Server Microprocessor Market Report

Published Date: 31 January 2026 | Report Code: server-microprocessor

Server Microprocessor Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Server Microprocessor market, covering market size, growth forecasts, trends, segmentation, technology advancements, and regional insights for the period of 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

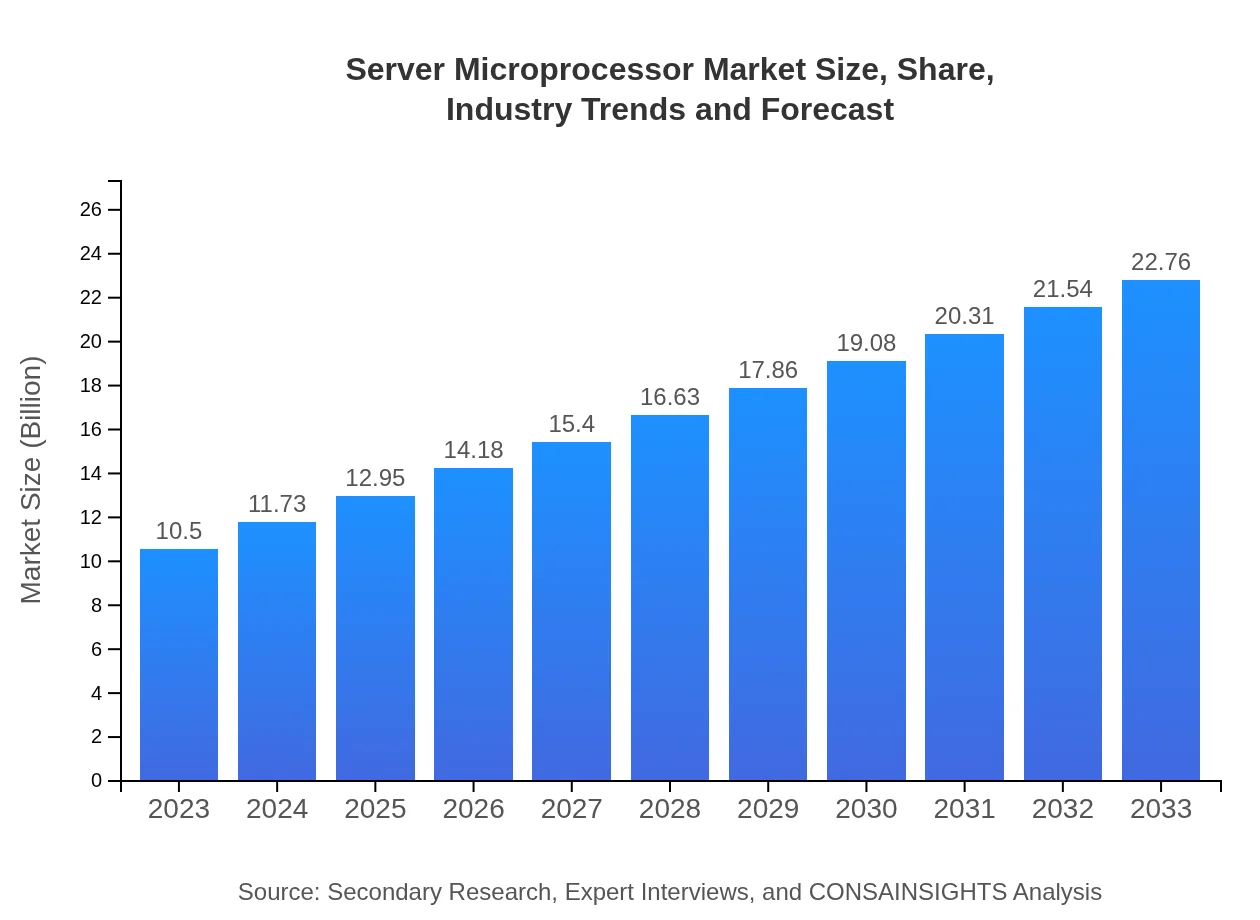

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Intel Corporation, AMD (Advanced Micro Devices), ARM Holdings, IBM |

| Last Modified Date | 31 January 2026 |

Server Microprocessor Market Overview

Customize Server Microprocessor Market Report market research report

- ✔ Get in-depth analysis of Server Microprocessor market size, growth, and forecasts.

