Singleuse Bioprocessing Material Market Report

Published Date: 31 January 2026 | Report Code: singleuse-bioprocessing-material

Singleuse Bioprocessing Material Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Singleuse Bioprocessing Material market, highlighting key insights, growth trends, and forecasts from 2023 to 2033.

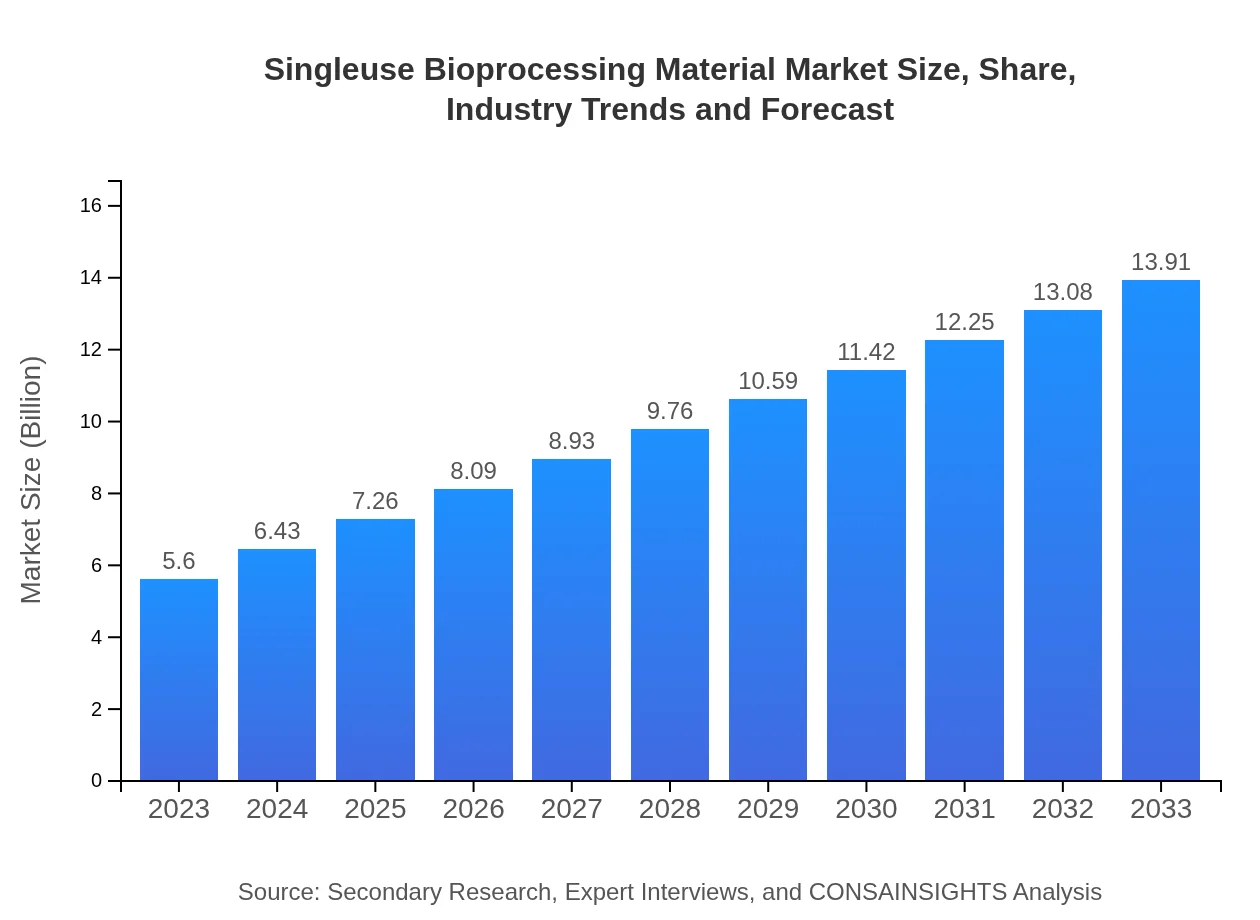

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Merck KGaA, Sartorius AG, Thermo Fisher Scientific, GE Healthcare, Pall Corporation |

| Last Modified Date | 31 January 2026 |

Singleuse Bioprocessing Material Market Overview

Customize Singleuse Bioprocessing Material Market Report market research report

- ✔ Get in-depth analysis of Singleuse Bioprocessing Material market size, growth, and forecasts.

