Smart Advisor Market Report

Published Date: 31 January 2026 | Report Code: smart-advisor

Smart Advisor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Smart Advisor market from 2023 to 2033. It encompasses market size, growth forecasts, segmentation, technology trends, and key industry leaders, offering valuable insights for stakeholders and investors.

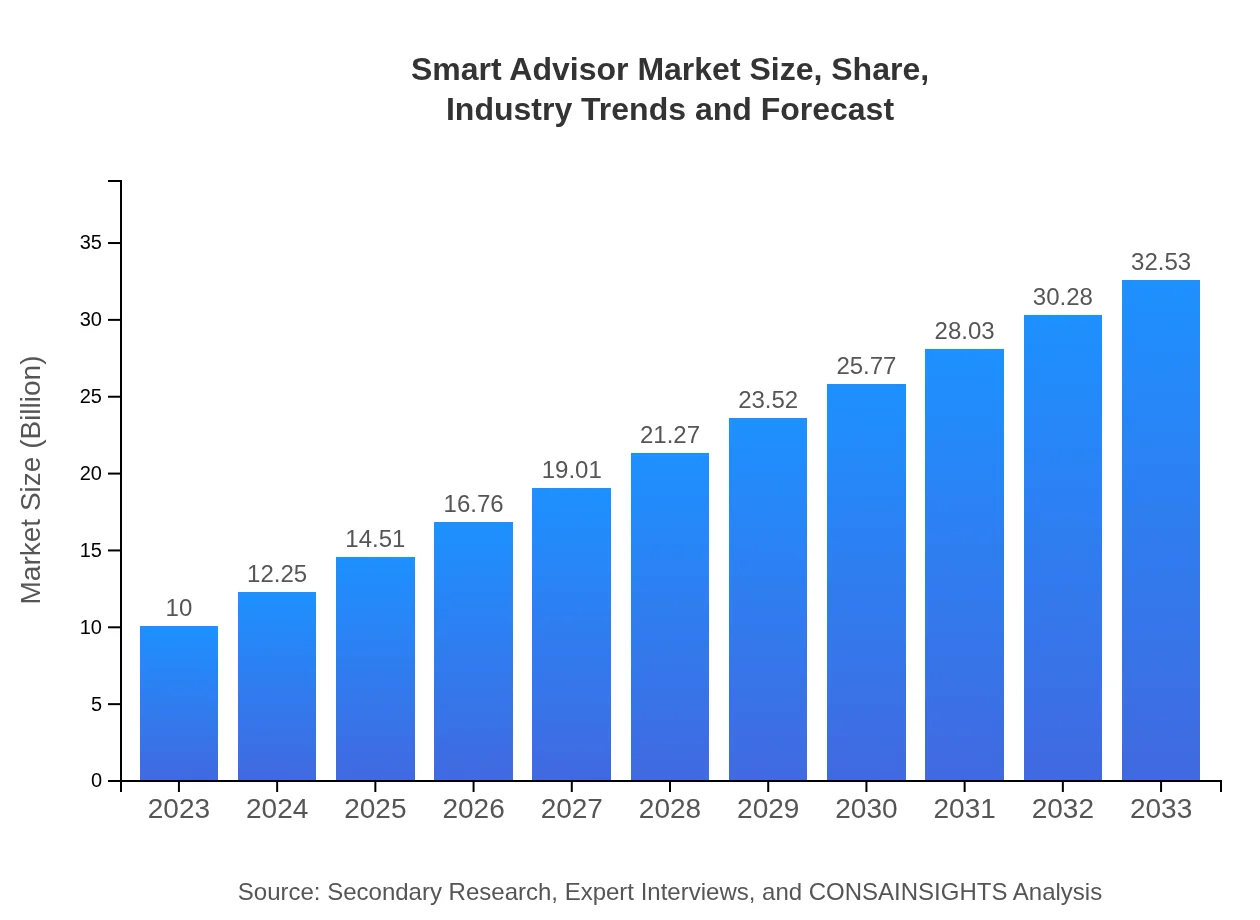

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | Microsoft Corporation, IBM, Salesforce, SAP, Oracle |

| Last Modified Date | 31 January 2026 |

Smart Advisor Market Overview

Customize Smart Advisor Market Report market research report

- ✔ Get in-depth analysis of Smart Advisor market size, growth, and forecasts.

