Sizing Agents Market Report

Published Date: 02 February 2026 | Report Code: sizing-agents

Sizing Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sizing Agents market, highlighting current trends, market dynamics, and strategic insights from 2023 to 2033, covering market size, growth forecasts, and regional analysis.

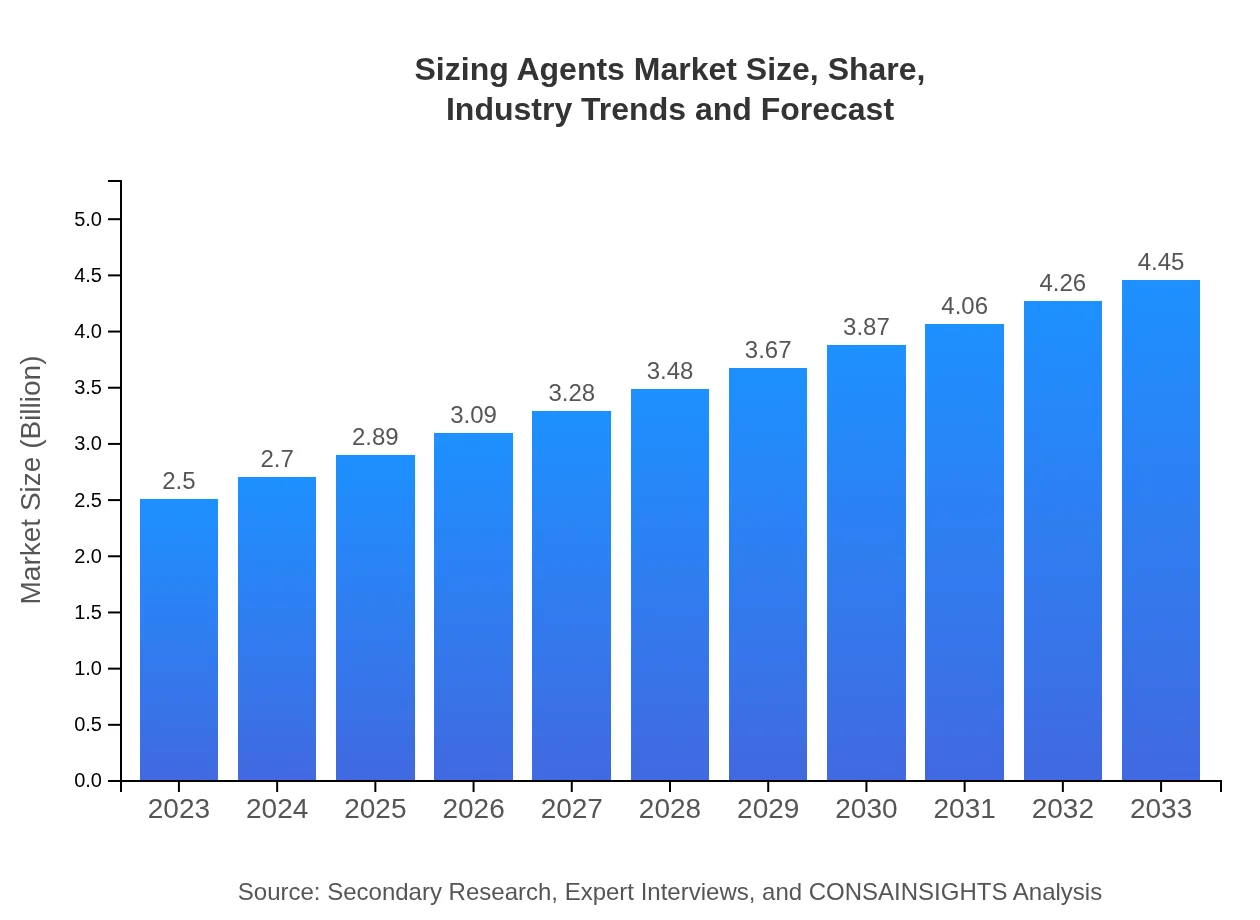

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $4.45 Billion |

| Top Companies | BASF SE, Stahl Holdings B.V., Ashland Global Holdings Inc., Huntsman Corporation |

| Last Modified Date | 02 February 2026 |

Sizing Agents Market Overview

Customize Sizing Agents Market Report market research report

- ✔ Get in-depth analysis of Sizing Agents market size, growth, and forecasts.

