Slovak Republic Life Annuity Insurance Market Report

Published Date: 24 January 2026 | Report Code: slovak-republic-life-annuity-insurance

Slovak Republic Life Annuity Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Slovak Republic Life Annuity Insurance market, capturing insights on market size, growth forecasts, regional dynamics, and industry trends from 2023 to 2033.

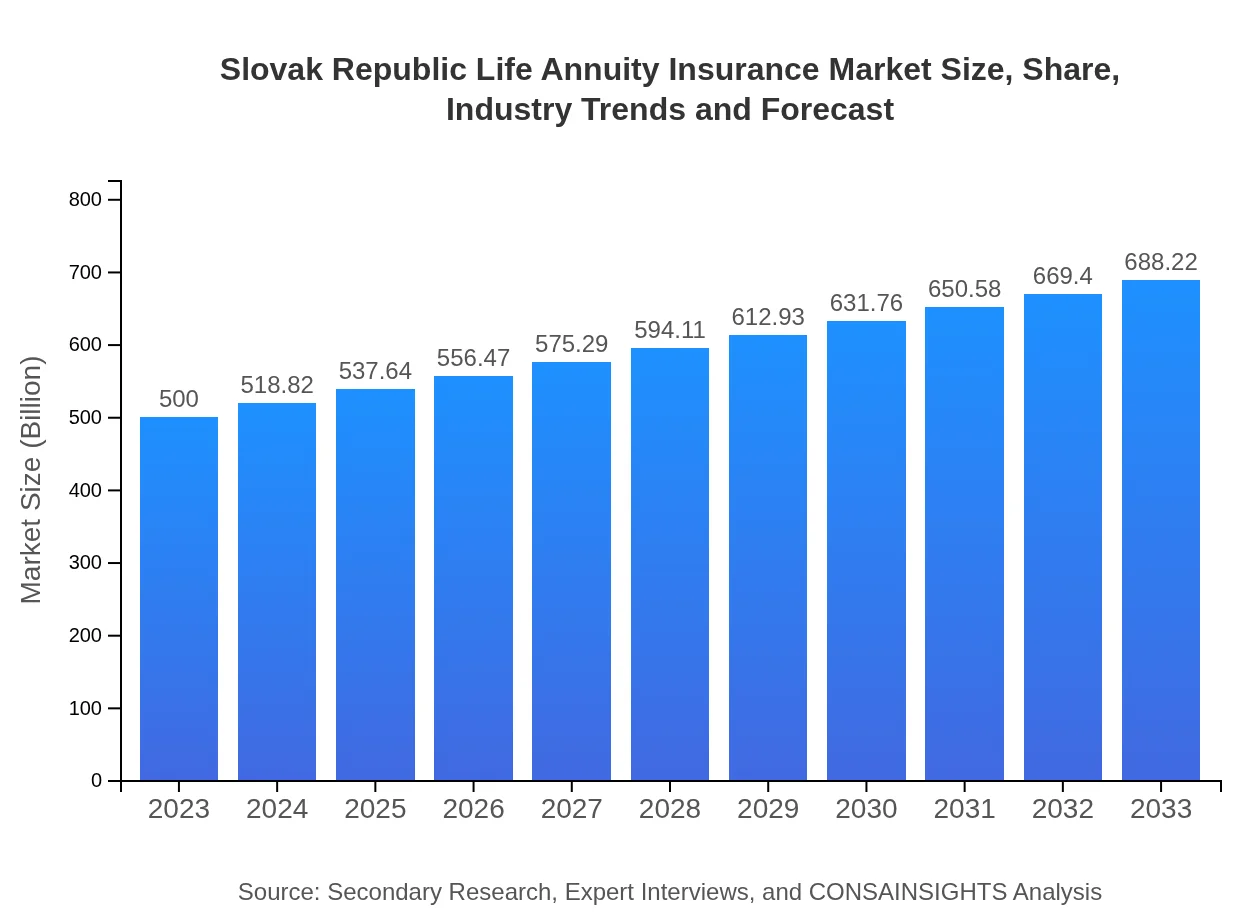

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 3.2% |

| 2033 Market Size | $688.22 Million |

| Top Companies | Allianz Slovakia, Generali Slovakia, insurance company SK |

| Last Modified Date | 24 January 2026 |

Slovak Republic Life Annuity Insurance Market Overview

Customize Slovak Republic Life Annuity Insurance Market Report market research report

- ✔ Get in-depth analysis of Slovak Republic Life Annuity Insurance market size, growth, and forecasts.

