Slovak Republic Cyber Liability Insurance Market Report

Published Date: 24 January 2026 | Report Code: slovak-republic-cyber-liability-insurance

Slovak Republic Cyber Liability Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Slovak Republic Cyber Liability Insurance market from 2023 to 2033, featuring insights into market size, growth trends, segmentation, key players, and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

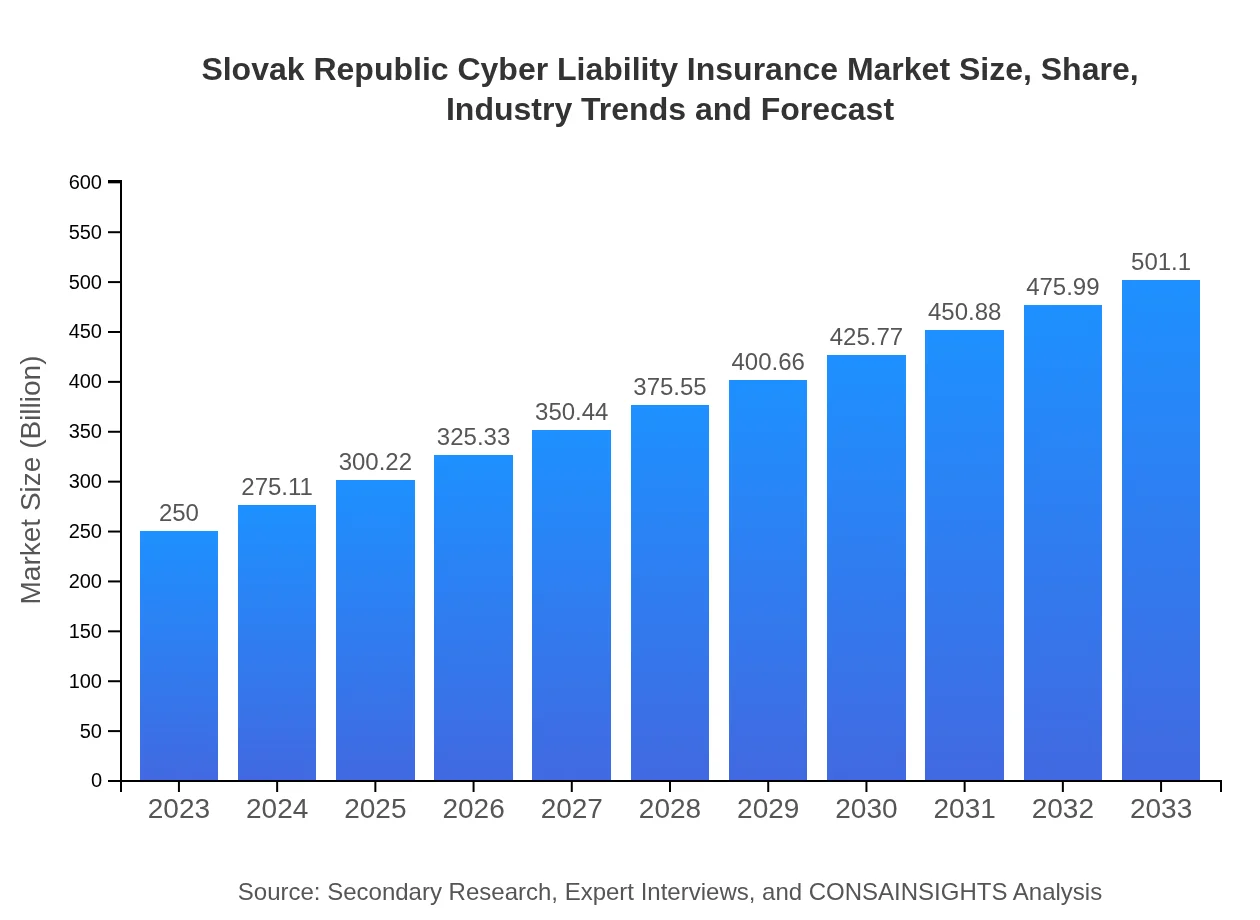

| 2023 Market Size | $250.00 Million |

| CAGR (2023-2033) | 7.0% |

| 2033 Market Size | $501.10 Million |

| Top Companies | Allianz, AIG, Zurich Insurance Group, AXA, Chubb |

| Last Modified Date | 24 January 2026 |

Slovak Republic Cyber Liability Insurance Market Overview

Customize Slovak Republic Cyber Liability Insurance Market Report market research report

- ✔ Get in-depth analysis of Slovak Republic Cyber Liability Insurance market size, growth, and forecasts.

