Small Molecule Drug Discovery Market Report

Published Date: 31 January 2026 | Report Code: small-molecule-drug-discovery

Small Molecule Drug Discovery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Small Molecule Drug Discovery market, highlighting key insights, market size, industry trends, and forecasts from 2023 to 2033.

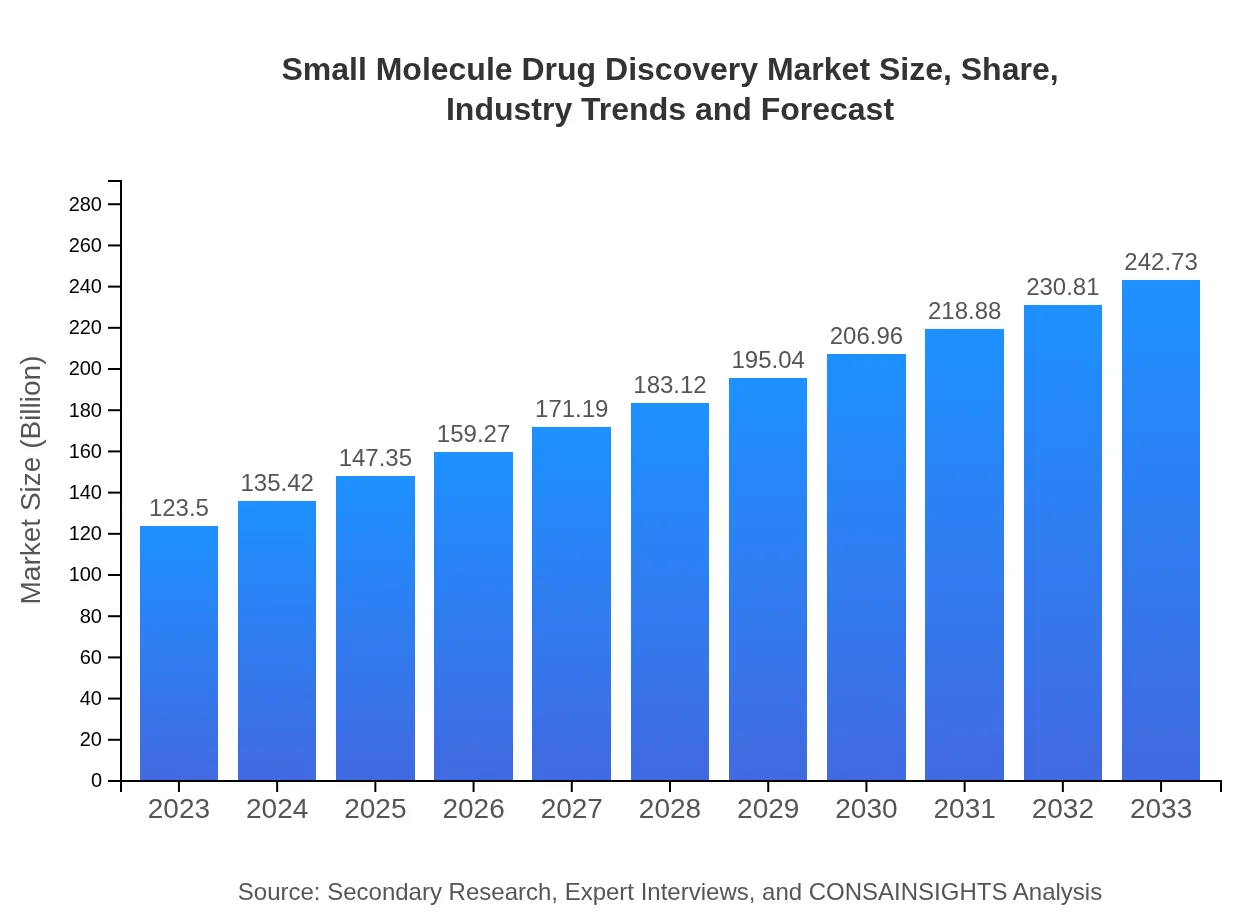

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $123.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $242.73 Billion |

| Top Companies | Pfizer Inc., Roche Diagnostics, Johnson & Johnson, Novartis, Merck & Co. |

| Last Modified Date | 31 January 2026 |

Small Molecule Drug Discovery Market Overview

Customize Small Molecule Drug Discovery Market Report market research report

- ✔ Get in-depth analysis of Small Molecule Drug Discovery market size, growth, and forecasts.

