Silage Additives Market Report

Published Date: 02 February 2026 | Report Code: silage-additives

Silage Additives Market Size, Share, Industry Trends and Forecast to 2033

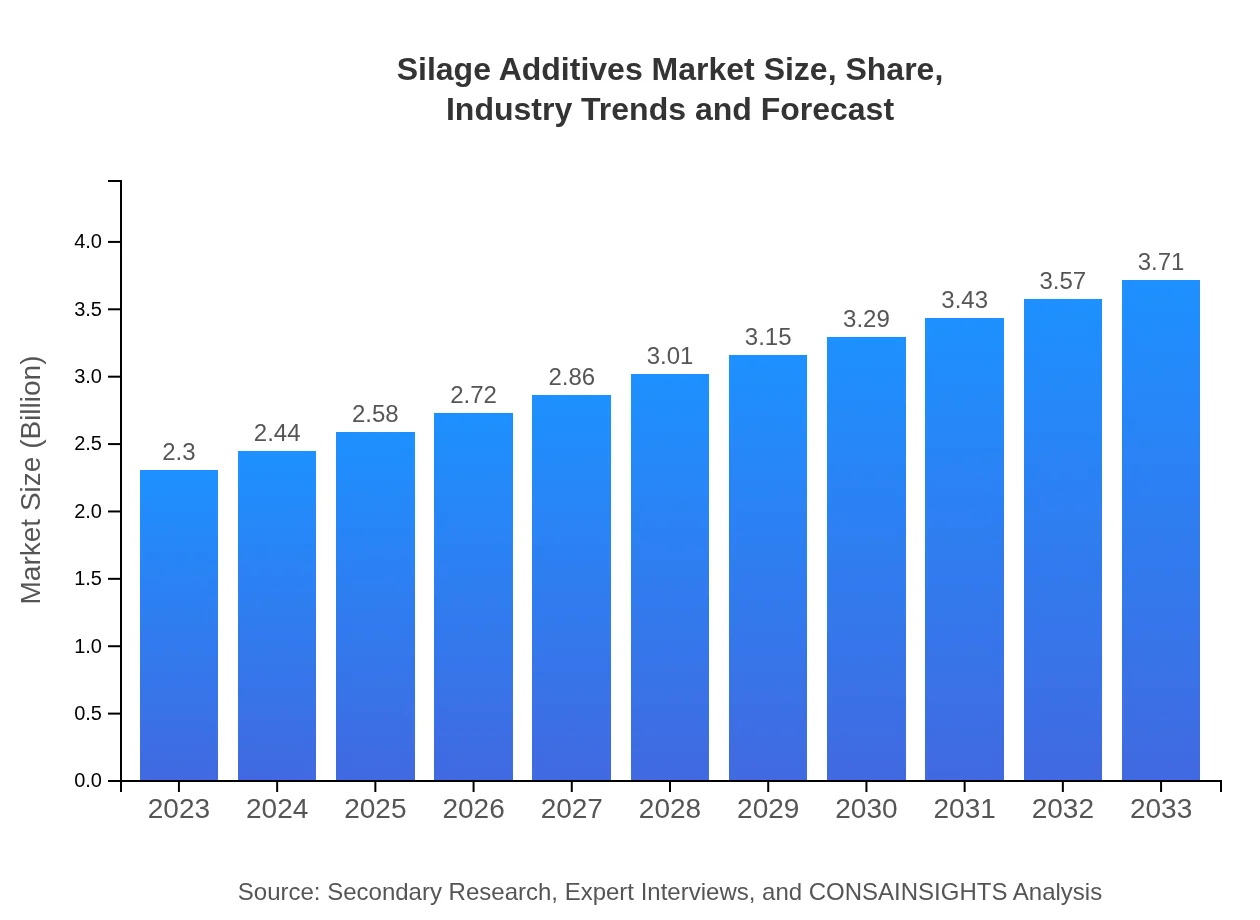

This market report provides an in-depth analysis of the Silage Additives industry, examining current trends, market size, growth rates, and forecasts from 2023 to 2033. The insights drawn are essential for stakeholders to understand the opportunities and challenges in this evolving market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $3.71 Billion |

| Top Companies | BASF SE, Lallemand Inc., Cargill, Inc., Nutrien Ltd. |

| Last Modified Date | 02 February 2026 |

Silage Additives Market Overview

Customize Silage Additives Market Report market research report

- ✔ Get in-depth analysis of Silage Additives market size, growth, and forecasts.

