Server Market Report

Published Date: 31 January 2026 | Report Code: server

Server Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global Server market, highlighting market trends, size, and growth forecasts from 2023 to 2033. It encompasses insights on various segments, regional performance, key players, and future trends impacting the industry.

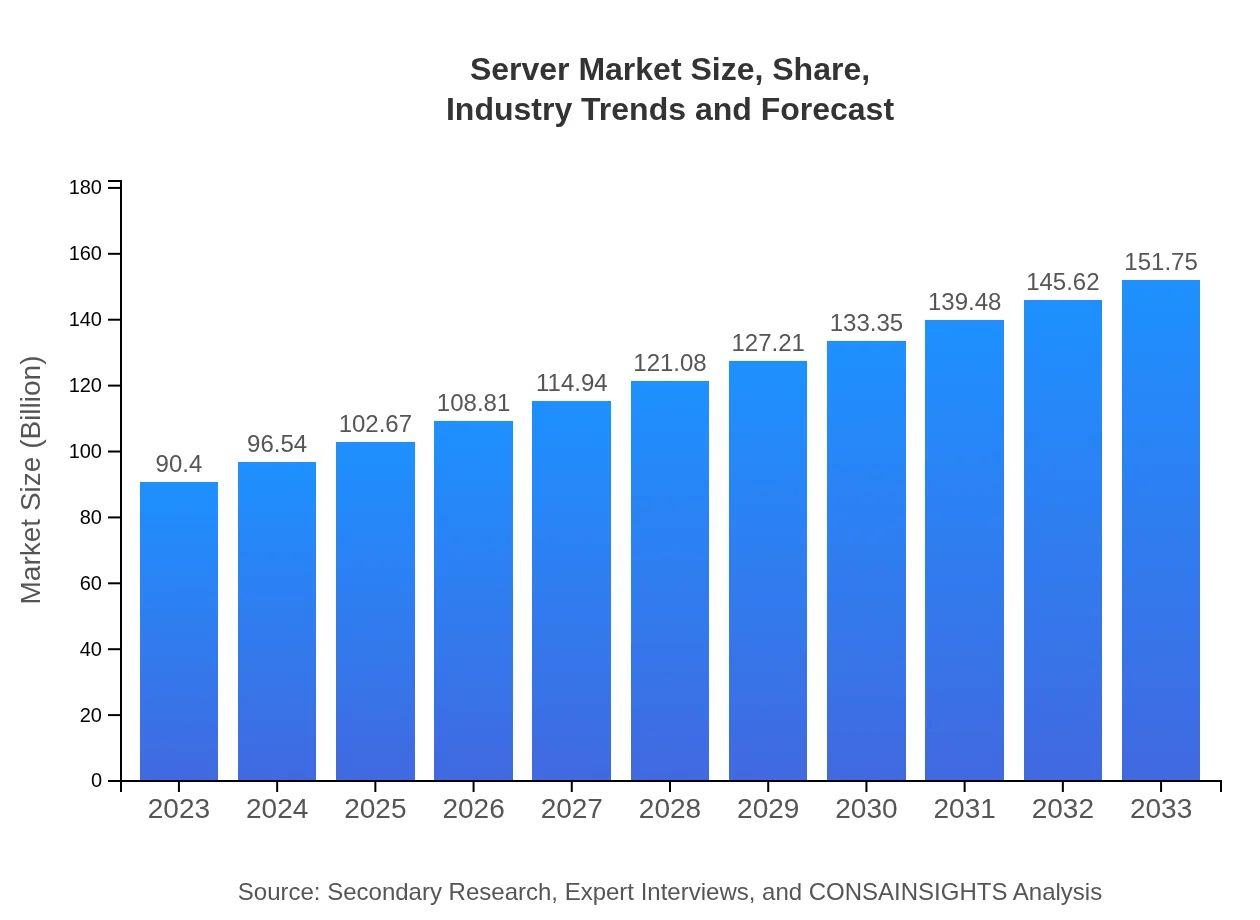

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $90.40 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $151.75 Billion |

| Top Companies | Hewlett Packard Enterprise (HPE), Dell Technologies, IBM Corporation, Cisco Systems, Inc., Lenovo Group Limited |

| Last Modified Date | 31 January 2026 |

Server Market Overview

Customize Server Market Report market research report

- ✔ Get in-depth analysis of Server market size, growth, and forecasts.

