Sizing Thickening Agents Market Report

Published Date: 02 February 2026 | Report Code: sizing-thickening-agents

Sizing Thickening Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sizing Thickening Agents market from 2023 to 2033, including market size, growth trends, segmentation, technological advancements, and regional insights, alongside a forecast of future trends.

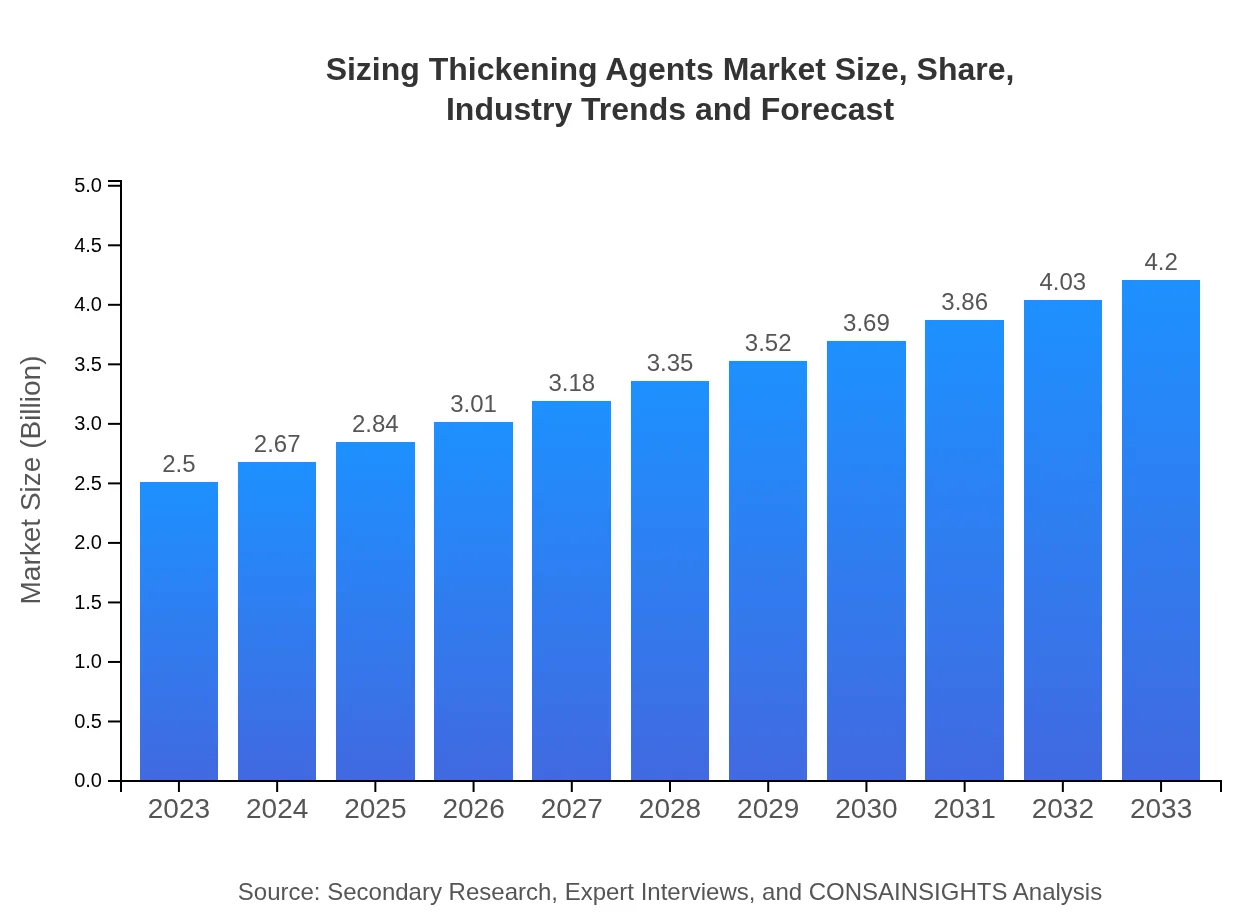

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $4.20 Billion |

| Top Companies | Dow Chemical Company, Ashland Global Holdings Inc., BASF SE, Ingredient Solutions Group, Kraton Corporation |

| Last Modified Date | 02 February 2026 |

Sizing Thickening Agents Market Overview

Customize Sizing Thickening Agents Market Report market research report

- ✔ Get in-depth analysis of Sizing Thickening Agents market size, growth, and forecasts.