- ✔ Understand Silage Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Silage Additives

What is the Market Size & CAGR of Silage Additives market in 2023?

Silage Additives Industry Analysis

Silage Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Silage Additives Market Analysis Report by Region

Europe Silage Additives Market Report:

In Europe, the market is set to experience significant growth, rising from $0.59 billion in 2023 to an estimated $0.96 billion by 2033. The focus on sustainable farming practices and organic feed usage enhances the demand for innovative silage additives.Asia Pacific Silage Additives Market Report:

In the Asia Pacific region, the Silage Additives market was valued at approximately $0.49 billion in 2023, with a projected growth to $0.79 billion by 2033. The rising livestock production and an emphasis on quality feed are significant growth drivers. Countries such as China and India are major contributors to this growth due to expanding dairy and livestock industries.North America Silage Additives Market Report:

The North American market for Silage Additives is anticipated to grow from $0.80 billion in 2023 to approximately $1.29 billion by 2033. The U.S. and Canada are leaders in livestock production, pushing strong demand for quality silage through advanced farming technologies.South America Silage Additives Market Report:

In South America, the Silage Additives market size is estimated at $0.20 billion in 2023, expected to grow to $0.32 billion by 2033. The region's increasing agricultural output, especially in beef and dairy, coupled with improved silage management practices, fuels this growth.Middle East & Africa Silage Additives Market Report:

The Middle East and Africa show promising market growth, with current estimates placing the value at $0.22 billion in 2023 and an expectation to reach $0.35 billion by 2033. Increasing investments in agricultural practices and livestock feeding are key contributors to this expansion.Tell us your focus area and get a customized research report.