- ✔ Understand Server Microprocessor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Server Microprocessor

What is the Market Size & CAGR of Server Microprocessor market in 2023?

Server Microprocessor Industry Analysis

Server Microprocessor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Server Microprocessor Market Analysis Report by Region

Europe Server Microprocessor Market Report:

In Europe, the market size is projected to increase from $2.81 billion in 2023 to $6.09 billion in 2033, driven by sustainability initiatives and a rapidly expanding data center network aimed at meeting needs for energy efficiency and computational power.Asia Pacific Server Microprocessor Market Report:

The Asia Pacific region is expected to experience substantial growth, with the market projected to increase from $2.10 billion in 2023 to $4.55 billion in 2033. This growth is supported by rising investments in data centers and expanding cloud services across nations like China and India.North America Server Microprocessor Market Report:

North America leads in market share, with the server microprocessor sector valued at $3.65 billion in 2023 and projected to reach $7.92 billion by 2033. The region is characterized by advanced technological adoption, significant cloud computing investments, and robust infrastructure support.South America Server Microprocessor Market Report:

In South America, the server microprocessor market is anticipated to grow from $0.49 billion in 2023 to $1.06 billion by 2033. Economic improvements and an increasing focus on digital transformation in businesses are key drivers for this growth.Middle East & Africa Server Microprocessor Market Report:

The Middle East and Africa are set to witness growth from $1.45 billion in 2023 to $3.14 billion in 2033, supported by increased government initiatives to digitize and expand IT infrastructure, especially in the Gulf Cooperation Council (GCC) countries.Tell us your focus area and get a customized research report.

