Sintered Steel Market Report

Published Date: 02 February 2026 | Report Code: sintered-steel

Sintered Steel Market Size, Share, Industry Trends and Forecast to 2033

This detailed market report covers the Sintered Steel industry, offering insights into current trends, market size, and forecasts from 2023 to 2033. The report provides in-depth analysis of various segments, regional performances, and identifies key players in the market.

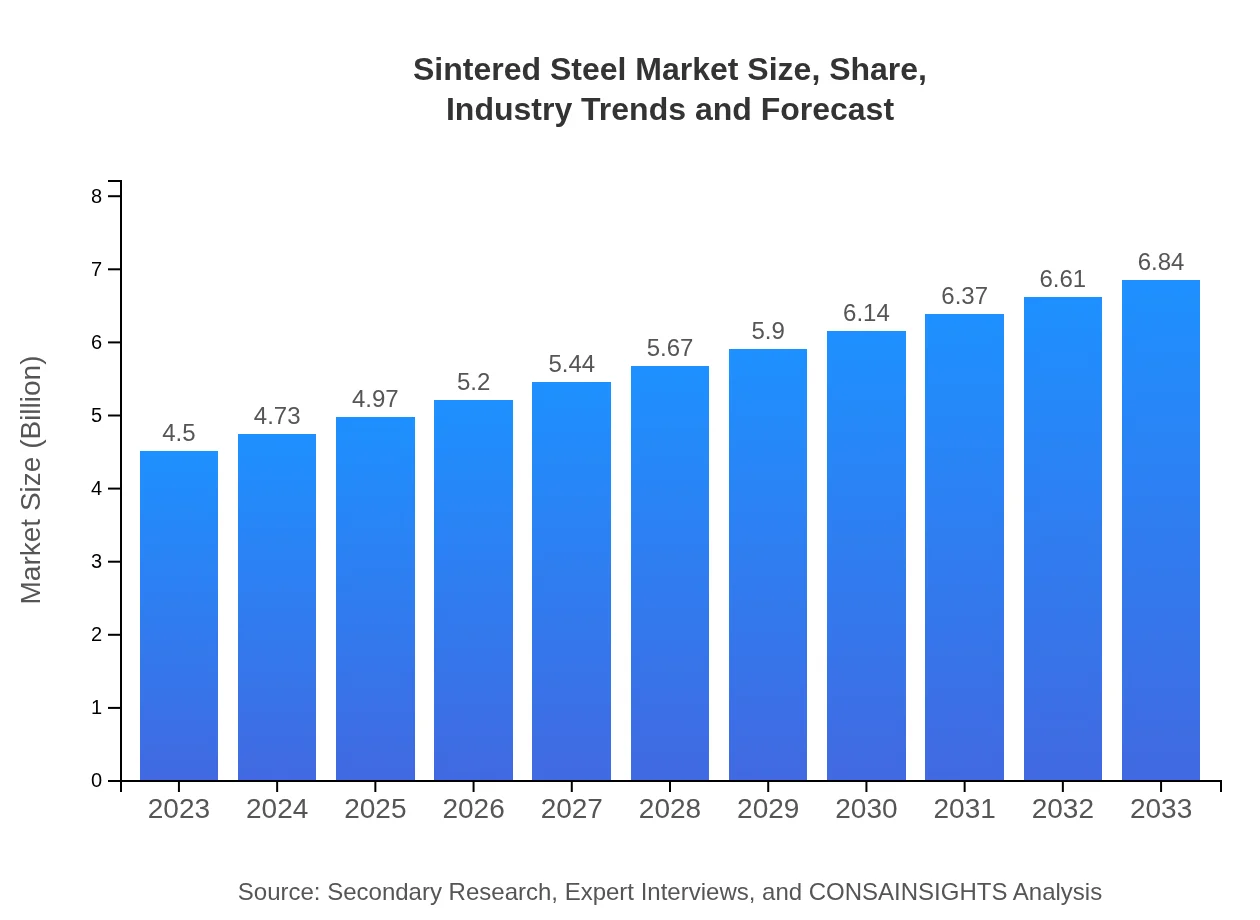

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $6.84 Billion |

| Top Companies | Höganäs AB, GKN Powder Metallurgy, Sumitomo Metal Mining, PMT Industries |

| Last Modified Date | 02 February 2026 |

Sintered Steel Market Overview

Customize Sintered Steel Market Report market research report

- ✔ Get in-depth analysis of Sintered Steel market size, growth, and forecasts.

