Silage Inoculant Market Report

Published Date: 31 January 2026 | Report Code: silage-inoculant

Silage Inoculant Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Silage Inoculant market from 2023 to 2033, including market size, trends, segmentation, and regional insights, along with forecasts of growth and market dynamics.

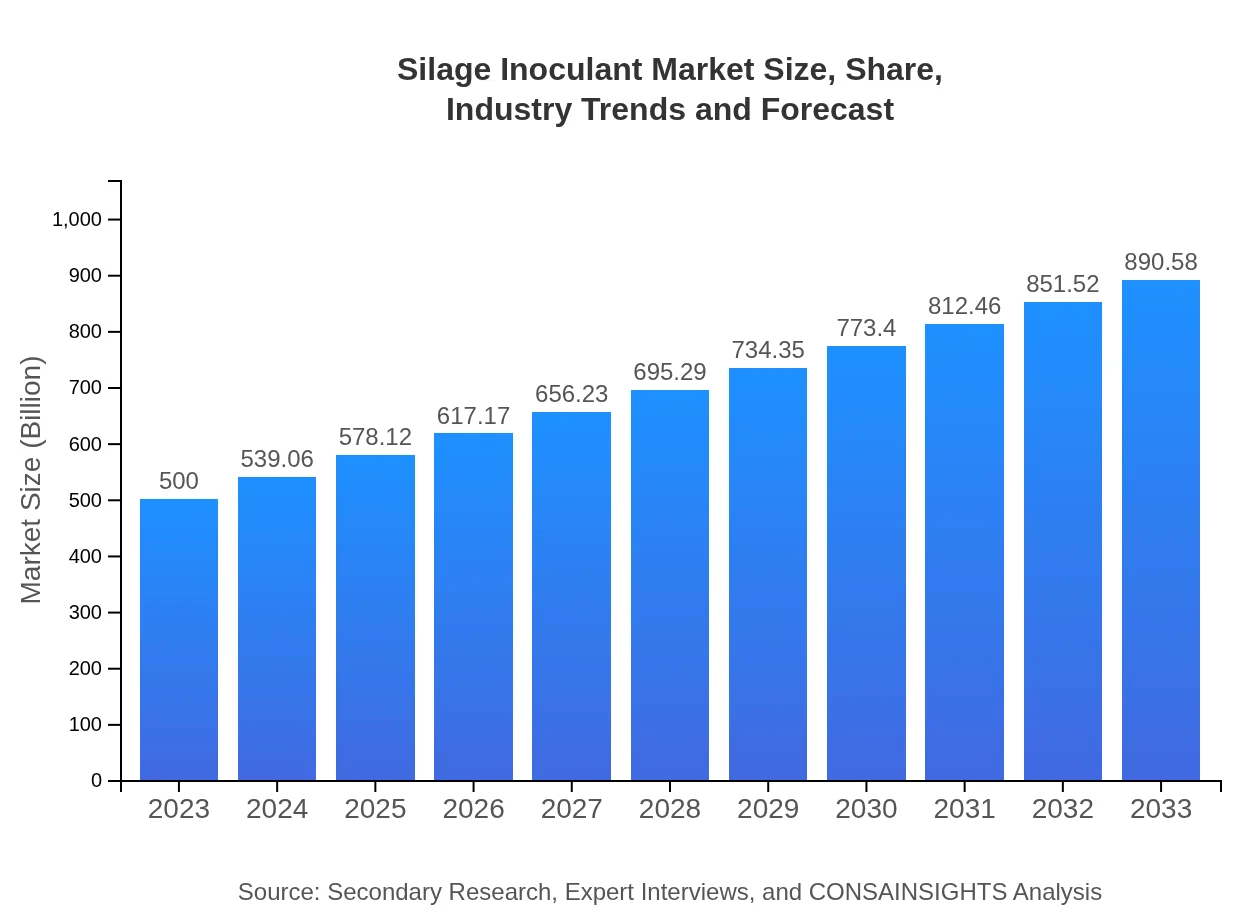

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $890.58 Million |

| Top Companies | Huangpu Huagong Technology Co., Ltd., Chr. Hansen, Alltech, Lallemand Animal Nutrition |

| Last Modified Date | 31 January 2026 |

Silage Inoculant Market Overview

Customize Silage Inoculant Market Report market research report

- ✔ Get in-depth analysis of Silage Inoculant market size, growth, and forecasts.

