Sheet Molding Compound And Bulk Molding Compound Market Report

Published Date: 02 February 2026 | Report Code: sheet-molding-compound-and-bulk-molding-compound

Sheet Molding Compound And Bulk Molding Compound Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Sheet Molding Compound and Bulk Molding Compound market, including market sizing, growth forecasts for 2023 to 2033, segmentation, and insights by region. It seeks to uncover trends and future outlook to guide stakeholders.

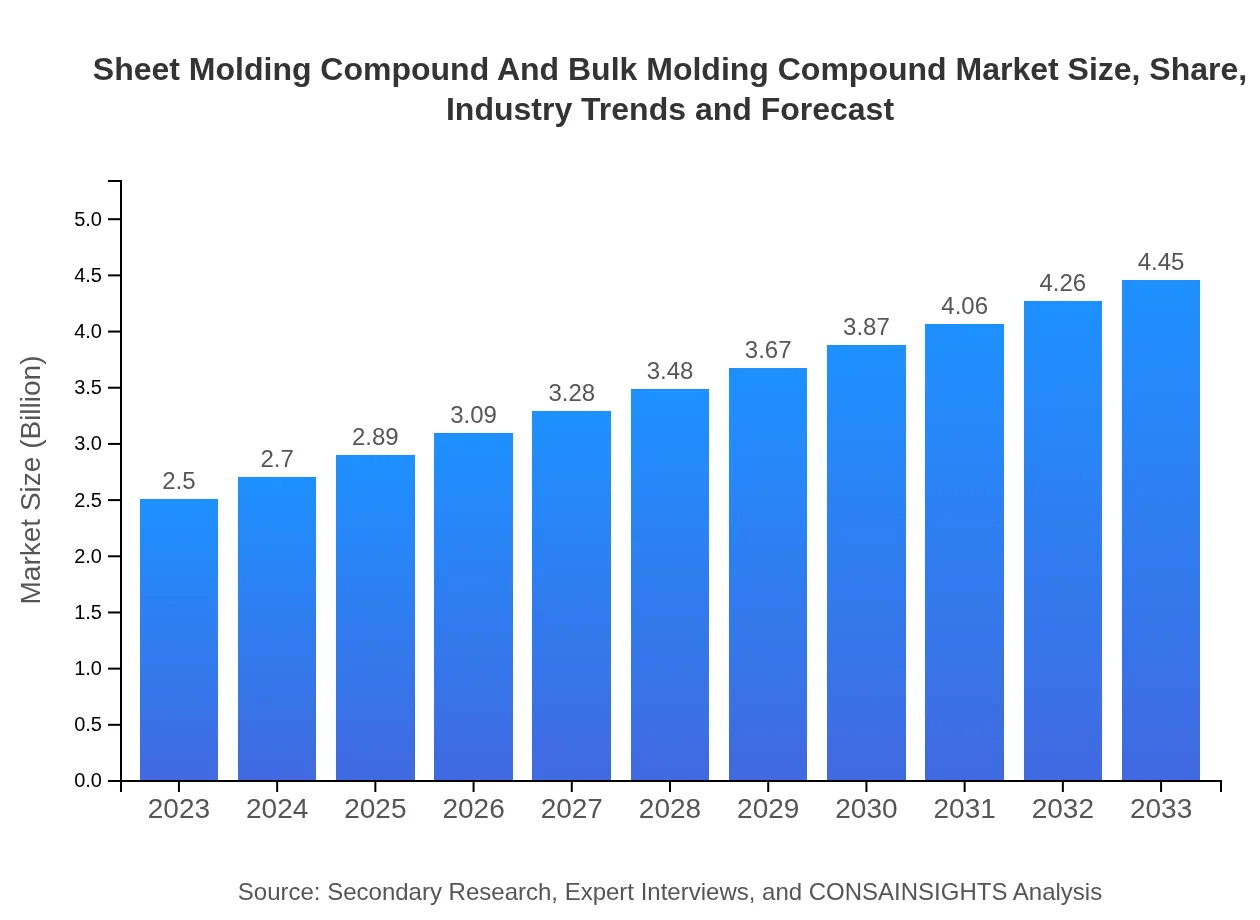

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $4.45 Billion |

| Top Companies | M. Holland Company, BASF SE, SABIC, IDI Composites International |

| Last Modified Date | 02 February 2026 |

Sheet Molding Compound And Bulk Molding Compound Market Overview

Customize Sheet Molding Compound And Bulk Molding Compound Market Report market research report

- ✔ Get in-depth analysis of Sheet Molding Compound And Bulk Molding Compound market size, growth, and forecasts.