- ✔ Understand Sintered Steel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sintered Steel

What is the Market Size & CAGR of Sintered Steel market in 2023?

Sintered Steel Industry Analysis

Sintered Steel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sintered Steel Market Analysis Report by Region

Europe Sintered Steel Market Report:

Europe’s market is anticipated to witness growth from USD 1.51 billion in 2023 to approximately USD 2.30 billion in 2033. The region’s push towards sustainable production and stringent regulations for emissions are driving the demand for sintered steel in the automotive and aerospace sectors.Asia Pacific Sintered Steel Market Report:

The Asia Pacific region is projected to experience substantial growth, with the market size expected to reach USD 1.17 billion by 2033, up from USD 0.77 billion in 2023. This growth is primarily driven by robust industrial activities, especially in countries like China and Japan, where there’s a high demand for automotive and industrial components utilizing sintered steel.North America Sintered Steel Market Report:

North America remains a key player in the Sintered Steel market, with a size forecast to grow from USD 1.57 billion in 2023 to USD 2.39 billion by 2033. The region benefits from high technological advancements and the presence of major automotive manufacturers adopting sintered steel for lightweight vehicle components.South America Sintered Steel Market Report:

In South America, the Sintered Steel market is poised for growth, with expectations of reaching USD 0.52 billion by 2033, increasing from USD 0.34 billion in 2023. Factors including rising urbanization and infrastructure development contribute to this growth, making sintered steel an important material for construction and industrial applications.Middle East & Africa Sintered Steel Market Report:

The Middle East and Africa are set to expand their Sintered Steel market from USD 0.31 billion in 2023 to USD 0.47 billion by 2033. The region’s growth is catalyzed by increasing investments in manufacturing and infrastructure projects, emphasizing the need for durable materials like sintered steel.Tell us your focus area and get a customized research report.

