Simultaneous Localization And Mapping Market Report

Published Date: 31 January 2026 | Report Code: simultaneous-localization-and-mapping

Simultaneous Localization And Mapping Market Size, Share, Industry Trends and Forecast to 2033

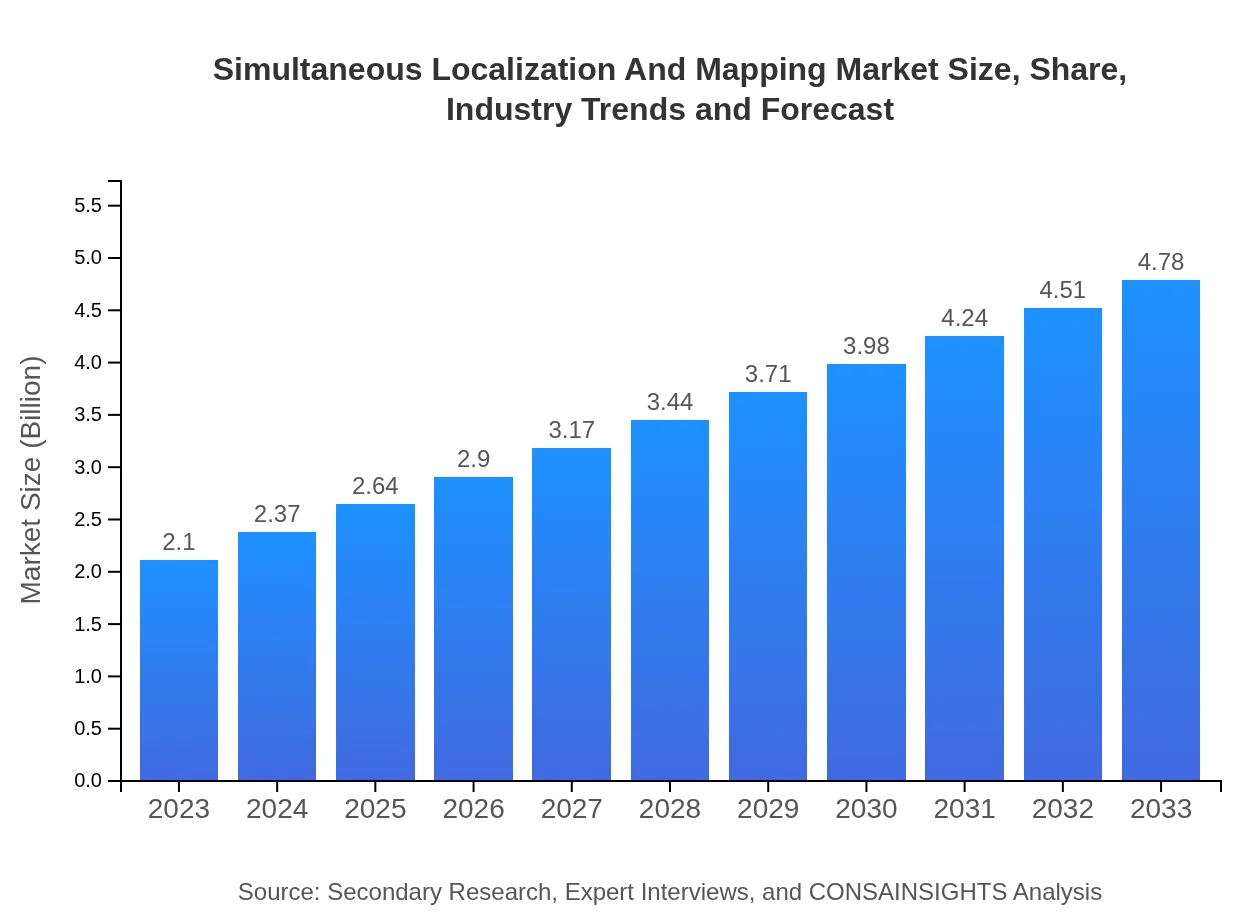

This report provides a comprehensive analysis of the Simultaneous Localization And Mapping (SLAM) market, covering its growth trajectory from 2023 to 2033. Detailed insights into market size, trends, segmentation, and regional analysis are presented, along with forecasts to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $4.78 Billion |

| Top Companies | Google, Microsoft, NavVis, SLAMcore |

| Last Modified Date | 31 January 2026 |

Simultaneous Localization And Mapping Market Overview

Customize Simultaneous Localization And Mapping Market Report market research report

- ✔ Get in-depth analysis of Simultaneous Localization And Mapping market size, growth, and forecasts.