- ✔ Understand Silage Inoculant's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Silage Inoculant

What is the Market Size & CAGR of Silage Inoculant market in 2033?

Silage Inoculant Industry Analysis

Silage Inoculant Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Silage Inoculant Market Analysis Report by Region

Europe Silage Inoculant Market Report:

The European market is forecasted to grow significantly, from $172.20 million in 2023 to $306.71 million by 2033, supported by stringent legislation on feed quality and increased focus on sustainable livestock practices.Asia Pacific Silage Inoculant Market Report:

The Asia-Pacific Silage Inoculant market is anticipated to grow from $93.05 million in 2023 to $165.74 million by 2033. Growth factors include increasing livestock populations and a surge in the demand for quality animal feed due to dietary changes.North America Silage Inoculant Market Report:

The North American market is projected to expand from $163.95 million in 2023 to $292.02 million in 2033. This growth is fueled by a robust dairy industry and continual adoption of innovative silage management practices.South America Silage Inoculant Market Report:

In South America, the market size is expected to increase from $43.55 million in 2023 to $77.57 million in 2033, driven largely by expansions in beef production and awareness around forage preservation.Middle East & Africa Silage Inoculant Market Report:

The market in the Middle East and Africa is expected to grow from $27.25 million in 2023 to $48.54 million in 2033, benefitting from rising agricultural investments and increased awareness regarding silage farming techniques.Tell us your focus area and get a customized research report.