- ✔ Understand Slovak Republic Cyber Liability Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Slovak Republic Cyber Liability Insurance

What is the Market Size & CAGR of Slovak Republic Cyber Liability Insurance market in 2023?

Slovak Republic Cyber Liability Insurance Industry Analysis

Slovak Republic Cyber Liability Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Slovak Republic Cyber Liability Insurance Market Analysis Report by Region

Europe Slovak Republic Cyber Liability Insurance Market Report:

The European market is expected to see consistent growth, with its value at 76.08 million euros in 2023, expected to reach 152.49 million euros by 2033. Strong regulatory frameworks in data protection are a great catalyst for this demand.Asia Pacific Slovak Republic Cyber Liability Insurance Market Report:

In the Asia Pacific region, the cyber liability insurance market was valued at 52.42 million euros in 2023 and is expected to double to 105.08 million euros by 2033. Rapid digitization and increasing cyber threats in countries such as India and Japan drive this growth.North America Slovak Republic Cyber Liability Insurance Market Report:

North America remains the largest market for cyber liability insurance, with a size of 80.38 million euros in 2023, expected to reach 161.10 million euros by 2033. The high adoption rate of digital technologies and comprehensive coverage needs push this robust growth.South America Slovak Republic Cyber Liability Insurance Market Report:

The South America market, though smaller, saw a valuation of 9.95 million euros in 2023, projected to grow to 19.94 million euros by 2033. The region is gradually recognizing the importance of cyber insurance in safeguarding digital assets.Middle East & Africa Slovak Republic Cyber Liability Insurance Market Report:

The Middle East and Africa market for cyber liability insurance stood at 31.18 million euros in 2023 and is anticipated to reach 62.49 million euros by 2033. Growing awareness around cyber threats is fostering a stronger market.Tell us your focus area and get a customized research report.