- ✔ Understand Smart Advisor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Advisor

What is the Market Size & CAGR of Smart Advisor Market in 2023?

Smart Advisor Industry Analysis

Smart Advisor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Advisor Market Analysis Report by Region

Europe Smart Advisor Market Report:

Europe's Smart Advisor market is forecasted to increase from $3.04 billion in 2023 to $9.88 billion by 2033. The growing focus on regulatory compliance and data analytics enhances the adoption of smart advisory solutions.Asia Pacific Smart Advisor Market Report:

The Asia Pacific region represents a significant market for Smart Advisors, with a projected growth from $1.60 billion in 2023 to $5.21 billion by 2033. The increase is driven by rapid technological adoption and a burgeoning middle class demanding better services.North America Smart Advisor Market Report:

North America is leading the Smart Advisor market, anticipated to grow from $3.87 billion in 2023 to $12.58 billion by 2033. The region's dominance is attributed to the presence of major technology players and high investment in automation technologies.South America Smart Advisor Market Report:

In South America, the Smart Advisor market is expected to grow from $0.73 billion in 2023 to $2.37 billion by 2033, supported by an increase in internet penetration and digital transformation initiatives across various industries.Middle East & Africa Smart Advisor Market Report:

The Middle East and Africa region is expected to witness growth from $0.77 billion in 2023 to $2.50 billion by 2033. Government initiatives around smart cities and digital infrastructure are crucial for market expansion.Tell us your focus area and get a customized research report.