- ✔ Understand Sizing Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sizing Agents

What is the Market Size & CAGR of Sizing Agents market in 2023-2033?

Sizing Agents Industry Analysis

Sizing Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sizing Agents Market Analysis Report by Region

Europe Sizing Agents Market Report:

Europe is expected to witness substantial growth moving from $0.64 billion in 2023 to $1.14 billion by 2033. With increasing regulations on sustainability, the market is shifting towards greener formulations. The textile and automotive sectors are driving demand owing to their need for specialized sizing solutions.Asia Pacific Sizing Agents Market Report:

In the Asia Pacific region, the Sizing Agents market is expected to grow from $0.54 billion in 2023 to $0.96 billion by 2033, driven by rapid industrialization and increasing manufacturing activities in countries like China and India. The textile sector is a significant contributor to this growth, fueled by high consumer demand for fashion and apparel.North America Sizing Agents Market Report:

In North America, the Sizing Agents market is set to rise from $0.93 billion in 2023 to $1.65 billion by 2033. This growth is largely attributed to an upscale in the demand for high-quality textiles and the booming paper industry. Companies are also focusing on eco-friendly product developments, catering to environmentally conscious consumers.South America Sizing Agents Market Report:

The South American market for Sizing Agents is projected to expand from $0.06 billion in 2023 to $0.11 billion by 2033. The increasing investments in the textile and paper industries, particularly in Brazil, are key drivers. Additionally, a growing awareness of sustainable practices is impacting product adoption in this region.Middle East & Africa Sizing Agents Market Report:

The Middle East and Africa market for Sizing Agents is projected to grow from $0.33 billion in 2023 to $0.59 billion by 2033, supported by developments in oil and gas, textiles, and construction. Investments in infrastructure and manufacturing are expected to spur demand for both textile and industrial applications in this region.Tell us your focus area and get a customized research report.