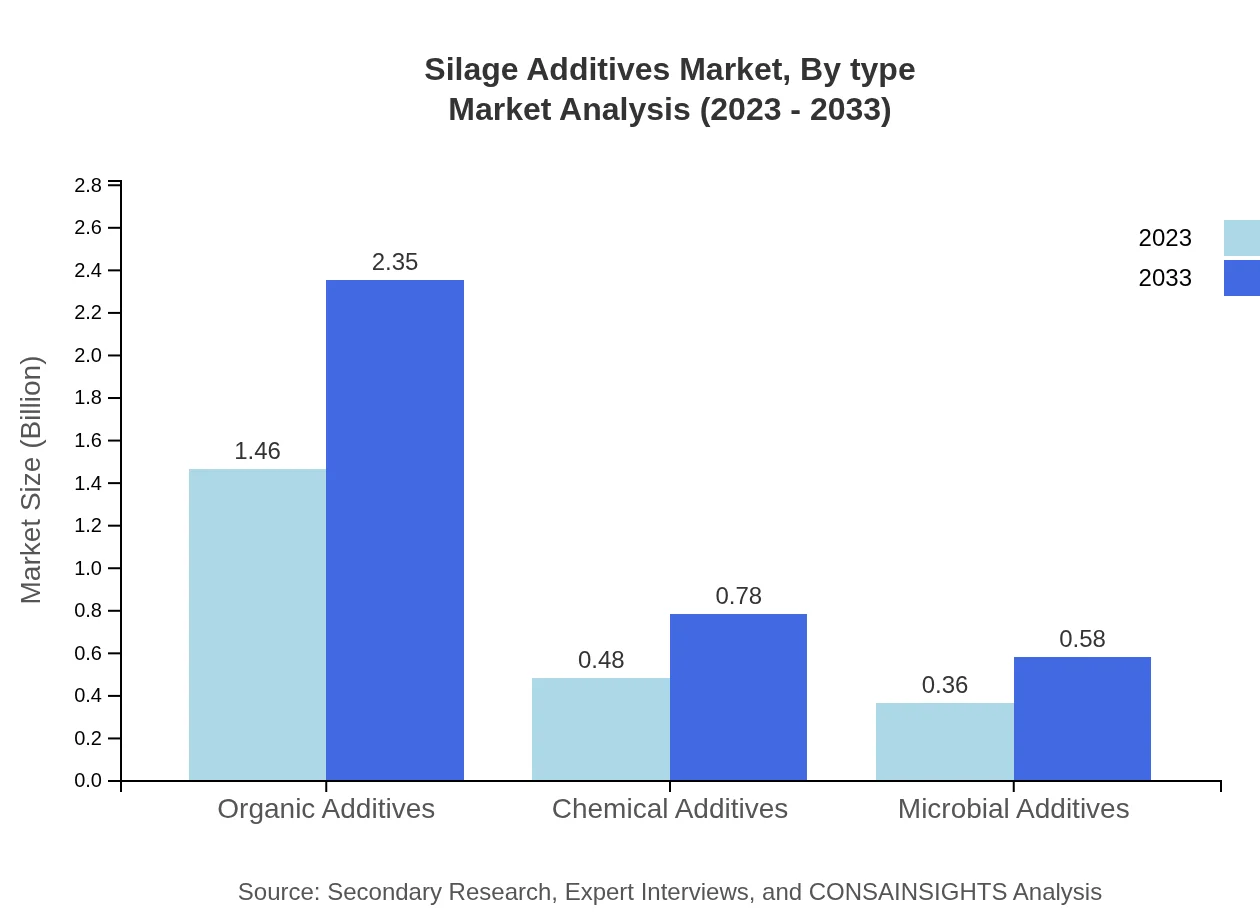

Silage Additives Market Analysis By Type

The Silage Additives market is significantly influenced by the product type. Liquid additives dominate the market with a size of $1.88 billion in 2023, anticipated to grow to $3.04 billion by 2033, holding an 81.86% market share. Powder additives account for $0.42 billion in 2023, with growth potential to $0.67 billion by 2033, representing 18.14% share. Organic additives, valued at $1.46 billion in 2023, are expected to rise to $2.35 billion by 2033, making up 63.27% of their market share. Chemical and microbial additives, although smaller segments, are witnessing steady growth, valued at $0.48 billion and $0.36 billion in 2023, respectively.