- ✔ Understand Sheet Molding Compound And Bulk Molding Compound's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sheet Molding Compound And Bulk Molding Compound

What is the Market Size & CAGR of Sheet Molding Compound And Bulk Molding Compound market in 2023?

Sheet Molding Compound And Bulk Molding Compound Industry Analysis

Sheet Molding Compound And Bulk Molding Compound Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sheet Molding Compound And Bulk Molding Compound Market Analysis Report by Region

Europe Sheet Molding Compound And Bulk Molding Compound Market Report:

The European market shows strong growth, from 0.71 billion USD in 2023 to 1.26 billion USD by 2033, as companies seek lightweight materials that contribute to vehicle efficiency and comply with stringent environmental regulations.Asia Pacific Sheet Molding Compound And Bulk Molding Compound Market Report:

In 2023, the Asia Pacific market is estimated at approximately 0.50 billion USD, growing to 0.89 billion USD by 2033. The region's rapid industrialization, especially in countries like China and India, enhances the demand for SMC and BMC across automotive and construction industries.North America Sheet Molding Compound And Bulk Molding Compound Market Report:

North America, led by the U.S., holds a significant share of the market, valued at 0.91 billion USD in 2023 and projected to grow to 1.63 billion USD by 2033. The region's advanced automotive sector and investments in green technology are key drivers.South America Sheet Molding Compound And Bulk Molding Compound Market Report:

The South American market is currently valued at 0.12 billion USD in 2023, expected to reach 0.21 billion USD by 2033. This growth is driven by an increasing focus on infrastructure development and transportation projects.Middle East & Africa Sheet Molding Compound And Bulk Molding Compound Market Report:

The Middle East and Africa market is expected to grow from 0.26 billion USD in 2023 to 0.46 billion USD by 2033, aided by growing infrastructure projects and energy sector innovations.Tell us your focus area and get a customized research report.