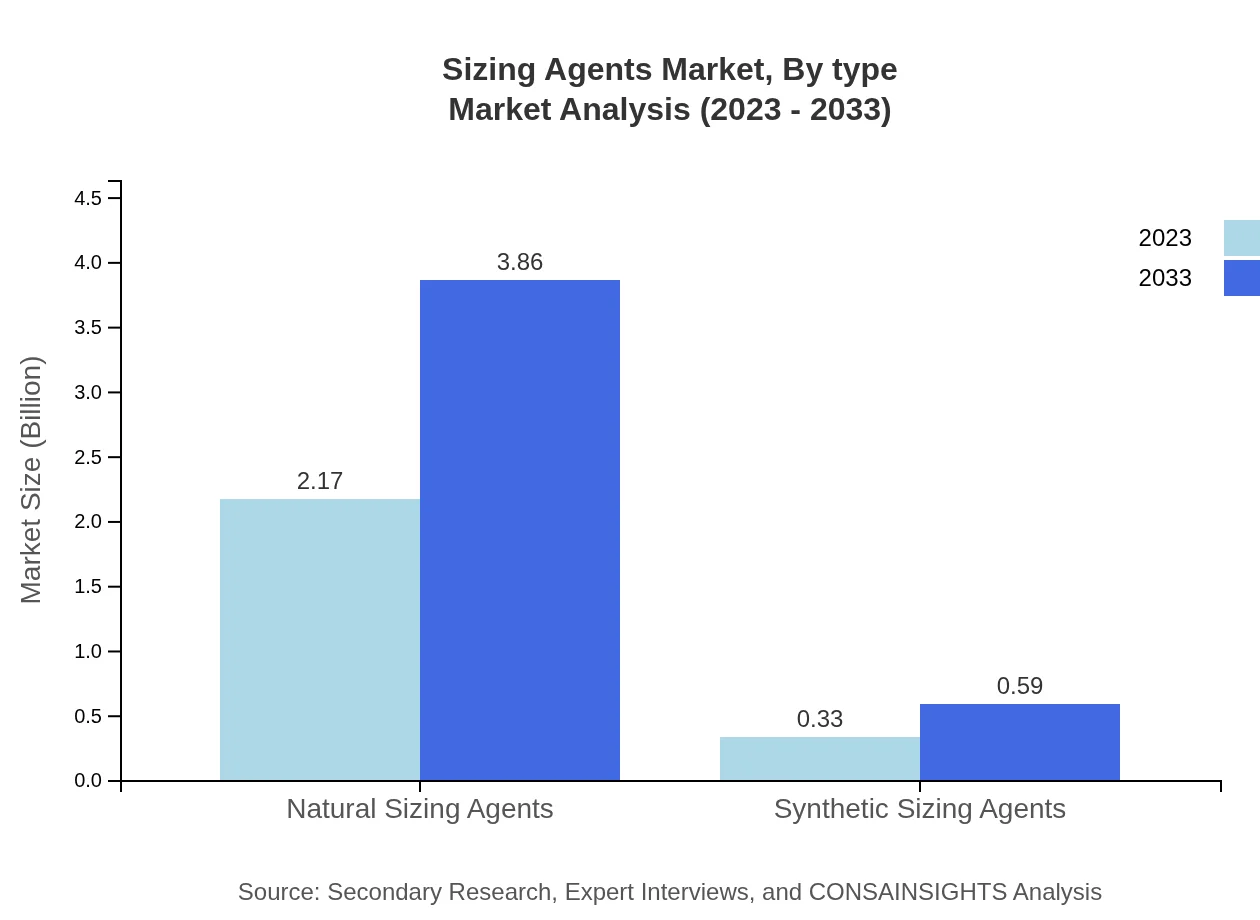

Sizing Agents Market Analysis By Type

The Sizing Agents market is segmented into natural and synthetic agents. The natural sizing agents dominate the market with a size of $2.17 billion in 2023, expected to grow to $3.86 billion by 2033, holding a market share of 86.65%. Synthetic agents, while smaller, are increasingly being recognized for their effectiveness, growing from $0.33 billion to $0.59 billion and capturing a 13.35% market share.

