Service Integration And Management Market Report

Published Date: 31 January 2026 | Report Code: service-integration-and-management

Service Integration And Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Service Integration and Management (SIAM) market, covering trends, forecasts, and regional insights from 2023 to 2033. It aims to equip stakeholders with critical data to make informed decisions.

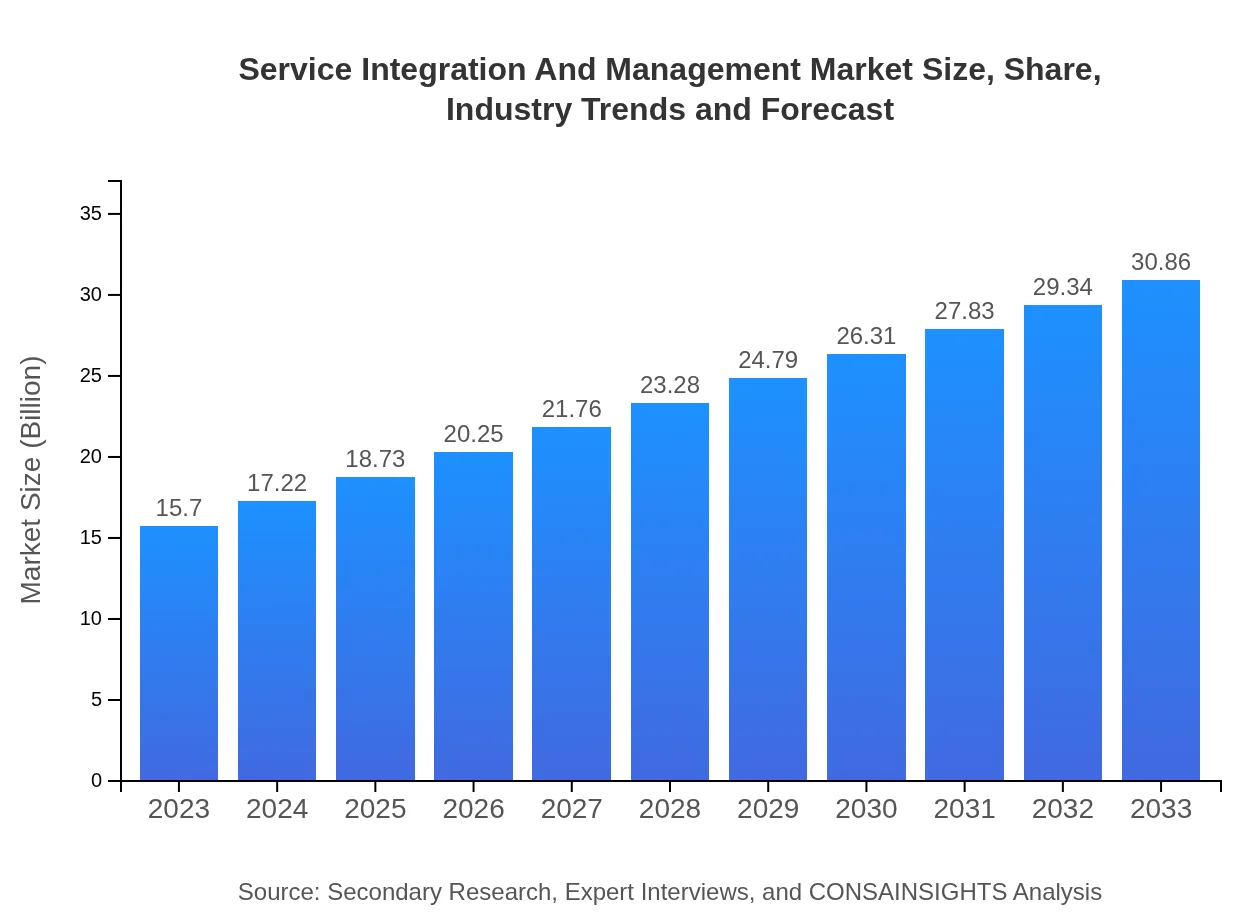

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.86 Billion |

| Top Companies | IBM, Accenture, TCS (Tata Consultancy Services), Cognizant, Deloitte |

| Last Modified Date | 31 January 2026 |

Service Integration And Management Market Overview

Customize Service Integration And Management Market Report market research report

- ✔ Get in-depth analysis of Service Integration And Management market size, growth, and forecasts.

