Silicate Coatings Market Report

Published Date: 02 February 2026 | Report Code: silicate-coatings

Silicate Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Silicate Coatings market, including market size, growth rates, and regional insights for the forecast period 2023 - 2033.

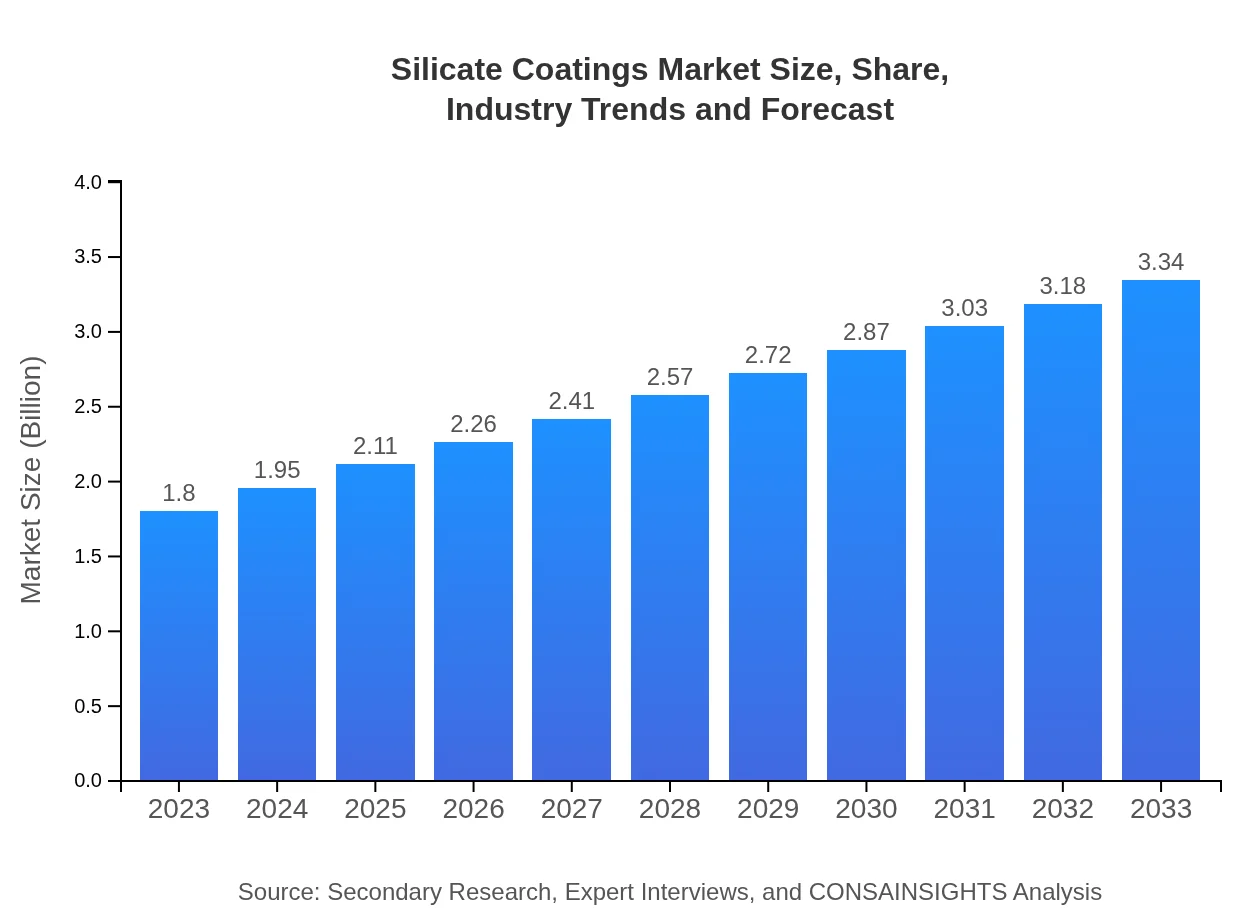

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | BASF SE, Sherwin-Williams, PPG Industries, AkzoNobel |

| Last Modified Date | 02 February 2026 |

Silicate Coatings Market Overview

Customize Silicate Coatings Market Report market research report

- ✔ Get in-depth analysis of Silicate Coatings market size, growth, and forecasts.

