Sizing And Thickening Agents Market Report

Published Date: 31 January 2026 | Report Code: sizing-and-thickening-agents

Sizing And Thickening Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sizing And Thickening Agents market from 2023 to 2033, highlighting key trends, market size, and growth projections along with insights on regional markets and industry leaders.

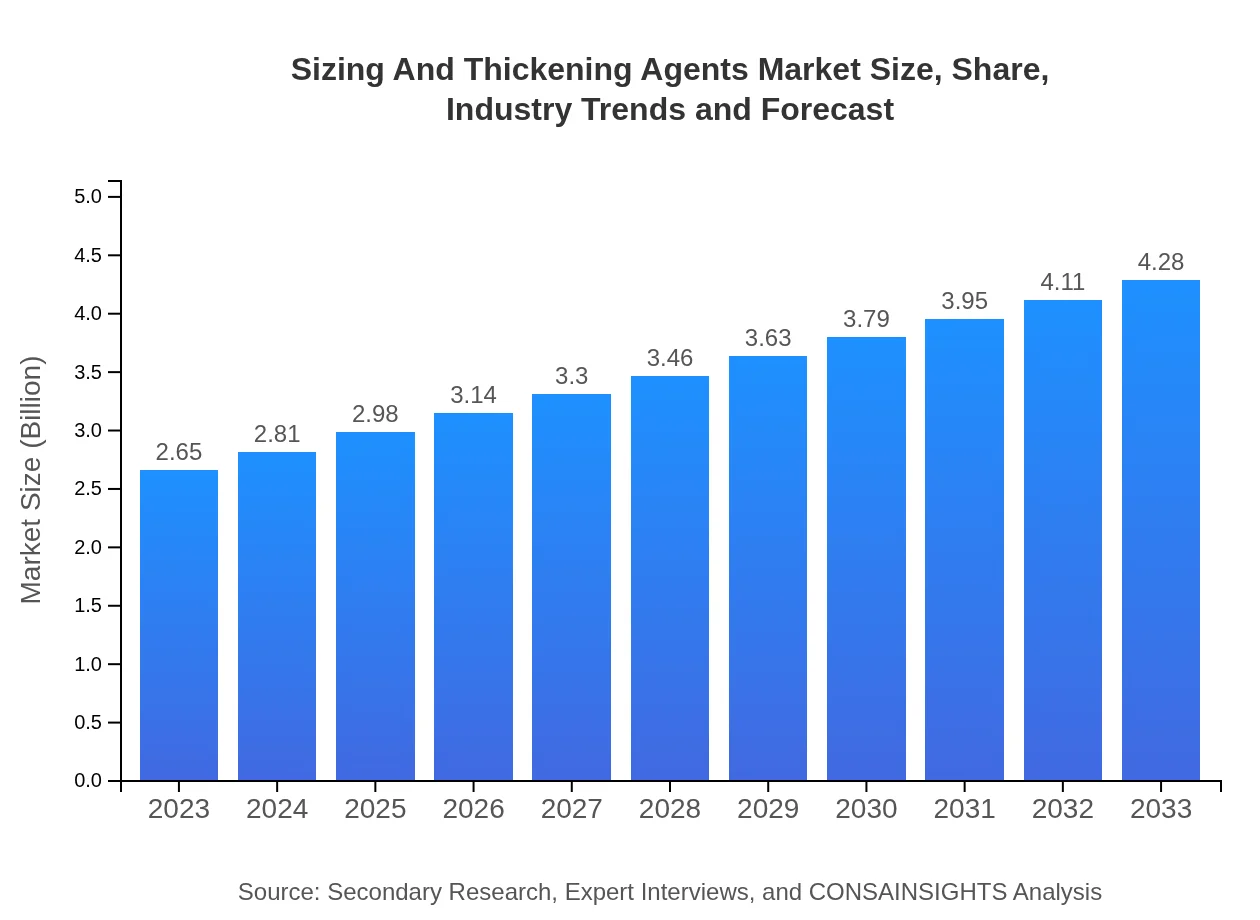

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.65 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $4.28 Billion |

| Top Companies | BASF SE, DuPont de Nemours, Inc., AkzoNobel N.V., Huntsman Corporation |

| Last Modified Date | 31 January 2026 |

Sizing And Thickening Agents Market Overview

Customize Sizing And Thickening Agents Market Report market research report

- ✔ Get in-depth analysis of Sizing And Thickening Agents market size, growth, and forecasts.

