Shale Gas Equipment Market Report

Published Date: 22 January 2026 | Report Code: shale-gas-equipment

Shale Gas Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides in-depth insights into the Shale Gas Equipment market, covering market trends, segmentation, regional analysis, and future forecasts from 2023 to 2033.

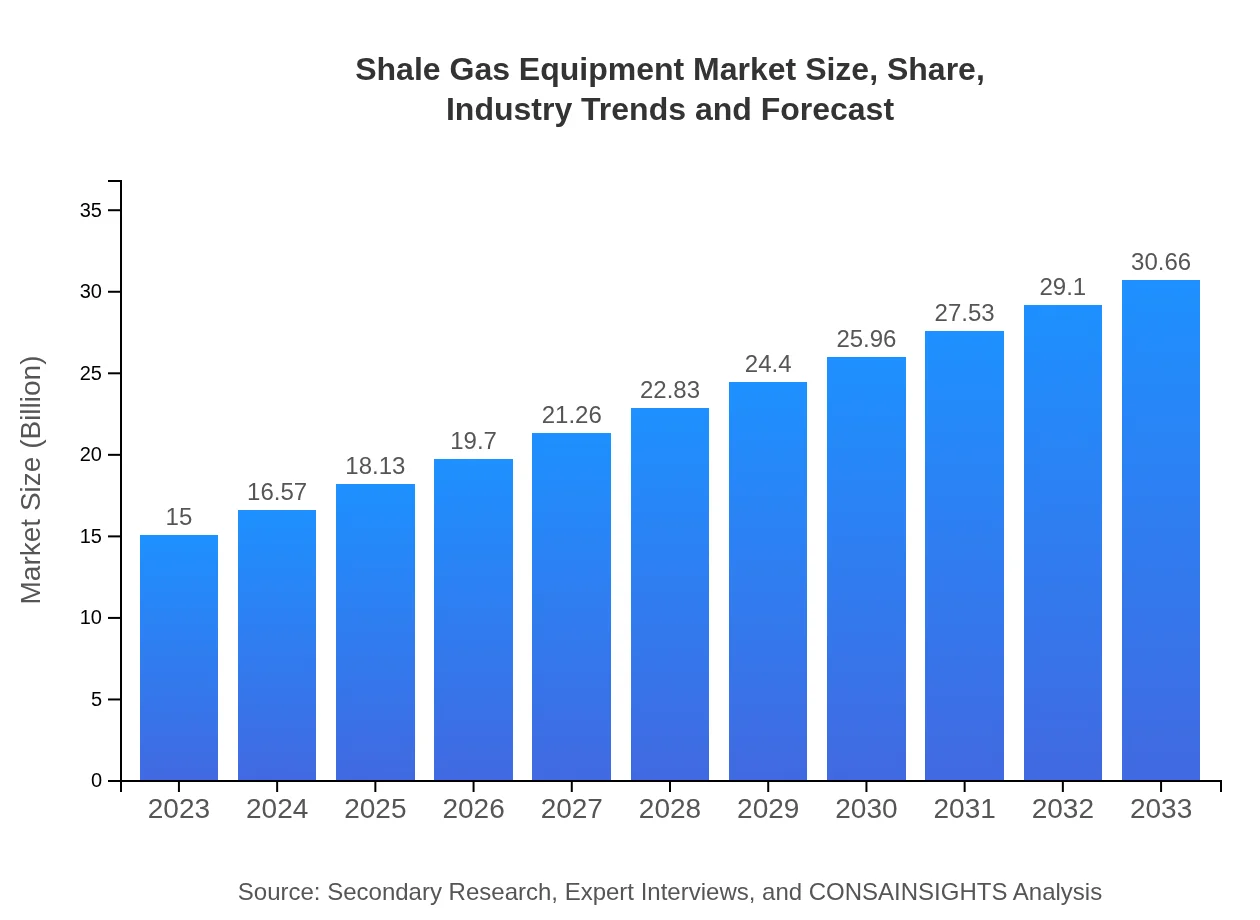

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Halliburton, Schlumberger, Baker Hughes, National Oilwell Varco, Weatherford International |

| Last Modified Date | 22 January 2026 |

Shale Gas Equipment Market Overview

Customize Shale Gas Equipment Market Report market research report

- ✔ Get in-depth analysis of Shale Gas Equipment market size, growth, and forecasts.

