Small Bone And Joint Orthopedic Devices Market Report

Published Date: 31 January 2026 | Report Code: small-bone-and-joint-orthopedic-devices

Small Bone And Joint Orthopedic Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Small Bone And Joint Orthopedic Devices market, detailing current market conditions, segmentation, regional insights, and trends. Insights include forecasts for the years 2023 to 2033, highlighting growth opportunities and challenges in the sector.

| Metric | Value |

|---|---|

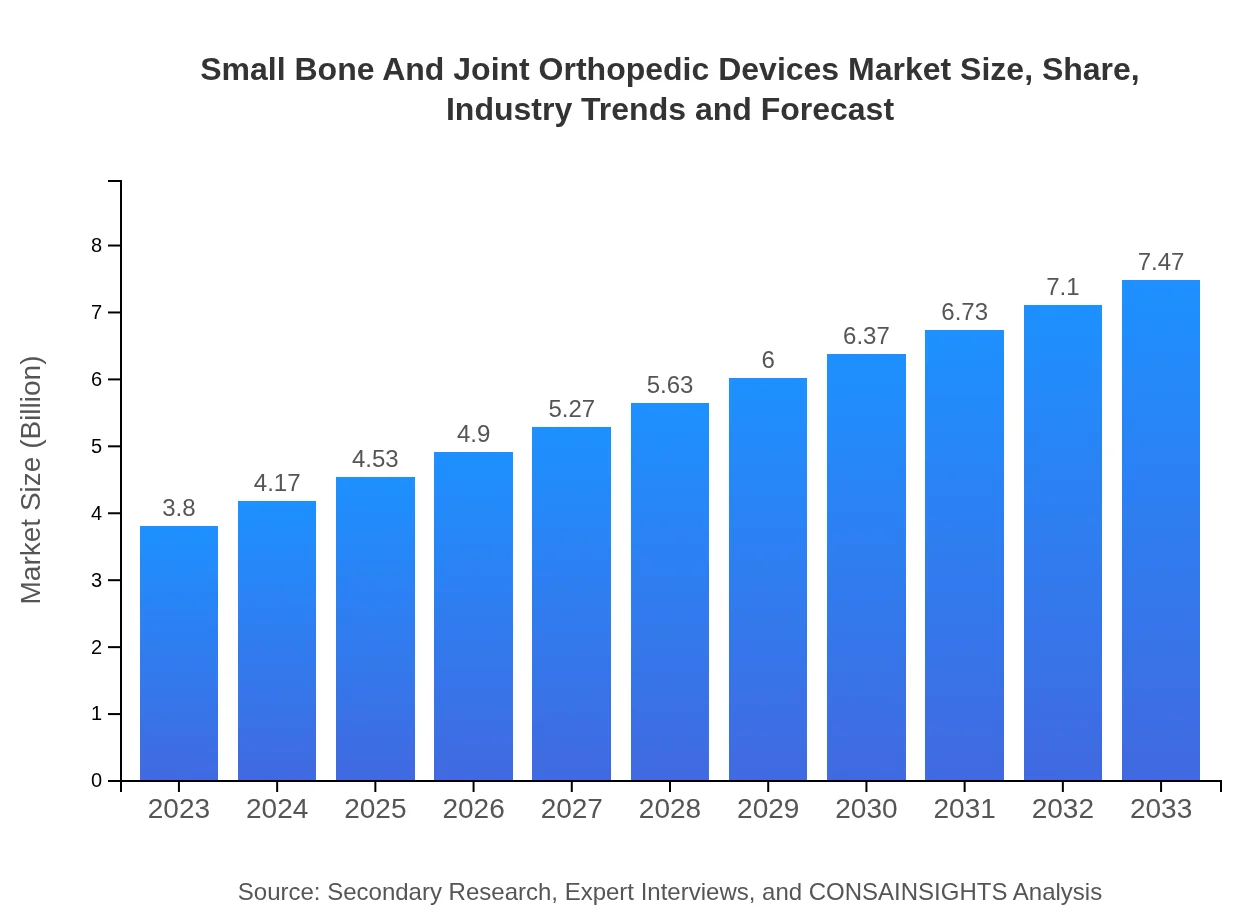

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $7.47 Billion |

| Top Companies | Medtronic , Stryker Corporation, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Smith & Nephew |

| Last Modified Date | 31 January 2026 |

Small Bone And Joint Orthopedic Devices Market Overview

Customize Small Bone And Joint Orthopedic Devices Market Report market research report

- ✔ Get in-depth analysis of Small Bone And Joint Orthopedic Devices market size, growth, and forecasts.