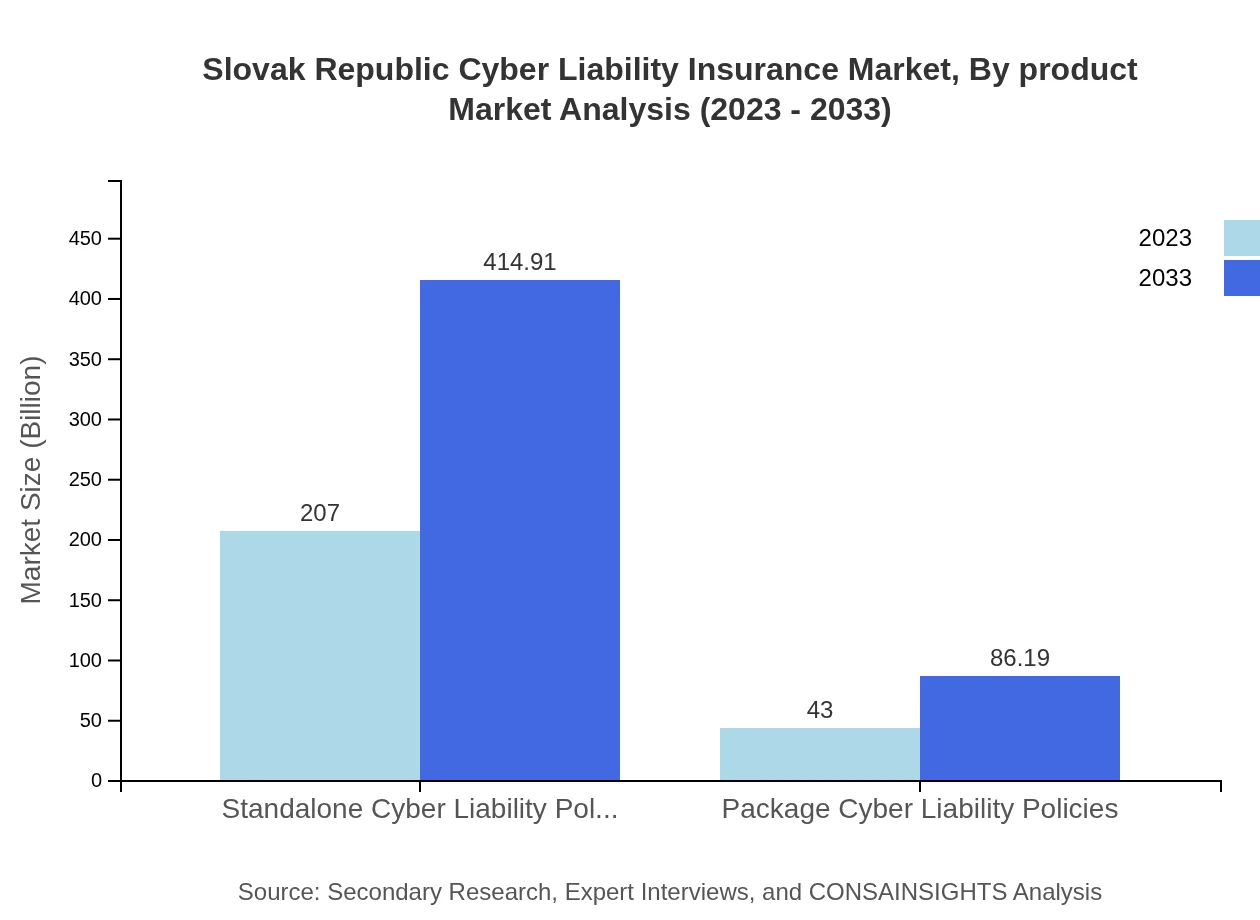

Slovak Republic Cyber Liability Insurance Market Analysis By Product

The market segmentation by product shows that standalone cyber liability policies dominate, valued at 207.00 million euros in 2023 and expected to reach 414.91 million euros by 2033, holding an 82.8% market share. Package cyber liability policies, although smaller in size at 43.00 million euros in 2023, are projected to double to 86.19 million euros with a consistent market share of 17.2%. This indicates a prevalent preference for specialized insurance options among businesses.