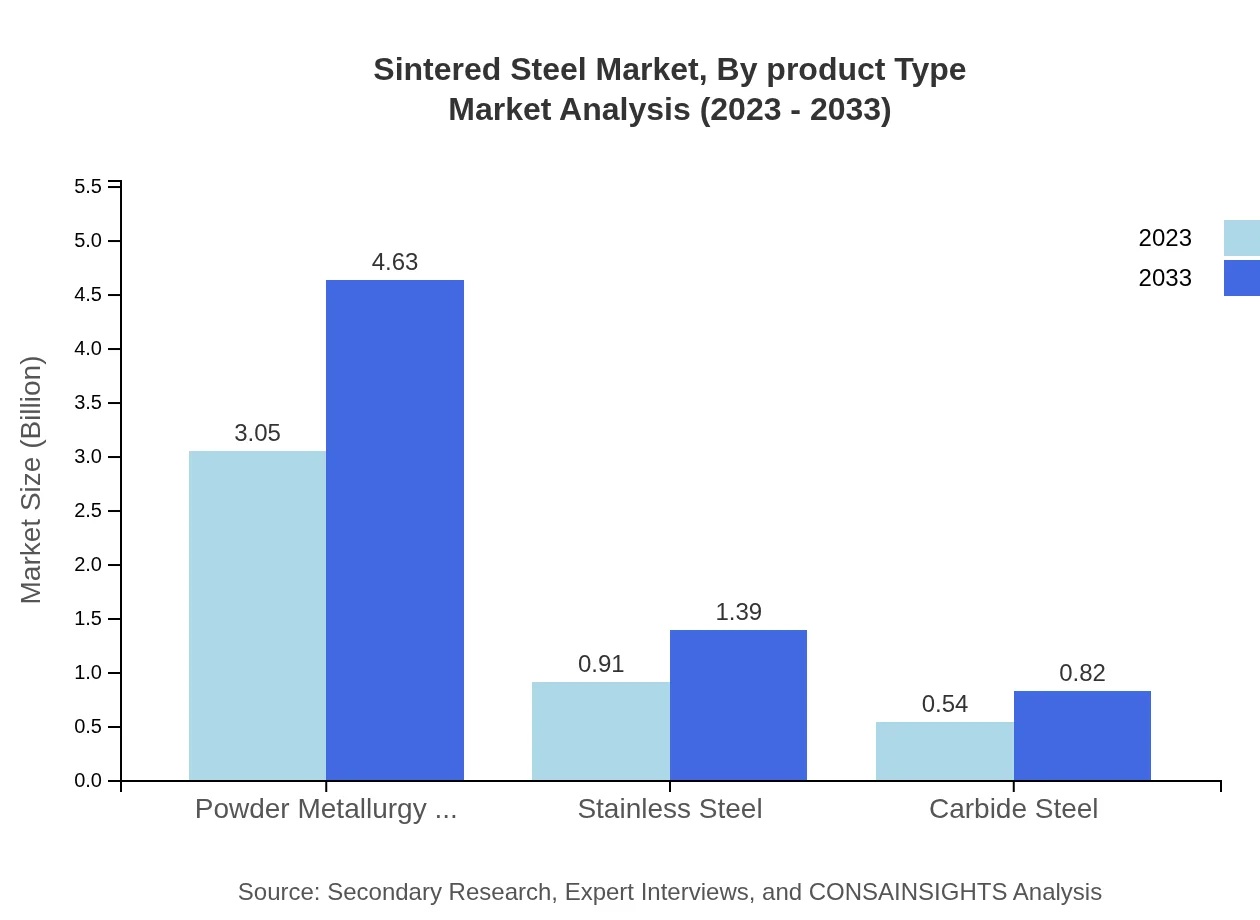

Sintered Steel Market Analysis By Product Type

The Sintered Steel market, categorized by product type, sees a diverse array of materials utilized in various applications. Powder Metallurgy Steel leads the market, accounting for approximately 67.73% of the share in 2023, expected to grow to 4.63 billion by 2033. Stainless Steel follows with a notable share, while Carbide Steel also maintains a significant presence in niche applications, reflecting the strategic importance of product type selection in market positioning.