- ✔ Understand Simultaneous Localization And Mapping's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Simultaneous Localization And Mapping

What is the Market Size & CAGR of Simultaneous Localization And Mapping market in 2023?

Simultaneous Localization And Mapping Industry Analysis

Simultaneous Localization And Mapping Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Simultaneous Localization And Mapping Market Analysis Report by Region

Europe Simultaneous Localization And Mapping Market Report:

The European market, valued at $0.55 billion in 2023, is projected to grow to $1.24 billion by 2033. The European Union’s push for technological innovation and sustainable urban mobility is driving the adoption of SLAM systems.Asia Pacific Simultaneous Localization And Mapping Market Report:

In 2023, the SLAM market in the Asia Pacific is valued at $0.46 billion, with projections estimating it to reach $1.04 billion by 2033. The rapid technological advancement in countries like China and Japan is spurring adoption across various industries, particularly in manufacturing and robotics.North America Simultaneous Localization And Mapping Market Report:

With a market size of $0.76 billion in 2023, North America is set to reach $1.73 billion by 2033. The booming automotive sector and technological hubs in the U.S. foster the growth of SLAM applications in autonomous vehicles and drones.South America Simultaneous Localization And Mapping Market Report:

The South American market is valued at $0.21 billion in 2023 and is expected to grow to $0.47 billion by 2033. Increased investment in smart technologies and public infrastructure is creating opportunities for SLAM applications in logistics and urban planning.Middle East & Africa Simultaneous Localization And Mapping Market Report:

The SLAM market in the Middle East and Africa is currently valued at $0.13 billion, with expectations to increase to $0.30 billion by 2033. Investments in smart cities and autonomous technologies are key drivers of growth in this region.Tell us your focus area and get a customized research report.