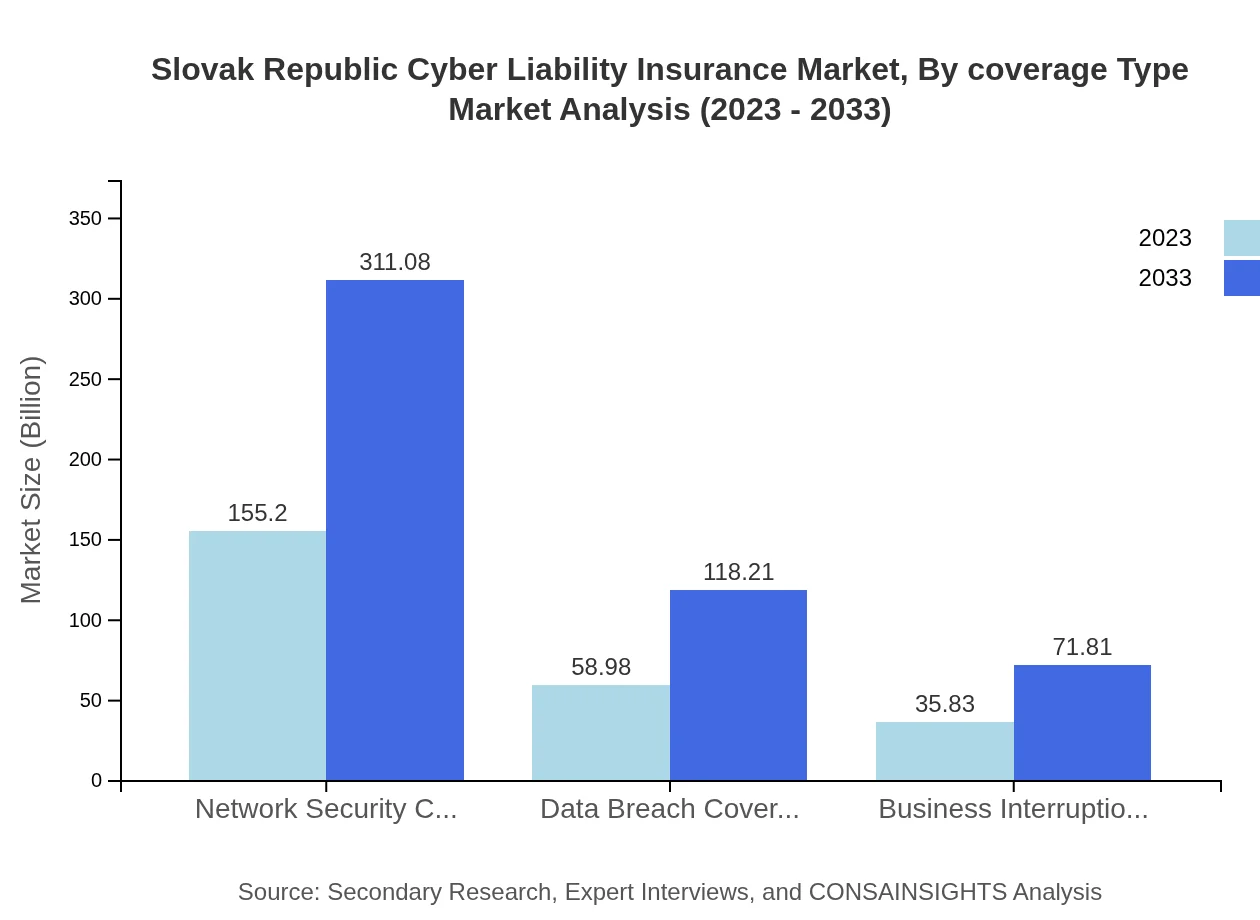

Slovak Republic Cyber Liability Insurance Market Analysis By Coverage Type

Coverage by type is crucial for understanding market dynamics. Network security coverage holds the largest segment, with a value of 155.20 million euros in 2023, expected to reach 311.08 million euros by 2033, taking up 62.08% of the market. Data breach coverage follows, valued at 58.98 million euros in 2023 and projected to reach 118.21 million euros by 2033; it maintains a market share of 23.59%. Business interruption coverage, valued at 35.83 million euros in 2023, will also see growth, reaching 71.81 million euros by 2033 with a share of 14.3%.