- ✔ Understand Silicate Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Silicate Coatings

What is the Market Size & CAGR of Silicate Coatings market in 2023?

Silicate Coatings Industry Analysis

Silicate Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Silicate Coatings Market Analysis Report by Region

Europe Silicate Coatings Market Report:

The European silicate coatings market is valued at USD 0.50 billion in 2023 and is anticipated to reach USD 0.93 billion by 2033, propelled by stringent regulations favoring low-emission products and a shift towards sustainable construction practices.Asia Pacific Silicate Coatings Market Report:

In 2023, the Asia-Pacific silicate coatings market is valued at USD 0.37 billion, projected to grow to USD 0.69 billion by 2033. The region's growth is driven by rapid urbanization and a robust construction sector, particularly in countries like China and India.North America Silicate Coatings Market Report:

North America shows significant promise, with the market valuation at USD 0.65 billion in 2023, projected to rise to USD 1.20 billion by 2033. The region is moving towards environmentally friendly materials, with strong demand from the construction industry.South America Silicate Coatings Market Report:

The South American market is currently valued at USD 0.17 billion in 2023, expected to expand to USD 0.31 billion by 2033. This growth is supported by increased infrastructure projects and investments in sustainable development.Middle East & Africa Silicate Coatings Market Report:

The Middle East and Africa market valuation in 2023 is USD 0.11 billion, with projections to reach USD 0.20 billion by 2033. This growth is attributed to increased infrastructure investments in developing countries as well as a focus on energy-efficient construction materials.Tell us your focus area and get a customized research report.

