Silica Market Report

Published Date: 02 February 2026 | Report Code: silica

Silica Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Silica market, focusing on market trends, size, and insights from 2023 to 2033. It includes segment performance, regional analysis, key players, and future forecasts to help stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

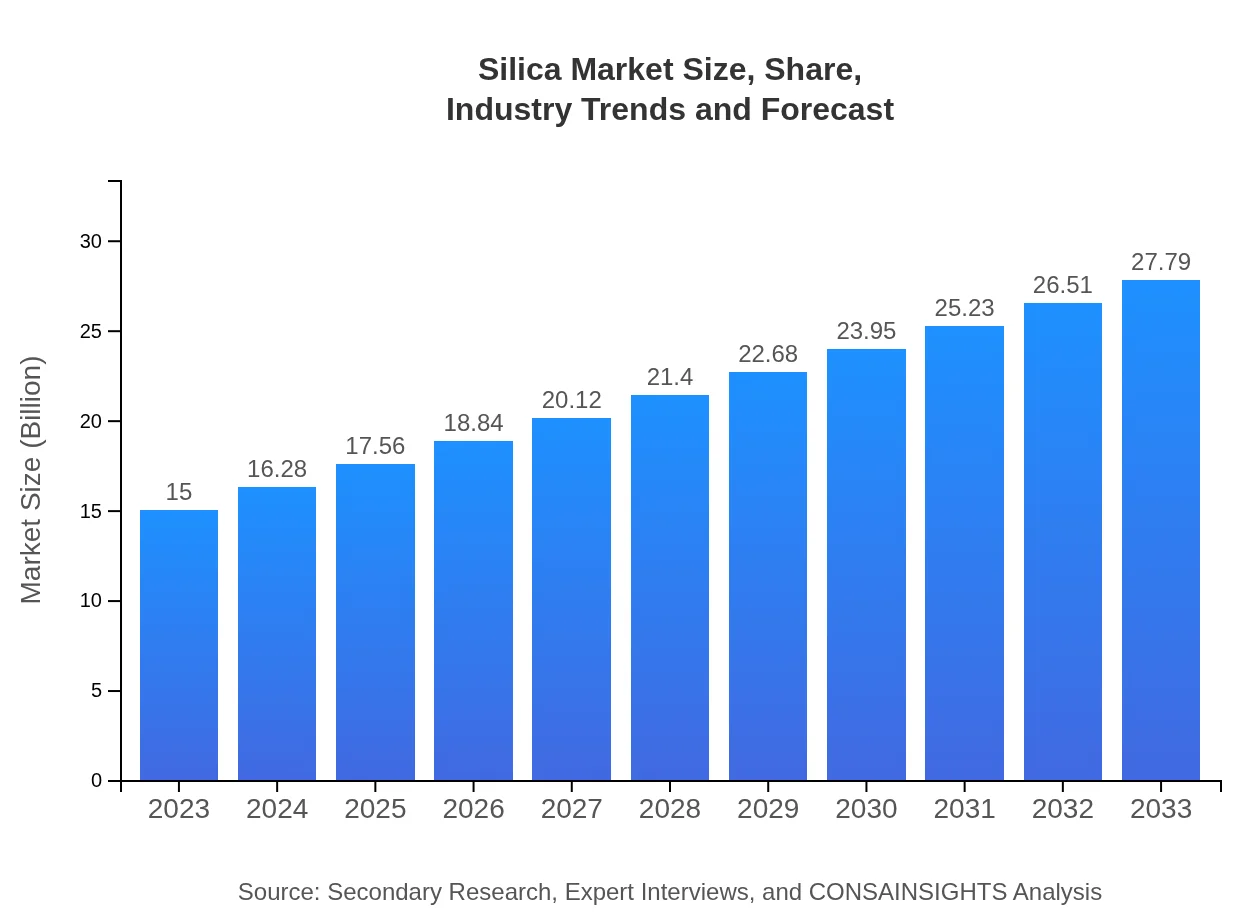

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Evonik Industries AG, PDK Silica Corporation, W.R. Grace & Co., Fuso Chemical Co., Ltd. |

| Last Modified Date | 02 February 2026 |

Silica Market Overview

Customize Silica Market Report market research report

- ✔ Get in-depth analysis of Silica market size, growth, and forecasts.