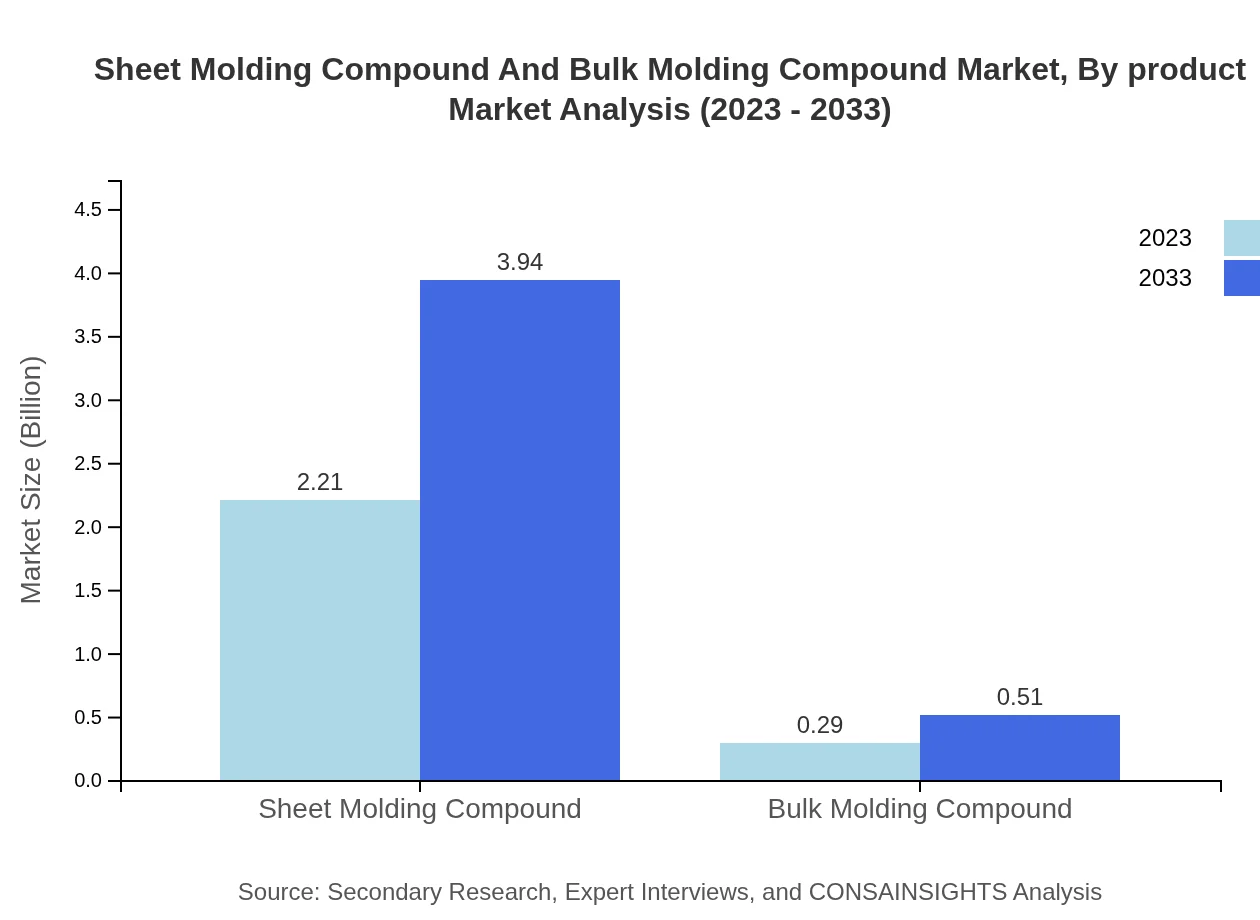

Sheet Molding Compound And Bulk Molding Compound Market Analysis By Product

The SMC and BMC market sees significant variations between product types. SMC dominated the market in 2023 with a size of 2.21 billion USD and anticipated growth to 3.94 billion USD by 2033, accounting for 88.49% of the market share. BMC, though smaller, shows an upward trend, growing from 0.29 billion USD to 0.51 billion USD, constituting 11.51% market share.