- ✔ Understand Shale Gas Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Shale Gas Equipment

What is the Market Size & CAGR of Shale Gas Equipment market in 2023?

Shale Gas Equipment Industry Analysis

Shale Gas Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Shale Gas Equipment Market Analysis Report by Region

Europe Shale Gas Equipment Market Report:

Europe's Shale Gas Equipment market is also expanding, with an increase anticipated from $4.45 billion in 2023 to $9.10 billion in 2033. The drive towards energy security and independence is crucial, especially in Eastern European countries incentivized by EU policies.Asia Pacific Shale Gas Equipment Market Report:

In the Asia-Pacific region, the Shale Gas Equipment market is expected to grow from $2.58 billion in 2023 to $5.28 billion by 2033. The growth is driven by increasing energy demands in countries like China and India, coupled with government initiatives to develop unconventional gas resources.North America Shale Gas Equipment Market Report:

North America leads the market, valued at $5.72 billion in 2023, with expectations to reach $11.69 billion by 2033. The U.S. shale boom continues to dominate due to technological advancements and significant reserves, further attracting investment.South America Shale Gas Equipment Market Report:

The South American market shows modest growth, with projections climbing from $0.87 billion in 2023 to $1.78 billion in 2033. Key countries, particularly Argentina, are exploring shale gas potential, bolstered by government support and global partnerships.Middle East & Africa Shale Gas Equipment Market Report:

In the Middle East and Africa, market growth will rise from $1.38 billion in 2023 to $2.82 billion by 2033 due to emerging shale gas projects in countries like South Africa and the potential for increased energy diversification.Tell us your focus area and get a customized research report.