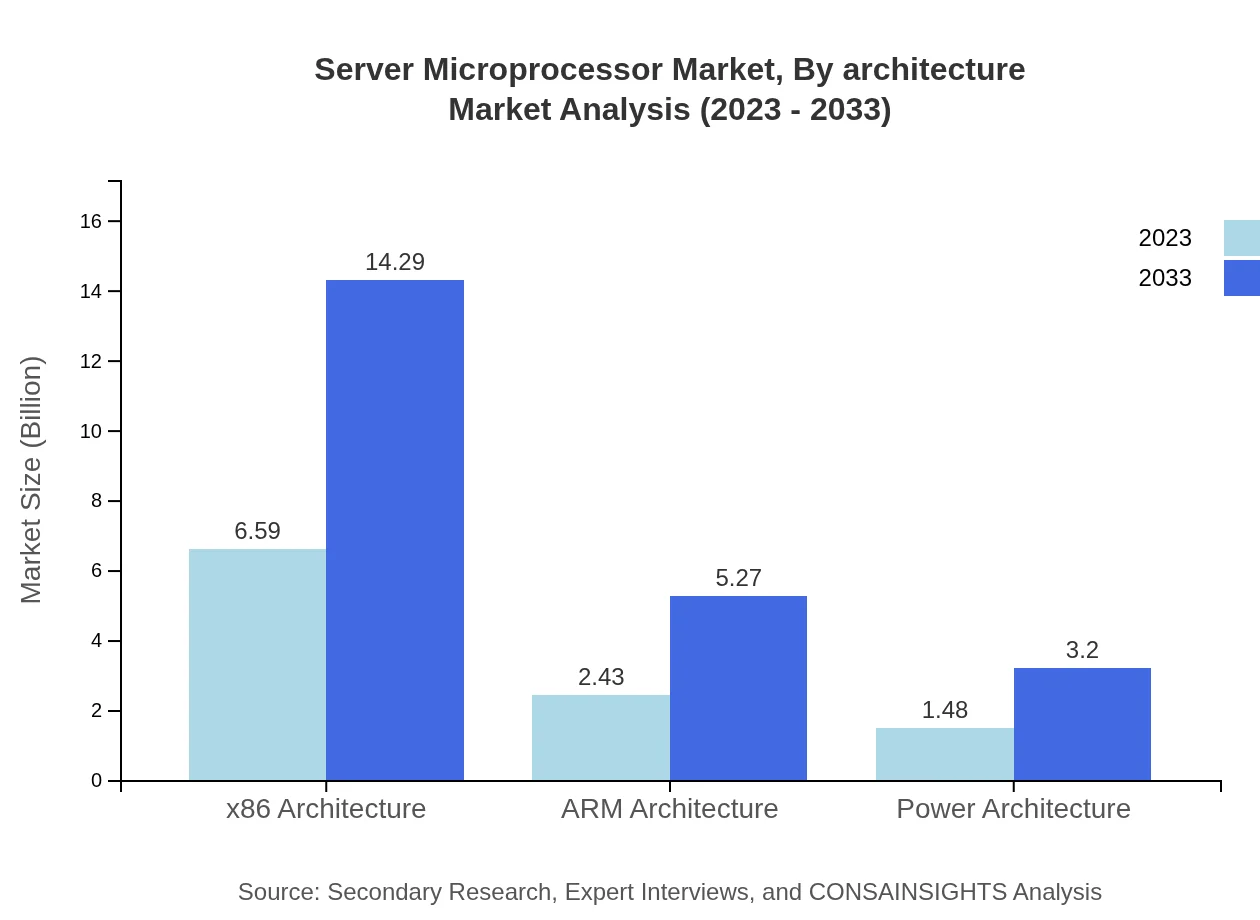

Server Microprocessor Market Analysis By Architecture

The Server Microprocessor market by architecture is characterized by the dominance of x86 architecture, which holds a significant market share. ARM architecture is gaining traction due to its power efficiency, while specialized processors for high-performance computing are also emerging. The continued evolution in architectures enhances overall performance and drives competitiveness in the market.

