Shortening Fat Market Report

Published Date: 31 January 2026 | Report Code: shortening-fat

Shortening Fat Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Shortening Fat market, including current trends, regional insights, segmentation details, and forecasts from 2023 to 2033.

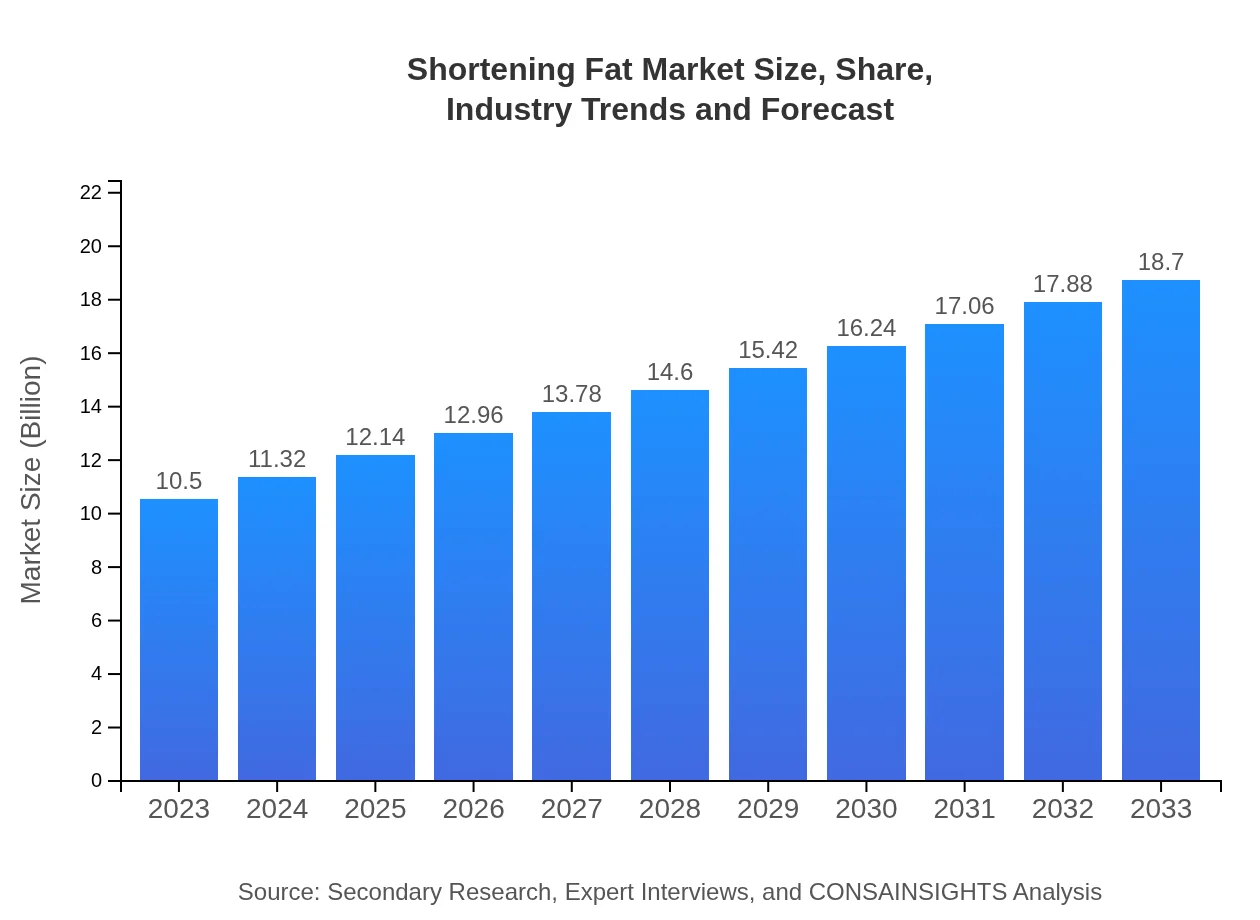

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited |

| Last Modified Date | 31 January 2026 |

Shortening Fat Market Overview

Customize Shortening Fat Market Report market research report

- ✔ Get in-depth analysis of Shortening Fat market size, growth, and forecasts.