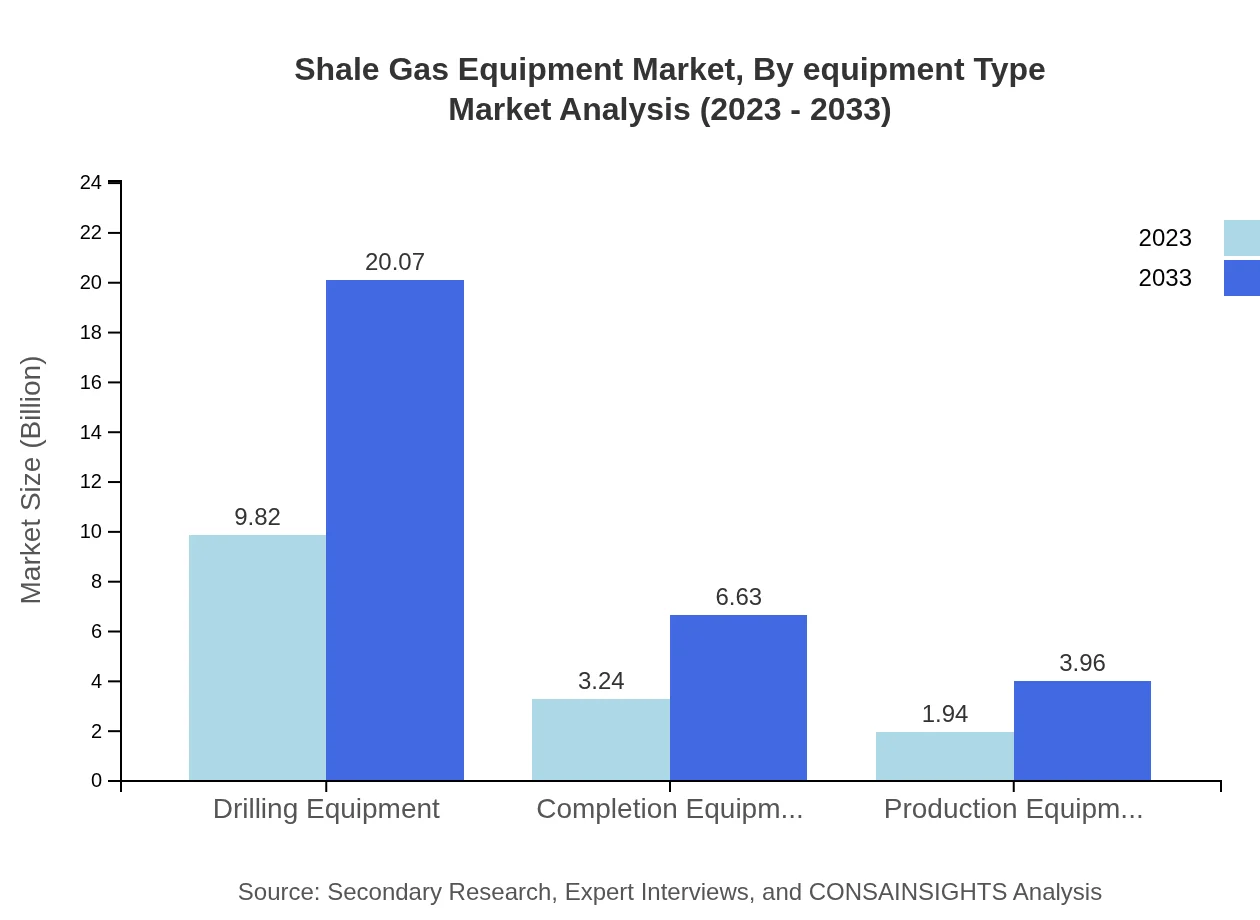

Shale Gas Equipment Market Analysis By Equipment Type

The Shale Gas Equipment market can be subdivided by equipment type, predominately featuring drilling and completion equipment. In 2023, drilling equipment contributes most significantly with approximately $9.82 billion, likely continuing its growth trajectory to $20.07 billion by 2033.