- ✔ Understand Silica's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Silica

What is the Market Size & CAGR of Silica market in 2023?

Silica Industry Analysis

Silica Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Silica Market Analysis Report by Region

Europe Silica Market Report:

In Europe, the Silica market size is $4.06 billion as of 2023, with a projected growth to $7.53 billion by 2033. The focus on sustainable building materials and strict regulatory compliance are propelling the market forward in this region.Asia Pacific Silica Market Report:

The Asia Pacific region comprises a significant share of the global Silica market, estimated at $2.89 billion in 2023 and projected to reach $5.36 billion by 2033. Countries like China and India are leading in consumption due to rapid industrialization and urbanization. The demand for Silica in construction and electronics is particularly strong in this region.North America Silica Market Report:

North America represents a robust market for Silica, with a valuation of $5.69 billion in 2023 anticipated to reach $10.54 billion by 2033. A significant demand for Silica in the automotive and construction sectors, coupled with advancements in manufacturing technologies, boosts the market growth.South America Silica Market Report:

In South America, the Silica market was valued at $1.42 billion in 2023 and is expected to grow to $2.63 billion by 2033, with Brazil driving the market due to its agricultural activities requiring silica-based products in fertilizers and pesticides.Middle East & Africa Silica Market Report:

The Middle East and Africa segment is emerging, with a market size of $0.94 billion in 2023, expected to grow to $1.73 billion by 2033. This growth is fueled by infrastructural developments and increased demand for Silica in oil and gas applications.Tell us your focus area and get a customized research report.