- ✔ Understand Slovak Republic Life Annuity Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Slovak Republic Life Annuity Insurance

What is the Market Size & CAGR of Slovak Republic Life Annuity Insurance market in 2023?

Slovak Republic Life Annuity Insurance Industry Analysis

Slovak Republic Life Annuity Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Slovak Republic Life Annuity Insurance Market Analysis Report by Region

Europe Slovak Republic Life Annuity Insurance Market Report:

The European market, including Slovakia, is projected to grow from €142.20 million in 2023 to €195.73 million in 2033. Regulatory frameworks supporting retirement savings plans play a significant role in this growth.Asia Pacific Slovak Republic Life Annuity Insurance Market Report:

In the Asia Pacific region, the life annuity insurance market is estimated to reach €141.57 million by 2033, up from €102.85 million in 2023. Rapid urbanization, an aging population, and a growing middle class are driving demand for retirement products.North America Slovak Republic Life Annuity Insurance Market Report:

In North America, the market is projected to increase from €179.30 million in 2023 to €246.80 million in 2033. High-income levels and sophisticated financial products contribute to strong demand in this region.South America Slovak Republic Life Annuity Insurance Market Report:

The South American life annuity insurance market is expected to grow from €35.55 million in 2023 to €48.93 million in 2033. Economic recovery and increasing awareness about retirement planning are key drivers of this market.Middle East & Africa Slovak Republic Life Annuity Insurance Market Report:

The Middle East and Africa market is expected to expand from €40.10 million in 2023 to €55.20 million in 2033, as rising henwealth levels and improved financial literacy increase demand for life annuities.Tell us your focus area and get a customized research report.