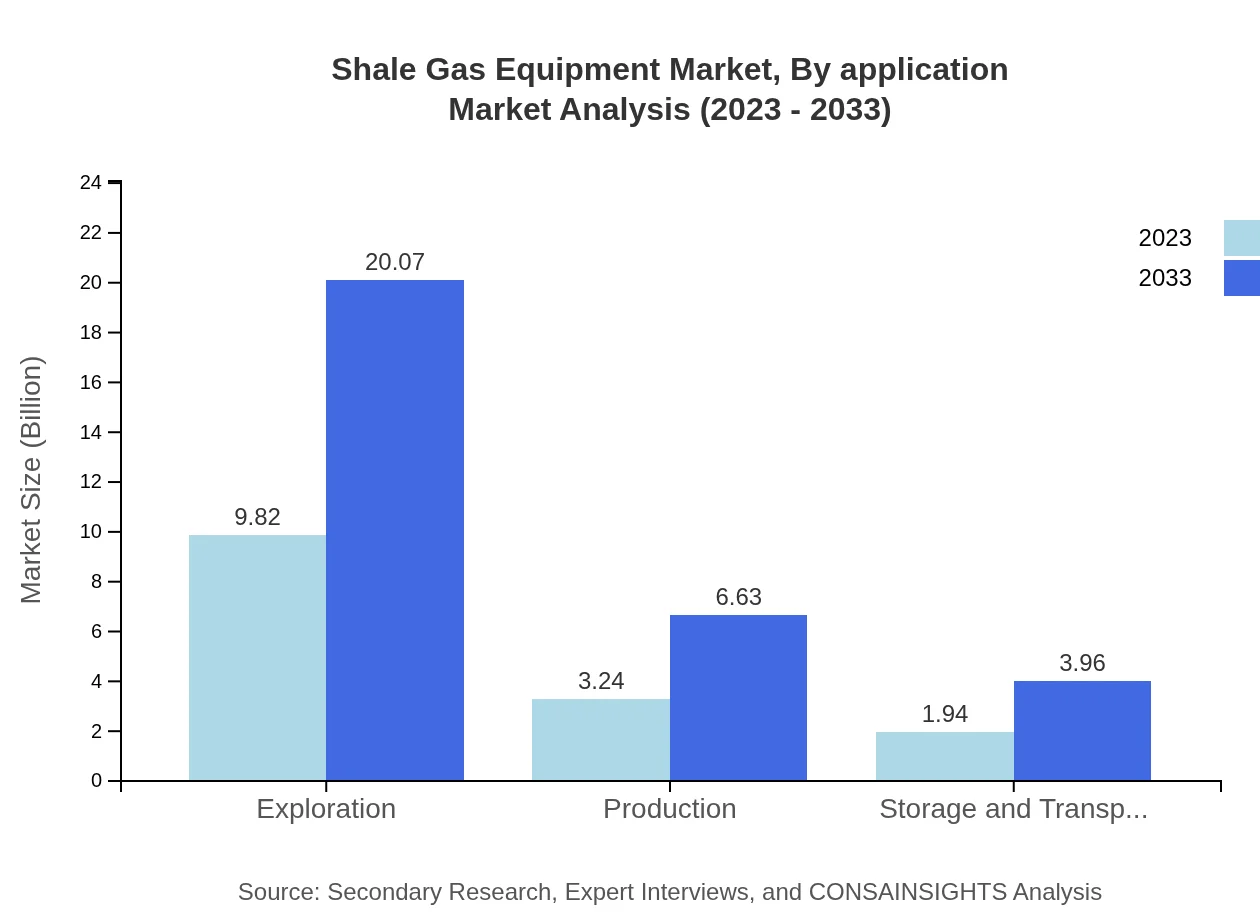

Shale Gas Equipment Market Analysis By Application

Application-wise, gas exploration remains dominant. The growth from $9.82 billion in 2023 to $20.07 billion by 2033 highlights the expansion of exploration activities to harness shale resources.