- ✔ Understand Service Integration And Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Service Integration And Management

What is the Market Size & CAGR of Service Integration And Management market in 2023?

Service Integration And Management Industry Analysis

Service Integration And Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Service Integration And Management Market Analysis Report by Region

Europe Service Integration And Management Market Report:

In Europe, the SIAM market is set to grow from $5.22 billion in 2023 to $10.26 billion by 2033. The growth is attributed to stringent regulatory requirements and a strong emphasis on digital transformation initiatives.Asia Pacific Service Integration And Management Market Report:

In the Asia Pacific region, the SIAM market is expected to grow from $2.99 billion in 2023 to $5.88 billion by 2033. Factors driving this growth include rapid digitalization, increasing adoption of cloud solutions, and rising demand for enhanced service integration capabilities across diverse sectors.North America Service Integration And Management Market Report:

North America holds a substantial share of the SIAM market, with a valuation of $5.10 billion in 2023, anticipated to reach $10.02 billion by 2033. The region's growth is driven by high technology adoption rates and the presence of leading SIAM solution providers.South America Service Integration And Management Market Report:

The South American SIAM market is relatively nascent but is projected to increase from $0.31 billion in 2023 to $0.61 billion by 2033. The growth is fueled by improving IT infrastructure and increasing awareness of service integration benefits.Middle East & Africa Service Integration And Management Market Report:

The SIAM market in the Middle East and Africa is projected to expand from $2.08 billion in 2023 to $4.09 billion by 2033, driven by increasing investments in IT, cloud adoption, and the need for improved service integration in diverse sectors.Tell us your focus area and get a customized research report.