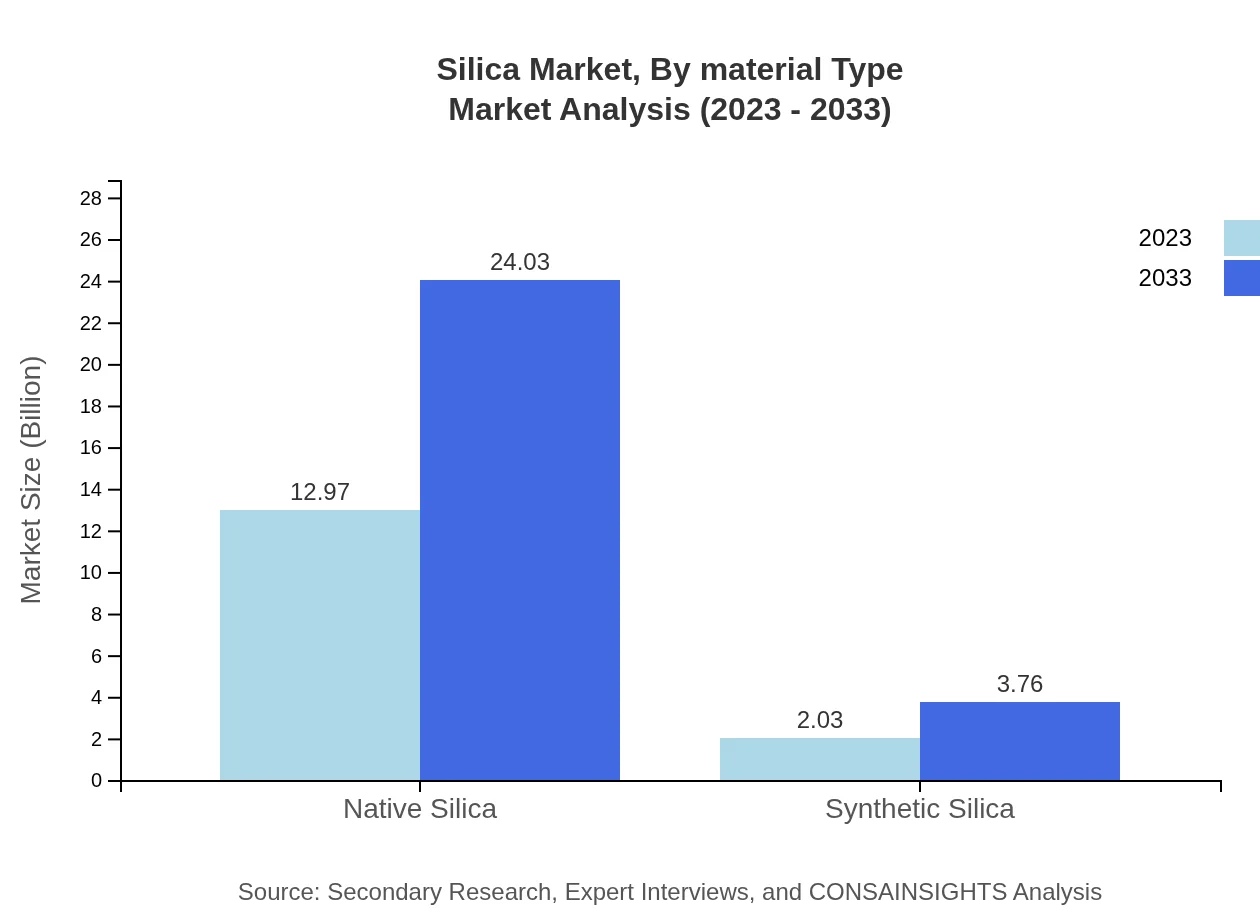

Silica Market Analysis By Material Type

Native Silica dominates the market, expected to grow from $12.97 billion in 2023 to $24.03 billion in 2033, maintaining a steady share. Synthetic Silica and colloidal Silica are also vital, though they comprise a smaller market share, growing significantly due to developments in industrial applications.