- ✔ Understand Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Server

What is the Market Size & CAGR of Server market in 2023?

Server Industry Analysis

Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Server Market Analysis Report by Region

Europe Server Market Report:

The European market is projected to expand from $25.33 billion in 2023 to $42.52 billion by 2033, driven by regulatory requirements concerning data security and increasing adoption of hybrid cloud solutions.Asia Pacific Server Market Report:

The Asia-Pacific region is projected to grow from $17.21 billion in 2023 to $28.89 billion by 2033, underscored by rapid digital transformation initiatives and an increase in data center establishments driven by cloud adoption.North America Server Market Report:

North America is anticipated to remain the largest market, with an expected growth from $34.20 billion in 2023 to $57.41 billion in 2033, propelled by significant technological investments and a robust presence of cloud service providers.South America Server Market Report:

In South America, the Server market is expected to rise from $6.19 billion in 2023 to $10.39 billion by 2033, fueled by growing internet penetration and increasing investments in IT infrastructure.Middle East & Africa Server Market Report:

The Middle East and Africa region is forecasted to grow from $7.47 billion in 2023 to $12.53 billion by 2033 as governments seek to enhance their digital architectures and modernize IT infrastructure.Tell us your focus area and get a customized research report.

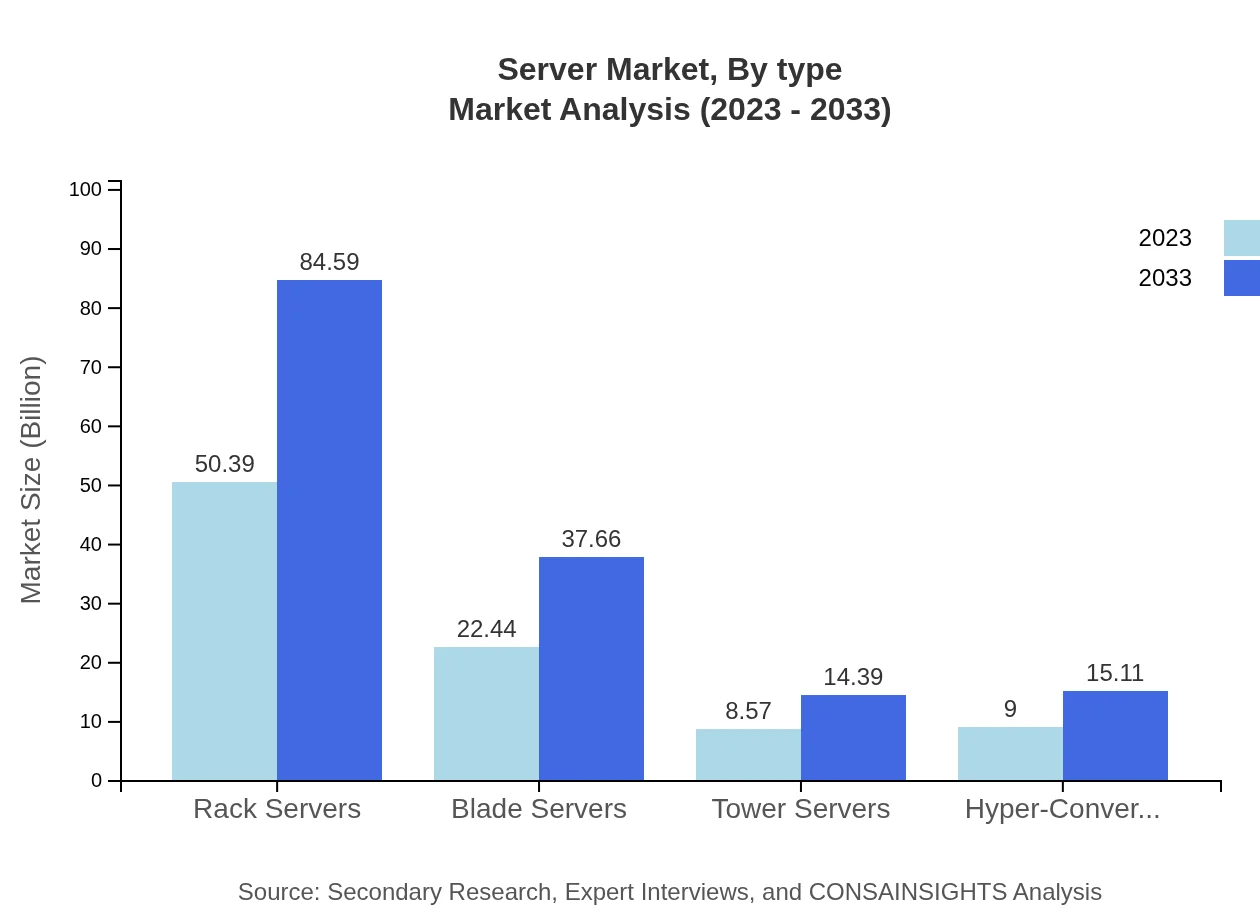

Server Market Analysis By Type

Rack Servers dominate the segment, valued at $50.39 billion in 2023, expected to reach $84.59 billion by 2033, showcasing a share of 55.74%. Blade Servers follow with a revenue of $22.44 billion in 2023 and a projected growth to $37.66 billion by 2033. Tower Servers and Hyper-Converged Infrastructure also contribute significantly to the market, alongside robust growth in Cloud Service Providers' segment.