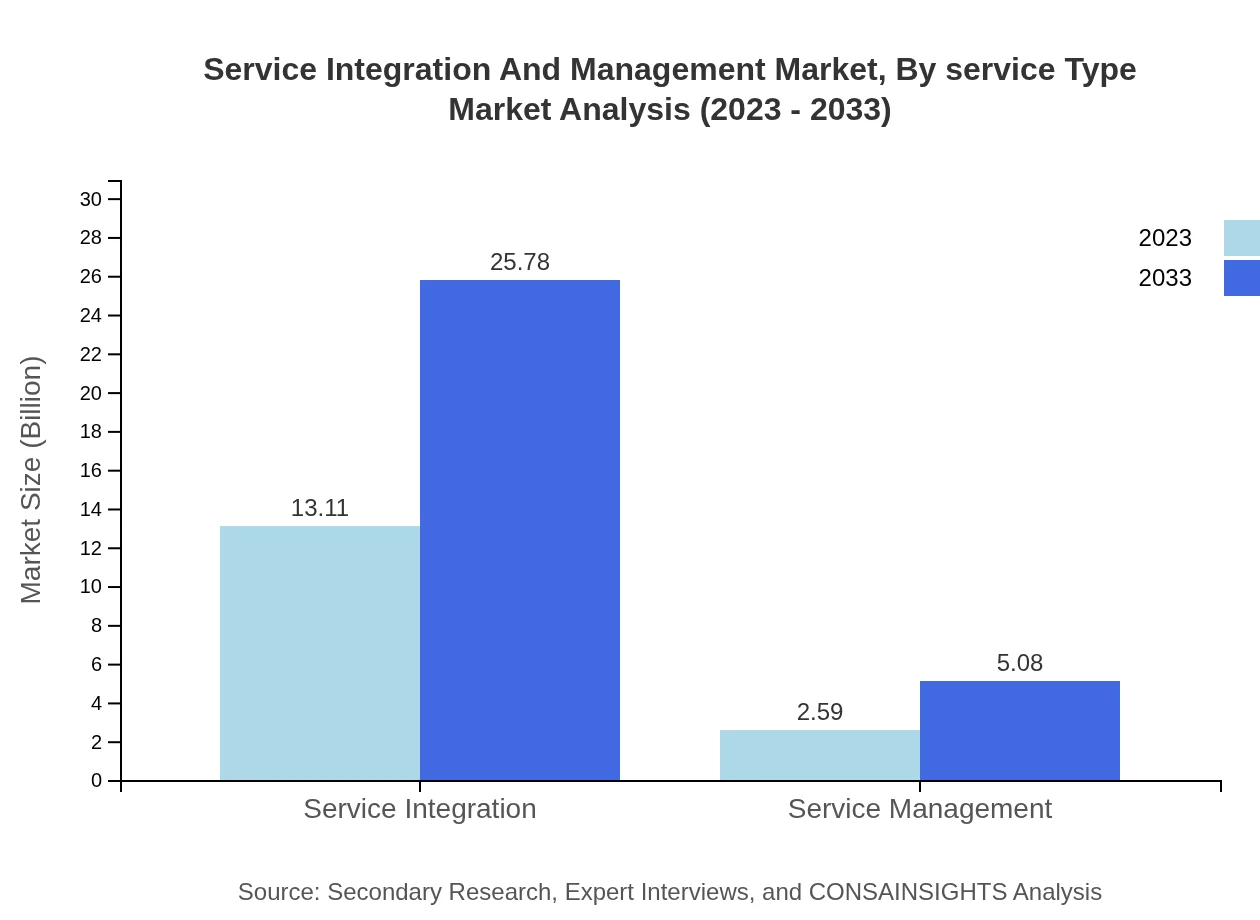

Service Integration And Management Market Analysis By Service Type

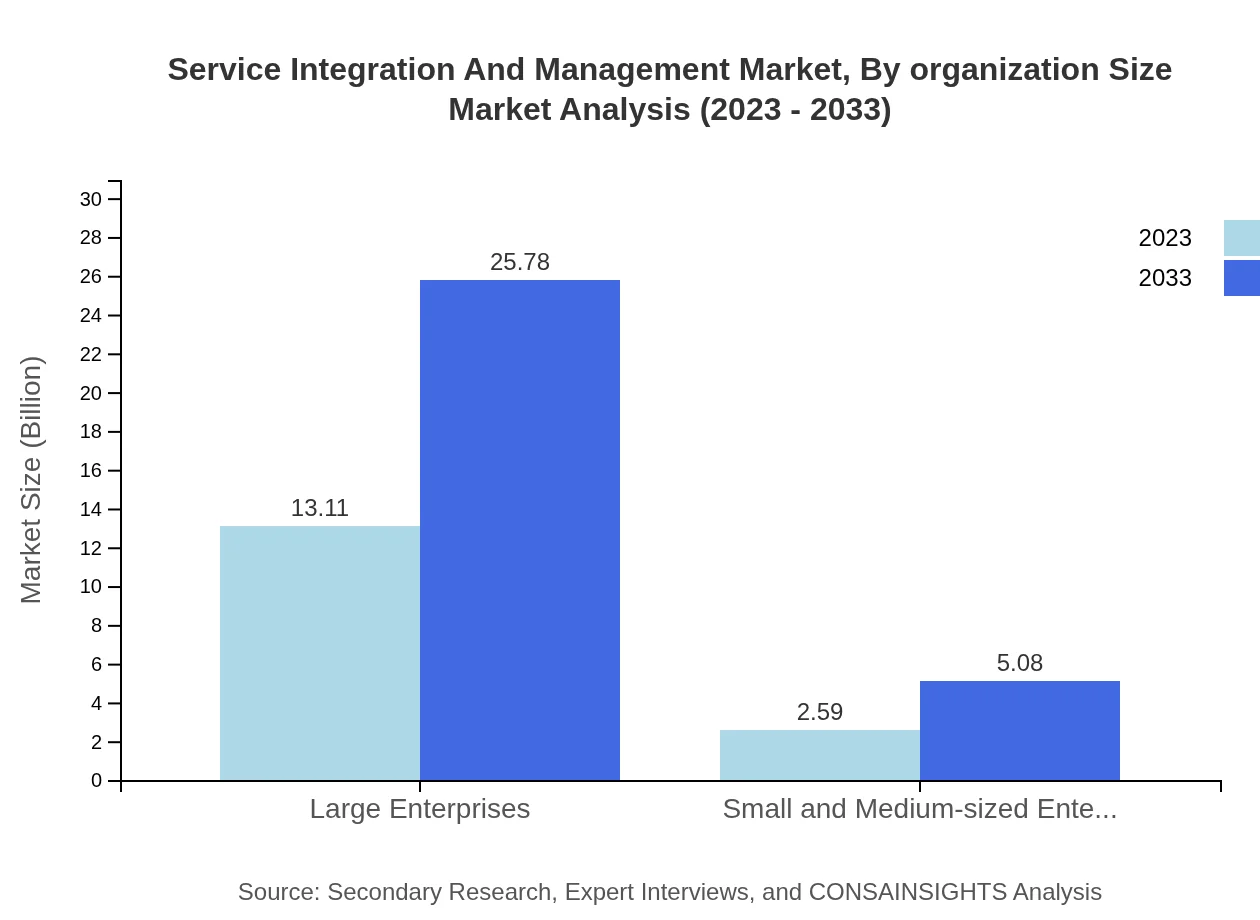

The Service Integration segment is the largest, valued at $13.11 billion in 2023 and expected to grow to $25.78 billion by 2033, maintaining an 83.53% market share. The Service Management segment is forecasted to grow from $2.59 billion to $5.08 billion with a 16.47% share.

