Short Fiber Thermoplastic Composites Market Report

Published Date: 02 February 2026 | Report Code: short-fiber-thermoplastic-composites

Short Fiber Thermoplastic Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Short Fiber Thermoplastic Composites market, encompassing market size, trends, and regional insights from 2023 to 2033. It aims to offer valuable data for stakeholders to make informed decisions in this growing industry.

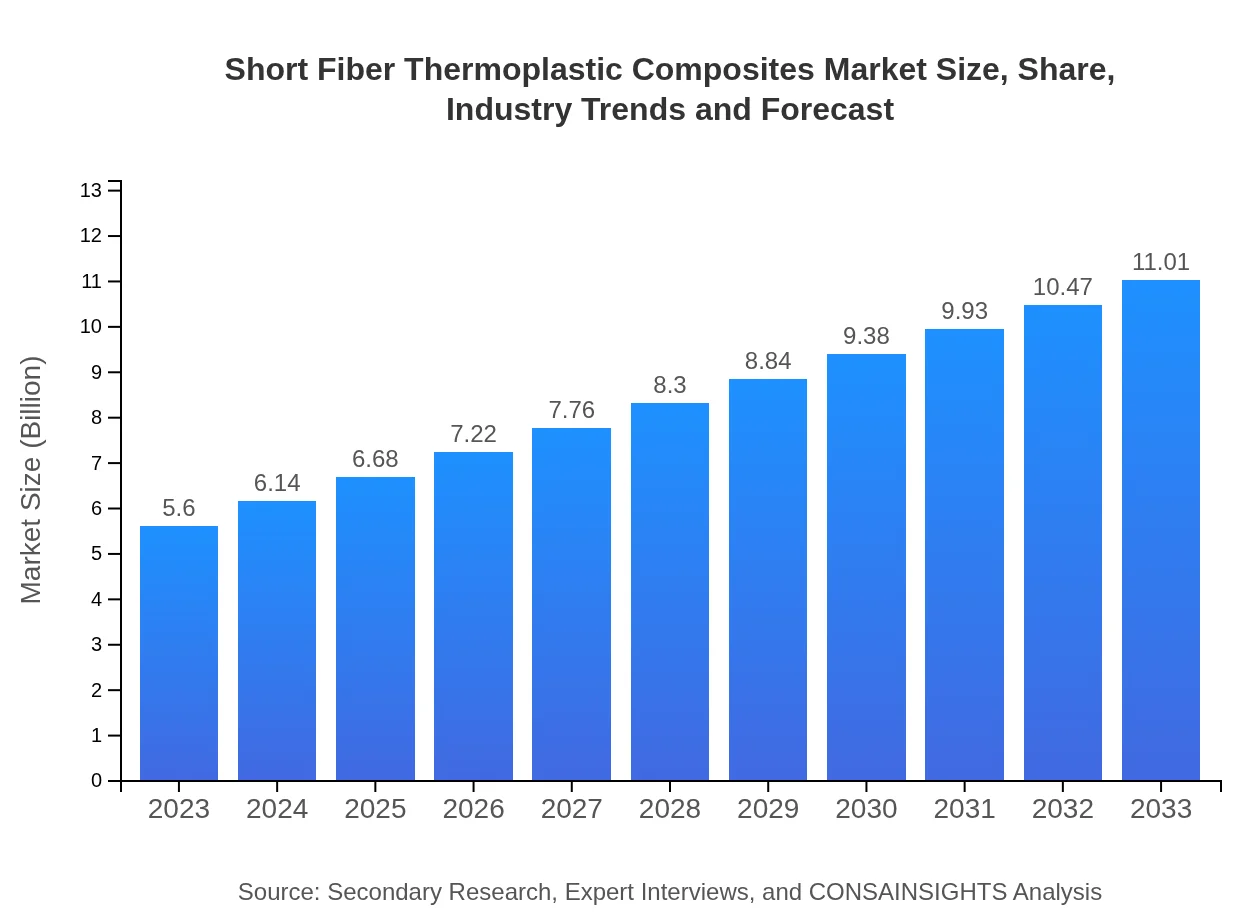

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | BASF SE, Toray Industries, Inc., SABIC |

| Last Modified Date | 02 February 2026 |

Short Fiber Thermoplastic Composites Market Overview

Customize Short Fiber Thermoplastic Composites Market Report market research report

- ✔ Get in-depth analysis of Short Fiber Thermoplastic Composites market size, growth, and forecasts.

