Single Use Assemblies Market Report

Published Date: 31 January 2026 | Report Code: single-use-assemblies

Single Use Assemblies Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Single Use Assemblies market, covering market trends, size estimates, and industry insights for the forecast period from 2023 to 2033.

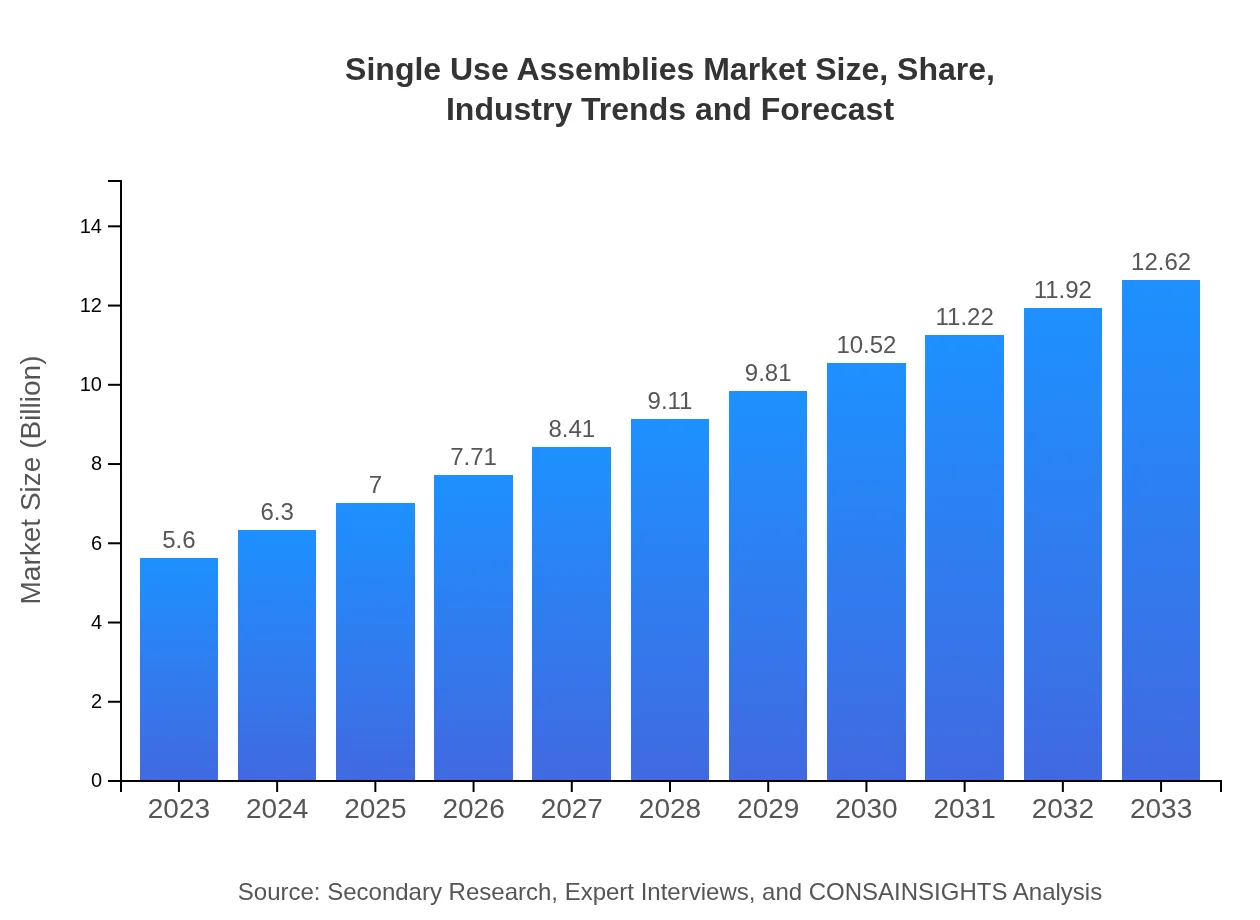

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $12.62 Billion |

| Top Companies | Thermo Fisher Scientific, Sartorius AG, GE Healthcare, Merck KGaA |

| Last Modified Date | 31 January 2026 |

Single Use Assemblies Market Overview

Customize Single Use Assemblies Market Report market research report

- ✔ Get in-depth analysis of Single Use Assemblies market size, growth, and forecasts.