Silage Additives Market Analysis By Application

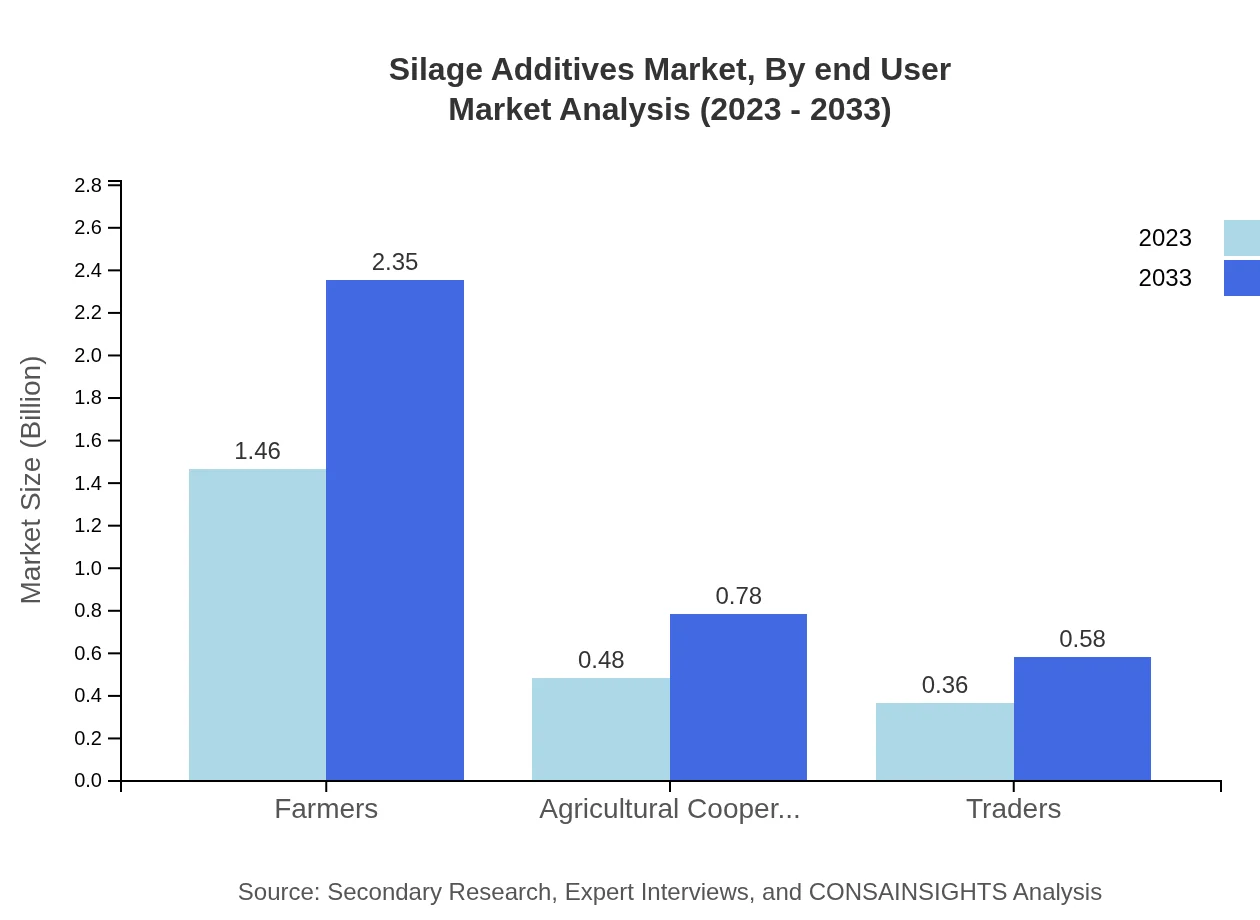

Applications for Silage Additives primarily focus on end-user segments such as farmers, agricultural cooperatives, and traders. Farmers represent a substantial share, valued at $1.46 billion in 2023 and expected to grow to $2.35 billion by 2033, indicating their vital role in market growth. Agricultural cooperatives, valued at $0.48 billion and projected to reach $0.78 billion by 2033, also contribute significantly. Meanwhile, traders are expected to grow from $0.36 billion to $0.58 billion within the same period.