- ✔ Understand Small Bone And Joint Orthopedic Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Small Bone And Joint Orthopedic Devices

What is the Market Size & CAGR of Small Bone And Joint Orthopedic Devices market in 2023?

Small Bone And Joint Orthopedic Devices Industry Analysis

Small Bone And Joint Orthopedic Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Small Bone And Joint Orthopedic Devices Market Analysis Report by Region

Europe Small Bone And Joint Orthopedic Devices Market Report:

The European market is projected to grow from $0.95 billion in 2023 to $1.88 billion in 2033. Increased focus on geriatric care, as well as research and innovations in orthopedic device technology, are key drivers of this segment.Asia Pacific Small Bone And Joint Orthopedic Devices Market Report:

The Asia-Pacific region is anticipated to witness substantial growth, moving from a market value of $0.75 billion in 2023 to $1.48 billion by 2033. Factors contributing to this growth include increasing healthcare infrastructure, rising disposable incomes, and heightened awareness of orthopedic treatments among the population.North America Small Bone And Joint Orthopedic Devices Market Report:

North America is currently the largest market, forecasted to increase from $1.46 billion in 2023 to $2.86 billion by 2033. This region benefits from advanced technology, a high prevalence of orthopedic disorders, and significant investment in healthcare services, leading to a growth potential for orthopedic devices.South America Small Bone And Joint Orthopedic Devices Market Report:

The South American market for Small Bone And Joint Orthopedic Devices is set to grow from $0.19 billion in 2023 to $0.36 billion in 2033. The growth is driven by improvements in healthcare accessibility and investment by governments in health programs aimed at addressing orthopedic needs.Middle East & Africa Small Bone And Joint Orthopedic Devices Market Report:

The Middle East and Africa market for Small Bone And Joint Orthopedic Devices is expected to see growth from $0.45 billion in 2023 to $0.89 billion by 2033, influenced by healthcare reforms and increased demand for trauma care.Tell us your focus area and get a customized research report.