- ✔ Understand Sizing And Thickening Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sizing And Thickening Agents

What is the Market Size & CAGR of Sizing And Thickening Agents market in 2023?

Sizing And Thickening Agents Industry Analysis

Sizing And Thickening Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sizing And Thickening Agents Market Analysis Report by Region

Europe Sizing And Thickening Agents Market Report:

The European market for Sizing And Thickening Agents is expected to grow from $0.76 billion in 2023 to $1.23 billion in 2033. Stringent regulations on food additives and a consumer shift towards organic products will significantly influence the market landscape in this region.Asia Pacific Sizing And Thickening Agents Market Report:

The Asia Pacific region is expected to experience robust growth in the Sizing And Thickening Agents market, increasing from $0.52 billion in 2023 to $0.83 billion in 2033. Rising industrialization and consumer demand for processed foods are significant driving factors, alongside innovation in product formulations.North America Sizing And Thickening Agents Market Report:

North America is anticipated to maintain a significant market share, increasing from $0.97 billion in 2023 to $1.57 billion in 2033. Strong demand from the food processing and pharmaceutical sectors, coupled with high disposable income, fuels this region's growth.South America Sizing And Thickening Agents Market Report:

In South America, the market for Sizing And Thickening Agents is projected to grow from $0.06 billion in 2023 to $0.10 billion in 2033. The region's growing food industry and increasing investments in personal care products are pivotal contributors to this growth.Middle East & Africa Sizing And Thickening Agents Market Report:

The Middle East and Africa segment is forecasted to rise from $0.34 billion in 2023 to $0.55 billion in 2033, driven by growing awareness of personal care products and the expansion of the food and beverage industry.Tell us your focus area and get a customized research report.