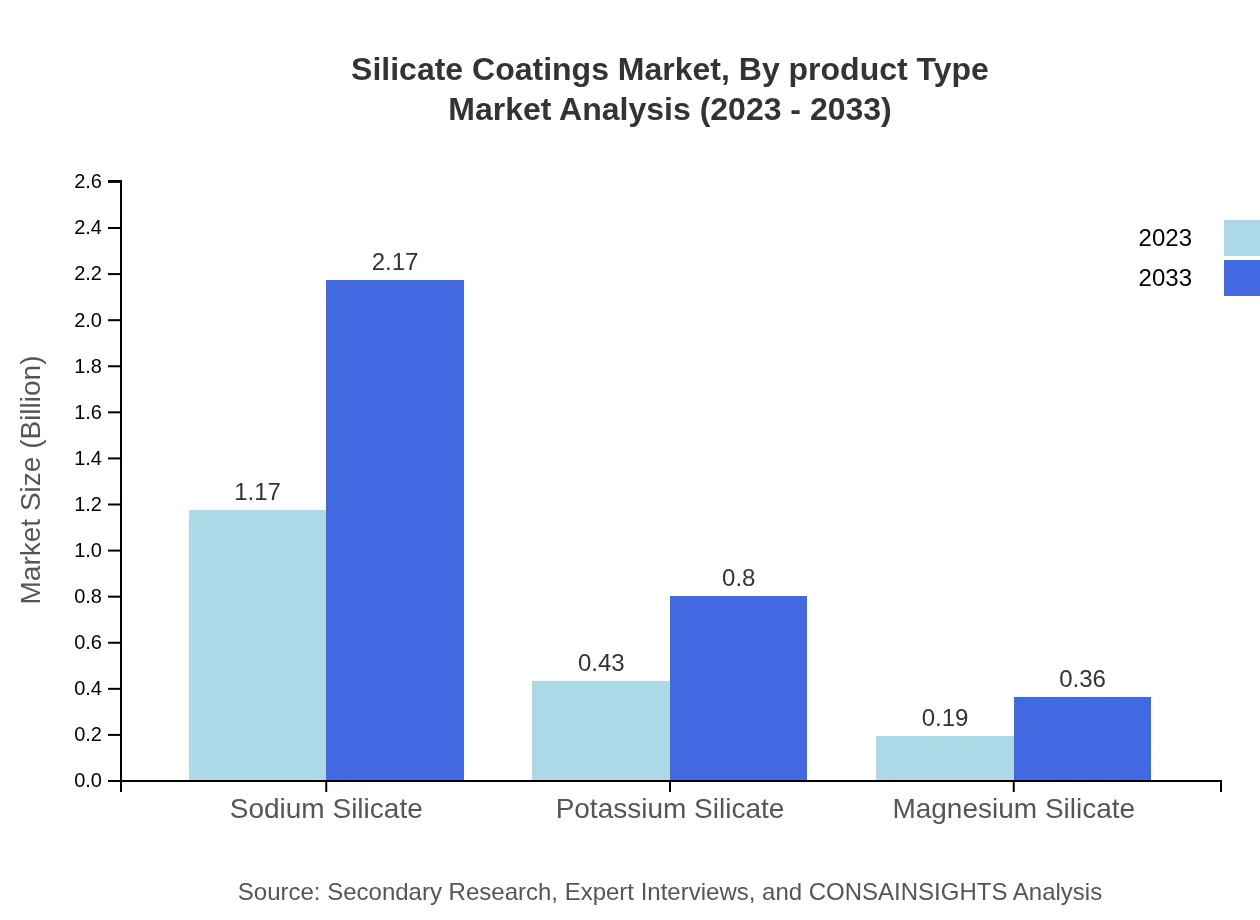

Silicate Coatings Market Analysis By Product Type

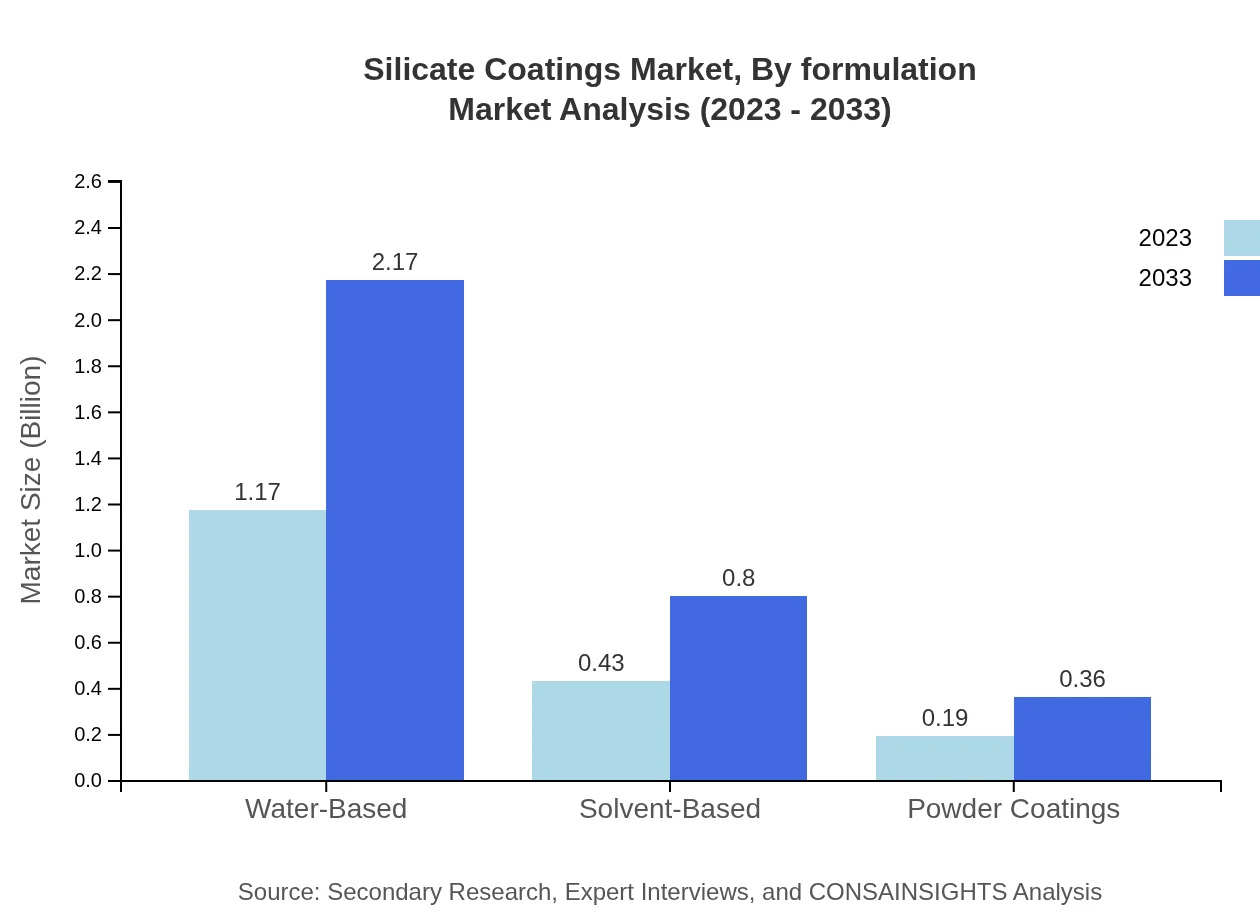

Water-based silicate coatings dominate the market, with a size projected at USD 2.17 billion by 2033, maintaining a 65.18% share throughout the decade. Solvent-based products are expected to reach USD 0.80 billion, holding 24.11% of the market, and powder coatings will grow to USD 0.36 billion, capturing 10.71% of the market.