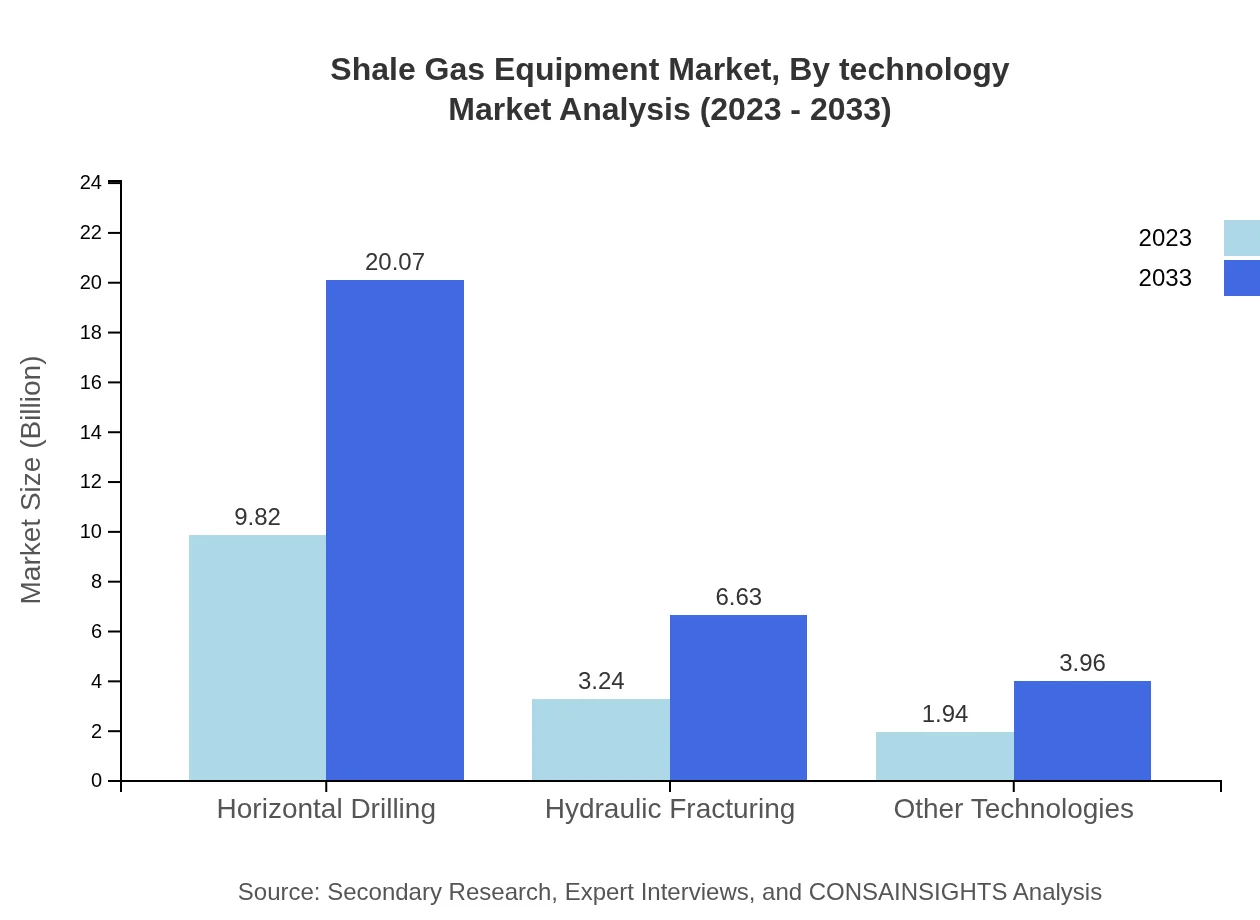

Shale Gas Equipment Market Analysis By Technology

Technological advancements like horizontal drilling and hydraulic fracturing are crucial, with significant market shares of 65.47% for drilling and 21.62% for hydraulic fracturing, consistent through 2023 to 2033.

