Small Satellite Market Report

Published Date: 03 February 2026 | Report Code: small-satellite

Small Satellite Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the small satellite market from 2023 to 2033, detailing market trends, size, growth predictions, technological advancements, and leading players, offering valuable insights for stakeholders in the space industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

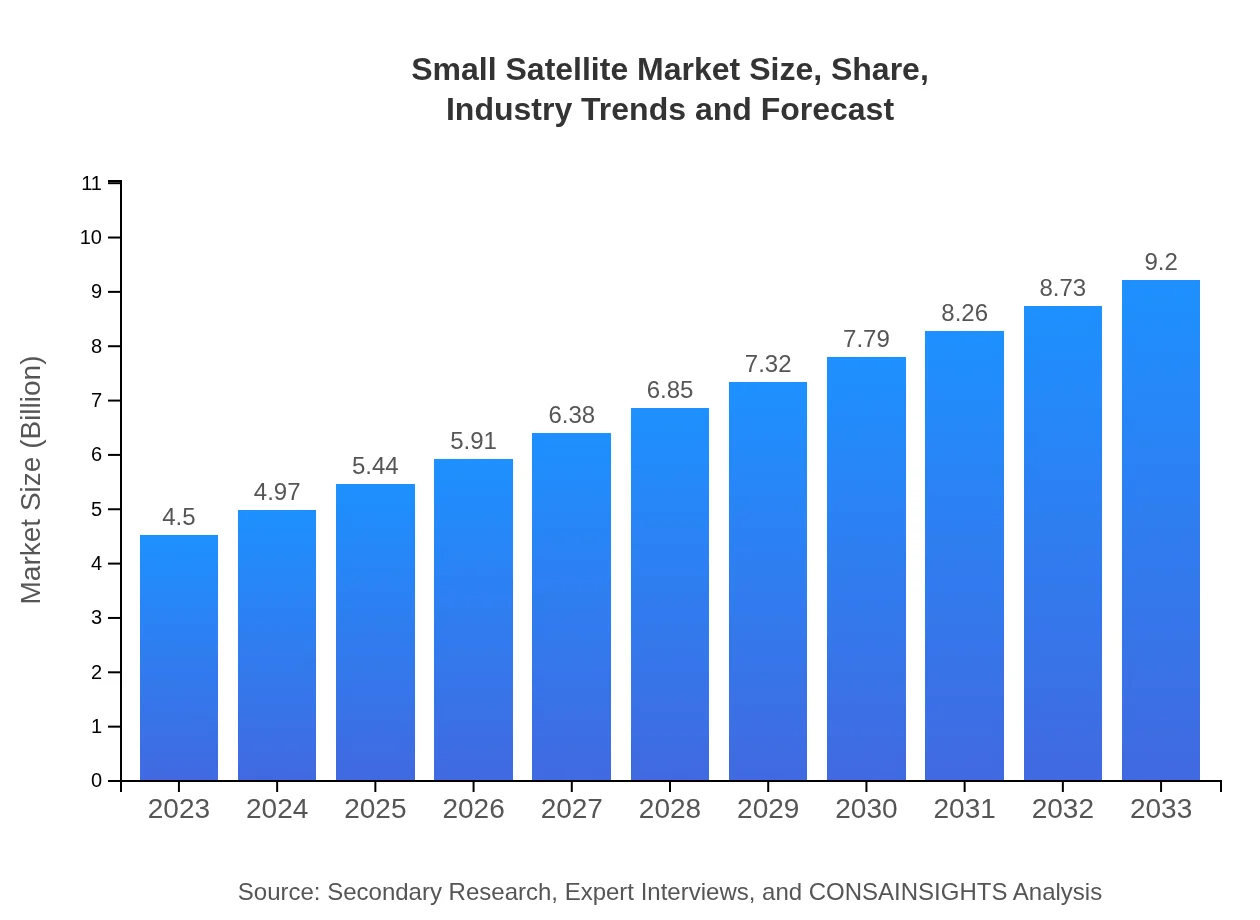

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $9.20 Billion |

| Top Companies | Planet Labs, Spire Global, Airbus Defence and Space, Northrop Grumman Innovation Systems |

| Last Modified Date | 03 February 2026 |

Small Satellite Market Overview

Customize Small Satellite Market Report market research report

- ✔ Get in-depth analysis of Small Satellite market size, growth, and forecasts.