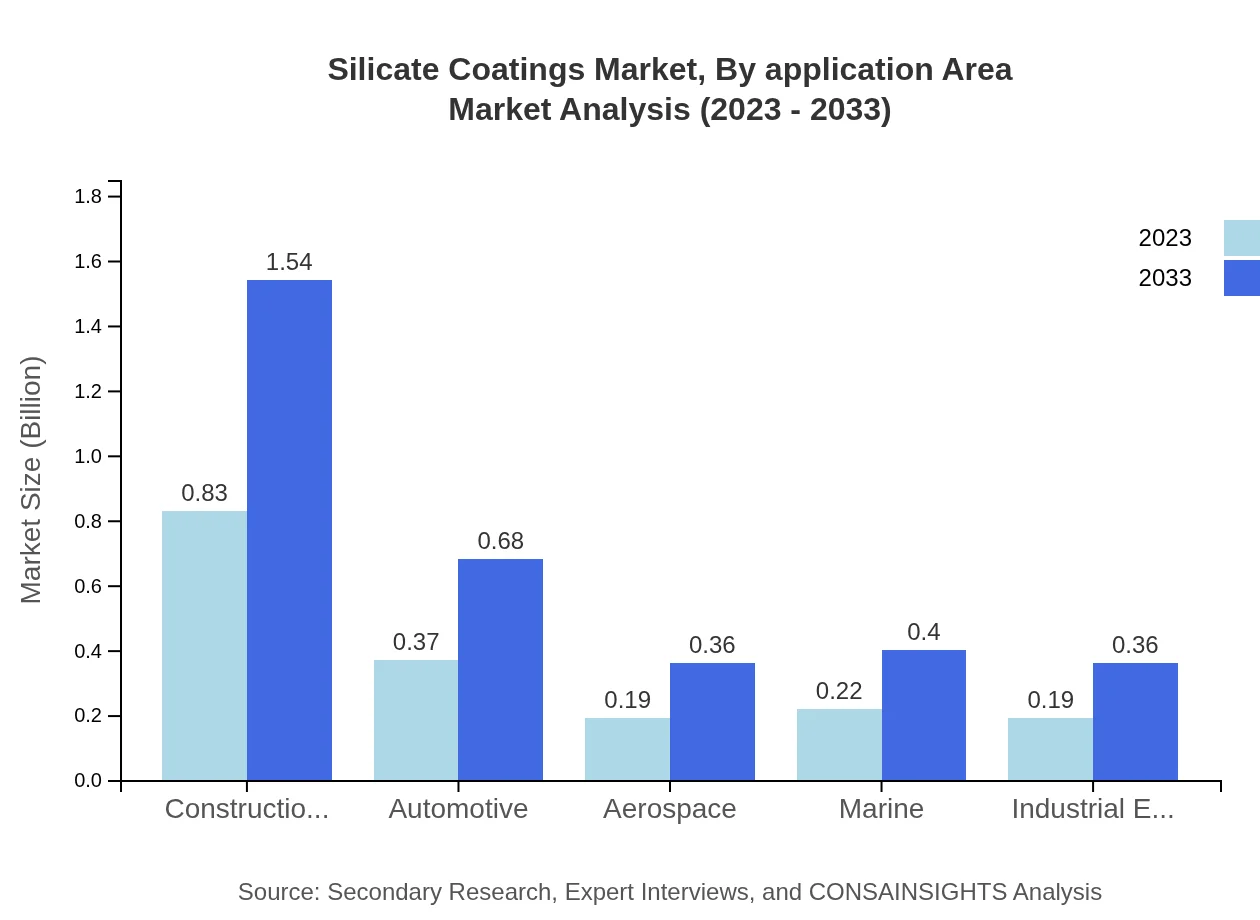

Silicate Coatings Market Analysis By Application Area

The construction and infrastructure segment represents the largest share of the market, at 46.19%, forecasting growth to USD 1.54 billion by 2033. Other notable segments include automotive and aerospace, which account for 20.37% and 10.77% respectively, emphasizing the versatility of silicate coatings across various applications.