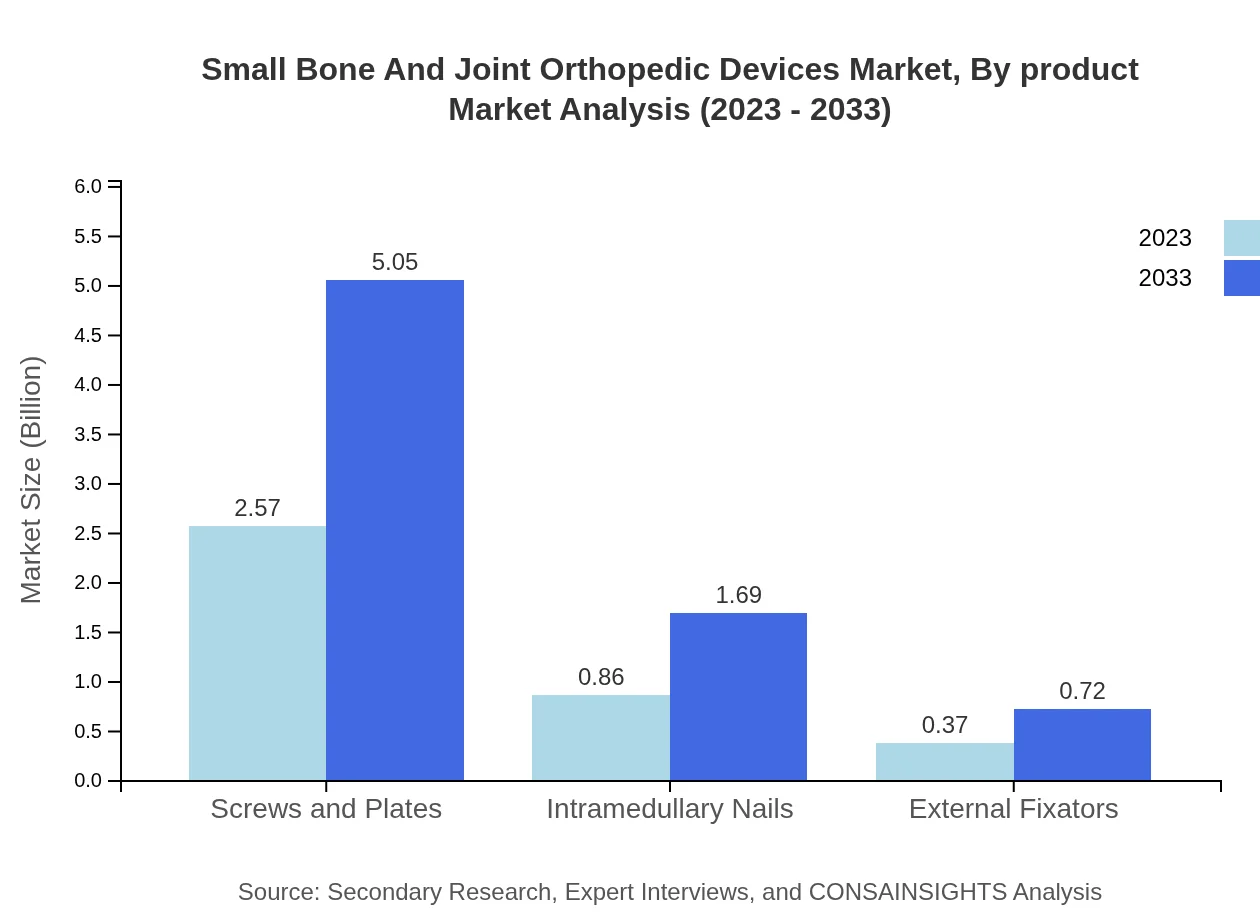

Small Bone And Joint Orthopedic Devices Market Analysis By Product

The market analysis reveals that screws and plates dominantly lead the market with a size of $2.57 billion in 2023, expected to double to $5.05 billion by 2033. Intramedullary nails follow, with a market size of $0.86 billion, projected to rise to $1.69 billion. External fixators hold a smaller share, with current values at $0.37 billion, expected to reach $0.72 billion in the same period.