- ✔ Understand Single Use Assemblies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Single Use Assemblies

What is the Market Size & CAGR of Single Use Assemblies market in 2023?

Single Use Assemblies Industry Analysis

Single Use Assemblies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

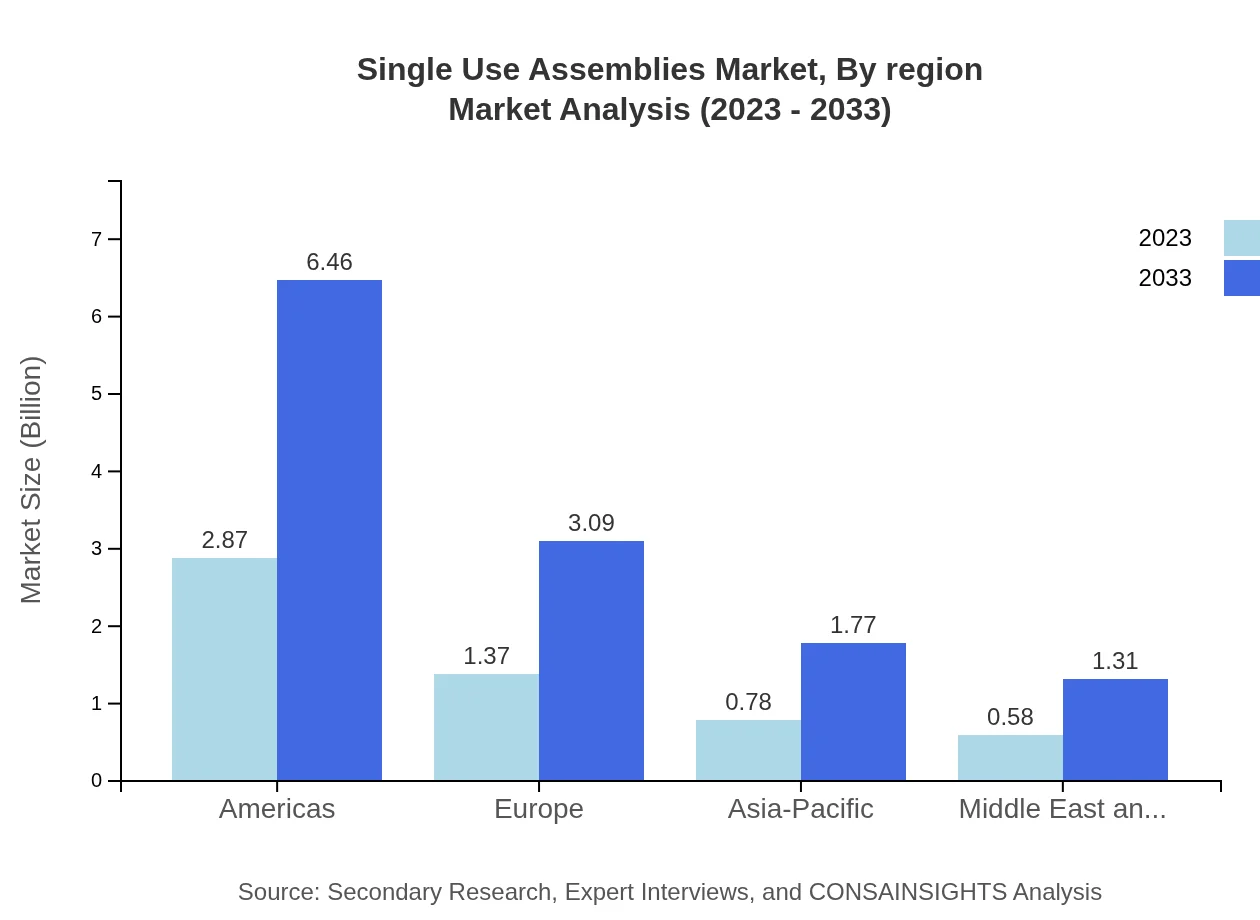

Single Use Assemblies Market Analysis Report by Region

Europe Single Use Assemblies Market Report:

In Europe, the market is valued at $1.47 billion in 2023 and anticipated to more than double to $3.31 billion by 2033. The region's stringent regulatory environment is fostering innovations in single-use technologies, particularly in biopharmaceutical applications.Asia Pacific Single Use Assemblies Market Report:

The Asia Pacific region, valued at $1.12 billion in 2023, is expected to grow to $2.53 billion by 2033. This growth is driven by increasing healthcare investments and a growing biotechnology sector, particularly in countries such as China and India, where demand for single-use technologies is surging.North America Single Use Assemblies Market Report:

North America leads the market with a projected value of $2.11 billion in 2023, expected to reach $4.75 billion by 2033. The U.S. remains a significant contributor due to robust healthcare infrastructure and increasing demand for sustainable manufacturing practices.South America Single Use Assemblies Market Report:

The South American market for Single Use Assemblies was valued at $0.46 billion in 2023 and is projected to reach $1.04 billion by 2033. This region is gradually adopting single-use technologies, encouraged by rising healthcare standards and an increasing number of biopharmaceutical research activities.Middle East & Africa Single Use Assemblies Market Report:

The Middle East and Africa market, valued at $0.44 billion in 2023, is projected to reach $1.00 billion by 2033. Growing investment in healthcare infrastructure and pharmaceutical manufacturing is boosting interest in single-use solutions in this region.Tell us your focus area and get a customized research report.