- ✔ Understand Singleuse Bioprocessing Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Singleuse Bioprocessing Material

What is the Market Size & CAGR of Singleuse Bioprocessing Material market in 2033?

Singleuse Bioprocessing Material Industry Analysis

Singleuse Bioprocessing Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

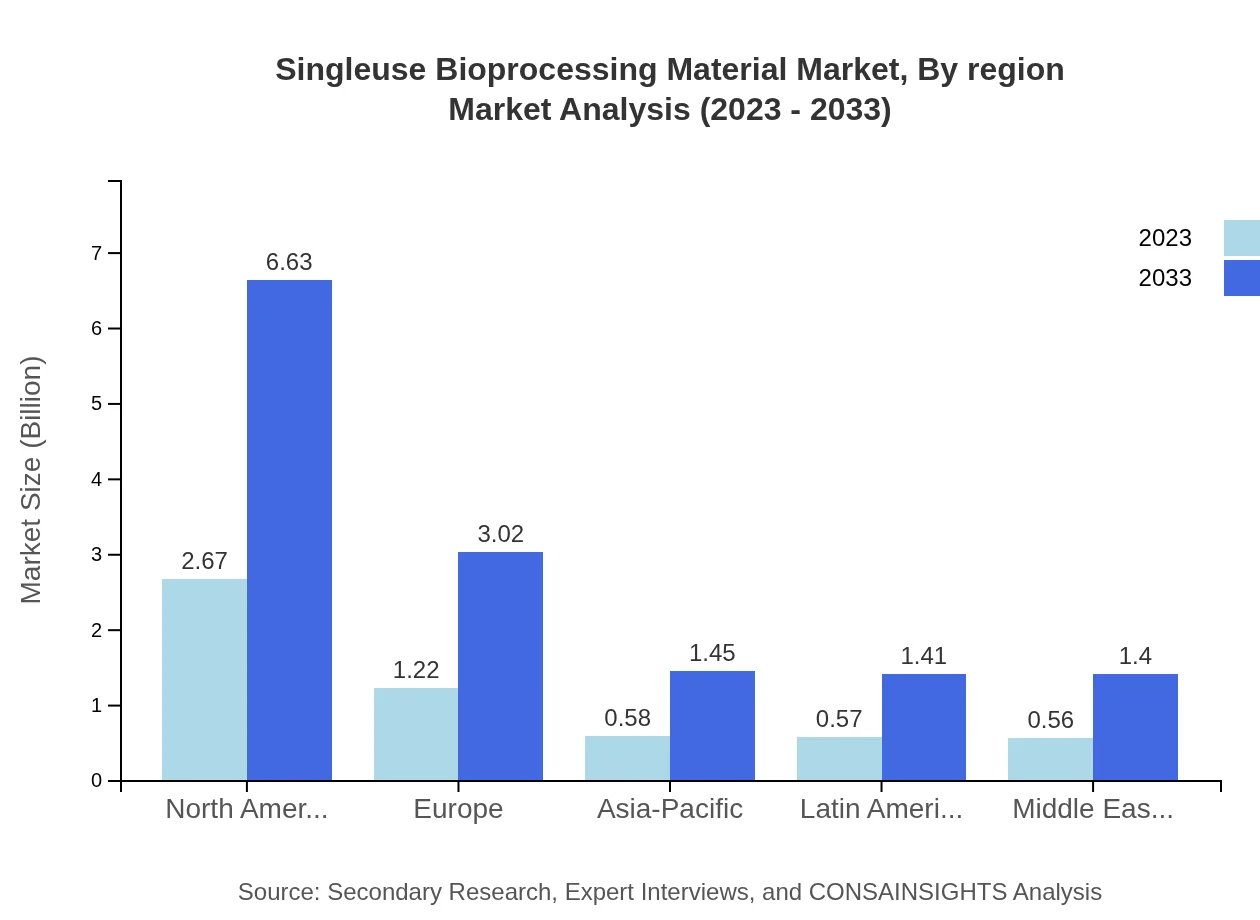

Singleuse Bioprocessing Material Market Analysis Report by Region

Europe Singleuse Bioprocessing Material Market Report:

In Europe, the market is anticipated to grow from $1.72 billion in 2023 to $4.27 billion by 2033. The growth is attributed to the increased adoption of single-use technologies by biopharmaceutical companies and strict regulatory standards promoting high-quality manufacturing processes. Key countries include Germany, France, and the UK.Asia Pacific Singleuse Bioprocessing Material Market Report:

In the Asia Pacific region, the Singleuse Bioprocessing Material market is expected to grow from $1.12 billion in 2023 to $2.77 billion by 2033. Rapid industrialization, increased investments in biotechnology, and growing healthcare infrastructure are fuelling this growth. Countries like China and India are becoming significant players in the biopharmaceutical manufacturing sector.North America Singleuse Bioprocessing Material Market Report:

North America remains a leader in the Singleuse Bioprocessing Material market, with a valuation of $1.80 billion in 2023, expected to rise to $4.48 billion by 2033. The region's advanced biopharmaceutical industry, coupled with a strong investment in R&D, drives demand for single-use technologies. Regulations favoring innovative manufacturing methods also enhance market growth prospects.South America Singleuse Bioprocessing Material Market Report:

The South American market for Singleuse Bioprocessing Material is projected to increase from $0.46 billion in 2023 to $1.15 billion in 2033. Factors contributing to this growth include rising healthcare standards and government initiatives to promote biotechnology research and development.Middle East & Africa Singleuse Bioprocessing Material Market Report:

The Middle East and Africa's market for Singleuse Bioprocessing Material is expected to escalate from $0.50 billion in 2023 to $1.24 billion by 2033. The increasing establishment of biopharmaceutical firms and rising efforts to improve healthcare systems are pivotal in driving this growth across the region.Tell us your focus area and get a customized research report.