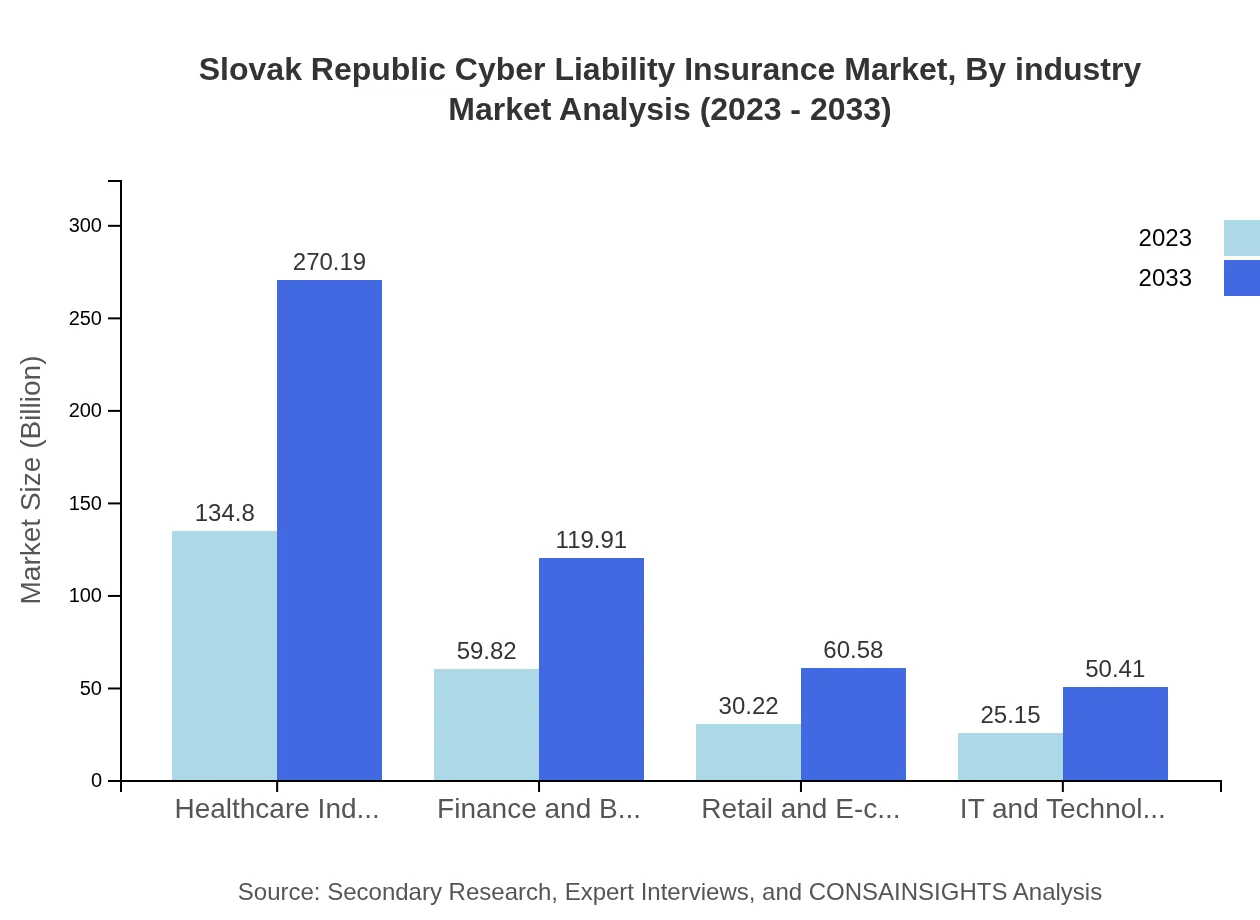

Slovak Republic Cyber Liability Insurance Market Analysis By Industry

The healthcare sector leads with a market size of 134.80 million euros in 2023, expected to grow to 270.19 million euros by 2033, handling 53.92% of the market share. The finance and banking industry follows, with a value of 59.82 million euros in 2023, projected to double to 119.91 million euros by 2033, holding 23.93% market share. Retail and E-commerce represent a smaller segment, at 30.22 million euros in 2023, rising to 60.58 million euros by 2033 with a share of 12.09%. IT and Technology, while the smallest, shows promise with growth from 25.15 million euros to 50.41 million euros, maintaining a 10.06% share.