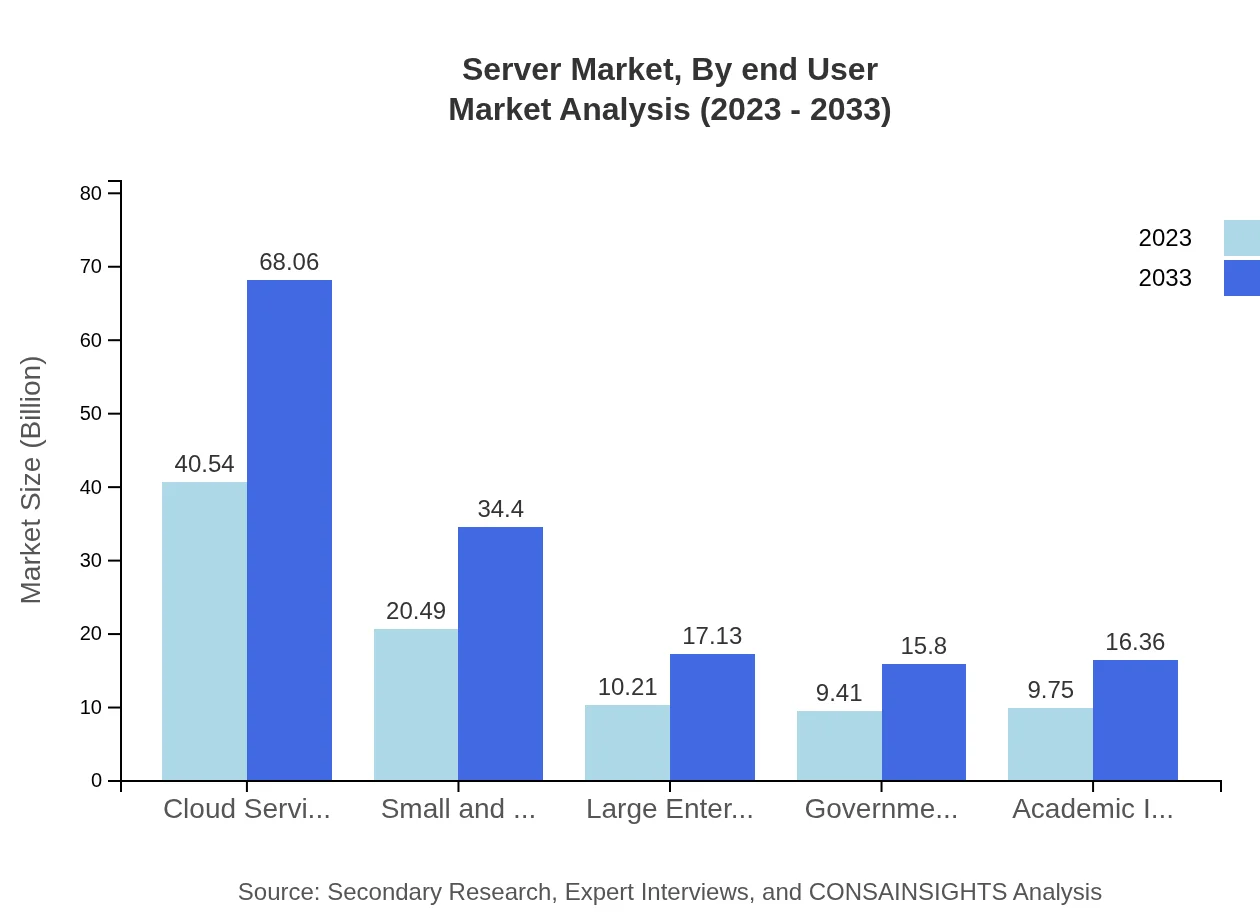

Server Market Analysis By End User

Cloud Service Providers constitute a major market segment with $40.54 billion in 2023 and expected to grow to $68.06 billion by 2033. SMEs are also gaining ground with an increase from $20.49 billion to $34.40 billion during the same period. Large Enterprises and Government Agencies continue to invest in upgrading their server infrastructures.