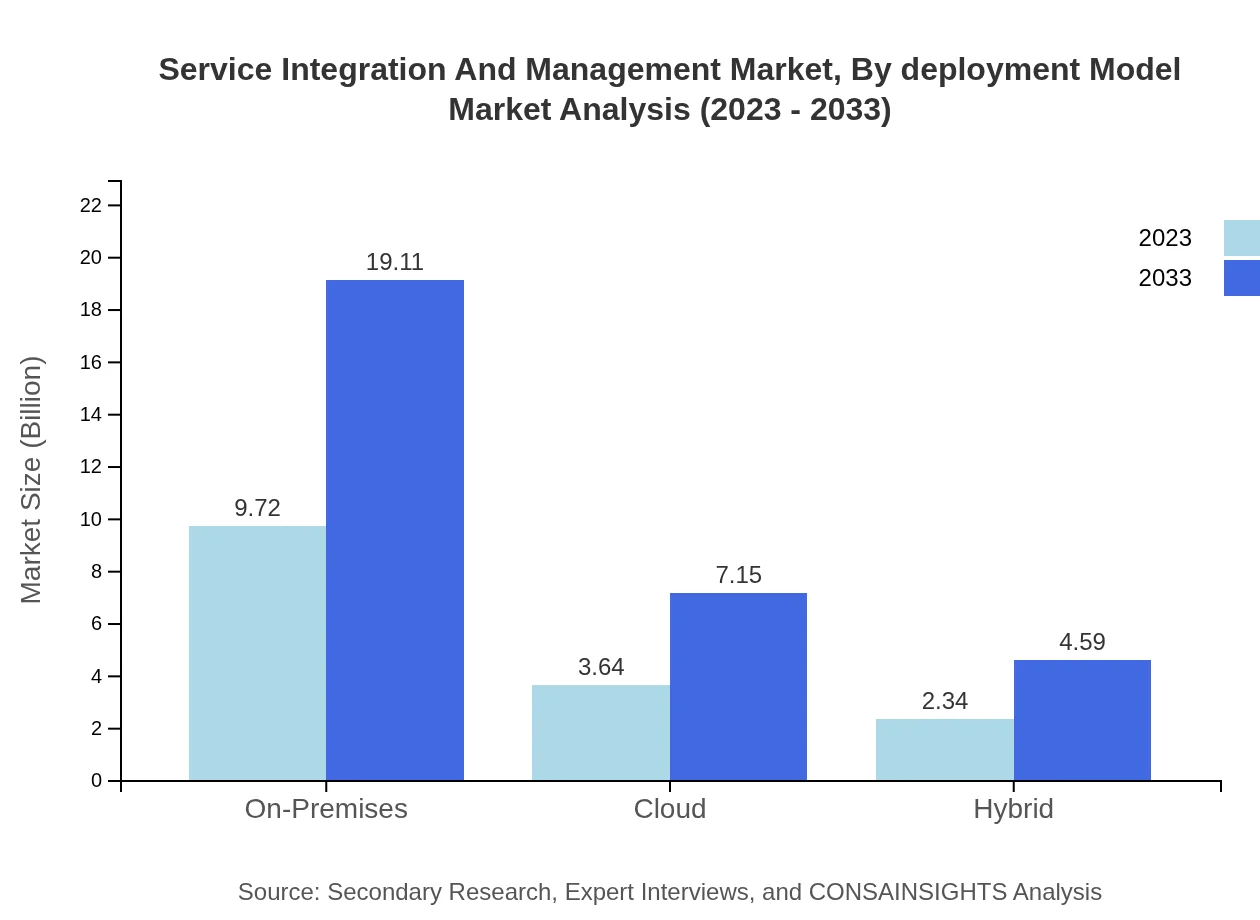

Service Integration And Management Market Analysis By Deployment Model

On-premises solutions dominate the market, with a valuation of $9.72 billion in 2023, expected to reach $19.11 billion by 2033, holding a 61.94% market share. Cloud solutions will also see significant growth from $3.64 billion to $7.15 billion, capturing 23.17% of the market.