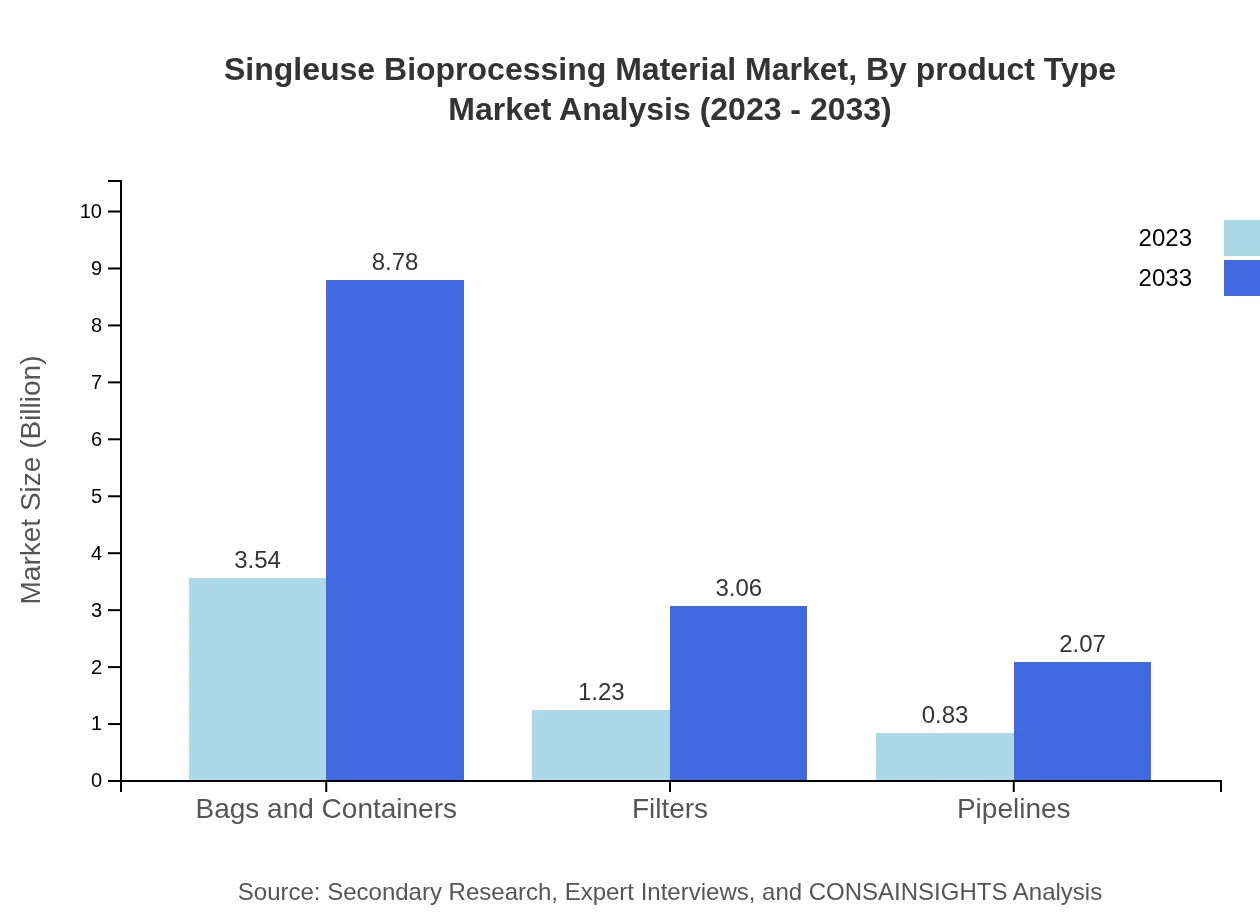

Singleuse Bioprocessing Material Market Analysis By Product Type

Key product segments within the Singleuse Bioprocessing Material market include bags and containers, filters, and pipelines. Bags and containers dominate the market, accounting for 63.14% of the market share in 2023, with expected growth to 8.78 billion by 2033. Filters and pipelines follow, with substantial shares of 21.97% and 14.89% respectively, indicating their essential roles in filtration and transportation in bioprocessing.