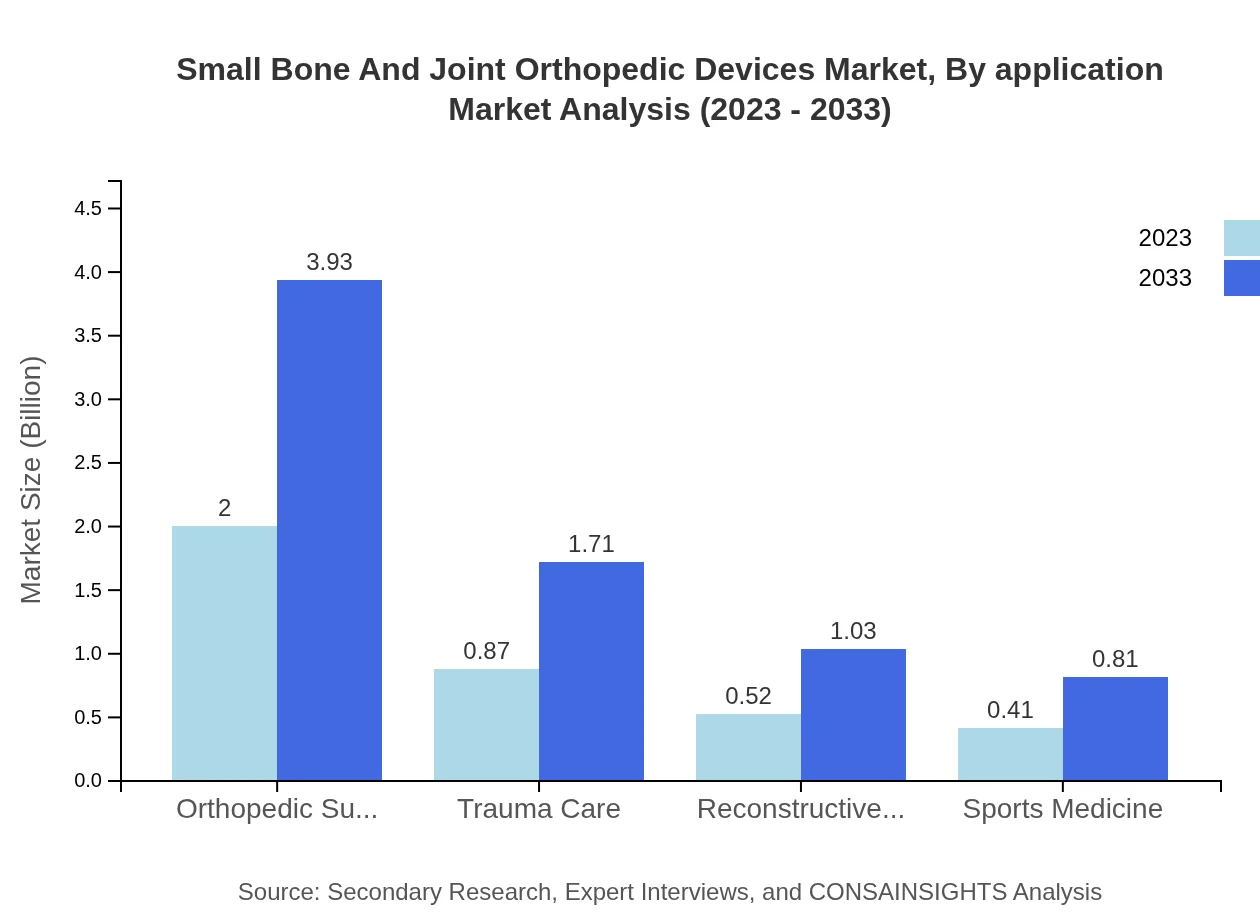

Small Bone And Joint Orthopedic Devices Market Analysis By Application

Orthopedic surgeries constitute a primary application segment, projected to grow from $2.00 billion in 2023 to $3.93 billion by 2033. Other segments include trauma care, expected to rise from $0.87 billion to $1.71 billion, and reconstructive surgery from $0.52 billion to $1.03 billion. Sports medicine holds a niche segment value of $0.41 billion, with growth forecasted to $0.81 billion.