- ✔ Understand Short Fiber Thermoplastic Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Short Fiber Thermoplastic Composites

What is the Market Size & CAGR of Short Fiber Thermoplastic Composites market in 2023?

Short Fiber Thermoplastic Composites Industry Analysis

Short Fiber Thermoplastic Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Short Fiber Thermoplastic Composites Market Analysis Report by Region

Europe Short Fiber Thermoplastic Composites Market Report:

Europe's market is forecasted to grow from $1.64 billion in 2023 to $3.21 billion by 2033. The demand for lightweight components in the automotive and aerospace industries, coupled with stringent environmental regulations promoting sustainable materials, is fueling this growth.Asia Pacific Short Fiber Thermoplastic Composites Market Report:

In the Asia Pacific region, the Short Fiber Thermoplastic Composites market is expected to grow from $1.07 billion in 2023 to $2.10 billion by 2033. The growth is attributed to the rapid industrialization and infrastructural developments in countries like China and India. The automotive sector's shift towards lightweight composites is also a driving factor.North America Short Fiber Thermoplastic Composites Market Report:

North America holds a significant market share with a projected size increase from $1.84 billion in 2023 to $3.62 billion in 2033. The region's emphasis on advanced manufacturing technologies and the rise in electric and hybrid vehicles contribute to robust market prospects.South America Short Fiber Thermoplastic Composites Market Report:

The South American market is projected to grow from $0.45 billion in 2023 to $0.88 billion in 2033. However, this growth is challenged by economic fluctuations in the region, although increasing investments in construction and automotive sectors could provide a boost.Middle East & Africa Short Fiber Thermoplastic Composites Market Report:

In the Middle East and Africa, the market is expected to grow from $0.61 billion in 2023 to $1.20 billion by 2033. Despite political and economic challenges, opportunities in the oil and gas, and construction sectors drive demand for composite materials.Tell us your focus area and get a customized research report.