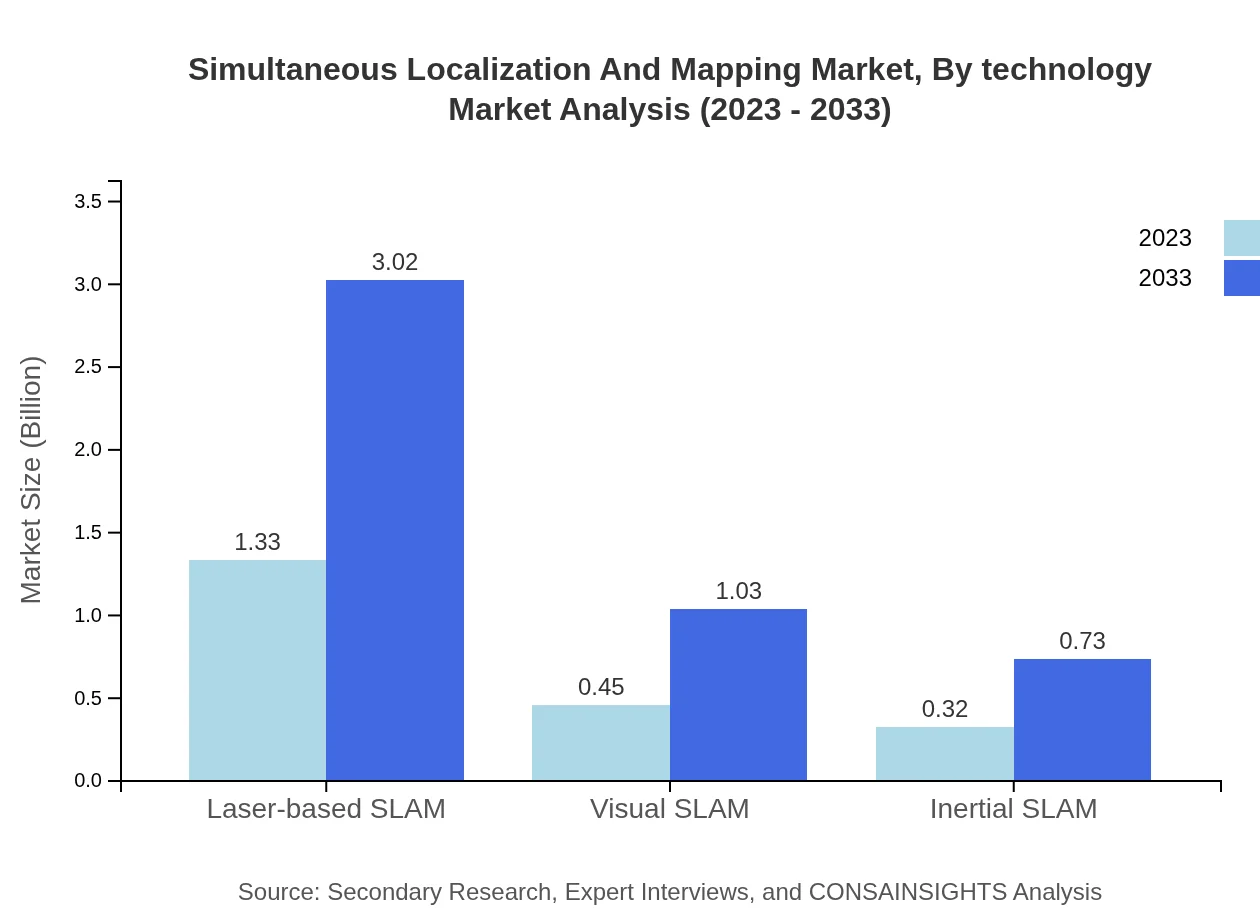

Simultaneous Localization And Mapping Market Analysis By Technology

The SLAM market by technology is primarily categorized into Laser-based SLAM, Visual SLAM, Inertial SLAM, Cloud-based SLAM, and Edge Computing SLAM, with unique market sizes and shares for each sector. The laser-based approach dominated with a market size of $1.33 billion in 2023 and is expected to reach $3.02 billion by 2033, indicating a 63.17% market share. Cloud-based SLAM also holds a significant position with a size of $1.69 billion in 2023 and projected growth to $3.84 billion by 2033, maintaining a dominant market share of 80.31%.