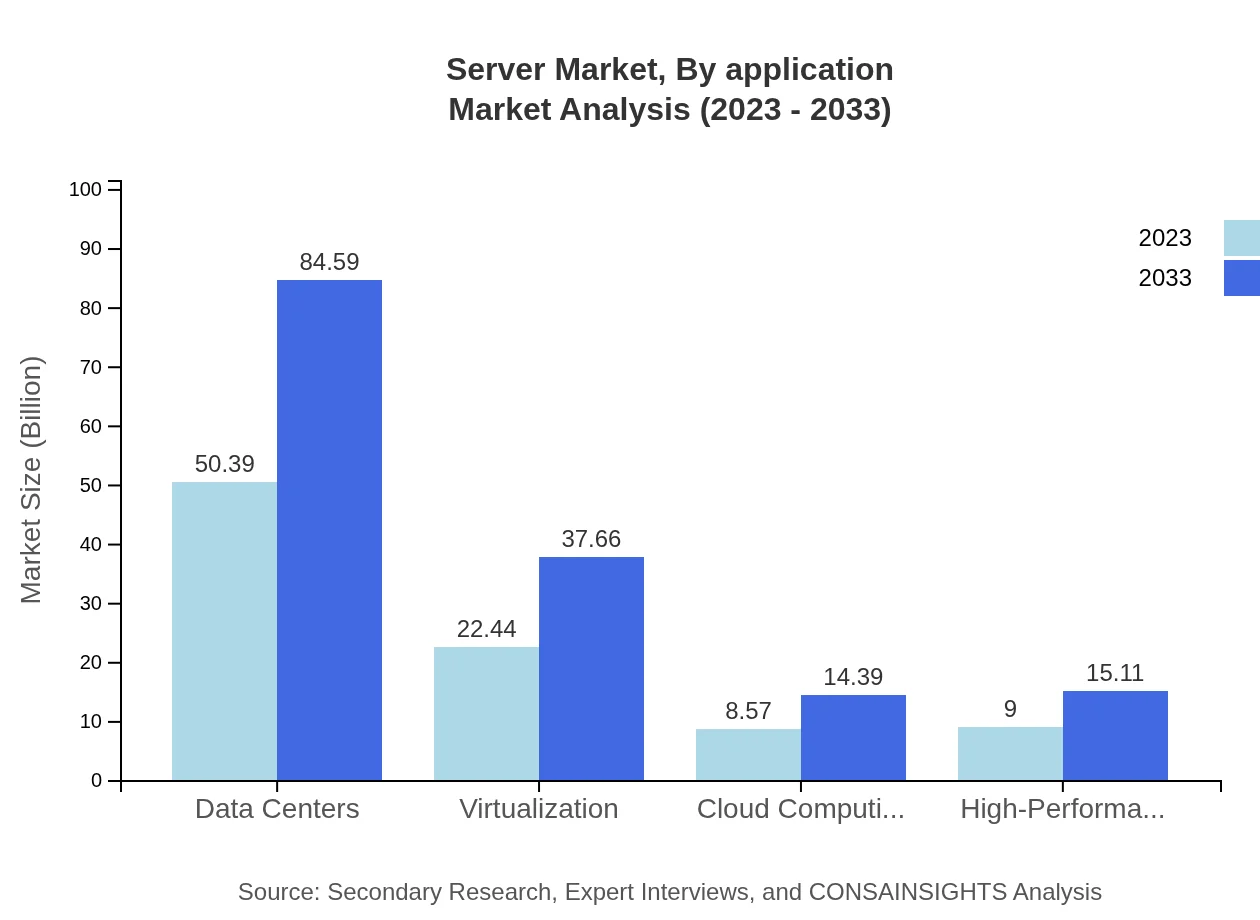

Server Market Analysis By Application

The Data Centers segment stands out, showcasing a revenue of $50.39 billion in 2023 and expected to hit $84.59 billion by 2033, making up 55.74% of the market share. Applications such as Virtualization, High-Performance Computing, and Cloud Computing are experiencing significant growth driven by an increasing need for higher workloads and computational capacity.