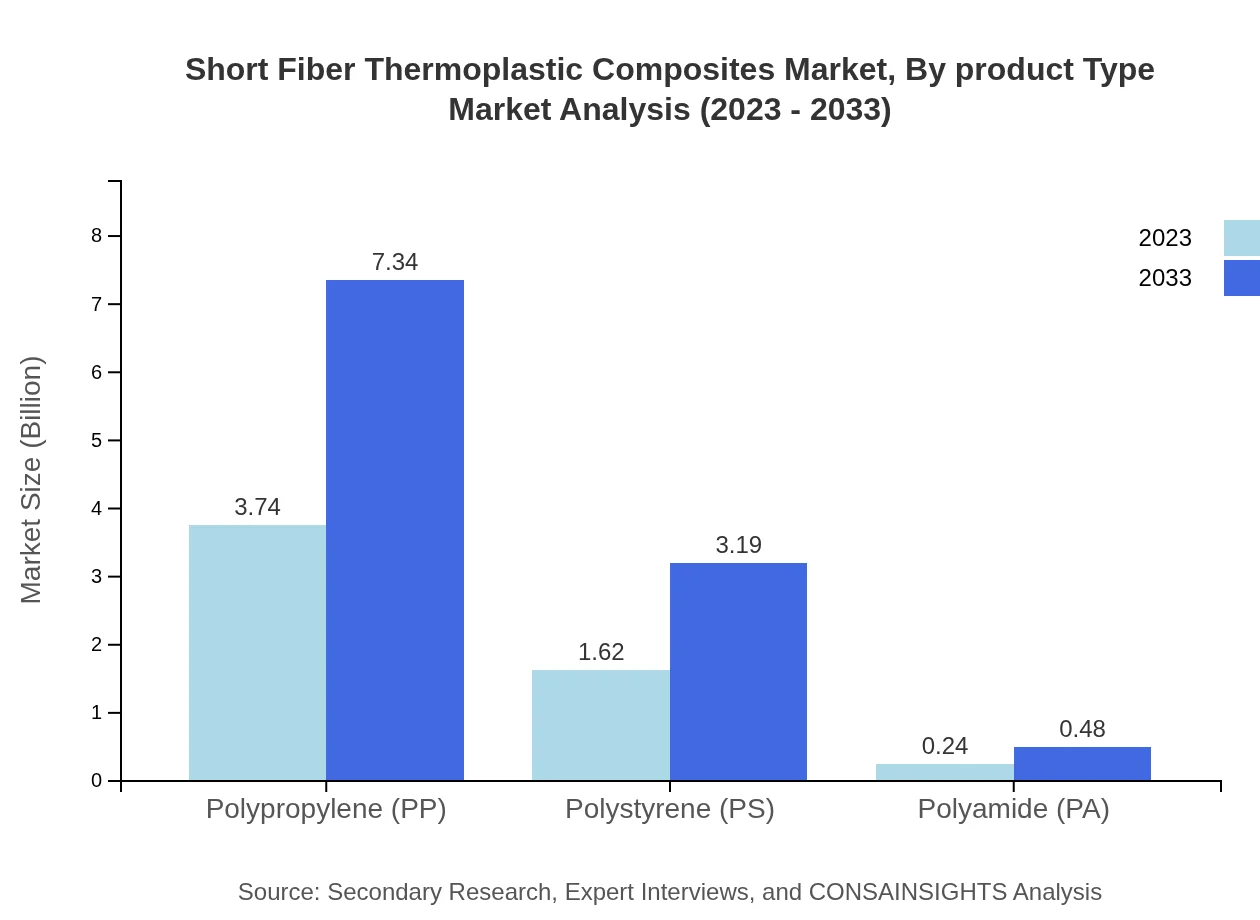

Short Fiber Thermoplastic Composites Market Analysis By Product Type

The product types in the Short Fiber Thermoplastic Composites market include polypropylene (PP), polystyrene (PS), polyamide (PA), reinforced composites, and non-reinforced composites. Among these, polypropylene is the leading segment, anticipated to grow from $3.74 billion in 2023 to $7.34 billion by 2033, and maintaining a 66.73% market share.