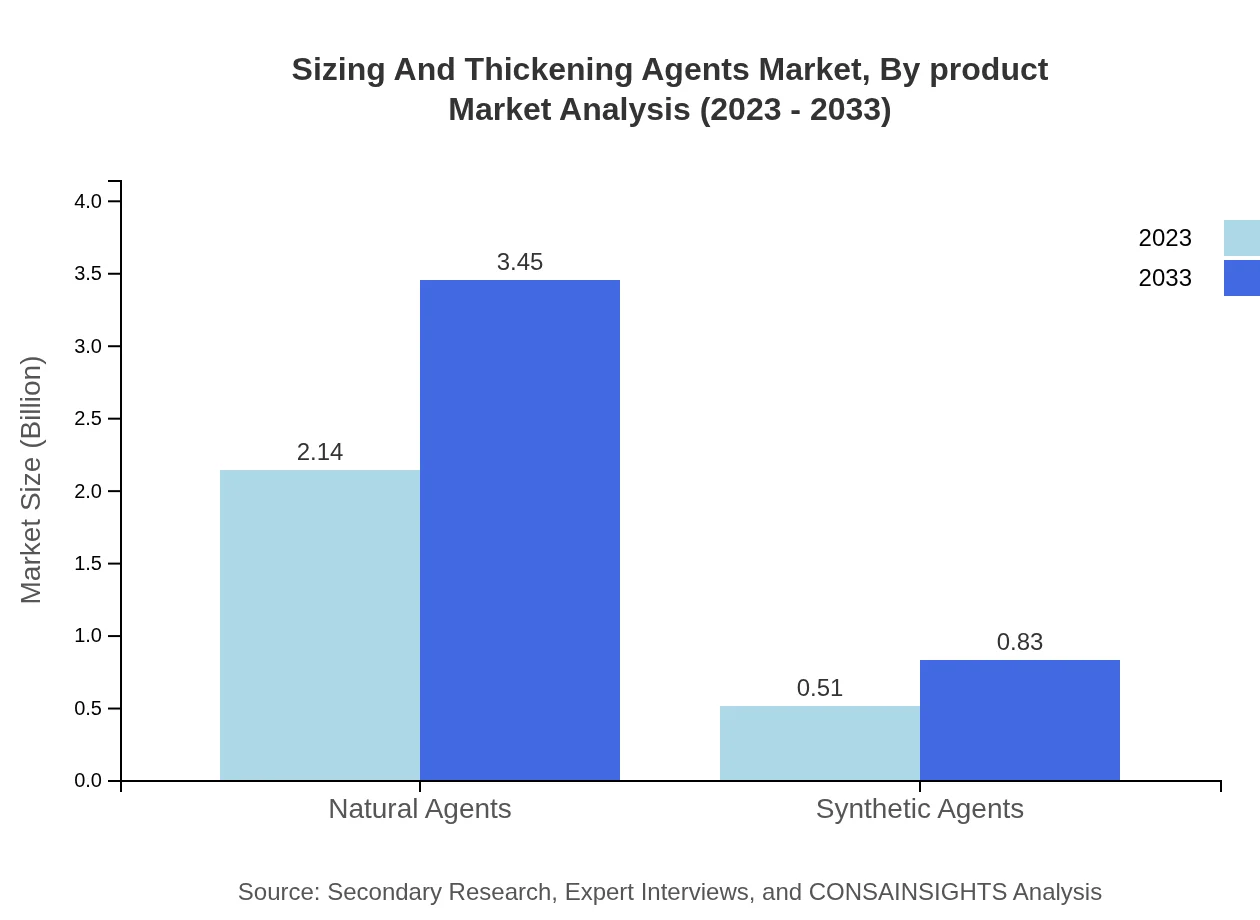

Sizing And Thickening Agents Market Analysis By Product

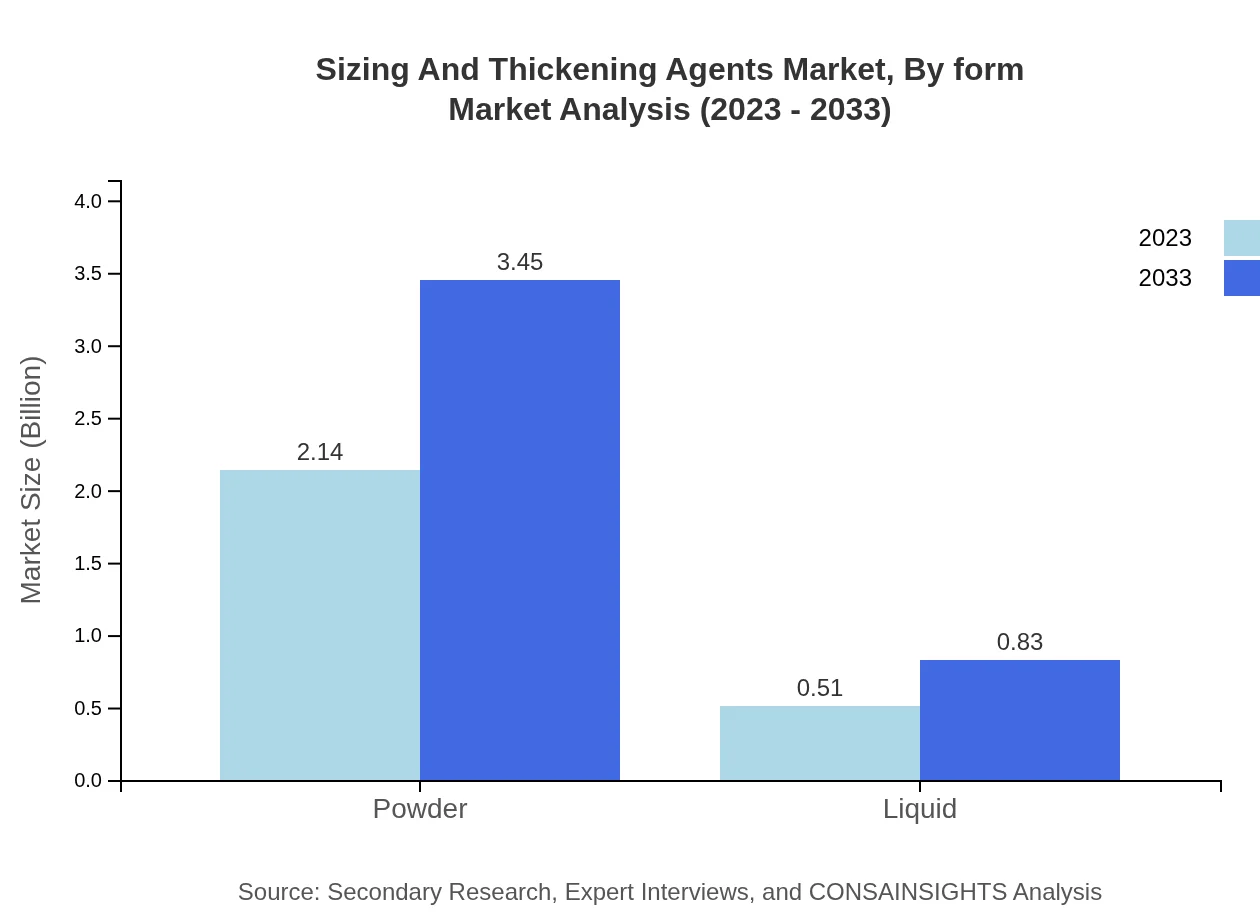

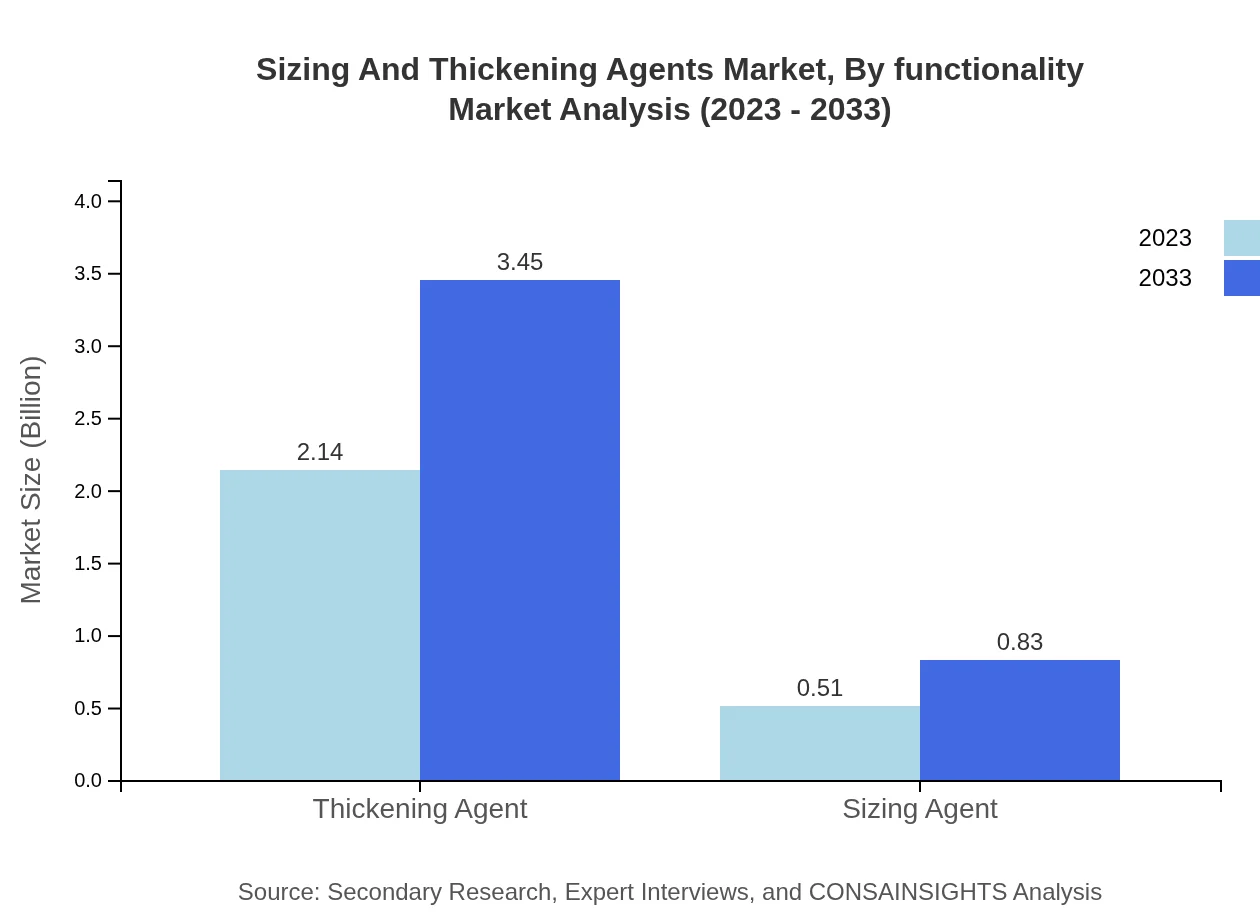

The product segment of the Sizing and Thickening Agents market is predominantly led by powders, which account for a significant market share of 80.69% in both 2023 and 2033. Powders are favored for their versatile applications across different industries, with a market size projected to increase from $2.14 billion to $3.45 billion. Liquids are also an important segment, accounting for 19.31% share and growing from $0.51 billion to $0.83 billion through the forecast period.

