Signature Verification Market Report

Published Date: 31 January 2026 | Report Code: signature-verification

Signature Verification Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Signature Verification market, highlighting major trends, technological advancements, and market forecasts from 2023 to 2033. Key insights into market size, regional analysis, and competitive landscape are included, providing valuable information for stakeholders.

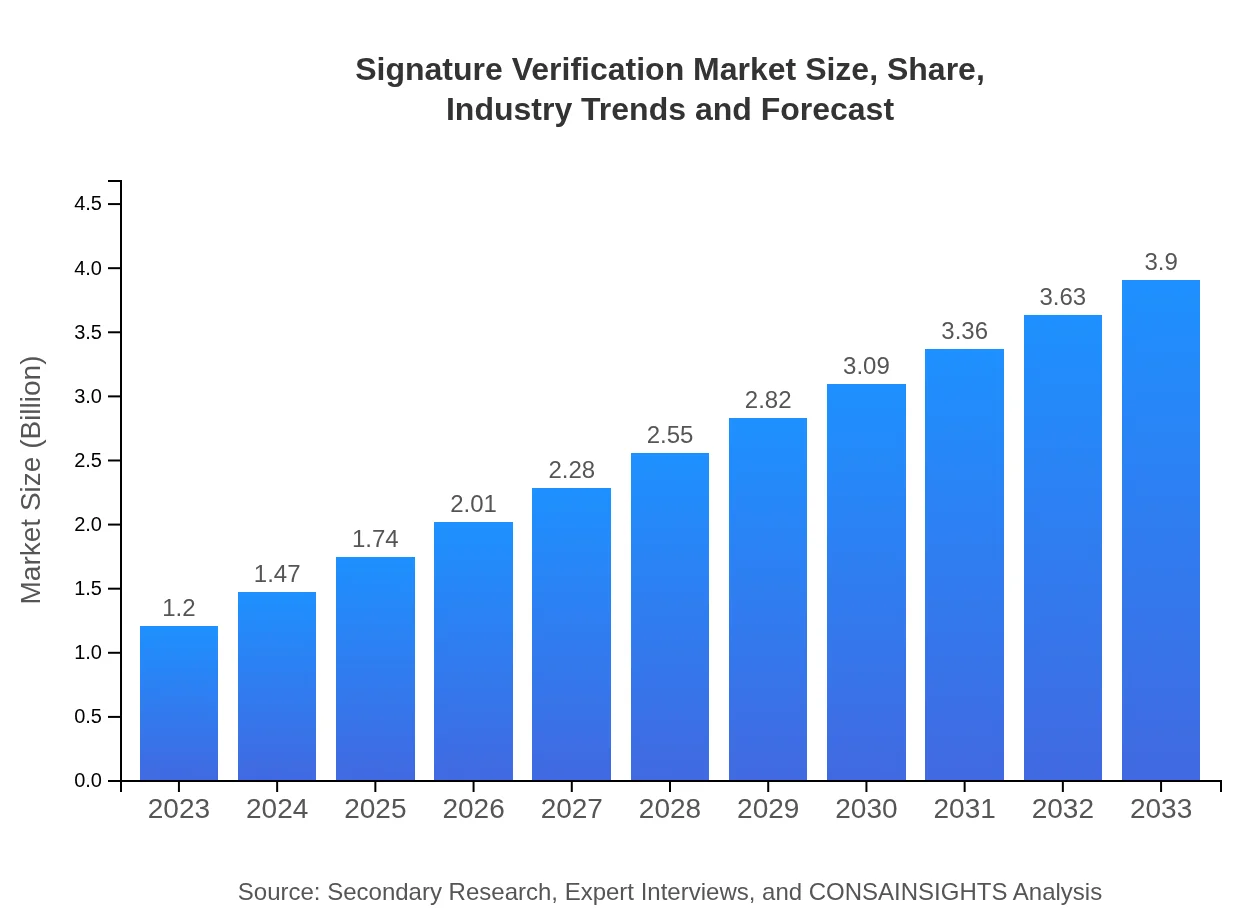

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $3.90 Billion |

| Top Companies | DocuSign, Signicat, IDology, Adobe Sign |

| Last Modified Date | 31 January 2026 |

Signature Verification Market Overview

Customize Signature Verification Market Report market research report

- ✔ Get in-depth analysis of Signature Verification market size, growth, and forecasts.