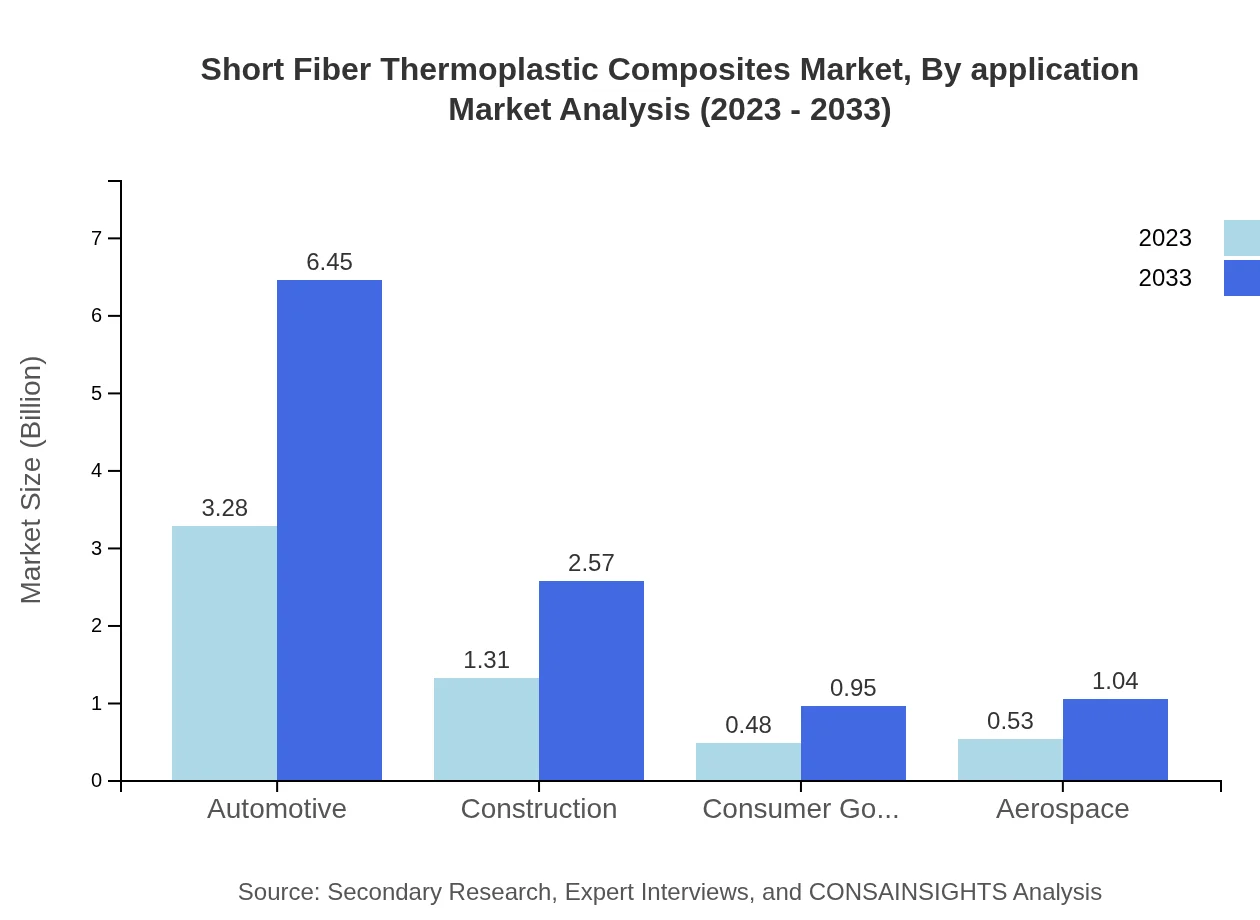

Short Fiber Thermoplastic Composites Market Analysis By Application

The application segments encompass automotive, aerospace, construction, consumer goods, and electronics. The automotive sector remains dominant, with market value rising from $3.28 billion in 2023 to $6.45 billion by 2033, representing 58.6% of the market share.