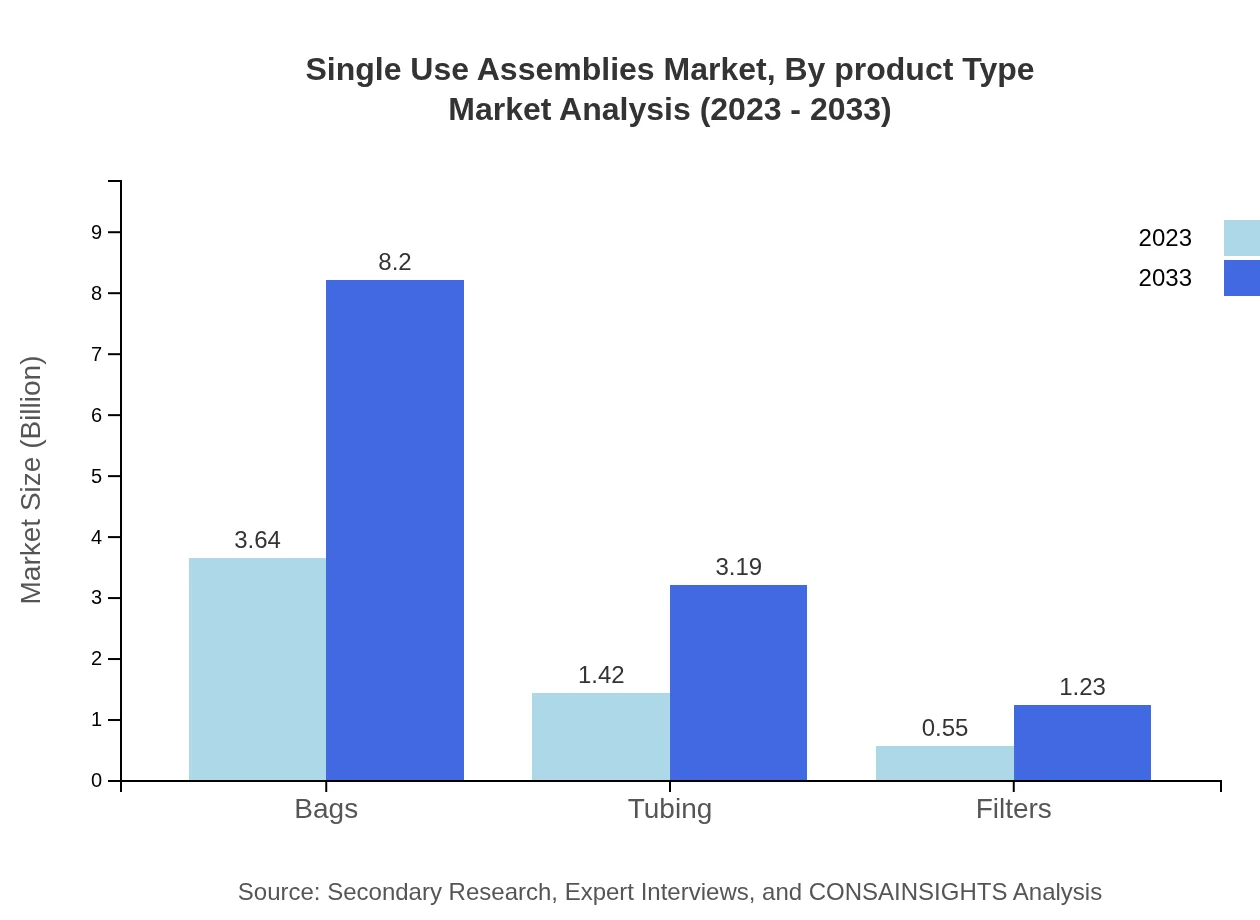

Single Use Assemblies Market Analysis By Product Type

The product type segmentation highlights bags as a leading segment, valued at $3.64 billion in 2023, which is expected to rise to $8.20 billion by 2033. Tubing and filters make significant contributions, aligning with the growing need for efficient manufacturing processes in the biopharmaceutical industry.