Silage Additives Market Analysis By End User

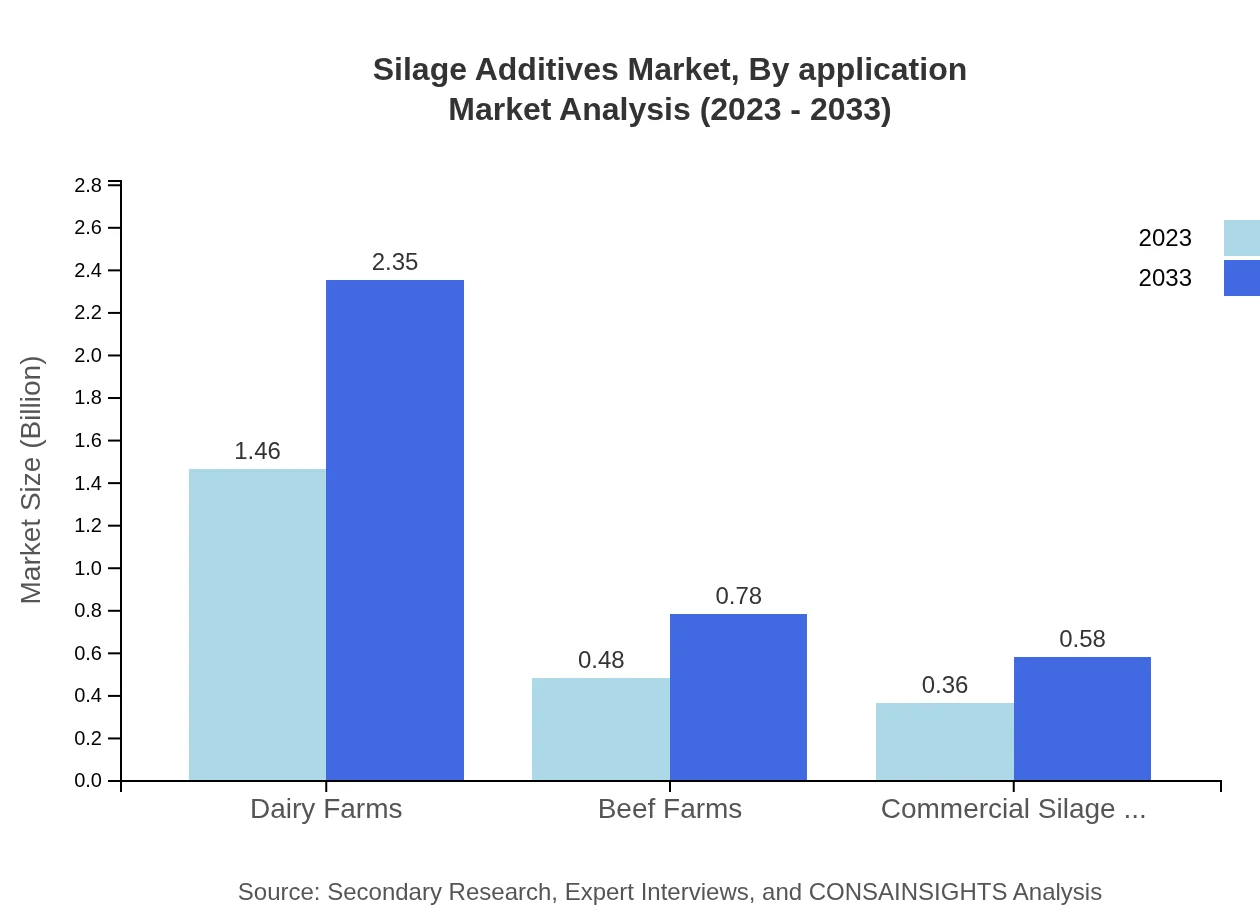

End-users of Silage Additives include dairy farms, beef farms, and commercial silage production. Dairy farms are the largest consumers, comprising a market size of $1.46 billion in 2023 and expected to grow to $2.35 billion by 2033. Beef farms account for $0.48 billion of the market, predicted to reach $0.78 billion by 2033. The commercial silage production segment, while smaller at $0.36 billion in 2023, is on a growth trajectory to $0.58 billion by 2033.