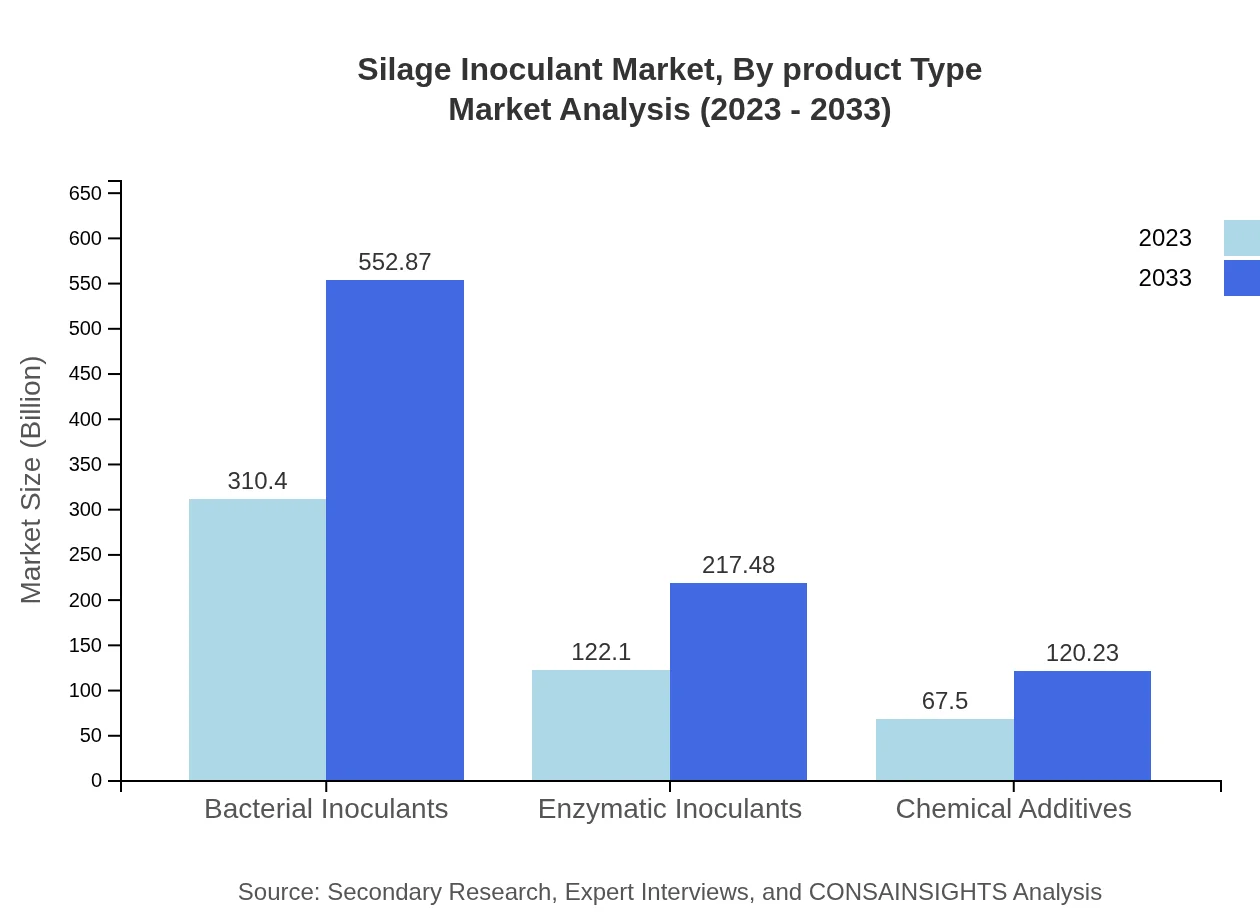

Silage Inoculant Market Analysis By Product Type

The product type segment plays a crucial role in market dynamics, with bacterial inoculants leading at $310.40 million in 2023 and projected to reach $552.87 million by 2033, alongside significant growth in enzymatic inoculants from $122.10 million to $217.48 million.