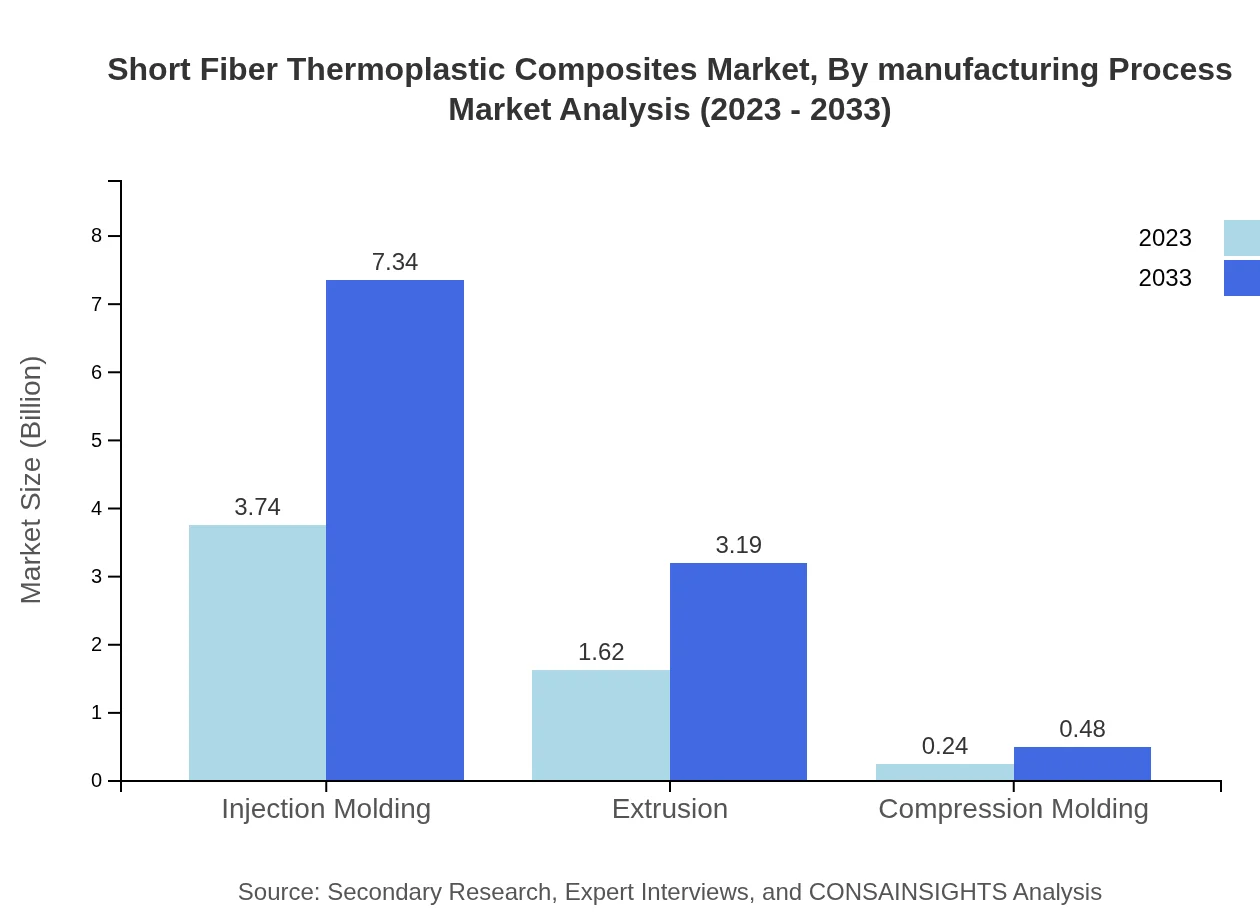

Short Fiber Thermoplastic Composites Market Analysis By Manufacturing Process

Manufacturing processes include injection molding, extrusion, and compression molding. Injection molding is forecasted to represent a significant share at 66.73%, growing from $3.74 billion in 2023 to $7.34 billion in 2033.