- ✔ Understand Small Satellite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Small Satellite

What is the Market Size & CAGR of Small Satellite Market in 2023?

Small Satellite Industry Analysis

Small Satellite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Small Satellite Market Analysis Report by Region

Europe Small Satellite Market Report:

Europe's market is expected to grow from $1.16 billion in 2023 to $2.38 billion by 2033, driven by projects funded by the European Space Agency and the increasing interest from private players. The region is focusing on developing innovative satellite designs and enhancing connectivity (e.g., Galileo program), thus utilizing small satellites for more precise global positioning.Asia Pacific Small Satellite Market Report:

In the Asia Pacific region, the small satellite market is expected to grow from $0.88 billion in 2023 to $1.80 billion by 2033. Rising investments from countries like India and Japan, aimed at enhancing their satellite capabilities, are key drivers of this growth. The increasing number of partnerships between governmental departments and private companies for satellite development is boosting the industry's growth prospects.North America Small Satellite Market Report:

The North American market, dominated by the U.S., is forecasted to expand from $1.63 billion in 2023 to $3.33 billion in 2033. The surge in private sector investments, particularly from new space companies, is driving the rapid growth. The U.S. government continues to play a crucial role, with numerous programs aimed at utilizing small satellites for defense and communication purposes.South America Small Satellite Market Report:

The South American small satellite market is projected to grow from $0.32 billion in 2023 to $0.66 billion by 2033. This growth is propelled by advancements in satellite technology and a growing interest in Earth observation applications from countries like Brazil and Argentina, which are leveraging low-cost satellites for agricultural monitoring and natural disaster management.Middle East & Africa Small Satellite Market Report:

In the Middle Eastern and African markets, small satellite investments are set to increase from $0.50 billion in 2023 to $1.03 billion by 2033. This growth can be attributed to increased government funding toward satellite technology and the utilization of small satellites to support telecom and remote sensing applications.Tell us your focus area and get a customized research report.