- ✔ Understand Shortening Fat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Shortening Fat

What is the Market Size & CAGR of Shortening Fat market in 2023?

Shortening Fat Industry Analysis

Shortening Fat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Shortening Fat Market Analysis Report by Region

Europe Shortening Fat Market Report:

In Europe, the market size is expected to grow from $3.06 billion in 2023 to $5.45 billion in 2033, with increasing health consciousness among consumers driving the demand for healthier shortening options.Asia Pacific Shortening Fat Market Report:

In the Asia-Pacific region, the Shortening Fat market is projected to grow from $2.17 billion in 2023 to $3.87 billion by 2033, driven by increasing urbanization and demand for convenience foods.North America Shortening Fat Market Report:

North America leads the market, projected to reach $6.17 billion by 2033 from $3.47 billion in 2023. The growth is attributed to the strong demand for processed and convenience foods.South America Shortening Fat Market Report:

The South American market is expected to witness growth from $0.78 billion in 2023 to $1.39 billion in 2033, supported by rising disposable incomes and rapid growth in the food services sector.Middle East & Africa Shortening Fat Market Report:

The Middle East and Africa region is anticipated to grow from $1.02 billion in 2023 to $1.81 billion in 2033, boosted by increasing investments in food processing industries.Tell us your focus area and get a customized research report.