- ✔ Understand Signature Verification's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Signature Verification

What is the Market Size & CAGR of the Signature Verification market in 2023?

Signature Verification Industry Analysis

Signature Verification Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Signature Verification Market Analysis Report by Region

Europe Signature Verification Market Report:

Europe's signature verification market is estimated to grow from $0.32 billion in 2023 to $1.04 billion by 2033. Stringent regulations regarding data protection and security, such as GDPR, have catalyzed the need for improved verification processes. Countries like Germany, France, and the UK are at the forefront of adopting sophisticated signature verification technologies.Asia Pacific Signature Verification Market Report:

The Asia Pacific region is anticipated to experience significant growth, with the market expected to reach $0.76 billion by 2033, growing from $0.23 billion in 2023. This growth is attributed to increasing digitalization, a rise in mobile usage, and government initiatives promoting biometric technologies. Countries like India, China, and Japan are leading the charge in adopting advanced security measures, creating substantial demand for signature verification solutions.North America Signature Verification Market Report:

North America, a leader in signature verification adoption, is projected to grow from $0.46 billion in 2023 to $1.51 billion by 2033. High penetration of technology and increased cyber threats are pushing organizations to adopt robust verification systems. The presence of major players in the U.S. contributes to strong market dynamics, leveraging innovations and extensive distribution networks.South America Signature Verification Market Report:

The South American market is forecasted to grow from $0.11 billion in 2023 to $0.35 billion in 2033. The region is experiencing improved regulatory frameworks and a surge in internet adoption, driving demand for secure transaction methods. However, market growth may be tempered by economic instability and varying technological readiness across the region.Middle East & Africa Signature Verification Market Report:

In the Middle East and Africa, the market is expected to grow from $0.07 billion in 2023 to $0.24 billion in 2033, as the region embraces digital transformation. Government initiatives focusing on smart city projects and digital governance are expected to fuel the adoption of signature verification solutions.Tell us your focus area and get a customized research report.