Small Satellite Market Analysis By Satellite Type

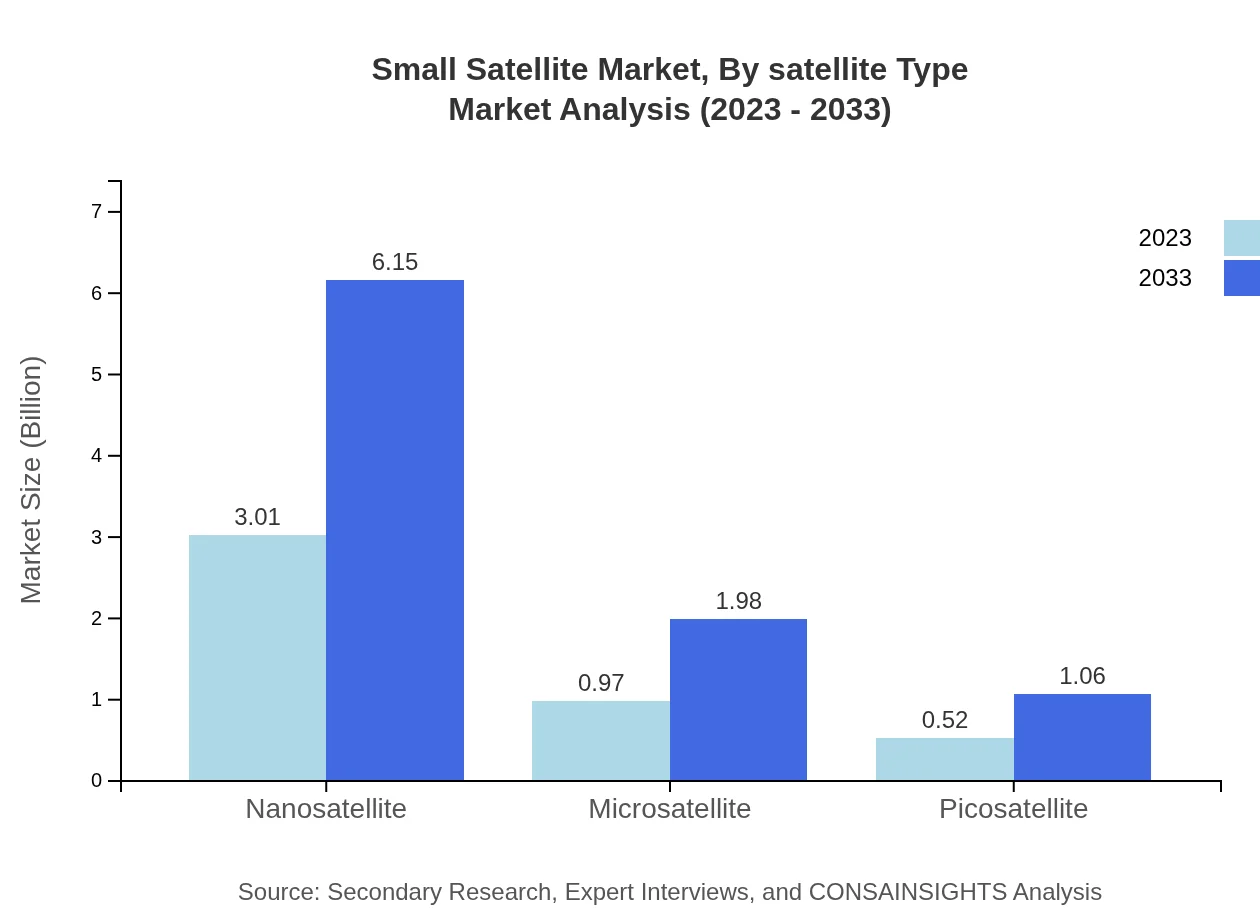

The small satellite market size for nanosatellites is projected to grow from $3.01 billion in 2023 to $6.15 billion by 2033, retaining a significant share of 66.9%. Microsatellites and picosatellites are anticipated to grow alongside, from $0.97 billion to $1.98 billion and $0.52 billion to $1.06 billion respectively, gaining shares of 21.54% and 11.56%. These trends underscore the increasing reliance on smaller satellite platforms for various applications.