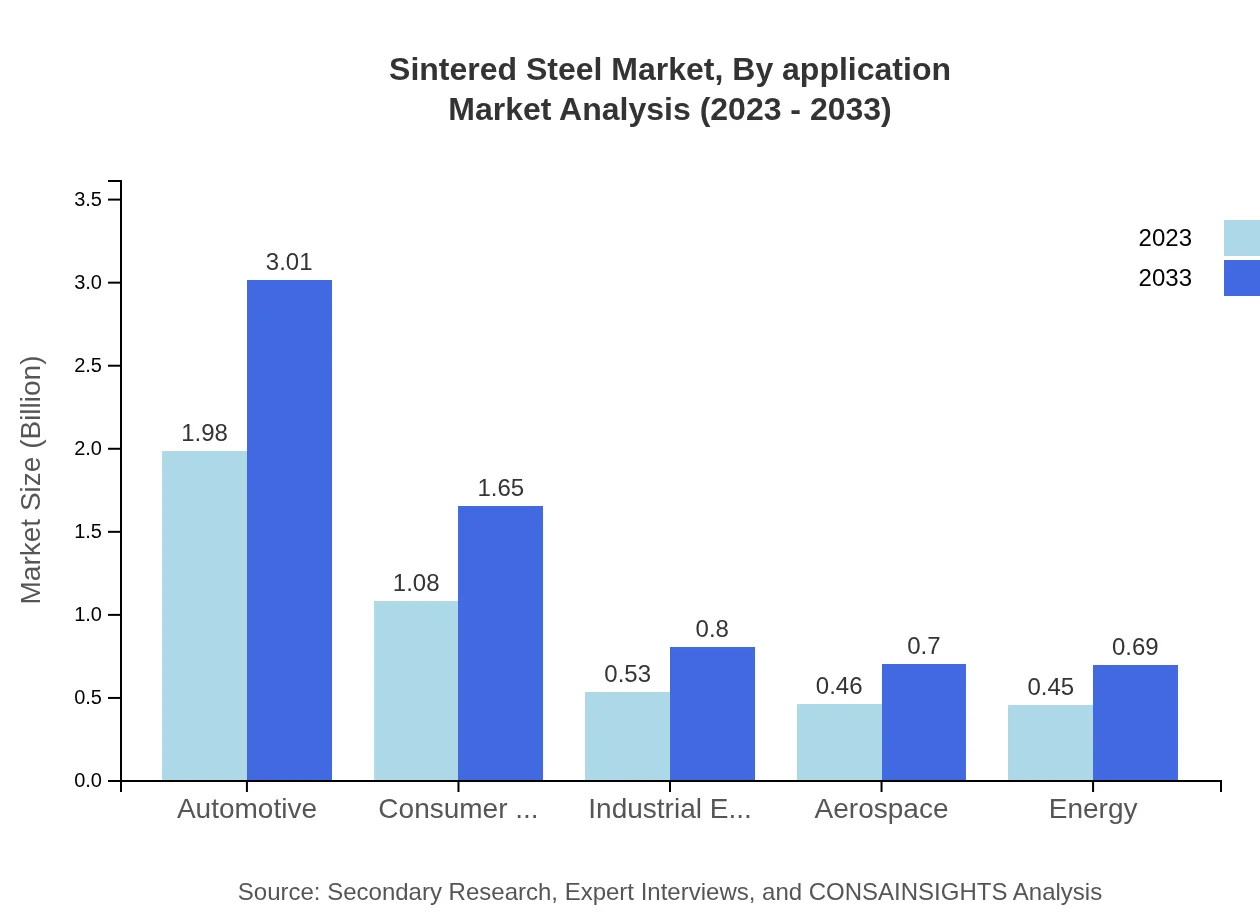

Sintered Steel Market Analysis By Application

The application analysis reveals that the automotive sector dominates the Sintered Steel market, with a substantial market size of 1.98 billion in 2023 and an anticipated 3.01 billion by 2033, constituting 44.03% of the total market share. Other noteworthy applications include construction, consumer goods, and industrial equipment, reflecting the material's versatility in manufacturing.