- ✔ Understand Small Molecule Drug Discovery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Small Molecule Drug Discovery

What is the Market Size & CAGR of Small Molecule Drug Discovery market in 2023?

Small Molecule Drug Discovery Industry Analysis

Small Molecule Drug Discovery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Small Molecule Drug Discovery Market Analysis Report by Region

Europe Small Molecule Drug Discovery Market Report:

The European Small Molecule Drug Discovery market is expected to increase from $35.83 billion in 2023 to $70.42 billion by 2033. Key factors contributing to this growth include a strong emphasis on research and development investments by pharmaceutical companies and a collaborative environment fostered by European Union initiatives aimed at enhancing drug discovery processes.Asia Pacific Small Molecule Drug Discovery Market Report:

The Asia Pacific region is expected to witness substantial growth from 2023 to 2033, with the market expanding from $23.39 billion in 2023 to $45.97 billion by 2033. Factors such as increasing investment in healthcare infrastructure, a growing population, and a rising prevalence of chronic diseases are driving this growth. Additionally, the region is home to numerous research and development centers and increasing government support for pharmaceutical innovation.North America Small Molecule Drug Discovery Market Report:

North America holds the largest share of the Small Molecule Drug Discovery market, anticipated to grow from $46.16 billion in 2023 to $90.73 billion by 2033, primarily due to the presence of key market players, extensive R&D activities, and a robust regulatory framework that supports drug development. The region also benefits from high healthcare expenditure and a favorable environment for innovation.South America Small Molecule Drug Discovery Market Report:

The South American market for Small Molecule Drug Discovery is projected to grow from $11.63 billion in 2023 to $22.87 billion by 2033. This growth is attributed to the increasing demand for effective treatment solutions and the rise of biopharmaceutical industries in countries like Brazil and Argentina, along with growing investment in drug discovery capabilities and initiatives to improve healthcare access.Middle East & Africa Small Molecule Drug Discovery Market Report:

The Middle East and Africa market is projected to grow from $6.48 billion in 2023 to $12.74 billion by 2033. The growth is spurred by improving healthcare systems, investments in biotechnology sectors, and increasing research initiatives in response to public health challenges prevalent in the region.Tell us your focus area and get a customized research report.