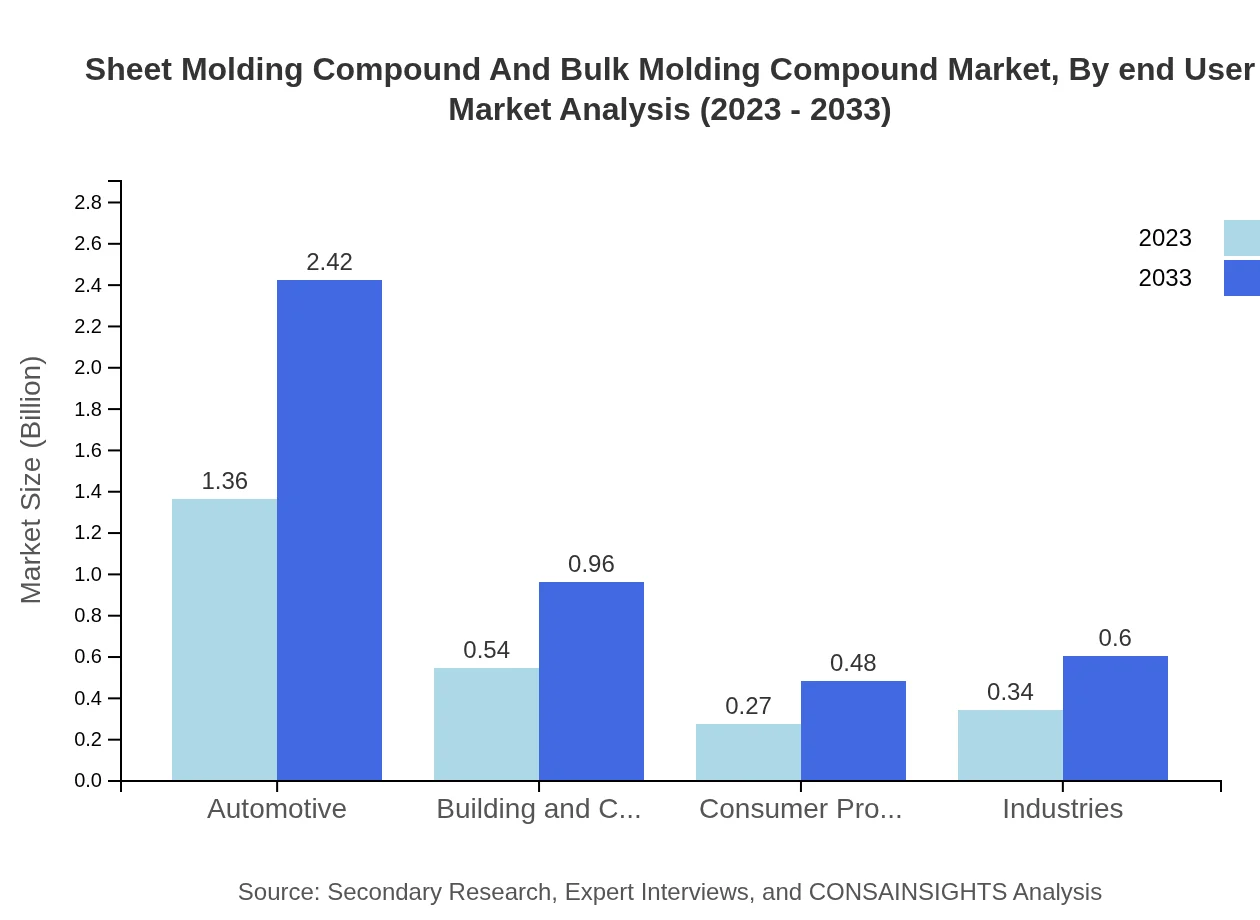

Sheet Molding Compound And Bulk Molding Compound Market Analysis By Application

The automotive segment leads the application market, with a size of 1.36 billion USD in 2023 forecasted to grow to 2.42 billion USD by 2033, holding a 54.34% share. Building and construction follows closely with a size of 0.54 billion USD, expected to increase to 0.96 billion USD, capturing 21.46% of the market.