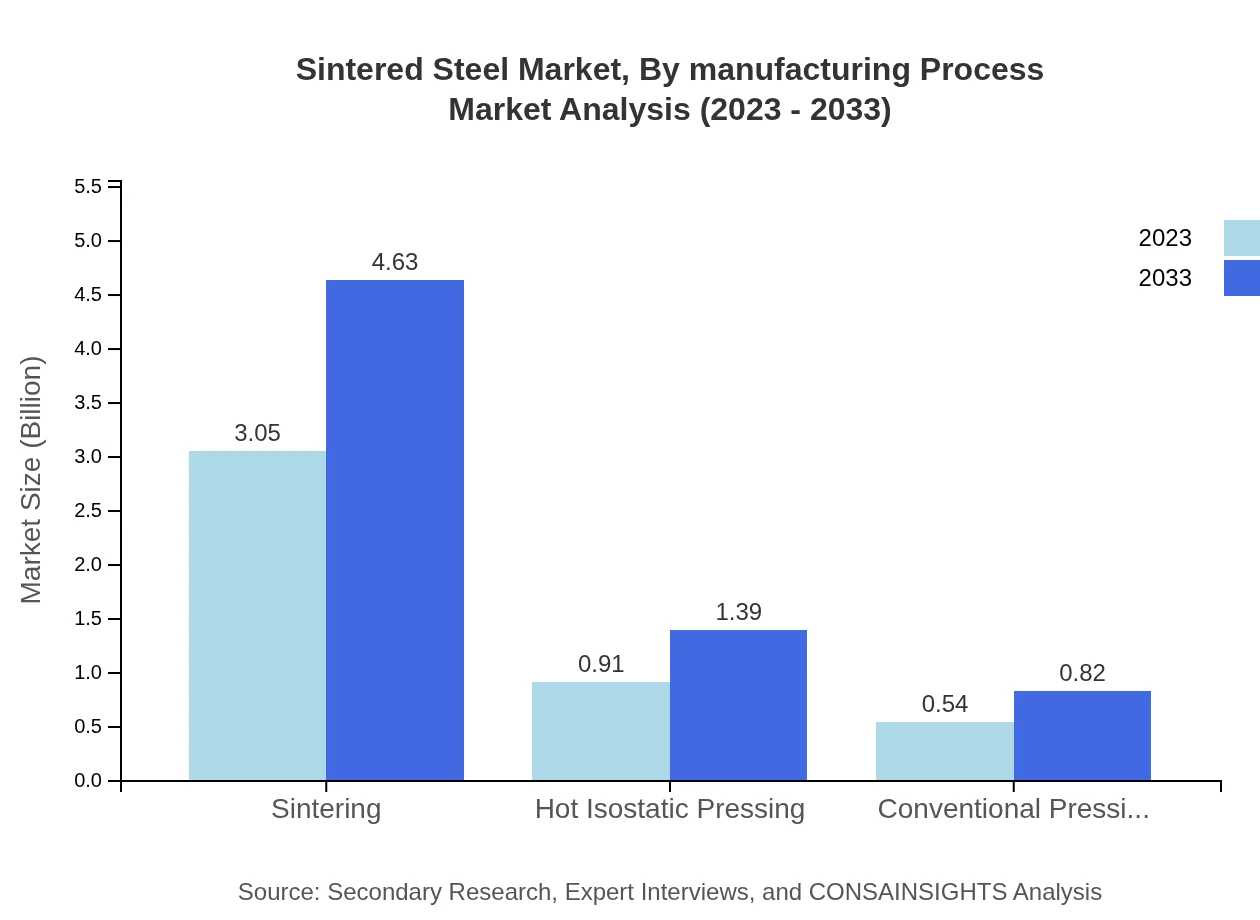

Sintered Steel Market Analysis By Manufacturing Process

Sintering remains the most prevalent manufacturing process, commanding a significant 67.73% market share in 2023 with projections hinting at growth due to enhanced technology and processes streamlining production. Hot Isostatic Pressing and Conventional Pressing are also notable processes contributing to market diversity, appealing to varying product specifications and industry needs.