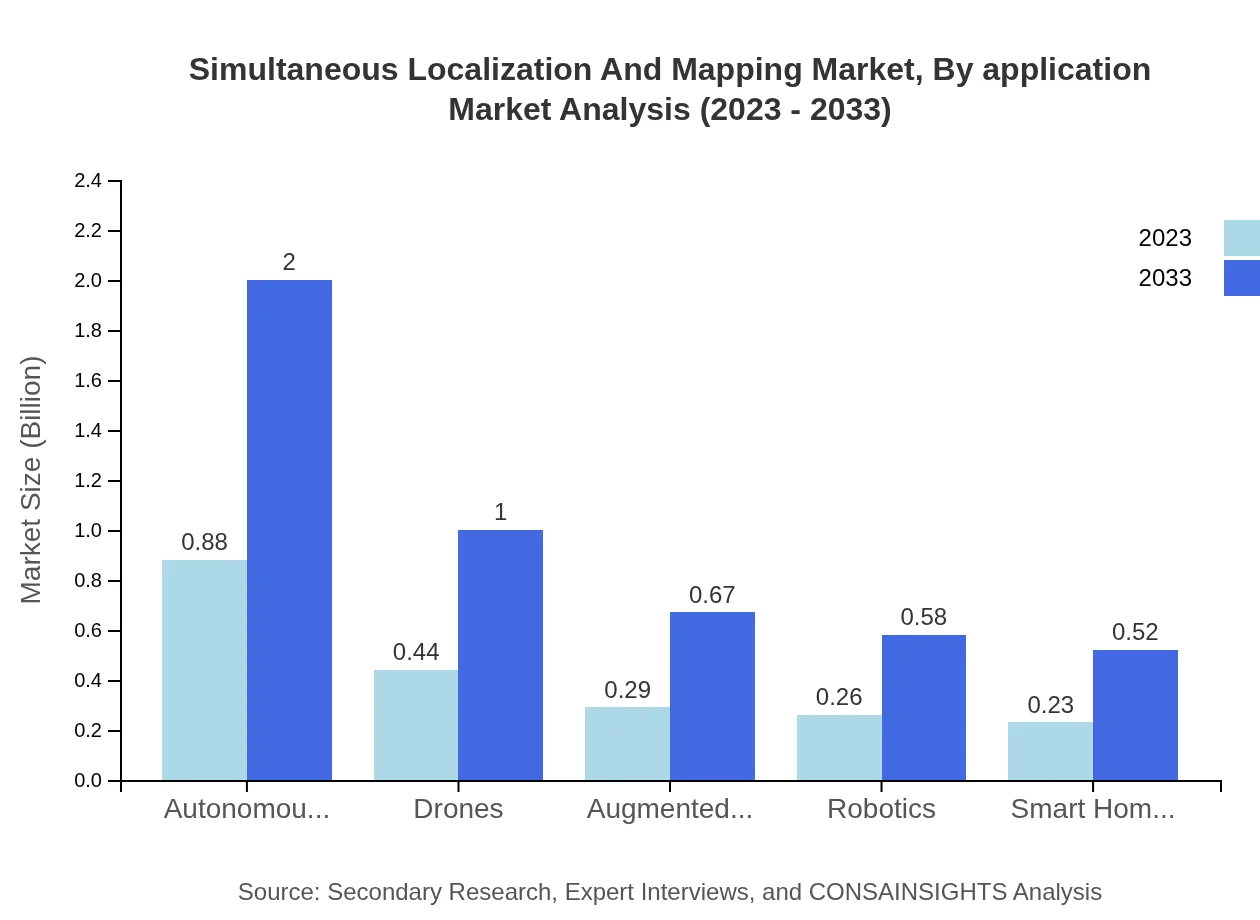

Simultaneous Localization And Mapping Market Analysis By Application

Applications of SLAM include Autonomous Vehicles, Drones, and Robotics, among others. Autonomous vehicles hold a market size of $0.88 billion in 2023, projected to grow to $2.00 billion by 2033. Drones reflect similar growth, starting at $0.44 billion and reaching $1.00 billion by 2033, highlighting their growing reliance on SLAM technologies for enhanced navigation and obstacle detection.