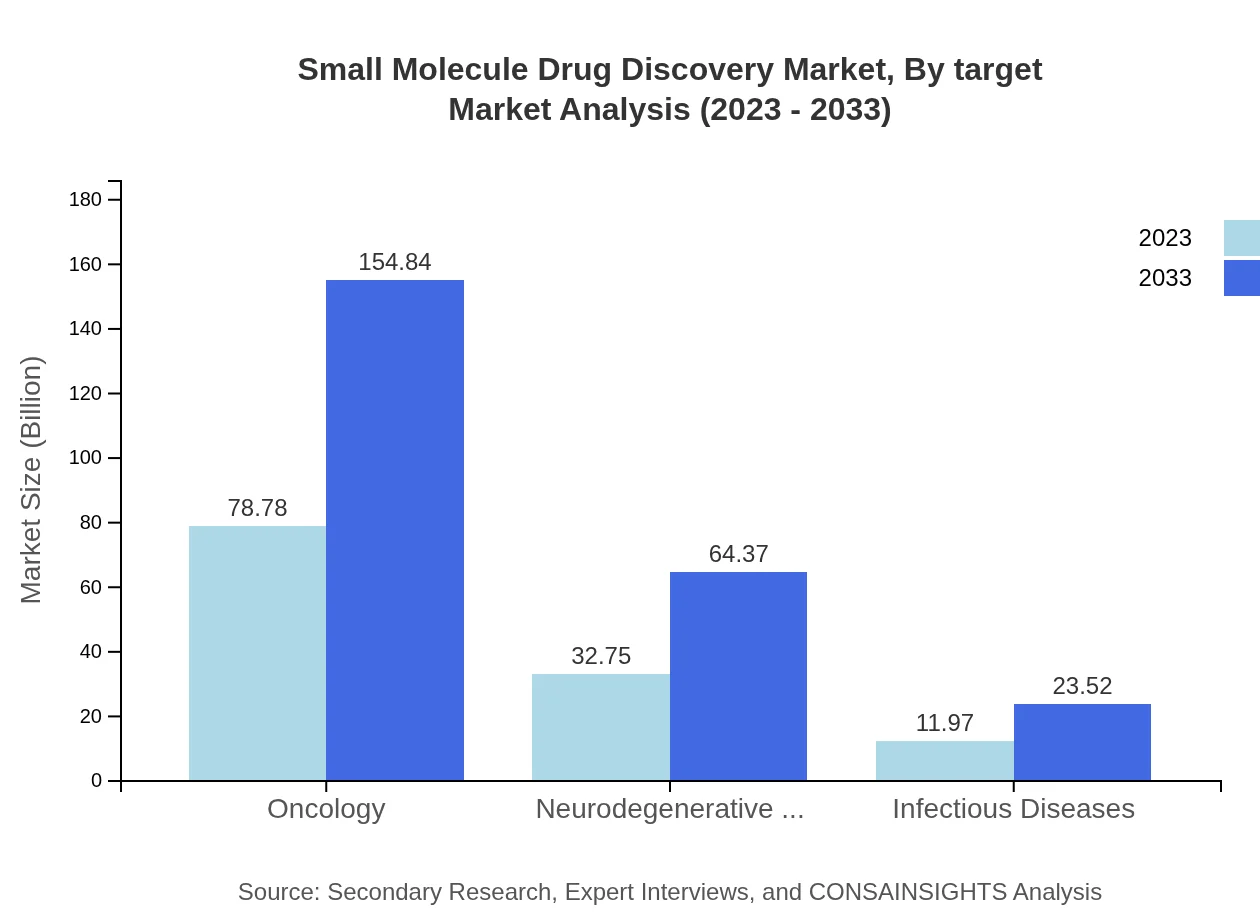

Small Molecule Drug Discovery Market Analysis By Target

The Small-Molecule Drug Discovery market segment related to targets reveals significant insights on drug discovery focus areas. Oncology leads the market with a size of $78.78 billion in 2023, expected to grow to $154.84 billion by 2033. Neurodegenerative diseases also show growth potential, with projections moving from $32.75 billion to $64.37 billion throughout the same period. This indicates that targeting cancer and neurological conditions remains critical in drug development efforts.