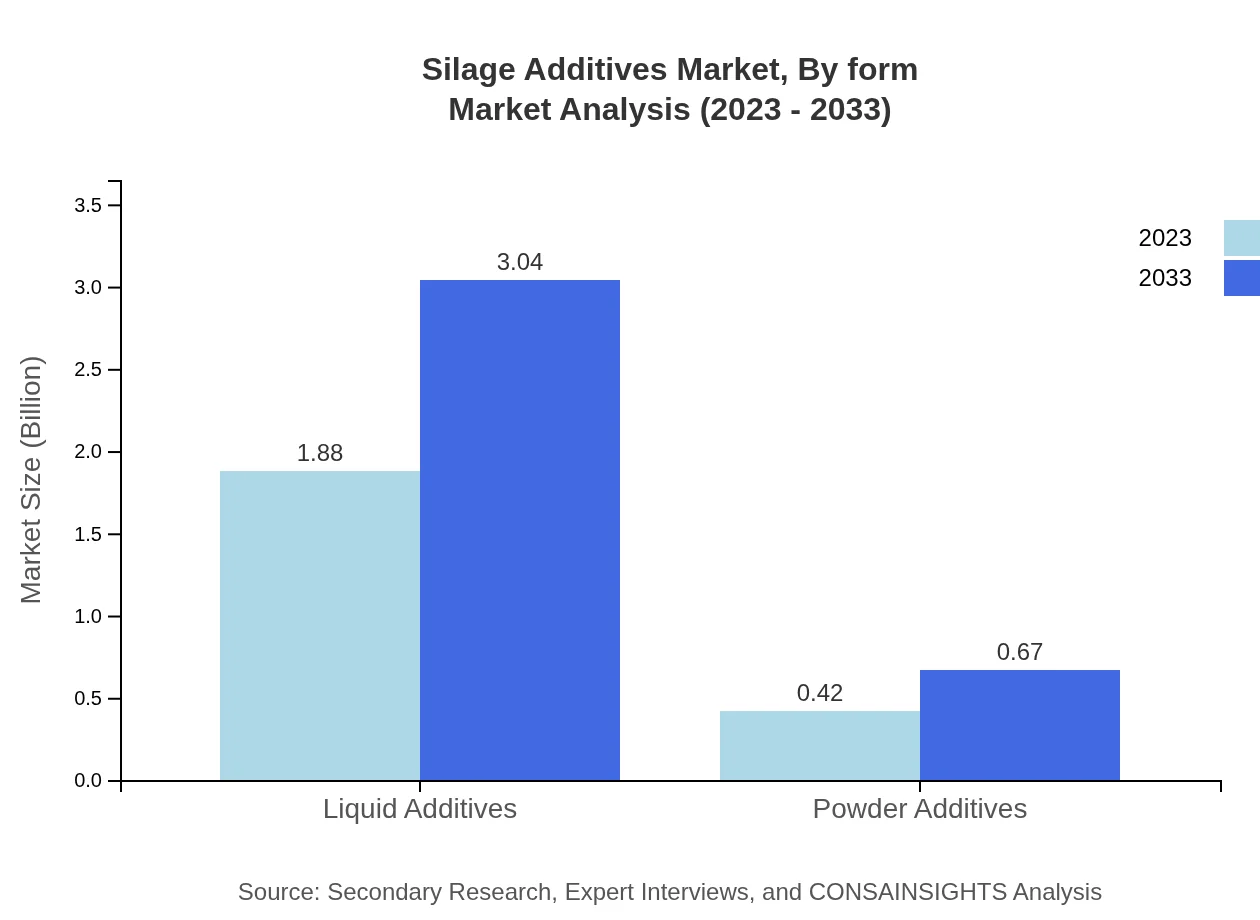

Silage Additives Market Analysis By Form

Silage Additives can be classified by form into liquid and dry. Liquid forms dominate due to their ease of application and effectiveness in fermentation processes. The market for liquid additives reached $1.88 billion in 2023 and is set to reach $3.04 billion by 2033. The dry form, having brought in a revenue of $0.42 billion in 2023, is projected to increase to $0.67 billion by 2033 as awareness of different application methods grows.