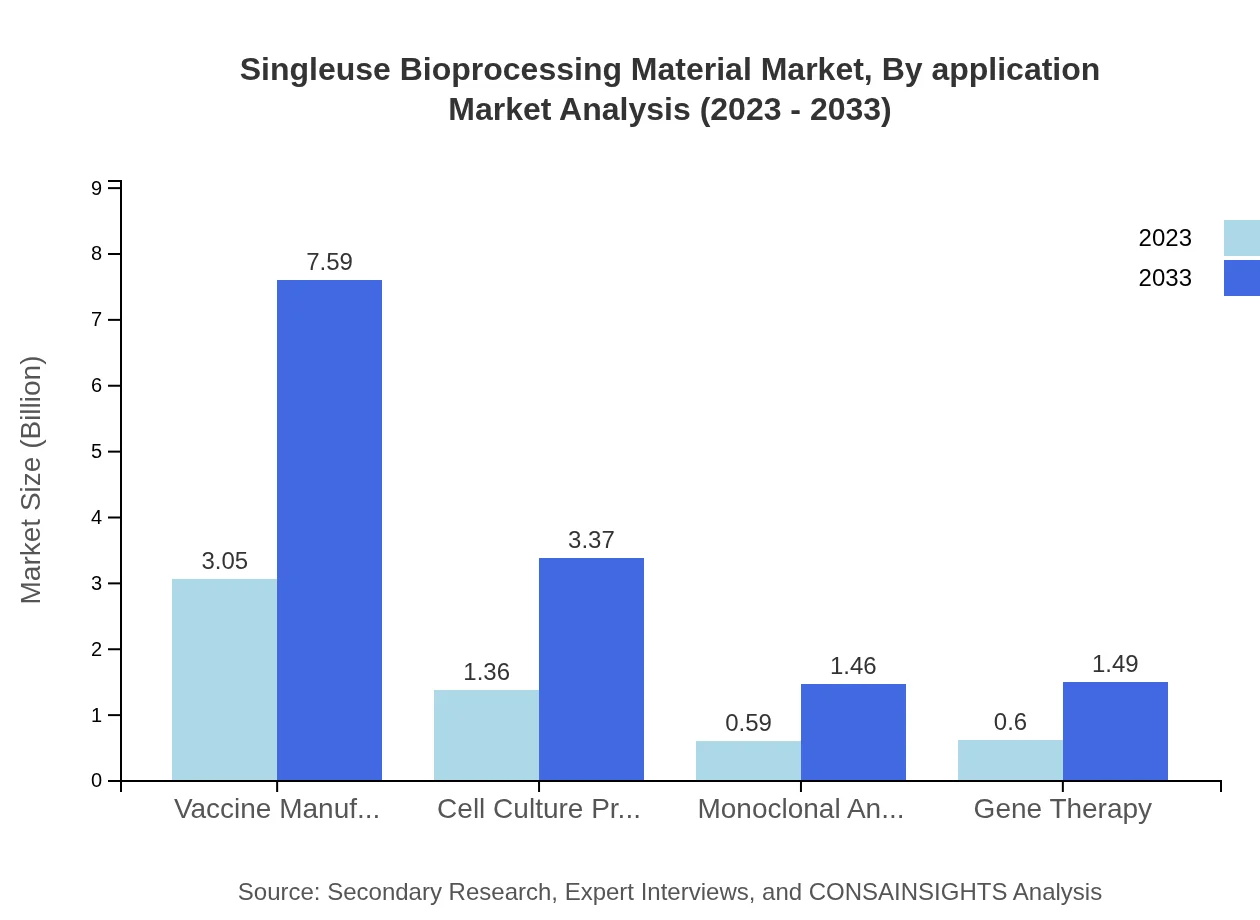

Singleuse Bioprocessing Material Market Analysis By Application

The application segments comprise vaccine manufacturing, monoclonal antibody production, cell culture production, and gene therapy. Vaccine manufacturing is the largest application, representing 54.54% of the market share in 2023, projected to grow to 7.59 billion by 2033. Other segments such as monoclonal antibody production and cell culture production also show significant growth potential.