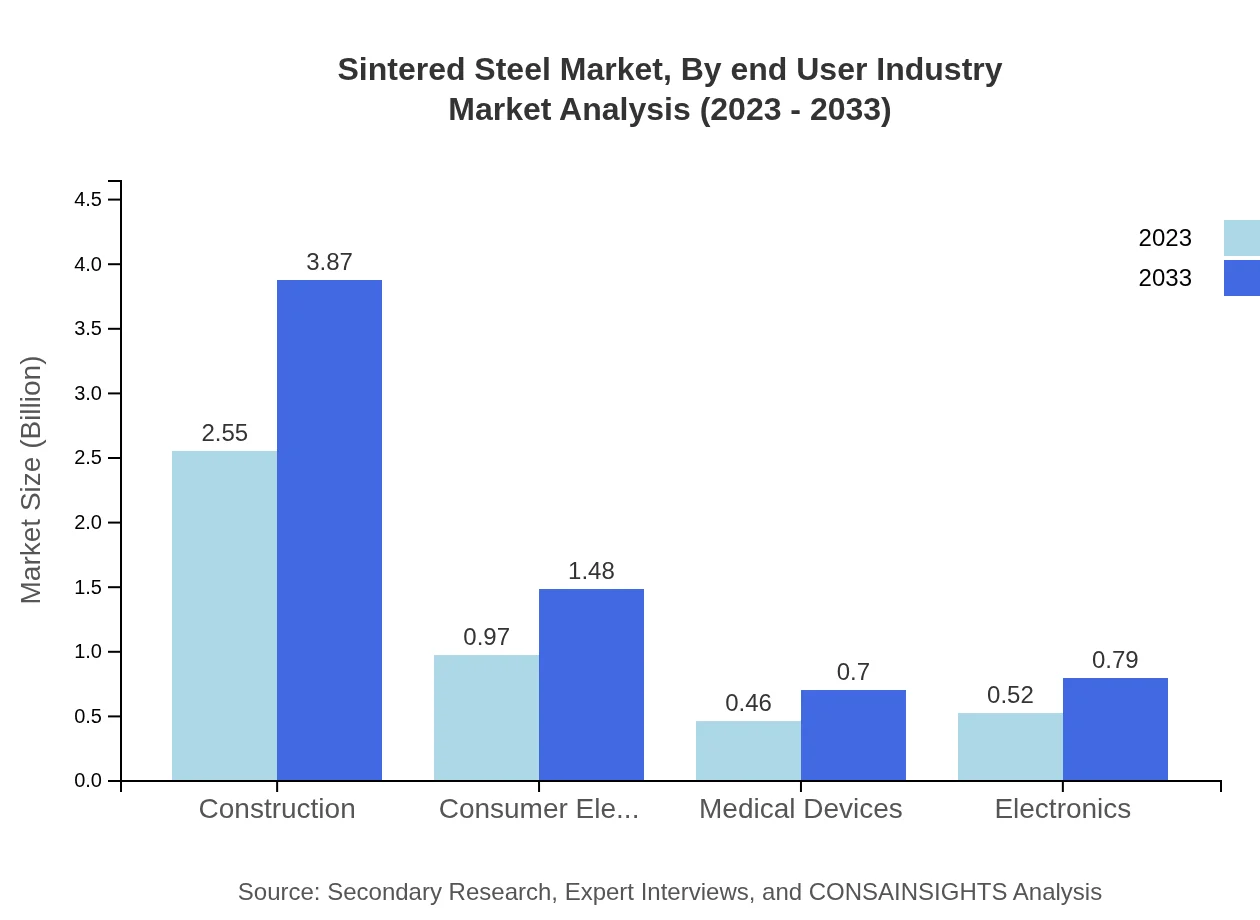

Sintered Steel Market Analysis By End User Industry

The end-user industry segmentation showcases the automotive industry as the frontrunner with a sizeable market size of 1.98 billion in 2023, predicted to reach 3.01 billion by 2033. Other significant industries include construction, consumer electronics, and medical devices, which rely on the unique properties of sintered steel to deliver innovative products.