Small Satellite Market Analysis By Application

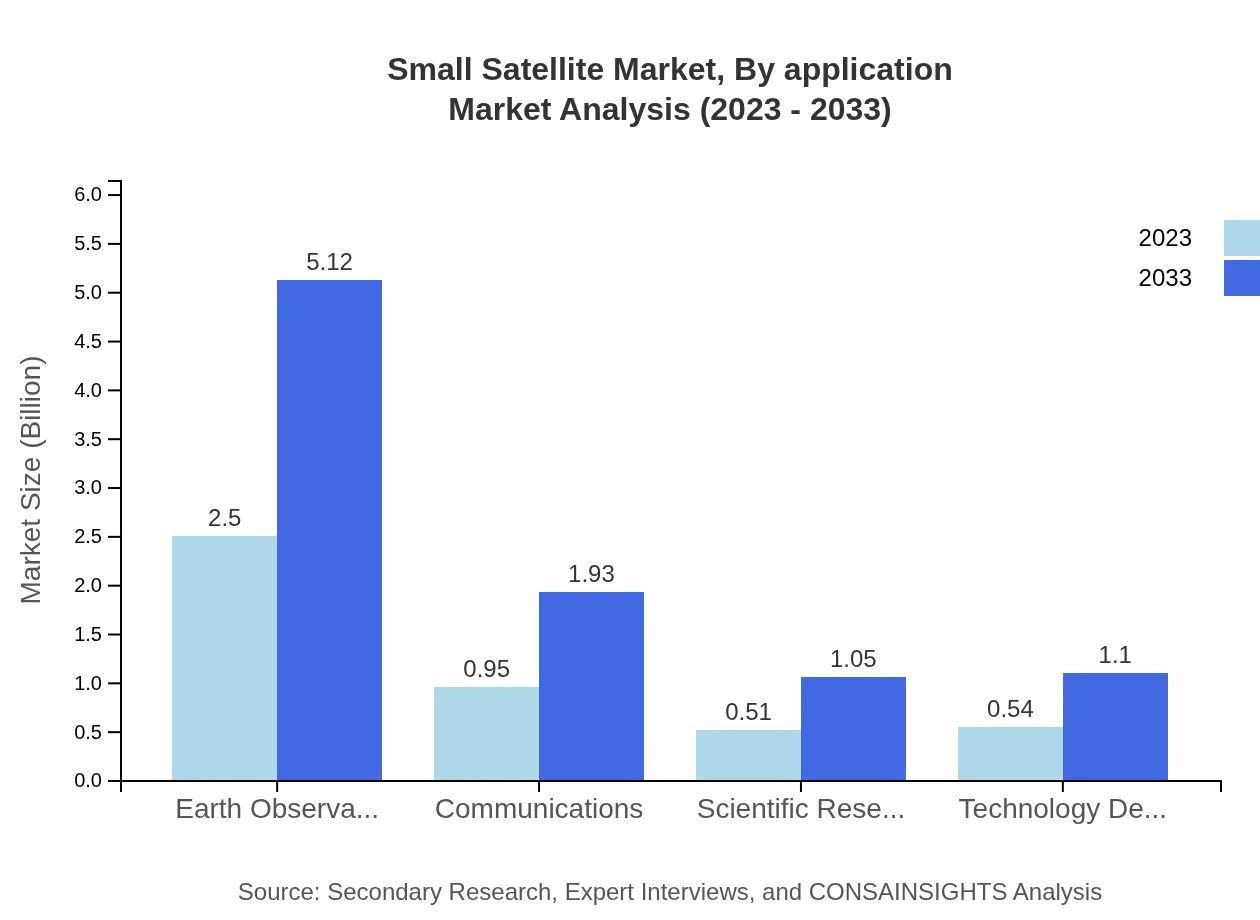

The largest segment in the application category is Earth observation, expected to increase from $2.50 billion in 2023 to $5.12 billion by 2033, comprising 55.63% of the market share. Other applications like communications are also anticipated to grow, from $0.95 billion to $1.93 billion, holding 21.01% of the share, emphasizing the importance of small satellites in modern infrastructures.