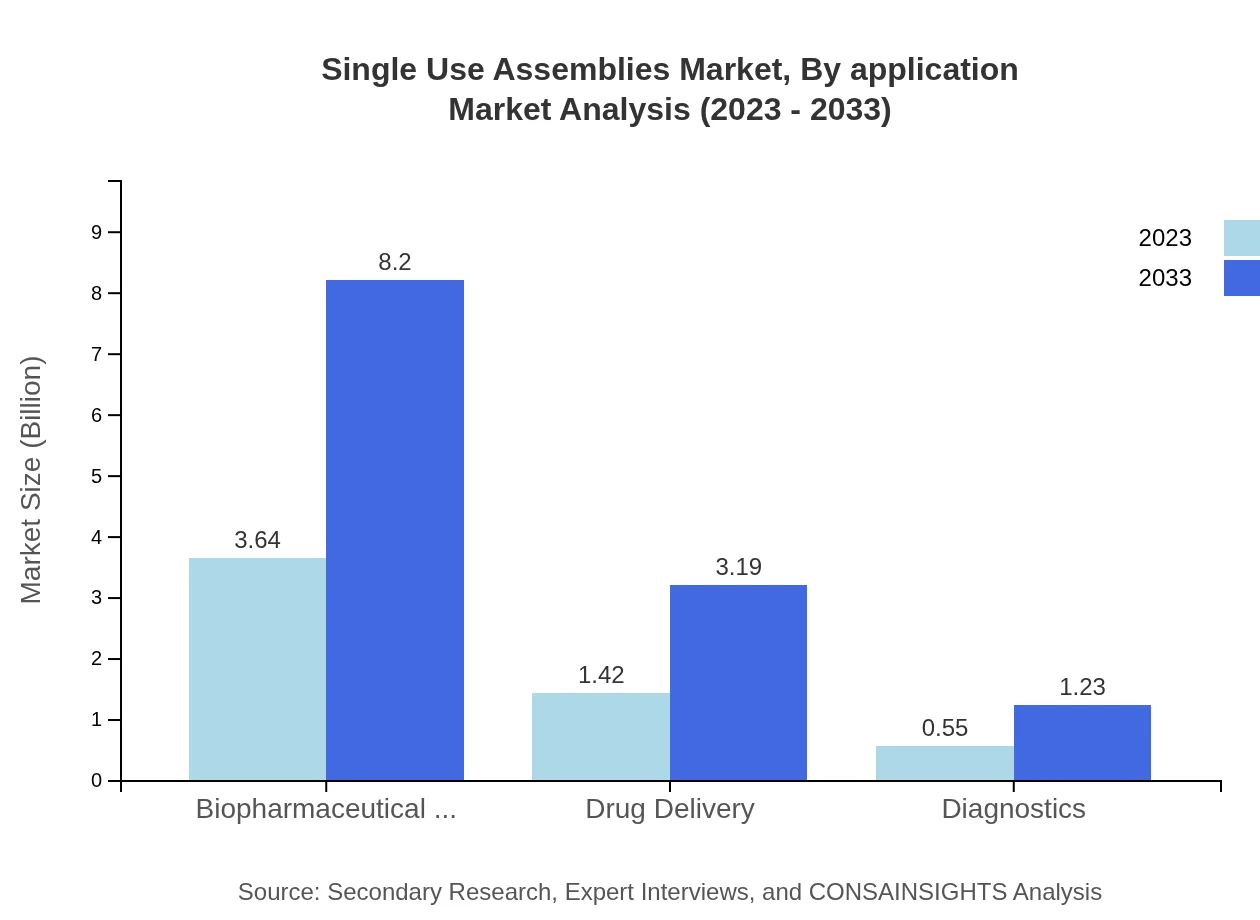

Single Use Assemblies Market Analysis By Application

Applications in biopharmaceutical manufacturing drive the bulk of the market, with a valuation of $3.64 billion in 2023. Diagnostics applications are also gaining traction, with expected growth reflecting rising demand for point-of-care testing and rapid diagnostic solutions.