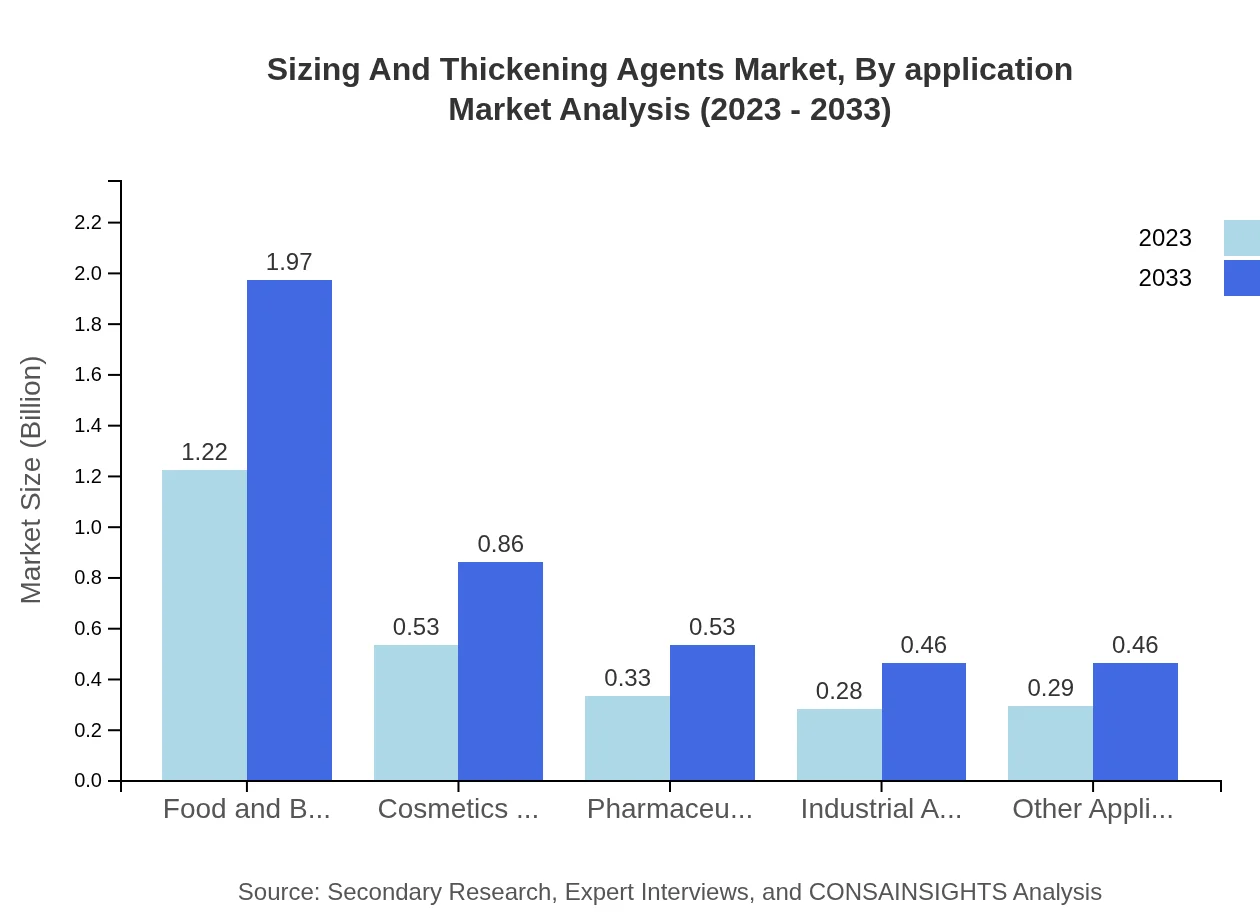

Sizing And Thickening Agents Market Analysis By Application

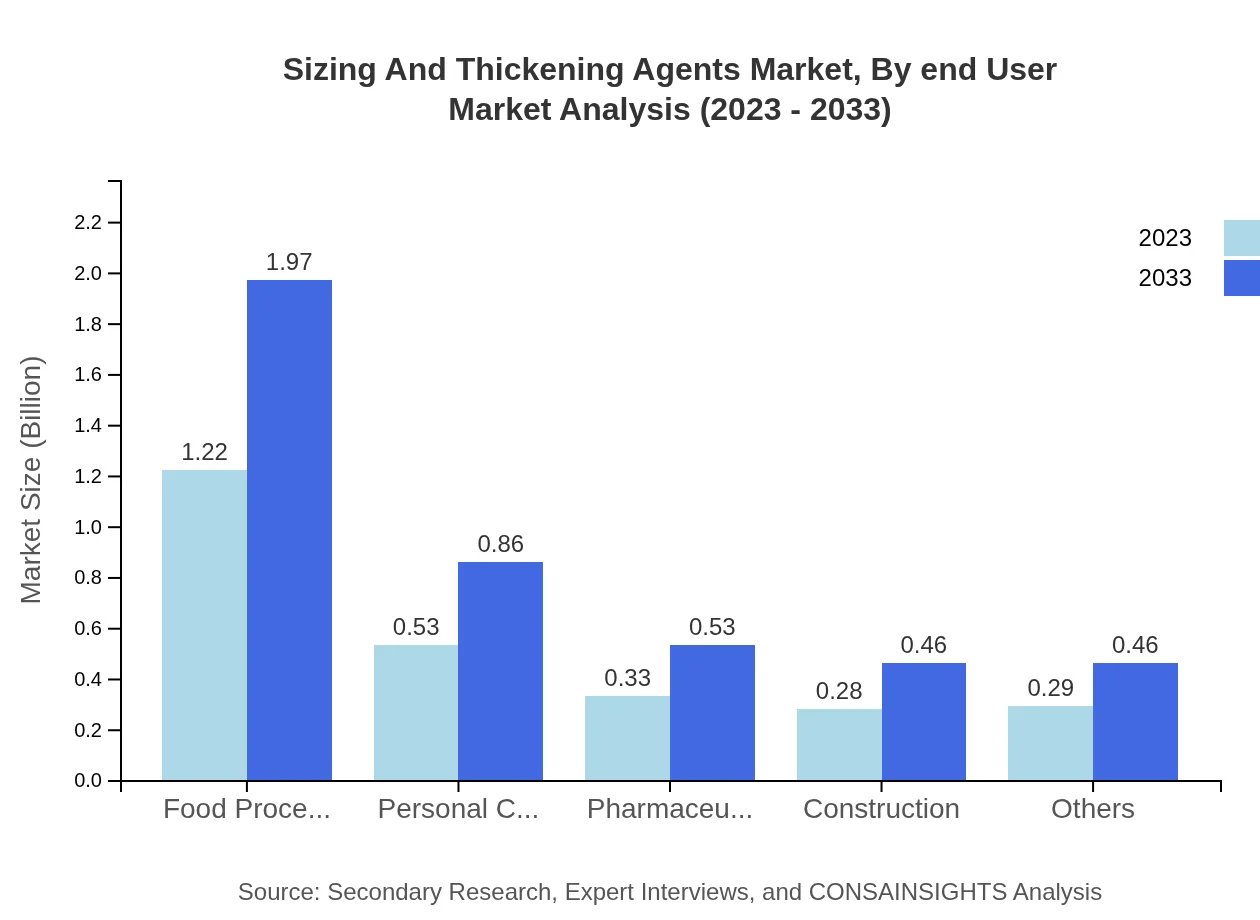

The market segmentation by application indicates that food processing, along with cosmetics and personal care, constitute the highest market shares, accounting for 45.97% combined in 2023. Food processing segment size is expected to grow from $1.22 billion to $1.97 billion, while personal care applications are anticipated to rise from $0.53 billion to $0.86 billion. Pharmaceutical applications, although smaller, show growth potential, increasing from $0.33 billion to $0.53 billion.

Sizing And Thickening Agents Market Analysis By Form

Market performance by form predominantly shows powders commanding the market with a robust share. While the powder form is anticipated to offer better stability and application versatility, liquid forms are experiencing increased adoption due to ease of use and convenience across various applications.

Sizing And Thickening Agents Market Analysis By End User

In terms of end-user industries, food and beverage dominate, holding a notable share of 45.97% in 2023. The pharmaceutical sector is also a vital market player, reflecting significant growth due to increased demand for oral and topical formulations. The construction industry, although smaller, shows gradual growth potential.

Sizing And Thickening Agents Market Analysis By Functionality

Sizing and Thickening Agents are primarily analyzed based on their functionality, focusing on their capacity to enhance viscosity, provide stability, and improve texture. The thickening agents segment is particularly vital, indicating a market share of 80.69%, projected to grow significantly alongside rising demand in various industries.

Sizing And Thickening Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sizing And Thickening Agents Industry

BASF SE:

BASF SE is a global leader in the chemical industry, specializing in sustainable production methods and innovative chemical solutions, including sizing and thickening agents used across various applications.DuPont de Nemours, Inc.:

A prominent player in the market, DuPont focuses on providing innovative solutions, enhancing the performance and usability of sizing and thickening agents in food and pharmaceutical applications.AkzoNobel N.V.:

AkzoNobel is known for its performance coatings and specialty chemicals, contributing significantly to the sizing and thickening agents market with a strong focus on sustainability.Huntsman Corporation:

Huntsman Corporation specializes in technology-driven, specialty chemicals for various applications, enhancing the functional properties of sizing and thickening agents.We're grateful to work with incredible clients.

FAQs

What is the market size of sizing And Thickening Agents?

The global sizing and thickening agents market is valued at approximately $2.65 billion in 2023 and is projected to grow at a CAGR of 4.8% over the next decade, aiming for significant expansion by 2033.

What are the key market players or companies in the sizing and thickening agents industry?

Key players in the sizing and thickening agents market include major chemical manufacturers and formulators such as Ashland, BASF, and DowDuPont, which are known for their innovations and extensive product lines.

What are the primary factors driving the growth in the sizing and thickening agents industry?

The growth in the sizing and thickening agents industry is driven by rising demand in food processing and personal care sectors, innovations in product formulations, and increasing consumer preferences for natural and organic ingredients.

Which region is the fastest Growing in the sizing and thickening agents market?

In the forecast period from 2023 to 2033, the Asia Pacific region is expected to be the fastest-growing area, with a market increase from $0.52 billion to $0.83 billion, driven by expanding manufacturing sectors.

Does ConsaInsights provide customized market report data for the sizing and thickening agents industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and segments of the sizing and thickening agents industry, allowing clients to make informed decisions based on their unique requirements.

What deliverables can I expect from this sizing and thickening agents market research project?

Deliverables from this research project typically include comprehensive market analysis reports, regional and segment-specific forecasts, competitive landscape assessments, and actionable insights for strategic planning.

What are the market trends of sizing and thickening agents?

Current market trends include a shift towards eco-friendly products, increased use of natural emulsifiers in food and cosmetics, and a rising focus on personalized formulations in pharmaceuticals and personal care.