Set Top Box Market Report

Published Date: 31 January 2026 | Report Code: set-top-box

Set Top Box Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Set Top Box market, covering insights on market size, trends, and forecasts from 2023 to 2033. It explores key segments, regional dynamics, and competitive landscape to equip stakeholders with valuable data for informed decision-making.

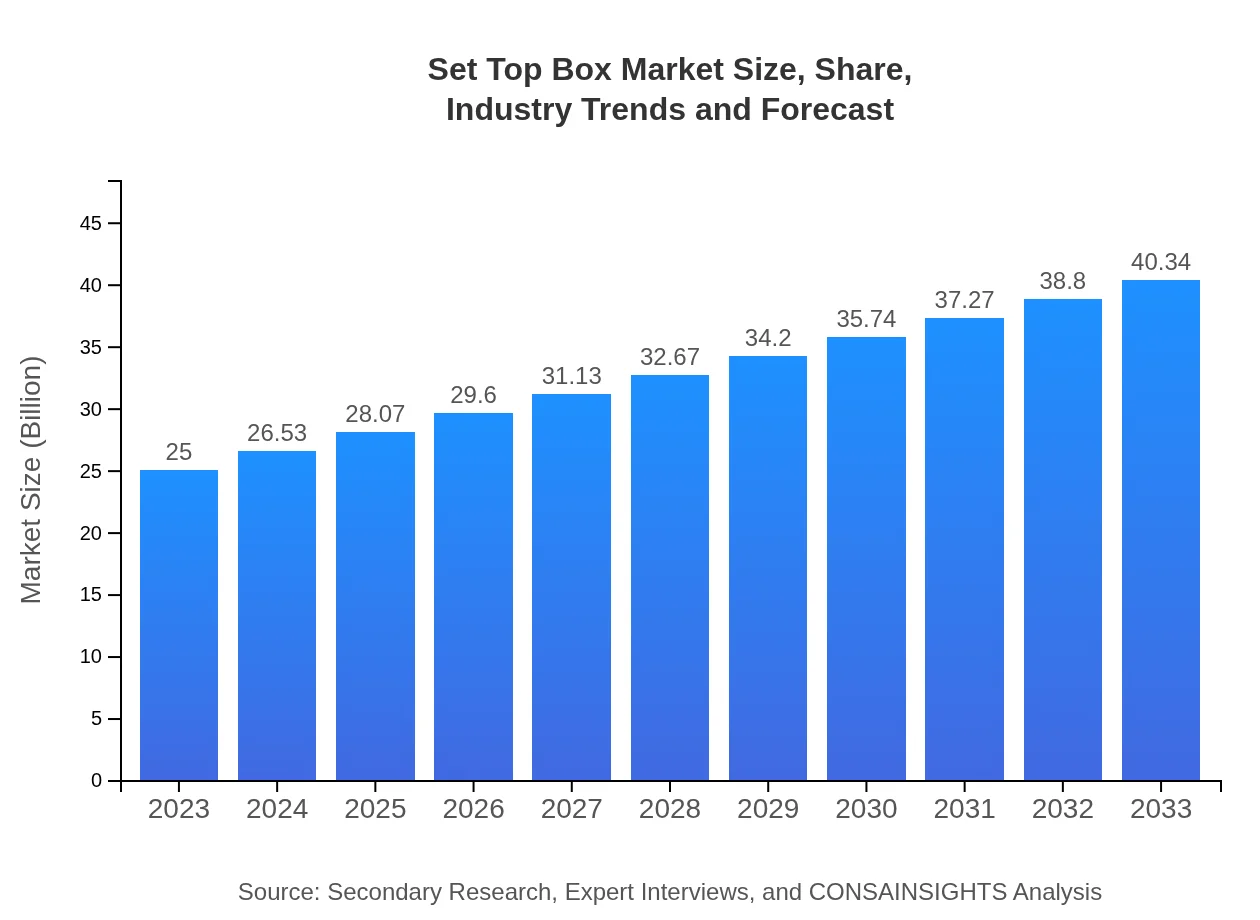

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $40.34 Billion |

| Top Companies | Roku, Inc., Apple Inc., Amazon.com, Inc., Comcast Corporation, Dish Network Corporation |

| Last Modified Date | 31 January 2026 |

Set Top Box Market Overview

Customize Set Top Box Market Report market research report

- ✔ Get in-depth analysis of Set Top Box market size, growth, and forecasts.

