Siding Market Report

Published Date: 22 January 2026 | Report Code: siding

Siding Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Siding market, encompassing market size, growth trends, regional analyses, and forecasts from 2023 to 2033. Detailed data on market segments and leading companies in the industry will also be discussed.

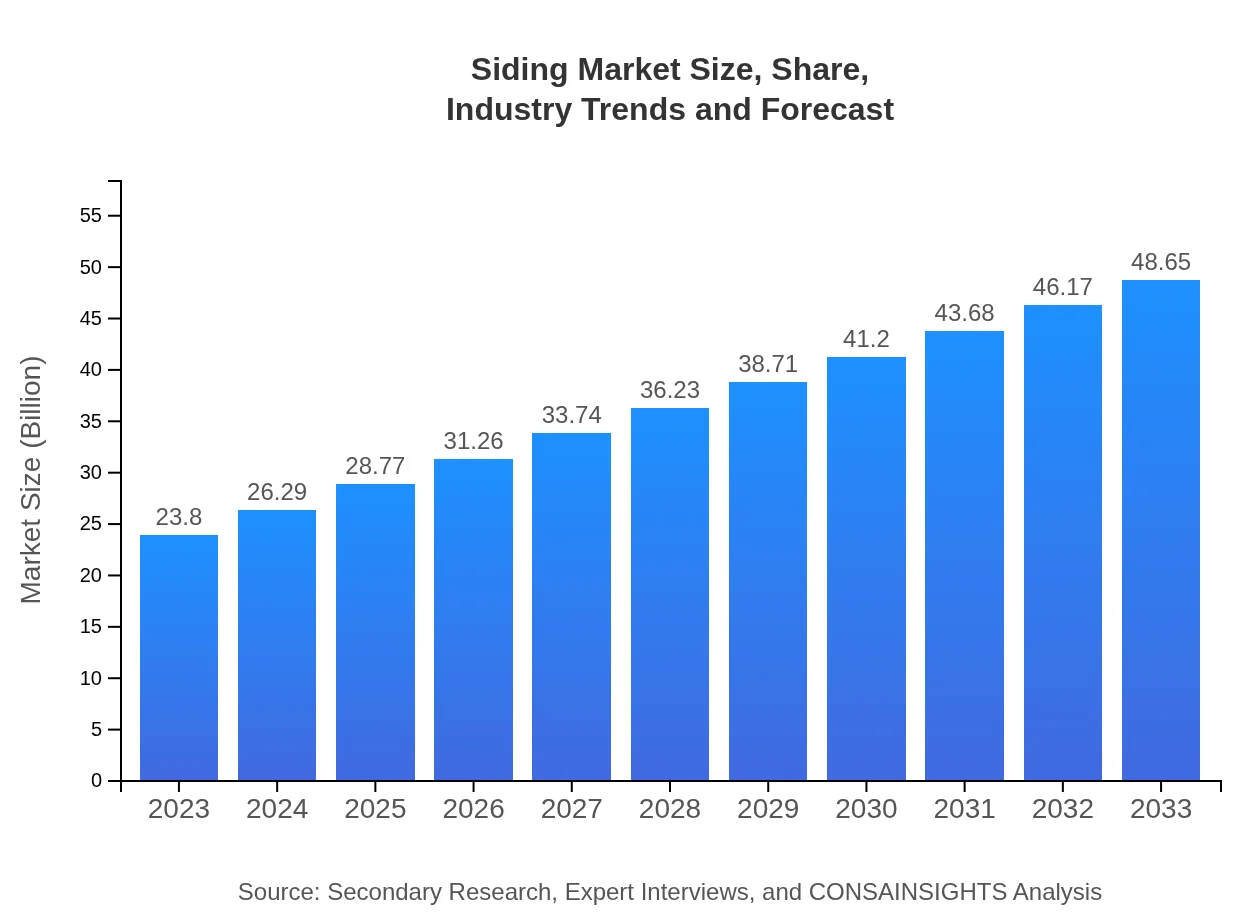

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $48.65 Billion |

| Top Companies | CertainTeed, James Hardie Industries, Royal Building Products, LP Building Solutions |

| Last Modified Date | 22 January 2026 |

Siding Market Overview

Customize Siding Market Report market research report

- ✔ Get in-depth analysis of Siding market size, growth, and forecasts.