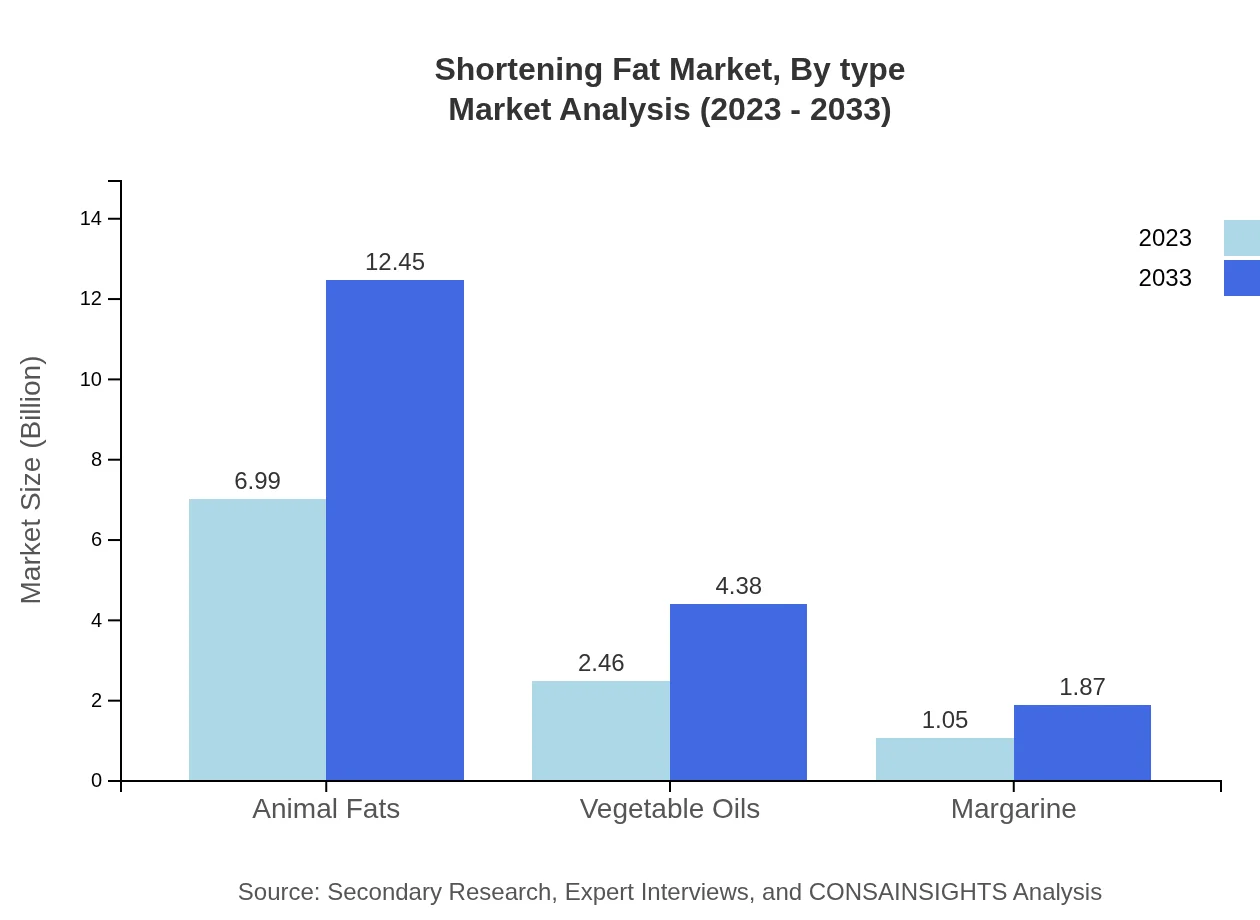

Shortening Fat Market Analysis By Type

The market comprises various types such as Animal Fats (market size in 2023: $6.99 billion, 2033: $12.45 billion), Vegetable Oils (2023: $2.46 billion, 2033: $4.38 billion), and Margarine (2023: $1.05 billion, 2033: $1.87 billion). Animal fats dominate the market with a share of 66.57%, while vegetable oils follow at 23.42%.