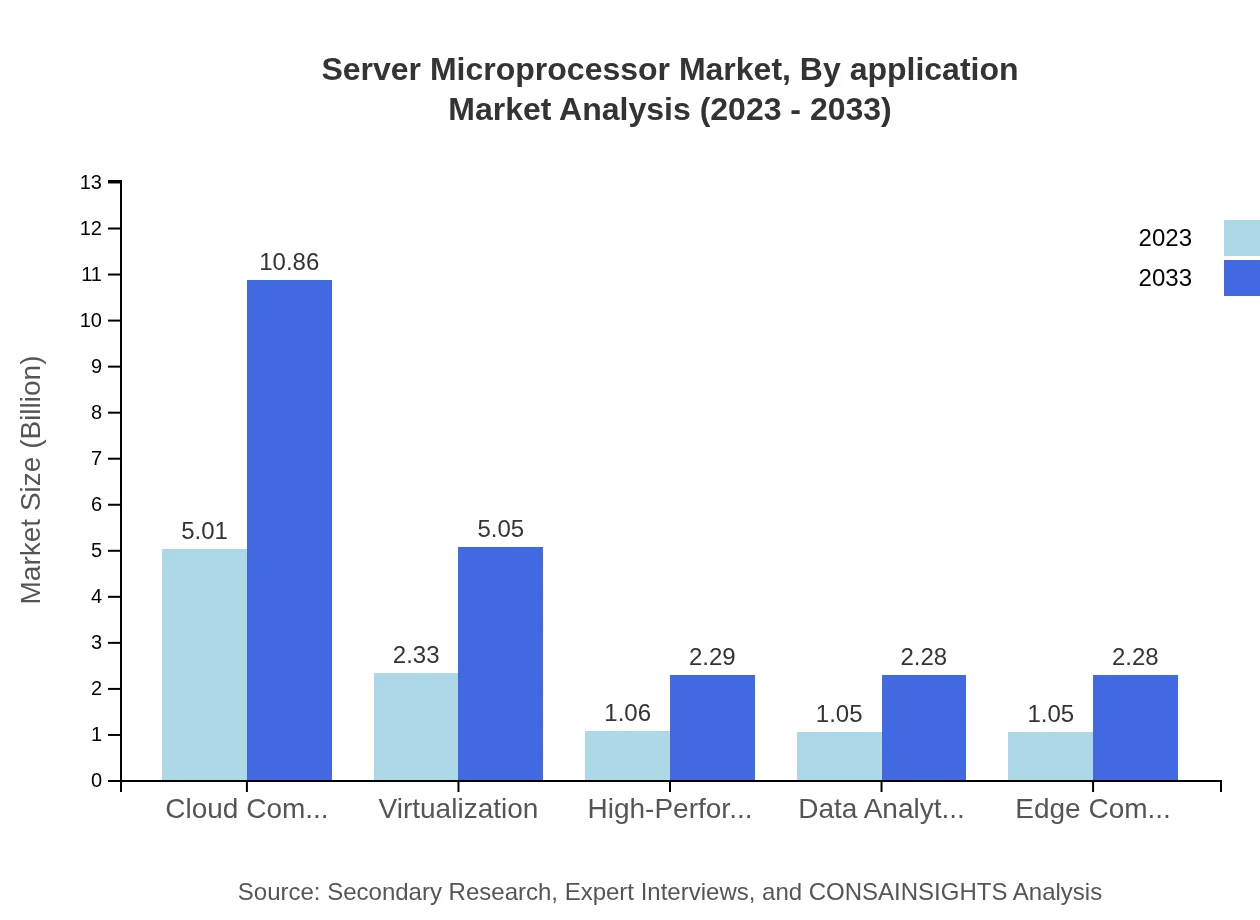

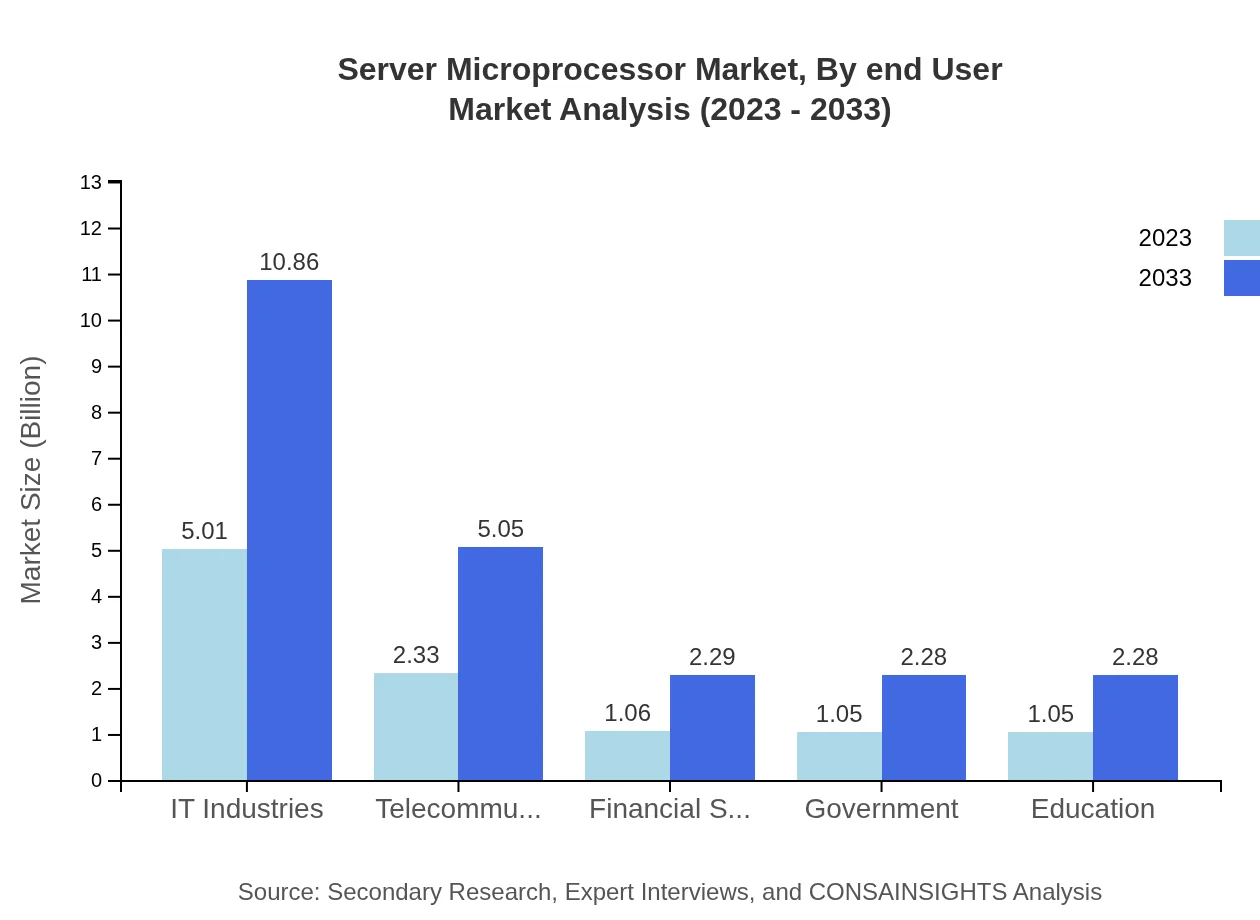

Server Microprocessor Market Analysis By Application

Applications across IT industries dominate the market, representing a market size of $5.01 billion in 2023, expected to rise to $10.86 billion by 2033. Telecommunications and cloud computing applications also contribute significantly to market growth, driven by the need for robust and scalable computing solutions.