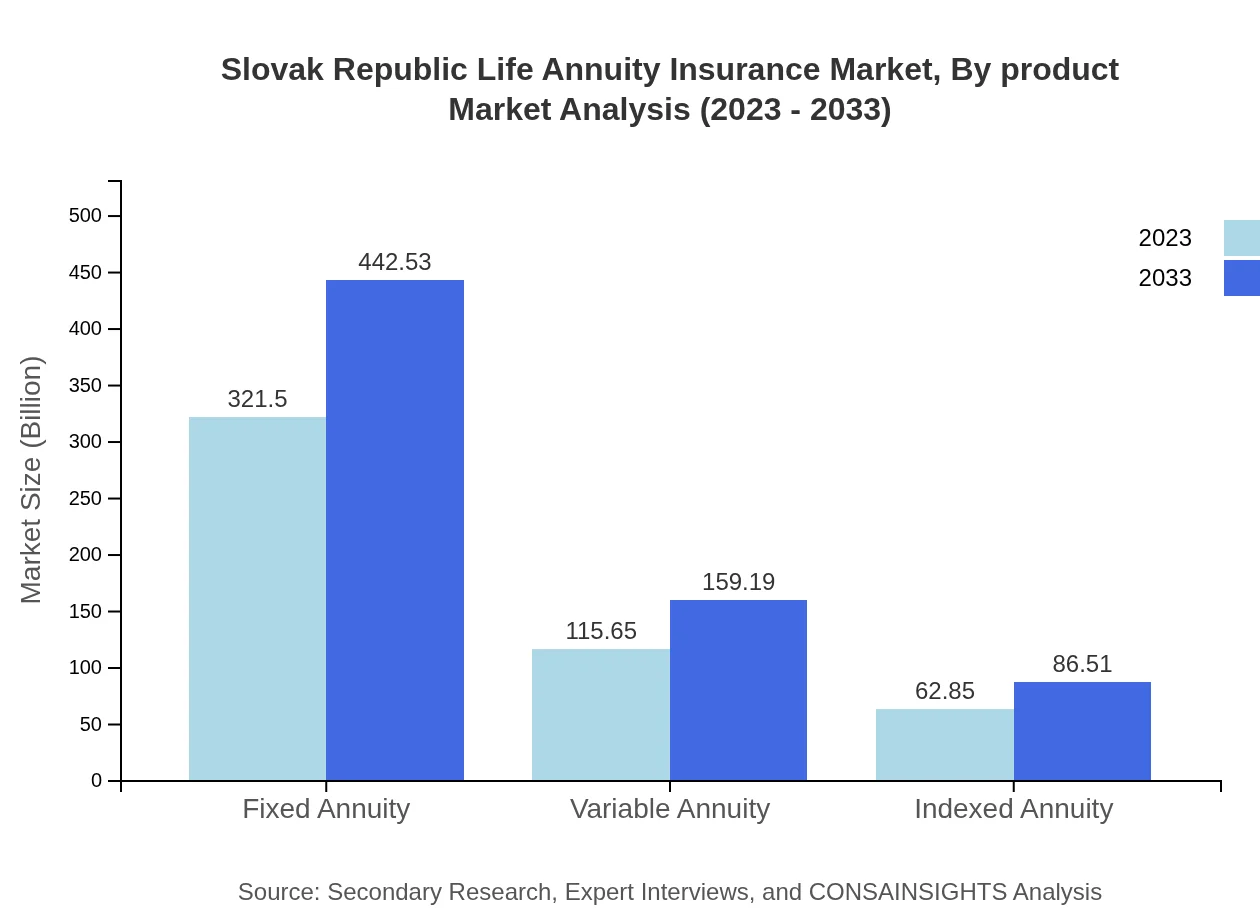

Slovak Republic Life Annuity Insurance Market Analysis By Product

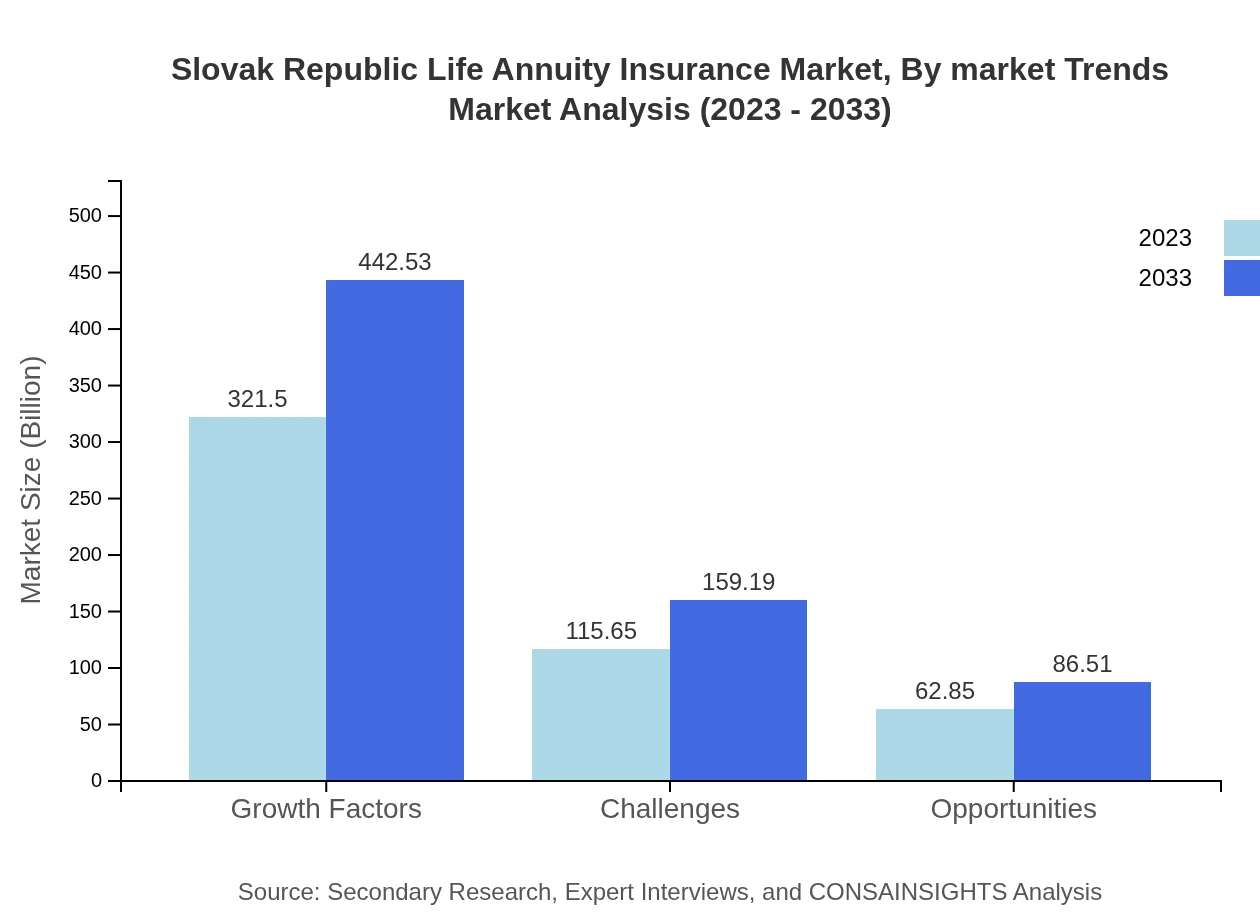

The product mix in the Slovak Republic life annuity market reveals significant performance differences. In 2023, Fixed Annuities dominate at €321.50 million, maintaining about 64.3% market share by 2033. Variable Annuities, while smaller at €115.65 million (23.13%), are expected to rise due to their potential for growth linked to market performance. Indexed Annuities, at €62.85 million (12.57%), although niche, show promise as innovative products attract attention.