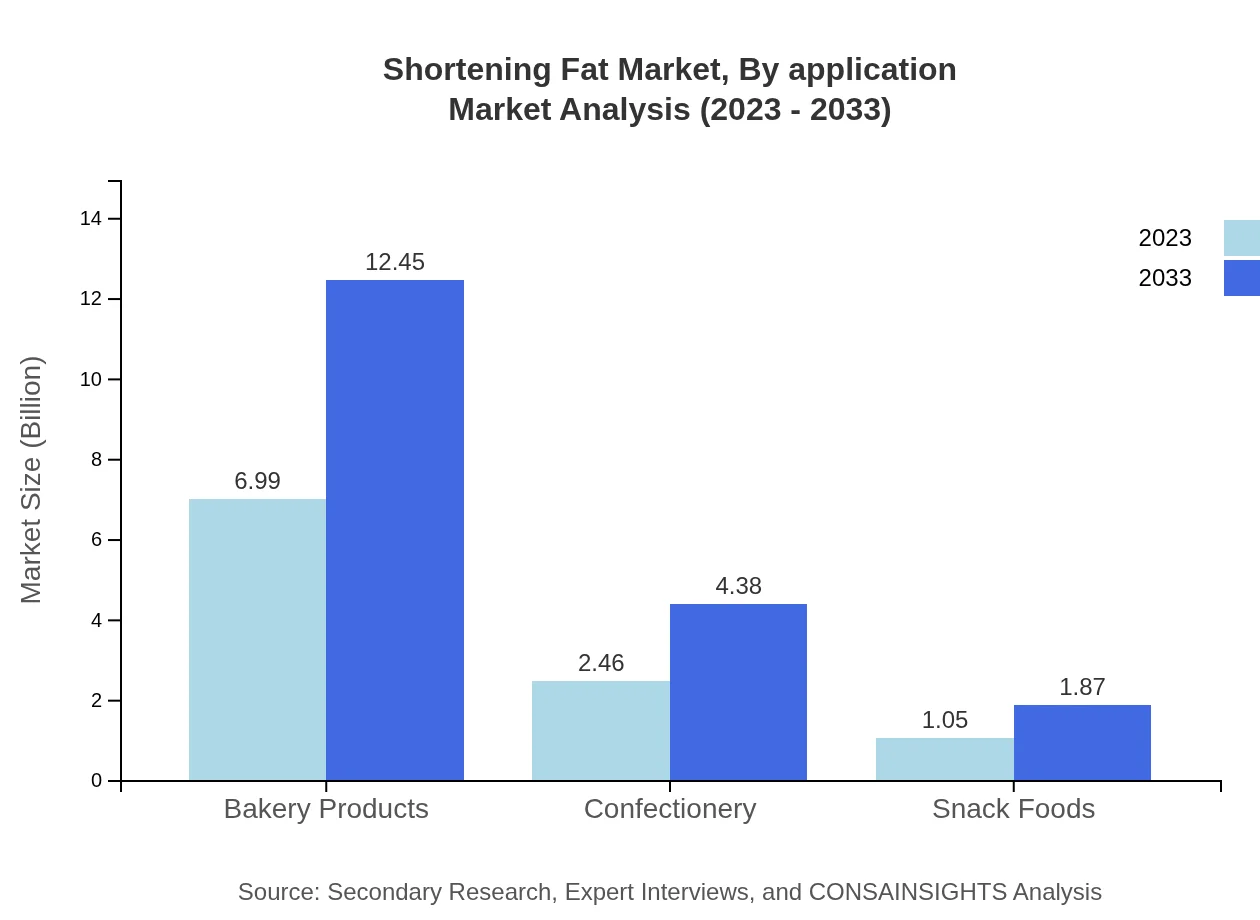

Shortening Fat Market Analysis By Application

Key applications include Bakery Products (2023: $6.99 billion, 2033: $12.45 billion), Confectionery (2023: $2.46 billion, 2033: $4.38 billion), and Snack Foods (2023: $1.05 billion, 2033: $1.87 billion). Bakery products hold the major share at 66.57%.