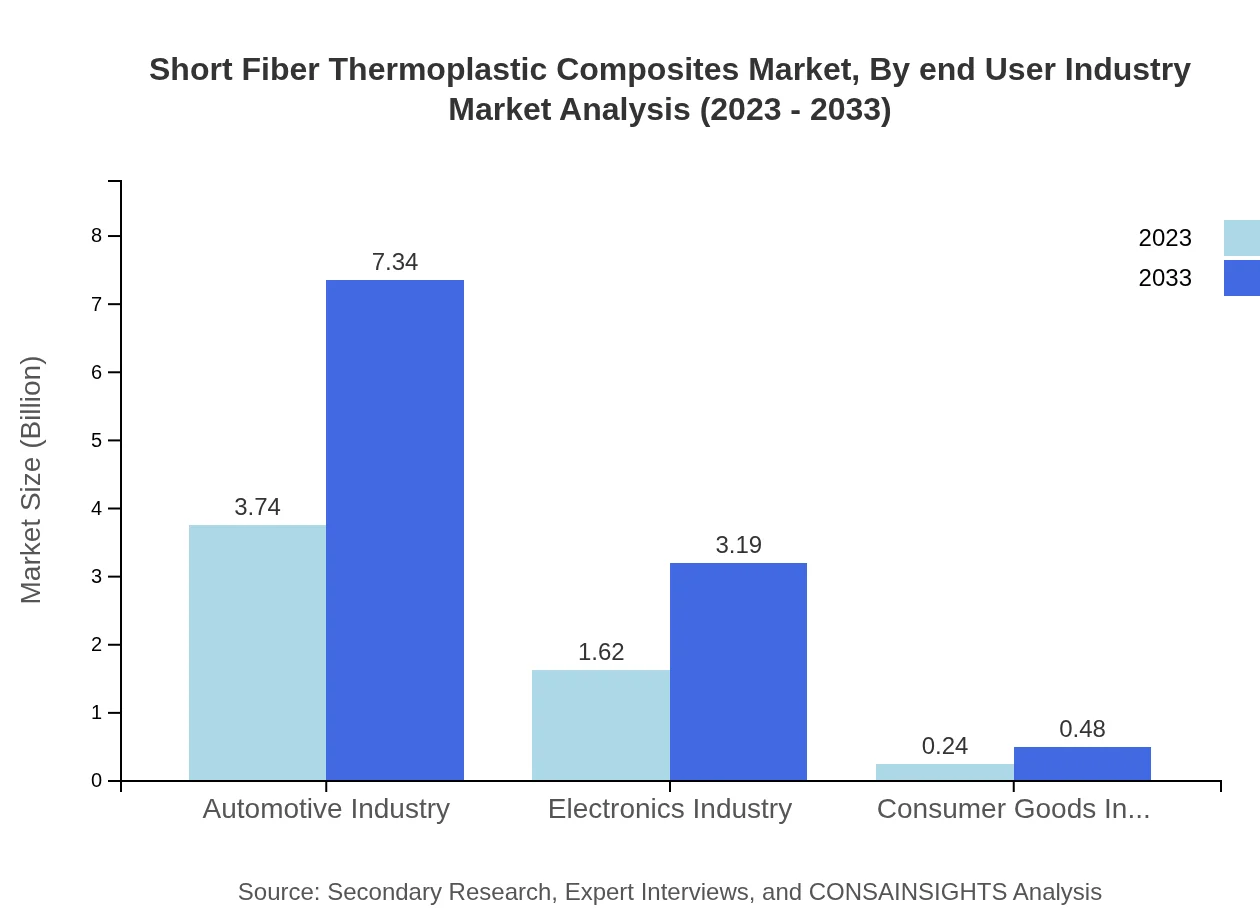

Short Fiber Thermoplastic Composites Market Analysis By End User Industry

End-user industries span automotive, electronics, consumer goods, and construction sectors. The automotive industry shows a strong presence, projected to grow from $3.74 billion in 2023 to $7.34 billion by 2033.

