Silane Market Report

Published Date: 02 February 2026 | Report Code: silane

Silane Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the silane market from 2023 to 2033. It includes insights into market size, growth trends, regional analysis, technological advancements, and competitive landscape, offering valuable information for stakeholders to understand market dynamics and future opportunities.

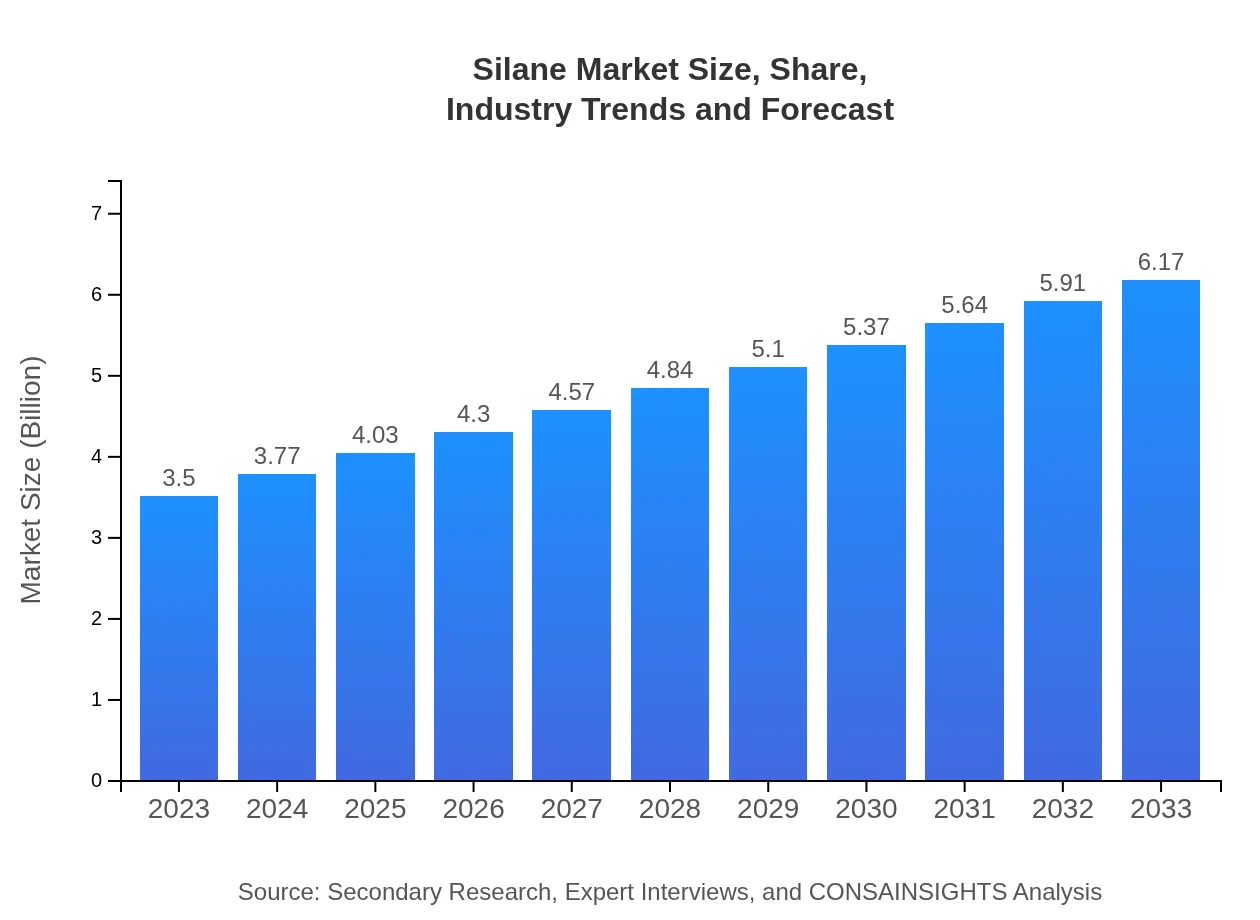

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $6.17 Billion |

| Top Companies | Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Evonik Industries AG |

| Last Modified Date | 02 February 2026 |

Silane Market Overview

Customize Silane Market Report market research report

- ✔ Get in-depth analysis of Silane market size, growth, and forecasts.