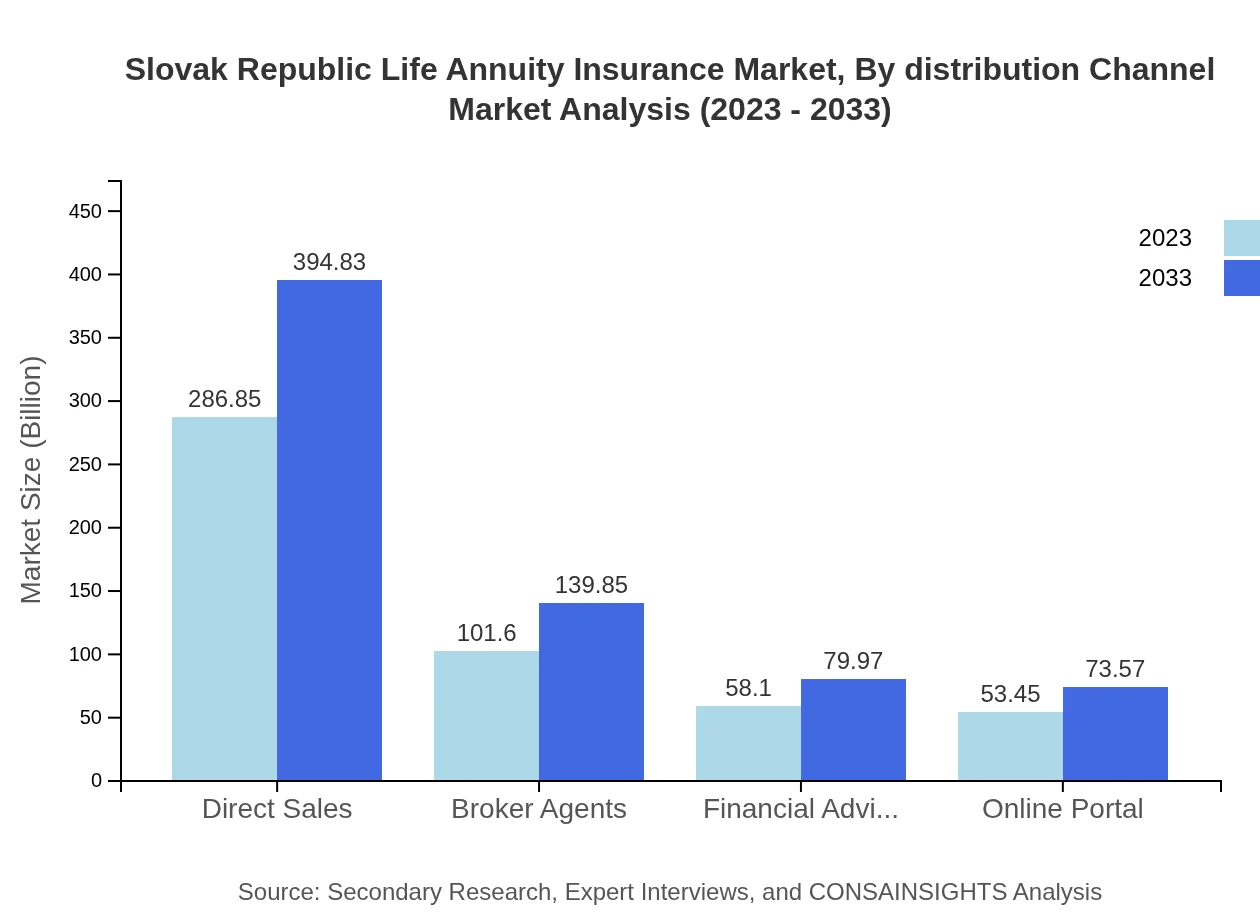

Slovak Republic Life Annuity Insurance Market Analysis By Distribution Channel

Direct sales hold a significant market share at €286.85 million in 2023, indicating a strong preference for personal engagement in purchasing decisions. Broker Agents follow with €101.60 million, reflecting reliance on professional advice. Financial Advisors, though smaller at €58.10 million, are pivotal in guiding consumer choices, while Online Portals, starting at €53.45 million, are increasing in popularity as digital solutions expand.