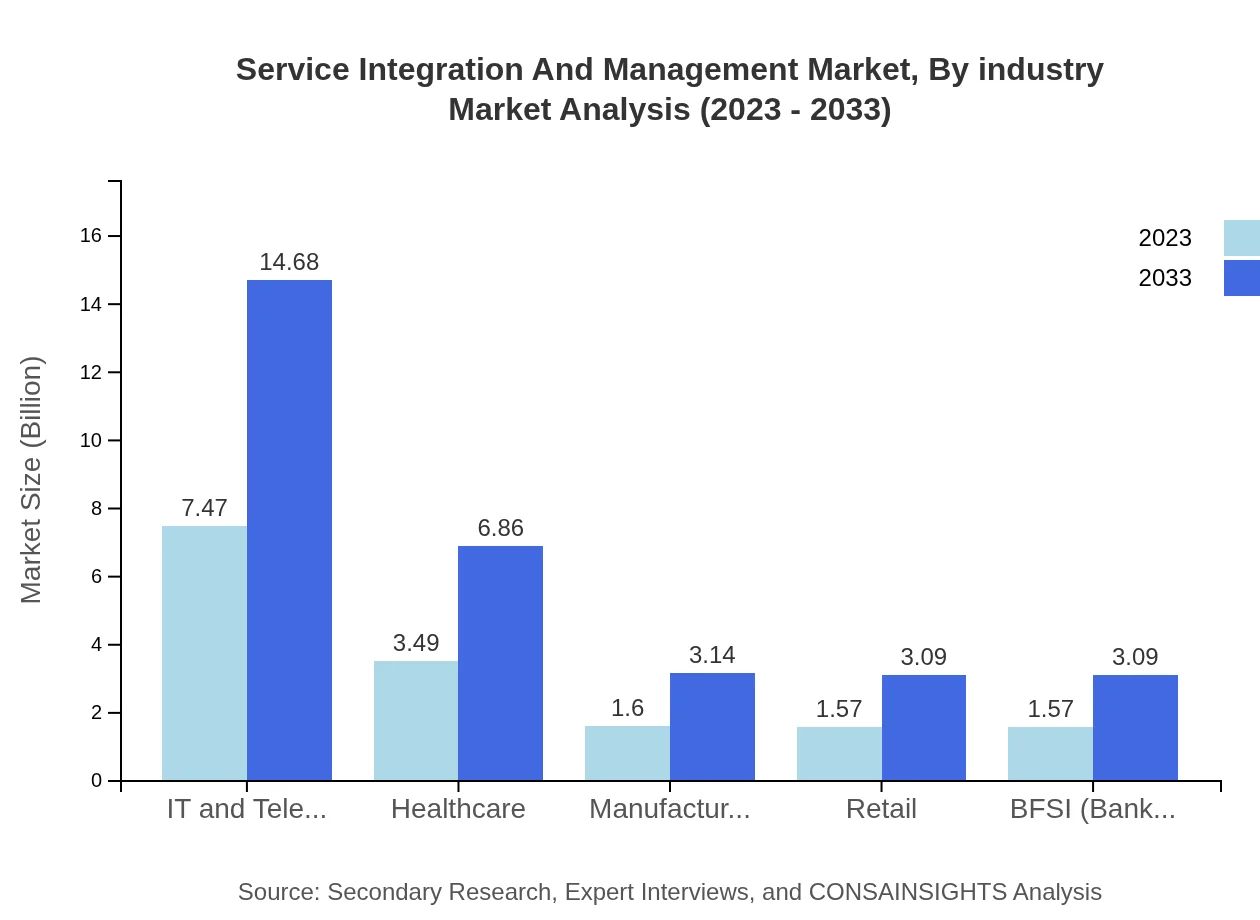

Service Integration And Management Market Analysis By Industry

The IT and Telecom sector leads the market, valued at $7.47 billion in 2023 and expected to grow to $14.68 billion by 2033, with a 47.56% market share. Healthcare follows with a growth from $3.49 billion to $6.86 billion, accounting for a 22.24% share.