- ✔ Understand Silane's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Silane

What is the Market Size & CAGR of Silane market in 2023?

Silane Industry Analysis

Silane Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Silane Market Analysis Report by Region

Europe Silane Market Report:

The European Silane market is valued at $1.01 billion in 2023 and projected to expand to $1.78 billion by 2033. The region is experiencing high demand for eco-friendly and high-performance materials in construction and automotive, which drives the uptake of silane products.Asia Pacific Silane Market Report:

In 2023, the Silane market in the Asia Pacific is valued at $0.71 billion and is projected to reach $1.25 billion by 2033. The region benefits from booming construction and automotive industries, particularly in countries like China and India, which are driving demand for silane products in adhesives and coatings.North America Silane Market Report:

In North America, the Silane market is expected to grow from $1.24 billion in 2023 to $2.19 billion by 2033. The region's growth is fueled by a strong focus on technological advancements in manufacturing processes and rising construction activity, particularly in the United States.South America Silane Market Report:

The South American market for Silane in 2023 is valued at $0.32 billion, projected to grow to $0.56 billion by 2033. Increasing infrastructure projects and growing automotive sectors in Brazil and Argentina contribute to the rising demand for Silane-based formulations.Middle East & Africa Silane Market Report:

In the Middle East and Africa, the market is valued at $0.22 billion in 2023, with expectations of growth to $0.39 billion by 2033. The expansion in construction projects and increasing automotive production in countries like the UAE and South Africa are primary growth factors.Tell us your focus area and get a customized research report.