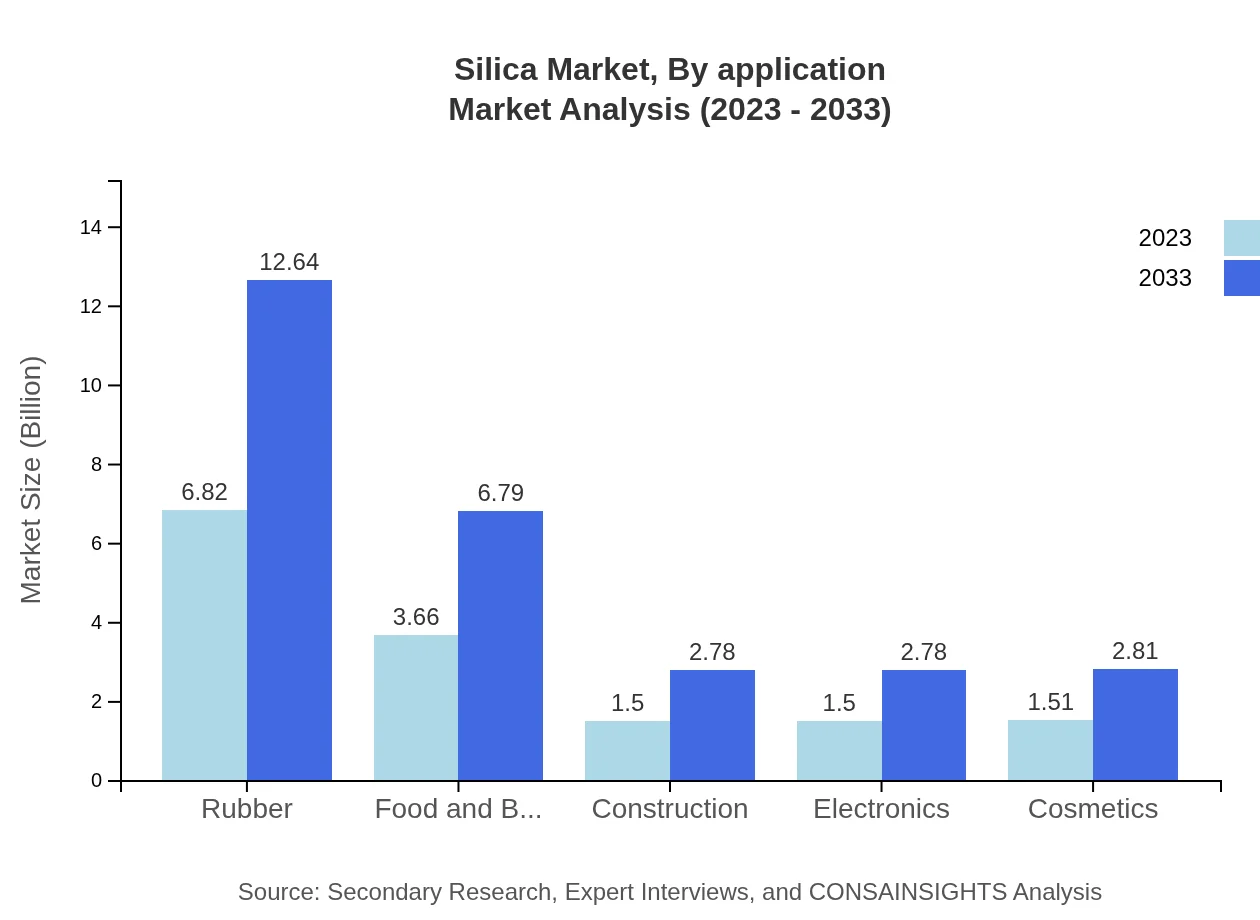

Silica Market Analysis By Application

The automotive sector is the largest application segment, valued at $6.82 billion in 2023 and expected to reach $12.64 billion by 2033. Other significant applications include construction, pharmaceuticals, and electronics, with each segment projected to enhance in alignment with technological advancements and increasing product needs.