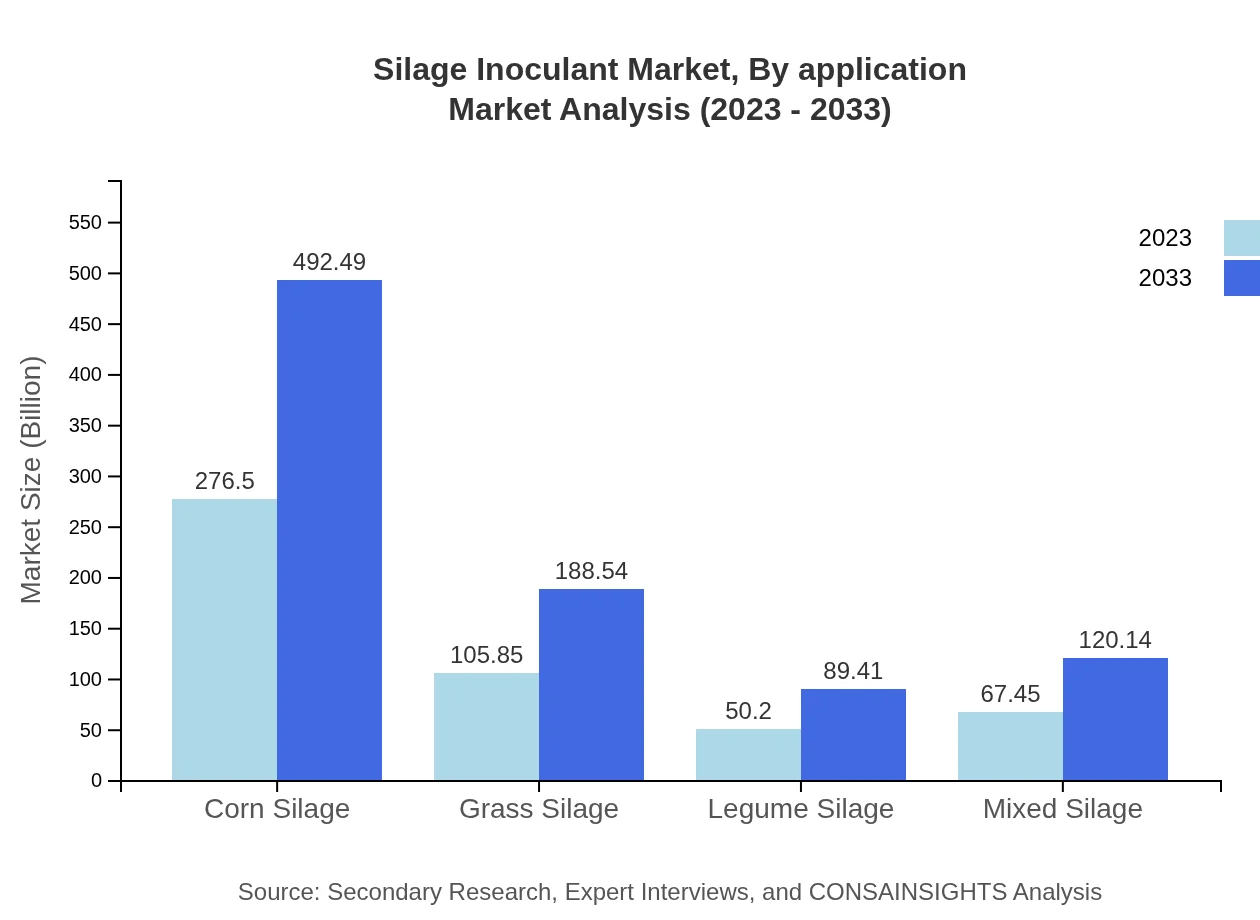

Silage Inoculant Market Analysis By Application

Dairy farms represent the largest application sector, going from $310.40 million in 2023 to $552.87 million in 2033, while beef farms are expected to grow from $122.10 million to $217.48 million during the same period.