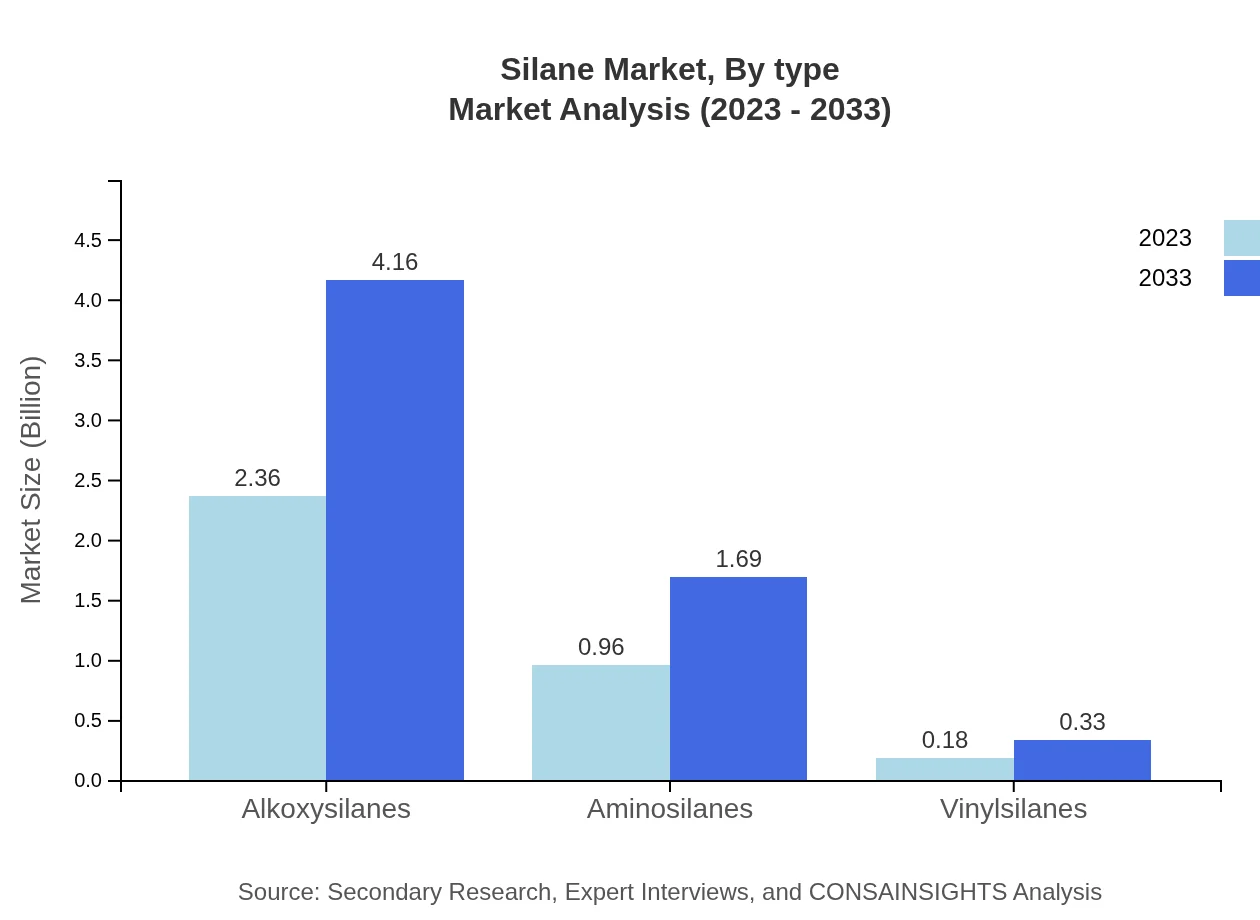

Silane Market Analysis By Type

The Silane market, categorized by type, emphasizes alkoxysilanes, accounting for a significant share of the market at 67.41% in 2023 and projected to remain stable at 67.41% through 2033. Aminosilanes and vinylsilanes also play crucial roles, representing 27.31% and 5.28% shares respectively in 2023.