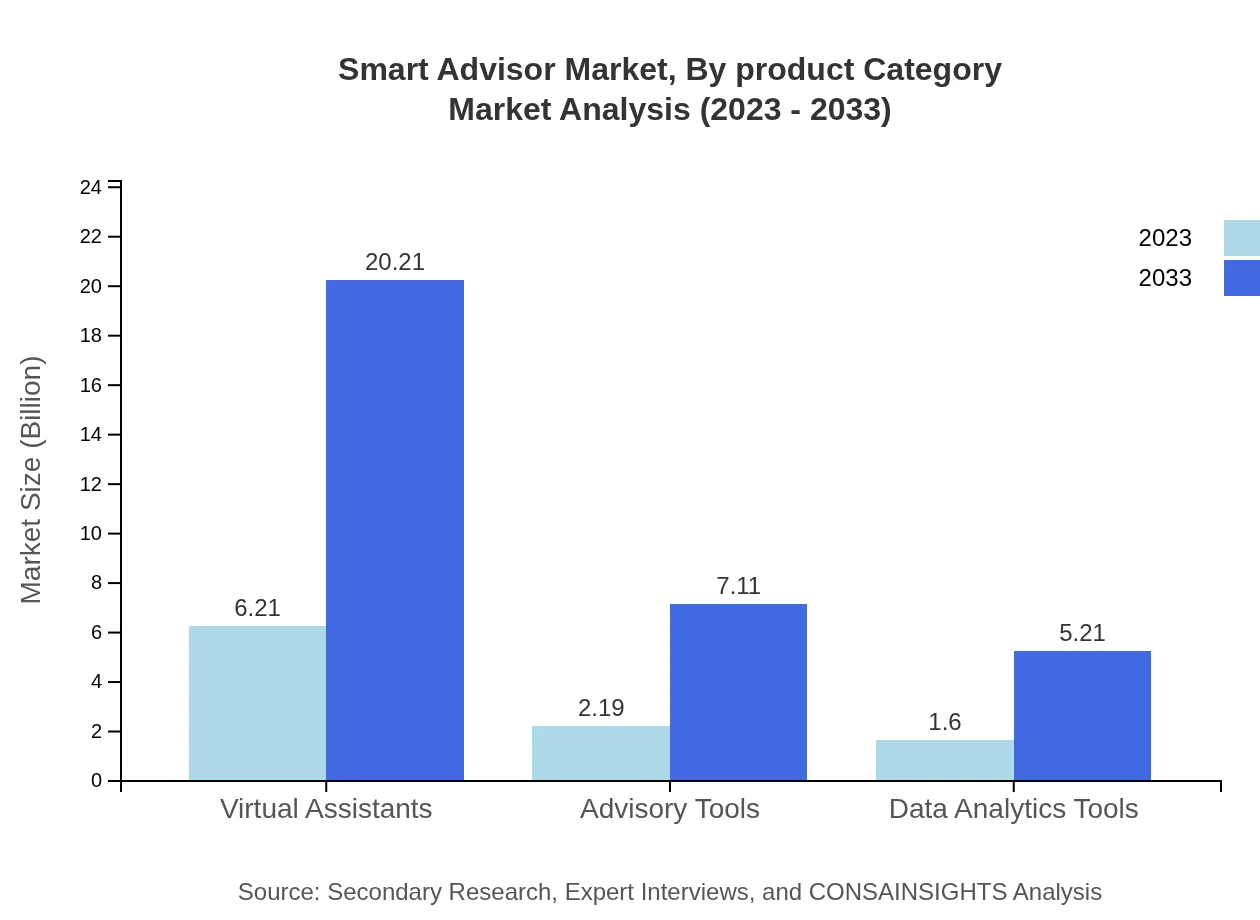

Smart Advisor Market Analysis By Product Category

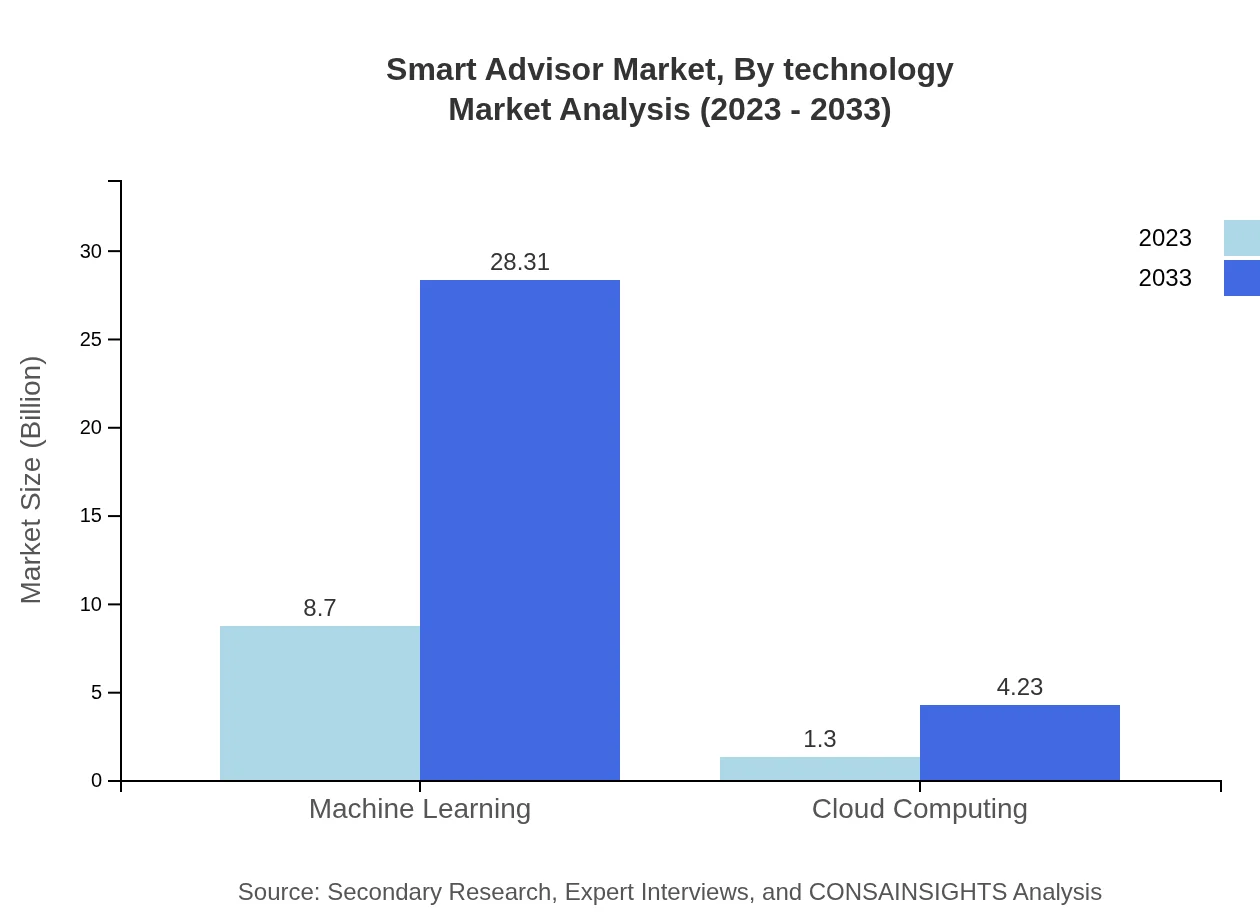

The Smart Advisor market is primarily driven by Machine Learning technologies, which are expected to grow from $8.70 billion in 2023 to $28.31 billion by 2033, comprising a dominant market share of 87.01% in both years. Cloud Computing solutions follow, with an increase from $1.30 billion to $4.23 billion, capturing a market share of 12.99%.