- ✔ Understand Siding's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Siding

What is the Market Size & CAGR of Siding market in 2023?

Siding Industry Analysis

Siding Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Siding Market Analysis Report by Region

Europe Siding Market Report:

Europe's siding market will grow from $5.84 billion in 2023 to $11.94 billion by 2033. The market's expansion is supported by regulatory frameworks aimed at improving energy efficiency in buildings and the growing trend of aesthetically pleasing facades.Asia Pacific Siding Market Report:

The Asia Pacific region is projected to see significant increases in demand for siding, with a market valuation of $10.64 billion by 2033, compared to $5.21 billion in 2023. Key growth factors include urbanization, population growth, and rising disposable incomes.North America Siding Market Report:

North America remains the largest market for siding, expected to increase from $7.74 billion in 2023 to $15.81 billion by 2033. The substantial demand is driven by renovation and new construction projects, alongside consumer preference for sustainable and energy-efficient products.South America Siding Market Report:

In South America, the siding market is expected to expand from $1.99 billion in 2023 to $4.07 billion by 2033. This growth is attributed to increasing construction activities and a growing awareness of the benefits of quality siding materials.Middle East & Africa Siding Market Report:

The Middle East and Africa are also poised for growth, projecting a rise from $3.03 billion in 2023 to $6.19 billion by 2033. Contributing factors include increasing urbanization and a surge in residential construction projects.Tell us your focus area and get a customized research report.