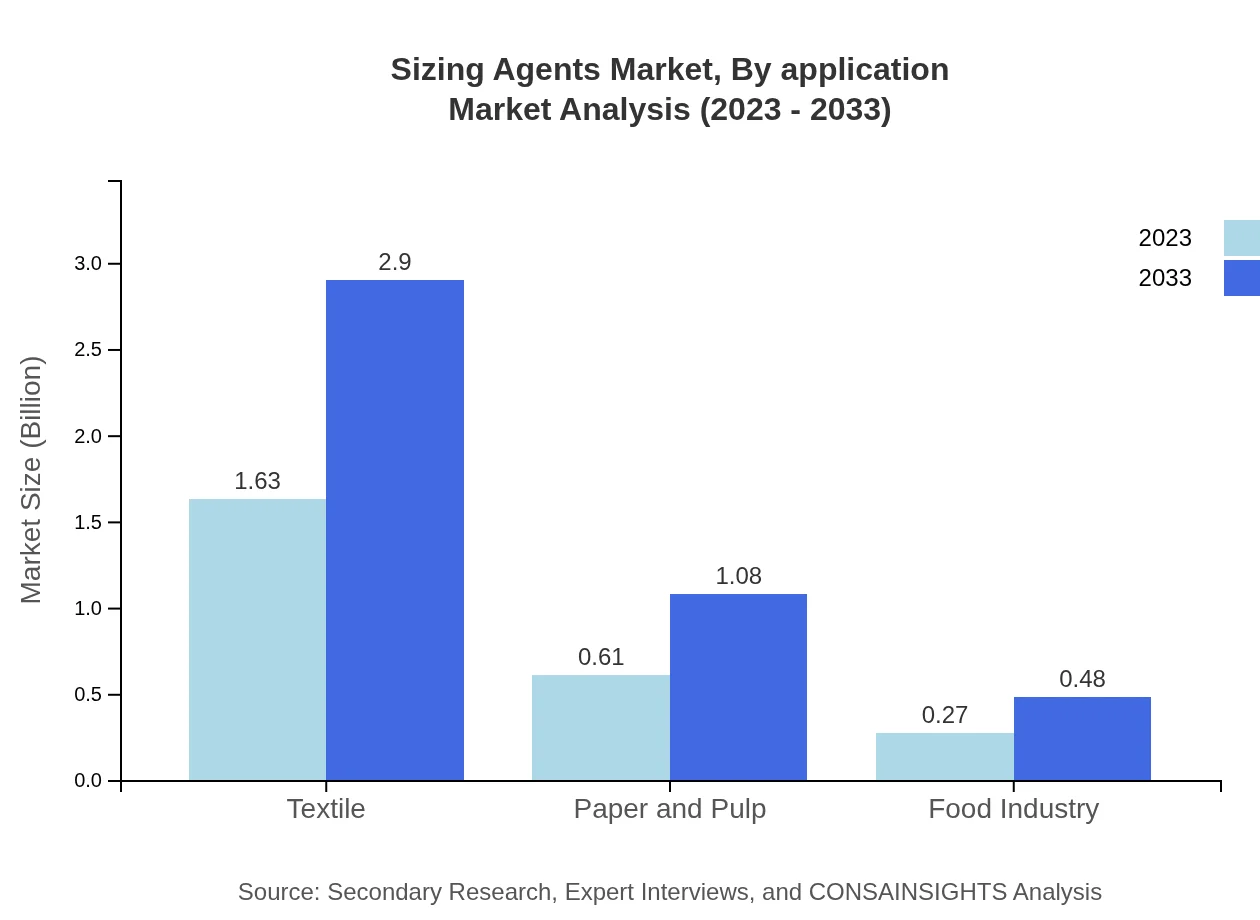

Sizing Agents Market Analysis By Application

Applications of Sizing Agents vary across sectors such as textiles, paper, and food. In 2023, the textile application segment is the largest, with a market size of $1.63 billion, projected to reach $2.90 billion by 2033, representing a 65.08% share. Paper and pulp applications follow with a size of $0.61 billion in 2023, set to increase to $1.08 billion. The food industry, while smaller, is also poised for growth from $0.27 billion to $0.48 billion.