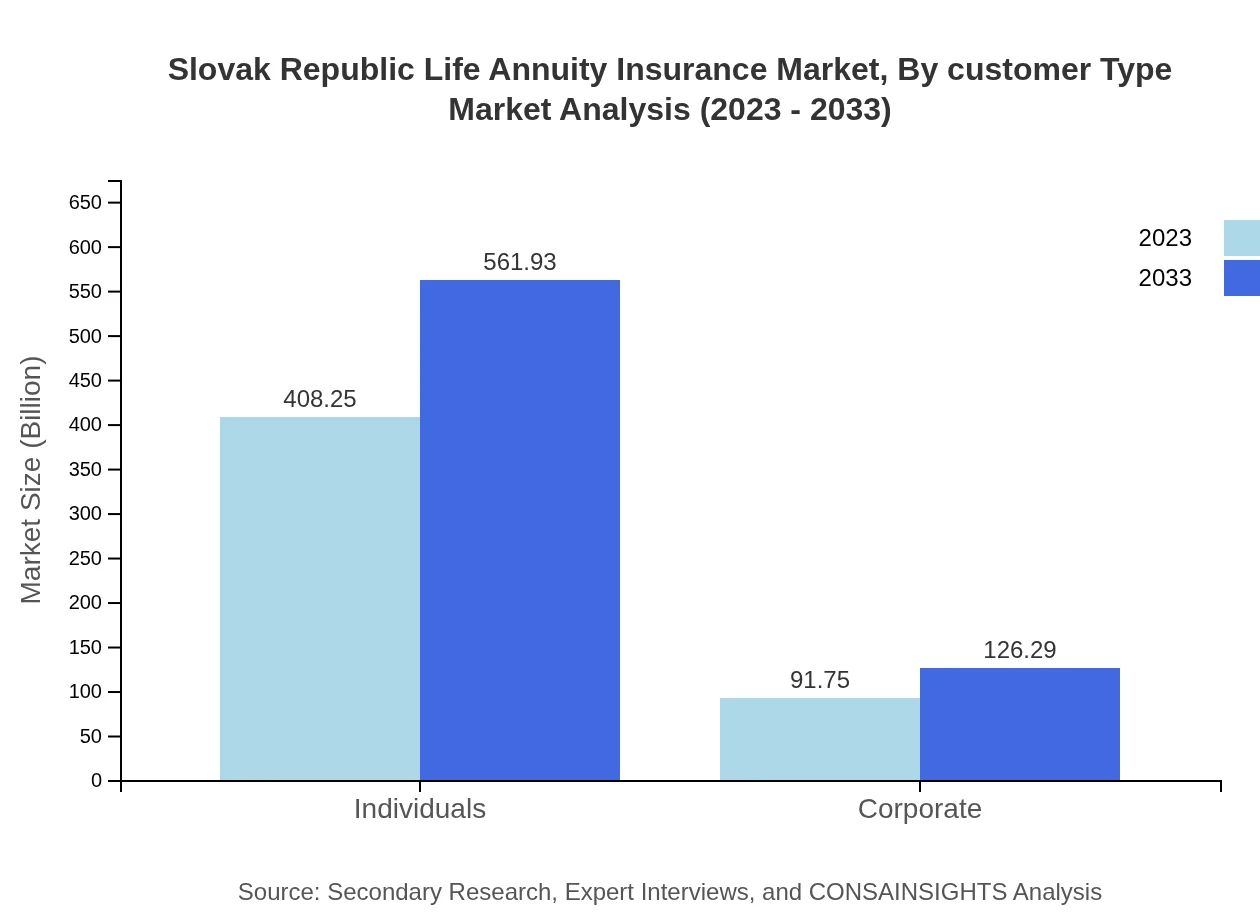

Slovak Republic Life Annuity Insurance Market Analysis By Customer Type

Individuals represent the predominant demographic, accounting for €408.25 million in 2023. This segment prioritizes personal financial security and often opts for fixed products. Corporate customers contribute €91.75 million, focusing on employee benefits and pension planning, emphasizing tailored solutions that address corporate retention strategies.