Small Satellite Market Analysis By Launch Technology

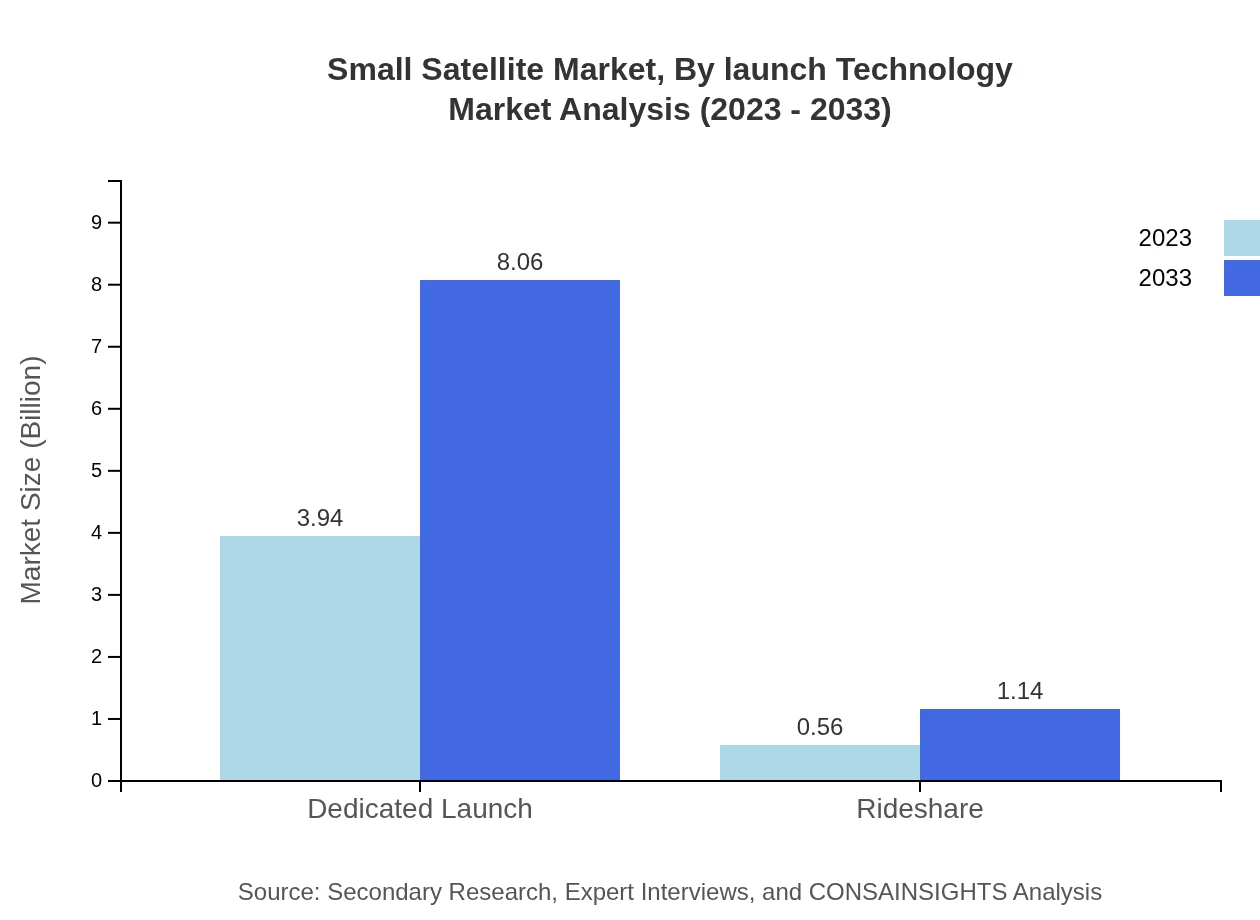

Dedicated launches exhibit significant dominance, growing from $3.94 billion in 2023 to $8.06 billion by 2033, maintaining an 87.57% market share. Rideshare options are also gaining traction, observing growth from $0.56 billion to $1.14 billion, suggesting a diversification in launch strategies for small satellites.