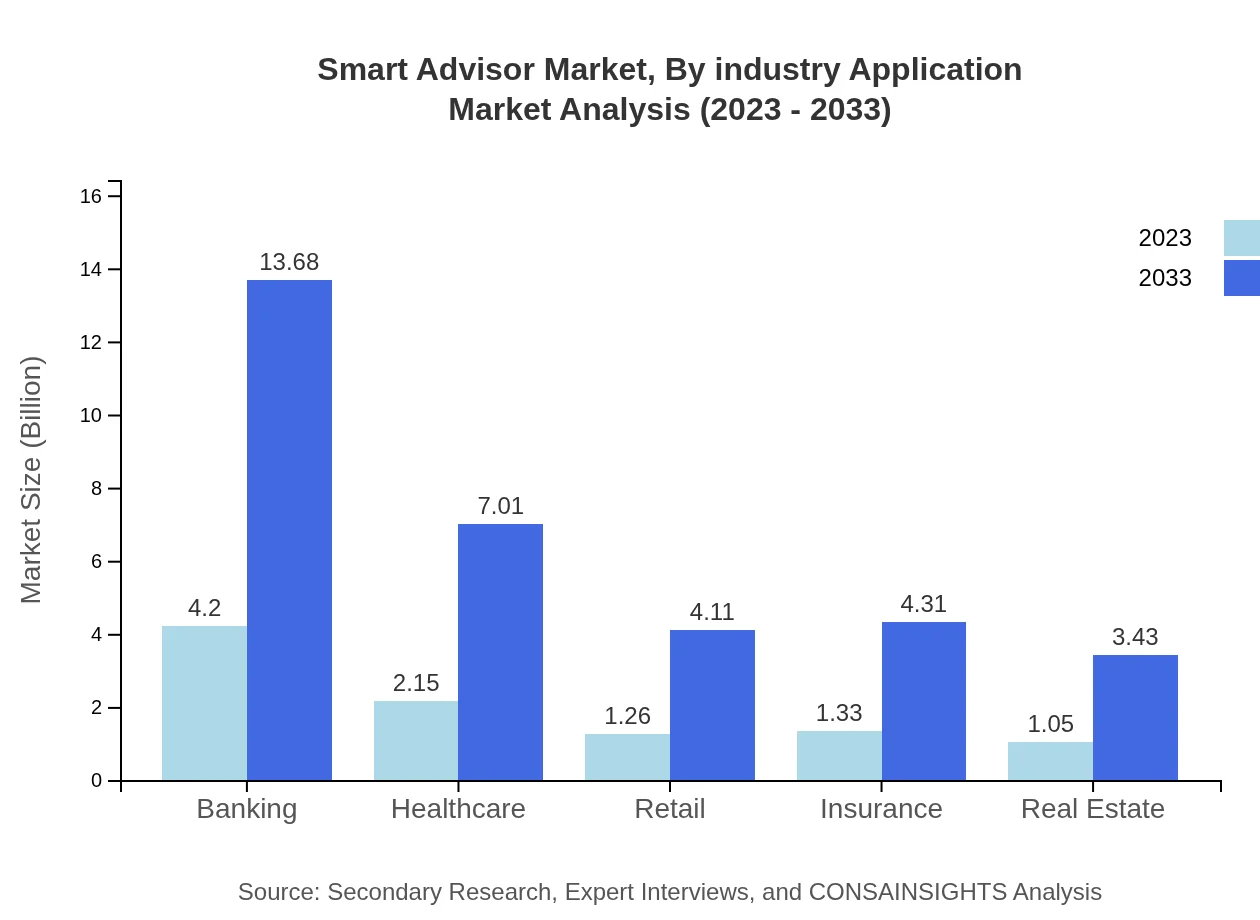

Smart Advisor Market Analysis By Industry Application

Key application sectors include Banking, which is anticipated to grow from $4.20 billion in 2023 to $13.68 billion by 2033, holding a significant market share of 42.04%. Healthcare applications are also notable with projections from $2.15 billion to $7.01 billion.

Smart Advisor Market Analysis By Technology

Technological advancements such as AI and Big Data analytics are reshaping the landscape of Smart Advisors, with particular emphasis on enhancing user-centric solutions across industries.