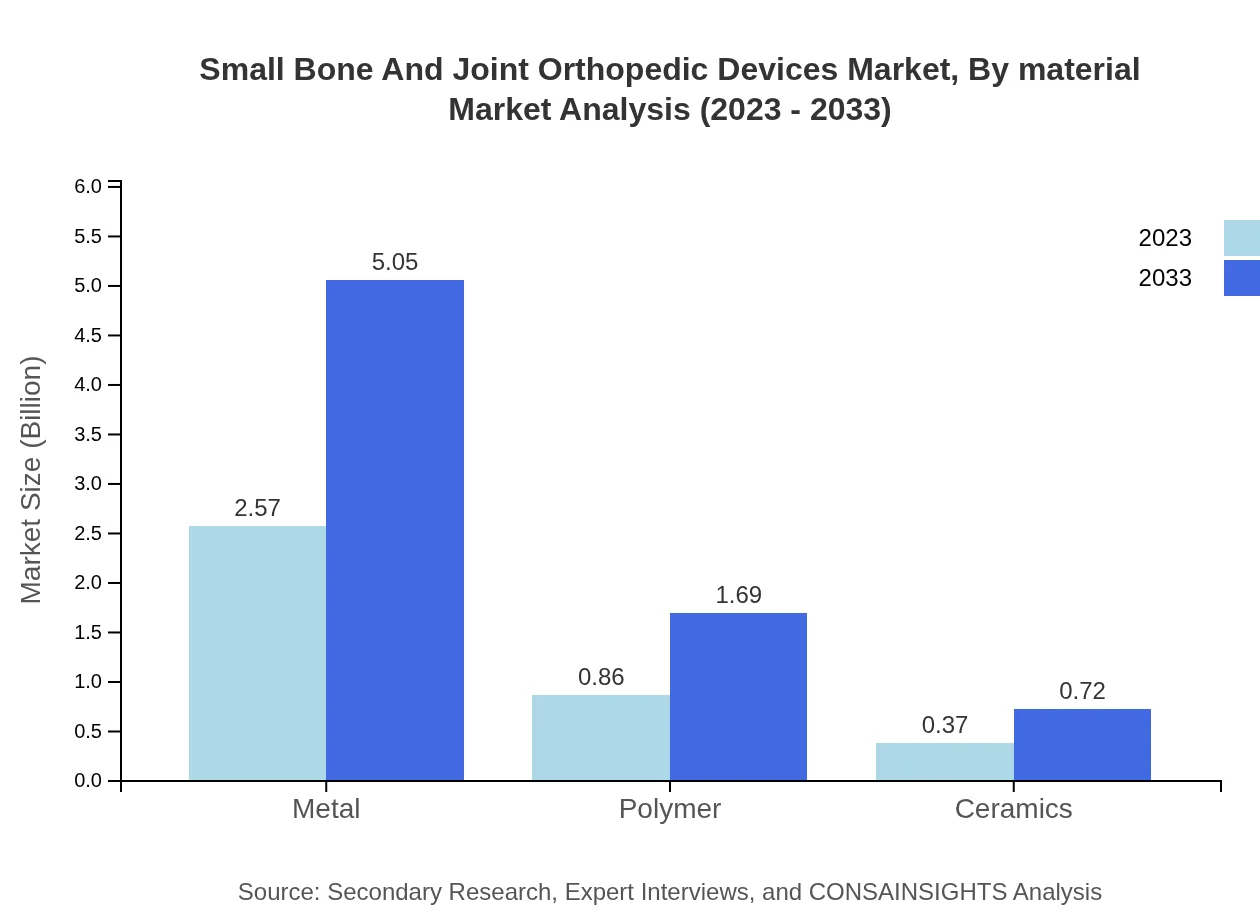

Small Bone And Joint Orthopedic Devices Market Analysis By Material

Metal remains the dominant material, showcasing significant market values of $2.57 billion in 2023 and $5.05 billion projected by 2033. Polymers maintain a share with a current market of $0.86 billion, slated to grow to $1.69 billion. Ceramics, though a smaller player, are projected to rise from $0.37 billion to $0.72 billion in the same timeframe.