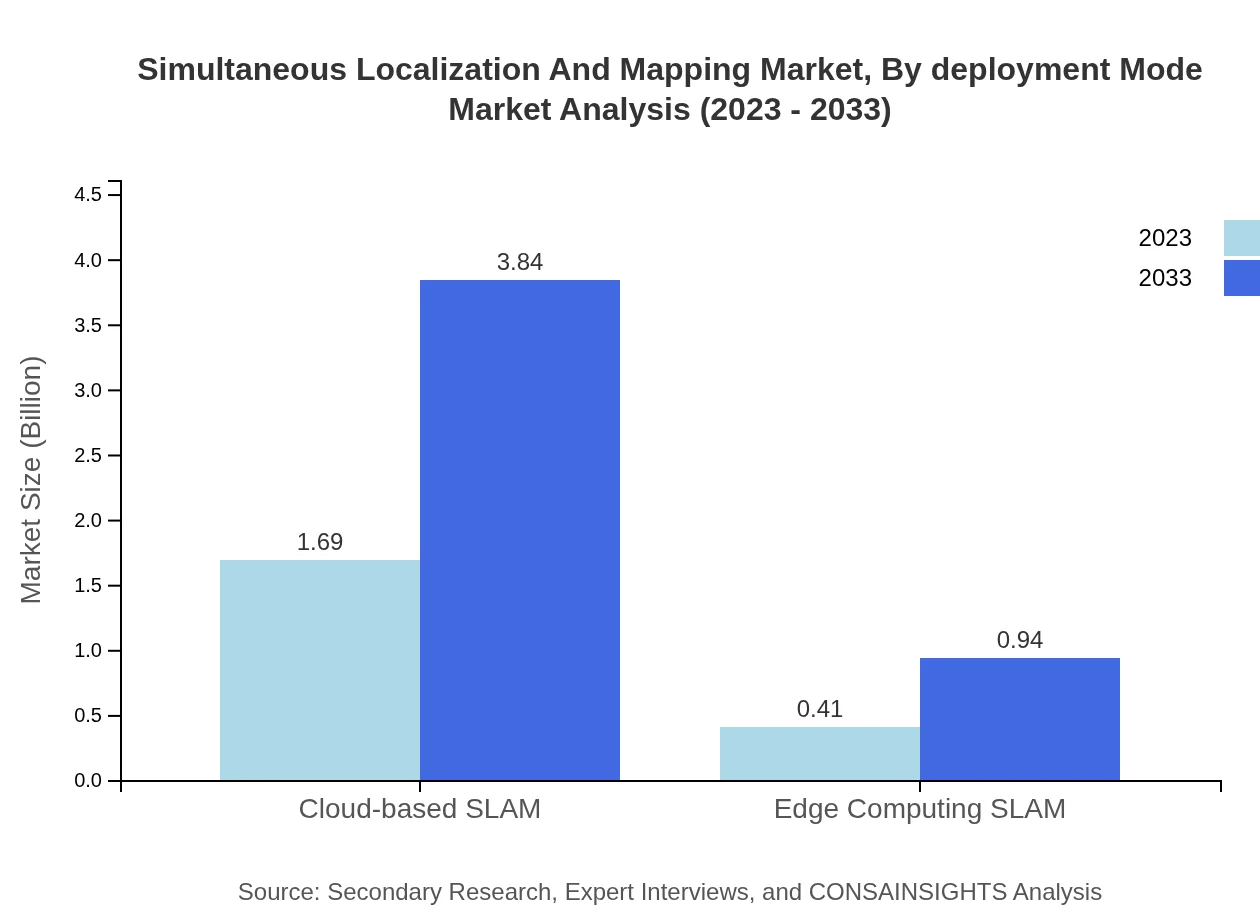

Simultaneous Localization And Mapping Market Analysis By Deployment Mode

The deployment modes of SLAM technology are primarily categorized into Cloud-based and On-Premise systems. Cloud-based SLAM solutions are preferred for their scalability and reduced infrastructure costs, allowing for greater data processing capabilities. The market share is rapidly increasing as industries lean towards mobile and remote computing solutions.