Sizing Agents Market Analysis By Region

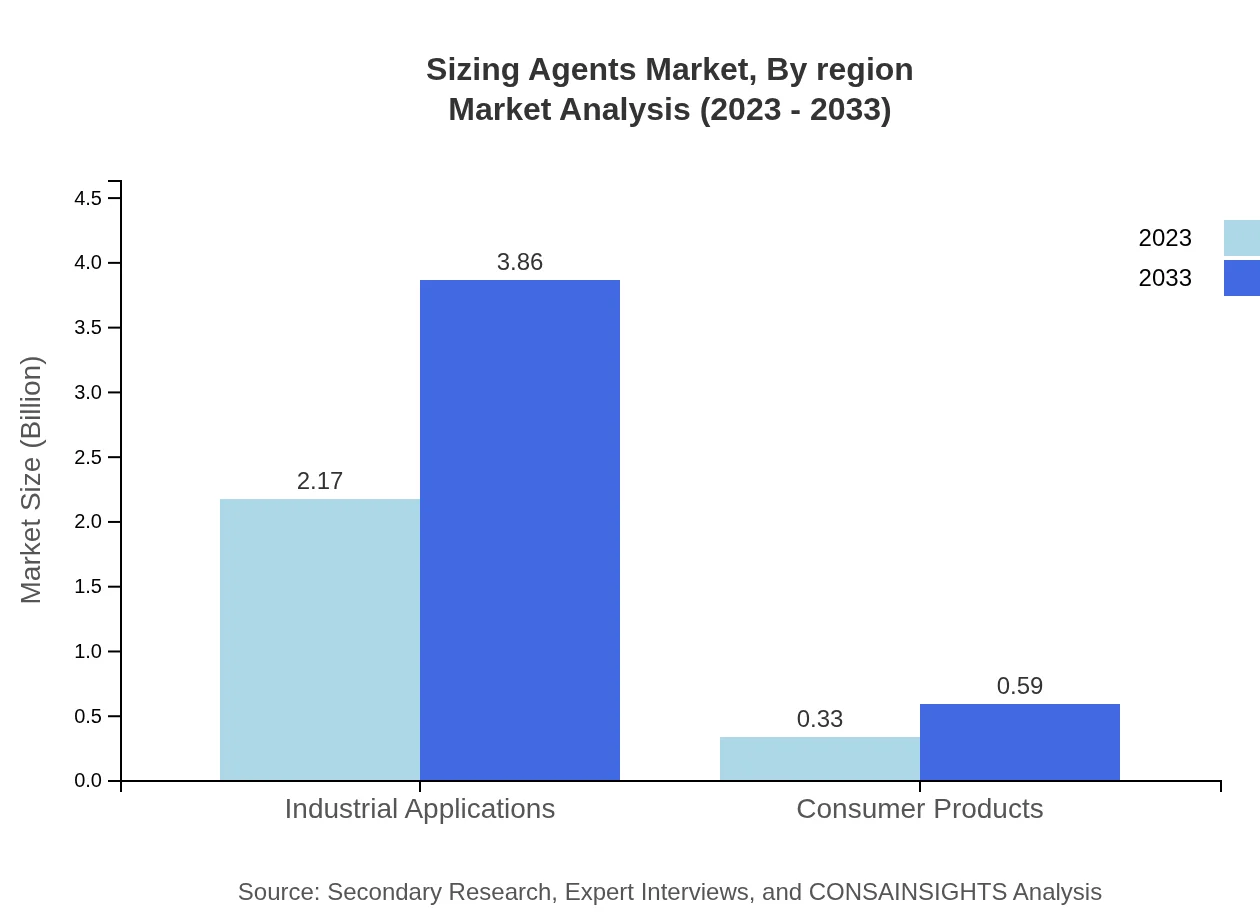

The Sizing Agents market is tied closely to end-user industries like textiles, where it represents 65.08% of the total share, followed by paper and pulp applications at 24.25%. Industrial uses are significant as well, driving demand for higher durability and performance in product offerings.