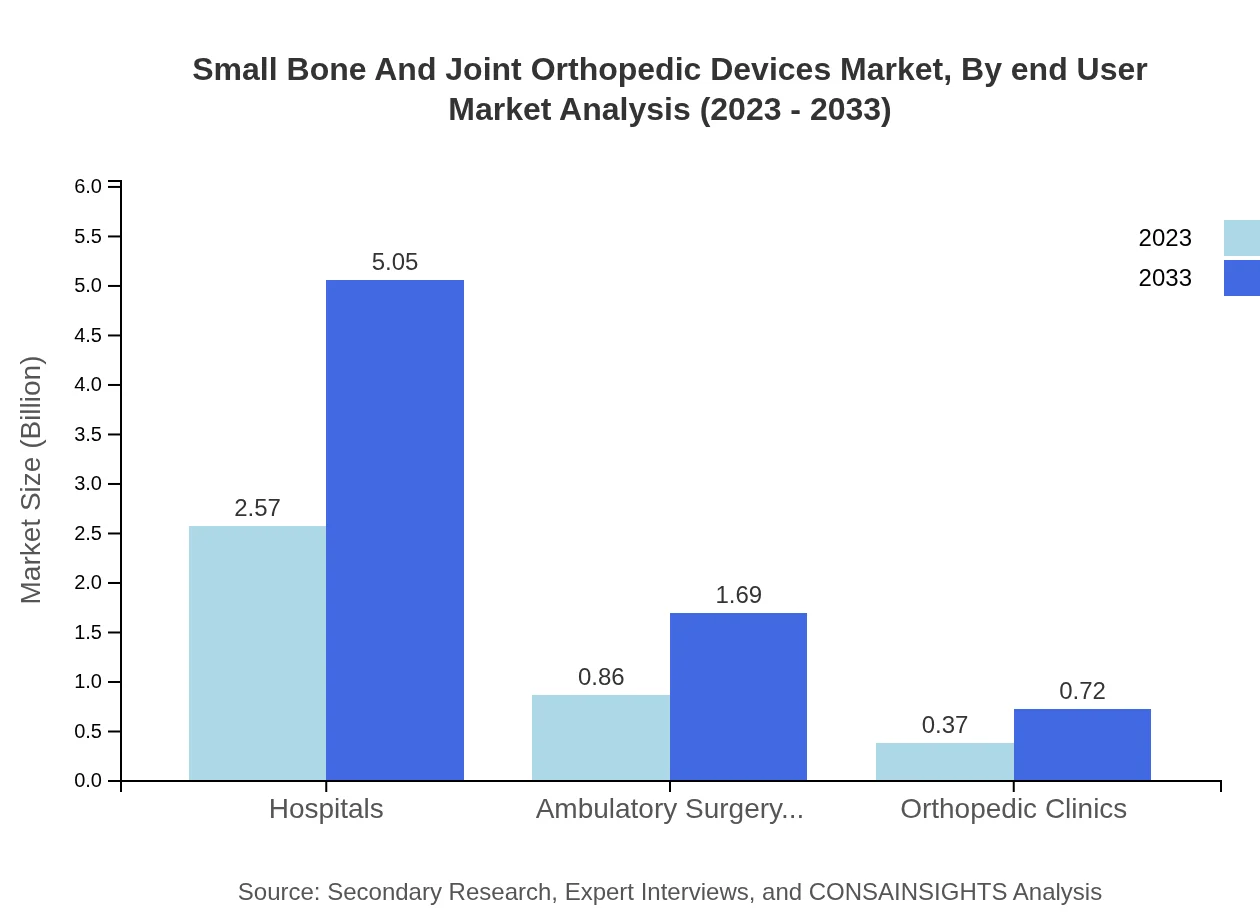

Small Bone And Joint Orthopedic Devices Market Analysis By End User

Hospitals are a major end-user in this market, reflecting a size of $2.57 billion in 2023 and expected growth to $5.05 billion. Ambulatory surgical centers currently account for $0.86 billion with an anticipated increase to $1.69 billion by 2033, and orthopedic clinics contributing sizes from $0.37 billion to $0.72 billion within the same period.

Small Bone And Joint Orthopedic Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Small Bone And Joint Orthopedic Devices Industry

Medtronic :

Medtronic is a key player in the orthopedic devices market, providing a wide range of surgical technologies that enhance patient care and improve surgical outcomes.Stryker Corporation:

As a leading medical technologies firm, Stryker Corporation offers innovative orthopedic solutions. Their commitment to research and development ensures they remain at the forefront of the market.DePuy Synthes (Johnson & Johnson):

DePuy Synthes specializes in orthopedic devices and surgical solutions, leading innovations through advanced techniques and extensive clinical evaluation.Zimmer Biomet:

Zimmer Biomet is recognized for its orthopedic innovations, particularly in reconstructive devices and solutions catering to surgeons and patients alike.Smith & Nephew:

Smith & Nephew provides advanced orthopedic technologies, focusing on minimally invasive surgery solutions that enhance recovery and reduce surgery time.We're grateful to work with incredible clients.

FAQs

What is the market size of small Bone And Joint Orthopedic Devices?

The small bone and joint orthopedic devices market is estimated to be $3.8 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This robust growth reflects rising demand for orthopedic solutions globally.

What are the key market players or companies in this small Bone And Joint Orthopedic Devices industry?

Key players in the small bone and joint orthopedic devices market include major manufacturers who are innovating products to enhance surgical outcomes and recovery. These companies contribute heavily to market dynamics and influence overall growth trends.

What are the primary factors driving the growth in the small Bone And Joint Orthopedic Devices industry?

The growth of the small bone and joint orthopedic devices market is driven by an aging population, increasing sports injuries, advancing technologies, and the rising prevalence of orthopedic disorders. These factors collectively stimulate demand for innovative medical solutions.

Which region is the fastest Growing in the small Bone And Joint Orthopedic Devices?

The fastest-growing regions in the small bone and joint orthopedic devices market between 2023 and 2033 include North America with growth from $1.46 billion to $2.86 billion, followed by Europe which expands from $0.95 billion to $1.88 billion.

Does Consainsights provide customized market report data for the small Bone And Joint Orthopedic Devices industry?

Yes, Consainsights offers tailored market report data for the small bone and joint orthopedic devices industry. Clients can receive customized analyses that address specific questions or data needs, ensuring relevance to their business.

What deliverables can I expect from this small Bone And Joint Orthopedic Devices market research project?

Expect comprehensive deliverables from the small bone and joint orthopedic devices market research project, including detailed market size analysis, segmentation insights, competitive landscape, trend forecasts, and actionable recommendations for strategic initiatives.

What are the market trends of small Bone And Joint Orthopedic Devices?

Current market trends in small bone and joint orthopedic devices include technological advancements in surgical tools, personalized patient solutions, increasing minimally invasive procedures, and a growing focus on patient recovery and rehabilitation processes.