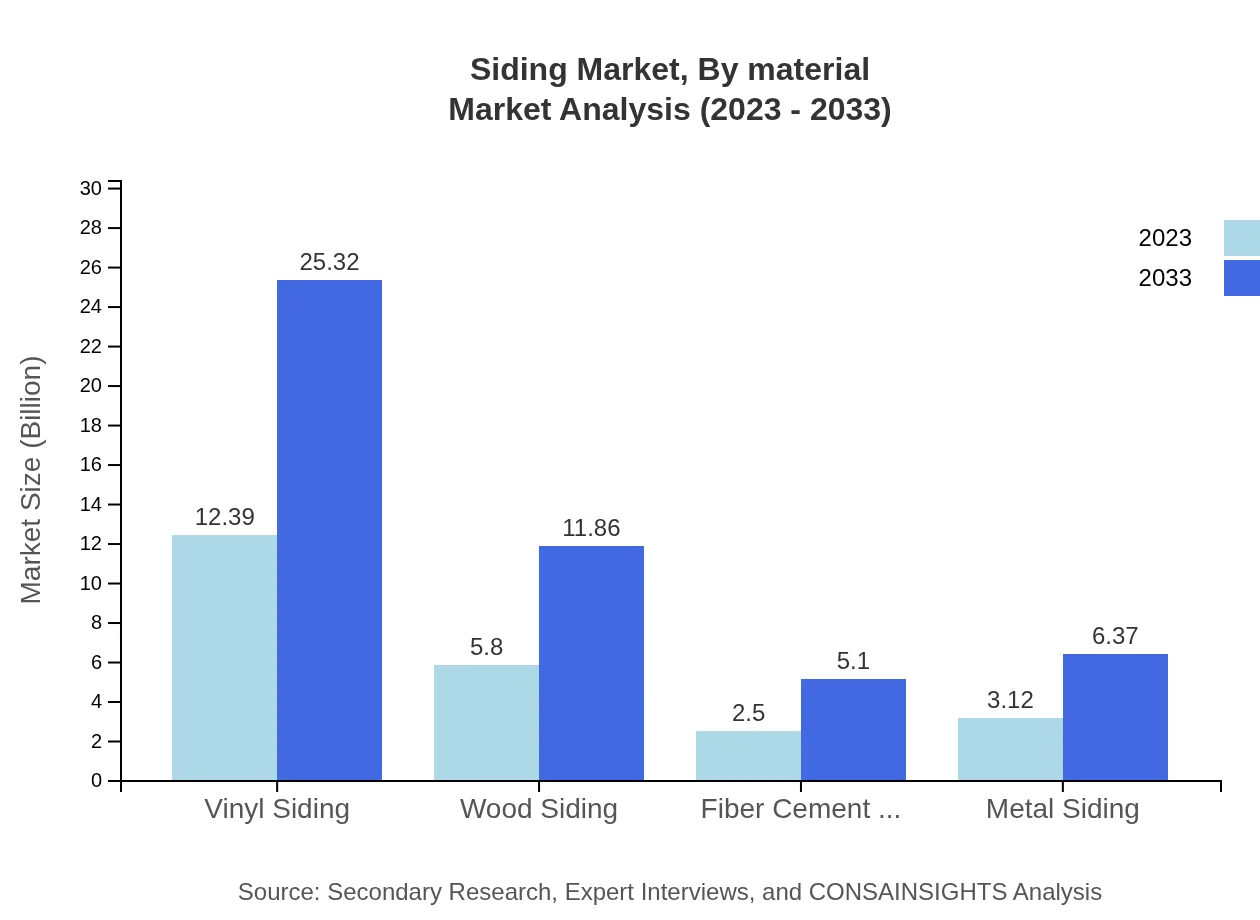

Siding Market Analysis By Material

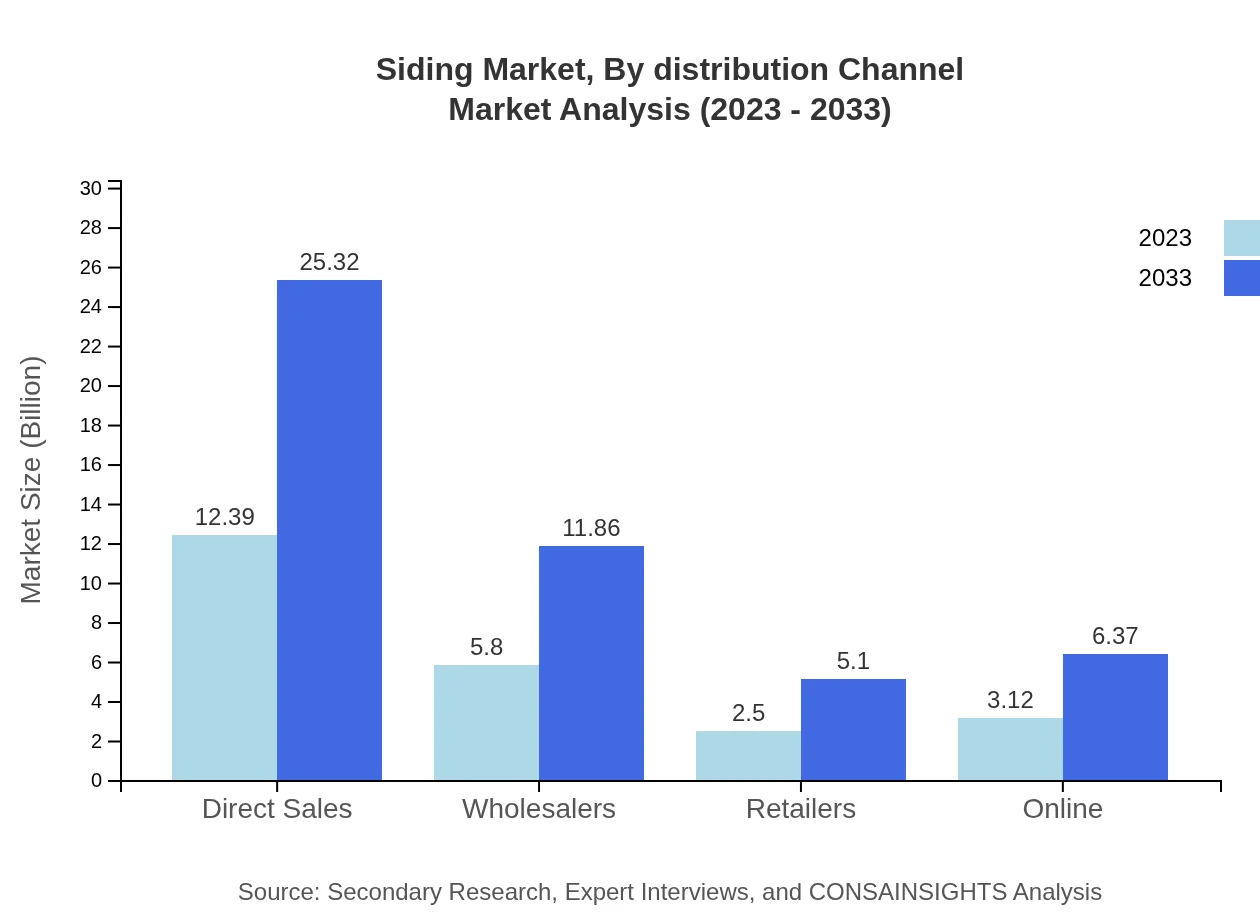

The Siding market by material includes vinyl, wood, fiber cement, metal, and others. Vinyl siding leads with a projected market size of $25.32 billion by 2033, reflecting its popularity due to low cost and low maintenance. Wood siding, being a traditional favorite, is anticipated to grow to $11.86 billion, while fiber cement is expected to reach $5.10 billion by the same year.