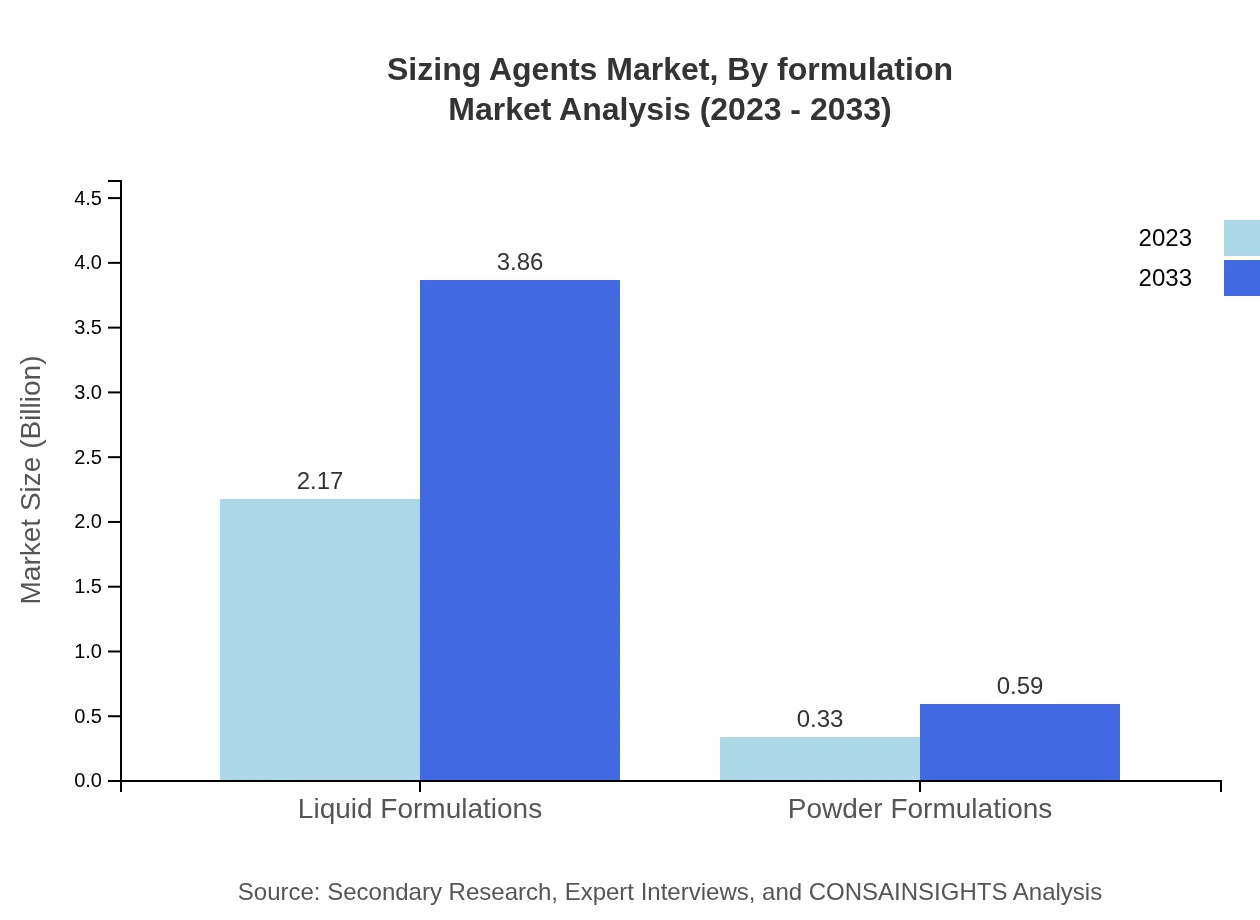

Sizing Agents Market Analysis By Formulation

The formulation segment includes liquid and powder types. Liquid formulations are dominant, accounting for $2.17 billion in 2023, with an increase to $3.86 billion by 2033, maintaining an 86.65% market share. Powder formulations, although smaller, are gaining ground with growth from $0.33 billion to $0.59 billion.