- ✔ Understand Sizing Thickening Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sizing Thickening Agents

What is the Market Size & CAGR of Sizing Thickening Agents market in 2033?

Sizing Thickening Agents Industry Analysis

Sizing Thickening Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sizing Thickening Agents Market Analysis Report by Region

Europe Sizing Thickening Agents Market Report:

The European market for Sizing Thickening Agents is projected to increase from $0.69 billion in 2023 to $1.15 billion by 2033. Regulatory policies favoring natural ingredients and a high standard for product efficacy enhance the market landscape in Europe.Asia Pacific Sizing Thickening Agents Market Report:

The Asia Pacific region is anticipated to experience substantial growth in the Sizing Thickening Agents market, projected to reach $0.81 billion by 2033 from $0.48 billion in 2023. The increasing urbanization, a burgeoning middle class, and rising consumer awareness regarding health and nutrition are pivotal factors driving market expansion in this region.North America Sizing Thickening Agents Market Report:

North America remains a significant contributor to the Sizing Thickening Agents market, anticipated to grow from $0.93 billion in 2023 to $1.57 billion by 2033. The region's strong focus on innovation, coupled with a rising preference for natural and organic products, propels market growth.South America Sizing Thickening Agents Market Report:

In South America, the market for Sizing Thickening Agents is expected to grow from $0.05 billion in 2023 to $0.08 billion by 2033. This growth is primarily influenced by an increasing demand for processed food and cosmetic products, presenting opportunities for market players to capitalize on.Middle East & Africa Sizing Thickening Agents Market Report:

The Middle East and Africa are expected to see gradual growth in the Sizing Thickening Agents market, reaching $0.59 billion by 2033 from $0.35 billion in 2023. Increasing urbanization and rising disposable incomes help drive demand for both food and cosmetic products.Tell us your focus area and get a customized research report.