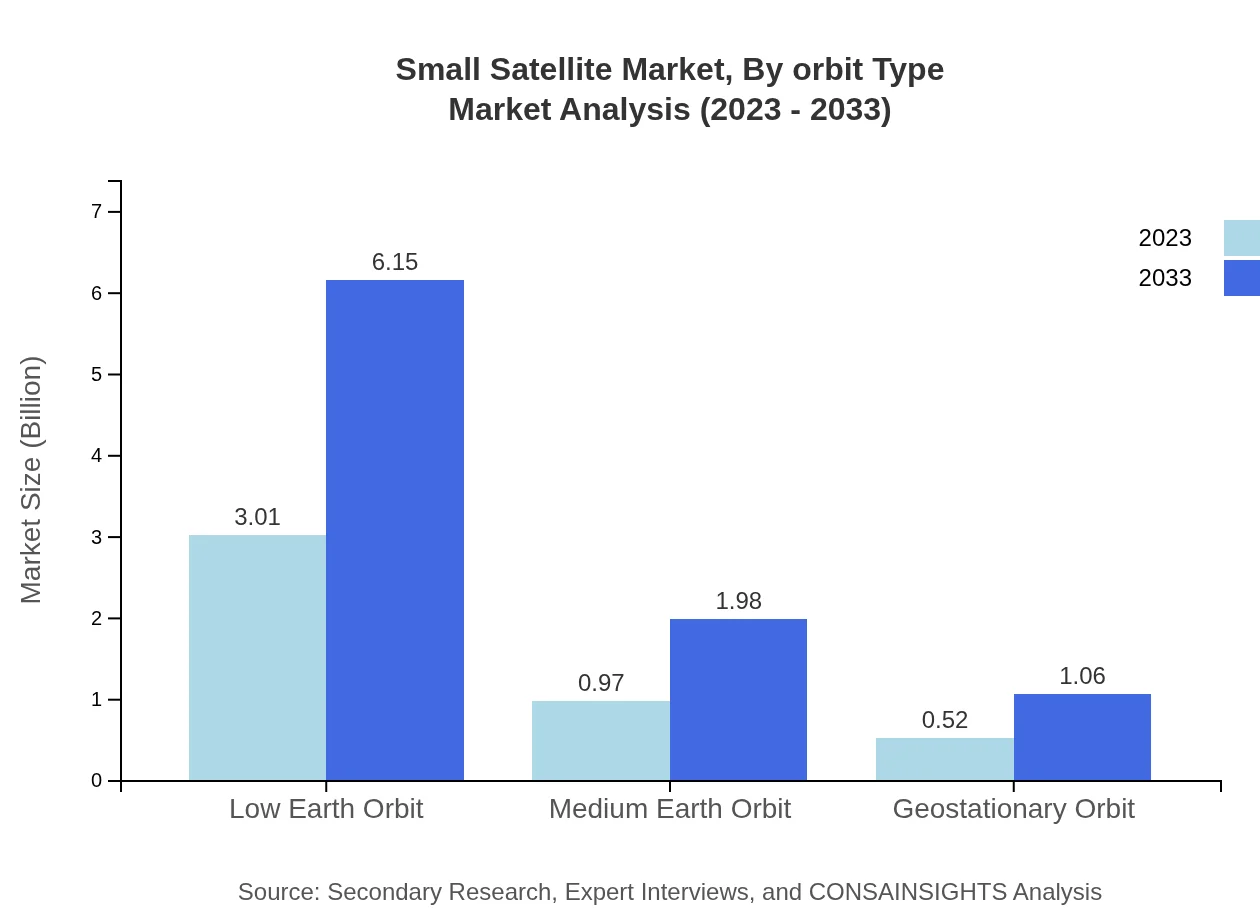

Small Satellite Market Analysis By Orbit Type

LEO holds the most substantial market share, anticipated to grow from $3.01 billion in 2023 to $6.15 billion by 2033, representing 66.9%. MEO and GEO markets are also on the rise, with MEO growing from $0.97 billion to $1.98 billion (21.54% share) and GEO expanding from $0.52 billion to $1.06 billion (11.56% share). This distribution reflects the strategic positioning of small satellites in various orbits to leverage operational capabilities.