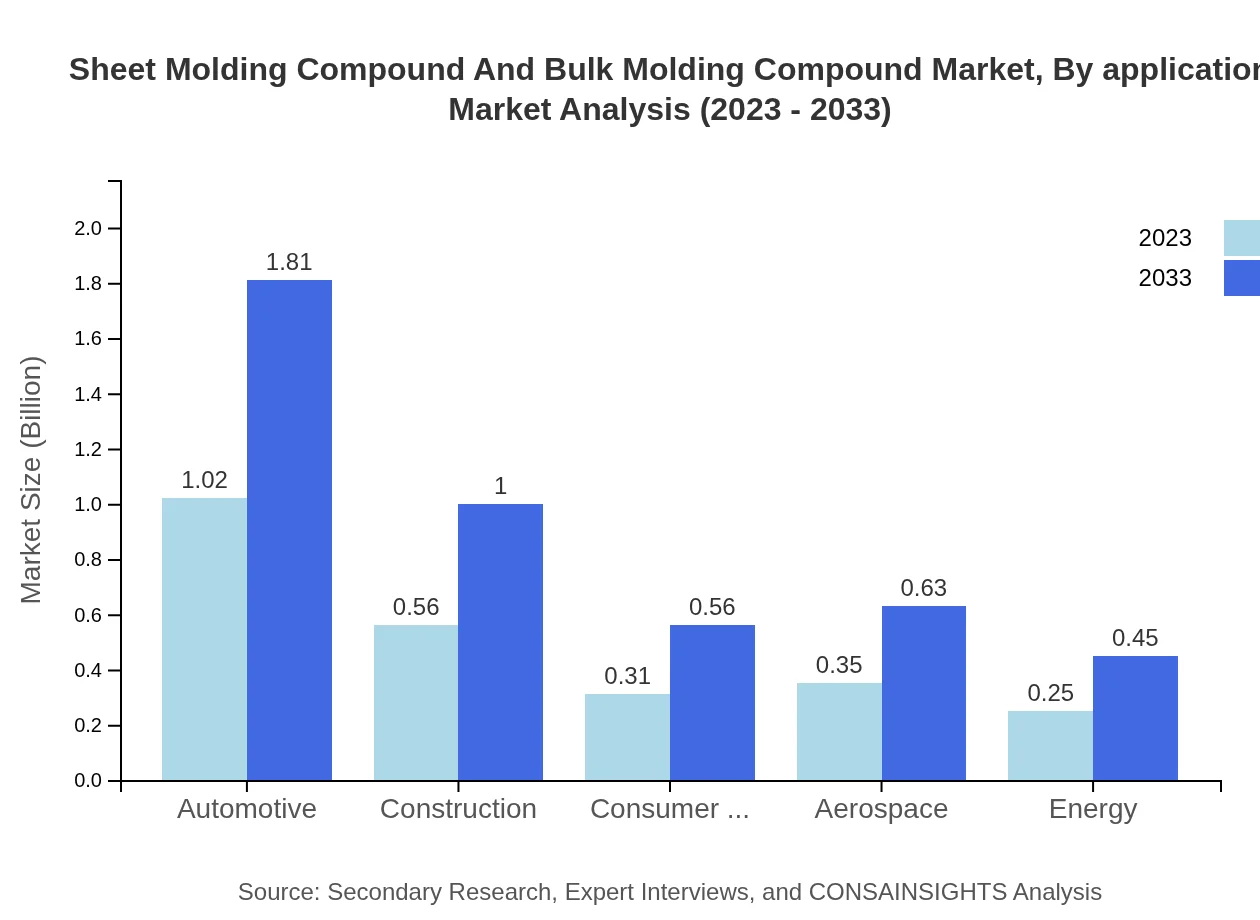

Sheet Molding Compound And Bulk Molding Compound Market Analysis By End User

End-user industries such as automotive and building are principal drivers. Automotive's growth from 1.02 billion USD to 1.81 billion USD highlights its importance, while construction applications due to rising infrastructure investments are also significant.