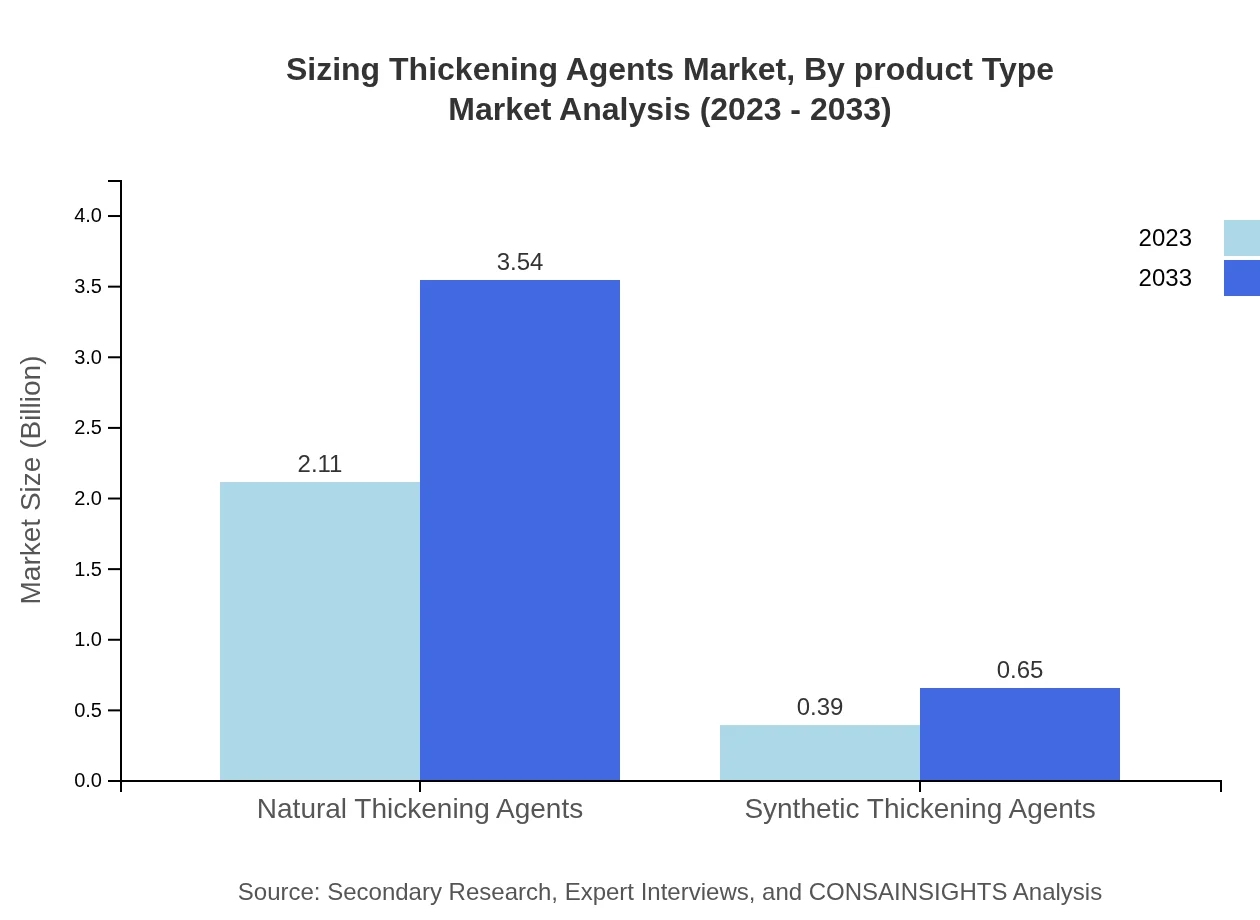

Sizing Thickening Agents Market Analysis By Product Type

The Sizing Thickening Agents market is segmented into natural and synthetic agents. Natural thickening agents dominate the market, accounting for approximately 84.43% of the market share in 2023, growing from a size of $2.11 billion. By 2033, this segment is projected to reach $3.54 billion. In contrast, synthetic thickening agents hold a smaller share at 15.57% but are essential in specific applications, anticipated to grow to $0.65 billion by 2033.