Silane Market Analysis By Application

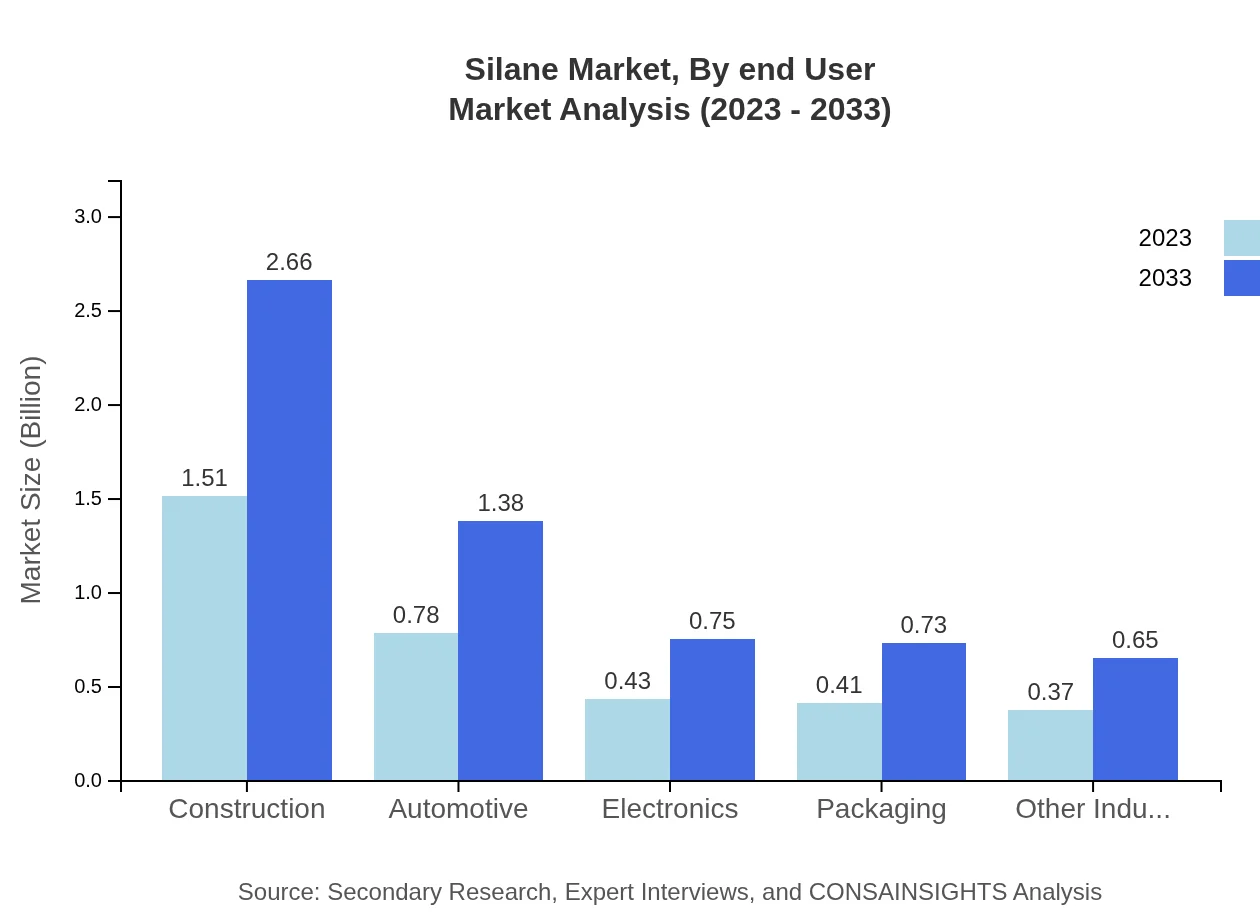

By application, the construction sector dominates the Silane market with a 43.1% share in 2023, expected to grow to 43.1% in 2033. Other significant sectors include automotive (22.41%), electronics (12.16%), and packaging (11.8%), reflecting diverse applicability and operational efficiency.