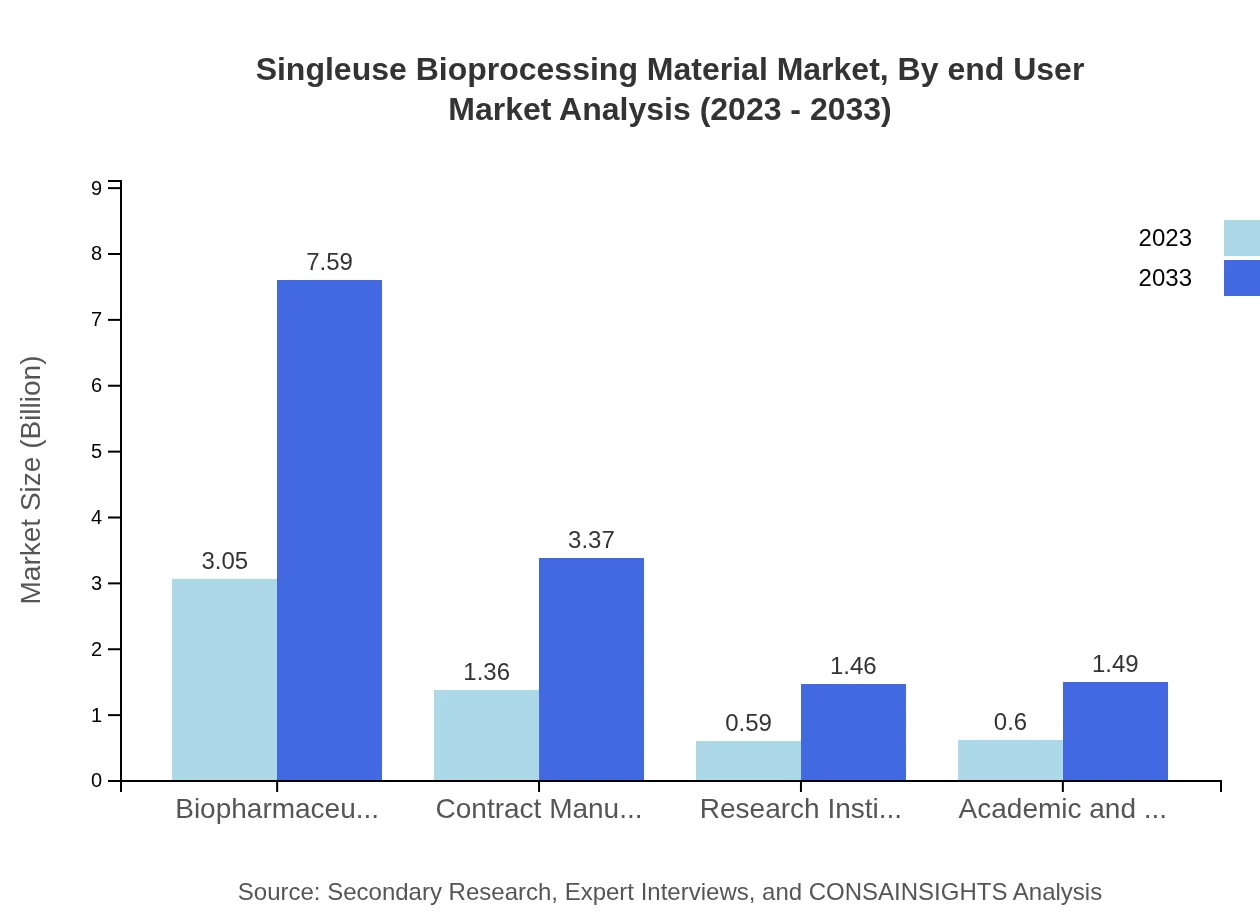

Singleuse Bioprocessing Material Market Analysis By End User

The market serves various end-user segments, including biopharmaceutical companies, contract manufacturing organizations (CMOs), research institutes, and academic/government research entities. Biopharmaceutical companies hold the largest share, contributing 54.54% in 2023 and showcasing steady growth through 2033. CMOs and research institutes follow, highlighting the market's diverse nature.

Singleuse Bioprocessing Material Market Analysis By Region

Analysis across regions reveals North America as a key market, with major contributions from the US and Canada, followed by Europe, where Germany and France are prominent. The Asia Pacific region, particularly China and India, is growing rapidly due to advancements in biotechnology. South America and the Middle East and Africa represent emerging markets with significant growth potential.

Singleuse Bioprocessing Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Singleuse Bioprocessing Material Industry

Merck KGaA:

A leader in the life sciences industry, Merck KGaA offers a comprehensive range of single-use bioprocessing solutions catering to various applications in biotechnology and pharmaceuticals.Sartorius AG:

Sartorius AG provides innovative bioprocess solutions, including single-use technologies, establishing a strong presence in the biopharmaceutical market.Thermo Fisher Scientific:

Thermo Fisher Scientific specializes in enabling customers to make the world healthier, cleaner, and safer through its advanced single-use bioprocessing solutions.GE Healthcare:

GE Healthcare offers a wide range of single-use bioprocessing products and technologies, supporting biotechnology and pharmaceutical manufacturing globally.Pall Corporation:

Pall Corporation is known for its filtration and separation technologies, providing a variety of single-use products aimed at enhancing bioprocess efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of singleuse Bioprocessing Material?

The global single-use bioprocessing material market is projected to reach approximately $5.6 billion by 2033, growing at a robust CAGR of 9.2%. This significant increase indicates the growing reliance on single-use technology in bioproduction across various industries.

What are the key market players or companies in this singleuse Bioprocessing Material industry?

Key players in the single-use bioprocessing material industry include major biopharmaceutical companies. These companies are crucial for driving innovation and reliability in production processes through the utilization of single-use technologies across the biopharmaceutical manufacturing landscape.

What are the primary factors driving the growth in the singleuse Bioprocessing Material industry?

The growth of the single-use bioprocessing materials market is driven by the increasing adoption of disposable technology, heightened demand for biopharmaceuticals, and the growing need for contamination-free manufacturing processes. These factors are fostering a push toward efficiency and cost-effectiveness.

Which region is the fastest Growing in the singleuse Bioprocessing Material?

North America currently stands as the fastest-growing region in the single-use bioprocessing material market, expected to expand from $1.80 billion in 2023 to $4.48 billion by 2033. This growth is attributed to advanced biotech infrastructures and significant investments in research.

Does ConsaInsights provide customized market report data for the singleuse Bioprocessing Material industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of stakeholders in the single-use bioprocessing material industry. This enables clients to obtain detailed insights and analytics specific to their operational requirements.

What deliverables can I expect from this singleuse Bioprocessing Material market research project?

From the single-use bioprocessing material market research project, clients can expect comprehensive reports including market analysis, regional breakdowns, segment specifics, growth forecasts, and competitive landscape assessments tailored to the industry's dynamics.

What are the market trends of singleuse Bioprocessing Material?

Current trends in the single-use bioprocessing material market include increasing integration of advanced materials, a shift towards personalized medicine, and heightened focus on sustainability. These trends are shaping the future of bioprocessing technology and market expansion.