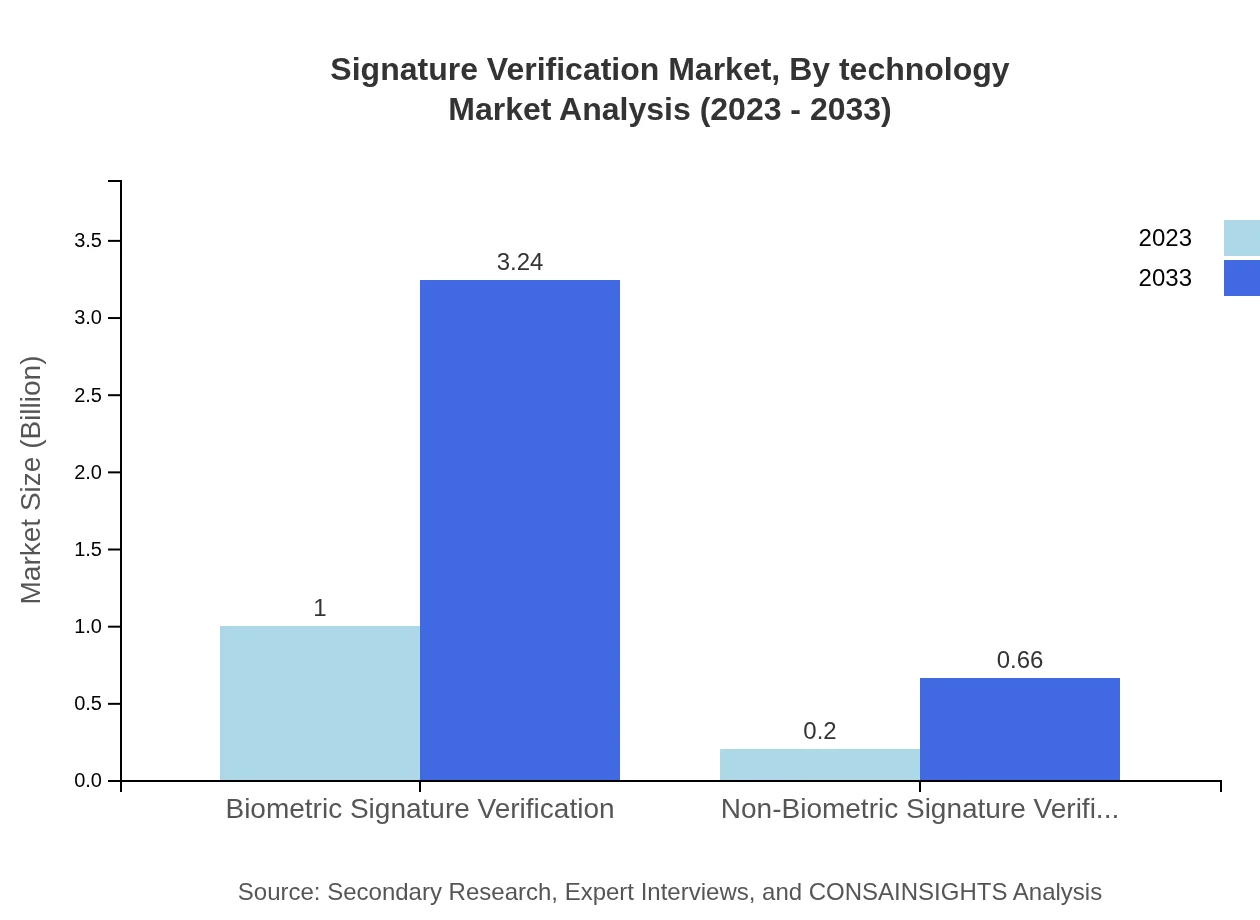

Signature Verification Market Analysis By Technology

The technology segment is divided into biometric signature verification and non-biometric signature verification. Biometric signatures are gaining an overwhelming market share due to their higher accuracy and security levels. In 2023, biometric methods accounted for approximately 83.12% of the market, valued at $1 billion, and are expected to grow to $3.24 billion by 2033. Non-biometric methods, while currently lesser-used, are steadily growing, with projections suggesting an increase from $0.20 billion in 2023 to $0.66 billion by 2033.