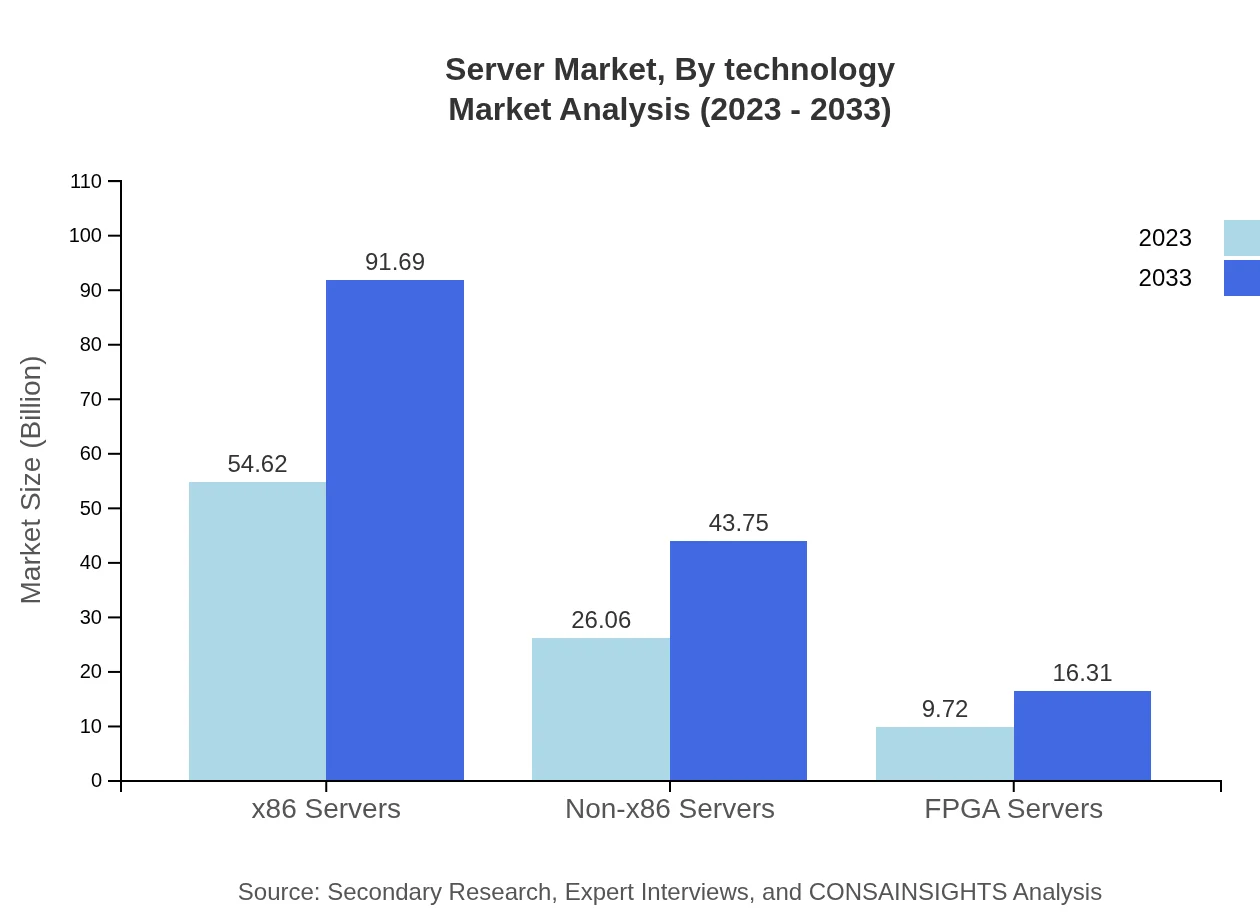

Server Market Analysis By Technology

x86 servers earlier dominated with a size of $54.62 billion in 2023, growing to $91.69 billion by 2033, indicating a market share of 60.42%. The rising need for non-x86 and FPGA servers is evident, pushing innovation and market depth.