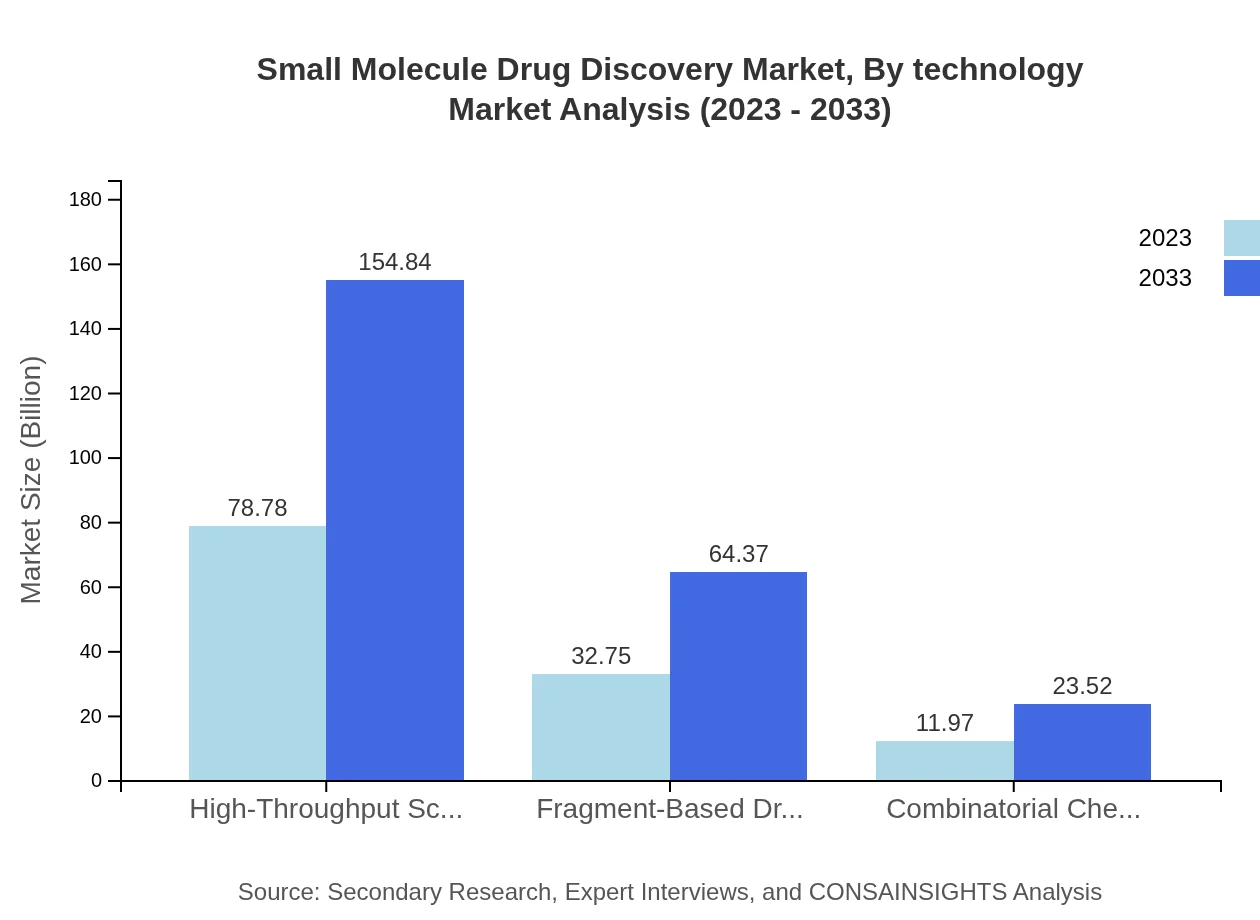

Small Molecule Drug Discovery Market Analysis By Technology

High-throughput screening technology dominates the Small-Molecule Drug Discovery landscape, with market values poised to increase from $78.78 billion in 2023 to $154.84 billion by 2033. Additionally, fragment-based drug discovery is anticipated to grow from $32.75 billion to $64.37 billion, highlighting the incorporation of innovative methodologies that streamline drug development, enabling rapid identification of viable candidates.