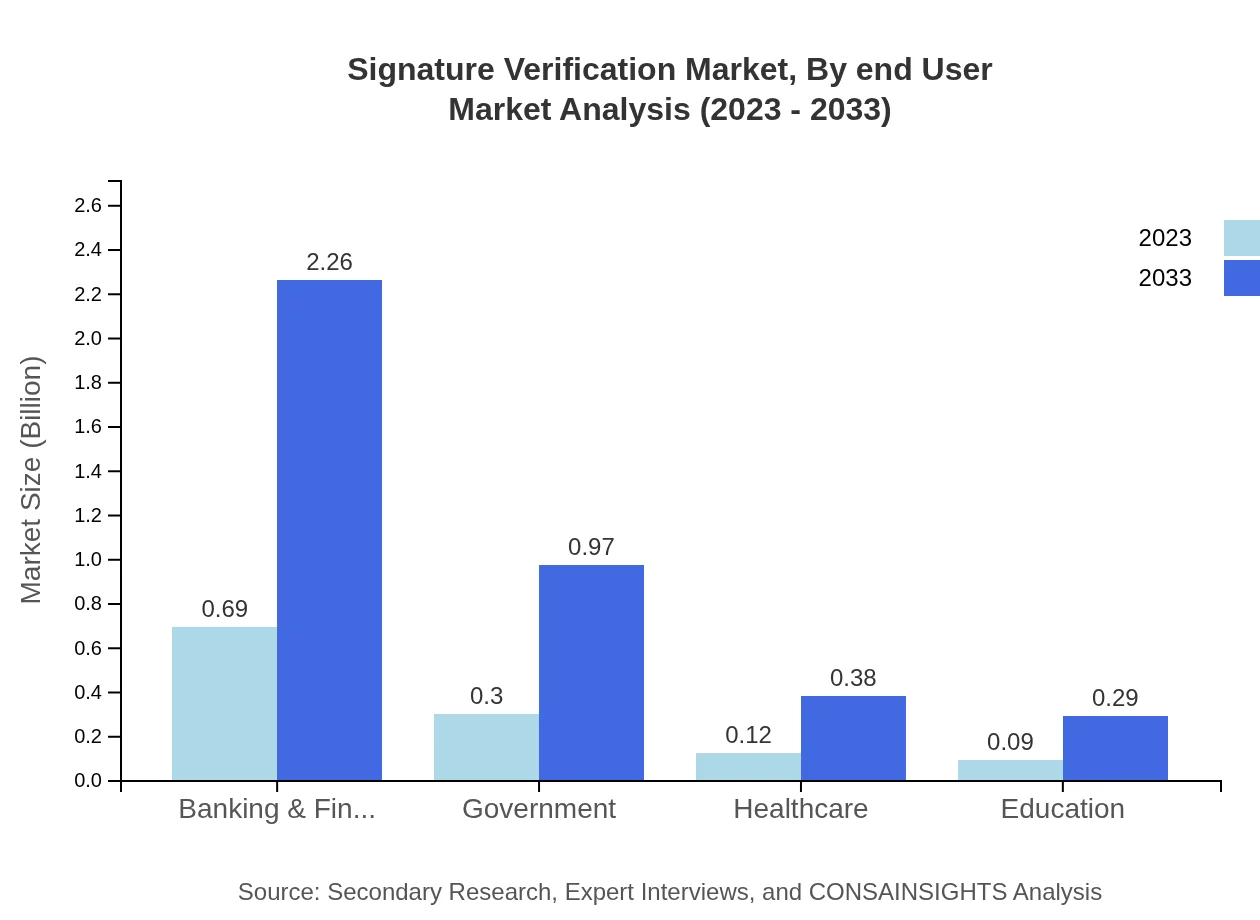

Signature Verification Market Analysis By End User

Key end-user segments include Banking & Financial Services, Government, Healthcare, and Education. The Banking & Financial Services segment is the largest, representing 57.88% of the market with a value of $0.69 billion in 2023, expected to reach $2.26 billion by 2033. Governments are also significant users, with a market share of 24.89%, growing to $0.97 billion by 2033. Healthcare and Education, while smaller segments, are increasing in importance as institutions seek to secure sensitive data.