Silane Market Analysis By End User

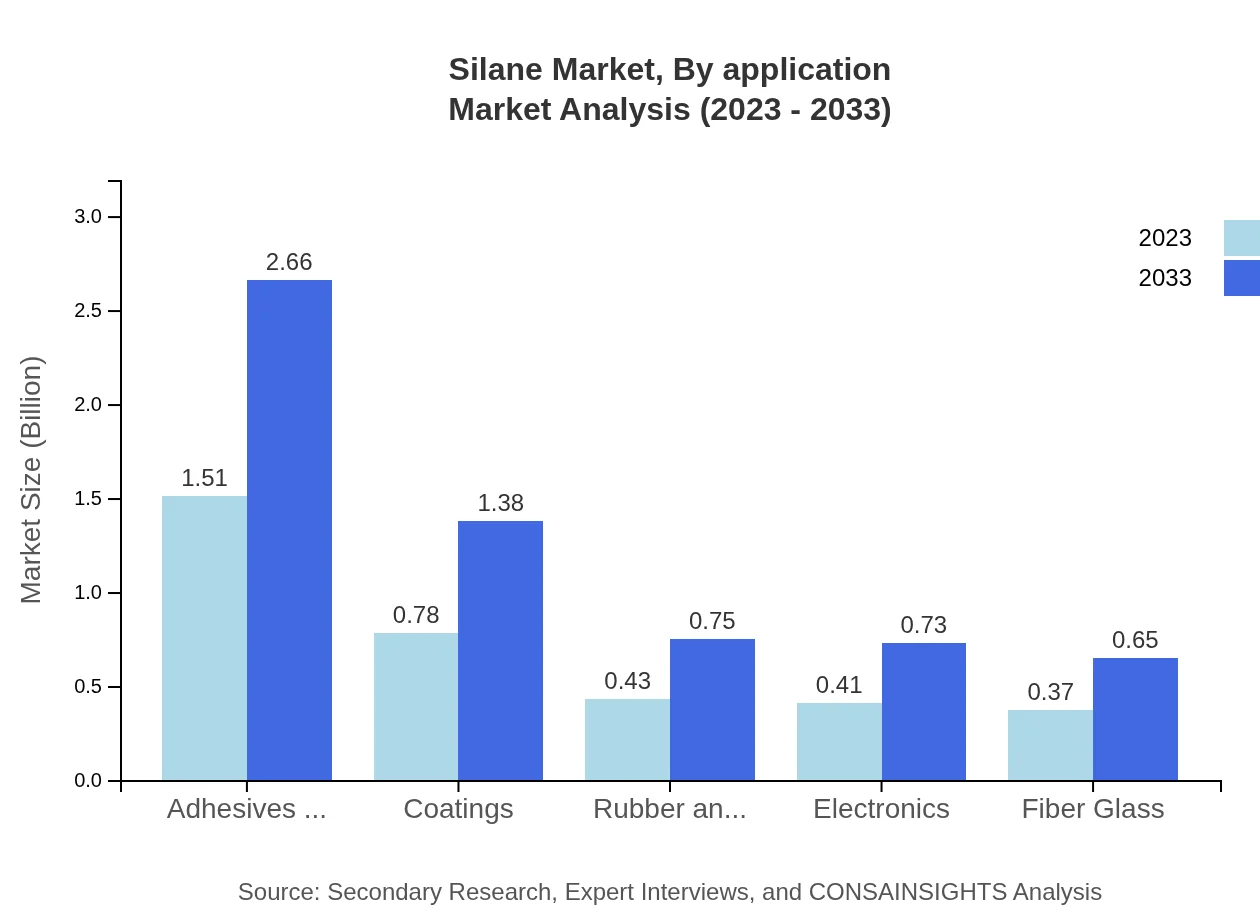

The Silane market by end-user industry highlights adhesives and sealants at 43.1% in 2023, expected to maintain the same share through 2033. This segment benefits significantly from the rising demand for superior bonding solutions across various industries.