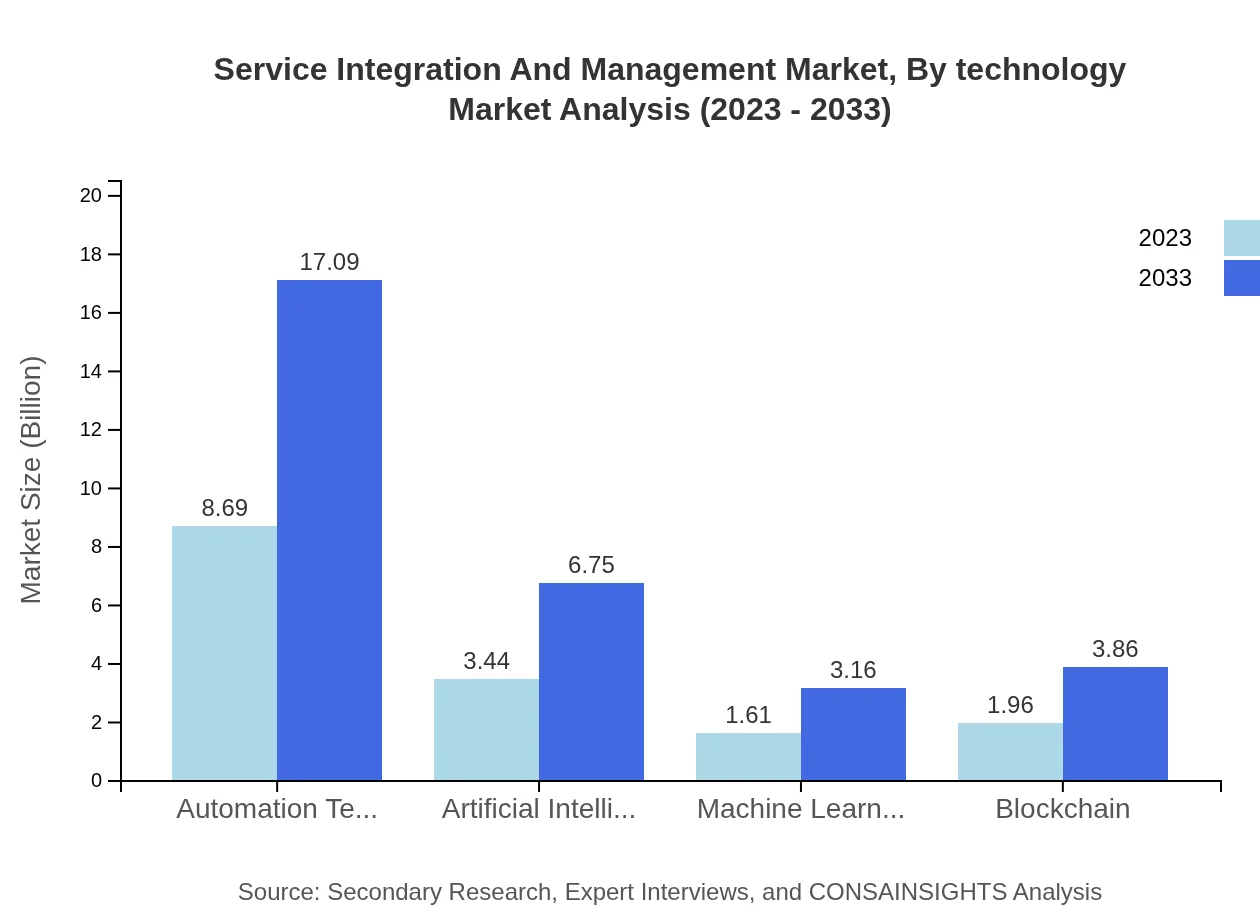

Service Integration And Management Market Analysis By Technology

Automation Technologies are crucial, holding a market size of $8.69 billion in 2023, projected to rise to $17.09 billion by 2033 with a 55.37% market share. Other significant technologies include Artificial Intelligence, growing from $3.44 billion to $6.75 billion.

Service Integration And Management Market Analysis By Organization Size

Large Enterprises dominate the market, with a size of $13.11 billion in 2023, expanding to $25.78 billion by 2033, maintaining an 83.53% share. SMEs are also growing, from $2.59 billion to $5.08 billion, representing 16.47% of the market.

Service Integration And Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Service Integration And Management Industry

IBM:

IBM offers comprehensive SIAM solutions that integrate services across various technology environments, focusing on automation and analytics to improve service delivery.Accenture:

Accenture provides consulting services that encompass SIAM, helping organizations optimize their service management strategies and achieve operational excellence.TCS (Tata Consultancy Services):

TCS specializes in IT services and consulting, providing important SIAM capabilities that enable businesses to integrate services effectively.Cognizant:

Cognizant's SIAM offerings emphasize digital transformation and integration, helping organizations navigate complex service delivery environments.Deloitte:

Deloitte offers SIAM advisory services, focusing on strategy and implementation to streamline service integration processes in diverse industries.We're grateful to work with incredible clients.

FAQs

What is the market size of Service Integration and Management?

The Service Integration and Management market was valued at approximately $15.7 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant global penetration by 2033.

What are the key market players or companies in the Service Integration and Management industry?

Key players in the Service Integration and Management industry include major tech firms specializing in IT, telecommunications, and automation solutions, which continuously innovate to enhance service offerings.

What are the primary factors driving the growth in the Service Integration and Management industry?

Growth drivers include increasing demand for IT services integration, the rise of automation technologies, and the necessity for effective service management in complex IT environments, propelling businesses to adopt such solutions.

Which region is the fastest Growing in the Service Integration and Management?

The fastest-growing regions for Service Integration and Management between 2023 and 2033 are Europe, expected to increase from $5.22 billion to $10.26 billion, and Asia Pacific, scaling from $2.99 billion to $5.88 billion.

Does ConsaInsights provide customized market report data for the Service Integration and Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the Service Integration and Management industry, ensuring that clients receive relevant and actionable insights.

What deliverables can I expect from this Service Integration and Management market research project?

Deliverables typically include detailed market analysis reports, segment-specific insights, growth forecasts, and strategic recommendations based on the latest market trends and quantitative data.

What are the market trends of Service Integration and Management?

Current trends include increased investment in automation and AI, rising demand for cloud services, and a shift towards hybrid service models, indicating evolving consumer preferences in the Service Integration and Management sector.