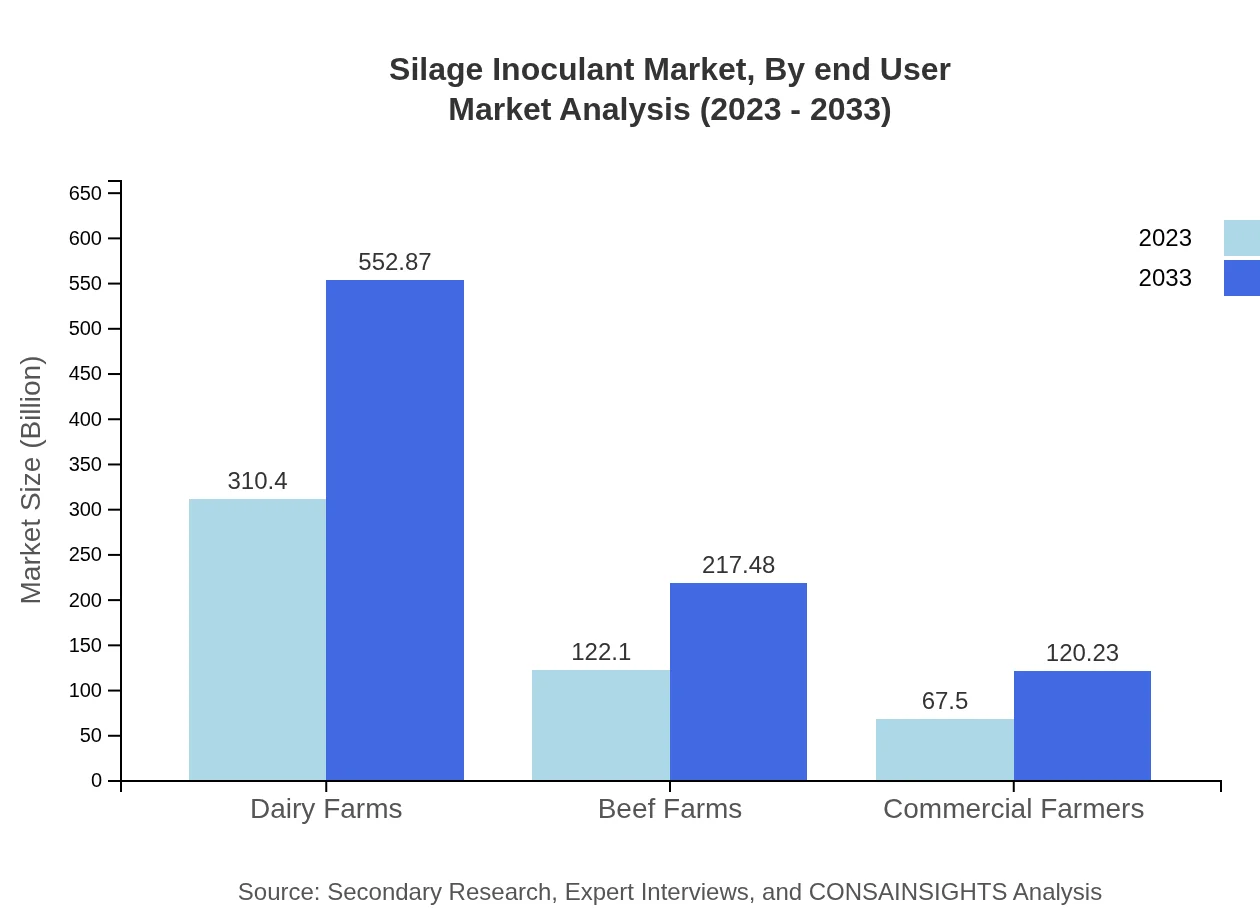

Silage Inoculant Market Analysis By End User

End-users tailored for dairy and beef farms will drive demand as farmers seek better silage quality for improved animal performance, with key insights emphasizing the importance of efficient silage management.