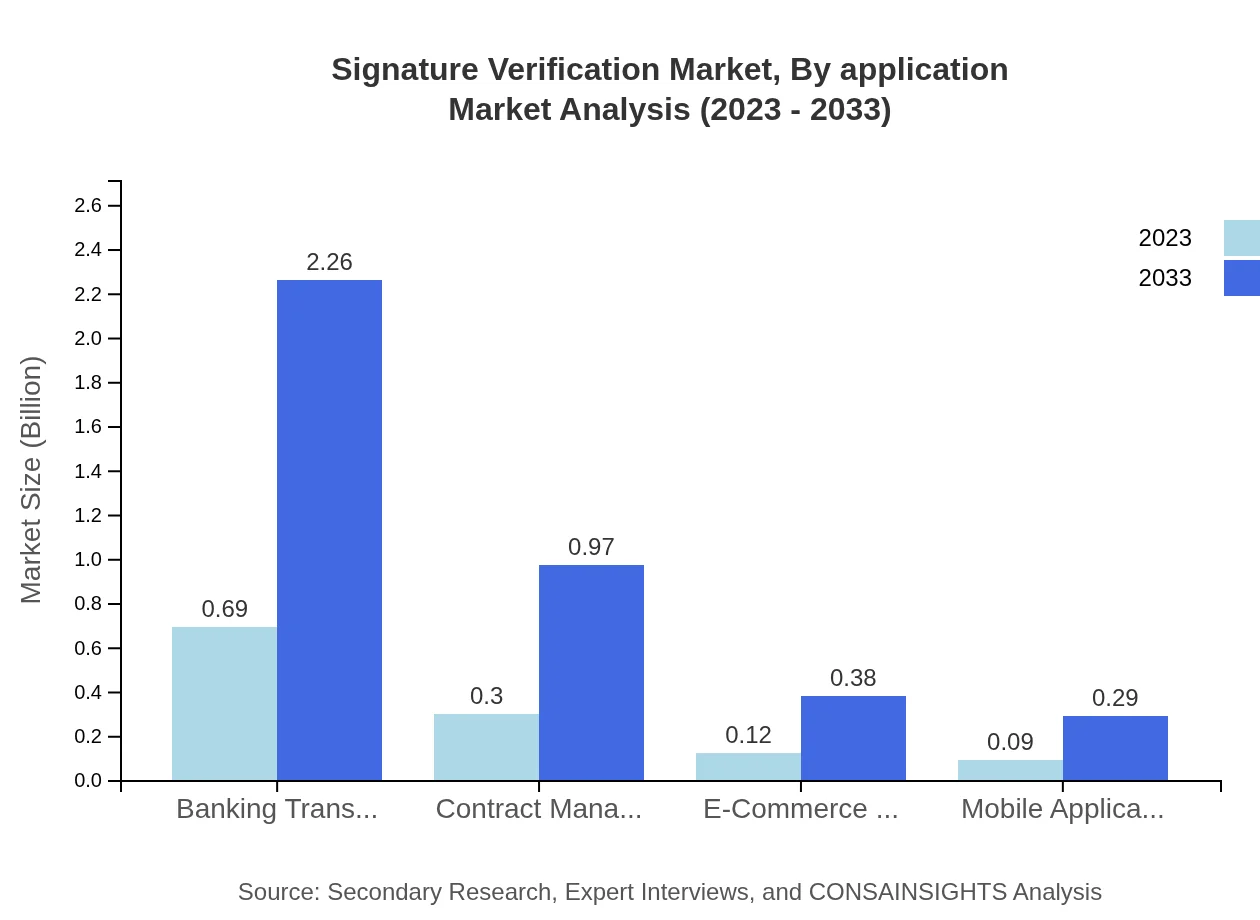

Signature Verification Market Analysis By Application

Applications include banking transactions, contract management, e-commerce platforms, and mobile applications. Banking transactions dominate, with a market share of 57.88%, while contract management holds 24.89%. These segments are expected to grow significantly as organizations increasingly digitize operations for efficiency and security. The growth of e-commerce and mobile applications also underscores the importance of secure signature verification solutions in fast-paced digital environments.