- ✔ Understand Set Top Box's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Set Top Box

What is the Market Size & CAGR of Set Top Box market in 2023?

Set Top Box Industry Analysis

Set Top Box Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Set Top Box Market Analysis Report by Region

Europe Set Top Box Market Report:

Europe's STB market is projected to grow from $7.23 billion in 2023 to $11.67 billion by 2033, driven by initiatives promoting digital television and an increase in demand for high-definition and smart devices.Asia Pacific Set Top Box Market Report:

The Asia Pacific region is poised for substantial growth, with a market size projected to increase from $5.08 billion in 2023 to $8.19 billion by 2033. The rising middle-class population and enhancing internet penetration are driving demand for STBs, with countries like India and China leading the pack.North America Set Top Box Market Report:

North America remains a stronghold for the STB market, with a market size expected to rise from $8.31 billion in 2023 to $13.41 billion by 2033. The dominance of subscription-based streaming services and the advanced technological infrastructure support this growth.South America Set Top Box Market Report:

In South America, the market is expected to grow from $1.72 billion in 2023 to $2.77 billion by 2033. This growth can be attributed to an increase in disposable income and a growing interest in digital entertainment options.Middle East & Africa Set Top Box Market Report:

The Middle East and Africa are witnessing growth from $2.67 billion in 2023 to $4.30 billion by 2033. Expanding urbanization and increasing consumer awareness about advanced STBs fuel this region's market expansion.Tell us your focus area and get a customized research report.