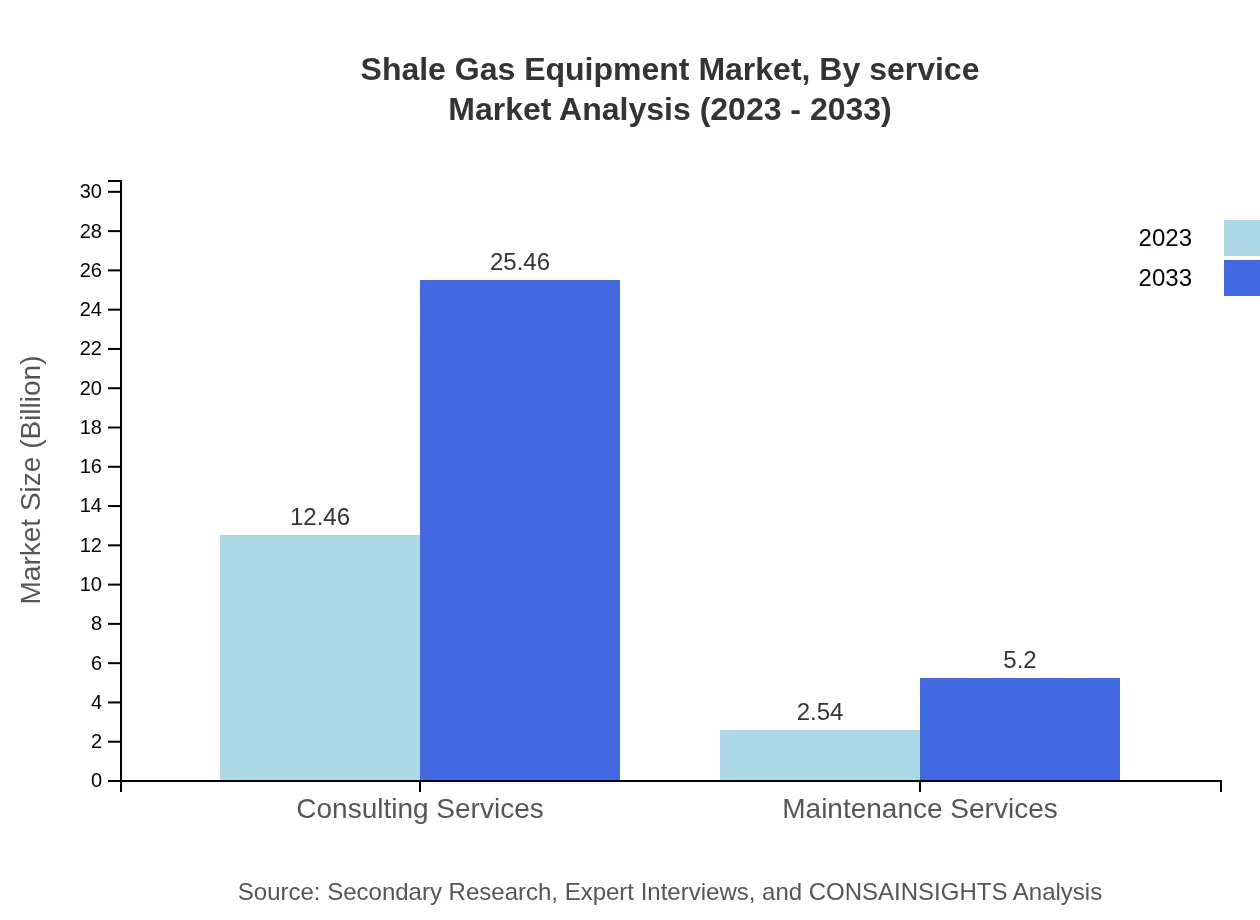

Shale Gas Equipment Market Analysis By Service

Maintenance and consulting services are essential to ensure operational efficiency, with anticipated growth from $12.46 billion in 2023 to $25.46 billion by 2033, highlighting the importance of ongoing expert support.