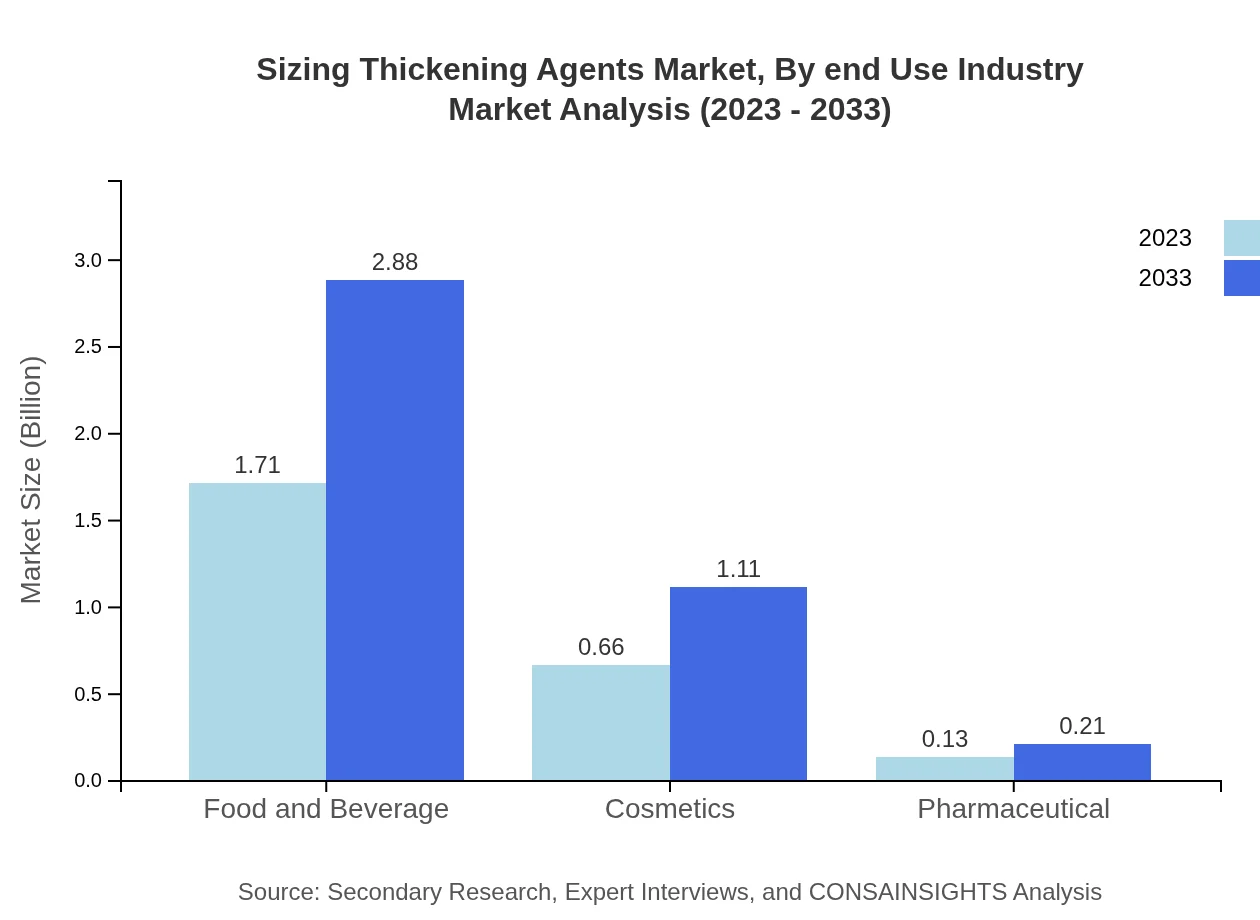

Sizing Thickening Agents Market Analysis By End Use Industry

The Food and Beverage industry is the largest consumer of Sizing Thickening Agents, making up 68.57% of the market share and expanding from $1.71 billion to $2.88 billion by 2033. The Cosmetics industry also significantly contributes, with a corresponding market share of 26.42%, forecasted to grow from $0.66 billion to $1.11 billion. Additionally, the pharmaceutical sector is witnessing a rise, albeit smaller, showcasing the versatility and importance of thickening agents across industries.