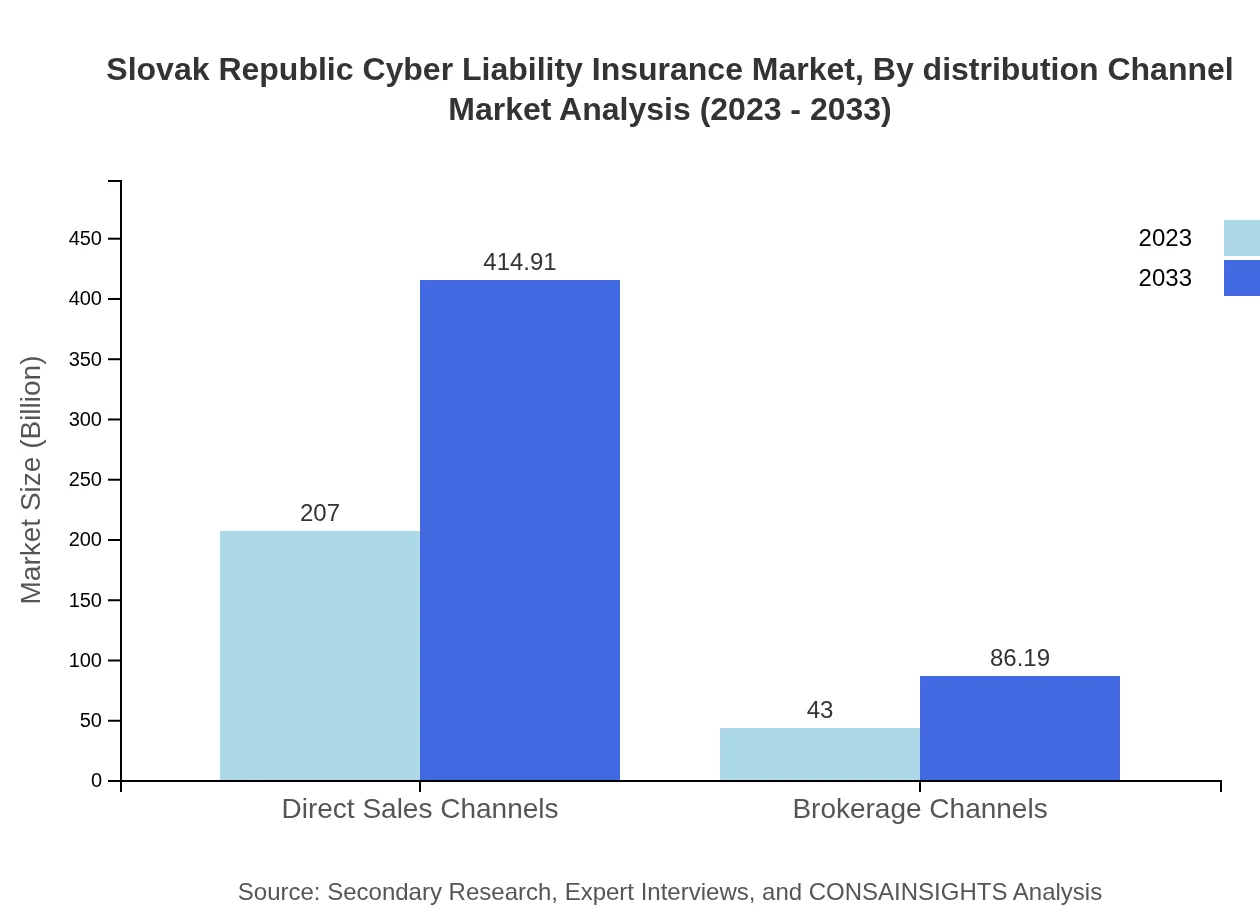

Slovak Republic Cyber Liability Insurance Market Analysis By Distribution Channel

Direct sales channels dominate the market at 207.00 million euros in 2023 with a consistent share of 82.8% expected to reach 414.91 million euros by 2033. This reflects a preference for businesses to purchase directly from insurers. Conversely, brokerage channels, starting at 43.00 million euros in 2023, are projected to expand to 86.19 million euros by 2033, holding a 17.2% share. This shows a stable demand for brokers among certain industry players.

Slovak Republic Cyber Liability Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Slovak Republic Cyber Liability Insurance Industry

Allianz:

A global leader in insurance and asset management, Allianz offers customized cyber liability insurance products specifically tailored for emerging risks, enabling businesses to safeguard their operations against digital threats.AIG:

American International Group has extensive experience in providing innovative insurance solutions, including specialized cyber insurance packages designed to protect companies from data breaches and business disruptions.Zurich Insurance Group:

With a focus on risk management, Zurich provides holistic cyber insurance solutions that help businesses navigate the complexities of cyber risks while ensuring comprehensive coverage.AXA:

AXA is recognized for its robust cyber liability offerings that combine insurance with extensive risk management support, assisting organizations in mitigating cyber threats effectively.Chubb:

As a leading global provider of insurance products, Chubb offers customizable cyber liability insurance solutions tailored for various industries to manage cyber risks effectively.We're grateful to work with incredible clients.

FAQs

What is the market size of Slovak Republic Cyber Liability Insurance?

The Slovak Republic Cyber Liability Insurance market is valued at approximately $250 million in 2023, with a projected CAGR of 7.0%. This growth indicates a strong demand for cyber liability coverage in the coming years.

What are the key market players or companies in this industry?

Key players in the Slovak Republic Cyber Liability Insurance market include leading global insurance companies and regional providers. These firms are focusing on enhancing their coverage options and services to cater to diverse industry needs.

What are the primary factors driving growth in the Slovak Republic Cyber Liability Insurance industry?

Growth in this industry is primarily driven by the increasing frequency of cyber threats, regulatory compliance requirements, and rising awareness about the importance of cyber risk management among businesses across various sectors.

Which region is the fastest Growing in the Slovak Republic Cyber Liability Insurance?

Europe is currently the fastest-growing region for Cyber Liability Insurance, with a market size expected to grow from $76.08 million in 2023 to $152.49 million by 2033, reflecting a robust demand for insurance coverage.

Does ConsaInsights provide customized market report data for the Slovak Republic Cyber Liability Insurance industry?

Yes, ConsaInsights offers customized reports tailored to specific needs within the Slovak Republic Cyber Liability Insurance market. Clients can request detailed analyses based on their unique requirements and focus areas.

What deliverables can I expect from this market research project?

Deliverables from the market research project include detailed reports, regional analysis, segment breakdowns, and strategic insights tailored to inform stakeholders about market dynamics and growth opportunities.

What are the market trends of Slovak Republic Cyber Liability Insurance?

Current trends in the Slovak Republic Cyber Liability Insurance market include a shift towards comprehensive coverage options, increased adoption of technology solutions, and a heightened focus on small to medium enterprises seeking tailored insurance solutions.