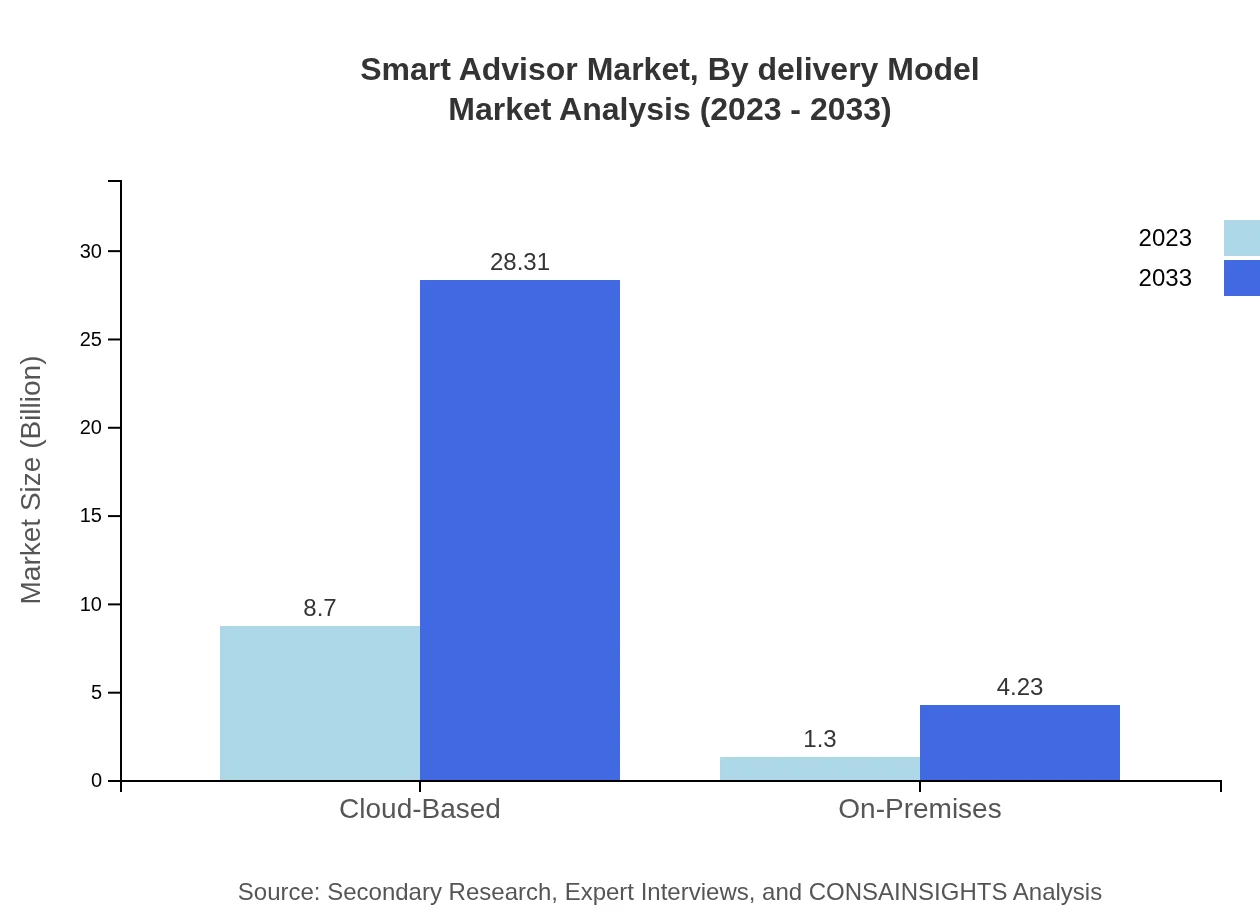

Smart Advisor Market Analysis By Delivery Model

The delivery model analysis indicates a preference for Cloud-Based solutions expected to dominate the market with a size growth from $8.70 billion to $28.31 billion, indicative of the need for scalable and flexible systems.