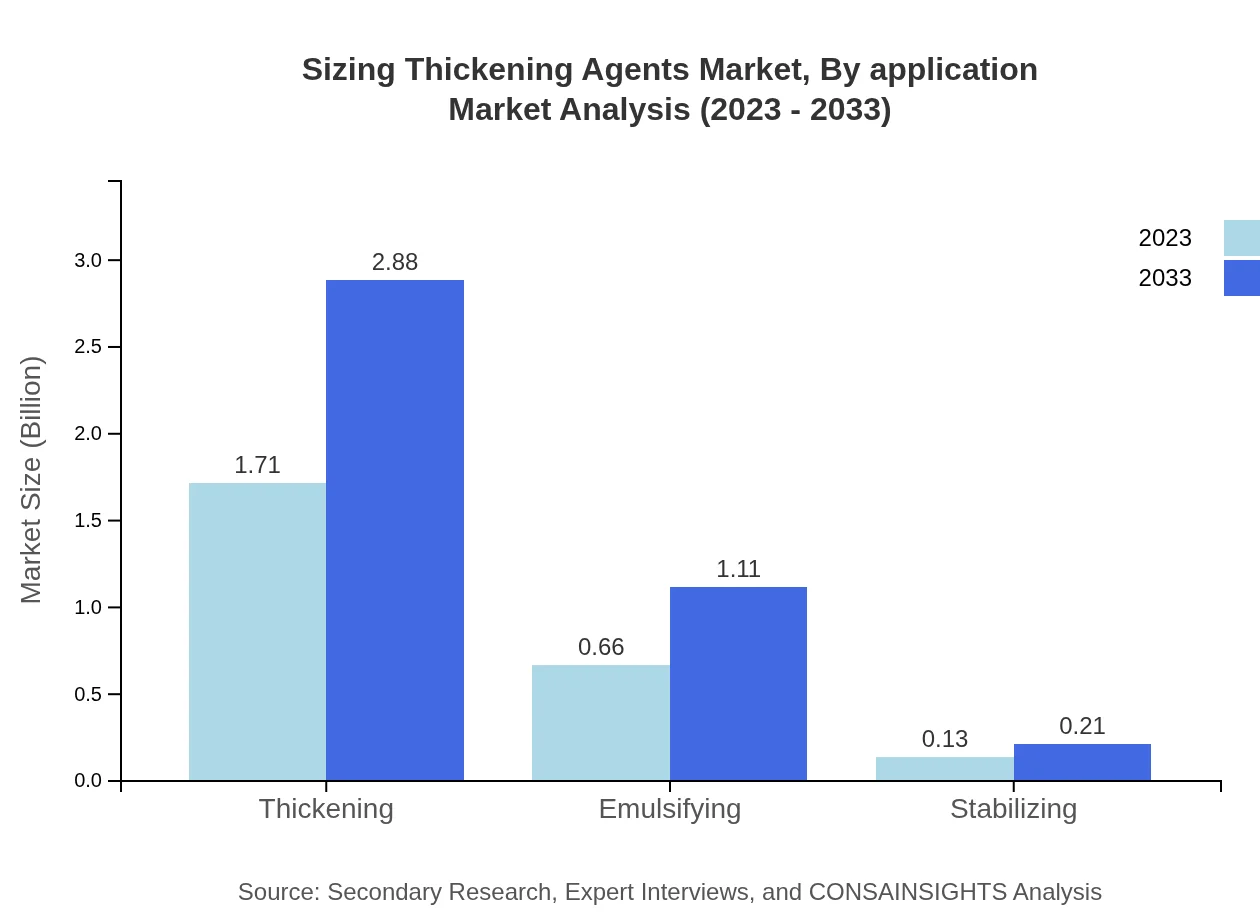

Sizing Thickening Agents Market Analysis By Application

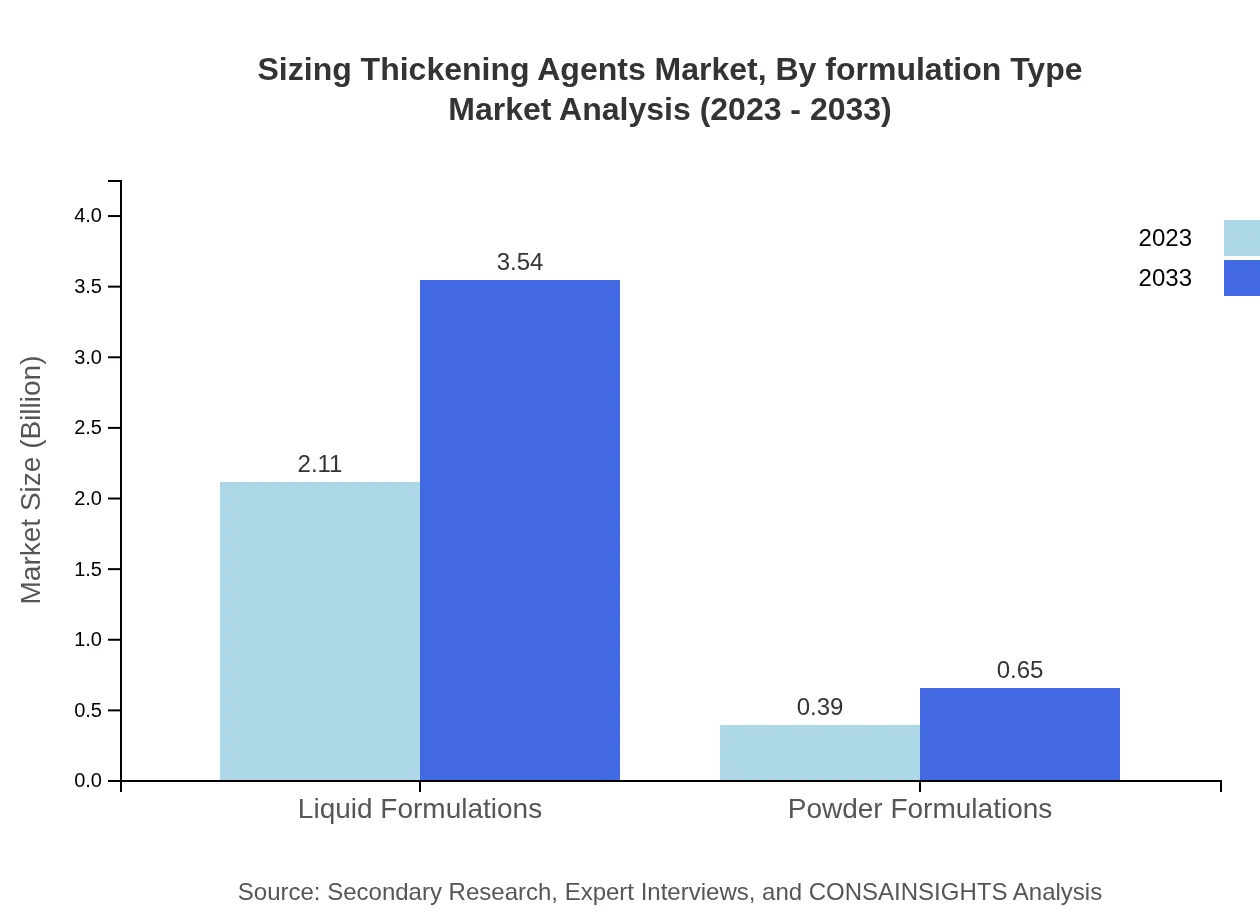

The application of Sizing Thickening Agents spans various product forms, primarily liquid formulations, which dominate the market with a share of 84.43% in 2023, expected to grow from $2.11 billion to $3.54 billion by 2033. Powder formulations hold a smaller share of 15.57%, growing from $0.39 billion to $0.65 billion, highlighting distinct preferences in application methods across industries.

Sizing Thickening Agents Market Analysis By Formulation Type

Formulation types affect the choice and application of thickening agents. Liquid formulations are favored for their convenience and performance, projected to rise significantly in both market size and share through 2033. Powder formulations, while less common, also represent a critical segment, especially in dry product applications.

Sizing Thickening Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sizing Thickening Agents Industry

Dow Chemical Company:

A leading player in the chemicals sector, Dow offers innovative thickening agents used in various applications, emphasizing sustainability and product quality.Ashland Global Holdings Inc.:

Ashland is a prominent global provider of specialty chemicals, including a diverse range of thickening agents that enhance product performance.BASF SE:

A leading chemical producer, BASF employs advanced technologies to manufacture effective and sustainable thickening agents for various industries.Ingredient Solutions Group:

Known for its natural ingredient offerings, Ingredient Solutions Group focuses on bio-based thickening agents catering to the food and beverage sector.Kraton Corporation:

Kraton specializes in sustainable chemistry, providing innovative thickening solutions that meet customer demands across multiple application areas.We're grateful to work with incredible clients.

FAQs

What is the market size of sizing Thickening Agents?