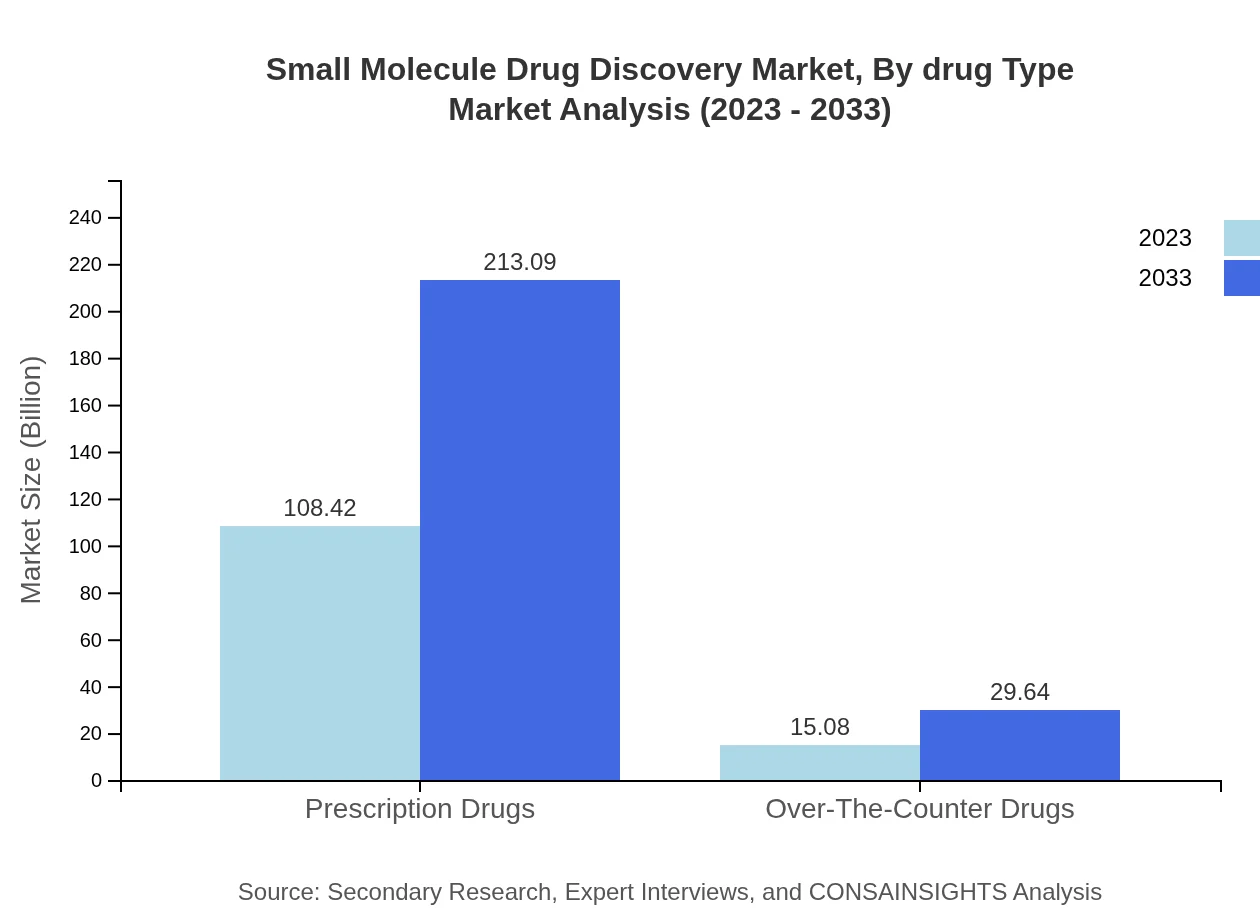

Small Molecule Drug Discovery Market Analysis By Drug Type

The market for prescription drugs in Small Molecule Drug Discovery is substantial, with sizes estimated at $108.42 billion in 2023 and projected to reach $213.09 billion by 2033. In contrast, OTC drugs are expected to grow from $15.08 billion to $29.64 billion, reflecting a shifting focus towards self-medication and preventive healthcare.