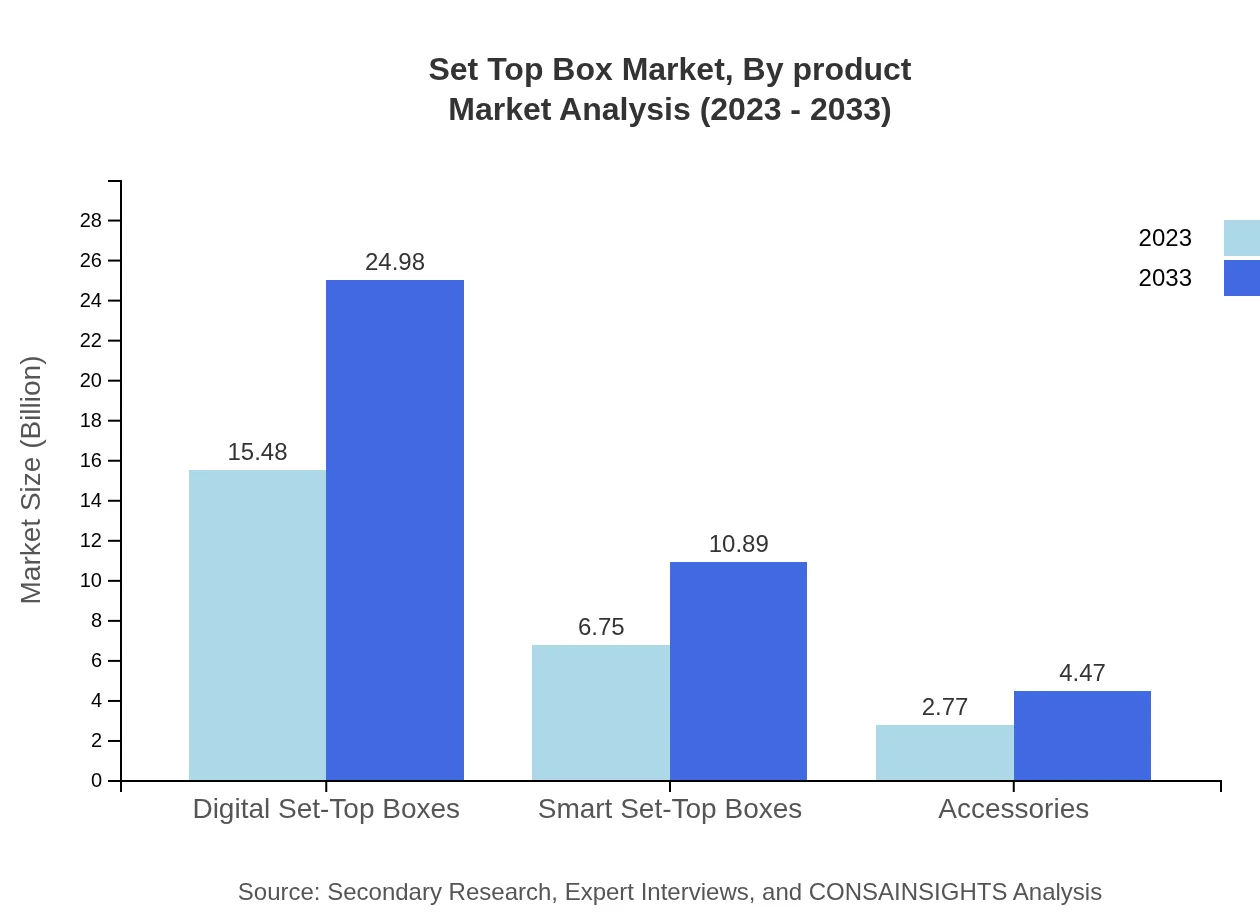

Set Top Box Market Analysis By Product

The Set-Top Box market by product type comprises Digital STBs, Smart STBs, and Accessories. Digital STBs dominate the market with a projected increase in size from $15.48 billion in 2023 to $24.98 billion in 2033, holding a steady market share of 61.93%. Smart STBs are anticipated to grow from $6.75 billion to $10.89 billion, constituting 27% of the market share. Accessories contribute significantly, growing from $2.77 billion to $4.47 billion, maintaining an 11.07% share.