The global market size for sizing thickening agents is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 5.2% from 2023. This growth reflects increasing demand across various applications in food, cosmetics, and pharmaceuticals.

What are the key market players or companies in this sizing Thickening Agents industry?

Key players in the sizing thickening agents market include companies like Dow, BASF, and Ashland Global Holdings. These firms represent a significant share of the market through innovative product offerings and strategic partnerships.

What are the primary factors driving the growth in the sizing Thickening Agents industry?

Growth in the sizing thickening agents industry is driven by rising consumer demand for clean label products, the rapid expansion of the food and beverage sector, and advancements in product formulations in cosmetics and pharmaceuticals.

Which region is the fastest Growing in the sizing Thickening Agents?

The Asia Pacific region is the fastest-growing market for sizing thickening agents, expected to expand from $0.48 billion in 2023 to $0.81 billion by 2033, supported by increased industrial activities and a growing population.

Does ConsaInsights provide customized market report data for the sizing Thickening Agents industry?

Yes, ConsaInsights offers customized market report data on sizing thickening agents, tailored to specific client needs, including detailed analysis on market trends, competitive landscape, and detailed segmentation.

What deliverables can I expect from this sizing Thickening Agents market research project?

From the sizing thickening agents market research project, you can expect comprehensive reports, data visualizations, segment analysis, and strategic insights, aimed at informing decision-making and market entry strategies.

What are the market trends of sizing Thickening Agents?

Current market trends in sizing thickening agents include an increased focus on natural ingredients, innovation in formulation technologies, and the shift towards sustainable practices within the food and cosmetic industries.