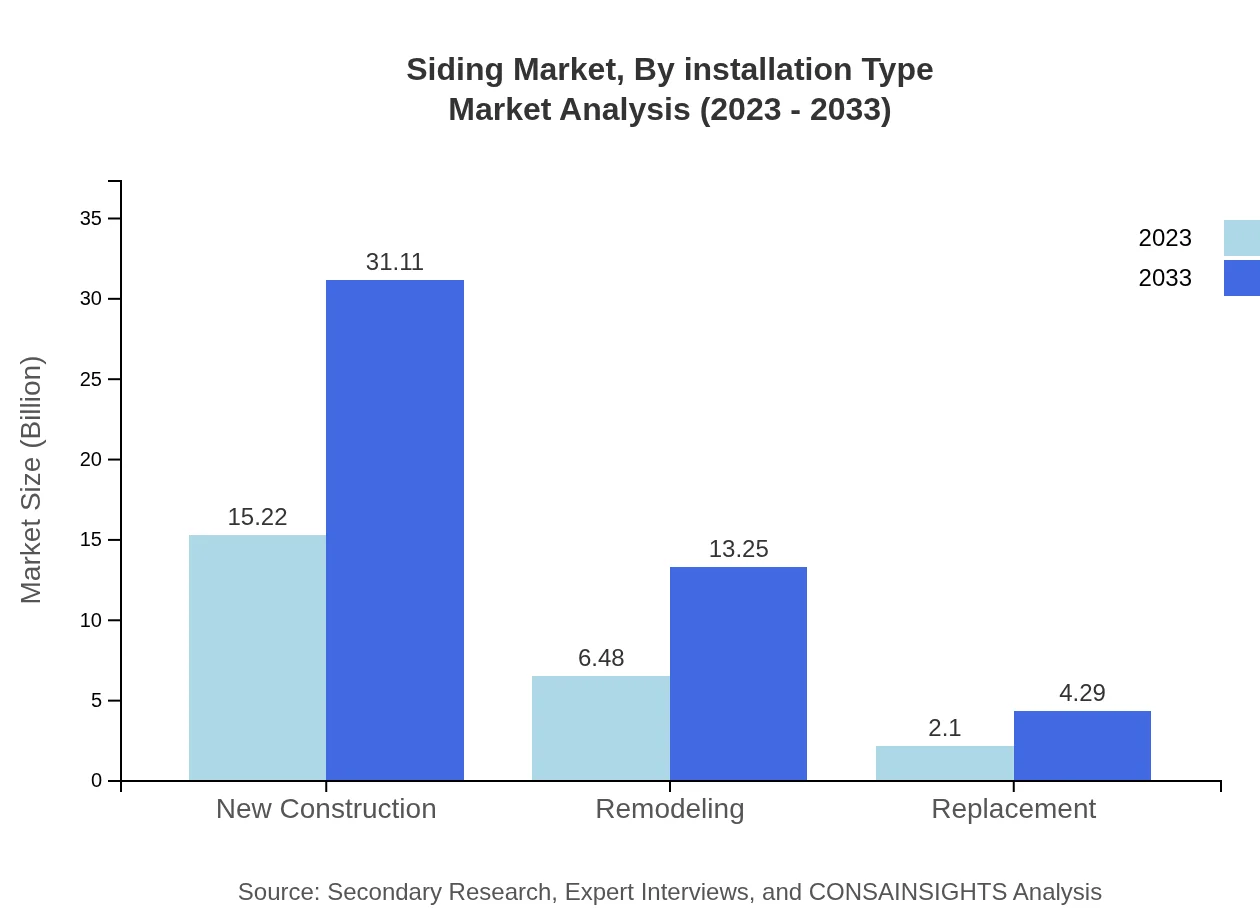

Siding Market Analysis By Installation Type

Market analysis by installation type shows that new construction will dominate, growing to $31.11 billion by 2033, driven by ongoing housing demand. Remodeling and replacement are expected to increase significantly, indicating a trend toward upgrading existing homes.