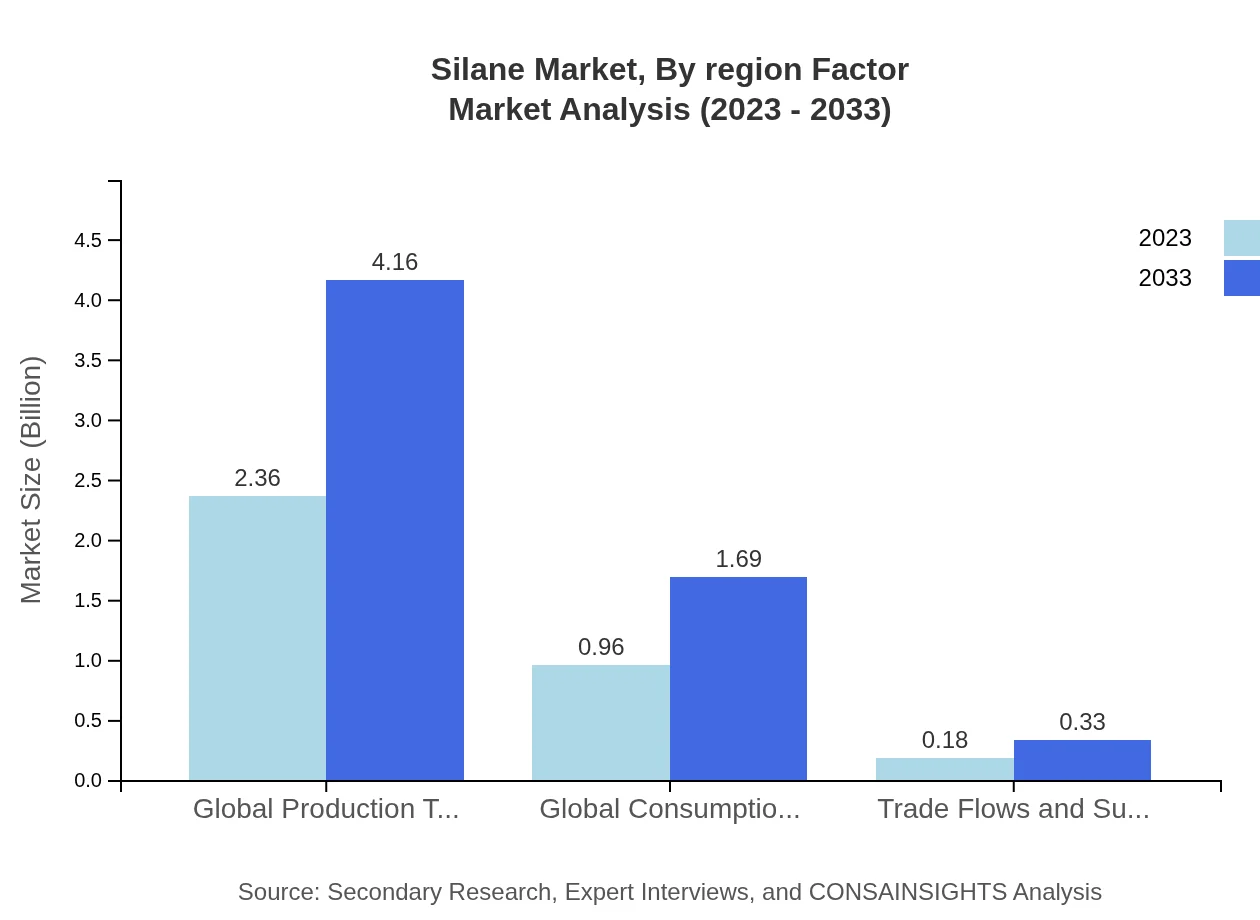

Silane Market Analysis By Region Factor

Regional factors play a pivotal role in shaping the Silane market dynamics, with North America and Europe leading in market value due to advanced manufacturing capabilities and stringent regulations promoting high-quality standards in silane applications.