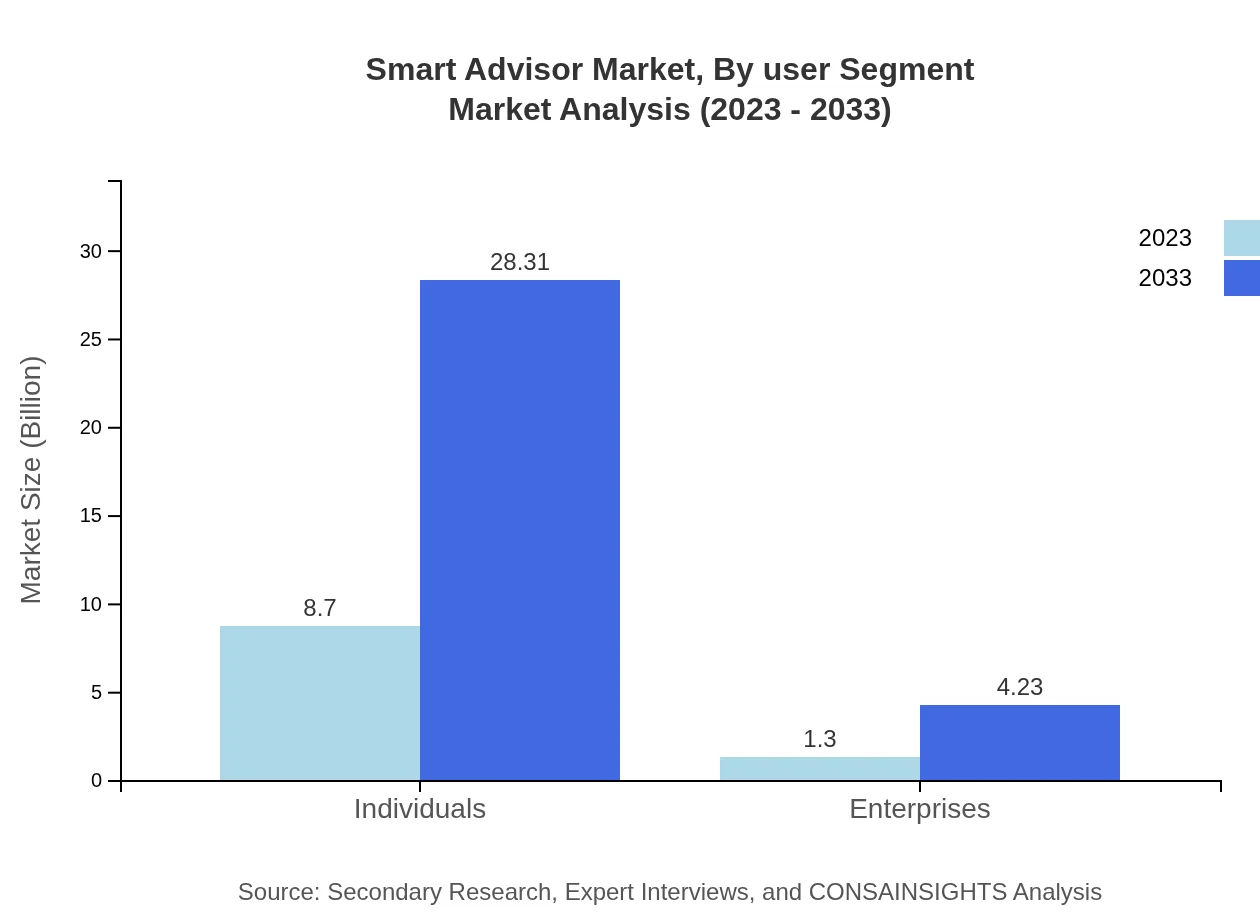

Smart Advisor Market Analysis By User Segment

User segments include Individuals and Enterprises, where individual applications will grow from $8.70 billion to $28.31 billion alongside increasing customization demands in product offerings.

Smart Advisor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Advisor Industry

Microsoft Corporation:

A leader in intelligent cloud solutions, Microsoft offers innovative Smart Advisor tools integrated with its Azure platform.IBM:

IBM leverages AI for enterprise solutions, providing advanced Smart Advisor technologies tailored for business needs across various sectors.Salesforce:

Known for its CRM solutions, Salesforce integrates Smart Advisor functionalities to enhance customer engagement and decision-making processes.SAP:

SAP offers robust analytics and advisory services that help organizations optimize their operations using Smart Advisor frameworks.Oracle:

Oracle's AI-based solutions are designed to streamline enterprise resource planning and provide insightful advisory services.We're grateful to work with incredible clients.

FAQs

What is the market size of Smart Advisor?

The global Smart Advisor market is projected to grow from approximately $10 billion in 2023 to a significant size by 2033, with a strong CAGR of 12%, reflecting increasing adoption of AI and advisory technologies.

What are the key market players or companies in the Smart Advisor industry?

The Smart Advisor industry features key players such as Google, IBM, Salesforce, and Microsoft, focusing on innovative technologies like machine learning and cloud computing, which drive competitive advantage and market growth.

What are the primary factors driving the growth in the Smart Advisor industry?

Key growth drivers include technological advancements in machine learning, increasing demand for personalized advice, growing enterprise adoption, and expanding cloud services, all contributing significantly to market expansion.

Which region is the fastest Growing in the Smart Advisor market?

North America is the fastest-growing region in the Smart Advisor market, projected to grow from $3.87 billion in 2023 to $12.58 billion by 2033, with a surge in demand for AI-driven solutions in various sectors.

Does Consainsights provide customized market report data for the Smart Advisor industry?

Yes, Consainsights offers customized market report data for the Smart Advisor industry, tailoring insights based on specific client needs, geographical focus, and market segments to ensure relevance and strategic advantage.

What deliverables can I expect from this Smart Advisor market research project?

Deliverables typically include comprehensive market analysis, trend forecasts, competitor analysis, segmented growth insights, and actionable recommendations tailored to the Smart Advisor market, ensuring clients receive strategic and data-driven guidance.

What are the market trends of Smart Advisor?

Current market trends in Smart Advisor include the rise of virtual assistants, increasing integration of AI and data analytics tools, a shift towards cloud-based solutions, and an emphasis on personalized customer experiences across various industries.