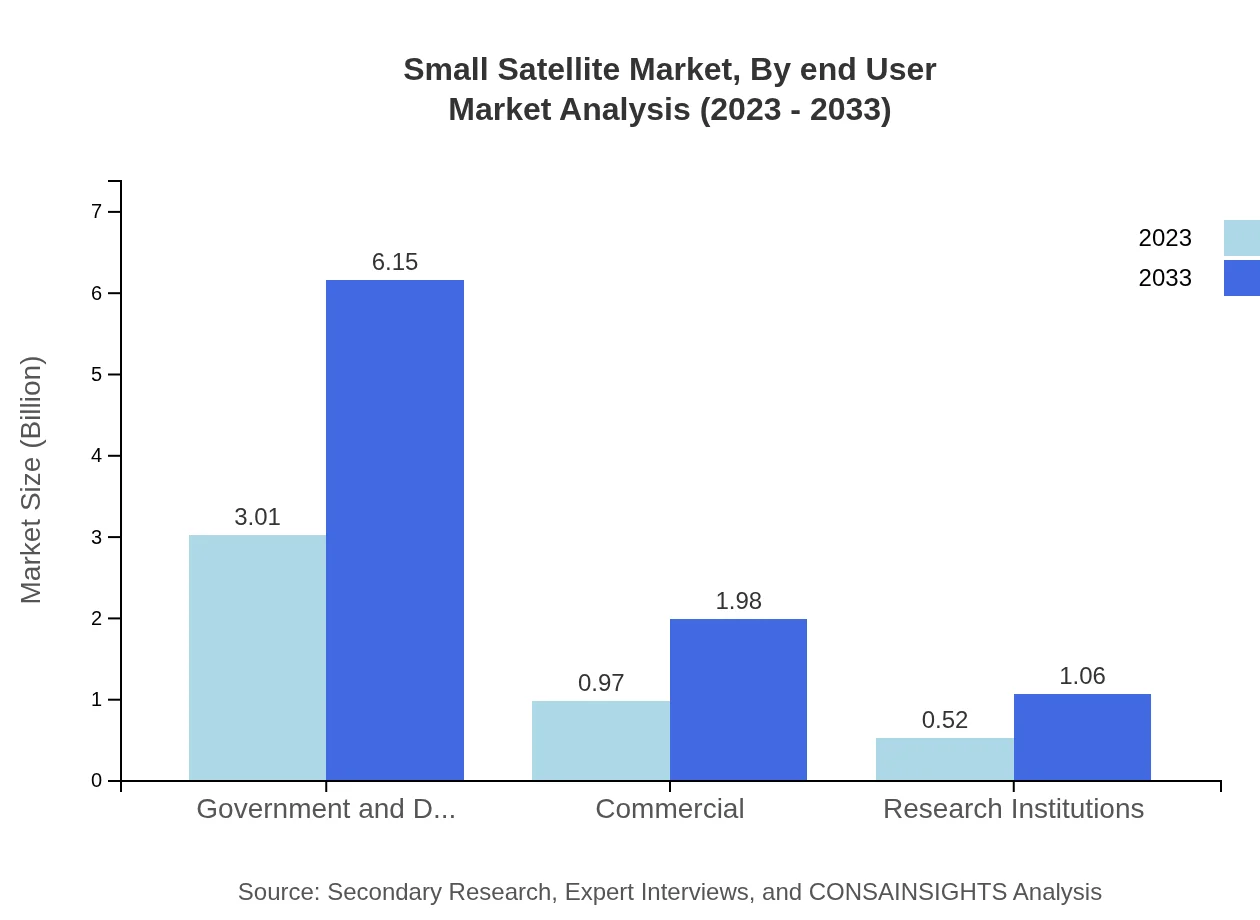

Small Satellite Market Analysis By End User

Government and defense sectors dominate, with a market size from $3.01 billion in 2023 to $6.15 billion in 2033, maintaining a consistent share of 66.9%. The commercial segment shows remarkable growth, from $0.97 billion to $1.98 billion (21.54% share), indicating an increasing adoption of small satellites for commercial purposes. Research institutions also play a vital role, expected to increase from $0.52 billion to $1.06 billion (11.56% share), contributing to innovative satellite applications.

Small Satellite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Small Satellite Industry

Planet Labs:

A pioneering company in small satellite imagery, Planet Labs operates the largest fleet of Earth-imaging satellites, enabling continuous monitoring of our planet.Spire Global:

Spire is focused on satellite-based data services, providing information about weather, maritime, and aviation sectors through its growing constellation of small satellites.Airbus Defence and Space:

A major player in aerospace, Airbus creates innovative small satellite systems for various applications, including Earth observation and telecommunication services.Northrop Grumman Innovation Systems:

Specializing in space and satellite systems, Northrop Grumman produces small satellites for defense applications, enhancing operational agility.We're grateful to work with incredible clients.

FAQs

What is the market size of small Satellite?

The small satellite market is valued at approximately $4.5 billion in 2023, with a projected CAGR of 7.2%. By 2033, this market is expected to expand significantly, highlighting the increasing demand for satellite technology.

What are the key market players or companies in the small Satellite industry?

Key market players in the small-satellite industry include established aerospace companies like SpaceX, Boeing, and Lockheed Martin, as well as specialized firms like Planet Labs, Spire Global, and Iceye, each contributing unique capabilities to the sector.

What are the primary factors driving the growth in the small satellite industry?

Growth in the small satellite industry is driven by advancements in technology, decreasing costs of satellite manufacturing, increasing demand for Earth observation data, and the rising deployment of satellite constellations for communication and connectivity.

Which region is the fastest Growing in the small satellite market?

The fastest-growing region in the small satellite market is North America, expected to increase from $1.63 billion in 2023 to $3.33 billion by 2033, owing to a high concentration of aerospace technology companies and federal investments.

Does ConsaInsights provide customized market report data for the small satellite industry?

Yes, ConsaInsights offers customized market report data tailored to the small satellite industry, catering to specific client needs, including segmentation analysis, market trends, and competitive landscape insights.

What deliverables can I expect from this small satellite market research project?

Deliverables from the small satellite market research project typically include comprehensive market analysis reports, segmentation breakdowns, regional insights, competitive landscape evaluations, and actionable recommendations for stakeholders.

What are the market trends of small satellite?

Market trends in small satellites indicate a shift towards nanosatellites and microsatellites for cost-effective solutions. Increasing collaborations for rideshare launches and enhanced capabilities in data collection and communication are also notable.