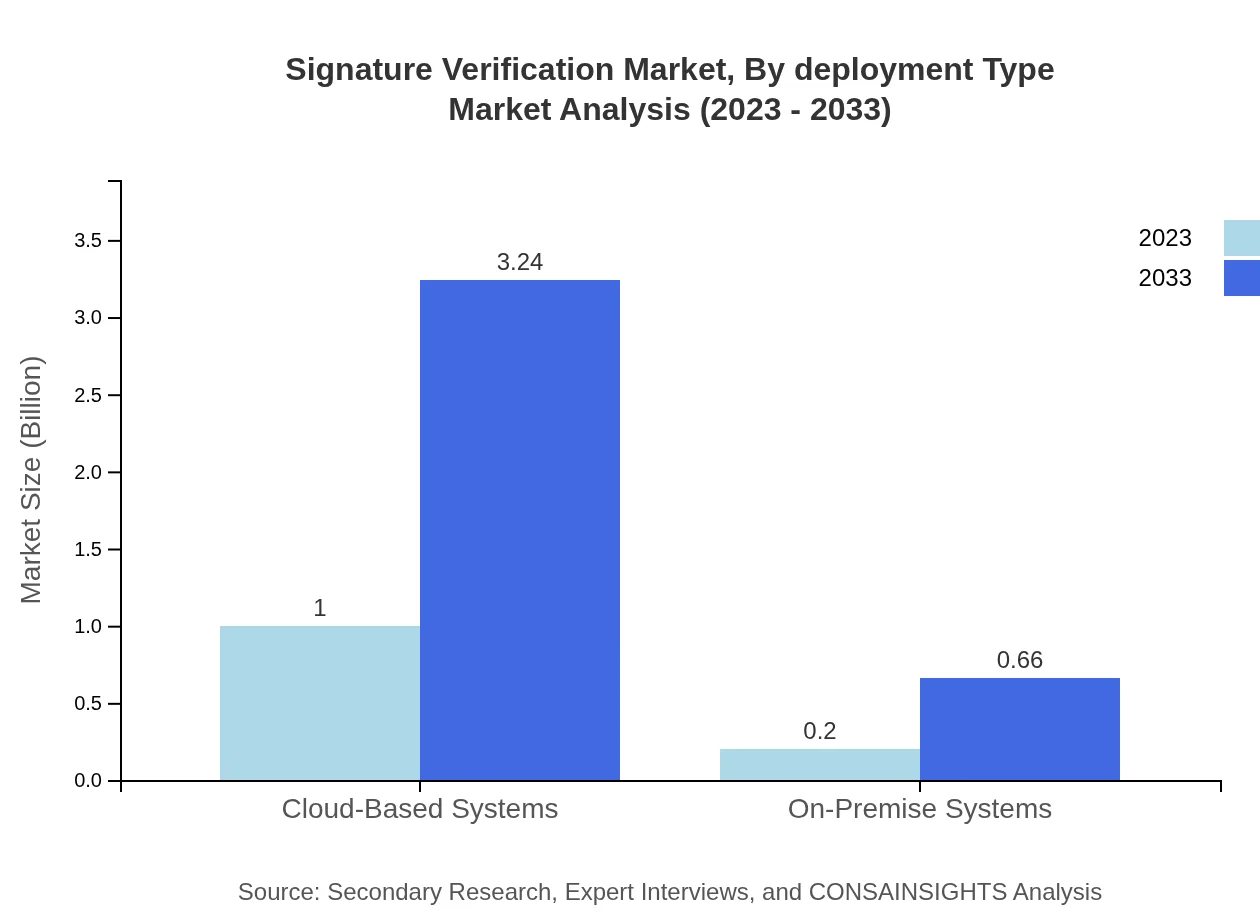

Signature Verification Market Analysis By Deployment Type

The market is segmented into cloud-based and on-premise systems. Cloud-based systems are rapidly gaining traction due to their scalability, flexibility, and cost-effectiveness, holding an 83.12% market share as of 2023. The trend towards cloud adoption is expected to continue, reflecting a shift in organizational preference towards comprehensive and integrated solutions. Meanwhile, on-premise systems, while still relevant for certain security-conscious organizations, are projected to grow at a slower pace.

Signature Verification Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Signature Verification Industry

DocuSign:

DocuSign is a leader in electronic signature technology, providing a cloud-based platform that offers secure and legally binding signatures for various transactions.Signicat:

Signicat specializes in digital identity solutions, offering comprehensive services around electronic signatures and identity authentication to enhance security.IDology:

IDology provides identity verification solutions, integrating signature verification into its platform to support digital transactions across various industries.Adobe Sign:

A part of Adobe Document Cloud, Adobe Sign offers e-signature services that enable users to sign documents from any device securely.We're grateful to work with incredible clients.

FAQs

What is the market size of signature verification?

The global market size of the signature verification is estimated at 1.2 billion USD in 2023, with a projected CAGR of 12% through 2033. This growth signifies a robust demand for enhanced security in various sectors.

What are the key market players or companies in this signature verification industry?

Key players in the signature verification market include established tech firms and startups that specialize in biometric technologies. Their innovations drive market competitiveness, especially focusing on AI-driven solutions and secure transaction systems.

What are the primary factors driving the growth in the signature verification industry?

The growth in the signature verification market is primarily driven by increasing demands for secure transactions in banking, rising cybersecurity threats, and the necessary compliance with regulatory requirements across various sectors.

Which region is the fastest Growing in the signature verification market?

The fastest-growing region in the signature verification market is North America, projecting an increase from 0.46 billion in 2023 to 1.51 billion USD by 2033, reflecting advancements in technology and higher expenditure on security.

Does ConsaInsights provide customized market report data for the signature verification industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the signature verification industry. This enables clients to focus on relevant information that matches their business strategies and objectives.

What deliverables can I expect from this signature verification market research project?

Deliverables from this market research project include detailed reports, segment analysis, trends, growth forecasts, and competitive landscape data for the signature verification industry, helping stakeholders make informed decisions.

What are the market trends of signature verification?

Current market trends in signature verification highlight the increasing adoption of biometric solutions, the shift towards cloud-based systems, and integration with mobile applications, driven by improved user experience and security advancements.