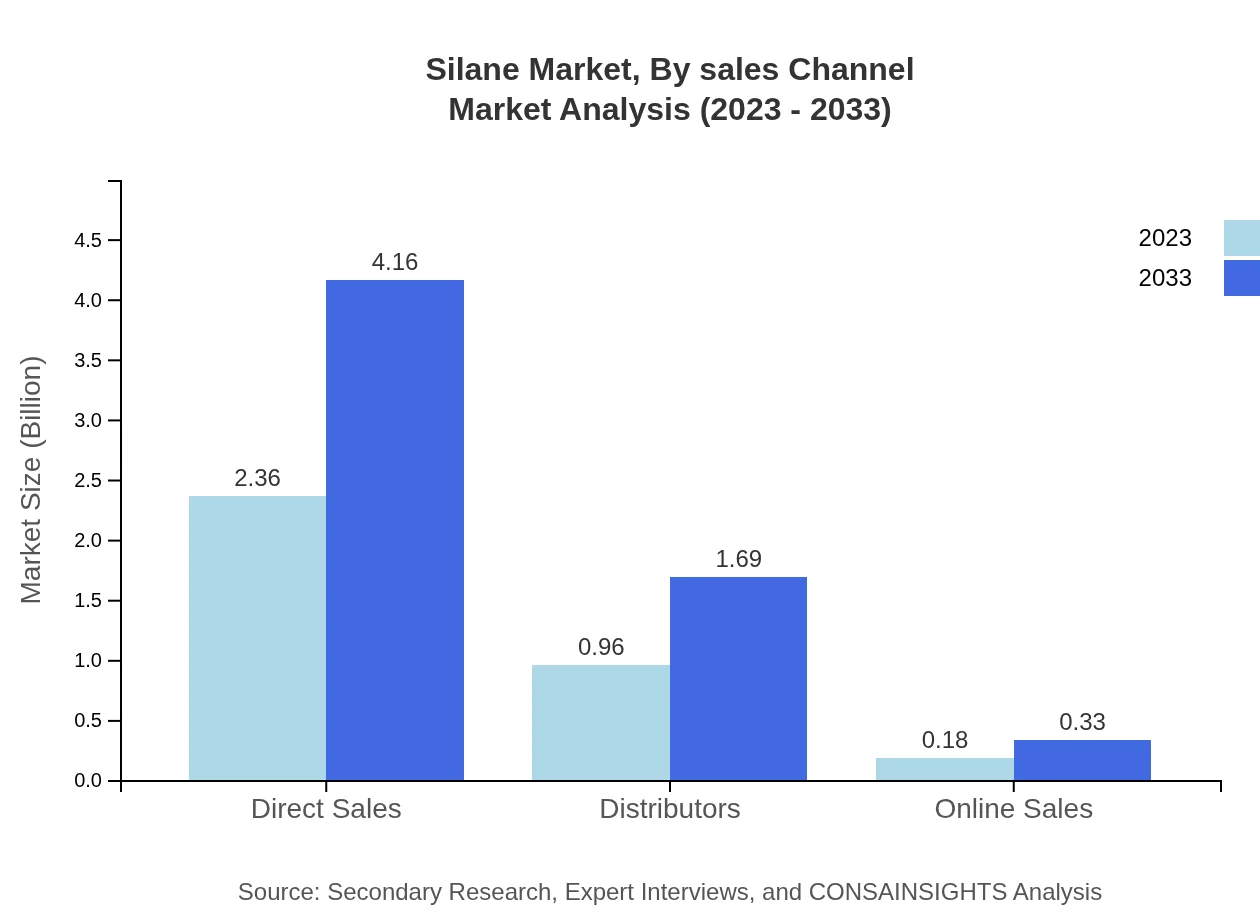

Silane Market Analysis By Sales Channel

Sales channels for Silanes include direct sales, distributors, and online platforms. In 2023, direct sales are projected to hold a 67.41% market share, illustrating a preference for direct engagement between manufacturers and large clients, while distributor channels also play a crucial role in market penetration.

Silane Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Silane Industry

Wacker Chemie AG:

A leading producer of silanes globally, Wacker Chemie AG specializes in silicone and silane chemical production, contributing significantly to the construction and automotive segments by providing high-quality bonding solutions.Shin-Etsu Chemical Co., Ltd.:

A major player in the silane market, Shin-Etsu Chemical provides a diverse range of silanes which find applications across electronics, automotive, and construction industries, known for their innovative approaches and quality assurance.Evonik Industries AG:

Evonik is recognized for its advanced silane solutions that enhance product performance in various applications. Their focus on R&D and sustainable practices positions them as a front-runner in the chemical industry.We're grateful to work with incredible clients.

FAQs

What is the market size of silane?

The global silane market is currently valued at approximately $3.5 billion, with a projected CAGR of 5.7% from 2023 to 2033, reflecting robust growth driven by various industrial applications and increased demand.

What are the key market players or companies in this silane industry?

Key players in the silane market include prominent companies such as Dow Corning, Wacker Chemie AG, and Evonik Industries. These companies contribute significantly to innovation and market expansion through their diverse product portfolios.

What are the primary factors driving the growth in the silane industry?

The growth of the silane industry is primarily driven by increasing demand in construction, automotive, and electronics sectors. Innovations in silane technology and expanding application areas also contribute significantly to market growth.

Which region is the fastest Growing in the silane?

The fastest-growing region in the silane market is expected to be North America, with a market increase from $1.24 billion in 2023 to $2.19 billion by 2033, fueled by advancements in technology and rising industrial applications.

Does ConsaInsights provide customized market report data for the silane industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the silane industry, ensuring comprehensive insights that address unique client requirements and market dynamics.

What deliverables can I expect from this silane market research project?

Clients can expect detailed analyses including market size evaluation, growth forecasts, competitive landscape assessments, regional breakdowns, and insights into market trends and consumer behavior surrounding silane.

What are the market trends of silane?

Current trends in the silane market include a shift towards eco-friendly formulations, increased use in advanced materials, and significant research and development activities aimed at enhancing performance and reducing production costs.