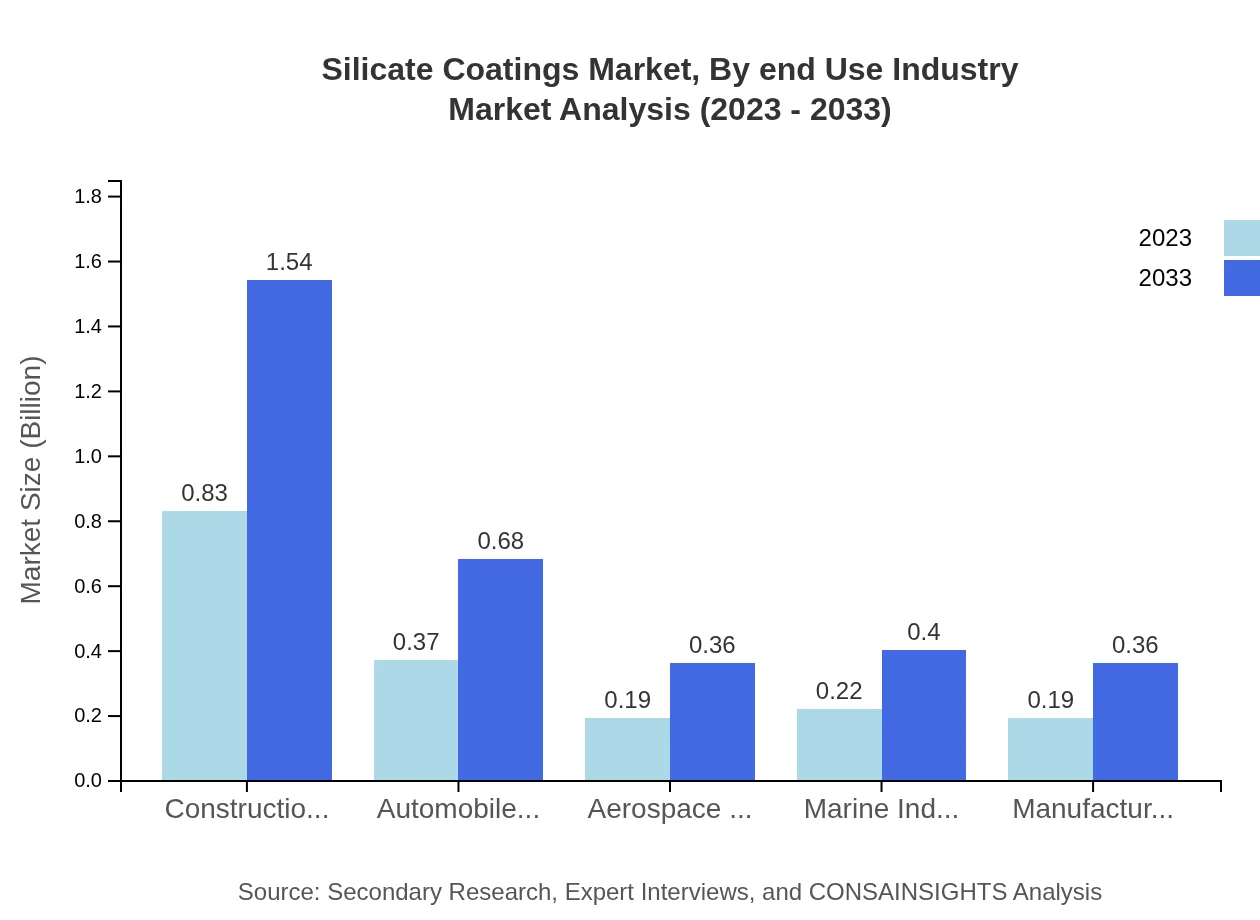

Silicate Coatings Market Analysis By End Use Industry

The silicate coatings market is also categorized by end-use industries, where the construction industry leads significantly with 46.19% market share, while automotive and aerospace follow with 20.37% and 10.77% respectively, highlighting the essentiality of these coatings in industrial applications.