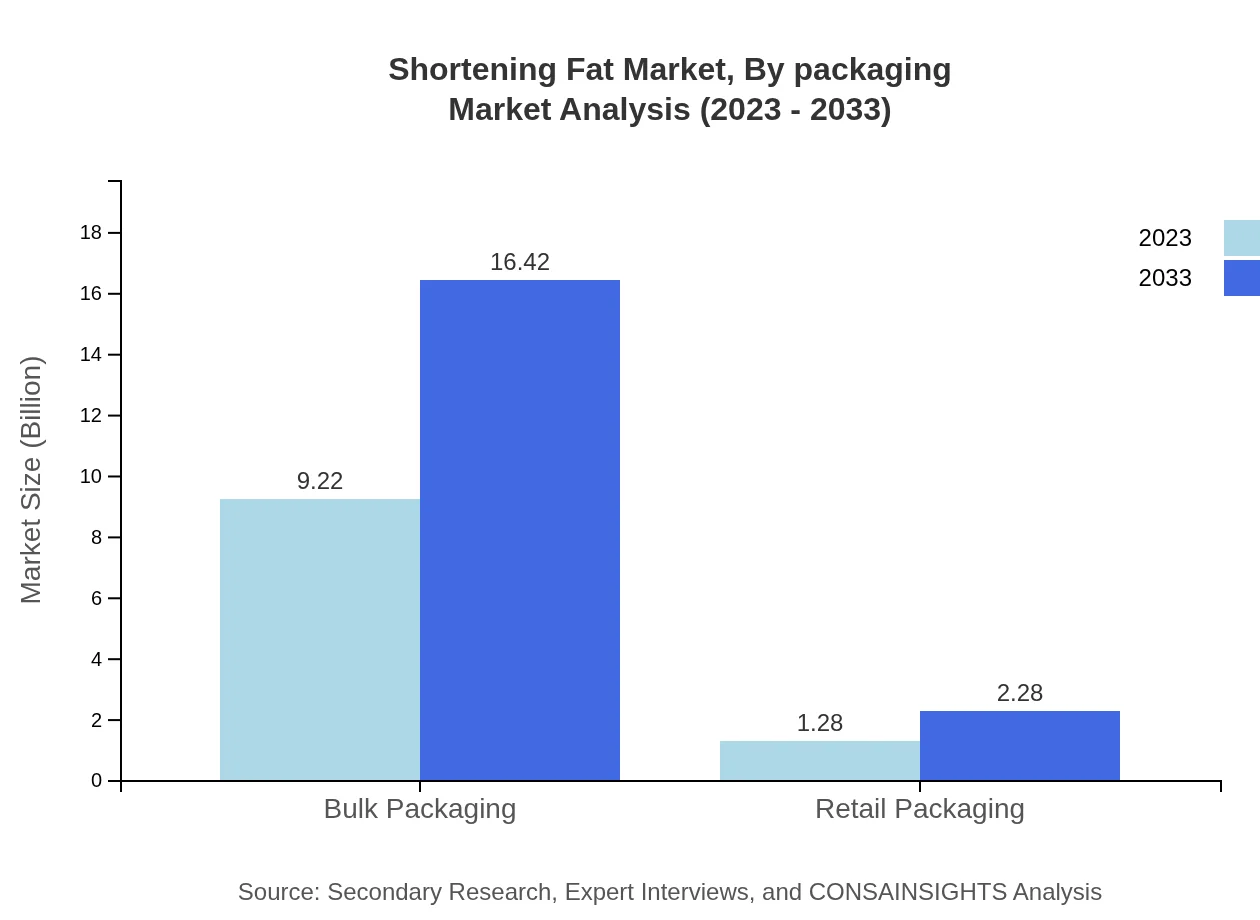

Shortening Fat Market Analysis By Packaging

The Shortening Fat market is segmented into Bulk Packaging (2023: $9.22 billion, 2033: $16.42 billion) and Retail Packaging (2023: $1.28 billion, 2033: $2.28 billion). Bulk packaging takes a significant share at 87.8%.