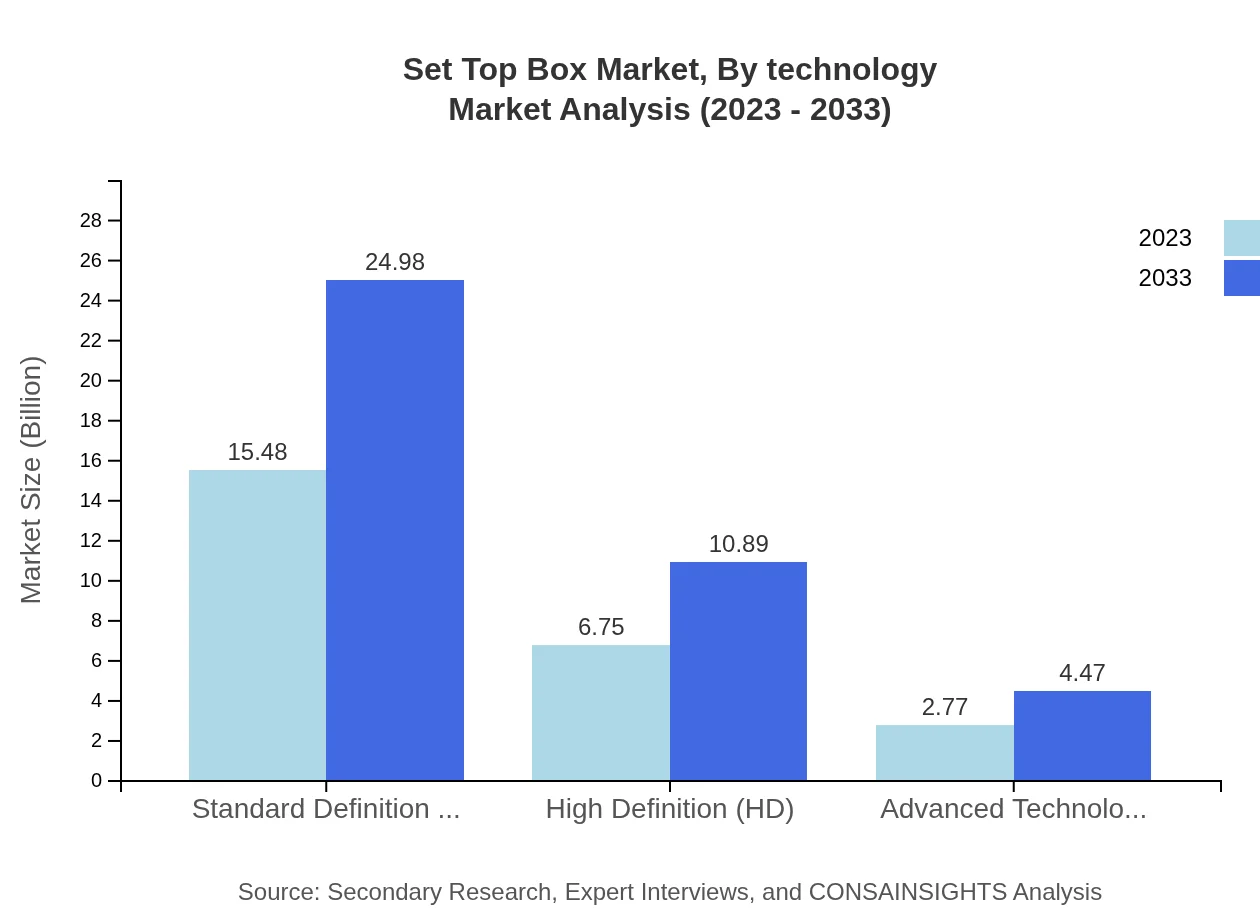

Set Top Box Market Analysis By Technology

The technology segment includes Standard Definition (SD), High Definition (HD), and advanced technologies. The SD segment is projected to increase from $15.48 billion in 2023 to $24.98 billion. HD STBs are similarly expected to grow, registering an increase from $6.75 billion to $10.89 billion. Emerging technologies, while smaller, are set to capture attention with growth from $2.77 billion to $4.47 billion.