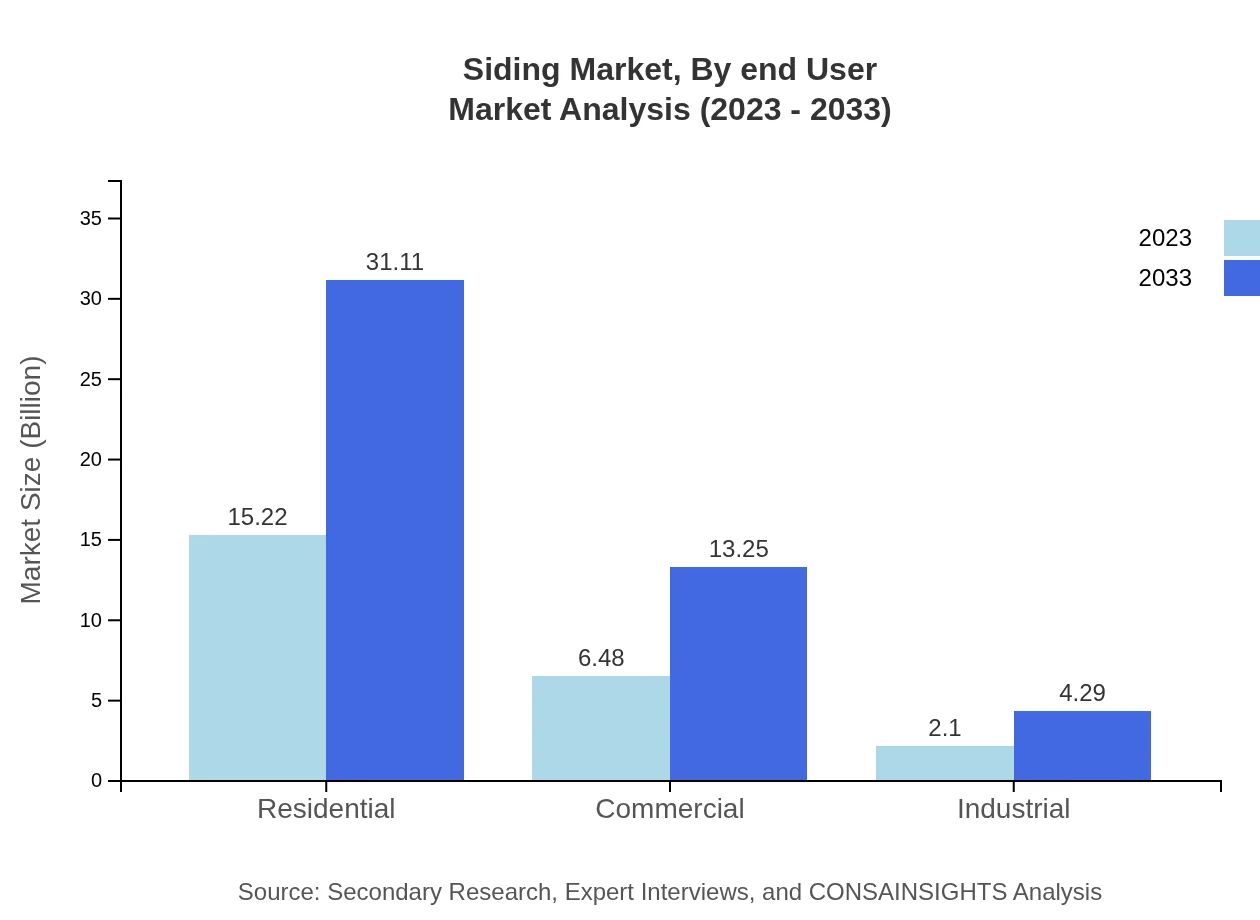

Siding Market Analysis By End User

In terms of end-user analysis, the residential sector will continue to lead the market, with a projected size of $31.11 billion by 2033. This trend highlights the growing preference for aesthetic and durable siding solutions in residential applications. The commercial sector will also see growth, particularly as businesses invest in sustainability.