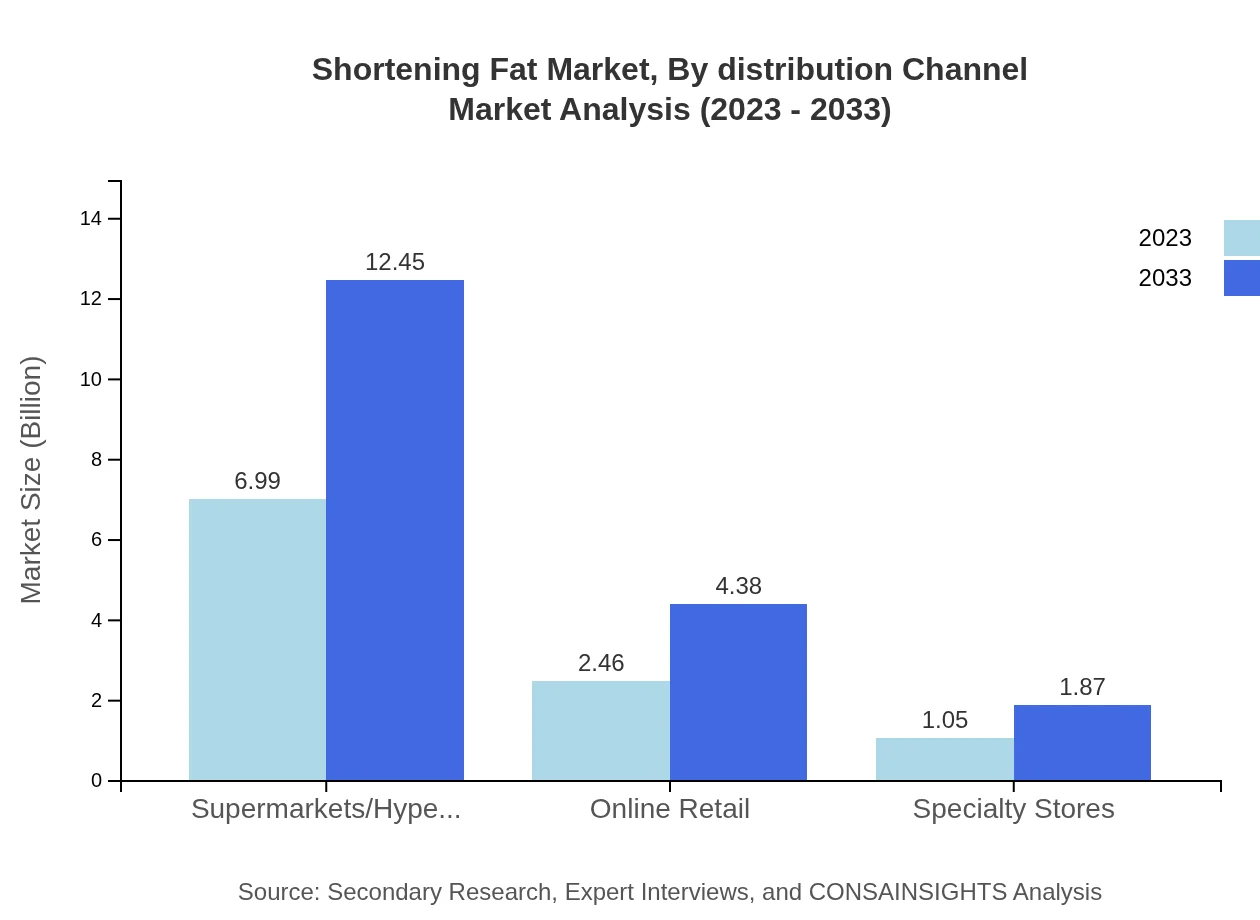

Shortening Fat Market Analysis By Distribution Channel

Distribution channels include Supermarkets/Hypermarkets (2023: $6.99 billion, 2033: $12.45 billion), Online Retail (2023: $2.46 billion, 2033: $4.38 billion), and Specialty Stores (2023: $1.05 billion, 2033: $1.87 billion). Supermarkets/hypermarkets dominate with a share of 66.57%.

Shortening Fat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Shortening Fat Industry

Cargill, Incorporated:

A leading global supplier of vegetable oils and fats offering a diverse portfolio of shortening products and innovative solutions to the food industry.Archer Daniels Midland Company (ADM):

ADM is a major player in the agricultural and food processing industry, producing various oils and shortenings that cater to the needs of food manufacturers.Bunge Limited:

Bunge is a top producer of cooking oils and fats, focusing on quality and sustainability in its products, including shortening fats for food applications.We're grateful to work with incredible clients.

FAQs

What is the market size of shortening Fat?

The global shortening-fat market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 5.8%, reaching significant growth by 2033.

What are the key market players or companies in this shortening Fat industry?

Key market players in the shortening-fat industry include major food manufacturers, agricultural producers, and companies specializing in fat and oil production, contributing significantly to the market dynamics.

What are the primary factors driving the growth in the shortening Fat industry?

Growth in the shortening-fat industry is driven by rising demand for processed foods, increasing popularity of bakery products, and innovations in food technology enhancing production processes.

Which region is the fastest Growing in the shortening Fat market?

North America is the fastest-growing region in the shortening-fat market, projected to reach $6.17 billion by 2033, driven by increased consumption of convenience foods and bakery products.

Does ConsaInsights provide customized market report data for the shortening Fat industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the shortening-fat industry, providing in-depth insights and market analysis for various stakeholders.

What deliverables can I expect from this shortening Fat market research project?

Deliverables include comprehensive market analysis reports, regional insights, segment data, and forecasts over the next decade, enabling informed business decisions within the shortening-fat sector.

What are the market trends of shortening Fat?

Current trends in the shortening-fat market include a shift towards healthier fat alternatives, increasing usage in vegan products, and growth in e-commerce platforms for distribution.