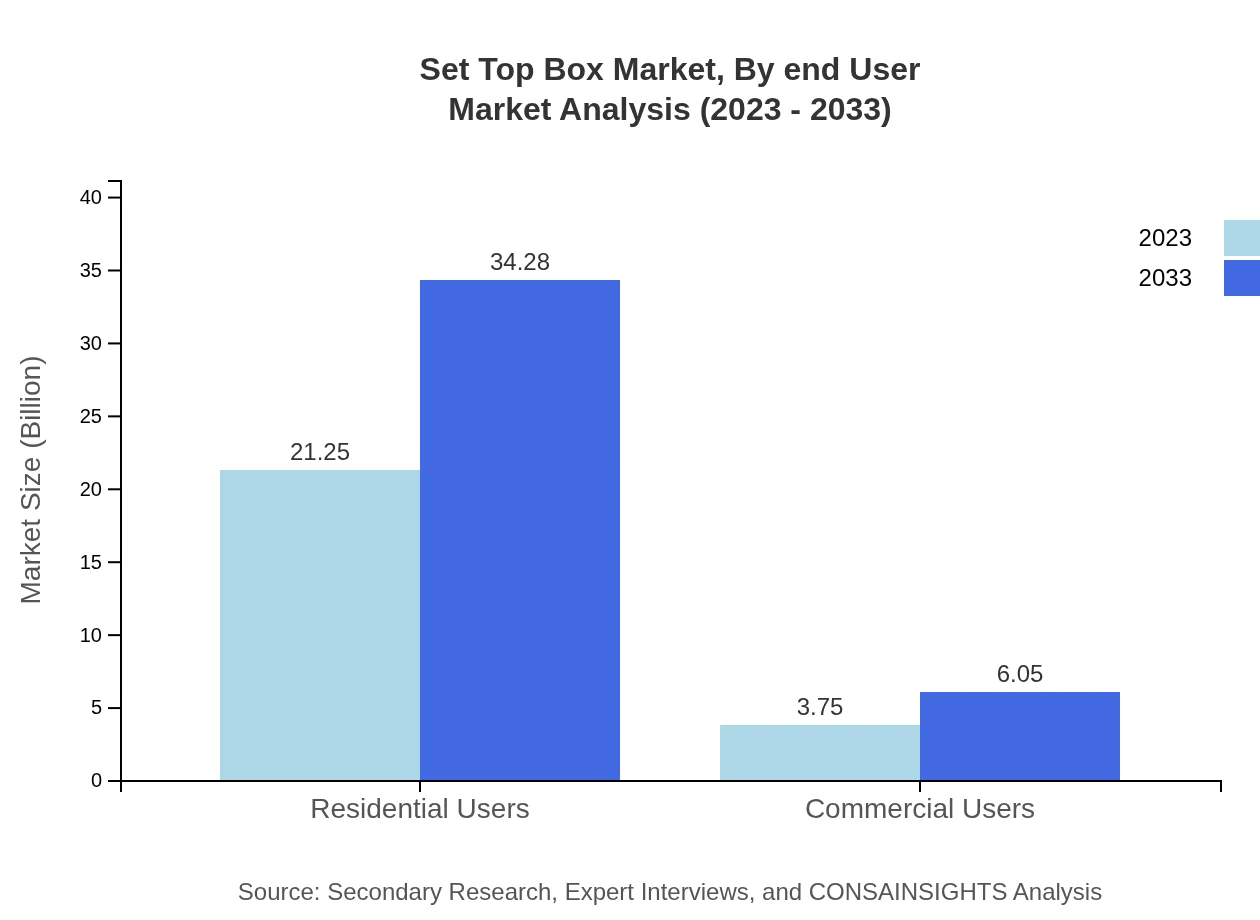

Set Top Box Market Analysis By End User

End-user segmentation is characterized by Residential and Commercial Users. The Residential segment leads the market, expanding from $21.25 billion in 2023 to $34.28 billion by 2033, capturing an impressive 84.99% of the market share. The Commercial segment shows robust growth from $3.75 billion to $6.05 billion, holding 15.01%.