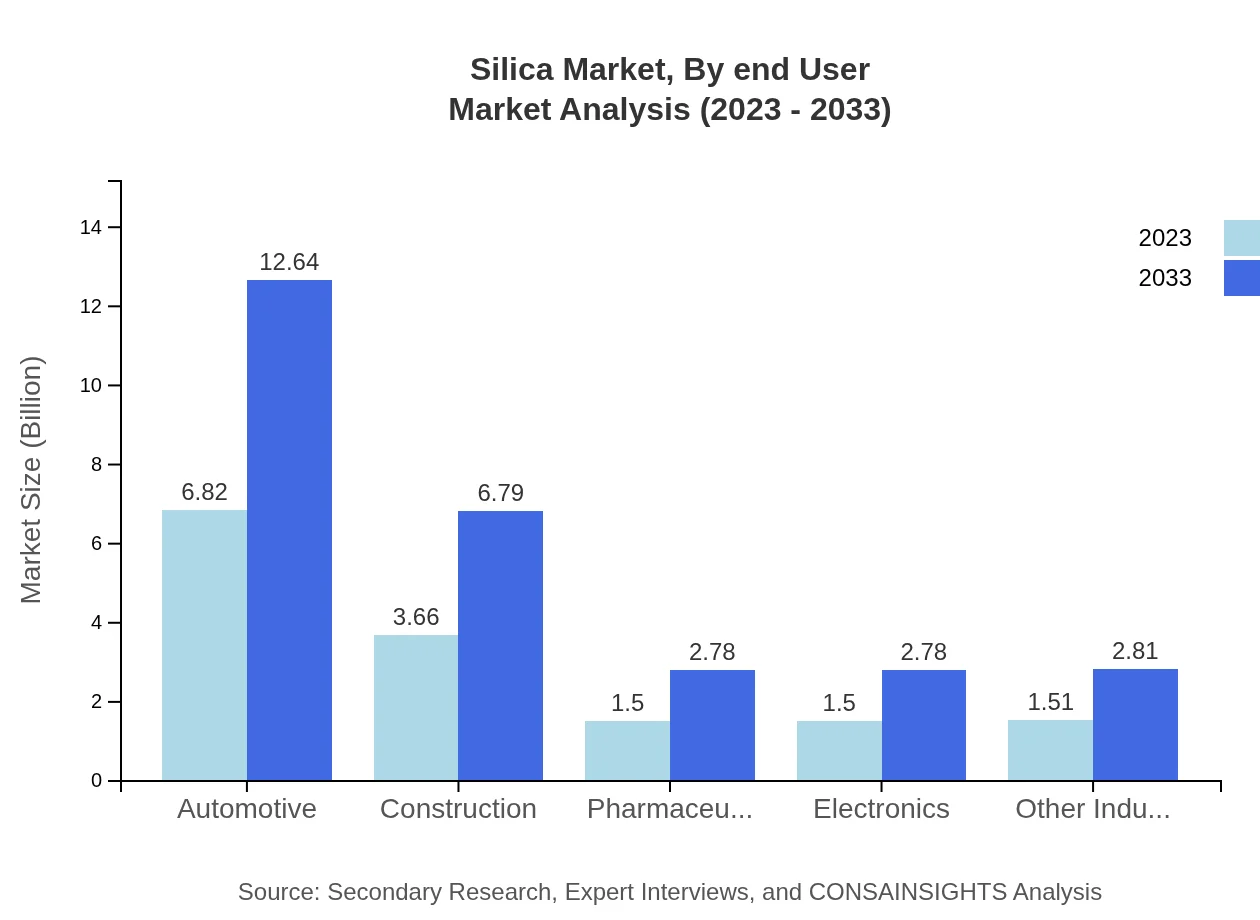

Silica Market Analysis By End User

End-users of Silica predominantly include the automotive, construction, and pharmaceuticals sectors, which are expected to witness significant growth over the next decade. The automotive industry’s focus on weight reduction and performance improvement will further enhance Silica's demand.