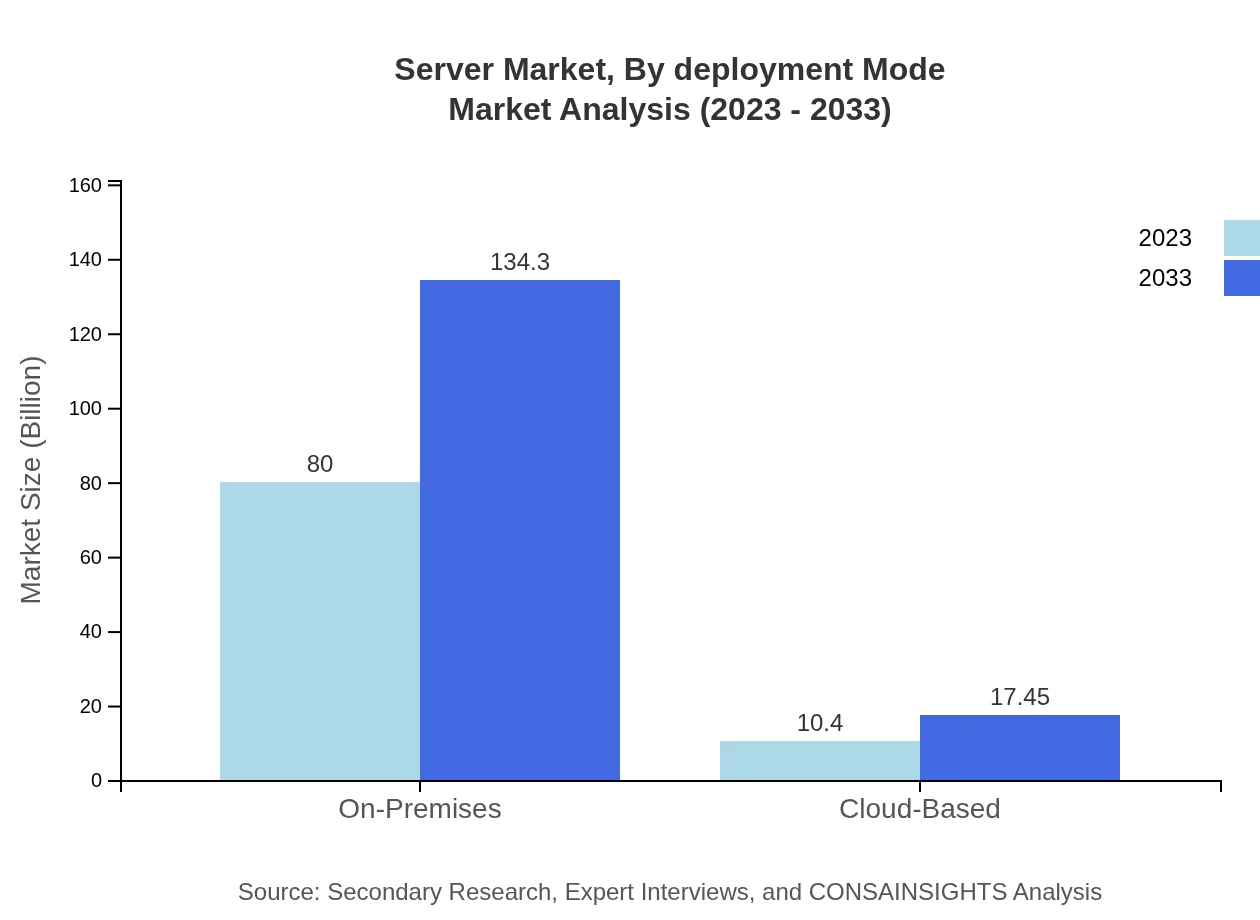

Server Market Analysis By Deployment Mode

The On-Premises deployment mode leads with $80.00 billion in 2023, projected to reach $134.30 billion by 2033, comprising 88.5% of the market. Cloud-based services are also gaining traction with a rise from $10.40 billion to $17.45 billion.

Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Server Industry

Hewlett Packard Enterprise (HPE):

HPE provides enterprise-level IT solutions, including servers, enabling business transformations with innovative products and services that drive efficiency.Dell Technologies:

Dell Technologies is a key player in server technology, offering a wide range of servers and storage solutions aimed at businesses of all sizes.IBM Corporation:

IBM delivers advanced server solutions focused on AI, cloud, and enterprise data management, significantly impacting large enterprises’ infrastructure.Cisco Systems, Inc.:

Cisco is recognized for its networking and security technology, complementing its robust server solutions designed to optimize data management.Lenovo Group Limited:

Lenovo provides diverse and scalable server options, focusing on enhancing performance while optimizing resources for enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of server?

The global server market was valued at approximately $90.4 billion in 2023 and is projected to grow at a CAGR of 5.2% to reach significant figures by 2033. This growth reflects increasing demands for computing power and storage.

What are the key market players or companies in this server industry?

The server industry features major players like Dell Technologies, HPE, Lenovo, Cisco Systems, and IBM, which dominate the market with leading-edge technology and expansive product lines across various segments.

What are the primary factors driving the growth in the server industry?

Driving factors include the rise in data centers, cloud computing demands, advancements in server technology, increased reliance on virtualization, and the expansion of IoT applications necessitating scalable computing solutions.

Which region is the fastest Growing in the server market?

North America leads as the fastest-growing region in the server market, projected to grow from $34.20 billion in 2023 to $57.41 billion by 2033, driven by technological advancements and high investment in data centers.

Does ConsaInsights provide customized market report data for the server industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the server industry, enabling businesses to obtain insights relevant to their operational landscapes and strategic goals.

What deliverables can I expect from this server market research project?

From the server market research project, clients can expect detailed reports including market analysis, growth forecasts, competitive landscape evaluations, and insights into regional and segment-wise performance.

What are the market trends of server?

Current market trends in the server industry involve a shift toward cloud-based solutions, increasing use of rack and blade servers, a focus on energy-efficient technology, and the growing adoption of hyper-converged infrastructure to optimize performance.