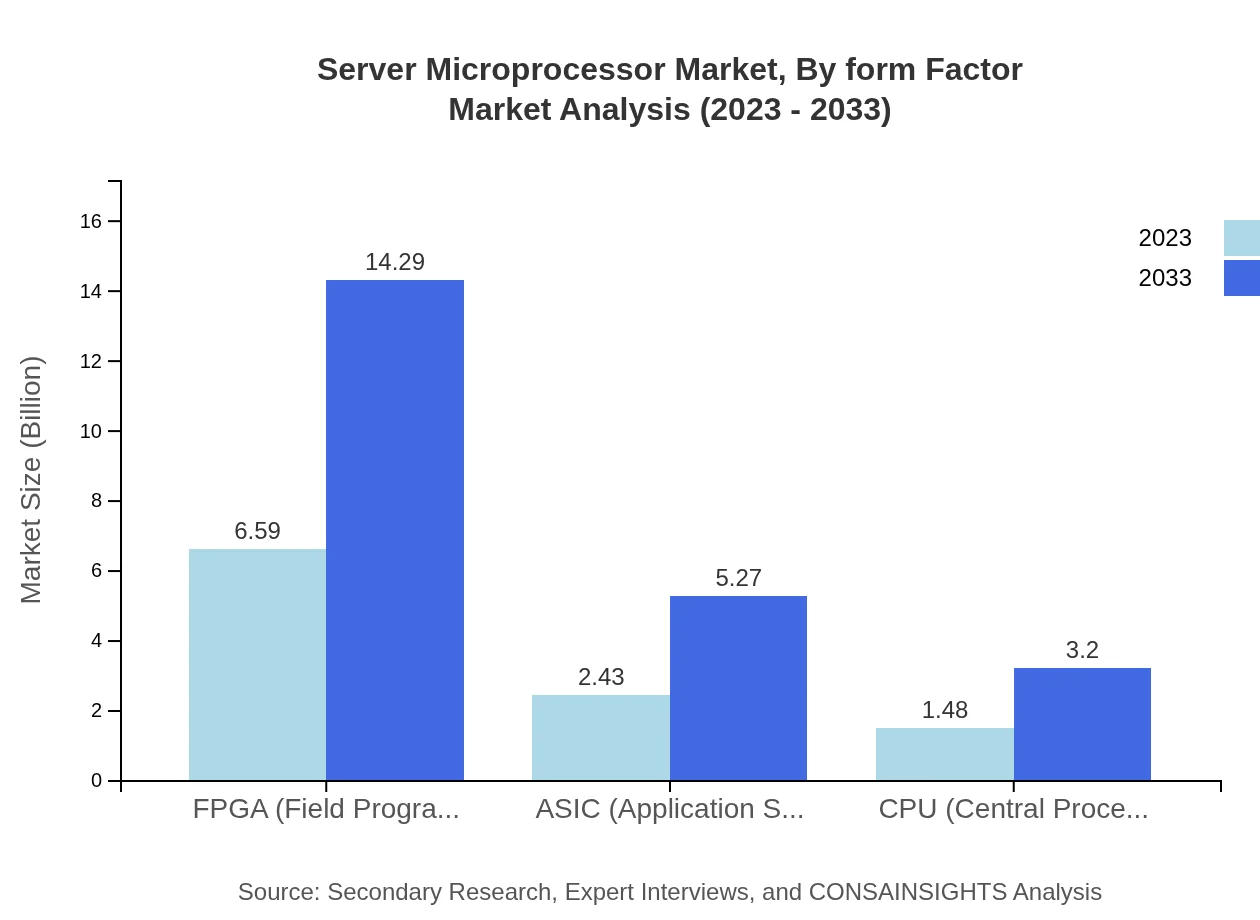

Server Microprocessor Market Analysis By Form Factor

The server microprocessor market by form factor highlights the prevalence of modular chip designs that allow for flexible configurations in data centers. These are crucial for optimizing space and performance, reflecting a shift toward more compact computing solutions.