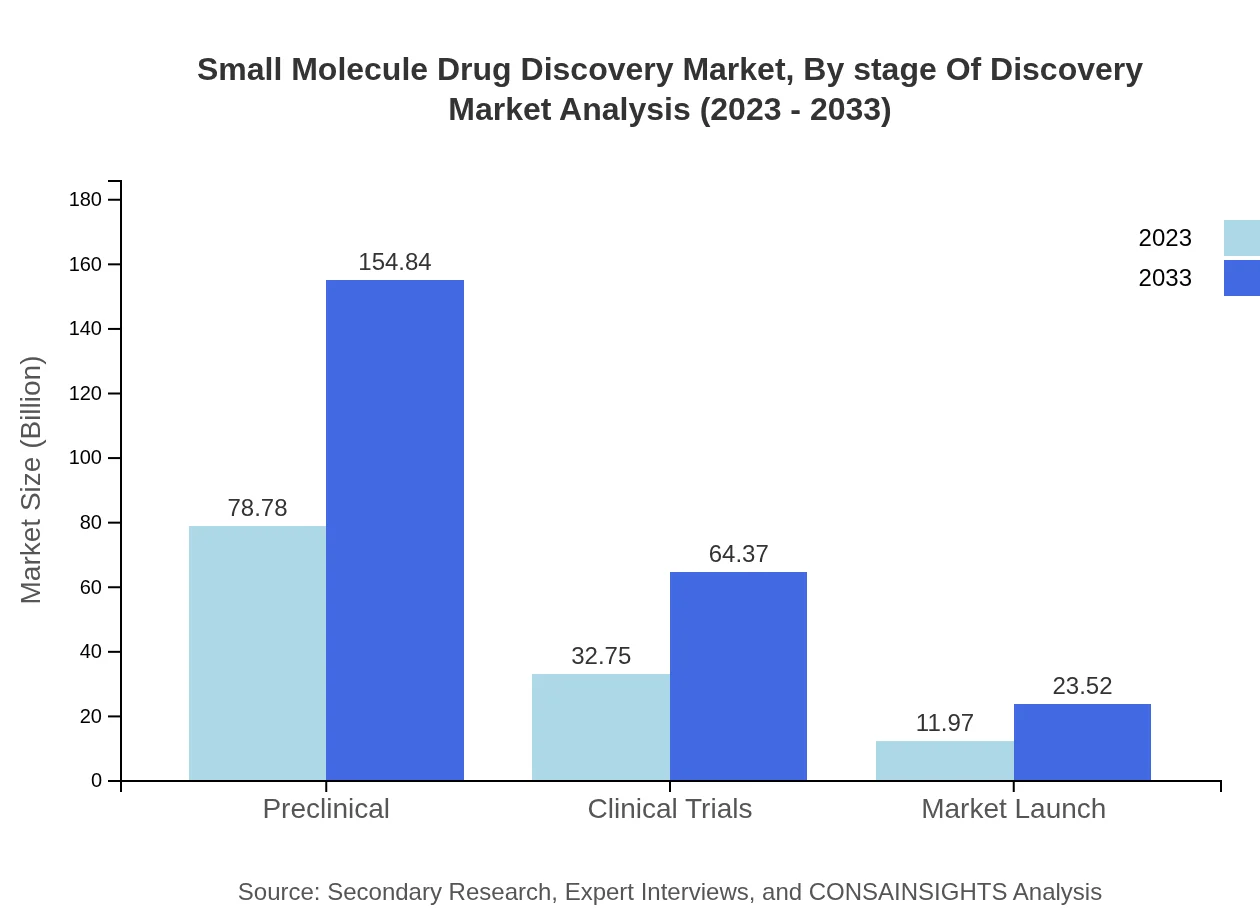

Small Molecule Drug Discovery Market Analysis By Stage Of Discovery

The stages of discovery segment show that preclinical studies represent a significant portion of the market, with growth from $78.78 billion in 2023 to $154.84 billion by 2033. Clinical trials follow, increasing from $32.75 billion to $64.37 billion. These stages provide critical insights into the drug development pipeline, emphasizing the importance of robust clinical validation before market launch, which is also growing significantly.

Small Molecule Drug Discovery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Small Molecule Drug Discovery Industry

Pfizer Inc.:

A global leader in pharmaceuticals, Pfizer is renowned for its innovative drug discoveries, particularly in the oncology segment, and its strong portfolio of small molecules.Roche Diagnostics:

Roche is a pioneer in personalized healthcare solutions, emphasizing RNAi and small molecule drug interactions to address complex diseases.Johnson & Johnson:

With a vast range of pharmaceutical products, Johnson & Johnson stands out for its commitment to research and development in small-molecule therapeutics.Novartis:

A leader in the healthcare sector, Novartis invests heavily in small molecule research, focusing on drug developments for various therapeutic areas.Merck & Co.:

Merck is known for its robust pipeline in small molecule drugs, particularly targeting infectious diseases and oncology, making significant contributions to the sector.We're grateful to work with incredible clients.

FAQs

What is the market size of small Molecule Drug Discovery?

The small-molecule drug discovery market is valued at approximately $123.5 billion in 2023, with a projected growth at a CAGR of 6.8% through 2033, indicating strong demand for innovative therapies.

What are the key market players or companies in this small Molecule Drug Discovery industry?

Key players in the small-molecule drug discovery industry include major pharmaceutical companies specializing in innovative therapies, biotechnology firms, and contract research organizations (CROs), which together contribute significantly to advancements in drug discovery.

What are the primary factors driving growth in the small Molecule Drug Discovery industry?

Growth in the small-molecule drug discovery industry is driven by increased R&D funding, advancements in technology, rising incidences of chronic diseases, and a continuous demand for personalized medicine solutions, enabling targeted therapies.

Which region is the fastest Growing in the small Molecule Drug Discovery market?

The Asia-Pacific region is the fastest-growing area for small-molecule drug discovery, with a market size projected to reach $45.97 billion by 2033, reflecting an increasing investment in pharmaceutical R&D in countries like China and India.

Does ConsaInsights provide customized market report data for the small Molecule Drug Discovery industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the small-molecule drug discovery industry, providing in-depth insights and analysis to inform strategic decisions.

What deliverables can I expect from this small Molecule Drug Discovery market research project?

Clients can expect comprehensive deliverables including market size analysis, growth projections, competitive landscape details, regional insights, and trends, enabling a thorough understanding of the small-molecule drug discovery market.

What are the market trends of small Molecule Drug Discovery?

Key market trends in small-molecule drug discovery include increased adoption of high-throughput screening technologies, a focus on oncology and neurodegenerative diseases, and the growth of precision medicine approaches, pointing towards enhanced drug efficacy.