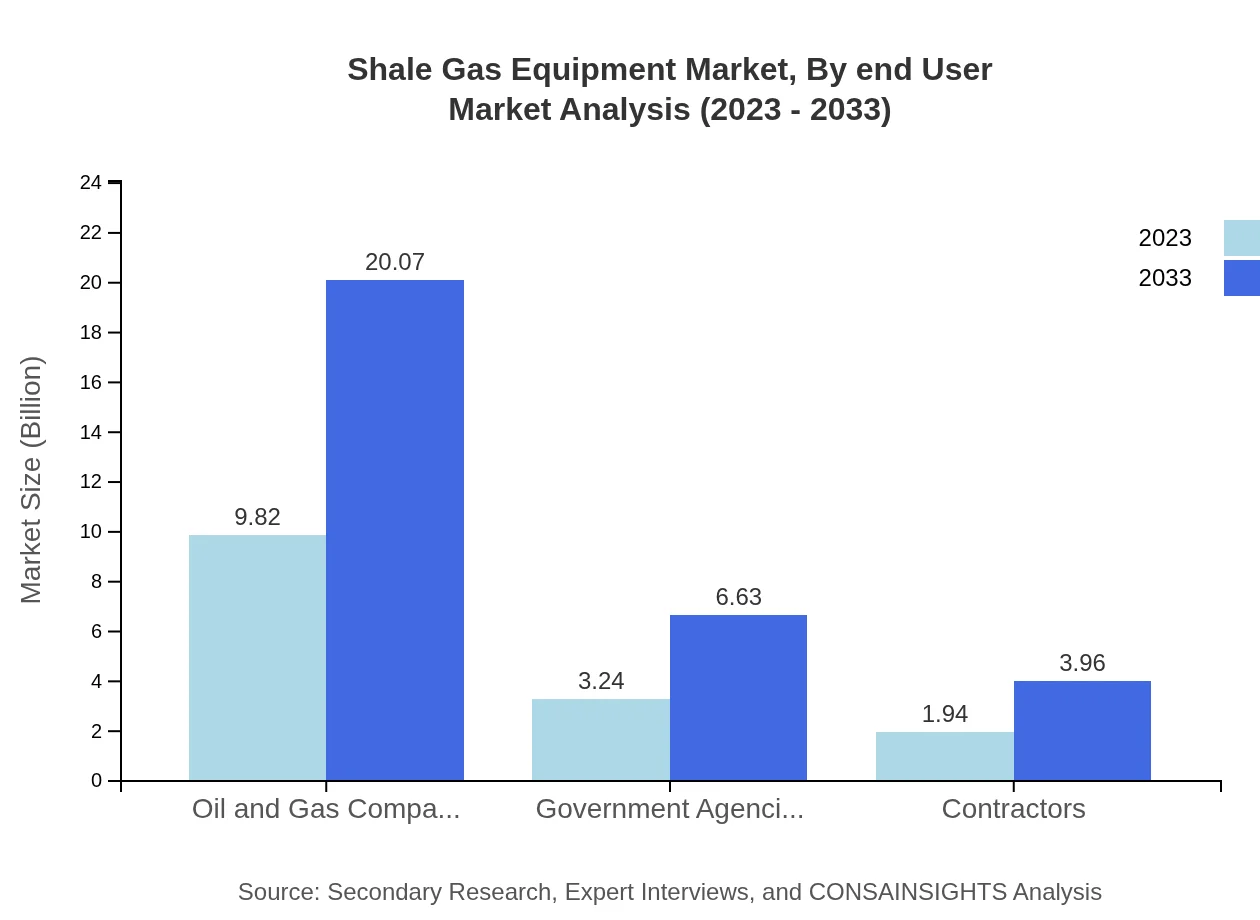

Shale Gas Equipment Market Analysis By End User

End-users primarily include oil and gas companies that dominate the sector, representing a 65.47% share by 2023. This percentage is crucial for projecting market dynamics through to 2033.

Shale Gas Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Shale Gas Equipment Industry

Halliburton:

One of the largest providers of products and services to the energy industry, specializing in hydraulic fracturing, Halliburton leads in innovative drilling and completion technologies.Schlumberger:

A global leader in technological advancements in oilfield services, Schlumberger plays a vital role in improving extraction efficiency and has a significant presence in shale gas markets.Baker Hughes:

With a strong focus on research and development, Baker Hughes provides comprehensive solutions for drilling, completion, and production, contributing significantly to the shale gas equipment sector.National Oilwell Varco:

Specializing in equipment and technology for oil and gas, National Oilwell Varco has a robust portfolio that supports shale gas operations effectively.Weatherford International:

Known for providing innovative solutions, Weatherford focuses on performance improvement in drilling and production technologies, playing a critical role in the shale sector.We're grateful to work with incredible clients.

FAQs

What is the market size of shale Gas Equipment?

The shale gas equipment market is projected to reach approximately $15 billion by 2033, growing from around $12.46 billion in 2023. This demonstrates a robust CAGR of 7.2% over the forecast period, reflecting increased demand in energy and drilling services.

What are the key market players or companies in the shale Gas Equipment industry?

Key players in the shale gas equipment industry include major energy corporations and specialized manufacturers. Leaders like Schlumberger, Halliburton, and Baker Hughes play pivotal roles in supplying equipment and technology used in drilling and hydraulic fracturing.

What are the primary factors driving the growth in the shale gas equipment industry?

Growth in the shale gas equipment industry is driven by the rising demand for energy, advancements in extraction technologies, increased investments in shale exploration, and the need for operational efficiency in drilling practices to meet global energy needs.

Which region is the fastest Growing in the shale gas equipment market?

North America leads as the fastest-growing region in the shale gas equipment market, projected to expand from $5.72 billion in 2023 to $11.69 billion in 2033, fueled by strong oil and gas production activities and technological advancements in extraction methods.

Does ConsaInsights provide customized market report data for the shale gas equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the shale gas equipment industry. This allows clients to receive personalized insights and analyses based on unique business requirements and market conditions.

What deliverables can I expect from this shale gas equipment market research project?

Expect comprehensive deliverables from the shale gas equipment market research project, including detailed reports, market segmentation data, trend analyses, competitive landscape assessments, and customized insights tailored to strategic planning and decision-making.

What are the market trends of shale gas equipment?

Key market trends in the shale gas equipment sector include a shift towards digital technologies, enhanced focus on sustainability, growing investments in R&D for efficient extraction technologies, and increased collaboration among industry players to streamline operations.