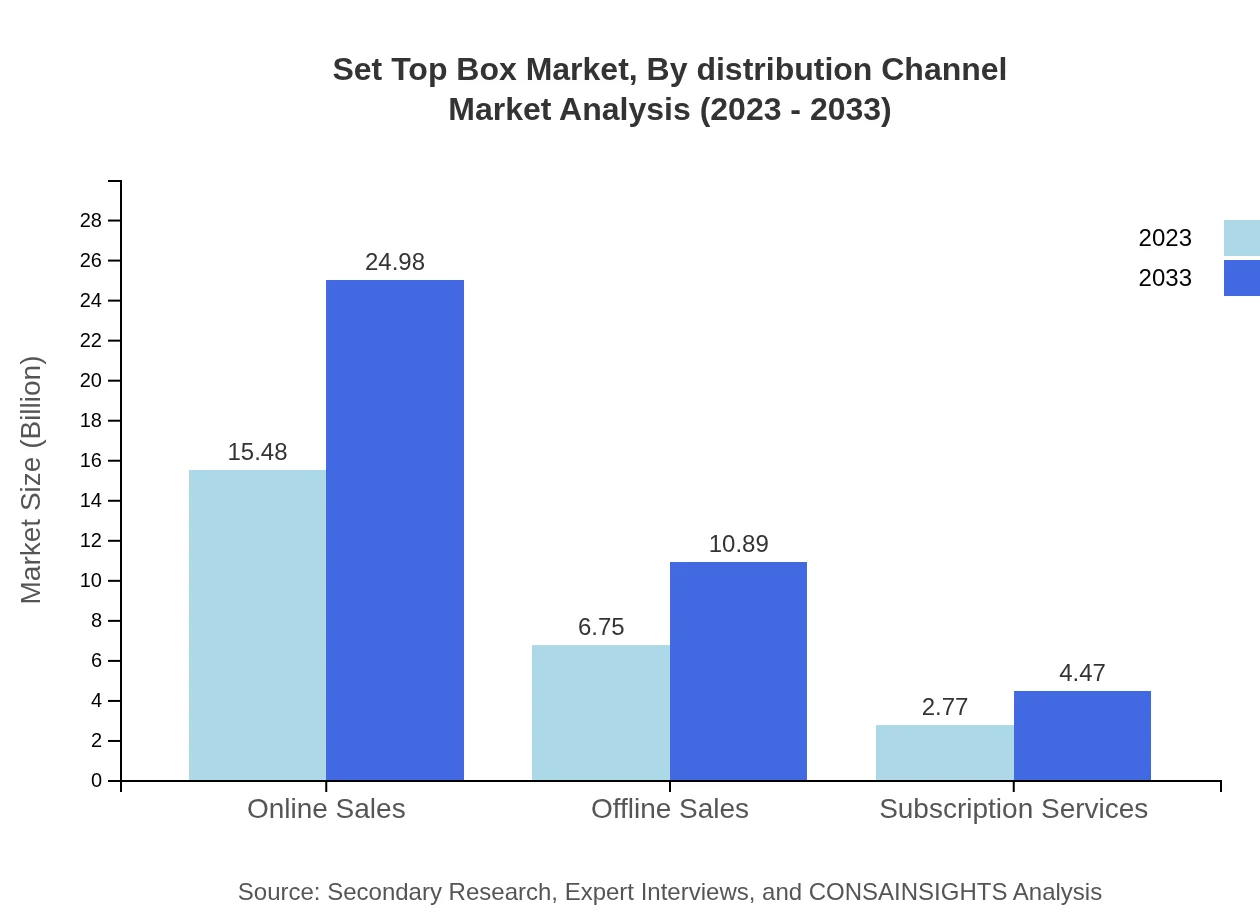

Set Top Box Market Analysis By Distribution Channel

Distribution channels include Online and Offline sales. Online sales dominate the market, with a size forecast to increase from $15.48 billion in 2023 to $24.98 billion, accounting for 61.93% market share. Offline sales, meanwhile, are projected to grow from $6.75 billion to $10.89 billion, supporting 27% market share.