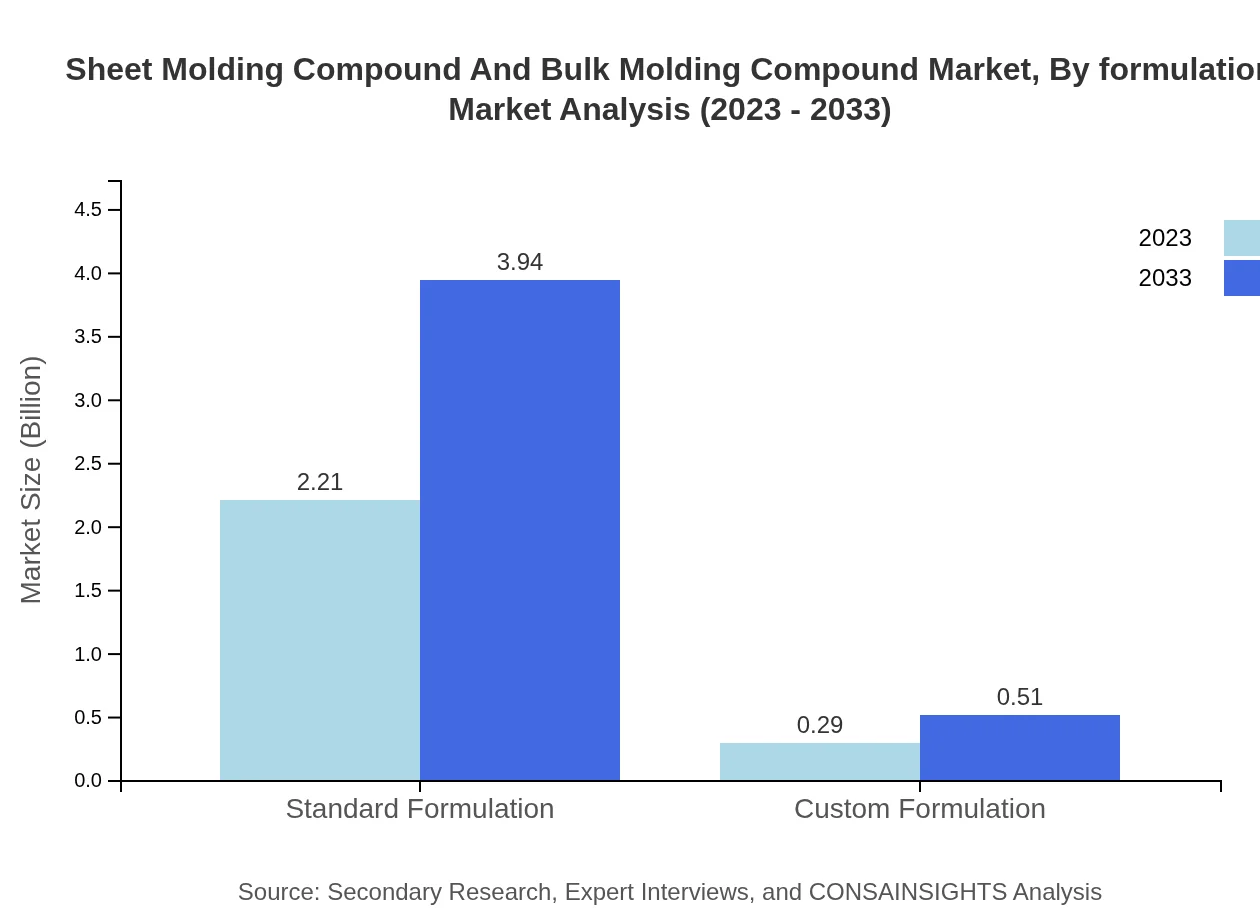

Sheet Molding Compound And Bulk Molding Compound Market Analysis By Formulation

The market is divided into standard and custom formulations. Standard formulations account for 88.49% of market share, significantly larger than custom formulations, which only capture 11.51% despite their growing relevance in specialty applications.