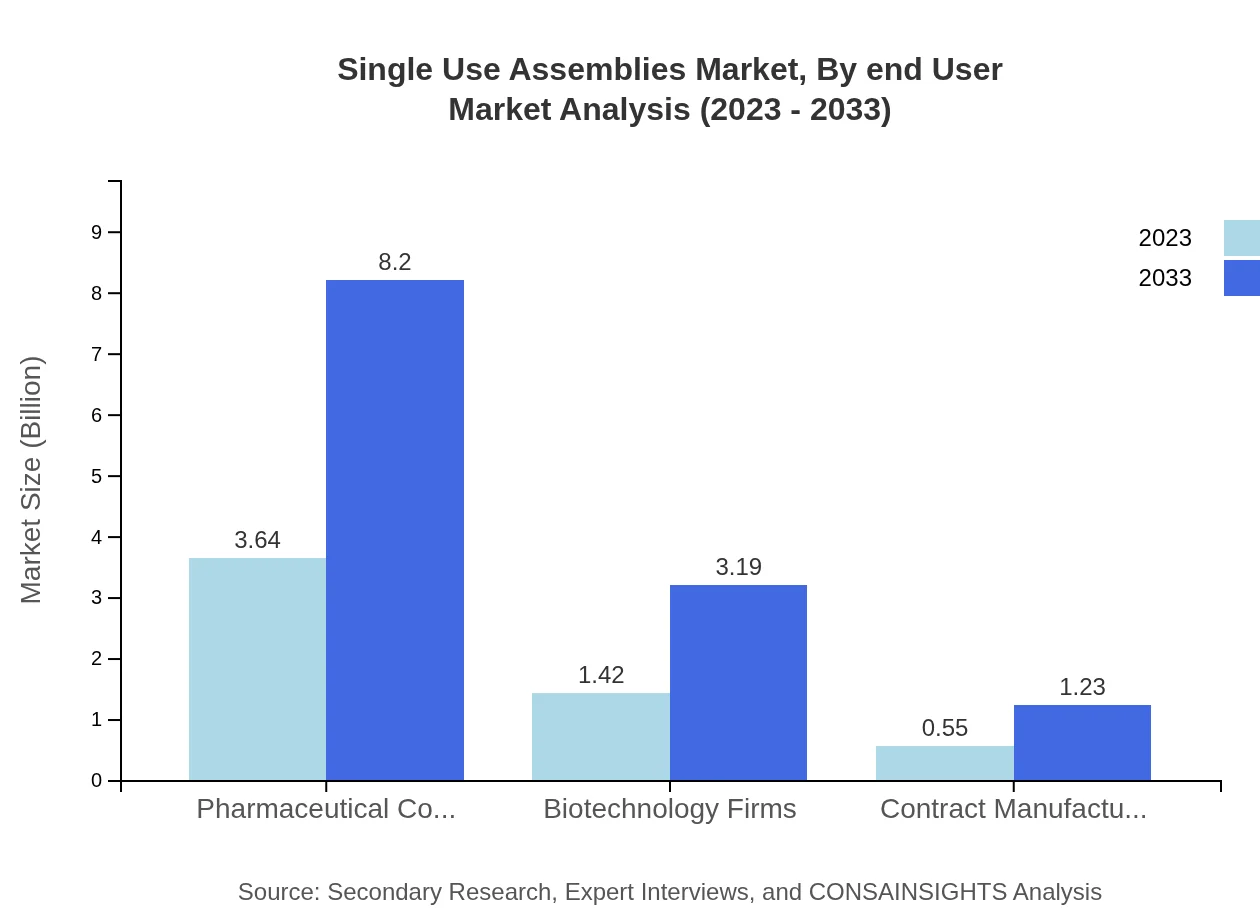

Single Use Assemblies Market Analysis By End User

Pharmaceutical companies dominate the Single Use Assemblies market, accounting for approximately $3.64 billion in 2023. Biotechnology firms and contract manufacturers also play critical roles, with increasing investments towards efficient disposable solutions to enhance operational efficiency.

Single Use Assemblies Market Analysis By Region

Regionally, the Americas hold a significant portion of the market due to advanced pharmaceutical ecosystems. Europe follows closely, with stringent regulations driving demand for Single Use Assemblies. The Asia-Pacific region is emerging rapidly, showcasing potential growth owing to healthcare expansion.

Single Use Assemblies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Single Use Assemblies Industry

Thermo Fisher Scientific:

A leading provider of scientific services, Thermo Fisher specializes in single-use technologies for the biopharmaceutical industry, focusing on enhancing safety and efficiency in drug manufacturing.Sartorius AG:

Sartorius offers a range of high-quality single-use solutions designed for biopharmaceutical applications, reinforcing its position as a key player in facilitating aseptic processing.GE Healthcare:

With a broad portfolio in medical technologies, GE Healthcare provides innovative single-use assembly systems aimed at improving bioproduction processes.Merck KGaA:

Merck KGaA is a major market participant known for its commitment to bioprocessing innovations, providing diverse single-use assemblies that meet evolving industry standards.We're grateful to work with incredible clients.

FAQs

What is the market size of single Use Assemblies?

In 2023, the global market size for single-use assemblies is estimated at $5.6 billion, with a projected CAGR of 8.2% from 2023 to 2033, signaling significant growth in this industry over the next decade.

What are the key market players or companies in this single Use Assemblies industry?

Key players in the single-use assemblies market include leading pharmaceutical and biotechnology firms, which dominate market shares through innovations in supply chain management and efficiency in production, enhancing competitive positioning significantly.

What are the primary factors driving the growth in the single Use assemblies industry?

The growth in the single-use assemblies market is driven by the increasing need for cost-effective manufacturing solutions, advancements in biotechnology, and a growing demand for faster drug development processes across the pharmaceuticals and healthcare sectors.

Which region is the fastest Growing in the single Use assemblies?

The fastest-growing region for single-use assemblies is projected to be Europe, with a market increase from $1.47 billion in 2023 to $3.31 billion in 2033, reflecting the rapid adoption of advanced bioprocessing technologies.

Does ConsaInsights provide customized market report data for the single Use assemblies industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the single-use assemblies industry, enabling effective decision-making backed by comprehensive insights and analytics.

What deliverables can I expect from this single Use assemblies market research project?

Deliverables from this market research may include comprehensive market analysis reports, detailed competitive landscape overviews, regional growth forecasts, trend assessments, and tailored recommendations based on industry insights.

What are the market trends of single Use assemblies?

Current market trends include increasing investments in biopharmaceutical manufacturing, a shift towards sustainability in packaging, and the adoption of automated processes, all enhancing the efficiency and environmental sustainability of production in single-use assemblies.