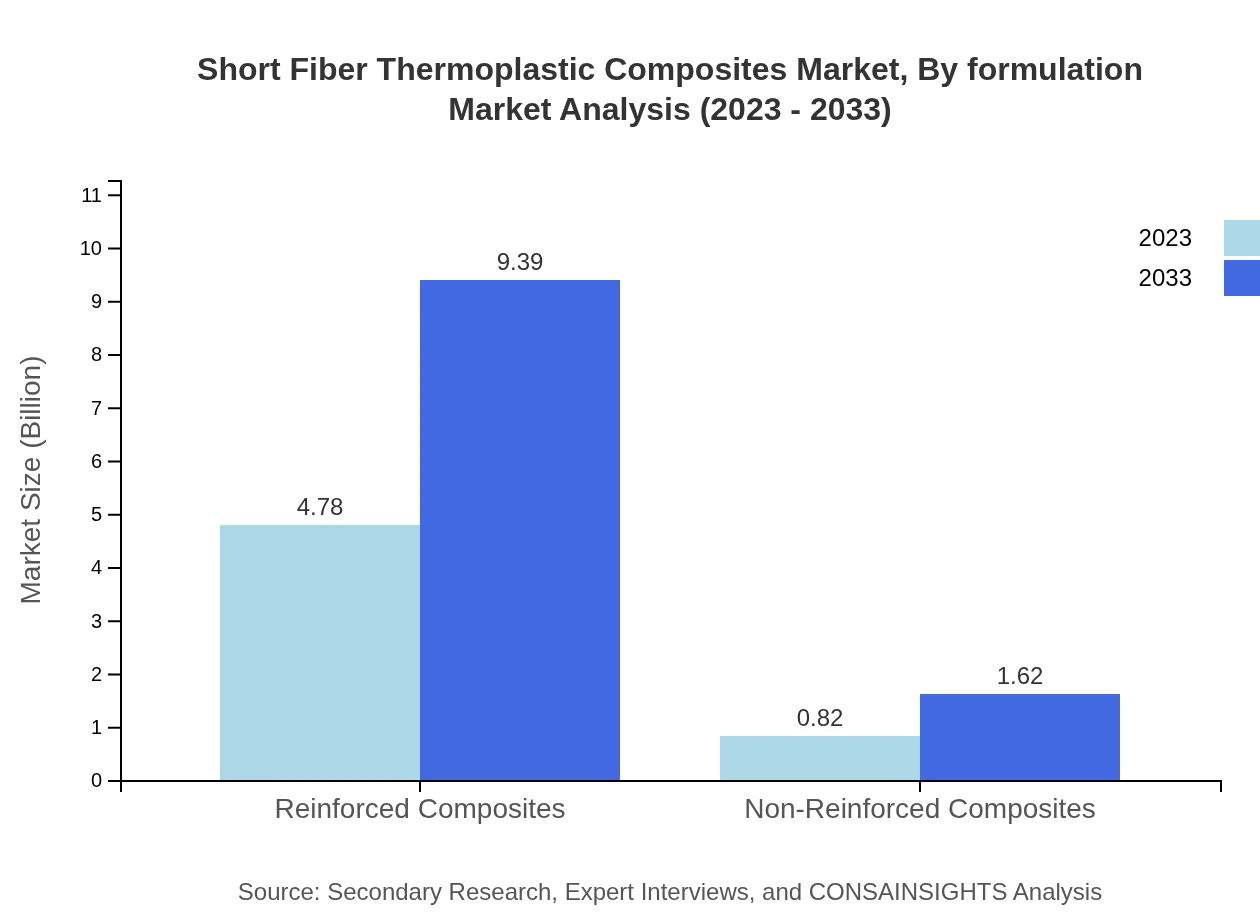

Short Fiber Thermoplastic Composites Market Analysis By Formulation

Formulations are segmented based on fiber types and resins. Reinforced composites are anticipated to dominate this segment with an 85.31% market share, signaling sustained demand for high-performance materials.

Short Fiber Thermoplastic Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Short Fiber Thermoplastic Composites Industry

BASF SE:

A leading chemical company, BASF develops innovative solutions and materials, including high-performance composites, focusing on sustainability and customer applications.Toray Industries, Inc.:

Known for its advanced composite technologies, Toray is a global leader in synthetic fibers, producing high-quality thermoplastic composites for various industries.SABIC:

A global leader in diversified chemicals, SABIC manufactures innovative polymer products and thermoplastic composites, emphasizing sustainable solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of short Fiber Thermoplastic Composites?

The short-fiber thermoplastic composites market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8%. This growth indicates robust demand and expansion expected over the next decade.

What are the key market players or companies in this short Fiber Thermoplastic Composites industry?

Key players in the short-fiber thermoplastic composites market include global leaders in materials and composites such as BASF, SABIC, and Solvay. These companies are at the forefront of innovation and growth in this emerging sector.

What are the primary factors driving growth in the short Fiber Thermoplastic Composites industry?

Growth in the short-fiber thermoplastic composites industry is driven by increased demand for lightweight materials in automotive and aerospace sectors, advancements in manufacturing technologies, and a rising focus on sustainability and recyclability.

Which region is the fastest Growing in the short Fiber Thermoplastic Composites?

The Asia Pacific region is currently the fastest-growing market for short-fiber thermoplastic composites, with a market size expected to increase from $1.07 billion in 2023 to $2.10 billion by 2033, driven by industrial growth and investments.

Does ConsaInsights provide customized market report data for the short Fiber Thermoplastic Composites industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing businesses to gain detailed insights into the short-fiber thermoplastic composites industry, including trends, forecasts, and competitive analysis.

What deliverables can I expect from this short Fiber Thermoplastic Composites market research project?

From the market research project on short-fiber thermoplastic composites, you can expect comprehensive reports, detailed market analysis, forecasts, segmentation data, and actionable insights for strategic decision-making.

What are the market trends of short Fiber Thermoplastic Composites?

Key trends in the short-fiber thermoplastic composites market include increasing adoption in automotive and construction industries, growing emphasis on sustainable materials, and innovation in manufacturing processes such as injection molding and extrusion.