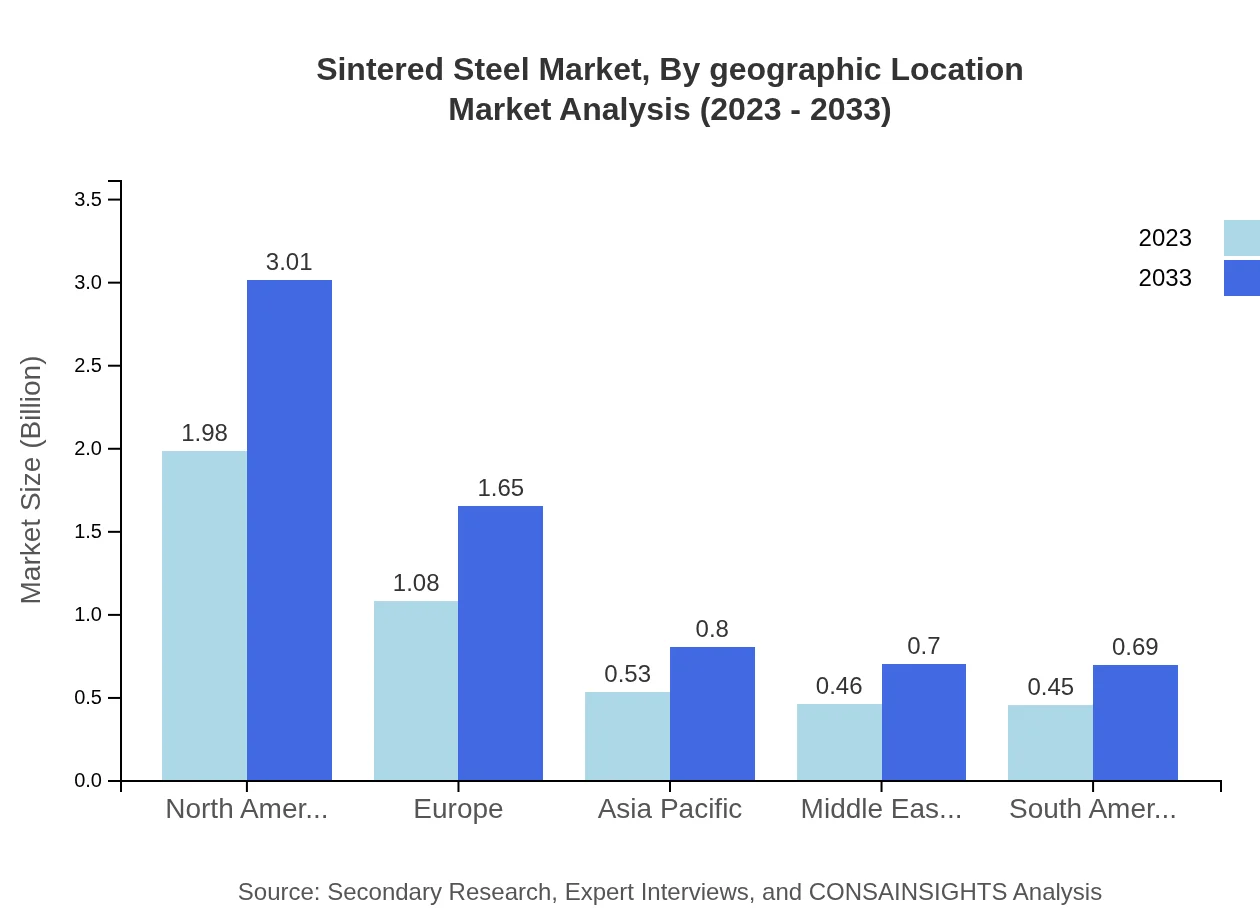

Sintered Steel Market Analysis By Geographic Location

Geographically, North America and Europe retain substantial positions within the Sintered Steel market, accounting for significant shares in revenue. The competitive landscape is marked by regional players innovating to tailor materials to local manufacturing processes and demands, while emerging markets in Asia Pacific and South America present opportunities for future expansion and growth.

Sintered Steel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sintered Steel Industry

Höganäs AB:

As one of the leading companies in the powder metallurgy sector, Höganäs specializes in the production of sintered steel and offers innovative solutions across various industries.GKN Powder Metallurgy:

GKN is recognized for its advanced manufacturing capabilities in sintered components, catering primarily to the automotive and aerospace sectors, driving significant market growth.Sumitomo Metal Mining:

With a strong foothold in both the sintered steel and metal powder industries, Sumitomo offers high-quality products and innovative manufacturing solutions.PMT Industries:

A notable player in the sintered steel market, PMT Industries focuses on high-precision components catering to diverse applications, enhancing the industry’s innovation spectrum.We're grateful to work with incredible clients.

FAQs

What is the market size of sintered Steel?

The sintered steel market is valued at $4.5 billion in 2023, with a projected CAGR of 4.2% over the next decade. By 2033, the market size is expected to grow significantly, driven by increased adoption in various sectors.

What are the key market players or companies in this sintered Steel industry?

Key market players in the sintered steel industry include major manufacturers and suppliers, renowned for innovation and quality. Companies develop advanced products and collaborate on research to maintain competitive pricing and expand global reach.

What are the primary factors driving the growth in the sintered steel industry?

Growth in the sintered steel industry is propelled by the increasing demand in automotive and industrial applications, advancements in manufacturing technologies, and the growing focus on sustainable materials. These factors enhance market attractiveness and investment opportunities.

Which region is the fastest Growing in the sintered steel?

The Asia Pacific region is anticipated to experience rapid growth in the sintered steel market, with a 2023 market size of $0.77 billion growing to $1.17 billion by 2033. This growth is driven by industrial expansion and increasing manufacturing capabilities.

Does ConsaInsights provide customized market report data for the sintered steel industry?

Yes, ConsaInsights offers customized market reports tailored to client needs. These reports include in-depth analysis, regional insights, and segment-specific data to assist businesses in strategic decision-making within the sintered steel market.

What deliverables can I expect from this sintered steel market research project?

Deliverables from the sintered steel market research include comprehensive reports, segment analysis, regional forecasts, and insights into key market players. Data visuals and strategic recommendations will also be included to support decision-making processes.

What are the market trends of sintered steel?

Current trends in the sintered steel market highlight a growing emphasis on eco-friendly production methods, innovations in sintering technologies, and enhanced applications in various industries. These trends signify a shift towards performance and sustainability.