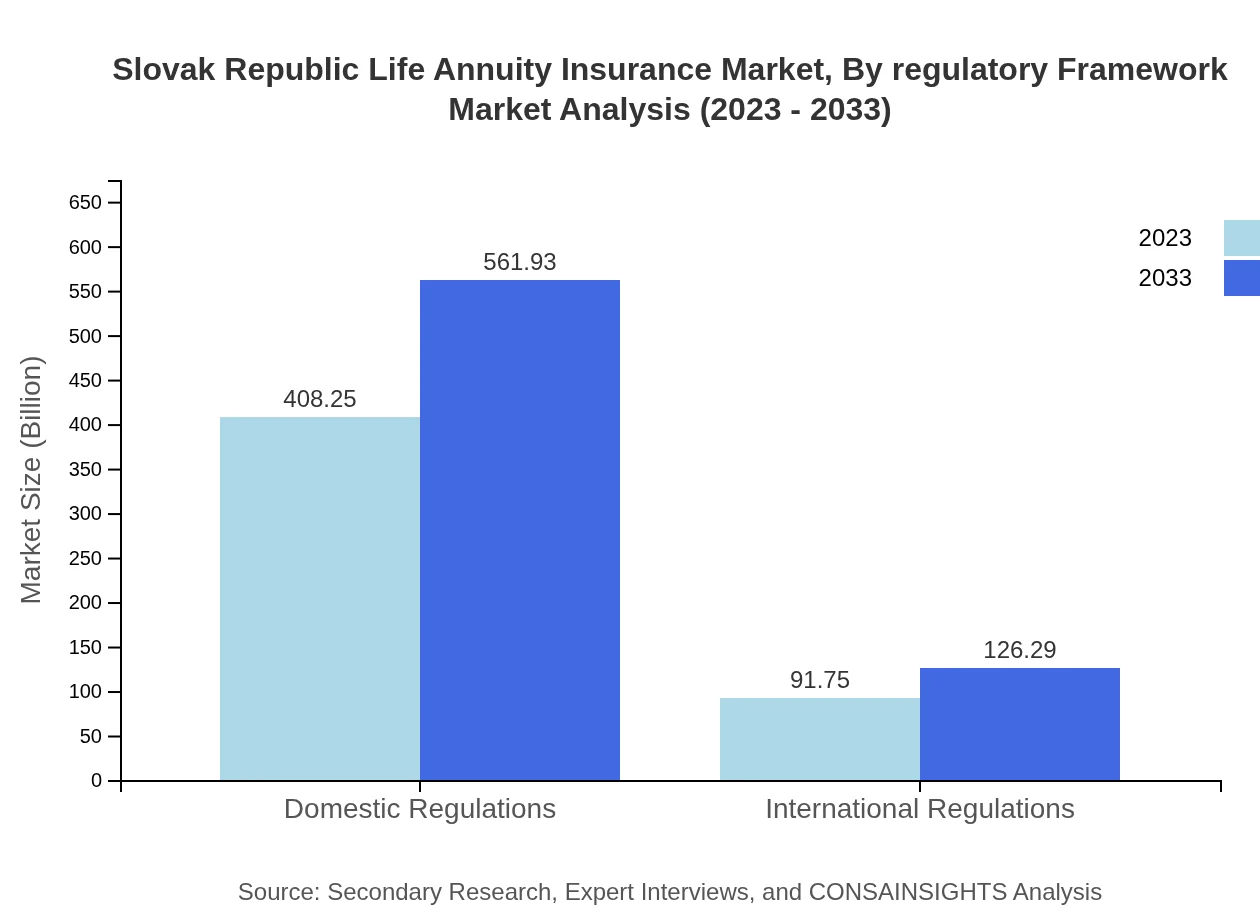

Slovak Republic Life Annuity Insurance Market Analysis By Regulatory Framework

Within regulatory frameworks, domestic regulations dominate at €408.25 million, indicating strong local governance influencing market operations. International regulations, accounting for €91.75 million, provide additional compliance structures, ensuring companies meet both local and global standards.

Slovak Republic Life Annuity Insurance Market Analysis By Market Trends

Market trends indicate a rise in digital solutions powering life annuity insurance sales. The industry's shift towards technology has led to greater accessibility of products via online platforms. Sustainability and ethical investment considerations are also gaining traction, with insurers seeking to align products with consumer values, particularly among younger demographics.

Slovak Republic Life Annuity Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Slovak Republic Life Annuity Insurance Industry

Allianz Slovakia:

A leading insurer providing diverse life insurance and annuity products, known for their strong customer service and innovative online platforms.Generali Slovakia:

A prominent player in the Slovak insurance market, offering tailored annuity solutions that cater to a wide range of customer needs and priorities.insurance company SK:

A key contributor to the Slovak life insurance landscape, focusing on competitively priced and flexible annuity products for individuals and corporations.We're grateful to work with incredible clients.

FAQs

What is the market size of Slovak Republic Life Annuity Insurance?

The market size of Slovak Republic Life Annuity Insurance is currently at approximately $500 million. It is expected to grow at a compound annual growth rate (CAGR) of 3.2% over the next decade, reflecting steady demand and market stability.

What are the key market players or companies in the Slovak Republic Life Annuity Insurance industry?

Prominent players in the Slovak Republic Life Annuity Insurance market include major insurance companies that offer various annuity products. These companies are continuously innovating to meet consumer demands and comply with evolving regulations.

What are the primary factors driving the growth in the Slovak Republic Life Annuity Insurance industry?

Key factors fueling growth include an aging population, rising awareness of financial planning, and increasing disposable income. Additionally, regulatory support and a shift toward retirement savings products are contributing to market expansion.

Which region is the fastest Growing in the Slovak Republic Life Annuity Insurance?

The fastest-growing region within the Slovak Republic Life Annuity Insurance market is Europe, projected to grow from $142.20 million in 2023 to $195.73 million by 2033, driven by increasing financial literacy and retirement planning.

Does ConsaInsights provide customized market report data for the Slovak Republic Life Annuity Insurance industry?

Yes, ConsaInsights provides tailored market research reports on Slovak Republic Life Annuity Insurance. Our customized reports cater to specific client needs, ensuring detailed insights and data analysis for informed decision-making.

What deliverables can I expect from this Slovak Republic Life Annuity Insurance market research project?

Deliverables include comprehensive market analysis, regional breakdowns, trend reports, competitive landscape assessments, and forecasts. Clients receive actionable insights that drive strategic decisions in the annuity insurance sector.

What are the market trends of Slovak Republic Life Annuity Insurance?

Current trends in the Slovak Republic Life Annuity Insurance market include a rise in demand for fixed annuities, increased product diversification, and a growing shift towards digital platforms for purchasing insurance products.