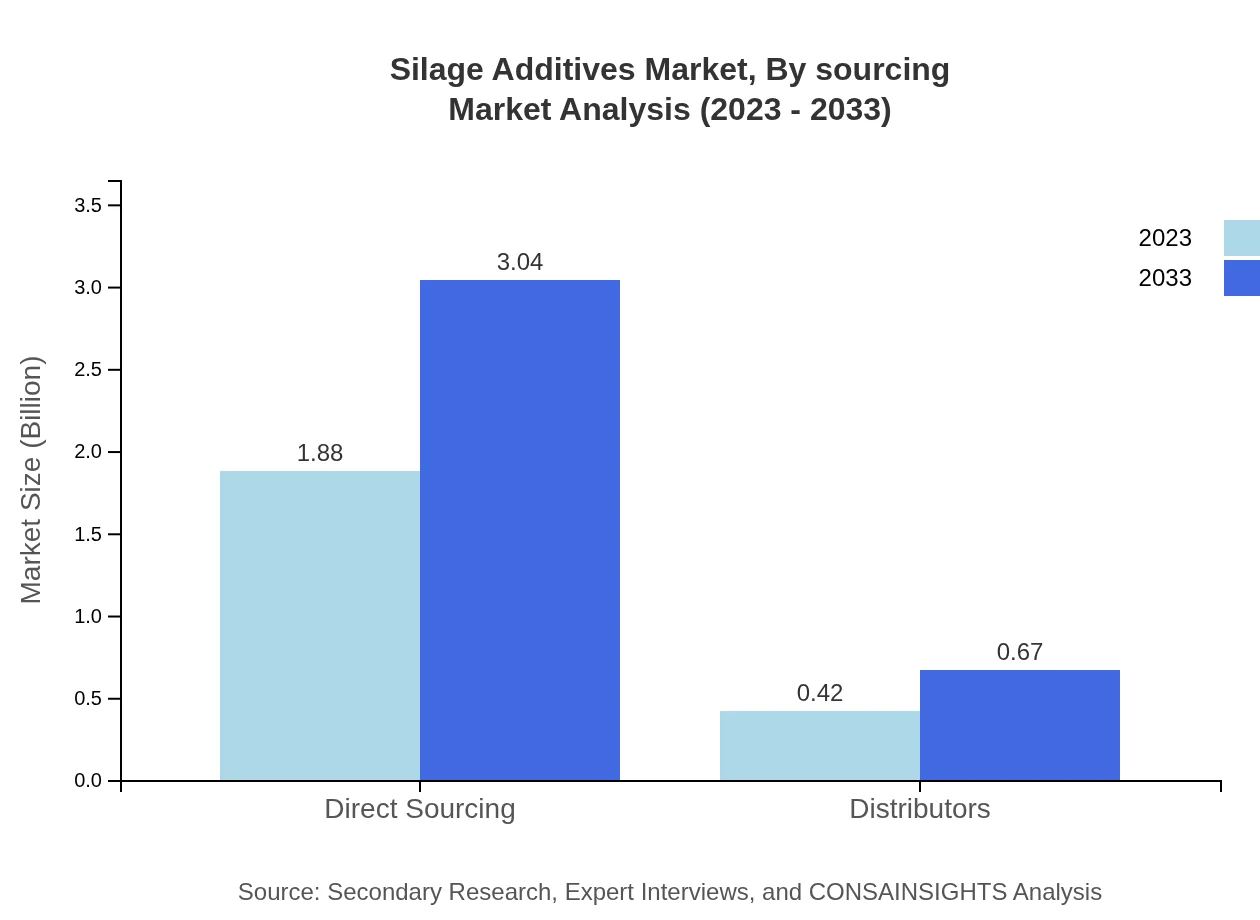

Silage Additives Market Analysis By Sourcing

Sourcing strategies for Silage Additives include direct sourcing and distribution through suppliers. Direct sourcing currently holds the largest segment, valued at $1.88 billion in 2023 and forecasted to grow to $3.04 billion by 2033. Distributors, although smaller at $0.42 billion in 2023, are projected to rise to $0.67 billion, further indicating a shift towards more structured sourcing methods in the industry.

Silage Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Silage Additives Industry

BASF SE:

BASF SE is a leading chemical company that offers a broad range of agricultural solutions, including innovative silage additives aimed at improving feed efficiency and fermentation processes.Lallemand Inc.:

Lallemand Inc. specializes in yeast and bacteria products for agriculture, providing silage additives that enhance the fermentation process and improve the nutritional quality of silage.Cargill, Inc.:

Cargill is a major player in the agricultural sector, supplying various products including silage additives designed to maximize livestock productivity.Nutrien Ltd.:

Nutrien is known for its fertilizer solutions but also provides silage additives to enhance feed quality for dairy and beef cattle.We're grateful to work with incredible clients.

FAQs

What is the market size of silage additives?

The global silage additives market is estimated to be valued at $2.3 billion in 2023, with a projected CAGR of 4.8% through 2033. This growth reflects increasing demand for effective silage treatment methods to enhance feed quality and livestock productivity.

What are the key market players or companies in the silage additives industry?

Key players in the silage additives market include companies like Alltech, Lallemand, and BASF, among others. These companies are known for providing innovative products that improve the quality and preservation of silage, catering to the agricultural sector.

What are the primary factors driving the growth in the silage additives industry?

The growth of the silage additives industry is primarily driven by rising demand for high-quality silage, increased livestock production, and a growing awareness among farmers about the benefits of using additives to enhance feed efficiency and reduce waste.

Which region is the fastest Growing in the silage additives market?

The fastest-growing region in the silage additives market is North America, with a current market value of $0.80 billion in 2023, projected to expand to $1.29 billion by 2033. This growth is supported by advanced agricultural practices and significant livestock production.

Does ConsaInsights provide customized market report data for the silage additives industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the silage additives industry. Clients can request detailed insights, regional analysis, and segment-specific data to support their strategic decisions.

What deliverables can I expect from this silage additives market research project?

From the silage additives market research project, clients can expect comprehensive reports that include market size estimates, growth forecasts, regional analyses, competitive landscape information, and insights into consumer behavior and trends.

What are the market trends of silage additives?

Market trends in the silage additives industry include a shift towards organic and microbial additives, increased investment in R&D for innovative solutions, and a focus on sustainability practices among farmers, reflecting the evolving demands of the agricultural sector.