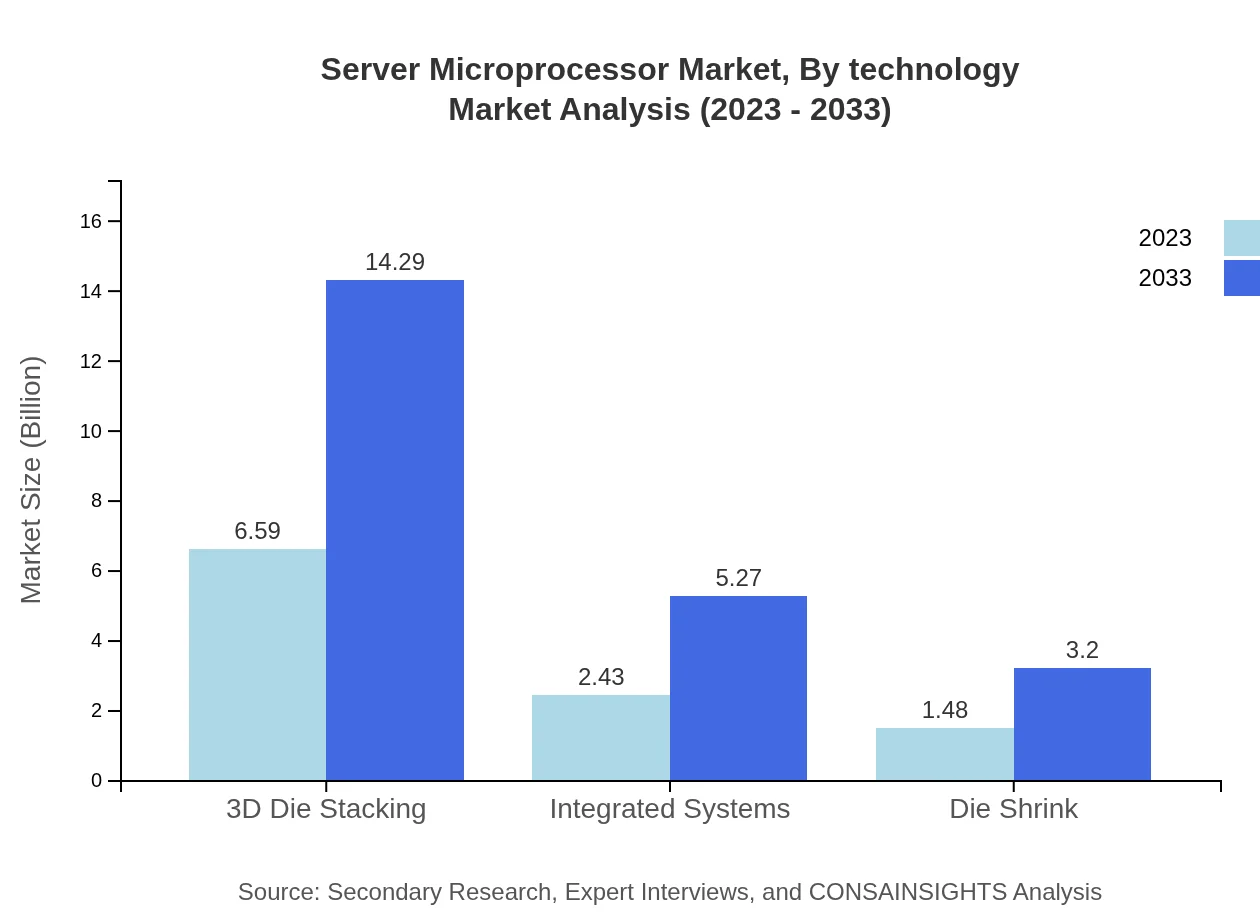

Server Microprocessor Market Analysis By Technology

Technological advancements such as 3D die stacking and virtualization technologies are shaping the future of the server microprocessor landscape. These innovations lead to increased performance, better energy efficiency, and enhanced capabilities regarding data processing and computation.

Server Microprocessor Market Analysis By End User

End-users in the IT industry constitute the largest segment, followed by telecommunications and financial services. The demand for high-performance computing resources across sectors underscores the essential role of server microprocessors in driving digital transformation initiatives.

Server Microprocessor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Server Microprocessor Industry

Intel Corporation:

Intel is a leading player in the server microprocessor sector, known for its Xeon processor family that dominates the high-performance computing market, focusing on innovation and energy efficiency.AMD (Advanced Micro Devices):

AMD offers a competitive edge with its EPYC processors, proving to be a major player by delivering high-performance computing capabilities at competitive pricing, driving growth in data centers.ARM Holdings:

ARM Holdings specializes in energy-efficient server microprocessors, providing designs that cater to mobile computing and embedded systems, gaining traction in cloud and edge environments.IBM:

IBM’s Power processors are crucial for enterprises requiring enterprise-grade servers for mission-critical workloads, focusing on integration of AI and big data solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of server Microprocessor?

The server microprocessor market is sized at approximately $10.5 billion in 2023 and is projected to reach significantly higher figures by 2033, with a CAGR of 7.8% indicating robust growth prospects into the next decade.

What are the key market players or companies in this server Microprocessor industry?

Key players in the server microprocessor industry include major global companies like Intel, AMD, IBM, and Qualcomm, which dominate technology innovations and market share, driving competitive advancements and pricing strategies.

What are the primary factors driving the growth in the server microprocessor industry?

Growth drivers in the server microprocessor industry encompass the rising demand for cloud computing, increased data center investments, advancements in technology, and the proliferation of Internet-of-Things (IoT), necessitating more powerful processing capabilities.

Which region is the fastest Growing in the server microprocessor?

Among various regions, North America is the fastest-growing market for server microprocessors, projected to expand from $3.65 billion in 2023 to $7.92 billion by 2033, driven by technological innovation and high demand.

Does ConsaInsights provide customized market report data for the server Microprocessor industry?

Yes, ConsaInsights offers customized market reports tailored to specific segments within the server-microprocessor industry, addressing unique client requirements to provide actionable insights and data.

What deliverables can I expect from this server Microprocessor market research project?

From the server microprocessor market research project, you can expect comprehensive reports with market forecasts, competitive analysis, segmentation insights, trends evaluation, and tailored solutions relevant to your business needs.

What are the market trends of server Microprocessor?

Current trends in the server microprocessor market include increased adoption of ARM architecture, a push toward energy-efficient designs, integration of AI capabilities, and a focus on enhancing cloud service performance across various sectors.