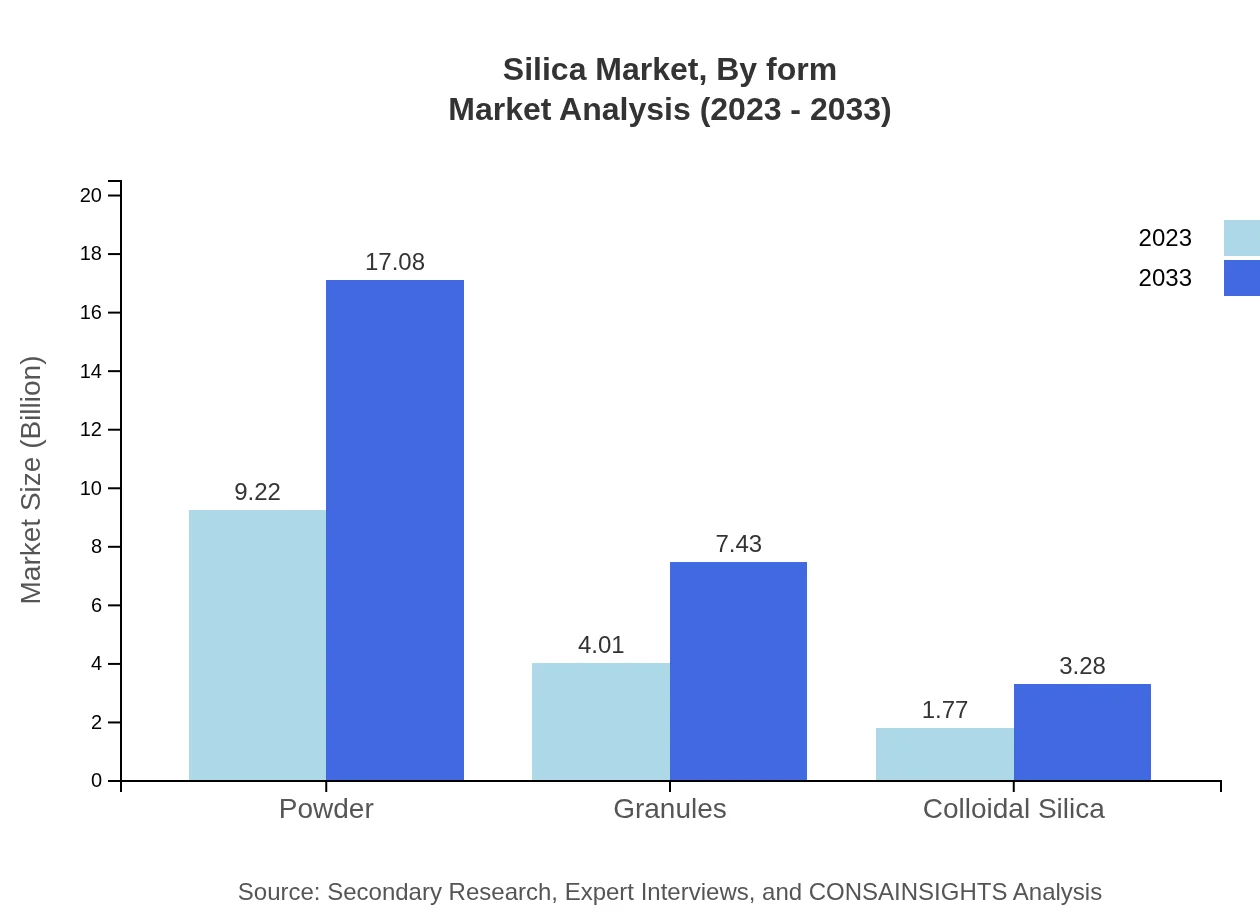

Silica Market Analysis By Form

In terms of forms, powder Silica leads the market with a size of $9.22 billion in 2023, forecasted to grow to $17.08 billion. Granular Silica and colloidal Silica also hold important shares, with each form showcasing unique properties and applications that cater to various industry needs.

Silica Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Silica Industry

Evonik Industries AG:

A global leader in specialty chemicals, Evonik produces high-performance Silica for a variety of applications including rubber and coating industries.PDK Silica Corporation:

PDK Silica focuses on manufacturing and innovation in the Silica market, contributing to advancements in both native and synthetic Silica products.W.R. Grace & Co.:

A major player in the industrial Silica market, W.R. Grace offers a range of Silica solutions tailored to various industrial applications.Fuso Chemical Co., Ltd.:

Fuso Chemical specializes in high-purity Silica for the pharmaceuticals and electronics industries, contributing to market expansion through innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of silica?

The silica market is projected to reach approximately $15 billion by 2033, growing at a CAGR of 6.2%. The market size is expected to expand significantly, reflecting increased demand across various industries.

What are the key market players or companies in this silica industry?

Key players in the silica market include multinational corporations and specialty chemical firms, although specific names are not provided. These businesses typically dominate through innovation and strategic partnerships.

What are the primary factors driving the growth in the silica industry?

The growth in the silica industry is driven by rising demand in construction, automotive, and electronics sectors, alongside the increasing application of silica in innovative technologies and products.

Which region is the fastest Growing in the silica market?

North America is the fastest-growing region in the silica market, with the market projected to increase from $5.69 billion in 2023 to $10.54 billion by 2033, indicating robust growth prospects.

Does ConsaInsights provide customized market report data for the silica industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the silica industry, allowing for detailed insights that cater to various stakeholders and market segments.

What deliverables can I expect from this silica market research project?

Deliverables from the silica market research project typically include comprehensive reports, data analytics, market forecasts, and segmented analysis, providing a holistic view of the market landscape.

What are the market trends of silica?

Current trends in the silica market highlight a shift towards eco-friendly products, increased demand in emerging applications across industries, and advancements in manufacturing technologies that enhance silica functionality.