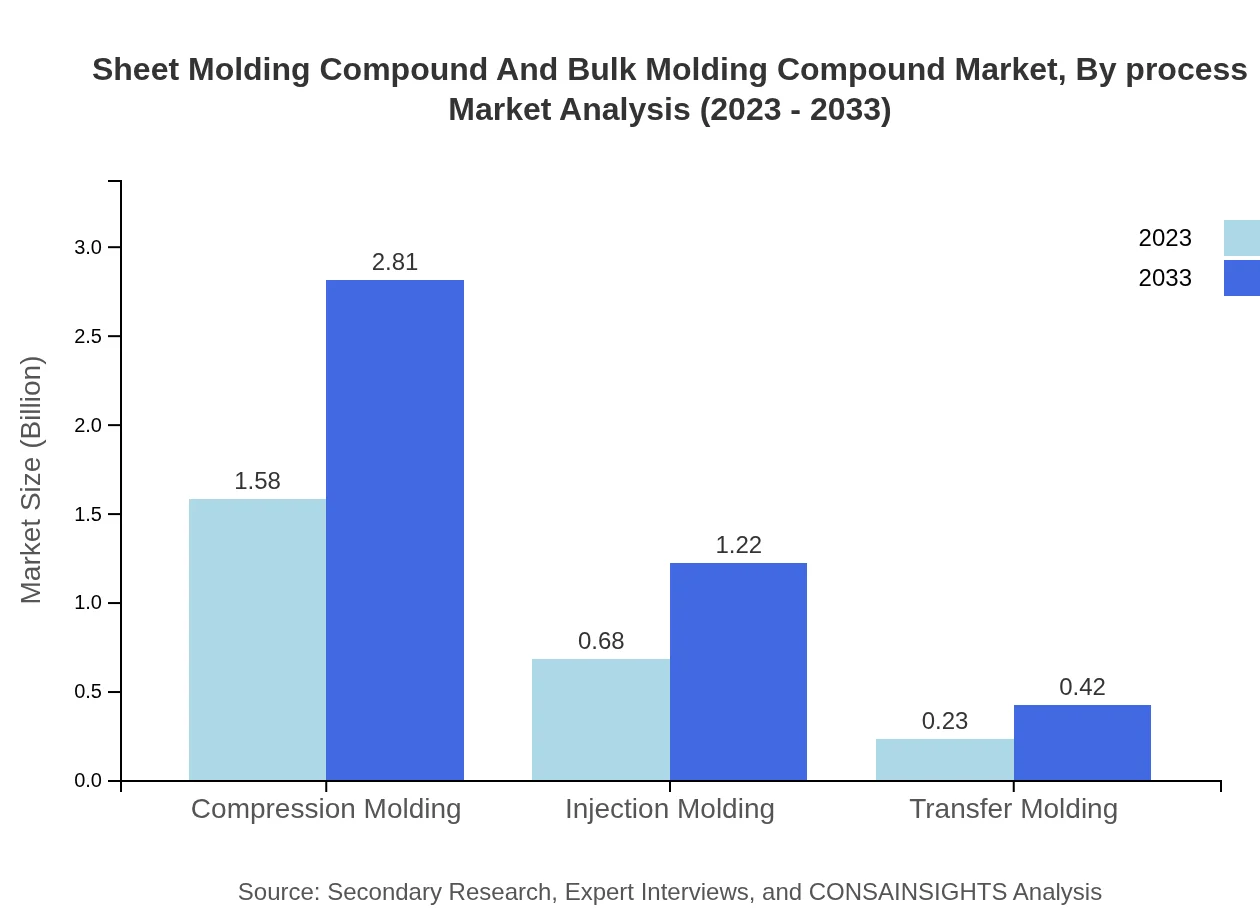

Sheet Molding Compound And Bulk Molding Compound Market Analysis By Process

In the processing segment, compression molding leads with a size of 1.58 billion USD in 2023, expected to grow to 2.81 billion USD. Injection molding and transfer molding, while smaller, play essential roles in specific applications.

Sheet Molding Compound And Bulk Molding Compound Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sheet Molding Compound And Bulk Molding Compound Industry

M. Holland Company:

M. Holland Company specializes in supplying thermoplastic and thermoset materials, widely recognized for their expertise in composite materials.BASF SE:

A global leader in chemicals, BASF SE offers a range of SMC and BMC products known for their high performance and sustainability.SABIC:

SABIC is a major player in the petrochemicals industry, providing advanced SMC/BMC solutions tailored to the automotive and consumer markets.IDI Composites International:

IDI specializes in manufacturing advanced composite solutions. Their innovative product lines have significantly contributed to the SMC/BMC market.We're grateful to work with incredible clients.

FAQs

What is the market size of sheet Molding Compound And Bulk Molding Compound?

The global market size for sheet molding compound and bulk molding compound is projected to reach $2.5 billion by 2033, growing at a CAGR of 5.8% from its current valuation in 2023, reflecting robust demand and innovation within the industry.

What are the key market players or companies in this sheet Molding Compound And Bulk Molding Compound industry?

Key market players in the sheet molding compound and bulk molding compound industry include established companies specializing in composite materials. These companies focus on innovation, operational excellence, and strategic partnerships to enhance their market presence and competitive advantage.

What are the primary factors driving the growth in the sheet Molding Compound And Bulk Molding Compound industry?

Primary factors driving growth in this industry include increasing demand in automotive applications, technological advancements in material properties, and the ongoing push for lightweight solutions in construction and manufacturing sectors, contributing to overall market expansion.

Which region is the fastest Growing in the sheet Molding Compound And Bulk Molding Compound?

Asia Pacific is identified as the fastest-growing region for the sheet molding compound and bulk molding compound market, with anticipated market growth from $0.50 billion in 2023 to $0.89 billion by 2033, spurred by increased industrial activity and infrastructure development.

Does Consaints provide customized market report data for the sheet Molding Compound And Bulk Molding Compound industry?

Yes, Consaints offers tailored market report data for the sheet molding compound and bulk molding compound industry, enabling clients to gain insights that match their specific business needs, ensuring a competitive edge in market strategy.

What deliverables can I expect from this sheet Molding Compound And Bulk Molding Compound market research project?

Deliverables from the market research project will include detailed market analysis reports, regional breakdowns, competitive landscapes, and forecasts, helping stakeholders to understand market dynamics and make informed decisions.

What are the market trends of sheet Molding Compound And Bulk Molding Compound?

Current market trends show a significant shift toward sustainable materials, increased application in electric vehicles, and advancements in composite technologies, with compression molding methods dominating market shares, suggesting an optimistic outlook for the future.