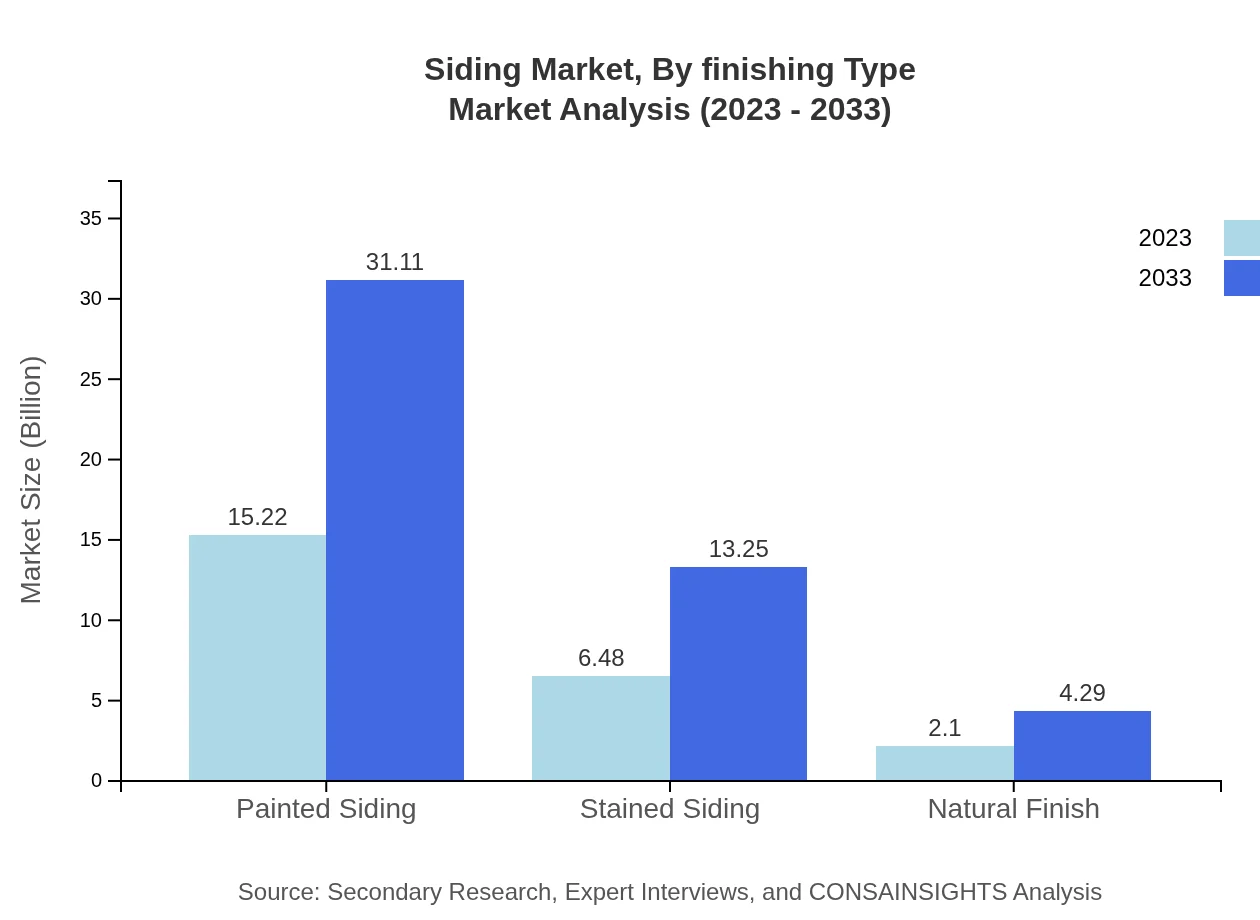

Siding Market Analysis By Finishing Type

The market segmented by finishing type indicates painted siding as the most significant segment with a share of 63.94% in 2023, projected to remain steady due to consistent demand for customization and aesthetics.

Siding Market Analysis By Distribution Channel

The distribution channel analysis shows direct sales leading at 52.05% market share. Online sales are also emerging as a significant channel due to the increasing preference for e-commerce, especially among homeowners looking for convenience.

Siding Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Siding Industry

CertainTeed:

A leading manufacturer known for its innovative vinyl siding solutions, CertainTeed emphasizes sustainability and efficiency in its products.James Hardie Industries:

Specializing in fiber cement siding, James Hardie is renowned for durable products that provide long-lasting performance and aesthetic appeal.Royal Building Products:

Royal Building Products offers a wide range of siding options, prioritizing quality and design, catering to both residential and commercial markets.LP Building Solutions:

This company focuses on engineered wood products and is known for its innovative siding solutions that prioritize sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of siding?

The global siding market size is projected to reach $23.8 billion by 2033, growing at a CAGR of 7.2% from 2023. The industry is driven by increasing housing construction and renovation activities.

What are the key market players or companies in the siding industry?

Key players in the siding market include major manufacturers such as James Hardie, LP Building Solutions, and CertainTeed, among others. These companies lead the industry with innovative products and strategic partnerships.

What are the primary factors driving the growth in the siding industry?

Factors such as urbanization, rising disposable incomes, and increasing awareness about home aesthetics contribute to the siding market's growth. Additionally, the trend of eco-friendly and energy-efficient materials boosts demand.

Which region is the fastest Growing in the siding market?

Asia Pacific is anticipated to be the fastest-growing region in the siding market, projected to grow from $5.21 billion in 2023 to $10.64 billion by 2033. This growth is fueled by rapid urbanization and infrastructure development.

Does ConsaInsights provide customized market report data for the siding industry?

Yes, ConsaInsights offers customized market report data for the siding industry, facilitating tailored insights that meet specific business requirements and strategic objectives.

What deliverables can I expect from this siding market research project?

Deliverables from the siding market research project include an in-depth analysis report, market trends, forecasts, competitive landscape, and strategic recommendations tailored to your business needs.

What are the market trends of siding?

Current trends in the siding market include a shift toward sustainable materials, innovative designs, and smart home integration. Additionally, vinyl siding continues to dominate due to its cost-effectiveness and durability.