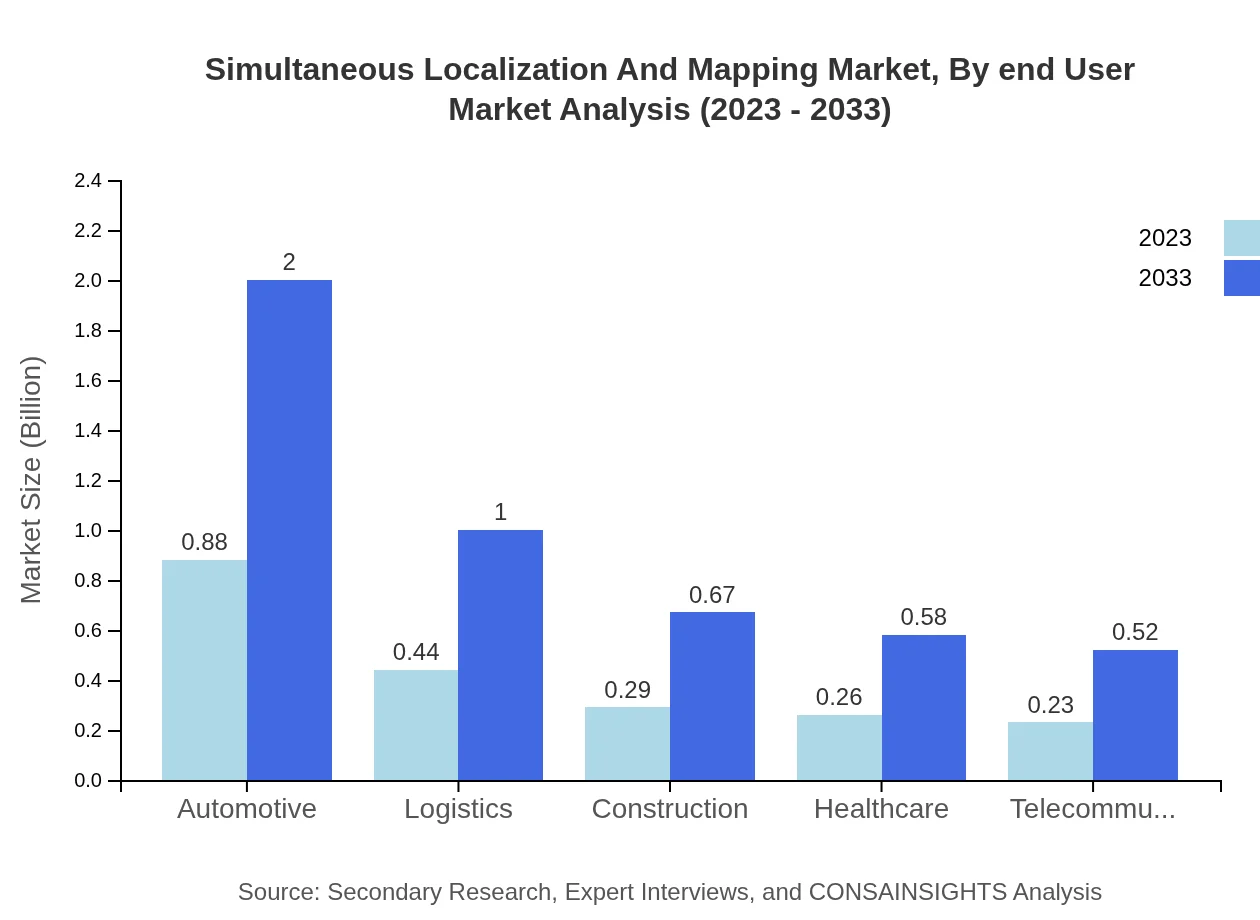

Simultaneous Localization And Mapping Market Analysis By End User

Key end-user industries for SLAM include Automotive, Healthcare, and Telecommunications. The Automotive sector alone holds a market share of 41.9% as of 2023, with a projected size growth reflecting its integral role in the development of autonomous driving technologies.

Simultaneous Localization And Mapping Market Analysis By Region

Global Simultaneous Localization and Mapping Market, By Region Market Analysis (2023 - 2033)

Regional analysis indicates significant growth opportunities across Asia Pacific, North America, and Europe, with each region showing unique demands based on technological infrastructure and industrial applications. Emerging markets in South America and the Middle East also present opportunities as technologies mature and investments increase.

Simultaneous Localization And Mapping Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Simultaneous Localization And Mapping Industry

Google:

A leading tech giant, Google has heavily invested in SLAM technology for applications in autonomous vehicles and mapping services.Microsoft:

Microsoft integrates SLAM technology in its mixed reality applications, enhancing user interactions with augmented environments.NavVis:

NavVis specializes in indoor navigation and mapping solutions, utilizing SLAM for accurate spatial data collection.SLAMcore:

An innovative startup focusing on providing SLAM algorithms for consumer and commercial robotics, enhancing navigation features.We're grateful to work with incredible clients.

FAQs

What is the market size of simultaneous localization and mapping?

The simultaneous localization and mapping market is projected to reach a size of approximately $2.1 billion by 2033, growing at a CAGR of 8.3%. This growth indicates a strong demand for SLAM technology across various sectors.

What are the key market players or companies in the simultaneous localization and mapping industry?

Key players in the SLAM market include technology giants and innovative startups focusing on robotics, automotive, and AR applications. Leading companies drive advancements in laser-based, cloud-based, and visual SLAM solutions, enhancing market competitiveness.

What are the primary factors driving the growth in the simultaneous localization and mapping industry?

Factors driving SLAM industry growth include the rise of autonomous vehicles, increased adoption of drones, and advancements in robotics. Additionally, the demand for real-time location systems in various sectors fuels market expansion.

Which region is the fastest Growing in the simultaneous localization and mapping market?

The Asia Pacific region is witnessing significant growth in the SLAM market, projected to grow from $0.46 billion in 2023 to $1.04 billion by 2033, reflecting increasing investments in automation and technology in this region.

Does ConsaInsights provide customized market report data for the simultaneous localization and mapping industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the SLAM industry. Clients can request detailed insights focused on market segments, geographical analysis, and growth forecasts.

What deliverables can I expect from this simultaneous localization and mapping market research project?

Deliverables include comprehensive market reports, trend analysis, sector segmentation, competitive landscape assessments, and forecasts. These insights will aid strategic planning and investment decisions in the SLAM domain.

What are the market trends of simultaneous localization and mapping?

Current trends include the increasing implementation of cloud-based and edge computing SLAM solutions, enhanced integration of SLAM in AR technologies, and growing applications in logistics and healthcare sectors, reflecting rising technological adoption.