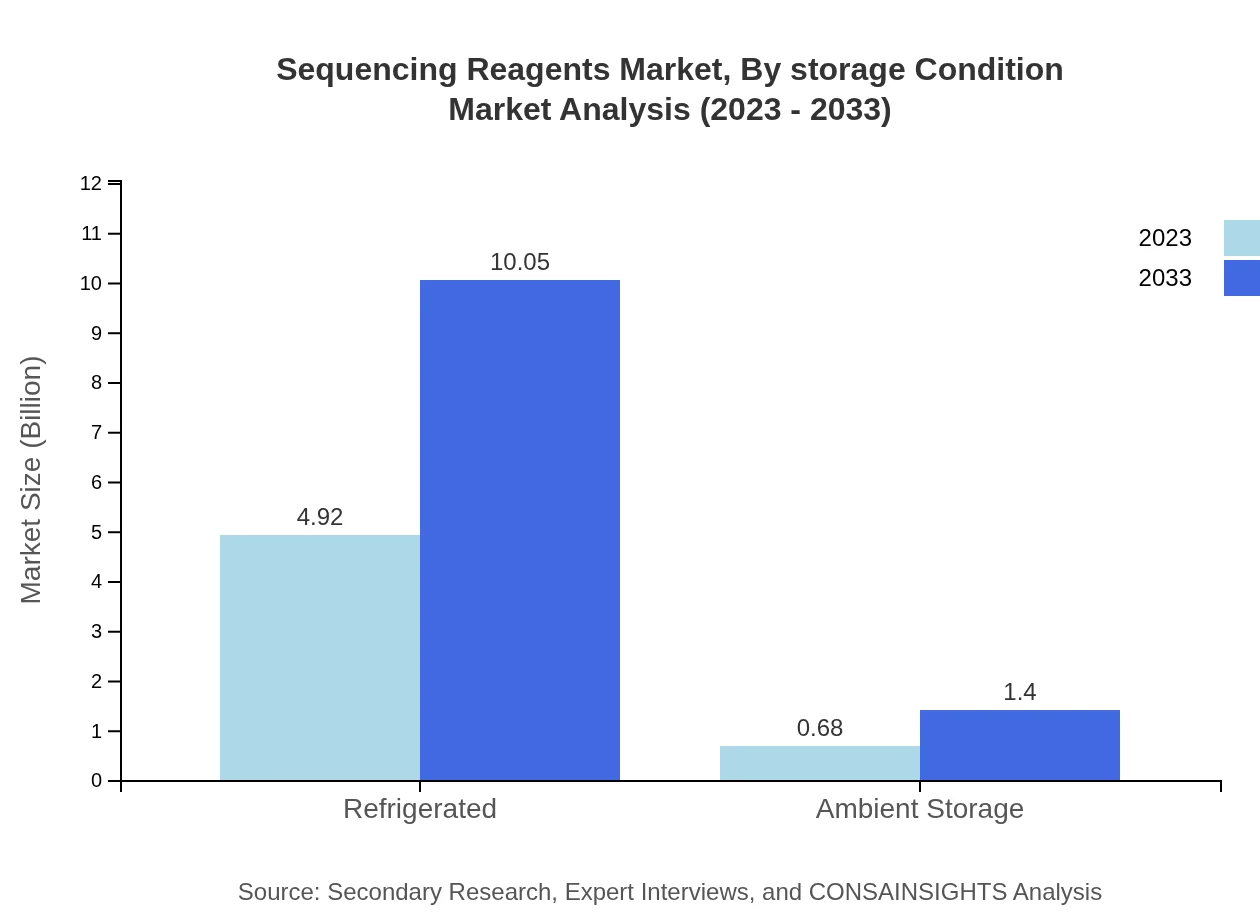

Sequencing Reagents Market Analysis By Storage Condition

Storage conditions significantly affect operational efficiency, with refrigerated storage dominating, holding a market size of $4.92 billion in 2023 and projected up to $10.05 billion by 2033. Ambient storage conditions represent a smaller but vital segment in laboratory settings.

Sequencing Reagents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sequencing Reagents Industry

Illumina, Inc.:

A pioneer in NGS technology, Illumina offers a range of sequencing reagents and systems that are widely used in research and clinical applications.Thermo Fisher Scientific Inc.:

Thermo Fisher provides extensive tools, reagents, and solutions for genomic research and diagnostics, contributing significantly to market advancements.Roche Diagnostics:

Roche is recognized for its contributions to genomics, offering high-quality sequencing reagents and platforms for diverse applications.Agilent Technologies, Inc.:

Agilent develops innovative sequencing reagents and kits, playing a vital role in molecular biology and genetic analysis.We're grateful to work with incredible clients.

FAQs

What is the market size of sequencing Reagents?

The global sequencing reagents market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 7.2%. This growth is driven by advancements in sequencing technologies and increasing applications in genomics.

What are the key market players or companies in this sequencing Reagents industry?

Key players in the sequencing reagents industry include Illumina, Thermo Fisher Scientific, and Roche Diagnostics, which dominate through innovative product offerings and strategic partnerships to enhance product portfolios.

What are the primary factors driving the growth in the sequencing Reagents industry?

Growth in the sequencing reagents market is driven by factors such as the rising application in clinical diagnostics, expanding genomic research, and increased funding for genomics research, coupled with technological advancements.

Which region is the fastest Growing in the sequencing Reagents?

The fastest-growing region in the sequencing reagents market is Asia Pacific, projected to grow from $1.10 billion in 2023 to $2.25 billion by 2033. North America follows closely due to robust research infrastructure.

Does ConsaInsights provide customized market report data for the sequencing Reagents industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and interests of clients in the sequencing reagents industry, providing in-depth insights and analysis.

What deliverables can I expect from this sequencing Reagents market research project?

Deliverables from the sequencing reagents market research project include detailed market analysis reports, forecasts, segment insights, competitive landscape summaries, and regional market assessments.

What are the market trends of sequencing Reagents?

Market trends in sequencing reagents include increasing adoption of next-generation sequencing (NGS) technologies, rising demand for personalized medicine, and expansion of applications in various research fields.