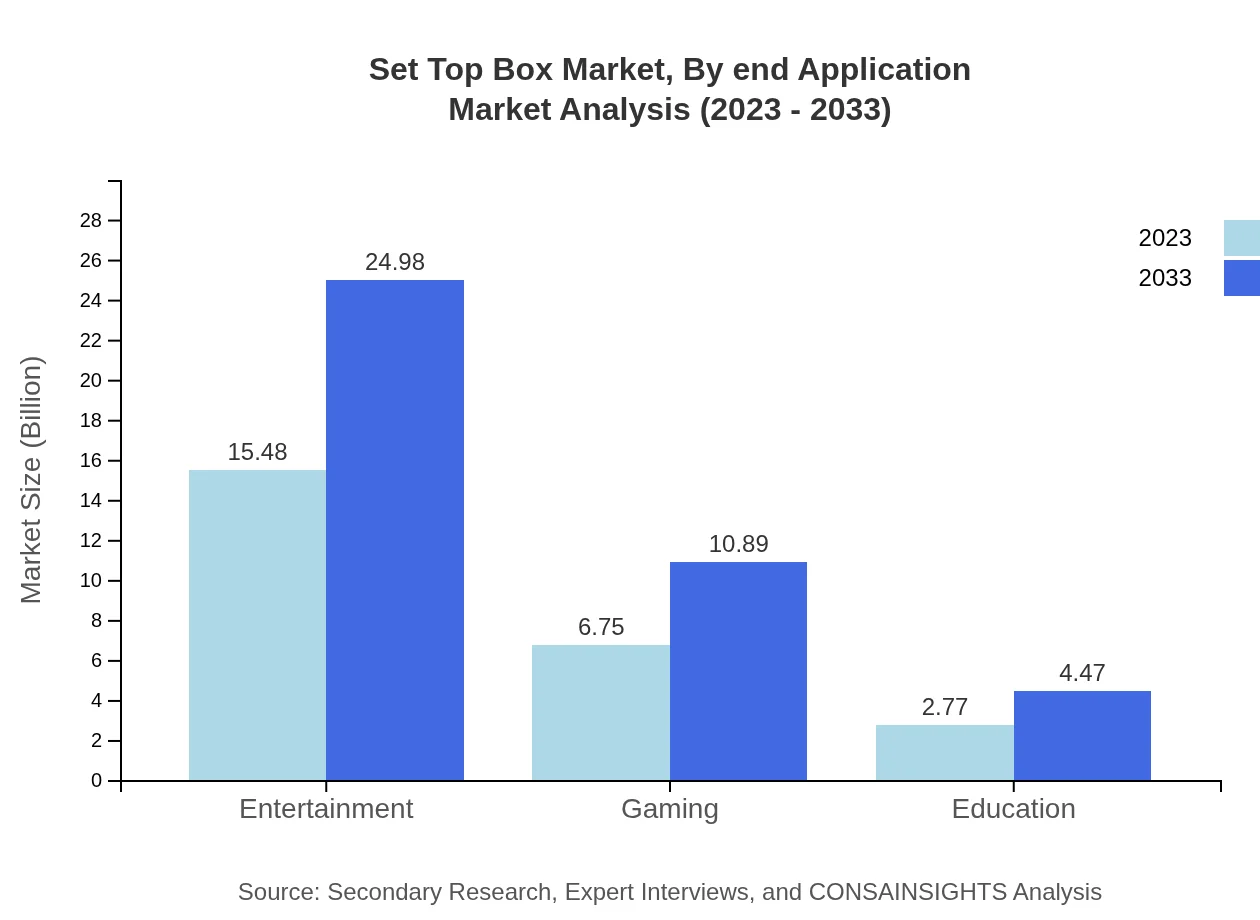

Set Top Box Market Analysis By End Application

Application segmentation covers Entertainment, Gaming, and Education. The Entertainment segment is the largest, expanding from $15.48 billion to $24.98 billion, while Gaming is expected to grow from $6.75 billion to $10.89 billion. The Education segment also shows promise with growth from $2.77 billion to $4.47 billion.

Set Top Box Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Set Top Box Industry

Roku, Inc.:

Roku is a prominent player in the streaming landscape known for its innovative STB solutions that emphasize user-friendliness and wide-ranging content availability.Apple Inc.:

Apple leads with its Apple TV device, combining entertainment with a suite of services such as Apple TV+, which attracts a vast user base.Amazon.com, Inc.:

Amazon's Fire TV series offers integrated services with its Prime offerings, driving notable growth in the STB market.Comcast Corporation:

Comcast's Xfinity Box has revolutionized user experience with its advanced features that integrate internet and entertainment services.Dish Network Corporation:

Dish Network continues to be a significant player in the satellite STB space, offering traditional broadcast and streaming integration.We're grateful to work with incredible clients.

FAQs

What is the market size of set Top Box?

The global set-top box market is valued at approximately $25 billion in 2023, with a projected CAGR of 4.8% from 2023 to 2033, indicating steady growth driven by technological advancements and consumer demand.

What are the key market players or companies in the set Top box industry?

Key players in the set-top box market include prominent companies like Roku, Apple, Amazon, and Harman, which dominate the digital segment with innovative products and services tailored for diverse consumer needs.

What are the primary factors driving the growth in the set Top box industry?

The growth in the set-top box industry is primarily driven by rising demand for streaming services, increasing adoption of smart technology, and enhanced user experiences offered by advanced features like 4K and HDR.

Which region is the fastest Growing in the set Top box market?

North America is the fastest-growing region in the set-top box market, expected to rise from $8.31 billion in 2023 to $13.41 billion by 2033, fueled by a strong broadband infrastructure and high content consumption.

Does ConsaInsights provide customized market report data for the set Top box industry?

Yes, ConsaInsights offers tailored market report data for the set-top box industry, allowing businesses to obtain specific insights and analyses according to their unique requirements and targets.

What deliverables can I expect from this set Top box market research project?

Deliverables from the set-top box market research project include detailed market analysis reports, segment breakdowns, competitive landscapes, and forecasts providing strategic insights for informed decision-making.

What are the market trends of set Top boxes?

Current market trends include a shift towards digital and smart set-top boxes, increased integration with OTT platforms, and growing consumer preference for subscription-based models, as digital convergence shapes the industry.