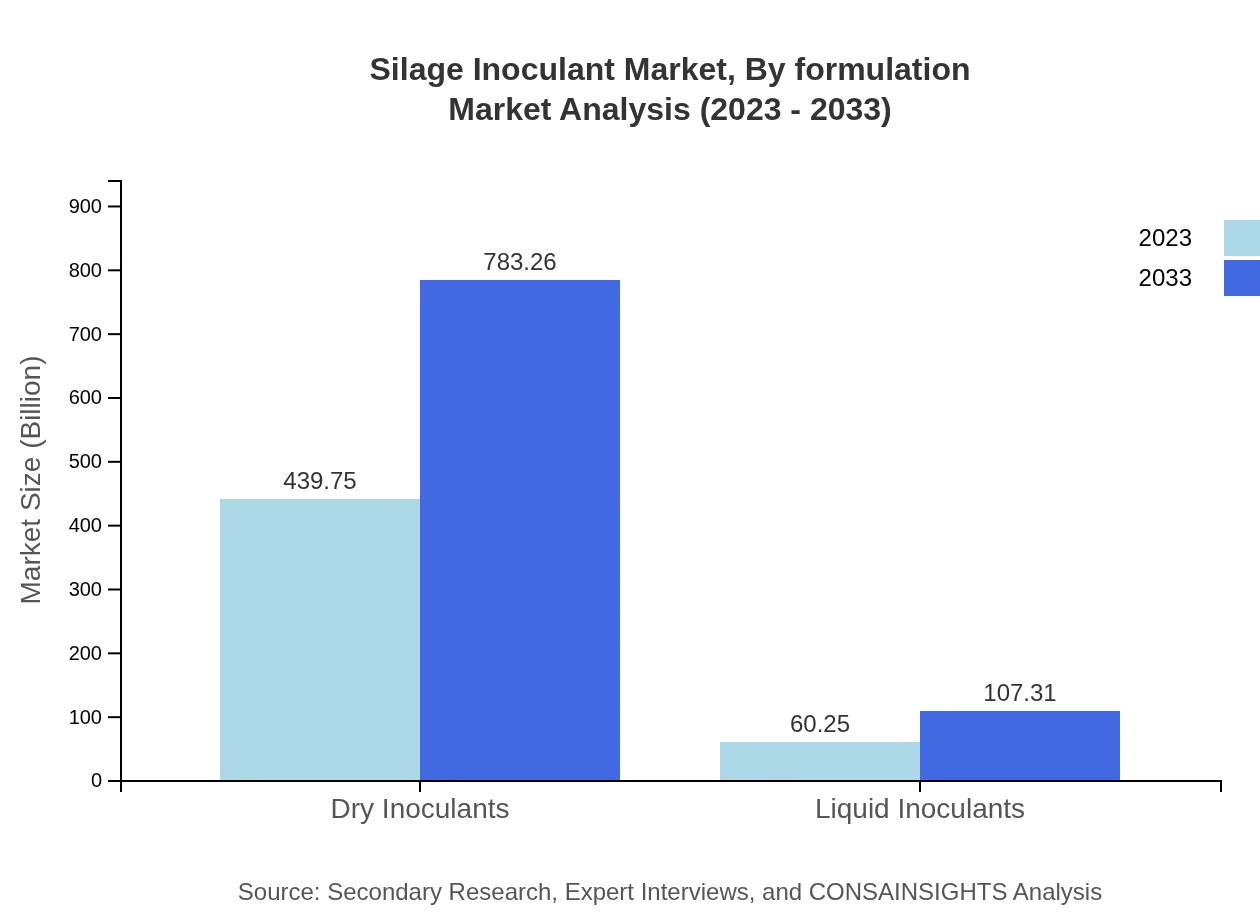

Silage Inoculant Market Analysis By Formulation

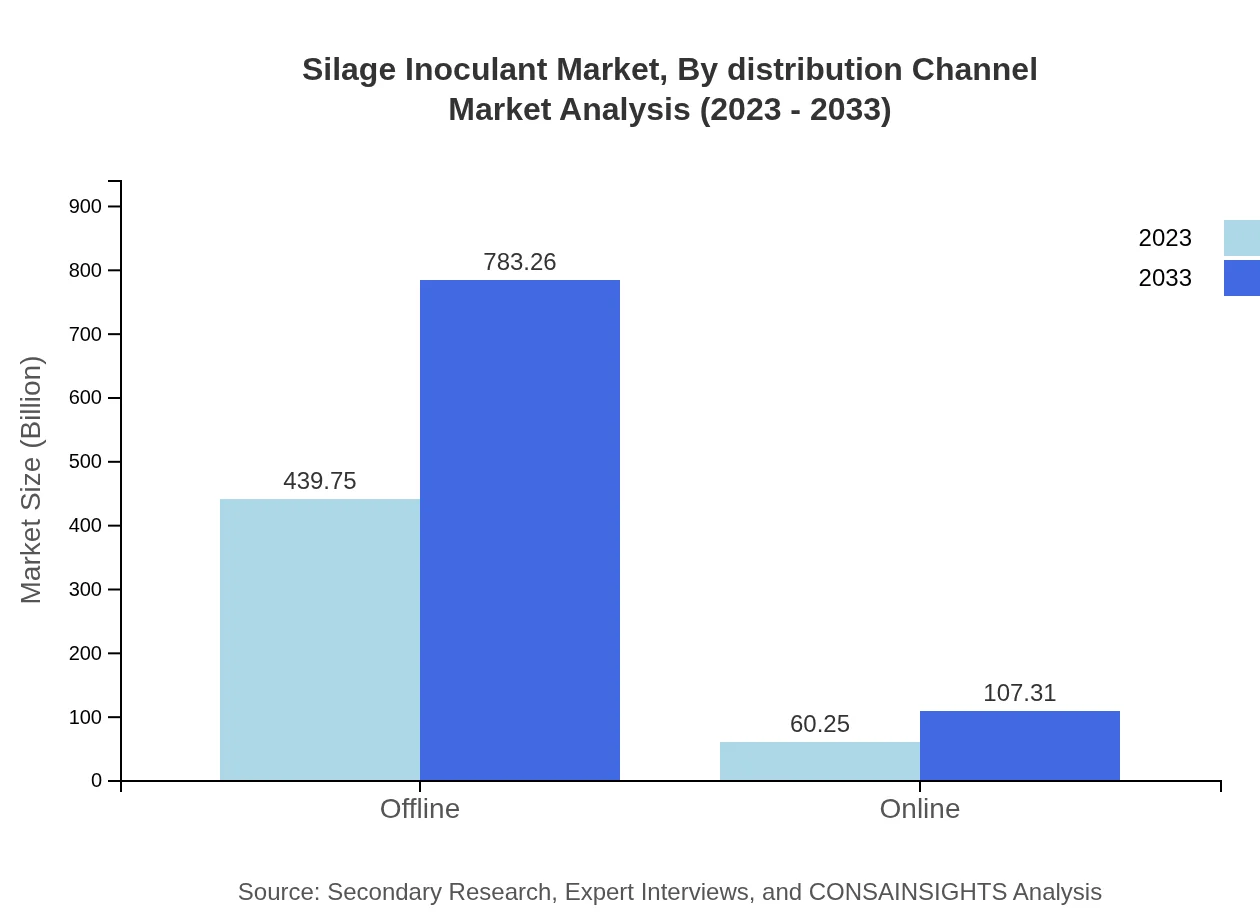

The market is highly segmented into offline and online formulations. Offline formulations dominate with $439.75 million in 2023, anticipated to rise to $783.26 million by 2033, while online sales are expected to increase from $60.25 million to $107.31 million.

Silage Inoculant Market Analysis By Distribution Channel

Distribution channels encompass a combination of farm supplies, agronomists, and direct online sales, facilitating wider access to silage inoculants and boosting market penetration across regions.

Silage Inoculant Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Silage Inoculant Industry

Huangpu Huagong Technology Co., Ltd.:

A key player in the Asia-Pacific region, specializing in fermentation technologies and providing innovative solutions for livestock health and productivity.Chr. Hansen:

A leading global supplier of biological solutions, focused on developing high-performance silage inoculants that enhance animal nutrition and dairy productivity.Alltech:

Known for their pioneering research in animal health and nutrition, Alltech offers advanced silage treatments to increase feed digestibility.Lallemand Animal Nutrition:

Specializes in yeast and bacteria to improve forage quality, offering a range of inoculants for both dairy and beef operations.We're grateful to work with incredible clients.

FAQs

What is the market size of silage Inoculant?

The global silage inoculant market was valued at $500 million in 2023, with a projected CAGR of 5.8% through 2033, indicating steady growth in demand for silage inoculants in agricultural practices.

What are the key market players or companies in the silage Inoculant industry?

Key players include leading agricultural biotechnology firms specializing in microbial solutions and additives, contributing to innovations and expanding their product portfolios in the silage inoculant sector.

What are the primary factors driving the growth in the silage Inoculant industry?

Growth is driven by increasing dairy and beef production, rising demand for animal feed efficiency, and advancements in microbial technology that enhance silage preservation and quality.

Which region is the fastest Growing in the silage Inoculant?

The Asia Pacific region is projected to be the fastest-growing market, increasing from $93.05 million in 2023 to $165.74 million by 2033, driven by expanding livestock industries and demand for quality fodder.

Does Consainsights provide customized market report data for the silage Inoculant industry?

Yes, Consainsights offers customized market research reports tailored to specific client needs, ensuring relevant market insights and data for the silage-inoculant industry.

What deliverables can I expect from this silage Inoculant market research project?

Deliverables include comprehensive market analysis, competitive landscape overview, regional insights, segmentation data, and actionable recommendations to inform business strategy in the silage-inoculant sector.

What are the market trends of silage Inoculant?

Key trends include increasing adoption of microbial inoculants, growth in organic farming, and heightened focus on sustainable agricultural practices, enhancing silage quality and livestock productivity.