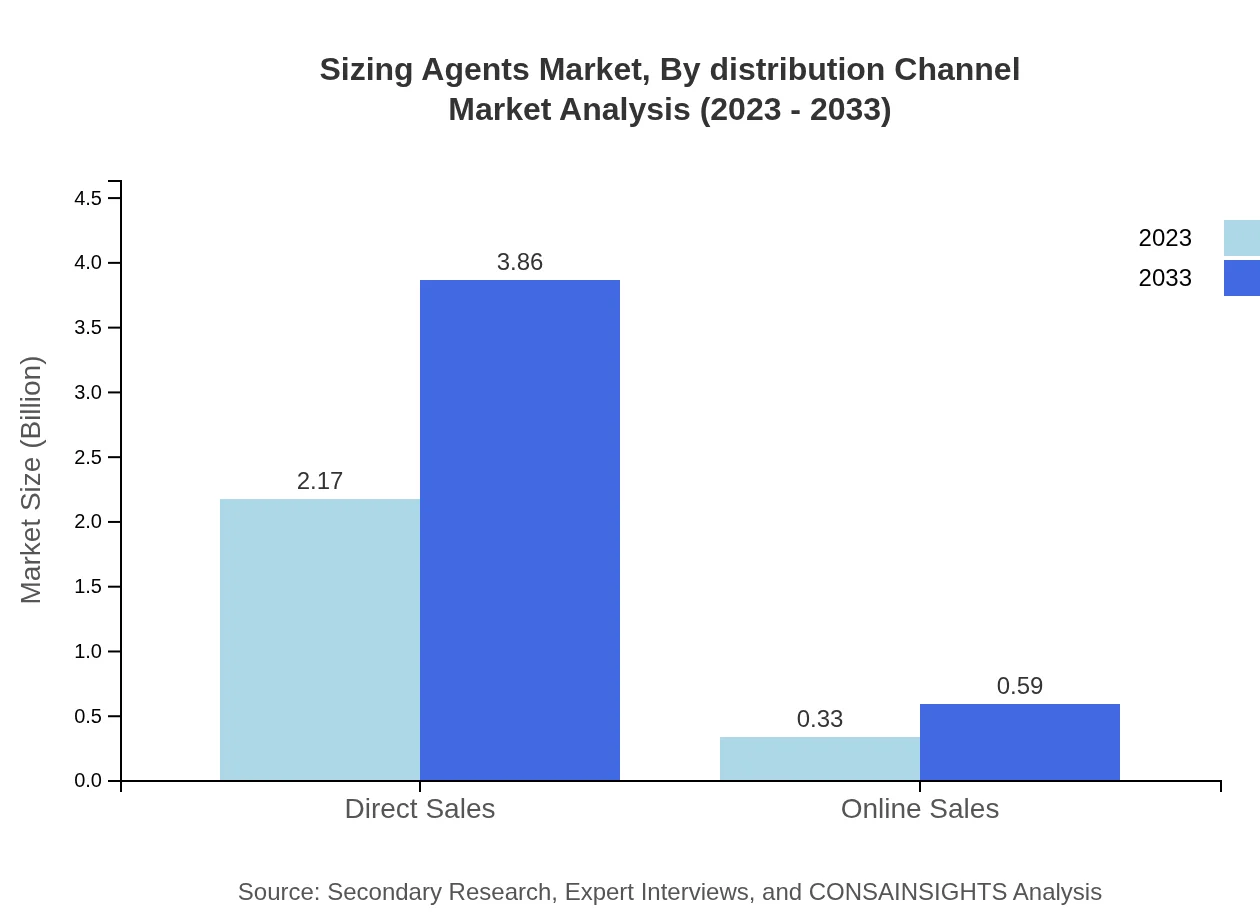

Sizing Agents Market Analysis By Distribution Channel

Distribution of Sizing Agents occurs through direct and online sales channels. Direct sales comprise the bulk of transactions, with a size of $2.17 billion in 2023 and expected to increase to $3.86 billion. Online sales, while smaller, are projected to grow significantly, reflecting changing consumer purchasing habits.

Sizing Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sizing Agents Industry

BASF SE:

BASF is a global leader in chemical manufacturing, providing innovative and sustainable solutions across various industries, including textiles and paper.Stahl Holdings B.V.:

Stahl focuses on high-performance solutions for textiles, leveraging sustainable practices and advanced technologies in their sizing agents.Ashland Global Holdings Inc.:

Ashland provides a variety of specialty chemicals, including sizing agents used in several applications, with a commitment to quality and sustainability.Huntsman Corporation:

Huntsman is recognized for its wide portfolio of specialty chemicals, including solutions for textile sizing, catering to high-performance requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of sizing Agents?

The global sizing agents market is currently valued at approximately $2.5 billion, with a projected compound annual growth rate (CAGR) of 5.8%. This growth indicates robust demand across various applications, shaping significant investment opportunities.

What are the key market players or companies in this sizing Agents industry?

Key players in the sizing agents market include global chemical manufacturers that specialize in textile, paper, and food industries. Their contributions are crucial in shaping market dynamics and driving innovations across different segments and applications.

What are the primary factors driving the growth in the sizing agents industry?

Growth drivers for the sizing agents market include increasing demand in the textile and paper industries as well as advancements in eco-friendly sizing technologies. Additionally, expanding applications in various sectors enhance growth potential and attract investments.

Which region is the fastest Growing in the sizing agents?

The North America region is anticipated to be the fastest-growing market for sizing agents, projected to grow from $0.93 billion in 2023 to $1.65 billion by 2033, supported by advancements in textile manufacturing and strategic industry developments.

Does ConsaInsights provide customized market report data for the sizing agents industry?

Yes, ConsaInsights offers tailored market report data specific to the sizing agents industry, allowing clients to obtain insights that cater to their unique needs and facilitate informed decision-making based on market trends and forecasts.

What deliverables can I expect from this sizing agents market research project?

Deliverables include comprehensive market analysis reports, segmented data insights, growth forecasts, and regional market analysis. Clients receive actionable recommendations, market trends, and competitive landscape evaluations for effective strategy formulation.

What are the market trends of sizing agents?

Key trends in the sizing agents market include a shift towards natural agents over synthetic ones, a focus on sustainable practices, and technological innovations. These trends are reshaping manufacturing processes and influencing consumer preferences.