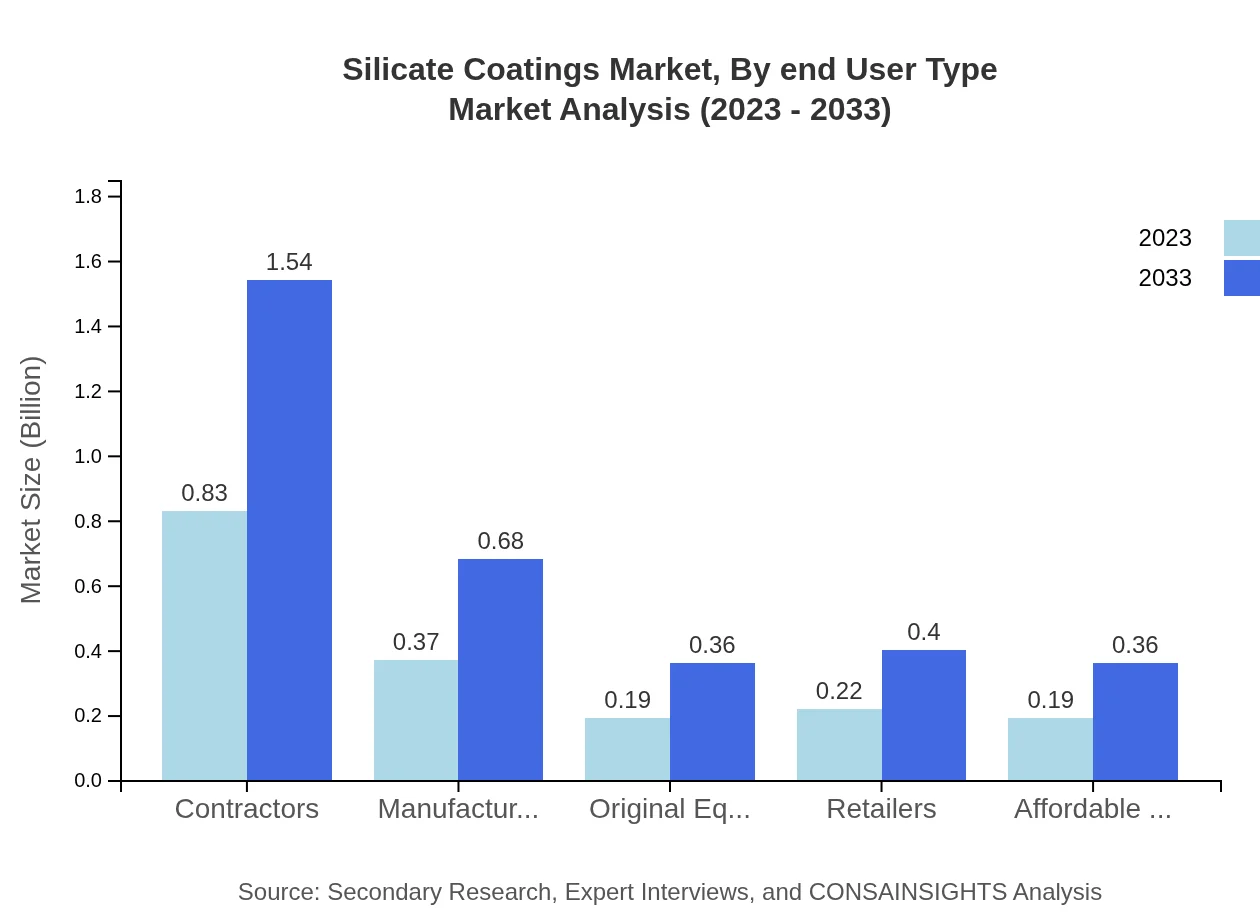

Silicate Coatings Market Analysis By End User Type

Key end-user types include contractors, manufacturers, and retailers. Contractors account for the largest portion with 46.19% market share, predictive growth to USD 1.54 billion by 2033, while original equipment manufacturers hold 10.77%, marking important segments in the industry.

Silicate Coatings Market Analysis By Formulation

The market is also analyzed by formulation, focusing on water-based and solvent-based coatings. Water-based formulations constitute the significant majority at a projected growth to USD 2.17 billion, while solvent-based formulations anticipate reaching USD 0.80 billion by 2033.

Silicate Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Silicate Coatings Industry

BASF SE:

BASF SE is a leading global chemical company that offers a wide range of silicate products, emphasizing sustainability and innovation in its coating solutions.Sherwin-Williams:

Sherwin-Williams is a renowned player in the coatings sector, providing durable silicate coatings with a focus on environmental safety and performance.PPG Industries:

PPG Industries specializes in protective and decorative coatings, consistently expanding its portfolio to include advanced silicate solutions for various applications.AkzoNobel:

AkzoNobel is a market leader in decorative paints and performance coatings, leveraging its R&D capabilities to innovate silicate coatings with enhanced features.We're grateful to work with incredible clients.

FAQs

What is the market size of silicate Coatings?

The global market size for silicate coatings is projected to reach approximately $1.8 billion by 2033, growing at a CAGR of 6.2%. This growth reflects increasing demand across construction and automotive sectors, among others.

What are the key market players or companies in the silicate Coatings industry?

Key players in the silicate coatings market include major manufacturers and suppliers who specialize in both water-based and solvent-based coatings, catering to sectors like construction, automotive, and infrastructure developments.

What are the primary factors driving the growth in the silicate coatings industry?

The growth of the silicate coatings industry is driven by the rising need for eco-friendly coatings and increasing construction activities globally. Additionally, advancements in technology and sustainability initiatives play pivotal roles.

Which region is the fastest Growing in the silicate coatings market?

The Asia Pacific region is anticipated to grow at the fastest rate, with market values rising from $0.37 billion in 2023 to approximately $0.69 billion by 2033, driven by construction and industrial activities.

Does ConsaInsights provide customized market report data for the silicate coatings industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the silicate coatings industry, ensuring relevant insights and trends are highlighted.

What deliverables can I expect from this silicate coatings market research project?

From this market research project, clients can expect comprehensive reports containing market analysis, segmentation data, forecasts, competitive landscape, and key drivers affecting the silicate coatings industry.

What are the market trends of silicate coatings?

Current trends in the silicate coatings market include a shift towards water-based solutions, increased demand for sustainable products, and innovations aimed at enhancing durability and performance in various applications.